Author The Lilly Commercial Team

MBA Reports Nearly 75 Percent Jump for Q1 2022 Commercial Borrowing

Commercial and multifamily mortgage loan originations increased 72% in the first quarter of 2022 compared to the same period last year, according to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations. In line with seasonality trends, originations during the first three months of 2022 year were 39% lower than the fourth quarter of 2021. “The strong momentum in commercial and multifamily borrowing and lending at the end of 2021 carried into the first quarter,” comments Jamie Woodwell, MBA’s vice president of commercial real estate research. “The continued growth in lending activity is the result of the ongoing strong demand for certain property types like industrial and multifamily, as well as renewed interest in other property types that saw more dramatic declines during the early stages of the pandemic, such as hotel and retail.”

“It’s likely that the rise in interest rates will take some wind out of the sails of borrowing in upcoming quarters, but strong market fundamentals, property values and investor interest should continue to support the market,” Woodwell continues.

Compared to a year earlier, a rise in originations for hotel, industrial, and retail properties led the overall increase in commercial/multifamily lending volumes. By property type, hotels increased by 359%, industrial increased by 145%, retail increased by 88%, health care properties increased by 81%, multifamily increase by 57% and office increased 30%.

Among investor types, the dollar volume of loans originated for depositories increased by 194% year-over-year. Life insurance company portfolios increased 81%, investor-driven lenders increased 77%, Commercial Mortgage-Backed Securities (CMBS) increased 56%, and Government Sponsored Enterprises (GSEs – Fannie Mae and Freddie Mac) increased 1%.

As is typical in the first quarter, originations decreased in comparison to the prior year’s fourth quarter, with total activity falling 39%. Among property types, declines were seen in office (48%), multifamily (41%), hotel (38%), retail (32%), and industrial (29%). Health care properties increased 17%.

Among investor types, the dollar volume of loans for CMBS decreased 61%, loans for depositories decreased 41%, originations for GSEs decreased 39%, investor-driven lenders decreased 30% and life insurance company loans decreased 23%.

Source Mortgageorb. Click here to read a full story

NWRE, First Gulf Plan More Industrial Condos In Ontario

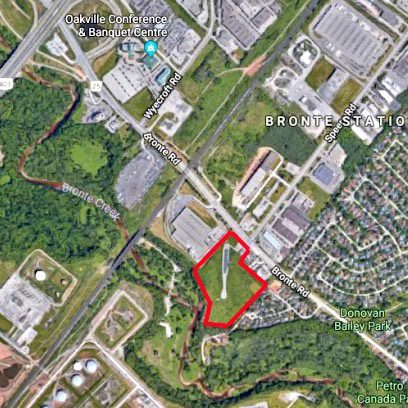

A partnership between Nicola Wealth Real Estate (NWRE) and First Gulf continues to acquire more Ontario industrial properties, the latest being a 13.4-acre site in Oakville, west of Toronto.

The vacant and unimproved site at 574-576 Bronte Rd. — immediately south of Hwy. 403, on the west side of Bronte Road at the intersection with Speers Road — was purchased from Suncor Energy for approximately $8.5 million.

First Gulf was contracted to acquire the property and brought in NWRE as a partner.

“We’ve done many projects with First Gulf,” NWRE director of acquisitions Alex Messina told RENX. “They’re a trusted and valued partner, and very skilled at industrial development.”

NWRE also partnered with PC Urban Properties to acquire a 3.4-acre property at 2660 Barnet Highway in Coquitlam, B.C., where it plans another strata industrial project. The property is just west of the Coquitlam Town Centre, at the edge of Greater Vancouver.

The price was not disclosed.

At this site, NWRE and PC Urban plan to develop two buildings totalling about 100,000 square feet.

Industrial condominium expansion plans

Vancouver-based NWRE has been involved with about 20 industrial condominium projects in its hometown and in Kelowna and Victoria.

It wants to add to that total in the Greater Toronto Area (GTA) and Montreal through multiple small-bay buildings with units ranging in size from approximately 2,000 to 5,000 square feet.

“It’s very difficult for users that require that size of industrial space to go and buy a freestanding building,” Messina explained. “At the same time, those same users have seen lease rates escalate significantly.

“We know there’s good demand from both building owners and investors. There’s good liquidity to these units. These types of buyers and business owners are typically entrepreneurs, so they’re very comfortable with the idea of owning their own real estate.”

Industrial space in the target size range is often older and there isn’t much new product available to lease. So, condos seem destined to catch on in Ontario the way they have in British Columbia as both users and investors become more accustomed to them.

“When you look at the economics of building this product, you can sell it for more on a per-square-foot basis than you could derive if you built it and leased it, or sold it in a block to a large investor like ourselves,” Messina said. “There’s an economic opportunity for developers to capitalize on this.”

NWRE has a number of other holdings in Oakville and Messina believes the wealthy city is particularly well-suited for industrial condos.

“Typically, business owners want to have their space close to where they live. We’ve had good success in picking locations that are close to where business owners and decision-makers live, which is typically in more affluent areas.”

NWRE and First Gulf

NWRE is the in-house real estate arm of Nicola Wealth, a financial planning and investment firm with $12.1 billion in assets under management.

NWRE manages a growing portfolio in major markets across North America, spanning the industrial, multiresidential rental apartment, office, self-storage, retail and seniors housing asset classes.

Its portfolio exceeds $8 billion in gross asset value after completing approximately $1.9 billion in acquisitions during 2021.

NWRE’s growth is being concentrated in the GTA, Greater Vancouver, Winnipeg, Vancouver Island and B.C.’s Okanagan region. It’s expanding into Ottawa and Montreal, with a focus on acquiring income-producing properties and value-add opportunities.

Toronto-headquartered First Gulf is a fully integrated development company that has developed more than 30 million square feet of office, industrial, mixed-use and retail properties worth more than $4 billion since its inception in 1987.

First Gulf is part of Great Gulf Group, which was established in 1975 and has major projects in Canada and the U.S.

Other NWRE and First Gulf acquisitions

NWRE and First Gulf have collaborated on several other projects in the GTA, including a large development property immediately across Bronte Road called Bronte Station Business Park that’s in the pre-leasing stage.

The partners expect to deliver buildings of 290,000 and 76,000 square feet for occupancy in Q4 2023.

A 77,000-square-foot industrial building in the southwest corner of Bronte Station Business Park is currently leased to Mancor Industries.

NWRE and First Gulf are working through the site-plan application approval process for 50 acres of industrial land at 10538 Coleraine Dr. in Brampton, where they’re looking to build multiple buildings totalling about 350,000 square feet.

The companies acquired a recently completed industrial development at 880 Avonhead Rd. in Mississauga that’s leased to Amazon.

Last year they acquired a 52-acre property on Allendale Road between Riverbank Drive and Hwy. 17 in Cambridge that offers quick access to Hwy. 401. The plan is to construct buildings of 157,000, 194,000, 275,000 and 330,000 square feet, valued at approximately $200 million upon completion.

The two partners acquired a nine-building, 473,000-square-foot industrial portfolio in Burlington, Hamilton and Stoney Creek near the Queen Elizabeth Way, but have already sold eight of them.

They’ve retained a property at 850 Legion Rd. in Burlington that had an existing leased industrial building which has now been converted to industrial condos.

“Part of the strategy was to acquire in bulk and resell the pieces as part of our merchant strategy,” Messina said. “There’s been really strong demand for industrial properties, so we’ve been able to execute on that strategy faster than anticipated.”

More NWRE Ontario industrial acquisitions

Other recent NWRE GTA and Greater Golden Horseshoe industrial acquisitions include a 20.84-acre property at 601-607 Milner Ave. in Scarborough with an existing 440,000-square-foot, two-storey building.

First Gulf is the general contractor for the project, which involves demolishing the current building and replacing it with a 350,000-square-foot distribution centre with 40-foot clear heights that should be completed in early 2024.

Pre-leasing has begun for the property, which was acquired in April 2021 and has good exposure to Hwy. 401.

NWRE acquired an 87,000-square-foot industrial plant on an 8.1-acre site at 2491 Royal Windsor Dr. in Oakville that’s currently leased on a long-term basis to Mancor.

“Our strategy is comprised of both acquiring existing income-producing properties and development sites,” Messina said. “Some we’ll retain long-term and others have natural exits, like industrial condos.”

NWRE acquired Blackwood Partners on Jan. 1, 2021, but has allowed it some autonomy.

In July the two acquired a 35-acre site at Kelson Avenue and South Service Road in Grimsby that fronts the Queen Elizabeth Way. There are plans to build more than 700,000 square feet of distribution space in two buildings.

NWRE and Blackwood also purchased 105 acres of industrial land in King Township in January 2021, where there are plans to build up to 1.8 million square feet.

The partners are working on site plan applications for the Grimsby and King Township properties.

Northbridge and Hopewell partnerships

NWRE and Northbridge acquired a 16-acre site on York Mills Road in Toronto where they’re working on pre-leasing strategies for a planned ground-up development with multiple buildings for last-mile distribution.

The two companies also partnered on a five-acre site at 7242 Hwy. 27 in Vaughan near the Hwy. 407 interchange. An old motel is being replaced by 88,000 square feet of industrial condo units.

NWRE and Hopewell Development acquired 51 acres of industrial land at 9555 Airport Rd. in Hamilton for $36 million in February that they’re working to entitle, with a goal of erecting three buildings comprising 750,000 square feet.

The two partners also purchased 17 acres of industrial land at 5179 North Service Rd. in Burlington for $44.075 million in February.

They’re working through the site plan application approval process and want to build two industrial buildings of 131,000 and 147,000 square feet to target mid-bay users.

Source Real Estate News EXchange. Click here to read a full story

Mississauga Mall For Sale In Emerging Development Corridor

A Mississauga property which has housed a community shopping centre for over a half century is for sale and could be destined to become the site of a multi-tower, mixed-use redevelopment.

High Point Mall sits on a 4.41-acre property at 3415 and 3461 Dixie Rd. at the corner of Bloor Street.

Institutional Property Advisors, a division of Marcus & Millichap Real Estate Investment Services Canada Inc., is representing the owner. It is being sold by the two families who developed it in the late 1960s.

“It’s an inter-generational disposition,” Institutional Property Advisors senior managing director Scott Chandler told RENX. “The original developers have passed on and their children are selling.”

“High Point Mall was built by immigrants who arrived in Canada without family, language or money,” said a statement from one of the unnamed owners, which was emailed to RENX via Chandler and IPA. “They did have tremendous energy, though, and hoped to become worthy Canadians who would contribute to society.

“The centrally located plaza and office building have morphed over the years, becoming the community hangout for the many demographics that make up Toronto.”

The statement concluded with: “Although the property is likely a development site now, it is our hope that in the future this location will again become a central community hub for the many and diverse peoples who live in the neighbourhood.”

High Point Mall status, future potential

There are 76,555 square feet of existing retail and office space at High Point Mall generating net operating income of $1.02 million annually. The property is 88 per cent occupied.

Grant’s Foodmart, a local grocer, accounts for 30 per cent of the total space and one-third of the current rent. Other retail occupies 37 per cent of the space, an office building comprises 20 per cent and mall office space accounts for 13 per cent. The average remaining lease term is more than three years.

“It has holding income, which is nice,” said Chandler. “You could continue to operate it as a shopping centre and office building complex for a long time while you’re entitling it.”

An initial planning review by Bousfields Inc. estimates 794,000 square feet of gross floor area could be approved in the designated mixed-use location, including 755,000 square feet of residential space.

The proposed concept plan includes five buildings, ranging in height from six to 25 storeys, including 876 residential units. It also includes a 0.59-acre public park and a new public road connecting Dixie Road to Williamsport Drive.

All but 7,719 square feet of the existing tenant spaces have demolition clauses in place, which would facilitate redevelopment.

High Point Mall’s location in East Mississauga borders Etobicoke in the Applewood neighbourhood, an established and amenities-rich area of schools, golf courses, parks and recreation trails.

It’s about a 10-minute drive from CF Sherway Gardens and Square One Shopping Centre.

The property isn’t far from the Dixie or Kipling GO Transit stations.

Chandler expects plenty of interest in the property from private, institutional and publicly traded developers. The bid date deadline is 3 p.m. on May 31.

Mississauga high-rise development

There were more than 3,900 high-rise unit sales in Mississauga in 2021, a 43 per cent increase from 2020. The average sale price per square foot has more than doubled since 2015 and reached a record $1,125 in February.

“We’re starting to see a natural expansion of the core market to include Mississauga and other 905 regions as the GTA continues to grow,” said Chandler.

“Especially with work from home, it’s becoming a very viable market to locate and buy your home versus the 416, especially where there are already existing amenities and infrastructure.”

There are more than 18,000 units in active high-rise apartment development applications in Mississauga, including more than 1,300 planned rental units.

While Mississauga City Centre and the Lakeshore Road area have attracted some of this growth, it has now spread across the city, including the Dixie Road corridor.

“We sold a large parcel at Dixie and Derry last year,” said Chandler. “Dixie Outlet Mall has been going through a lot of entitlement to the south of this property.

“It’s a nice central corridor where we see intensification starting to happen.”

Source Real Estate News EXchange. Click here to read a full story

Vaughan Ind. Building Becomes Coveted Life Sciences Space

Life sciences space is hard to come by in the Greater Toronto Area (GTA), but a newly renovated 25,000-square-foot building is now available to lease in Vaughan.

The former manufacturing and warehousing building at 196 Citation Dr. is near the intersection of Langstaff Road and Dufferin Street, not far from major highways, the Toronto Transit Commission Vaughan Metropolitan Centre subway station, and dining, shopping and leisure amenities.

It has been retrofitted with about $10 million in specialized improvements since last year by its longtime private owner in order to become a 22,000-square-foot facility that meets European Union good manufacturing practice standards. It also includes 3,000 square feet of office space.

“This is a 25,000-square-foot, ready-to-go, brand new life science lab building in a market where there isn’t a single comparable,” Colliers senior vice-president Matthew Johnson, who’s leading the team marketing the property, told RENX.

Leasing interest is picking up

While the owner is looking to lease the property, Johnson said it could be made available for sale if the right offer comes along. There has been strong interest since the property started being marketed late last year, Johnson added.

Renovations have been ongoing during that time and are nearing completion. Johnson said it should be ready for occupancy on July 1.

“We’re coming out of the pandemic here and it’s been interesting in our market to watch the willingness and openness for groups to engage and go view the building,” Johnson said of marketing the property. “One of the realities of the marketplace that we’re talking about is many of the executives and decision-makers related to buildings of this nature are not in Canada.

“Over the past few months, we’ve had a bit of a build-up in demand for groups to cross the border, which is now happening. We have a group coming in from Germany in a couple of weeks. We had a group in from the U.S. a couple of weeks ago.

“Those are all groups that would have been here previously had it not been for border restrictions.”

Life sciences activity in the area

Johnson said there’s pharmaceutical and technology business activity in and around Vaughan. LEO Pharma, which employs 130 people, moved its Canadian office to Steeles Avenue East on Feb. 1. Apotex’s global head office is just south of Vaughan, as is Sanofi Canada’s large and growing campus.

The 196 Citation Dr. building is also in relatively close proximity to York University.

On a wider scale, the site fits in the Southern Ontario life sciences corridor that also includes Hamilton and Kitchener-Waterloo as well as the GTA — especially downtown Toronto’s Discovery District and “Pill Hill” in Mississauga’s Meadowvale area.

The corridor contains the largest life sciences community in Canada and one of the largest clusters of biotech, medtech, health tech and life sciences companies in North America.

According to Toronto Global, the city has more than 11,000 researchers and technicians working at 37 research institutes, nine teaching hospitals and the University of Toronto’s Faculty of Medicine.

Life sciences space is scarce

One of the reasons why life sciences space is so scarce in the GTA is that, at least until the pandemic, it had an extremely low office vacancy rate. Landlords didn’t feel obligated to build or retrofit more expensive specialized lab space if they knew they could easily lease to more traditional office tenants.

“Wet lab inventory in this market is ridiculously low, frankly, in comparison to major markets around the world,” said Johnson, who pointed out that Boston already has significantly more life sciences space than Toronto and has more under development.

There’s lots of talent available now, and more coming from universities and immigration, and venture capital funding from Canadian and American sources is on the rise. Government funding is also increasing in the life sciences sector. It’s just a matter of finding real estate for these people to work at and for the money to be invested in.

Toronto has about 15 million square feet of life sciences space, according to Johnson, and he said about 40 per cent of that is user-owned. User-owners represent 15 to 25 per cent of the market in large life sciences hubs like Boston and San Francisco, Johnson pointed out.

“They have more inventory, but also more of it available.”

New Toronto life sciences facilities coming

Sanofi and the federal and provincial governments announced in March 2021 that a $925-million investment would be made in a vaccination manufacturing facility at its North York site. The new facility is expected to create more than 1,200 jobs and be up and running in 2027.

The University of Toronto’s Schwartz Reisman Innovation Centre is under construction in the Discovery District. When completed it will provide a 12-storey, 250,000-square-foot building that will focus on artificial intelligence and innovation and a 20-storey, 500,000-square-foot tower that will provide space for biomedical innovation.

A KingSett Capital-owned, 20-storey, 1.22-million-square-foot building at 700 University Ave. in the Discovery District will add four storeys dedicated to high-performance life sciences research space that will encompass 187,000 square feet.

“There are a ton of groups, local and non-local, that are looking to invest, develop, retrofit or otherwise create space for wet lab use in the region right now,” said Johnson, who expects announcements to be made in the coming months.

Source Real Estate News EXchange. Click here to read a full story

The Well Is Taking Shape, And Leasing-Up Retail Tenants

Construction and leasing are both progressing well at The Well, a 7.8-acre mixed-use residential, office and retail site which is one of the most prominent ongoing developments in downtown Toronto.

When completed next spring after a construction period that began in 2017, The Well will provide 1.5 million square feet of residential space with approximately 1,700 condominium and purpose-built rental units, 1.2 million square feet of office space, and 320,000 square feet of retail space in seven mixed-use towers and mid-rise buildings, as well as park and public spaces.

RioCan REIT acquired the site between Front Street West and Wellington Street west of Spadina Avenue in 2012, along with Allied Properties REIT and DiamondCorp (which sold its 20 per cent interest to its two partners in 2017). Along with more recent partners, Tridel and Woodbourne Capital Management, the development is well underway and journalists were offered guided tours on May 6.

Major retail leasing announcements were made the same day.

Retail leasing moving forward at The Well

The Well’s retail space is approximately 79 per cent leased, or with tenants in advanced stages of negotiation.

“You can’t really do retail leasing three or four years in advance, but retail leasing is now picking up and we’re really excited about that,” RioCan chief investment officer Andrew Duncan said.

“Tenants we’ve been talking to have seen the project for what the value proposition will be in Toronto, and we’ve been finalizing those deals without issue,” RioCan vice-president of leasing Ashtar Zubair added. “This is not a mall.

“Our intent here, with regards to the merchandising, is to curate to the customers that we consider our residents. There will be 11,000 people living and working here, and we know the services and needs they need.

“We’re not going to go deep on one specific category. We want to curate the centre to effectively be a streetfront controlled by one landlord, so we’ll be able to interchange as needs evolve for customers.”

Arcadia Earth, HealthOne and more

One new tenant at The Well will be Arcadia Earth, an immersive exhibition powered by augmented reality that takes entrants on a multi-sensory journey through Planet Earth by visiting underwater worlds, mystical forests and underground caves. Arcadia Earth is in New York City and Las Vegas and The Well will be the first Canadian location.

HealthOne is a medical and wellness centre that will occupy 15,000 square feet at The Well and offer: family medicine; rehabilitation services such as physiotherapy and osteopathy; dental services; optometry and optical services; mental health support with virtual and in-person psychotherapy; wellness services such as naturopathy; and a full-service skin clinic.

Other finalized retail tenants at The Well include Sweat and Tonic, Oliver & Bonacini, Shoppers Drug Mart, BMO, Scotiabank, Quantum Coffee, Tokyo Smoke, Bailey Nelson, Bone & Biscuit, dentalcorp, Fix Coffee + Bikes, Prince Street Pizza, Lumea Laser Clinic, Maverick, The Village Collective and Vie by Lê.

The site tour included a walk under a 35,000-square-foot canopy comprised of almost 2,000 panes of glass that will provide both shelter from the elements and natural light to an unenclosed retail area. There will be landscaping on all floors under the canopy, bridges will allow people to cross from side to side on the upper levels of the retail component, and open-air alleys will connect the north and south ends of The Well.

“We believe the site is a really good opportunity to transition from Front all the way through to King West,” Duncan said.

Wellington Market at The Well

The Well will also feature Wellington Market, a 70,000-square-foot, fully liquor-licensed food and drink market with indoor and outdoor seating for 900 people. The 4,200-person space will offer local produce, prepared food kiosks, packaged food vendors, artisanal fare and casual dining options day and night. It will include 25,000 square feet of gross leasable area and house approximately 60 vendors.

Confirmed tenants include La Cubana, Hooky’s Fish and Chips, Ren Sushi, Chun Yang Tea, Lobster Burger Bar, Rosie’s Burgers, Isabella’s and Sweetie Pie.

There will be “activation space” embedded into the market to allow for events, concerts, comedy shows and other activities intended to draw people to the location.

Other restaurant concepts at The Well will include an upscale French bistro and a two-level British-inspired tavern.

Parking for 744 vehicles, shipping and loading functions will be below ground, where there will also be storage space and full-service catering operations powered by an Oliver & Bonacini commissary and ghost kitchen.

Office component is progressing well

The tour went up to the 32nd floor of the RioCan and Allied-developed primary office tower that, while still not completed, has begun occupancy. Office space at The Well is 90 per cent leased, with major tenants including Shopify, Index Exchange, Spaces, BDP Quadrangle, Financeit and Konrad.

Almost one million square feet of space is in the primary office tower, with the remainder spread over the lower levels of three other mixed-use buildings.

“We started well before COVID and were lucky enough to be one of the projects that could work all of the way through COVID because we have residential components all the way through,” Duncan said. “We did a lot of good pre-leasing on the office side pre-COVID and that was maintained throughout COVID.”

Office floor plate sizes grow smaller the higher you go in the tower, while an offset elevator core opens up the floor plates.

All heating, ventilation, air conditioning and electrical systems are located under the floors. Heating and cooling throughout the development will be taken care of through a partnership with Enwave’s renewable energy system using water from deep in Lake Ontario.

The Well’s system includes a 7.6-million-litre water tank that acts as a thermal battery to create and store energy at night, leveraging off-peak costs. The green and clean technology will also supply a high-efficiency hot water network to deliver efficient, resilient heating and cooling to The Well and 13 million square feet of space on nearby King Street West.

The tower, which is targeting LEED Platinum certification, will be topped by a 36th-floor restaurant offering 360-degree city views and a mix of seating options and guest experiences, including a luxurious dining room, bar, sushi counter and chef’s rail.

Economic impact and residential components

An economic impact report on The Well by Altus Group concluded annual benefits from the ongoing operation of its commercial and retail spaces, and the management of the property, will generate more than 23,000 person-years of employment and more than $300 million in income by households.

The estimated annual economic benefit from the ongoing operations of The Well will add up to approximately $939 million for Toronto. Once complete, The Well will offer space for 5,000 office jobs, 1,200 retail jobs, and 1,700 residences split between three condos and three purpose-built rental apartments.

RioCan Living and Woodbourne’s 46-storey FourFifty The Well will have 592 residential rental suites. Woodbourne also owns two mid-rise rental apartment buildings on Wellington Street that will have more than 300 units.

Ninety per cent of The Well’s condo component, representing more than 650 units, has been sold by Tridel.

Tridel at The Well – Signature Series is a luxury 14-storey, 98-unit building fronting Wellington Street. Prices started at $2.1 million and suite sizes range from 1,468 to 3,259 square feet.

Tridel at The Well – Classic Series I is a 38-storey condo with limited suite availability, while Classic Series II has 258 suites of up to 1,800 square feet.

Source Real Estate News EXchange. Click here to read a full story

Blackstone Keeps Focus On Canada: To Open Toronto Office

As Blackstone continues to increase its investments in Canada, the world’s largest real estate owner and operator has announced it will open an office in Toronto and appointed Janice Lin to head its real estate operations in the country.

The New York-based global investor says its current portfolio in Canada comprises about $14 billion in assets (all figures Cdn), or 429 properties, with about 75 per cent of that value in the logistics sector.

Blackstone has been diversifying its Canadian holdings during the past couple of years, acquiring several major office properties in the country’s three largest urban centres, and entering partnerships in both the multifamily and seniors living sectors.

“We are excited to officially open a real estate office in Canada and welcome Janice to lead our real estate business in the country,” said Nadeem Meghji, Blackstone’s head of real estate, Americas, in the announcement Monday morning.

“We are long-term believers in the strength of the Canadian economy, and we look forward to leveraging her expertise and on-the-ground views to help us expand our presence in the Canadian real estate market.”

Janice Lin’s background

In Lin, the company brings onboard an executive with experience in several Canadian commercial real estate sectors. Most recently, she was chief investment officer at Revera, an international retirement living operator with residences throughout Canada, the U.S. and U.K.

“Blackstone’s long-term investment approach has enabled it to build a growing logistics, office and residential footprint across Toronto, Montreal and Vancouver. Canada’s population growth is the highest among G7 nations and is nearly double that of the U.S.,” Lin said in the announcement. “I believe that will continue to create exciting opportunities in the market.

“I look forward to strengthening Blackstone’s strong presence in Canada and supporting businesses across a number of different sectors.”

Previously, she held senior investment roles at CPP Investments, another of the country’s largest real estate investors. CPP Investments, an arms-length entity which is charged with stewarding the real estate holdings of Canada’s government-operated pension plan, is a global investor across multiple CRE sectors.

Lin holds a bachelor of science in economics from the Wharton School at the University of Pennsylvania and an MBA from Harvard Business School.

A spokesperson for Blackstone told RENX in an email exchange the company has not announced any other details of the office, or how many people it will be hiring, at this point. The firm’s operations across Canada currently employ about 3,550.

Blackstone’s Canadian investments

One of Blackstone’s largest investment in the country came when it partnered with Ivanhoé Cambridge (Blackstone owns a 62 per cent interest) to acquire the then-Pure Industrial REIT for $3.8 billion in 2018.

Pure has been steadily growing its portfolio ever since, participating in the huge takeover of Cominar REIT last year which netted it an additional 190 industrial properties comprising 15.3 million square feet. At the time, it raised Pure’s portfolio to a total of over 41 million square feet.

Toronto-based Pure also created offices in Montreal and Quebec City as part of that transaction.

On the office front, Blackstone and Hudson Pacific Properties acquired the billion-dollar Bentall Centre complex in Vancouver in 2019, and are now developing an additional 450,000-square-foot mass timber tower at the property.

Blackstone partnered with Kevric to acquire the three-building, 260,000-square-foot Atlantic Complex in Toronto’s Liberty Village for $240-million in late 2021, and it has agreed to acquire the Air Canada Tower and 1100 Atwater class-A office buildings in Montreal for $231 million. Together, they comprise 413,000 square feet of space.

In a joint venture with Quebec-based seniors housing provider Group Selection, Blackstone acquire 13 seniors living properties across the province.

It has also invested in Toronto-based Tricon Residential Inc., which owns and manages over 30,000 single-family rental homes and multifamily units in the U.S. and Canada. They have 11 multifamily rental projects under development in Canada.

About Blackstone

Blackstone’s real estate business was founded in 1991. Globally, it has $385 billion of investor capital under management.

Its opportunistic funds seek to acquire under-managed, well-located assets across the world. Blackstone’s Core+ business invests in substantially stabilized real estate assets globally, through both institutional strategies and strategies tailored for income-focused individual investors including Blackstone Real Estate Income Trust, Inc., a U.S. non-listed REIT, and Blackstone’s European yield-oriented strategy.

Blackstone Real Estate also operates a global real estate debt business, providing comprehensive financing solutions across the capital structure and risk spectrum, including management of Blackstone Mortgage Trust.

Source Real Estate News EXchange. Click here to read a full story

Brookfield Looks to Coordinate Hudson’s Bay Centre Renos with Bloor-Yonge Station Improvements

Brookfield Property Partners has submitted a Site Plan Approval application to the City of Toronto for the proposed renovation and redesign of the retail podium of the Hudson’s Bay Centre complex at 2 Bloor Street East. The renovation of the retail podium would convert the current department store into integrated office and retail space in the Brookfield-owned podium portion of the block. (The eastern half of the building is owned by Larco Investments, and was recently marked by the renovations to the W Hotel, soon to open.)

The Brookfield-owned part of the complex includes the 2 Bloor Street East 36-storey office building, and the west half of the Hudson’s Bay store and retail complex. Larco owns the new 9-storey W Hotel, the 35-storey Bloor-Yonge Residences above it, and the base of the 28-storey The Residences of 8 Park Road (the condo is under separate ownership), and a 6-storey above-grade parking structure.

According to planners at Urban Strategies Inc., since the block is essentially constructed as one building, planning restrictions have been administered for the block as a whole.

The retail podium of Brookfield’s portion of the complex currently features a portion of the larger Hudson’s Bay store (which will be shuttering in the coming weeks) along with a collection of smaller retail stores on the concourse level that connects to the Bloor-Yonge Station entrance of the TTC.

Designed by KPMB Architects, Brookfield’s proposed redevelopment will be a renovation and redesign of the existing podium for an integrated office and retail development. Updated flagship retail space is proposed at-grade and on the concourse level, along with new office space above the retail.

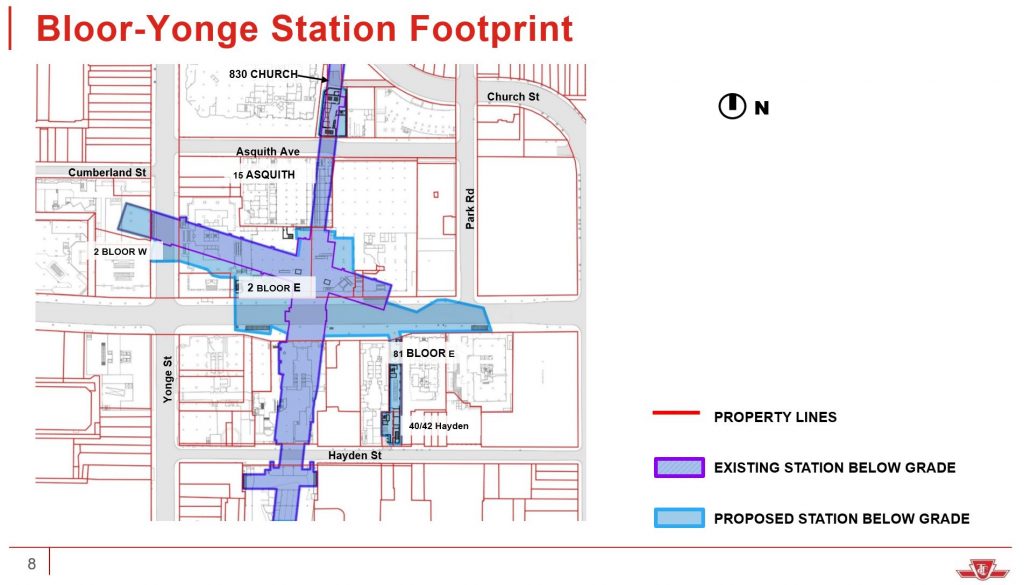

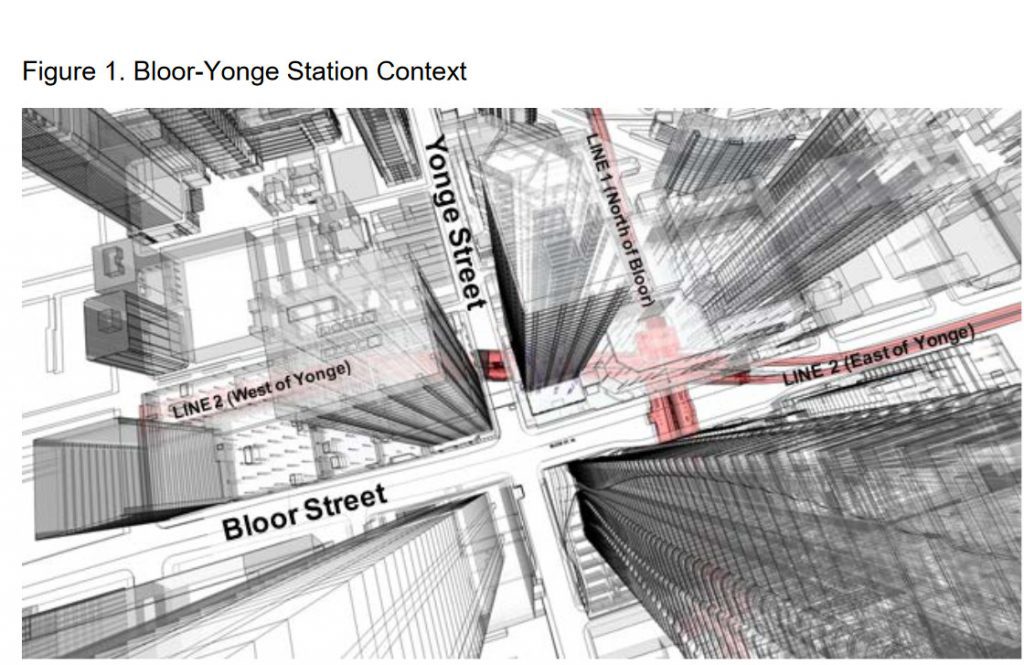

The proposed renovation is located above and beside Bloor-Yonge subway station, which the TTC has plans for. According to the TTC, Bloor-Yonge Station will be, “undergoing a design retrofit and significant expansion to meet both current and future ridership demand.” Proposed to the City in 2020, which we covered at the time, the Bloor-Yonge Station project includes the construction of a new, second platform to enhance capacity for eastbound passengers on Line 2, as well as the reconfiguration of the original westbound platform to enhance the capacity for westbound passengers.

An expansion of Line 1 northbound and southbound platforms is also in the plans, followed by enhancements to the station as a whole. Specifically, some of these enhancements would include a new barrier-free entrance to the station, a new exit to Bloor Street, new escalators, elevators, and stairs, new public art and station finishes, and new fan plants to improve ventilation.

Brookfield’s submission to the City indicates, however, some frustration with attempts to coordinate the redevelopment. A document written by Brookfield’s lawyers states that Brookfield has spent a significant amount of time and effort to work with the TTC and CreateTO to ensure that the objectives of all players at the site are met, as an important part of the station’s redevelopment is hinged on the need to remove a chiller plant — which cools the air of the complex— from its present location on Brookfield’s property, and to reconstruct it elsewhere to make way for the TTC Subway platform expansion.

Engineers have since advised both parties that the reconstructed chiller plant would be best situated on Brookfield’s property at the northeast corner of Yonge and Bloor – which would eliminate the possibility of the property being redeveloped. In response to this, in July of 2021, Brookfield offered to accommodate the chiller plant on its property, if the City and the TTC can agree on the redevelopment that the company is currently proposing. CreateTO and the TTC have not responded to the offer yet, according to Brookfield.

Brookfield’s lawyers detail that they provided the TTC and the City with a proposal that they believe accomplishes the TTC’s platform expansion objectives, while respecting Brookfield’s long term interests and re-development objectives. With concern over TTC’s timelines, Brookfield called a meeting with representatives of the City in December, 2021 to outline the details of the proposal in an attempt to get a response, and to try to obtain clarity on TTC’s land requirements.

Brookfield was promised a quick answer at the end of December 2021, but has still heard nothing from either the City or the TTC. Brookfield says its plans for its renovation of the Hudson’s Bay Podium must be informed by comprehensive knowledge of all of TTC’s project requirements and the construction schedule, and that has become an issue here. Now a potential expropriation looms.

Brookfield’s lawyers write, “We ask that the proposed expropriation not be approved at this time, and that staff be directed to actively engage Brookfield with a view to reaching a fair and reasonable strategy for the project that respects the needs of the City and TTC, but also those of Brookfield, other stakeholders of the property and their tenants.”

In order to achieve this, the lawyers are requesting that staff hold weekly meetings with Brookfield, to make sure that the issue is sorted out in a way that best suits all parties.

More information on the development will come soon, but in the meantime, you can learn more from our Database file for the project, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread, or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

The City Of Toronto Has Received A Site Plan Approval (SPA) Application for Richview Square

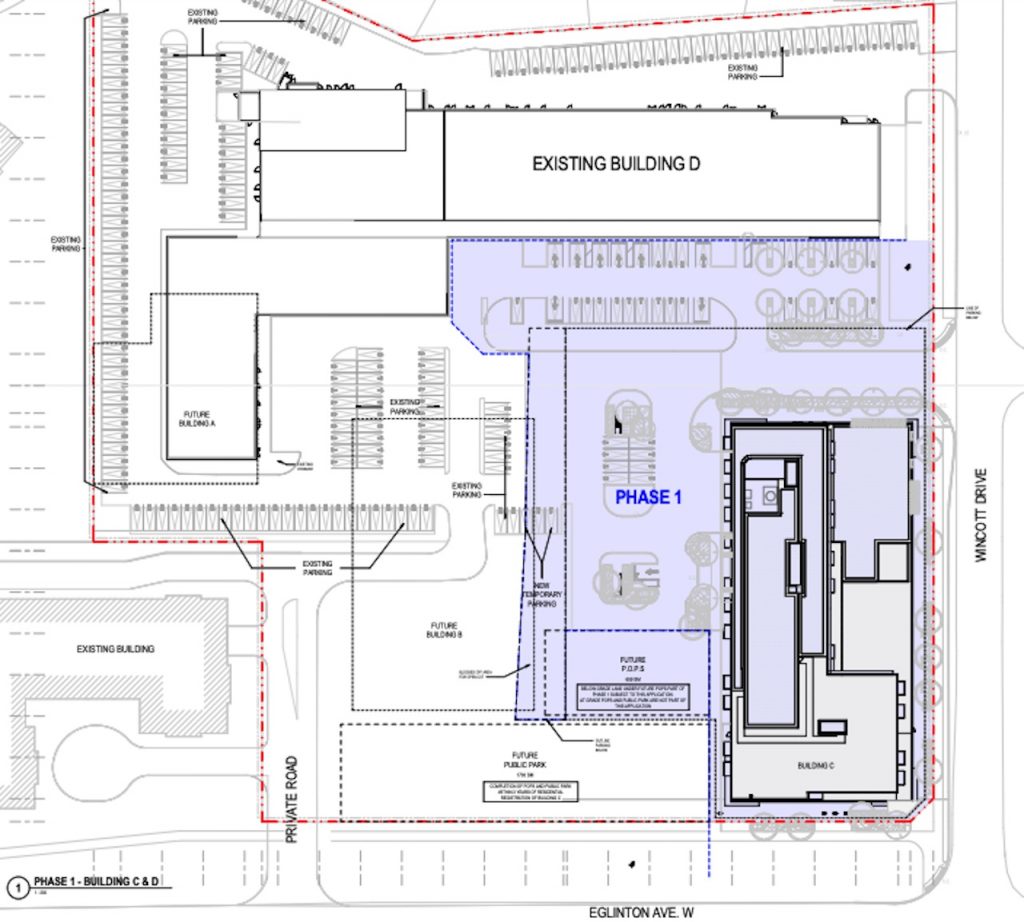

The submission has been a long time coming, as often happens in the development world. Back in April of 2018, a rezoning application was filed by Trinity Development and CreateTO to permit the redevelopment of the site located at the northwest corner of Wincott Drive and Eglinton Avenue West, between Kipling Avenue and Islington Avenue in Etobicoke. The redevelopment was proposed to include three new mixed-use buildings in addition to the partial retention and renovation of an existing one-storey commercial plaza.

Following the initial submission, resubmissions of revised materials in support of the rezoning application were filed a total of five separate times, changes based on comments received from various municipal departments, outside agencies, and the community. The Zoning By-law Amendment was finally adopted in July of last year. Designed by B+H Architects, the three new towers were originally proposed at heights of 22, 22, and 18 storeys. Now, they have been approved at reduced heights of 13, 13 and 12 storeys tall.

The existing plaza building will be partially retained and renovated, with its southwesterly wing being removed, an 8.6 metre-wide addition to be made to the east side of the building, and enhancements planned to the building’s facade.

Overall, the buildings will offer a total gross floor area of 65,237m², consisting of 53,723m² of residential space, 11,038m² of non-residential space, and 465m² of community agency space. The development will have 587 residential units, 54 of which are to be purpose-built affordable rentals.

In addition, the development is to be accompanied by a new 1,700m² public park at the southwest corner of the site fronting Eglinton Avenue West, as well as a 659m² POPS (Privately-Owned Publicly accessible Space) between two of the new towers.

Trinity is proposing to redevelop the site in three phases. The recently submitted SPA asks the City to facilitate the development of Phase One and Phase Two.

Phase One consists of the 12-storey tower at the southeast corner of the site, fronting both Wincott and Eglinton. Phase Two would then include the partial demolition and renovation of the existing plaza building.

The Phase One Building will offer 281 residential units. The building will have a total height of 42.5 metres to the top of the roof, and a total gross floor area of approximately 24,697m², including 22,519m² of residential GFA and 2,179m² of at-grade retail GFA.

Of the units, 144 (51%) will consist of larger units of two bedrooms or greater, including 97 (35%) two-bedroom units and 47 (17%) three-bedroom units. The building will also have approximately 677m² of indoor amenity space, located on Level 2 and the mechanical level, in addition to 1,179m² of outdoor amenity space comprised of rooftop amenity terraces accessible on Level 2 and the mechanical level.

The building will have a total of 369 parking spaces primarily located below grade, consisting of 267 resident spaces, 46 visitor spaces, and 56 commercial spaces. Spaces for 271 bicycles will also be provided.

Phase Two consists of the retained portion of the existing commercial strip plaza which will continue to be used for retail commercial purposes. As a result of the alterations to the building, its gross floor area will decrease from the current 6,255m² to approximately 3,577m², while the front facade is to be enhanced with a series of brick, metal, and glass materials in order to modernize its look and match the general aesthetic of the neighbouring tower of Phase One.

An application for Site Plan Approval is to be filed at a later date to accommodate Phase Three, which will consist of the two 13-storey towers as well as the proposed public park and POPS along the Eglinton Avenue frontage.

More information on the development will come soon, but in the meantime, you can learn more from our Database file for the project, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread, or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

Q1 2022: Investor Demand Continues To Be Strong With Heightened Investor Scrutiny

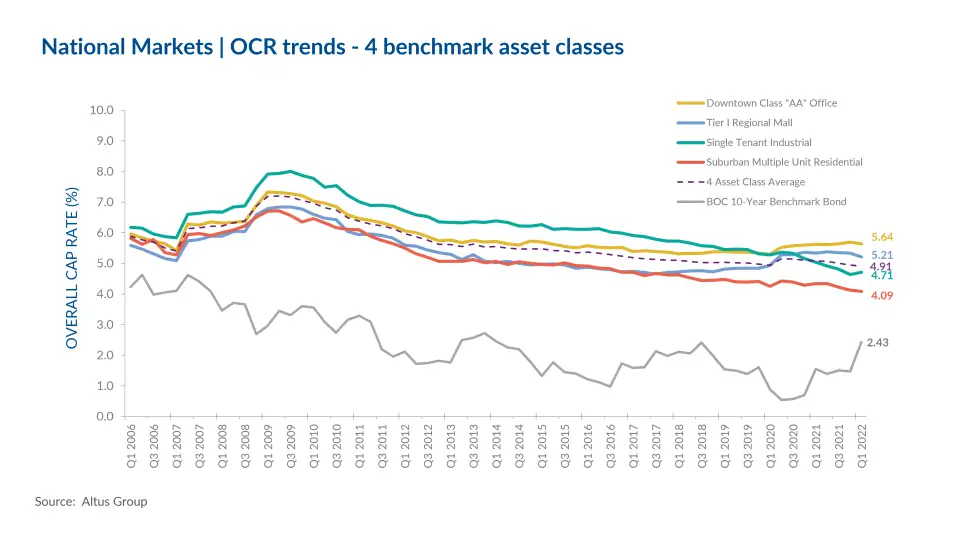

The latest results from Altus Group’s Canadian Investment Trends Survey (ITS) for the four benchmark asset classes show that the Overall Capitalization Rates (OCR) dropped to 4.91% in Q1 2022 compared to the previous quarter which was at 4.94%, and from 5.08% in Q1 2021, with cap rates remaining mostly steady. With the Omicron Variant and a lockdown in the second part of Q4 2021 slowing activity, the first quarter of 2022 has seen boosted activity levels.

Employment in February climbed by 337,000, more than compensating the losses seen driven by the tighter public health measures in the fourth quarter of 2021. This addition in jobs has dropped the unemployment rate to 5.5%, beating pre-pandemic levels for the first time since February 2020. With new jobs being created, the number of vacancies can also be seen dropping. According to Statistics Canada, job vacancies were down 5.4% from the beginning of December 2021, but up 62% as compared to the first quarter of 2020, prior to the onset of the pandemic. The sectors hardest hit in terms of job vacancy declines were the food and accommodation services sector and the arts, entertainment, and recreation sectors. Meanwhile, the construction sector and professional, scientific, and technical services sectors noted increases in employment. With vacancies dropping in the construction sector, investment in non-residential building construction continues to rise, up by 1.5% in January 2022 from the previous month reaching the $5 billion dollar mark for the first time since June 2020. The drop in vacancies along with the increase in non-residential building investment is reflective of the increase in activity in the commercial sector. After a tough year riddled with volatility, lockdown measures, and labor shortages, 2022 has begun with recovery on the horizon, and expected to continue the momentum throughout the year.

The Bank of Canada bond rate as of March 2022 was reported to be 2.43%, continuing its upwards trend from the 147-bps recorded in the fourth quarter of 2021. As the Bank of Canada continues to focus on inflationary control measures, the average internal rates of return were seen increasing the most in the Downtown Class “AA” Office asset class and dropping the most in the Suburban Multiple Unit Residential asset class. Overall, the Internal Rate of Return was 616-bps, rising from the 478-bps seen in the fourth quarter of 2021.

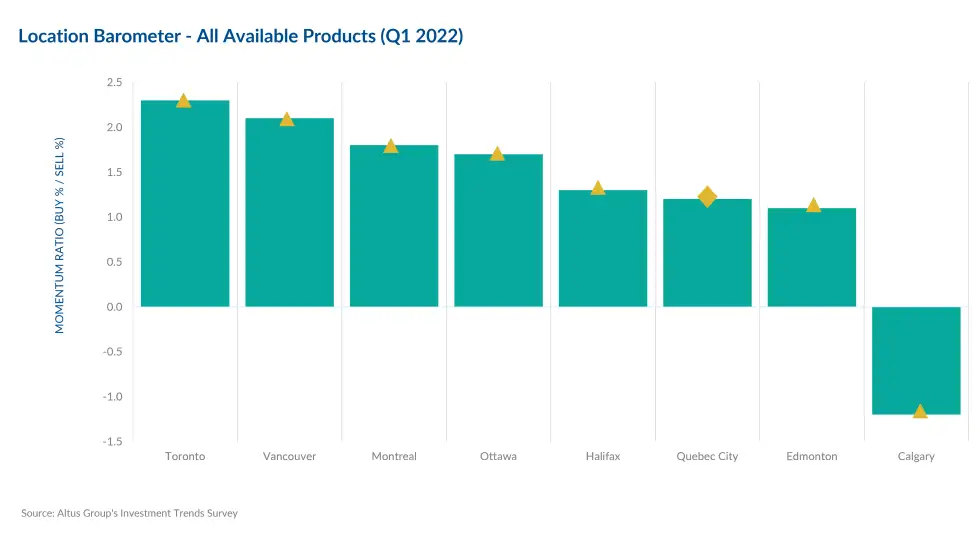

The Canadian commercial real estate space has faced many challenges as the pandemic has highlighted vulnerabilities and catalysed shifts in demand for typically high yielding assets such as office and retail. Compared to the previous quarters, the location barometer for available products in the third quarter showed an increase in all markets except for Calgary, which reported a downturn. According to Altus Group’s Investment Trends Survey for Q1 2022, the top three markets preferred by investors, Toronto, Vancouver, and Montreal, respectively (Figure 2), were also the most active in investment volume as of the 2021-year end. Still, many other regions have remained resilient and managed to grow in the first quarter of 2022, primarily due to pent up demand and lack of investment product amongst other macroeconomic challenges.

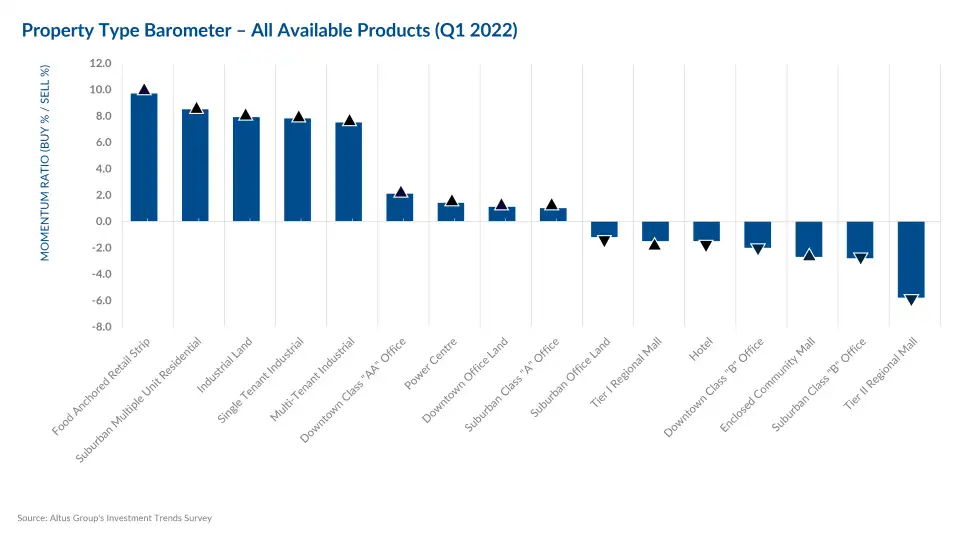

The top assets preferred by investors this quarter were Food Anchored Retail Strip, Suburban Multiple Unit Residential, and Industrial Land, with Suburban Multiple Unit Residential assets reporting the largest upswing in momentum ratio (Figure 3). These products have generated great investor interest due to their essential nature, and flexibility for redevelopment. These characteristics are increasingly vital to investors due to the rapid shift in consumer preferences as we weather the loosening of restrictions and sixth wave. While activity in the first quarter of 2022 reported an uptick with some deals from the previous year going through, and renewed optimism catalyzed by loosening restrictions, a note of cautiousness is retained in the market with persistent inflation and the Bank of Canada raising interest rates within the quarter with highly likely more increases throughout the year.

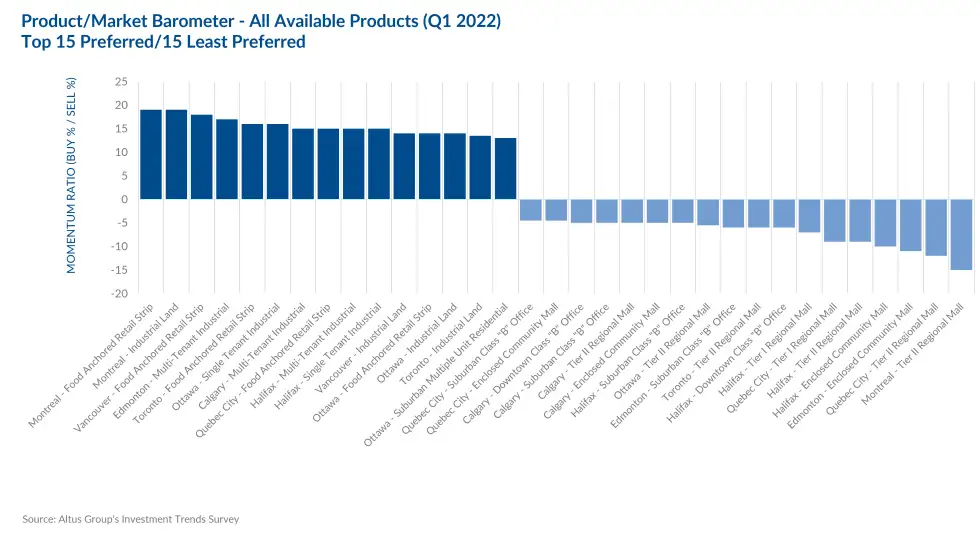

The assets with an increase in investor momentum were also some of the less preferred products, with the least preferred product this quarter being Tier II Regional Malls. When looking at the Product/Market Barometer, the bottom three least preferred assets were all retail. Enclosed Community Mall in Edmonton, Tier II Regional Mall in Quebec City, and Tier II Regional Mall in Montreal were the least preferred, with Montreal Food Anchored Retail Strip and Industrial Land ranking first and second as most preferred by investors (Figure 4). Retail has continued to struggle, especially owing to the changes in public health measures, and with investors trying to figure out and meet consumer needs, assets in secondary markets with prime locations are likely to be those positioned for potential redevelopment.

While 2022 is poised for growth and recovery as the commercial real estate space stays resilient, market impacts of the current geopolitical climate, the sixth wave, and economic challenges will become slowly apparent as the year progresses.

Market highlights for the quarter include:

- The office sector has continued to face volatility as employers continue to redefine their return to office plans and better accommodate employee needs. Downtown Class “AA” Office cap rates decreased slightly from 5.69% in the previous quarter to 5.64% in the first quarter of 2021. Quarter-over-quarter, the Vancouver, Edmonton, Toronto, and Ottawa markets saw a compression in cap rates. Meanwhile, Quebec City and Halifax saw an increase, with the Calgary and Montreal markets remaining the same.

- The demand for industrial product remains strong with the cap rate for Single-Tenant Industrial product increasing slightly and going from 4.64% in the previous quarter to 4.71%. While a compression in cap rates was seen in the Vancouver and Calgary markets, they stayed the same in the Edmonton, Toronto, and Ottawa markets. Meanwhile, the Montreal, Quebec City, and Halifax markets saw an increase in cap rates.

- Tier I Regional Mall cap rates continued to compress dropping from 5.34% in Q4 of 2021 to 5.21% in Q1 of 2022. While cap rates rose stayed the same in the Toronto market, they trended downwards across all other major markets, further attesting to the recovery seen in the asset class. With malls and other retailers opening with restrictions easing has brought a fresh sense of renewed optimism to the retail sector.

- In the first quarter of 2022 cap rates for Suburban Multi-Unit Residential assets continued to compress, dropping slightly from the 4.13% seen in the previous quarter to 4.09% in Q1 2022. A compression in cap rates was seen across Edmonton, Calgary, Halifax and Quebec City, whereas an increase was seen in the Vancouver and Toronto markets. The Ottawa and Montreal markets continued to remain steady.

Source Altus Group. Click here to read a full story

Developing Workplaces Close To Condos, Residential Areas Prevents ‘Warehousing’ People

Intensification is commonly associated with the building of housing at higher densities in neighbourhoods, but intensification of office, industrial and retail space is equally important to combat sprawl, developers say.

“The key to intensification is to move from the single use for a property [such as a mall] toward integrated community building,” says Ken Greenberg, principal at Greenberg Consultants Inc.

The reimagining of downtown Brampton, Ont. – Canada’s ninth-largest city – is just one example of the urban planning trend seen across the country, says Mr. Greenberg, who is a strategic adviser to the city.

Keeping growth within existing urban boundaries delivers [a] better fiscal outcome compared to business-as-usual sprawl— Pamela Blais, principal at Metropole Consultants

The redevelopment includes the replacement of its centrepiece – the 53-year-old Shoppers World Mall – with a mixed-use neighbourhood featuring about 800,000 square feet of commercial space.

“It’s happening in a lot of places – elsewhere in Toronto, Winnipeg, Edmonton and more,” says Benjamin Shinewald, president and chief executive officer of BOMA Canada, an umbrella group for builders, owners and maintenance operators. “There is no lack of ambition to promote [intensification] in Canada’s commercial real estate community.”

The Well, a project now under construction in Toronto that spreads over 7.7 acres in the city’s King Street West neighbourhood (including the site of the former headquarters of The Globe and Mail), is another example. While much attention is being paid to the site’s 1,700 residential units, it also includes more than one million square feet of office space and 420,000 square feet of retail and food services.

According to former Toronto mayor and federal cabinet minister David Crombie, cities are recognizing the importance of finding the right mix of non-residential space – workplaces, recreation and entertainment and parks – in addition to housing.

“If you don’t build the workplaces in the areas where people live, you end up just warehousing people,” he says.

Winnipeg’s True North Square is another massive project designed to breathe life into a downtown core through intensification. Scheduled to be completed next year, the approximately $500-million project is designed as a centrepiece of a downtown entertainment district that includes the home of the National Hockey League’s Winnipeg Jets.

True North will feature four towers, with a total of one million square feet of class A office, retail, hotel and public space as well as affordable housing. The first building, opened in 2017, was the first privately constructed office building built in Winnipeg since 1990.

Edmonton’s Ice District is another hockey team-centred intensification project, in this case a $2.5-billion, 25-acre mixed-use district that includes the home of the Edmonton Oilers. The mixed-use district will also have a 50,000-square-foot public plaza, a climate-controlled winter garden, a hotel, a casino and three new office buildings, with the third one scheduled to be completed in 2025.

Commercial intensification is not a particularly new idea, Mr. Shinewald says, but it’s gaining more positive attention as planners and the public question the economics, efficiency and the lifestyles that come from urban sprawl.

“Everything old is new again. Not long ago, people lived and worked nearby because of a lack of transportation. So, everything was cheek by jowl,” he explains.

“The automobile enabled distance between work and play, but many in the new generation want density – they want to walk or cycle to work or take an efficient train. They want to meet their friends for lunch or dinner and live a vibrant urban life, 24/7.”

It’s no easy task overcoming many decades of ingrained planning ideas that encouraged sprawling development, Mr. Greenberg says. Cities like Brampton are re-examining these ideas as their populations explode and their infrastructure struggles to keep up, he explains.

He notes how Brampton, for example, is using the reconstruction of its core mall site to promote a “2040 vision to reimagine a future Brampton that grows not only in population size.”

The vision, which Mr. Greenberg collaborated on with the city, is based on Brampton growing from its current population of 600,000 to a projected one million, with the creation of 185,000 jobs that won’t necessarily require commuting.

Stopping sprawl is becoming a hot political issue in places like Ontario, where a wide coalition of planners, environmentalists, residents groups and others has been urging the provincial government to favour intensification.

So far, Premier Doug Ford has instead proposed a $10-billion highway that will cut across wilderness, wetlands and farms and the Ontario Greenbelt around Toronto.

Yet, intensification is cost-effective, says planner Pamela Blais, principal at Metropole Consultants. In early April, she published an analysis of Edmonton that shows that “keeping growth within existing urban boundaries delivers [a] better fiscal outcome compared to business-as-usual sprawl, not to mention quality-of-life benefits too.”

The analysis shows that using Edmonton’s urban land more intensely for development (including commercial properties) would allow the city to keep its property taxes 10 per cent lower by 2065 than if new builds sprawl outside the city’s boundaries, where it can’t levy taxes.

It’s better for quality of life, too, Mr. Greenberg says. Brampton, for example, “will be a neighbourhood including office, residential, a main street with local shopping and a community hub,” he explains.

“It all works together.”

Source The Globe And Mail. Click here to read a full story