UrbanToronto Pro's June Report Shows More Office Less Space

UrbanToronto Pro’s June Report Shows More Office Less Space

As inflation roared and interest rates climbed in June, many property owners were under stress. Applications for new developments, however, remained strong.

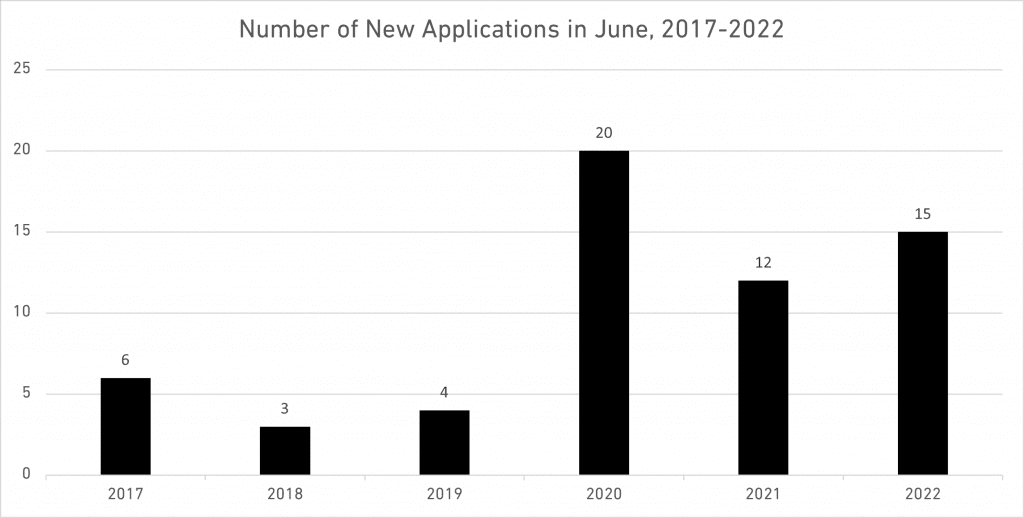

As the number of home sales tumbled in June, due to the rising costs of both inflation and interest rates, it was possible that developers would want to sit back on their proposals in order to wait out the uncertainty of the market. Yet applications for new large developments in the city of Toronto were higher in June than they were in May, and furthermore, June, 2022 applications were higher still than June, 2021.

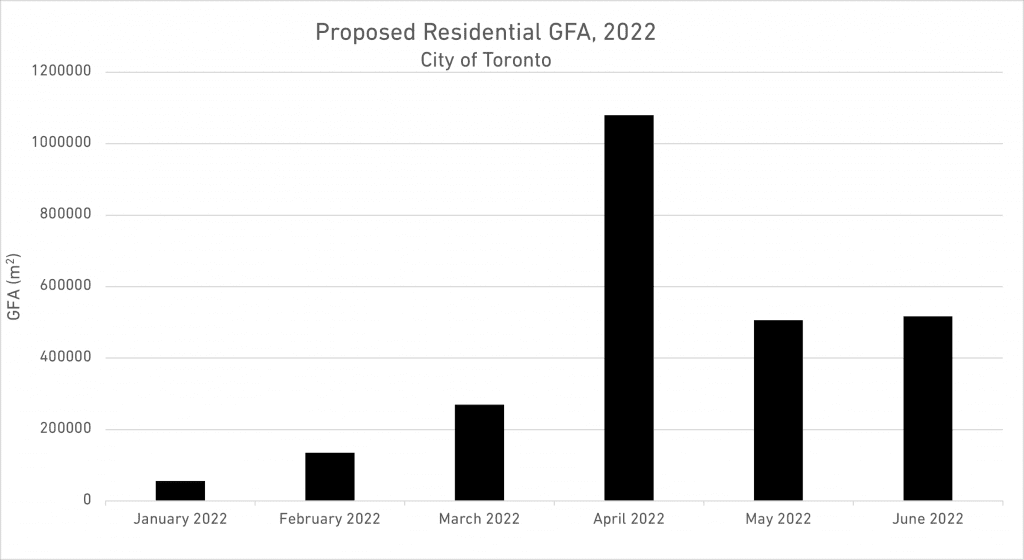

More still; along with the increase in the number of applications, the Gross Floor Area (GFA) proposed in June was higher than both the previous month and the previous year. Although this could indicate confidence in the future, this isn’t necessarily the case. Projects could still be canceled or majorly revised during the approval process. As the market is still dealing with the double-uncertainties of rising inflation and rising interest rates, it’s important to watch how project proposals evolve in the next few months.

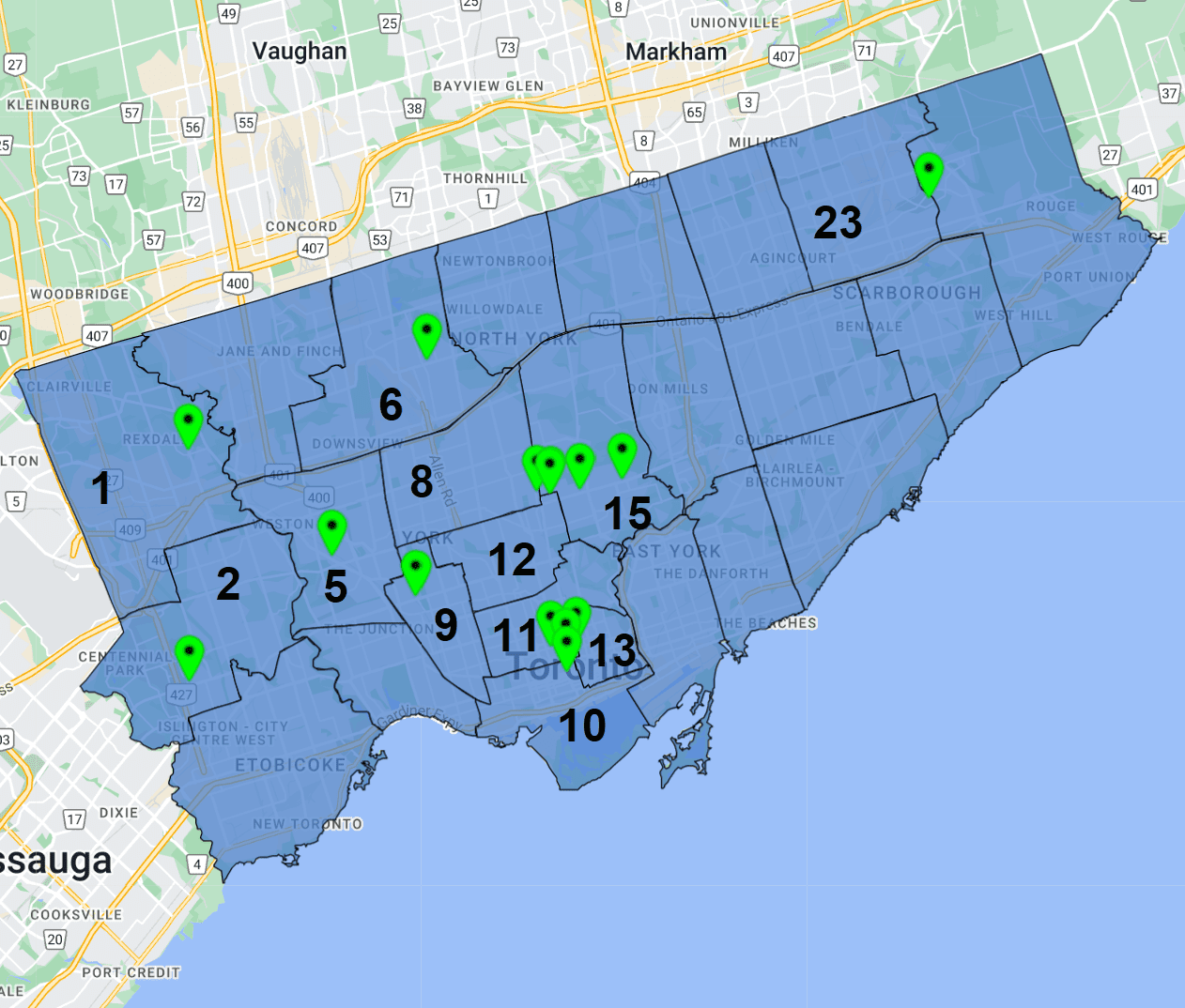

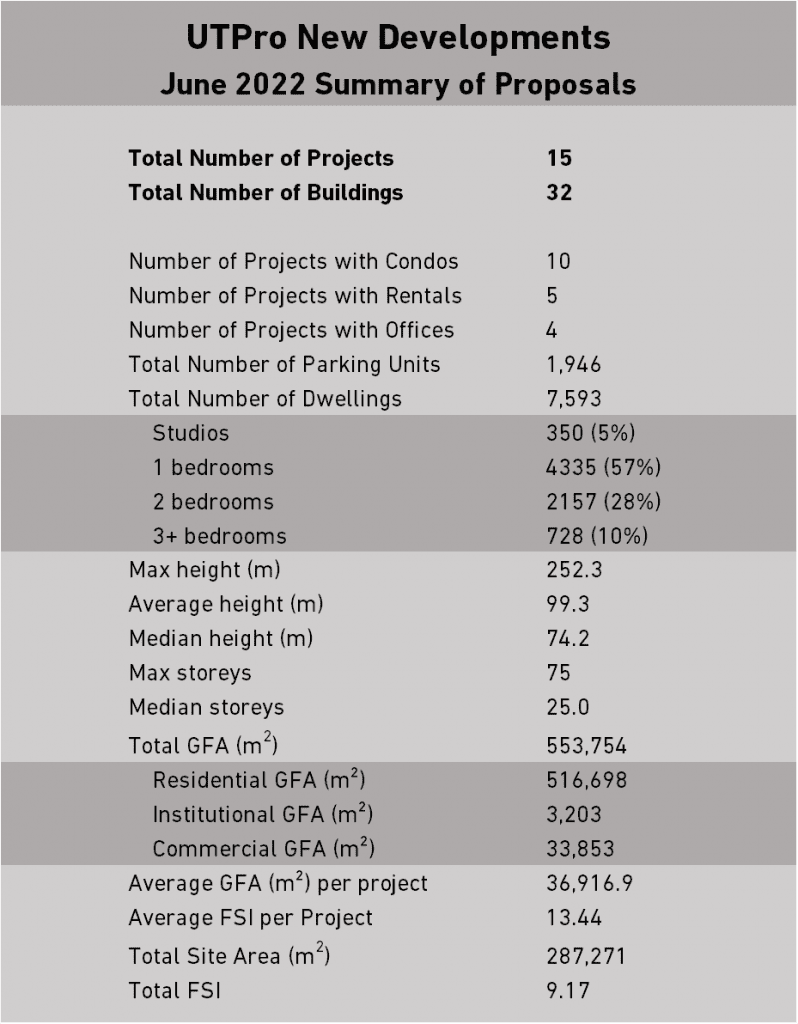

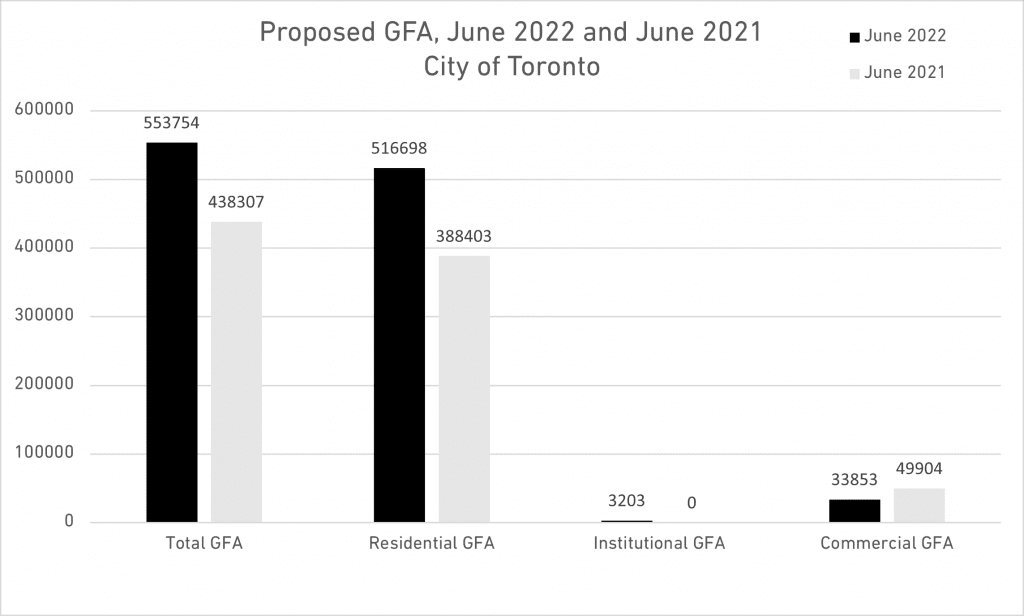

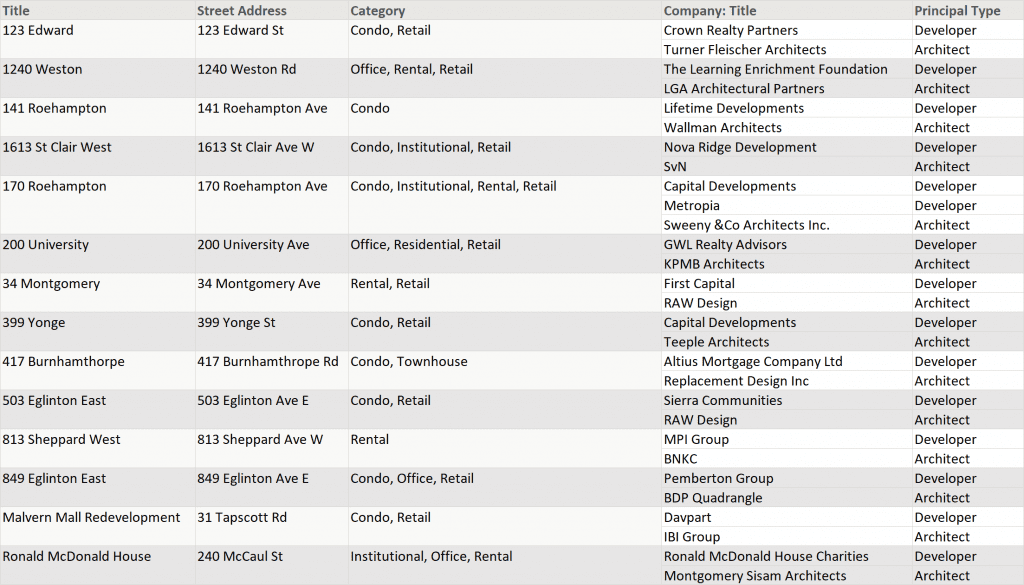

The 15 projects submitted in June were proposed across 12 Wards. The total GFA for all proposed projects is 553,754m², across a total site area of 287,271m². This implies a total Floor Space Index (FSI) of 9.17, twice the average for this year. Developers are proposing ever taller projects.

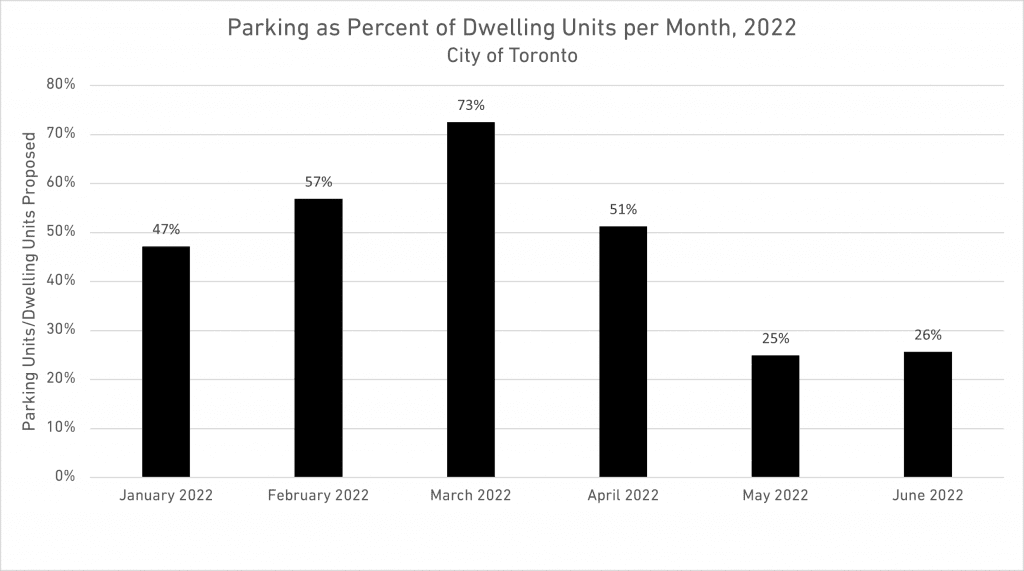

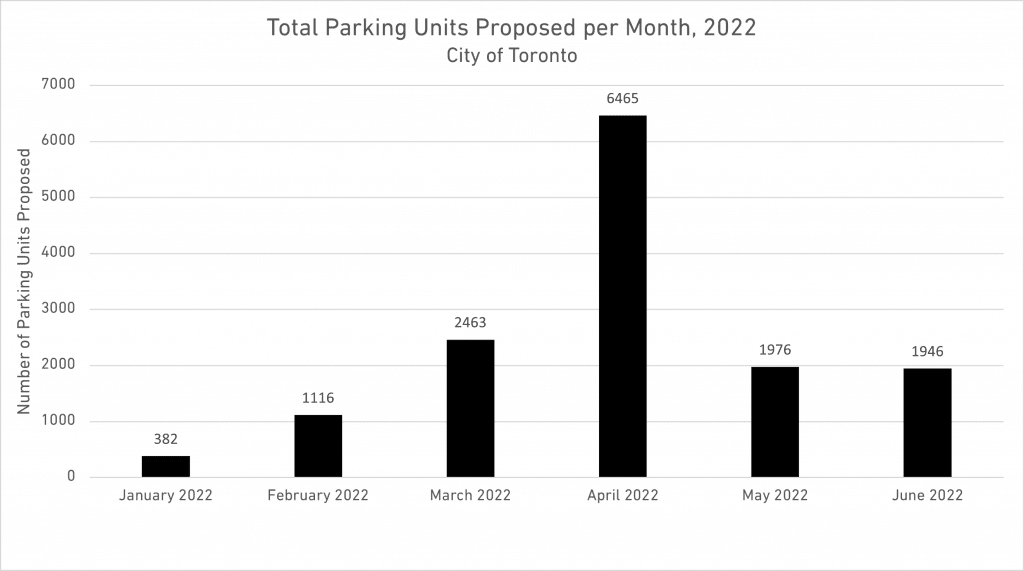

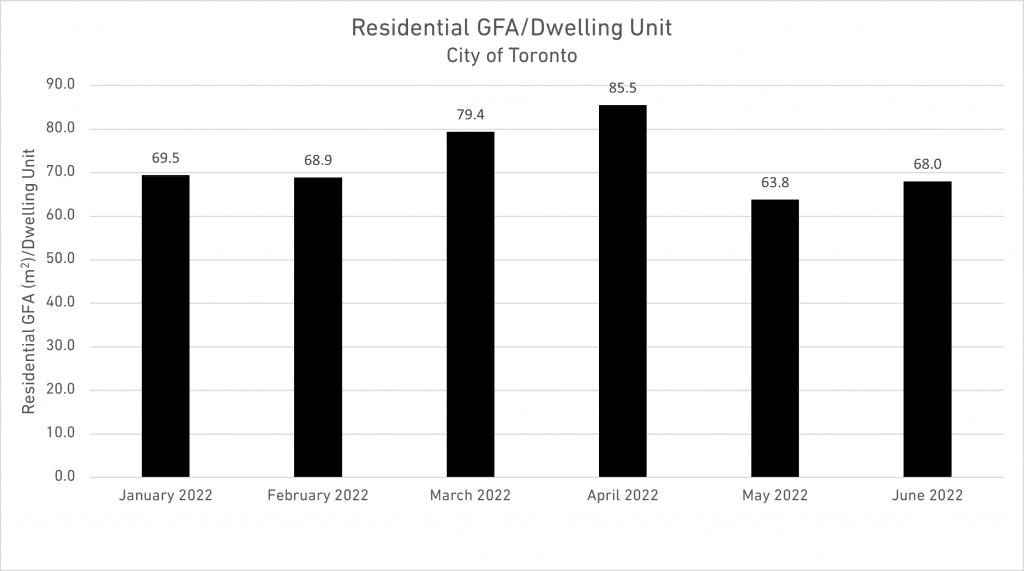

The average residential GFA proposed per dwelling unit was 68.0m², which is the third-lowest of this year. But it is 4.7% higher than the 64.9m² proposed for June, 2021. While this doesn’t correspond perfectly with larger units, it does run counter to the narrative that developers are building ever-smaller units. With only 1 parking spot proposed for every 4 dwelling units in June, the narrative of focusing on walkability and cycling is buttressed by this report.

There was 26% more GFA proposed in June compared to June, 2021. The distribution of the GFA across residential and commercial spaces was quite different. While the number of projects proposing some office space increased to normal levels this month, the gross floor area dedicated to them has shrunk significantly. In June, 2022, the amount of commercial GFA (which includes office and retail) proposed was only two-thirds of that proposed of the previous year. On the other hand, there was a 33% increase in residential GFA this year compared to last.

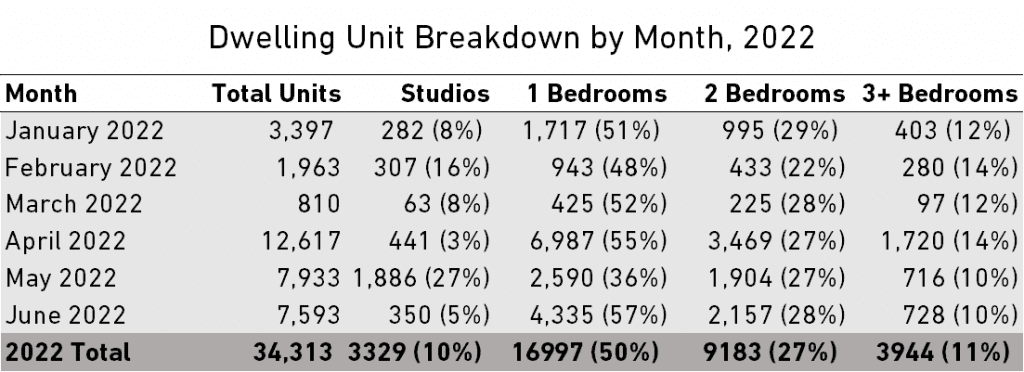

Of the 7,593 residential units proposed this month, 5% were studios, 57% were 1-bedroom units, 28% were 2-bedroom units, and 10% were 3+ bedroom units. (Note that this is in line with the city’s “Growing Up” guidelines that at least 15% of units are 2-bedrooms, and 10% are 3+ bedrooms.) These are in line with the year-long averages of 10% studios, 50% 1-bedroom units, 27% 2-bedroom units, and 11% 3+ bedroom units.

Will these trends continue? It’s possible that as higher interest rates push up borrowing costs, the price of land becomes more attractive for well-capitalized buyers. So long as investors anticipate that these higher rates are temporary measures in the fight against inflation, the long development cycle could prove to be an advantage for buying more land now, and continuing to develop more units for a growing population later.

This data is two months old. If you want to track this information live as it comes in, with your ability to customize reports and maps, set up a call about getting a tour of UT Pro.

* * *

UT Pro is UT’s premium database service that collects and reports information on development applications across the Greater Toronto Area.

This UTPro New Development Report analyzes new development proposals for large projects submitted to the City of Toronto. (UrbanToronto defines a “large project” as anything larger than a typical detached home.) These numbers are for proposals only, and are subject to change at any time up until (and sometimes even after) completion. Due to the early stage of the development process, some documentation may be missing; the numbers for some components of the data might not add up in some cases.

* * *

If you would like to stay updated on the latest development news, sign up for a free trial of the New Development Insider. And if you are interested in the data used to generate this report, you can get more details about the UTPro subscription database service here or on the official UTPro page. If you require an instant report on a specific area in the city, check out our Instant Reports.

For more information about UTPro, contact Edward Skira.

Source URBAN TORONTO. Click here to read a full story

Create Account | Jun 10,2023

The point of view of your article has taught me a lot, and I already know how to improve the paper on gate.oi, thank you.