Industrial Sector Helps Drive Total Returns of 8.5% for Canadian Institutions

Industrial Sector Helps Drive Total Returns of 8.5% for Canadian Institutions

Closely Watched Property Index Shows Canadian Real Estate Results

Canadian real estate investments had a total return of 8.48% over the past 12 months, led by the industrial sector.

The MSCI-RealPAC annual Canada property index, which measures existing investments of 47 institutional portfolios that make up about 40% of the real estate market in Canada, found the returns for the 12-month period that ended in June was split relatively evenly between capital growth and income.

“It is an important point of the year from the perspective of the data because we find a lot of of those 47 funds have revalued most if not all of their assets at this point,” Simon Fairchild, executive director of U.S. data analytics firm MSCI, said during an online presentation. “It’s a good indicator of what might be happening in the marketplace.”

Returns over the past year matched well with the index’s long-term historical average of 8.5% which goes back almost 40 years, Fairchild said. Returns plummeted during 2020 and 2021 below that average.

MSCI produces the closely watched quarterly index based on about $175 billion in assets with the Real Property Association of Canada, known as RealPAC. Fairchild said there was minimal capital improvement of just 0.2% in the second quarter, while income returned 1.1% in the period.

“There was a slowdown in the market over the last quarter, and that’s what we were expecting given what we know about the wider market, inflation risks, the war in Ukraine and supply chain challenges,” said Fairchild.

On a global basis, the United States led the world in the second quarter with total returns of 23.1% over the 12-month period. Canada was middle of the pack globally.

“The story of returns holding firm at least through the first half of the year is probably the story in most markets with the exception of the U.S. and the U.K.,” said Fairchild. “There was a strong acceleration through the tail end of 2021 and 2022, but recent numbers” in the U.S. and the U.K. had slowdowns.

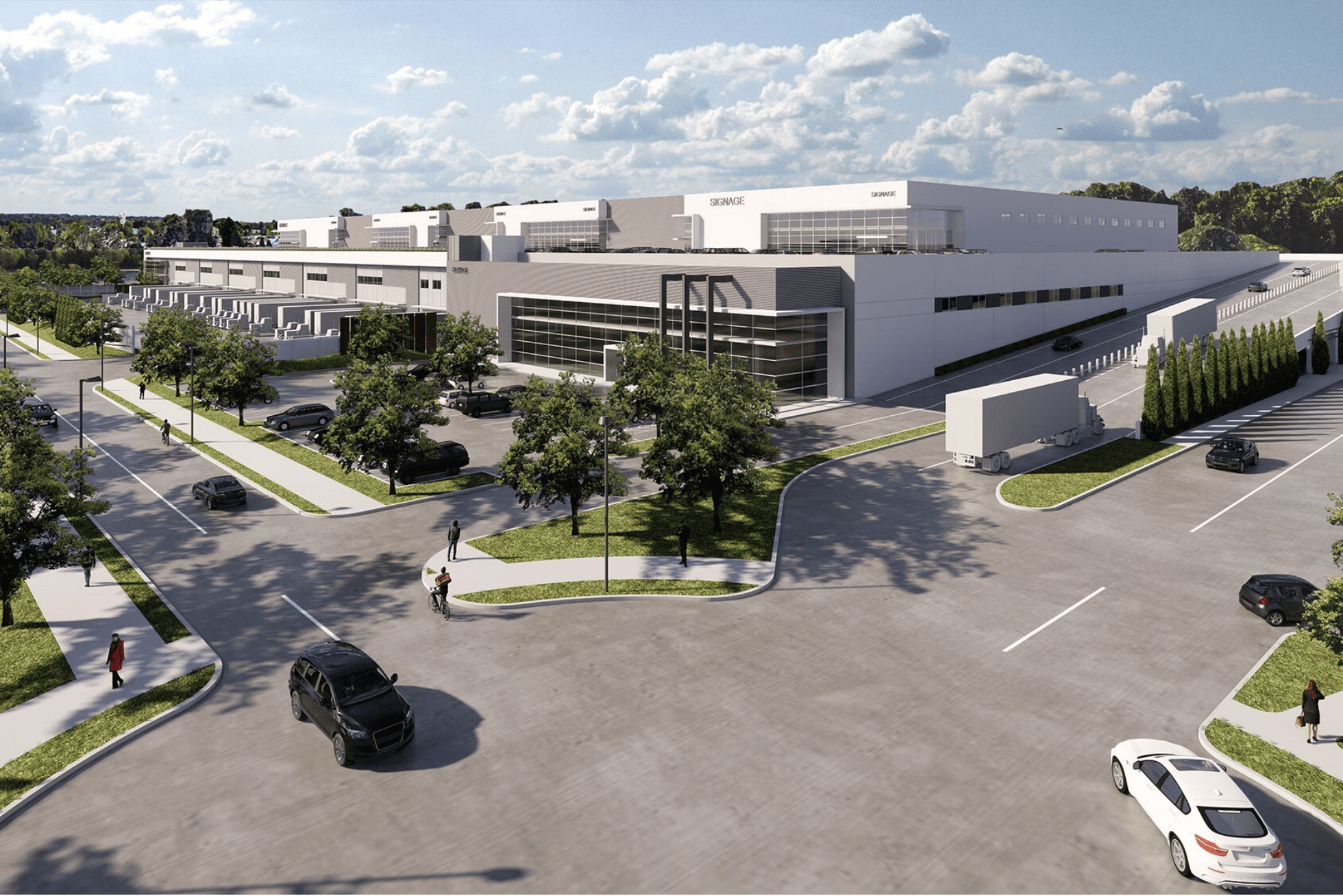

The industrial sector bolstered the Canadian numbers with total returns of 32.7% over the past 12 months. Residential returns were 7.4%, retail had 3.1% and office had 1.4%.

“Industrial returns seem to be accelerating. It is the highest of any sector in any year,” said Fairchild. “But retail and office are the pillars of investing for pension funds for the last two decades.”

Toronto had the top total return of 10.9% out of the eight Canadian cities surveyed, followed by Halifax at 9.2% and Vancouver at 8.8%. Calgary was last at a 1.5% total return.

“Values are still falling [in Calgary], but we are at least seeing positive returns there,” said Fairchild.

With interest rates going up, people are focused on whether cap rates should follow, according to Jim Costello, chief economist with MSCI Real Estate, who was part of the presentation.

“Are the spreads too narrow? That’s been a major point of discussion with everybody,” said Costello, noting buyers don’t reveal some of their underwriting criteria, including net operating growth. “The sector is still opaque.”

Source CoStar. Click here to read a full story

gate.io | Feb 27,2023

For my thesis, I consulted a lot of information, read your article made me feel a lot, benefited me a lot from it, thank you for your help. Thanks!

Kayıt Ol | Gate.io | May 3,2023

I am an investor of gate io, I have consulted a lot of information, I hope to upgrade my investment strategy with a new model. Your article creation ideas have given me a lot of inspiration, but I still have some doubts. I wonder if you can help me? Thanks.

binance h"anvisningskod | Mar 2,2024

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Featured Properties

FOR SUBLEASE – Industrial Space – Ajax

Available area: 1,810 Sq Ft Lease rate: $15.50 Sq Ft Net + $5.65/2023/T.M.I. Rare Small Bay Industri ...

Read More

FOR LEASE – Office Spaces – Scarborough

Available units: #218 – 1,248 SF – $11.00 psf + $19.01 TMI psf #221 – 777 SF ̵ ...

Read More

FOR LEASE – Retail Space – Toronto

Available area: 595 SF Lease rate: $1,800.00 Net Lease Located in Toronto’s upscale Leaside ne ...

Read More

BUSINESS FOR SALE – Sports Equipment Shop – Peterborough

Available area: 783 Sq Ft Asking Price: $300,000.00 An exclusive business opportunity awaits in Pete ...

Read More

FOR LEASE – Office Space – Toronto

Available area: 1,124 SF Lease rate: $17.00 Net Lease Perfectly located near the 401 with easy trans ...

Read More

FOR LEASE – Office Space – Toronto

Available area: 755 SF Lease rate: $1,800 Gross Lease CLICK HERE TO DOWNLOAD THE BROCHURE Prime Scar ...

Read More

FOR LEASE – Office Space – Toronto

Available area: 638 SF Lease rate: $1,700 Gross Lease CLICK HERE TO DOWNLOAD THE BROCHURE Prime Sc ...

Read More

FOR LEASE – Office Space – Toronto

Lease price: $23.50 Sq Ft Net + $17.68/2023/T.M.I. Available area: 3,901 Sq Ft 1,820 Sq Ft Elevate y ...

Read More