Author The Lilly Commercial Team

It’s Slowing Down The Demand For B- and C-Class Product and Increasing The Demand For A- and AAA-Class Product

Canadian class-AAA office product is doing well, industrial remains hot and retail has rebounded, according to JLL Canada chief executive officer Alan MacKenzie and a new national outlook report.

The national office vacancy rate rose 40 basis points to 14.7 per cent in the second quarter, but MacKenzie told RENX that’s comparatively low from a global perspective.

Vancouver’s office vacancy rate of 7.3 per cent is the lowest in North America while Calgary’s 26.8 per cent rate is the highest. However, Alberta’s largest city is showing signs of a bounce-back due to a rebound in the oil and gas industries that has resulted in some companies taking sublet space off the market.

JLL expects the office vacancy rate to continue to rise across Canada, given the current economic uncertainty, which will bring balance to markets that have favoured building owners for several years.

Return to office has spinoff benefits

Several major institutional office occupiers have started mandating employees back to the office two to three days a week.

“As occupiers bring their people back for more days of the week in the downtown areas of Canada, we’re predicting a really positive impact on the surrounding retail, with people buying coffees and lunches and socializing after work with cocktails and dinners,” said MacKenzie.

Office occupiers are also trying to determine how much space they’ll need over the next 10 to 15 years and how to design it to attract and retain employees and enhance productivity.

Environmental, social and governance, air and light quality, design and accessibility are all top of mind as the flight to quality by office occupiers which picked up in earlier waves of the pandemic has continued.

High demand for class-A and -AAA office space

“It’s slowing down the demand for B- and C-class product and increasing the demand for A- and AAA-class product,” said MacKenzie.

Owners of class-C office space on the periphery of downtown Calgary need to be more aggressive with inducements and pricing to attract tenants, while owners of AAA space in downtown Toronto don’t have to offer incentives because there’s ample demand and scarce availability, MacKenzie added.

There’s an increasingly high demand for built-out space, as tenants don’t want to spend the time or money to improve their real estate unless it’s absolutely necessary.

The flight to the suburbs that occurred with some office occupiers during earlier stages of the pandemic is being reversed and many are looking to return downtown, according to MacKenzie.

Net rental rates fell from a historically high $20.52 per square foot in the first quarter to $20.22. Montreal was the only major market with an increase as office rents rose by 5.4 per cent.

Industrial vacancy very low

After five consecutive quarters of declines, the national industrial vacancy rate remained steady at 1.5 per cent in Q2. Vancouver’s vacancy rate was 0.8 per cent, Toronto’s was 0.9 per cent and Montreal’s was 1.7 per cent, while Calgary’s rate dropped by 290 basis points year-over-year to 1.7 per cent.

“Because of the length of time it takes to entitle land and develop industrial product, and the limitation of available land, we can’t build it fast enough in order to meet the demand,” said MacKenzie.

“Notwithstanding that there are some headwinds with the economy and interest rates and the potential for a recession to be coming up that could put a little pressure on the demand side from occupiers, the scarcity of product is so rampant that we don’t see it as a risky place at this stage of the game.

“It’s still a very healthy market and it’s healthy to be an investor in that space right now.”

Industrial vacancies are expected to rise modestly but will remain landlord-favourable over the next few years, the report states.

Industrial rents continued to rise at an exponential rate across the country. Average asking net rents hit $12.11, a 17 per cent increase year-over-year, after expanding 14.4 per cent in Q1. While Canada’s three largest markets continued to expand 20 per cent and more year-over-year, Calgary and Winnipeg entered double-digit territory with rents increasing 11.6 and 10.4 per cent, respectively.

Southwestern Ontario had a surprisingly large and unanticipated 41.2 per cent year-over-year industrial rent increase.

“Land is less expensive in Southwestern Ontario so the overall production costs of building there are less than it would be in the Greater Toronto Area and developers are able to pass along those cost savings with slightly lower rental rates than the GTA,” said MacKenzie.

“We’re also seeing more and more Toronto-based investors and developers buying land in Southwestern Ontario and developing industrial product to try and take advantage of that demand and opportunity.”

MacKenzie expects rents to continue to increase for the next couple of years as supply trails demand.

Industrial transactions reached $4.1 billion in Q2 – a 58 per cent increase over the five-year quarterly average – though not quite as high as the all-time high of $5.3 billion in Q1. Pricing was at an all-time high with an average of over $242 per square foot.

More than 11 million square feet of industrial projects were started in the second quarter. Total space under construction was almost 48.4 million square feet, a five-million-plus-square-foot increase quarter-over-quarter.

Retail has rebounded

Canada had harsher and longer COVID-19 lockdowns than many other countries, which created wealth as people saved more money since there were fewer places to spend it.

Now that lockdowns are over, people are spending money on restaurants, entertainment and experiential retail, as well as clothing and shoes as more workers return to offices.

Accelerating wage growth and record lows in unemployment suggest people will keep spending, but high inflation and rising interest rates may curb discretionary purchases.

In-store purchases continue to trend up while e-commerce has trended down in the short term. The long-term outlook remains positive for e-commerce, however, because shoppers still like the convenience.

“Notwithstanding the disruption in retail as an industry during COVID, there has been a resurgence of investor demand in purchasing retail — specifically grocery-anchored retail in strong trade areas,” said MacKenzie, who noted pricing for class-A grocery-anchored retail in strong trade areas is higher than before the pandemic and the number of bids for it is high.

Transaction activity has been strong

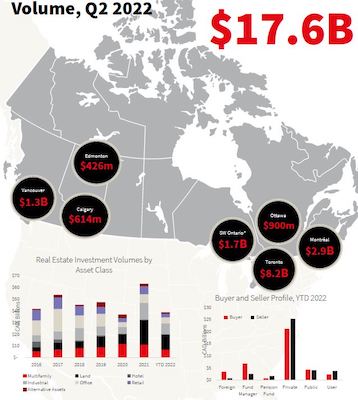

There was $17.6 billion in multiresidential, industrial, land, office, hotel, retail and alternative asset class investment transaction volume in seven large Canadian markets during Q2, the JLL report states.

Toronto led the way with $8.2 billion, followed by Montreal with $2.9 billion, Southwestern Ontario (Hamilton, Kitchener, Waterloo, Cambridge, Guelph, Stratford, Woodstock and Brantford) with $1.7 billion, Vancouver with $1.3 billion, Ottawa with $900 million, Calgary with $614 million and Edmonton with $426 million.

Transaction activity was very strong in the first half of the year and private buyers and sellers were the dominant players.

Institutional investors have focused on the asset management of existing portfolios, trying to mitigate risks and drive value through leasing, redevelopment and capital expenditures over the past two years.

“They’re all internally looking at their portfolio allocations very carefully and how much exposure they have in office, retail, multifamily and industrial, and the exposure geographically, in order to set strategies for the future and take advantage of future trends of growth,” said MacKenzie.

“They’ve become portfolio analysts of their own portfolios much more heavily than they were five years ago.”

Shrinking buyer pool for some office product

There’s a shrinking pool of buyers for class-B and -C office product and even for class-A product in weaker markets such as Calgary and Edmonton, MacKenzie said.

“Now we’re going through a period of price discovery for some of the asset classes and markets because interest rates have gone up and the cost of carrying debt has put downward pressure on the ability of some buyers to have appropriate spreads over their debt costs.”

Vancouver, Toronto and Montreal class-AAA office product is in high demand and MacKenzie said there’s ample institutional and private capital waiting for trophy assets to become available.

Ivanhoe Cambridge outsourced property management and leasing for its 16-million-square-foot shopping centre portfolio to JLL last October and other investment management companies and institutional investors are evaluating that model.

“Maybe there’s an opportunity to move faster and become more efficient at growing their assets under management if they outsource the property management and leasing functions of their business,” said MacKenzie. “We anticipate this outsourcing trend to accelerate, not just in Canada but globally over the next several years.

“They’ll focus on their investment management activities in trying to grow their assets under management.”

Source Real Estate News EXchange. Click here to read a full story

Canadian Net REIT Has Completed All 2022 Leasing Renewals, With No Tenant Turnover, At Rent Hikes Ranging From Five To 25 Per Cent.

Canadian Net Real Estate Investment Trust reported year-over-year gains in funds from operations (FFO), FFO per unit and net operating income (NOI) in its second quarter ended June 30.

Quarterly FFO jumped 27 per cent to $3.29 million from a year earlier, while FFO per unit rose by seven per cent to 16 cents per unit. The FFO increase was primarily due to the impact of newly acquired properties, which was partially offset by interest on mortgages associated with those properties.

NOI was 32 per cent higher, at $4.51 million, than during the same quarter a year earlier. The NOI increase was also attributable to the impact of newly acquired properties.

Canadian Net REIT (NET-UN-X) is an open-ended trust that acquires and owns triple-net and management-free commercial real estate properties. It owned 99 properties in Eastern Canada valued at $285 million at the end of the second quarter.

Insiders own 14 per cent of the units of the Montreal-headquartered REIT.

99 per cent occupancy rate

Much of the portfolio is leased to retailers, national service station and convenience store chains, and quick-service restaurants. It had a 99 per cent occupancy rate at the end of Q2.

“Our business, which is focused on owning and acquiring properties on a triple-net-lease basis, allows us to be somewhat immune to inflation, as higher operating costs are borne by our tenants,” president and chief executive officer Jason Parravano said during the REIT’s Aug. 25 second-quarter results conference call.

“The REIT’s operating costs for our properties are almost exclusively charged back to our tenants under the structure of our leases, with a few exceptions.

“With respect to interest rates, we have been able to take advantage of mortgage assumptions at pre-heightened levels, which has allowed us to take advantage of meaningful spreads between interest rates and going-in cap rates on newly acquired acquisitions.”

Acquisitions and developments

Canadian Net REIT made four property acquisitions during the second quarter:

• a 30,500-square-foot Giant Tiger store in Truro, N.S.;

• a 35,991-square-foot Metro grocery store-anchored retail strip in St-André-Avellin, Que.;

• a 29,698-square-foot Metro store in Chénéville, Que.;

• and a 3,500-square-foot Couche-Tard service station and convenience store in St-Jérôme, Que.

“We continue to add properties to the portfolio that diversify our tenant mix as well as the geographies we are exposed to,” Parravano said.

Subsequent to the quarter, Canadian Net REIT purchased its first New Brunswick property: a 4,400-square-foot Midas auto service centre in Fredericton acquired for $975,000. It also bought a 53,151-square-foot RONA hardware store in Chateauguay, Que. for $8.3 million.

“These properties are positioned in irreplaceable locations in high-traffic retail nodes and leased to strong covenant retailers, similar to the composition of the existing portfolio,” said Parravano.

Parravano said pricing seems similar to that seen before the recent interest-rate hikes, but not a lot of product has come to the market. Interest-rate volatility may be scaring off some private investors and reducing competition for some assets, he added.

“We’re looking at a lot of deals that are being presented to us,” Parravano said.

Canadian Net REIT will complete the development of a quick-service restaurant in Terrebonne, Que. in the coming weeks and recently began the redevelopment of a Burger King location in Jonquiere, Que.

The REIT has a 40 per cent interest, in collaboration with Benny & Co. and Odacité Immobilier, in the development of three new Benny & Co. restaurants which will launch in the coming quarters.

Canadian Net REIT leasing

Canadian Net REIT has completed all 2022 leasing renewals, with no tenant turnover, at rent hikes ranging from five to 25 per cent.

The REIT has 10 leases expiring in 2023, representing approximately $800,000 in NOI, of which half have already been renewed.

Rent bumps have ranged from 2.5 to six per cent, while some leases include consumer price index-based increases. The remainder of the 2023 renewals should be completed by the end of this year.

The weighted average lease term for the portfolio is 7.2 years.

Debt and mortgages

“We continue to maintain a conservative approach with respect to our leverage and our payout ratio,” chief financial officer Ben Gazith said during the call.

Canadian Net REIT reduced its debt-to-asset ratio to 56 per cent from 57 per cent for the same period a year earlier, while the FFO payout ratio increased to 55 per cent from 52 per cent during the same time frame.

Parravano said he would be willing to go up to a 60 per cent debt-to-asset ratio if the right acquisition opportunities present themselves.

Canadian Net REIT’s preference over the years has been to take the longest available term for mortgages in order to mitigate rate reset risk. It has three mortgage renewals remaining in 2022, with a maturity value of less than $4 million.

The trust has $10 million in mortgages rolling over in 2023, including in joint ventures, but the bulk of its renewals won’t occur before 2027. The current average term to mortgage renewal is 5.5 years.

Source Real Estate News EXchange. Click here to read a full story

Tenant Demand Is 141 Times More Than What Is Available in the Toronto-Hamilton Area

There is virtually no lab space available in the Greater Toronto and Hamilton Area, according to a new report that suggests tenant demand is 141 times higher than what’s available on the market.

Real estate company CBRE said in its inaugural lab report on Canada’s largest market that “ballooning demand” for space is attracting growing investor interest.

“In the past, a lack of investor participation in the GTHA lab real estate market had forced most tenants to use their own capital in order to expand their footprints in the region. This has resulted in an undersupplied market that is facing growing demand from both tenants and investors,” said CBRE in a 23-page report that identifies the lab vacancy rate in GTHA at 0.2% with 12.3 million square feet.

The real estate company said outside of the MaRS Discovery District in downtown Toronto and the McMaster Innovation Park campus in Hamilton, multitenant lab properties are scarce and account for only 2.3% of total inventory.

The real estate company said lab inventory in the GTHA is concentrated in smaller facilities, which limits the ability for tenants to expand.

“Most of the lab spaces in the GTHA are single-tenant properties, totalling 9.1 million square feet and representing 73.7% of the total inventory,” said CBRE, noting the MaRS site is 2.3 million square feet and McMaster is 700,000 square feet.

“The predominance of single tenant lab inventory in the GTHA is the result of a lack of investor participation in the lab real estate market in Ontario,” CBRE said.

CBRE said occupiers have been forced to buy or build their facilities but lack the upfront capital and are not willing to wait for years before occupying the space. Therefore, they are compelled to look at U.S. markets for available space.

The real estate company said that as of the first half of 2022, there was 3.5 million square feet of demand for lab space in the GTHA, with 1.9 million square feet for research and development and 1.4 million square feet for what is called good manufacturing practices or biomanufacturing facilities.

CBRE said the construction costs vary based on facilities’ demands, but interior fit-out costs can range from between $100 and $600 per square foot for the core and shell and between $100 and $850 per square foot for the interior fit-out.

The real estate company said there are three notable lab buildings in GTHA that are expected to be completed in 2023: the 120,000-square-foot OmniaBio B project at McMaster Innovation Park, the 160,000-square-foot Sheridan Innovation Centre in Mississauga and a confidential 119,000-square-foot facility in downtown Toronto.

“Combined with the success and growth of the lab sector seen in the U.S., investor demand has also grown as they come to better understand the nuances and associated costs with building and leasing highly sophisticated lab space,” said CBRE in the report.

Source CoStar. Click here to read a full story

Famous Canadian Discount Retailer With Leases Once Sold to Target Corp. To Open Stores Next Year

Zellers, the discount Canadian retail chain that once had 220 leases acquired by Target Corp. as part of the U.S. company’s failed Canadian expansion, is being resurrected by HBC.

HBC, the parent company that counts The Bay and Saks Fifth Avenue among its holdings, said shoppers will have something to “zelebrate” by early 2023 when Zellers returns to Canada with a new e-commerce site and Bay locations across the country.

Zellers is planning a “digital-first shopping journey that taps into the nostalgia of the brand” as it expands its footprint in major cities across the country at prime brick-and-mortar Hudson’s Bay locations, according to a statement from HBC.

At launch, Zellers will sell housewares and home decor, furniture, small appliances, toys, pet accessories and a value-driven private brand. Apparel will be introduced later in the year.

“We know how special Zellers is in the hearts and minds of people in Canada,” Adam Powell, chief business officer of Zellers, said in the statement. “Zellers is a brand deeply rooted in the Canadian experience. Spanning generations, people hold distinct connections to Zellers through shared experiences with family and friends, and we look forward to building on that in the future.”

Founded in 1931 in London, Zellers became famous in Canada with a campaign that touted Zellers was “where the lowest price is the law.” The company was acquired by HBC in 1978. Then, after dealing with declining fortunes, some of Zellers lease agreements were sold to Minneapolis-based Target Corp. for $1.825 billion in 2011.

HBC kept 64 locations but eventually liquidated those stores in 2013. Target itself left Canada and closed 133 stores starting in 2015 after recording a nearly $7 billion loss, which many blamed on supply chain issues that kept the company’s shelves bare across the border.

HBC said Zellers locations would open in select Hudson’s Bay stores early next year, but exact locations were not disclosed. Zellers had introduced a pop-up location in Burlington, Ontario, in 2020.

Source CoStar. Click here to read a full story

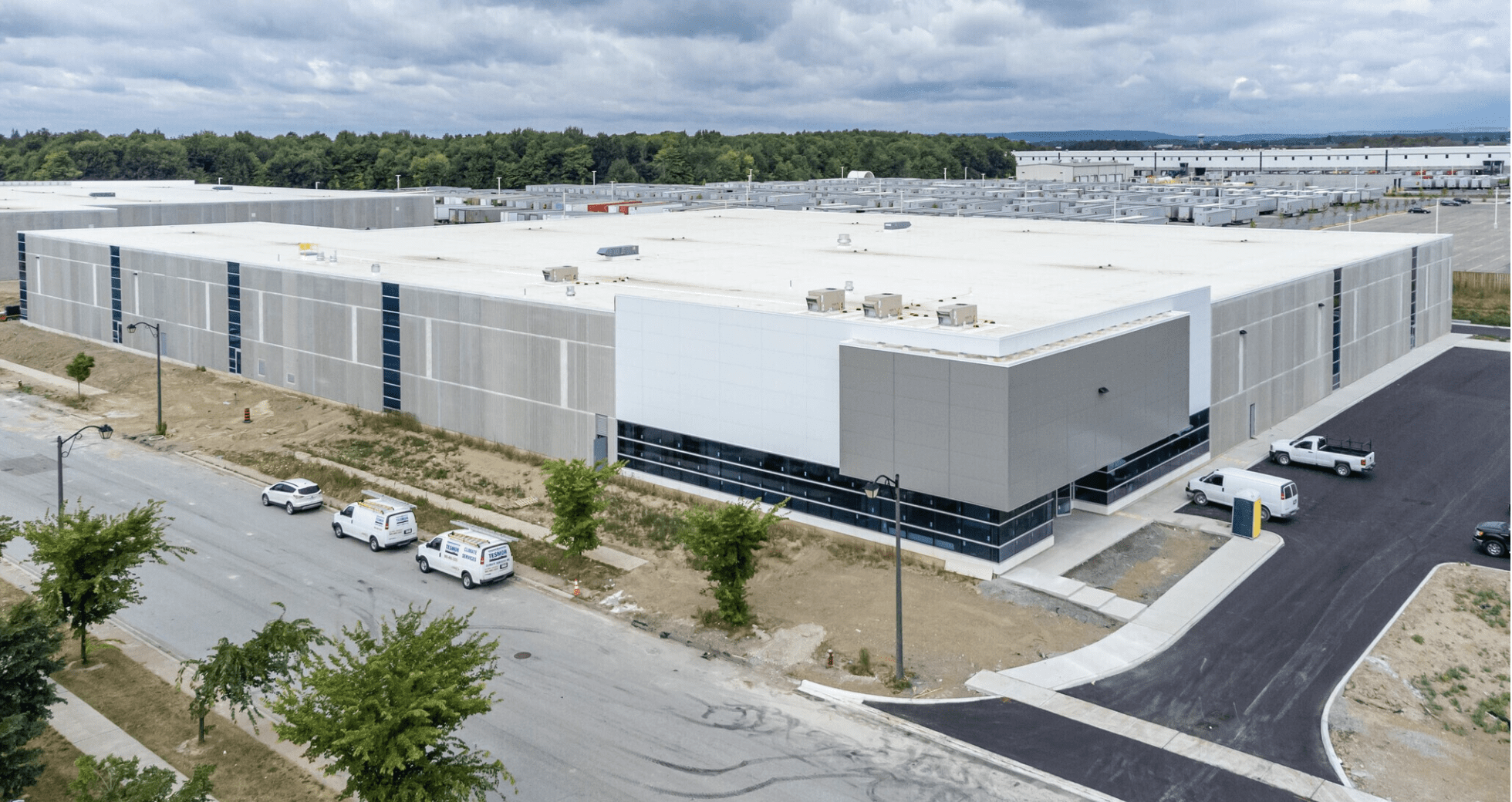

Construction Supplier Signs Full-Building Distribution Centre Lease in Caledon

Lindstrom Fastener Expanding to 410 Gateway Business Park

A master distributor and manufacturer of specialty construction fasteners is expanding its Canadian distribution centre after leasing a new building nearing completion in the 410 Gateway Business Park at 34 Speirs Giffen Ave. in Caledon.

Lindstrom Fastener (Canada) Ltd., which also operates in several U.S. states, leased the entire 105,014-square-foot building with 28’ clear heights. As a master distributor, the firm supplies other distributors with a wide range of metric fasteners, socket products, nuts, washers, pins, retaining rings, flange bolts, screws and assemblies.

Located near the interchange of Mayfield Road and Ontario Highway 410, the new facility is owned by Toronto-based H&R REIT and is expected to be completed next month.

Scot Steele, Chris Bournakas, Sarah McNamara and Deman Dulat arranged the lease on behalf of H&R REIT and are currently marketing space for lease in an adjoining building at 140 Speirs Giffen Ave.

Source CoStar. Click here to read a full story

Industrial Sector Helps Drive Total Returns of 8.5% for Canadian Institutions

Closely Watched Property Index Shows Canadian Real Estate Results

Canadian real estate investments had a total return of 8.48% over the past 12 months, led by the industrial sector.

The MSCI-RealPAC annual Canada property index, which measures existing investments of 47 institutional portfolios that make up about 40% of the real estate market in Canada, found the returns for the 12-month period that ended in June was split relatively evenly between capital growth and income.

“It is an important point of the year from the perspective of the data because we find a lot of of those 47 funds have revalued most if not all of their assets at this point,” Simon Fairchild, executive director of U.S. data analytics firm MSCI, said during an online presentation. “It’s a good indicator of what might be happening in the marketplace.”

Returns over the past year matched well with the index’s long-term historical average of 8.5% which goes back almost 40 years, Fairchild said. Returns plummeted during 2020 and 2021 below that average.

MSCI produces the closely watched quarterly index based on about $175 billion in assets with the Real Property Association of Canada, known as RealPAC. Fairchild said there was minimal capital improvement of just 0.2% in the second quarter, while income returned 1.1% in the period.

“There was a slowdown in the market over the last quarter, and that’s what we were expecting given what we know about the wider market, inflation risks, the war in Ukraine and supply chain challenges,” said Fairchild.

On a global basis, the United States led the world in the second quarter with total returns of 23.1% over the 12-month period. Canada was middle of the pack globally.

“The story of returns holding firm at least through the first half of the year is probably the story in most markets with the exception of the U.S. and the U.K.,” said Fairchild. “There was a strong acceleration through the tail end of 2021 and 2022, but recent numbers” in the U.S. and the U.K. had slowdowns.

The industrial sector bolstered the Canadian numbers with total returns of 32.7% over the past 12 months. Residential returns were 7.4%, retail had 3.1% and office had 1.4%.

“Industrial returns seem to be accelerating. It is the highest of any sector in any year,” said Fairchild. “But retail and office are the pillars of investing for pension funds for the last two decades.”

Toronto had the top total return of 10.9% out of the eight Canadian cities surveyed, followed by Halifax at 9.2% and Vancouver at 8.8%. Calgary was last at a 1.5% total return.

“Values are still falling [in Calgary], but we are at least seeing positive returns there,” said Fairchild.

With interest rates going up, people are focused on whether cap rates should follow, according to Jim Costello, chief economist with MSCI Real Estate, who was part of the presentation.

“Are the spreads too narrow? That’s been a major point of discussion with everybody,” said Costello, noting buyers don’t reveal some of their underwriting criteria, including net operating growth. “The sector is still opaque.”

Source CoStar. Click here to read a full story

Work-From-Home Trend Could Result in $500 Billion of Lost Value in Office Real Estate

Researchers from the NYU Stern School of Business and the Columbia University Graduate School of Business say the work-from-home movement will result in $500 billion of lost value in office real estate.

In a recent study, the researchers found a 32% decline in office values in 2020 and predict a 28% fall “in the longer-run.” The work-from-home shift since the pandemic has caused significant changes in lease revenues, office occupancy, lease renewal rates, lease durations, and market rents, researchers say.

Robust tools for working from home had been in place for years, but the necessities of the pandemic pushed widespread adoption of remote work. According to the researchers, office occupancy dropped from 95% in February 2020 to 10% within a month. By May 2022, it had only bounced back to 50%.

If the trend remains strong, a lot of office space might not be necessary. That would mean massive financial implications for land values and valuations in lending, nearby retail space, and tax resources for local governments.

The declines don’t fall evenly. There is “some evidence of a ‘flight to quality,’ particularly in rents,” researchers say. But rents may have yet to bottom out, as vacancy rates are at 30-year highs in many cities, and on average two-thirds of leases haven’t come up for renewals yet.

Source Building Design+Construction . Click here to read a full story

Toronto Bylaw Changes Could Permit Businesses to Open in Areas Currently Zoned for Residential Use

Toronto city council is adopting new amendments that will open the door to retail and service outlets flourishing in areas previously zoned residential.

A July 21 press release announced the acceptance of key motions that Michael Noble, project manager, City Planning with the City, said in an email would allow Toronto residents to more easily access goods, services and jobs close to home, by permitting businesses like barbershops to open in residential neighbourhoods.

Currently, according to Noble, the most notable approval from city council’s July meeting is the agreement to move forward with zoning bylaw changes that would allow barbers, hairdressers, beauticians, dressmakers, seamstresses, tailors, and health/medical offices in residential zones. While already approved, there is a 30-day period, he said, where the changes can be appealed. If by Aug. 22 there is no appeal, the amendments will go into effect.

Per the press release, further work, including a city-wide zoning bylaw that expands permissions for local neighbourhood retail and service uses is anticipated to be considered by Council in 2023.

“Zoning is going through a revolution right now across North America and we’re seeing a lot of really problematic zoning bylaws completely upended,” Jennifer Keesmaat, co-founder, Markee Developments, and former chief planner of the City of Toronto, said. “If you look at what we’re trying to do from a city-building perspective, it’s a good thing people can walk to a café in the area … it’s good for walking because less cars and it’s good for building a social fabric.”

“The opportunity [here] is to enable these types of places right in our neighbourhoods, street sides and corners.”

Zhixi Zhuang, program director at the School of Urban & Regional Planning at the recently renamed Toronto Metropolitan University, agreed.

“We talk about complete communities … if you want to improve the completeness of community life, we have to provide that kind of land use, not to separate them in a silo but to have them all mixed and allow people to do what they enjoy, get food, get services, meet other people,” she said.

James DiPaolo, associate at Urban Strategies Inc., while positive on the direction the City is moving, was curious to see how many people actually open new businesses in neighbourhoods.

He pointed toward larger forces like the rise of car ownership, decreased population density in many localities, and the rise of online shopping as factors that may impact how well these local shops do.

A Scarborough Bluffs neighbourhood resident, D. McCourt, who lives on Quentin Avenue, said that while she liked the economic boon these types of changes could provide, she was a bit unsure about having her quiet life be disrupted, having already grown accustomed to the traffic she gets as a result of living near the beach.

DiPaolo said there needs to be space for people in the community to have a say in what happens in their neighbourhoods and added businesses should be “compatible” in attributes like esthetic sense, physical scale and parking.

Noble wrote that consultations would define things like use, size and location to minimize adverse local impacts.

“As an example of appropriate locations, some options being explored include permitting establishments on TTC routes and marked bicycle routes,” he said.

“We can’t really impose a plan on communities who are the actual users of those spaces,” Dr. Zhuang said. “We have to look at whether we’ve consulted communities meaningfully … all the neighbourhoods are different, are unique, they have their own characteristics, community dynamics, histories.”

Source The Star. Click here to read a full story

UrbanToronto Pro’s June Report Shows More Office Less Space

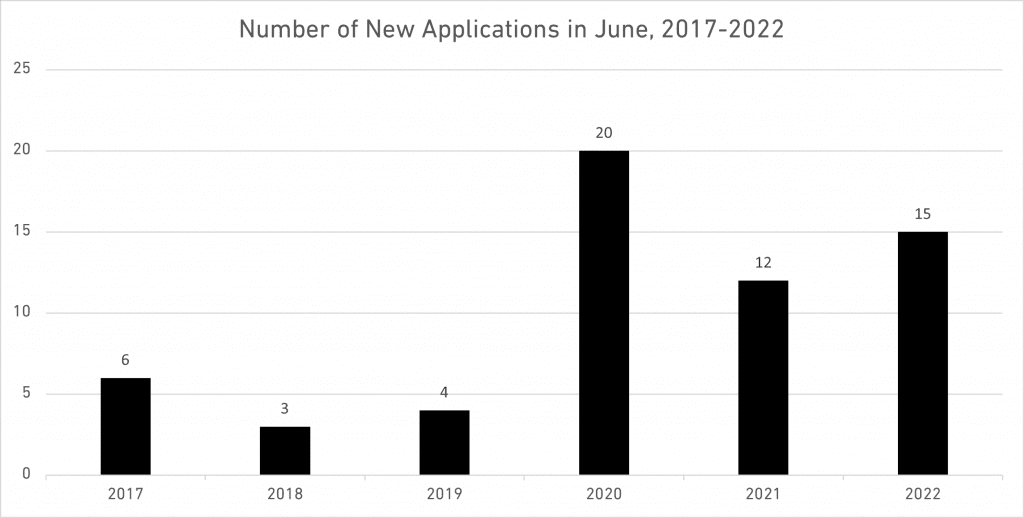

As inflation roared and interest rates climbed in June, many property owners were under stress. Applications for new developments, however, remained strong.

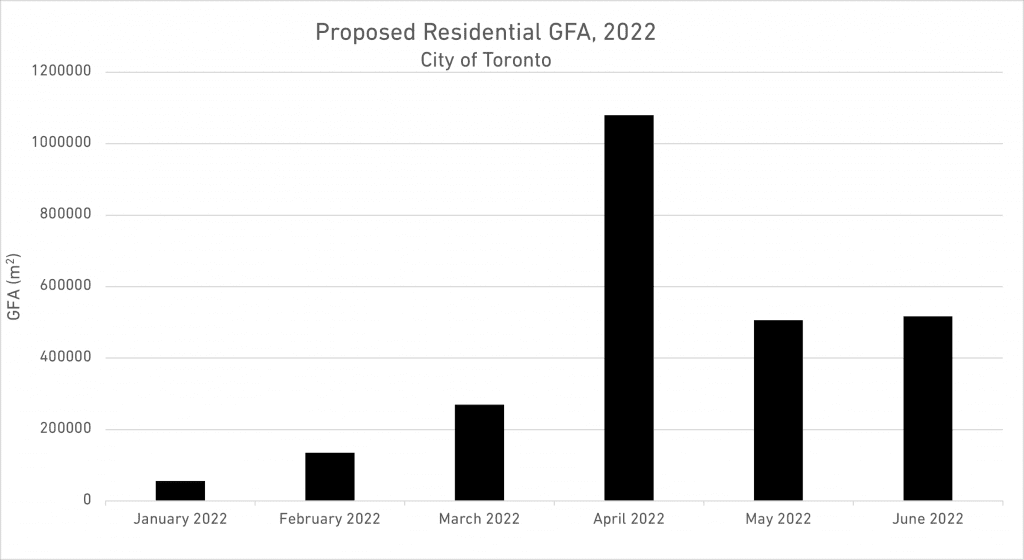

As the number of home sales tumbled in June, due to the rising costs of both inflation and interest rates, it was possible that developers would want to sit back on their proposals in order to wait out the uncertainty of the market. Yet applications for new large developments in the city of Toronto were higher in June than they were in May, and furthermore, June, 2022 applications were higher still than June, 2021.

More still; along with the increase in the number of applications, the Gross Floor Area (GFA) proposed in June was higher than both the previous month and the previous year. Although this could indicate confidence in the future, this isn’t necessarily the case. Projects could still be canceled or majorly revised during the approval process. As the market is still dealing with the double-uncertainties of rising inflation and rising interest rates, it’s important to watch how project proposals evolve in the next few months.

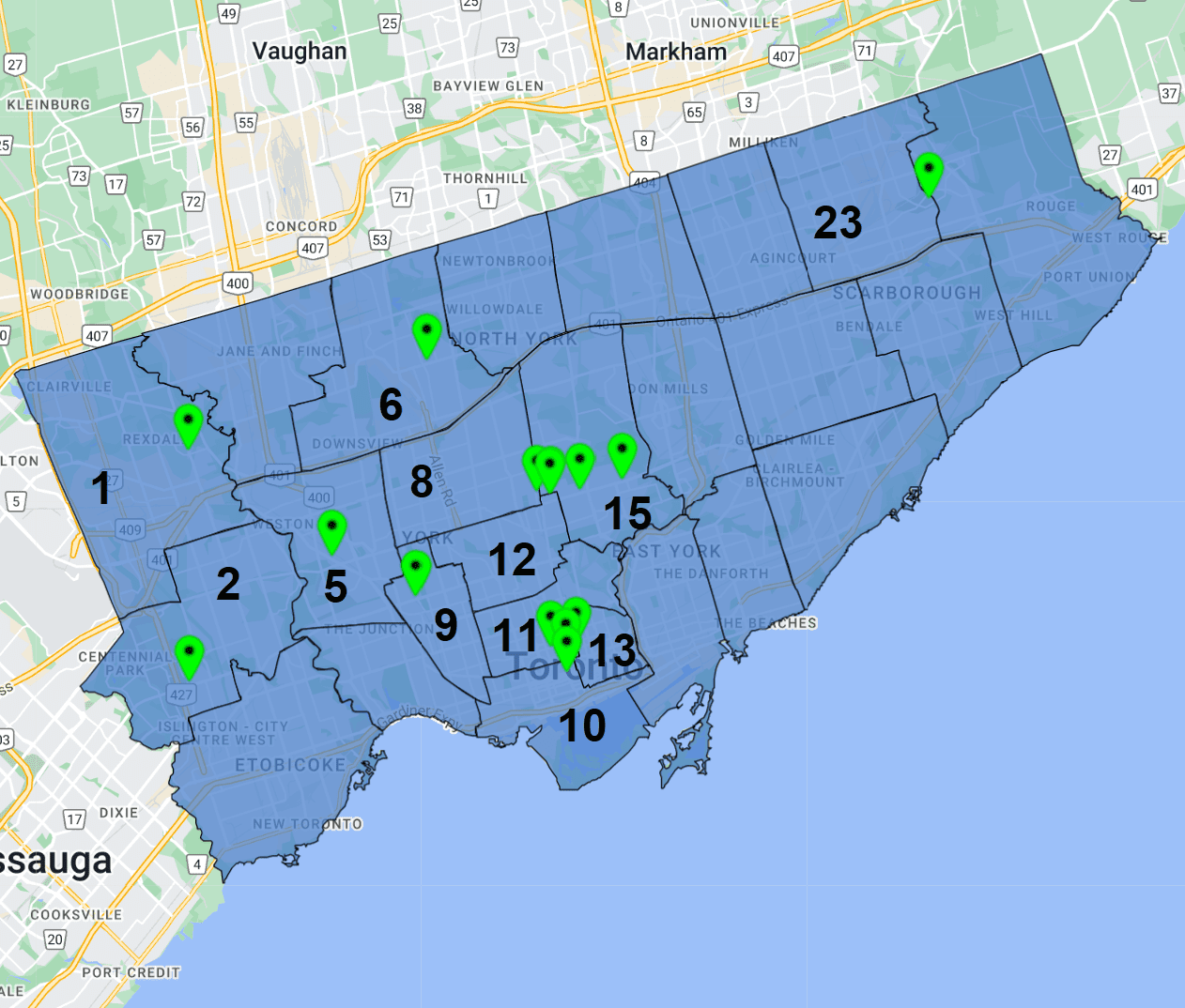

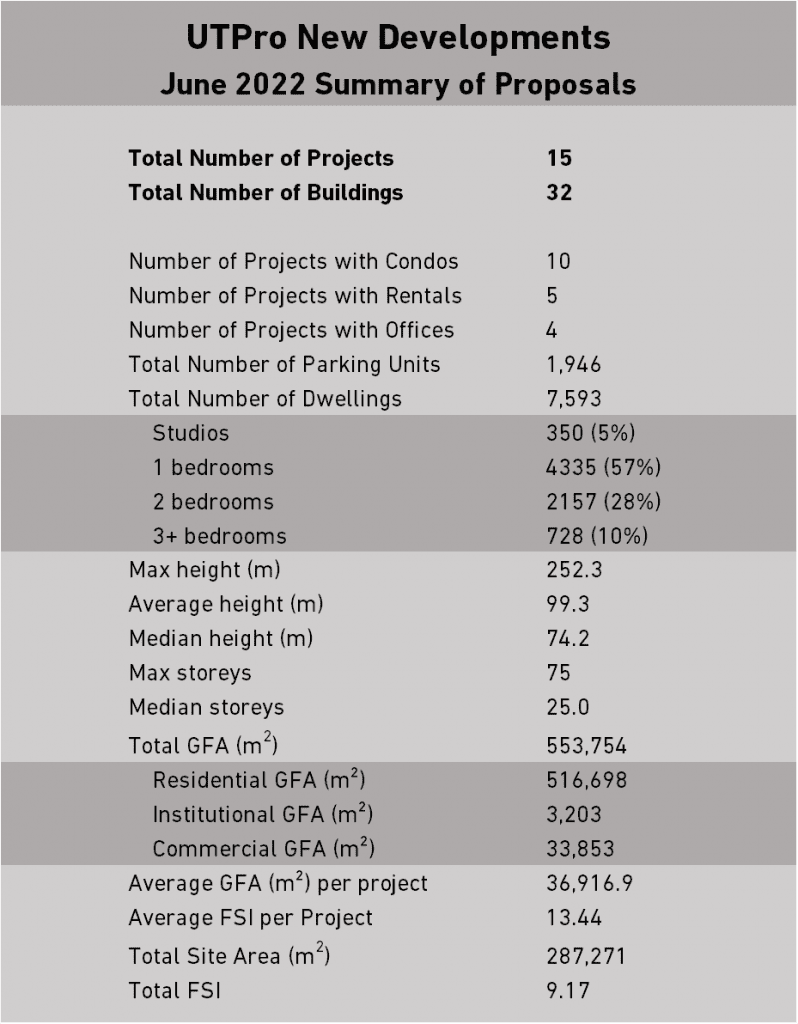

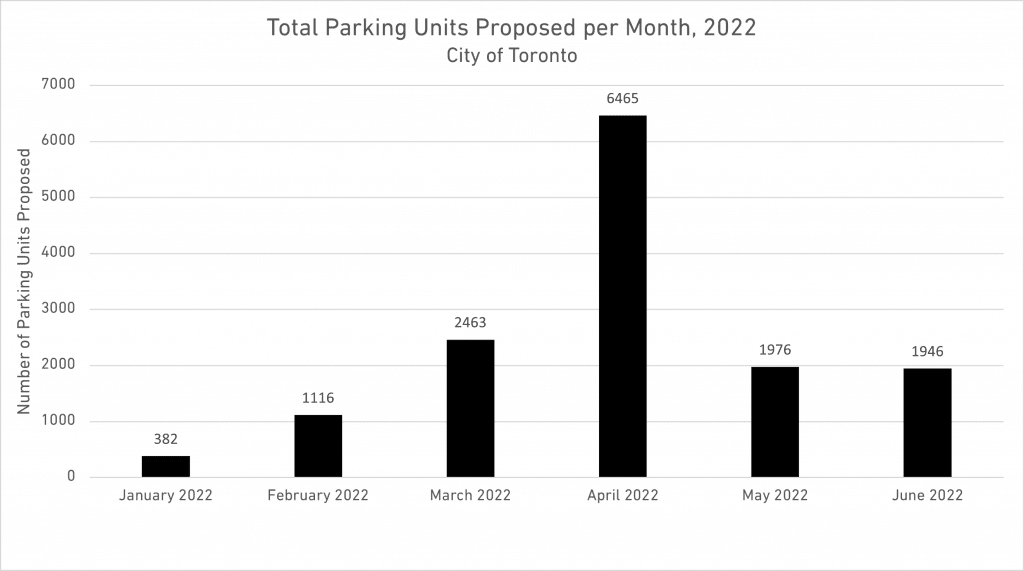

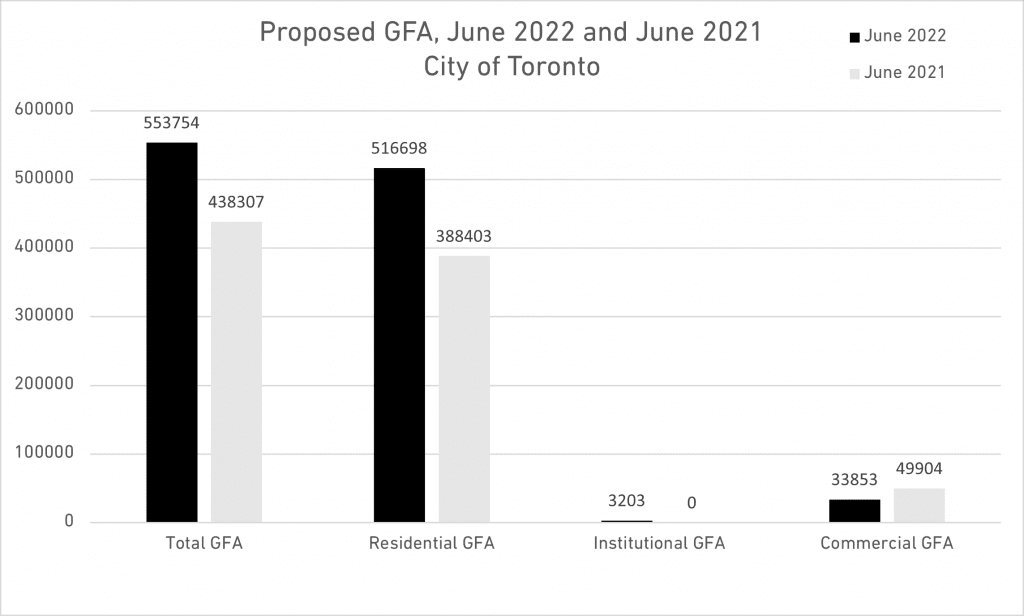

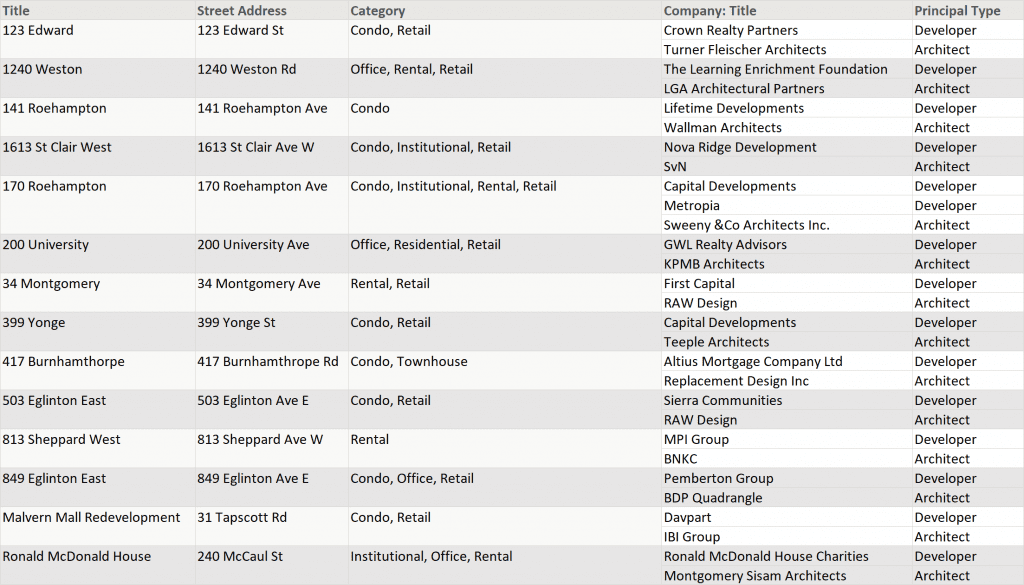

The 15 projects submitted in June were proposed across 12 Wards. The total GFA for all proposed projects is 553,754m², across a total site area of 287,271m². This implies a total Floor Space Index (FSI) of 9.17, twice the average for this year. Developers are proposing ever taller projects.

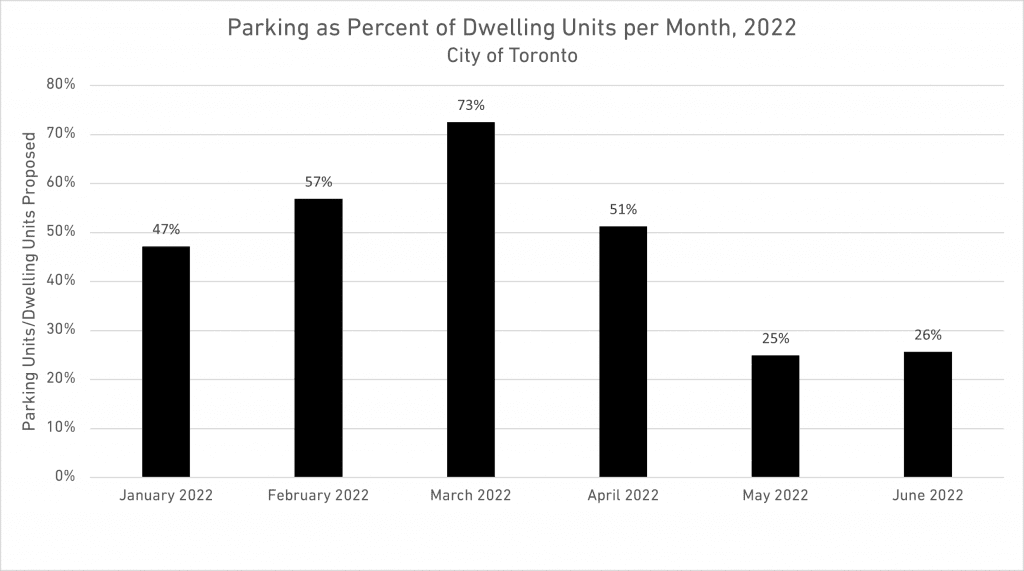

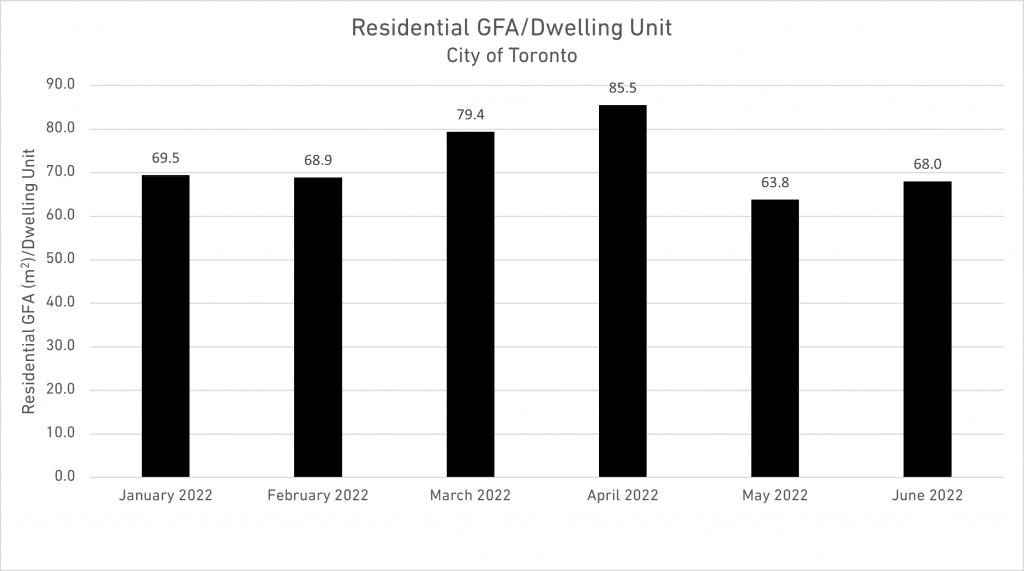

The average residential GFA proposed per dwelling unit was 68.0m², which is the third-lowest of this year. But it is 4.7% higher than the 64.9m² proposed for June, 2021. While this doesn’t correspond perfectly with larger units, it does run counter to the narrative that developers are building ever-smaller units. With only 1 parking spot proposed for every 4 dwelling units in June, the narrative of focusing on walkability and cycling is buttressed by this report.

There was 26% more GFA proposed in June compared to June, 2021. The distribution of the GFA across residential and commercial spaces was quite different. While the number of projects proposing some office space increased to normal levels this month, the gross floor area dedicated to them has shrunk significantly. In June, 2022, the amount of commercial GFA (which includes office and retail) proposed was only two-thirds of that proposed of the previous year. On the other hand, there was a 33% increase in residential GFA this year compared to last.

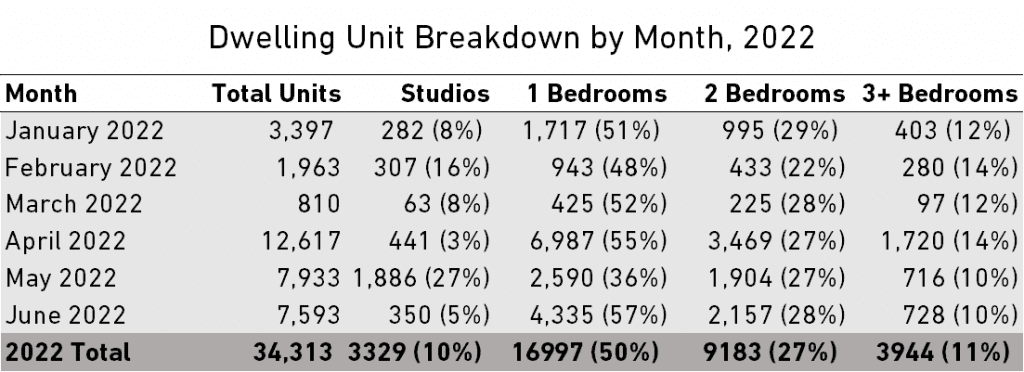

Of the 7,593 residential units proposed this month, 5% were studios, 57% were 1-bedroom units, 28% were 2-bedroom units, and 10% were 3+ bedroom units. (Note that this is in line with the city’s “Growing Up” guidelines that at least 15% of units are 2-bedrooms, and 10% are 3+ bedrooms.) These are in line with the year-long averages of 10% studios, 50% 1-bedroom units, 27% 2-bedroom units, and 11% 3+ bedroom units.

Will these trends continue? It’s possible that as higher interest rates push up borrowing costs, the price of land becomes more attractive for well-capitalized buyers. So long as investors anticipate that these higher rates are temporary measures in the fight against inflation, the long development cycle could prove to be an advantage for buying more land now, and continuing to develop more units for a growing population later.

This data is two months old. If you want to track this information live as it comes in, with your ability to customize reports and maps, set up a call about getting a tour of UT Pro.

* * *

UT Pro is UT’s premium database service that collects and reports information on development applications across the Greater Toronto Area.

This UTPro New Development Report analyzes new development proposals for large projects submitted to the City of Toronto. (UrbanToronto defines a “large project” as anything larger than a typical detached home.) These numbers are for proposals only, and are subject to change at any time up until (and sometimes even after) completion. Due to the early stage of the development process, some documentation may be missing; the numbers for some components of the data might not add up in some cases.

* * *

If you would like to stay updated on the latest development news, sign up for a free trial of the New Development Insider. And if you are interested in the data used to generate this report, you can get more details about the UTPro subscription database service here or on the official UTPro page. If you require an instant report on a specific area in the city, check out our Instant Reports.

For more information about UTPro, contact Edward Skira.

Source URBAN TORONTO. Click here to read a full story

63-Storey Tower Proposed Atop Brutalist Mid-Rise on Bloor East

Osmington Gerofsky Development Corporation have submitted Official Plan Amendment and Zoning By-law Amendment applications to the City of Toronto to build a tower that would rise to 63 storeys and 209 metres atop a 6-storey Brutalist building on the northeast corner of Bloor Street East and Mount Pleasant Road.

Designed by Hariri Pontarini Architects, precast cladding is proposed for the residential tower that would complement the exterior of the 1968 to 1970-built 350 Bloor East, currently occupied by and branded with the Rogers logo. Heritage specialists ERA Architects are handling restoration of the exterior of the existing John B. Parkin Associates-designed office building, the interiors of which would be demolished and replaced with a contemporary structure.

A restaurant/retail area is proposed to be constructed within the western portion of the ground floor, overlooking Mount Pleasant Road and the Rosedale Ravine. Only the east wall of the existing building, which faces the blank wall of the residential condo building to the east, would be replaced by new construction, with then north, west, and south walls and their wedged precast concrete pillars maintained.

UrbanToronto will continue to follow progress on this development, with a more fully detailed story soon, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

* * *

UrbanToronto’s new data research service, UrbanToronto Pro, offers comprehensive information on construction projects in the Greater Toronto Area—from proposal right through to completion stages. In addition, our subscription newsletter, New Development Insider, drops in your mailbox daily to help you track projects through the planning process.

Source Urban Toronto. Click here to read a full story