This fall, the construction site of a pair of large warehouses near Kingston will look vastly different than a regular building site.

Instead of the typical dozen or so workers on site wielding tools to erect the structures, there will be just a few people – working mobile devices that control software to operate an immense 3-D-printing machine.

The printer’s human-sized nozzle methodically extrudes layer after layer of concrete to create walls. In just one pass, the printer can produce the equivalent of cladding, sheathing, thermal breaks and formwork for structure and interior finish, leaving perfect cut-outs for windows and doors (which, along with floors and roof, aren’t part of the printing process – yet).

If all goes according to plan, these warehouses will become Canada’s first 3-D-printed buildings permitted for commercial use.

Last August, the developers, Kingston-based nidus3D, printed the country’s first-ever multifamily apartment building, a fourplex in Leamington, Ont. And in December, the company printed the first two-storey structure in North America, a house on Wolfe Island, also near Kingston.

Those two residential projects are relatively narrow because the printable area of nidus3D’s gantry-style 3-D concrete printer stretches just 40 feet. The upcoming warehouse development will inaugurate a nidus3D-pioneered system that uses site-printed wall sections that will be fitted together by crane – allowing the company to print buildings that are much larger than the printer.

The company says 3-D-printed structures can be built quickly – the ground floor of the Wolfe Island house went up in two weeks – using less materials and producing virtually zero waste, such as off-cuts, to deliver sustainable, highly insulated, airtight and energy-efficient buildings.

For now, costs are equivalent to typical masonry structures, but it aims to become more affordable as it scales up, with more printers expected to be delivered to Toronto and Vancouver by next year.

“We do anticipate costs dropping dramatically,” says Ian Arthur, nidus3D’s president and founder, and until recently, Kingston’s NDP MPP. “We think that, within a couple of years, it will be the most affordable means of putting up a building.”

According to a 2018 study in the U.K. research publication IOP Science: Materials Science and Engineering, 3-D printing can cut costs by at least 35 per cent compared with current manual costs.

Mr. Arthur says his one-term political career spurred an entrepreneurial interest in solving housing affordability and some of the mounting issues challenging the construction industry.

“It’s a sector in nothing short of a crisis,” he says. “It’s facing pressures from so many different directions.”

In addition to material-cost and supply volatility, “we have a huge labour crisis across the country, and as the boomer generation retires, this labour pinch is only going to get worse.”

”We have a huge labour crisis across the country and as the boomer generation retires, this labour pinch is only going to get worse.

— Ian Arthur, president of nidus3D

Statistics Canada’s latest report records an all-time high job vacancy rate in the construction sector of 7.7 per cent, with employers seeking to fill 81,500 vacant positions.

Citing BuildForce, it says the industry needs to recruit 309,000 new construction workers over the next decade, driven predominantly by the expected retirement of 259,100 workers.

Meanwhile, the Canada Mortgage and Housing Corporation (CMHC) estimates that to meet affordable housing requirements, the country needs to substantially increase the number of homes projected to be produced by 2030 – from 2.3 million units to 3.5 million. The biggest housing supply gap is in Ontario and B.C., where housing is least affordable, according to the CMHC.

Unless the industry “starts solving how to build in a different way” that requires fewer workers, Mr. Arthur says, it is unlikely to meet the country’s housing demands.

“We build homes with hundreds of materials, thousands of components and, honestly, millions of steps to get a building out of the ground,” he says. “3-D construction printing simplifies the process and automates it,” making it substantially less labour-intensive, Mr. Arthur says, adding that nidus3D’s construction printers will eventually be run by just two people.

Another company goal is to print with an eco-friendly concrete alternative, “such as wood fibre with a binding agent,” he says. “We have research partnerships with universities, so over the winter we’re looking to print a lot of samples.”

Even if nidus3D succeeds at lowering costs and emissions, the question remains whether Canadian lenders and investors will be quick to embrace 3-D-printed buildings.

“Quick is never a word that’s used in Canada when it comes to banks,” says Marlon Bray, senior director at Altus Group. “The Canadian environment is a lot more risk- averse, a lot more cautious, than other countries.”

The international real estate industry has slowly started to warm to 3-D-printed buildings, a product Mr. Bray describes as “extremely niche.” China, an early adopter, boasts the world’s tallest 3-D-printed structure, a five-storey apartment building, while a 6,900-square-foot municipal building in Dubai is the world’s largest, according to ArchDaily.

In the U.S., last year construction firm SQ4D sold what it claims was the country’s first 3-D-printed home, in Riverhead, N.Y., for US$299,000 ($403,000).

U.S. construction company Icon is at the forefront of the country’s 3-D printing and is currently printing a 100-home community in Texas designed by Bjarke Ingels Group. In December, the partners were awarded a US$57-million NASA contract to develop a livable, 3-D-printed lunar base on the moon’s surface.

Mr. Bray says advances in construction automation, such as 3-D printing and robotically manufactured modular structures, will be part of Canada’s future, but it might take “at least a decade” to reach critical mass.

“The entire capacity for robotics in construction right now is about 2 to 3 per cent of the whole North American market: A tiny, tiny bit,” Mr. Bray says. “And while I think it’s a huge part of the future, it’s a mid- to long-term time range.”

Prefabricated buildings are further along than 3-D-printed ones, he says, “but could even modular apartments ramp up in two or three years? No. The technology needs significant investment.”

And that usually takes many, many years, he says.

“If you look at the car, it took 13 years for it to replace the horse,” he points out.

Source The Globe And Mail. Click here to read a full story

E-commerce giant Shopify has reportedly listed its shiny new downtown Toronto office space for sublease.

In December, Shopify confirmed that it would not be occupying the multi-storey office space it had leased at The Well complex, despite having, in 2018, signed a 15-year lease that began in 2022. The Ottawa-based company originally signed on for 254,000 sq. ft of space, with the option to expand to 434,000 sq. ft.

According to The Globe and Mail, Shopify has now listed for sublease 348,103 sq. ft of office space, spread across seven floors of The Well’s gargantuan office-retail-residential community, located on the north-west corner of Spadina Avenue and Front Street West.

Shopify plans to keep its current office space at the nearby King Portland Centre and will centralize Toronto operations there.

Neither Shopify nor The Well’s owners, RioCan REIT and Allied Properties REIT, responded to STOREYS’ requests for comment by the time of publication.

The news comes as office vacancy in downtown Toronto continues to rise, hitting 13.6% during the final quarter of 2022, per CBRE’s Q4 Office Figures report. This uptick, the report says, came amidst the delivery of 2.4M sq. ft of new supply in 2022.

“Much of the vacancy rise in Canada’s largest city is attributed to major tenant relocations to new developments, leaving behind dated product – the proverbial ‘flight to quality,’” CBRE notes in a press release.

Seeming to nail the Shopify situation on the head, CBRE goes on to explain how the sublease space is also rising in Toronto. “While most units are smaller than 10,000 sq. ft. and are from groups that have elected to work from home, Toronto is seeing an increased number of larger subleases from corporate occupiers curbing their growth plans,” CBRE says.

Office vacancy rates are even higher in Toronto’s suburban areas, at 19.3%, bumping up the city’s overall vacancy rate to 16.2%. Although the numbers may seem large, they are far from the highest in Canada and are actually below the national average of 17.1%. Edmonton office space clocks in at 22.2% vacant, meanwhile Calgary has a staggering 30% vacancy rate. Of the 10 major markets observed for the report, Vancouver had the lowest vacancy rate of just 7.8%.

Looking forward, CBRE Canada Chairman Paul Morassutti says “the office sector will face a bumpy 2023 as it contends with a potential recession, a re-structuring of the tech sector and continued uncertainty around the impact of hybrid work patterns.”

Source Storeys. Click here to read a full story

On Monday, Dream Office Real Estate Investment Trust (Dream Office REIT) announced the sale of Toronto’s 720 Bay Street, known as the McMurtry-Scott Building, named in honour of two former attorney generals. The fully-leased, single-tenant commercial office building is presently the headquarters of the Ontario Ministry of the Attorney General.

Built in 1989, 720 Bay Street is a Class B building containing 11-storeys and 247,700 sq. ft, including 240,000 sq. ft of total office space. It’s a short distance from Queen’s Park — the site of the Ontario Legislative Building — the provincial courts, the Toronto Eatons Centre, and numerous hospitals, hotels, restaurants, and retailers.

Although Dream Office REIT has yet to release details on the buyer, they have revealed that the transaction will generate gross proceeds of $135M, “which is higher than the Trust’s carrying value as at September 30, 2022,” according to a news release from the Canadian real estate investment trust.

“The transaction is expected to close in the first quarter of 2023, subject to customary closing conditions,” the release goes on to say. “The unmortgaged property is currently pledged as security for the Trust’s $375 million revolving credit facility. The Trust intends to use the net proceeds from the sale to repay debt and to opportunistically repurchase REIT A Units under the Trust’s normal course issuer bid program.”

Dream Office REIT is a premier office landlord with over 3.5M sq. ft of landmark property owned and managed. According to a Q3 2022 update, the Trust’s portfolio contains 27 active investment properties valued at $2,596,815, with 5.4M sq. ft in gross leasable area and an 85.7% portfolio occupancy. The investments are primarily concentrated in Toronto’s Financial District. Dream Office REIT also has two projects in the development pipeline.

Source Storeys. Click here to read a full story

As more and more Canadians become renters, interest and investment in multi-family rental properties are expected to remain high, despite an uncertain financial environment.

In a new 2023 Canadian Economic Outlook from real estate and property management firm Morguard, the Ontario-based company says that after a decline in spring 2020, demand for purpose-built, multi-family rental properties strengthened during the second half of 2021, extending to the midway point of 2022.

“Investment transaction volume totalled $7.1B for the first half of 2022, as reported by CBRE,” Morguard points out. “The total was in line with the record annual high of $14.1B in 2021.”

Multiple offers on investment properties were commonplace during that time, the report says, with confident investment in major markets amidst the supply of large portfolios falling short of demand.

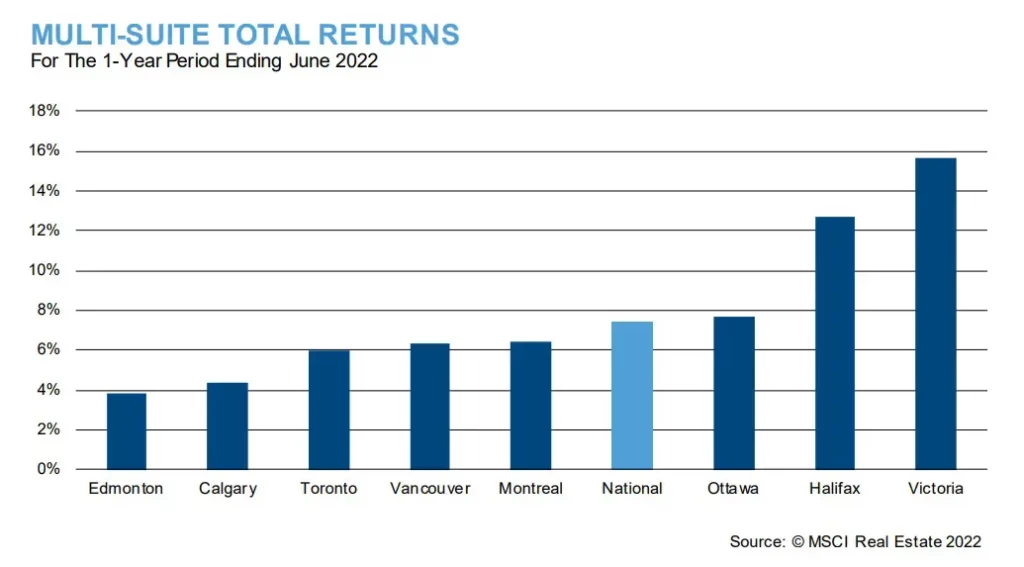

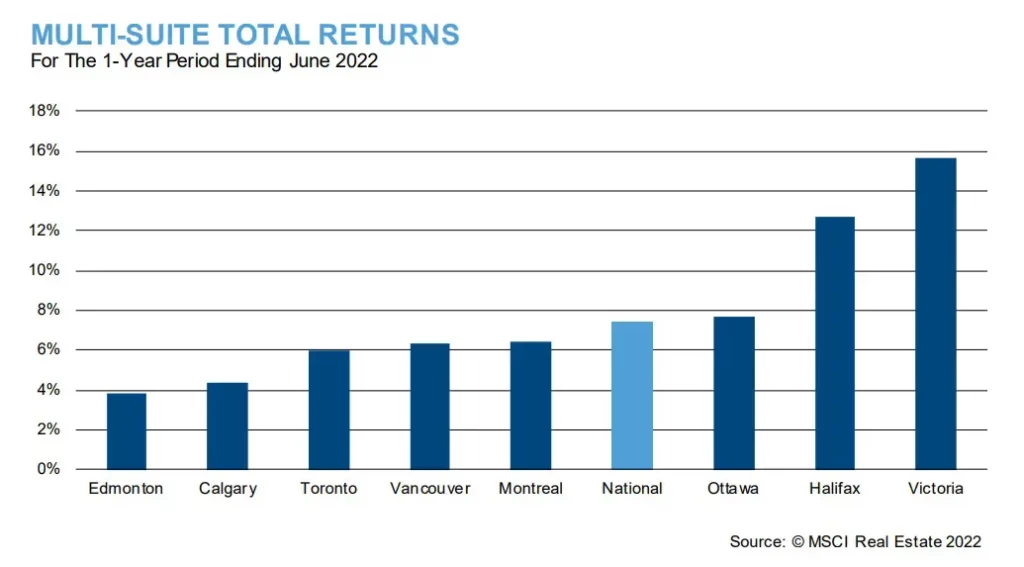

The returns on those investments also remained healthy, with a national average return of 7.4% for the fiscal year ending June 30, 2022 — an increase of 2.2% compared to the previous year.

Returns on multi-family investments in Victoria were the highest in the nation at nearly 16%, followed by Halifax at nearly 13% — the only two markets in Canada that saw average returns over 10%.

Meanwhile, in the larger markets such as Toronto and Vancouver, average returns were at about 6%. Calgary and Edmonton saw the smallest returns on multi-family investments in the nation, with both hovering around 4%.

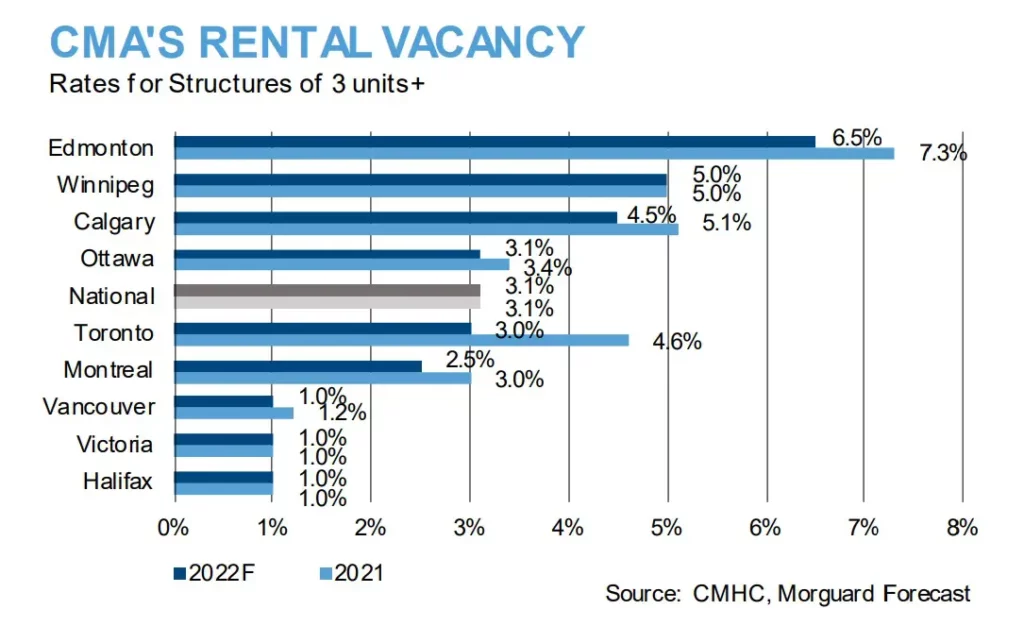

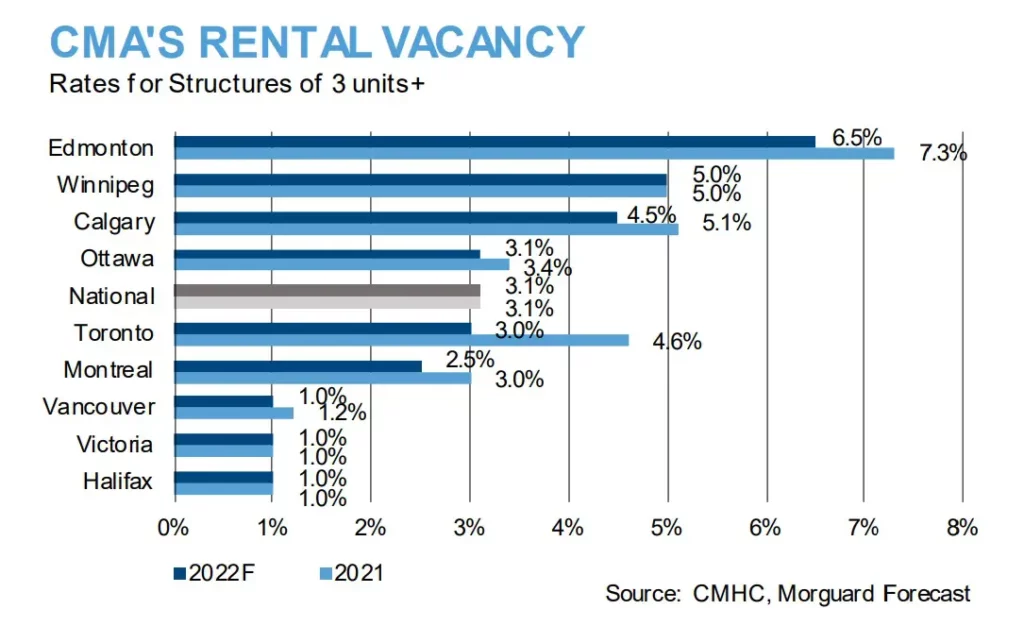

The strength of returns was found to be closely correlated to vacancy rates in their respective markets, particularly at the two ends of the spectrum: Calgary and Edmonton had some of the highest vacancy rates while Halifax and Victoria had some of the lowest.

By transaction volume, in the 18 months leading up to June 2022, Montreal accounted for 30% of total national sales, the most of any market in the country. Second was Toronto at 27%, followed by Vancouver at 16%.

In that same timespan, multi-family properties accounted for 22% of all real estate transactions, second only to industrial real estate sales, which accounted for 30%.

Notable transactions include CAPREIT’s $281M purchase of six properties from JOIA’s portfolio in Montreal, Q Residential’s $165M purchase of the 423-unit Golfview Towers in Toronto, and Centurion Apartment REIT’s $81.7M purchase of a 233-unit development in Surrey, British Columbia. Those three transactions were the largest transactions by price and amount of units in their respective markets.

The Rental Market

The increased investment in multi-family properties came as the national average rent price increased significantly. According to Rentals.ca data, the average listed rent in December across all types of rental unit was up 12.4% compared to a year ago, to $2,024.

And there is no evidence that the increases will be slowing down.

“Several factors contributed to the recent rental demand strengthening,” Morguard says. “Canada’s economic recovery boosted employment levels and rental demand. At the same time, young workers in the 15 to 24 age cohort were able to secure employment and rental accommodation.”

Morguard also pointed to increased international migration as adding to the demand for rentals. Many are concerned about whether the nation’s housing supply can keep up with Canada’s immigration targets, and those concerns will likely remain in place for the foreseeable future.

Vancouver-based Toby Chu, Chairman and CEO of CIBT Education Group — the parent company of GEC Living, which specializes in student rental buildings across Metro Vancouver — previously told STOREYS: “International and domestic students arriving in Vancouver to study, they rent. Migrants moving to Vancouver for work, they rent. New immigrants arriving in Canada, they rent before they buy. Interest rate causes stress test issues for new home buyers, thus they rent. Homeowners downsize from owning to renting, they rent. I think the rental crisis will transform a bad dream into a nightmare.”

Source Storeys. Click here to read a full story

Commercial real estate transaction activity in the Greater Toronto and Greater Golden Horseshoe areas slowed considerably in the second half of 2022 after an initial strong carry-over from 2021.

This year could see a reversal of that trend, with a slower start and business picking up in the third and fourth quarters, according to Altus Group vice-president of data operations Ray Wong. He believes the amount of deals that happened in 2021 and the first part of last year were unusually high and that a level of normalcy will return to the market in 2023.

“I think investment demand is still there,” Wong told RENX. “The challenge is the product.

“I think that, depending on what happens with interest rates and the availability of product, we’re probably going to see about the same amount of activity — or maybe less — compared to a year ago.”

Wong said there’s a challenge in finding price points that will satisfy both sellers and buyers, given rising interest rates, capitalization rates and carrying costs, as well as a more subdued commercial lending environment.

Most popular asset classes

Industrial, commercial and investment land deals accounted for four of the 10 biggest deals in the region in 2022, while industrial and office accounted for three each.

“Industrial and multires demand remains strong, but the challenge with multifamily is finding product,” Wong said. “The market fundamentals — especially on the industrial side, the multifamily side and to a certain extent the retail side — are still strong.”

There are buyers in the office market despite increasing vacancy rates and the questions surrounding hybrid labour models allowing employees to continue to work part-time from home. Wong said good-quality, class-A office product continues to lease well and there’s demand for it.

High downtown Toronto housing costs and residential rents are causing affordability issues for people, which Wong said is likely contributing to higher downtown office vacancy rates.

Retail performed better than some in the industry would have expected as some large properties in prime locations made them good candidates for redevelopment with the addition of residential or mixed-use components.

Private investors were again the most active in the market, according to Wong.

The top 10 transactions

These were the 10 largest (dollar value) commercial real estate transactions of 2022 in the Greater Toronto and Greater Golden Horseshoe areas, according to Altus Group data:

1. Pontegadea, the family office of Spanish billionaire Amancio Ortega, acquired the 3.15-acre, two-tower, 1.5-million-square-foot Royal Bank Plaza at 200 Bay St. in Toronto for $1.16 billion from Oxford Properties and CPP Investments in February. The property, which includes 627 underground parking stalls, was 92 per cent occupied with a weighted average lease term of 8.4 years at the time of sale. Colliers Real Estate Management Services took over the building’s real estate management services from Oxford.

2. Tribal Partners acquired two parcels of land totalling 288 acres at 12861 and 12489 Dixie Rd. in Caledon for $567 million from a numbered company and private individuals in August. The site is on the east side of Dixie Road between Mayfield Road to the south and Old School Road to the north. Tribal Partners previously acquired 247 acres on this stretch of Dixie Road for $214.61 million in two separate transactions in December 2021.

3. Slate Asset Management closed on the $518-million acquisition of 800 acres of industrial development land and buildings from Stelco Inc. in Hamilton in June. Slate entered into a sale-leaseback of 75 acres of land and two million square feet of buildings to Stelco for 35 years. Slate plans to develop up to 12 million square feet of new industrial space on the remaining land, which is already zoned for a wide range of uses.

4. Prologis acquired 194 acres of land at 12519 and 12713 Humber Station Rd. in Caledon for $479.62 million from Solmar Development Corp. in June. The site is at the edge of an area designated for industrial and commercial development where a number of large facilities — including Canadian Tire and Amazon warehouses — have recently been developed. Solmar had assembled the site from acquisitions made in 2003 and 2015 for a total of $51.97 million.

5. KingSett Capital acquired a 21-building, 1.47-million-square-foot industrial portfolio with properties in Mississauga, Oakville and Etobicoke for $461 million from Sagitta Development & Management in May. The portfolio was 99 per cent occupied at the time of the sale.

6. Pure Industrial acquired a 1.5-million-square-foot industrial portfolio with five buildings in Brampton and one in Milton for $428 million from TD Asset Management in December.

7. Crestpoint Real Estate Investment Ltd. and Alberta Investment Management Corporation (AIMCo) acquired a 25-storey, 540,000-square-foot class-A office building at 121 King St. W. in Toronto for $379.25 million from BentallGreenOak in April. BentallGreenOak acquired the building in December 2012 for $306 million.

8. Allied Properties REIT acquired office buildings at 110 Yonge St., 525 University Ave. and 175 Bloor St. E. in Toronto for $365 million from Choice Properties in March. The three buildings total 587,226 square feet and were purchased as part of a larger portfolio that also included two office buildings in Vancouver and one in Montreal. The acquisition price of the total portfolio was $794 million.

9. LaSalle Investment Management acquired 21 industrial and flex office buildings in Mississauga, comprising 809,316 square feet of space on 45.5 acres, for $294.3 million from Everlast Group in April. The buildings were 98 per cent leased and had a weighted average lease term of approximately two years at the time of the sale.

10. Panattoni Development Company Canada acquired 423 acres of Brantford industrial development land for $290 million in March. The vendor was James Dick Ltd., which acquired the land out of bankruptcy several years ago and shepherded it through the zoning process. Panattoni previously acquired a 108-acre site in the vicinity for $52.95 million in July 2021.

Source Real Estate News EXchange. Click here to read a full story

What is inflation? What caused it in 2022? Why is it hard to predict? What are the differences between 2022 and 1970s inflation?

Let’s examine the issue, its impact on real estate and how we can prepare for and attempt to mitigate those effects.

What is inflation and why did it skyrocket in 2022?

Inflation is a general increase in the price of goods and services in an economy over time.

We see it as a percentage and the Bank of Canada has the mandate to keep it at two per cent. The reason it skyrocketed in 2022 is that the cost of raw materials, labour and transportation all shot up.

But why did they become more expensive? We need to explain this if we want to have a chance at predicting what comes next.

It’s demand-driven: Too much money.

The COVID-19 fiscal response injected massive amounts of money into many economies. This explains increases in prices as “demand-driven” inflation. This means that governments, people and businesses had more money and spent more money.

But Europe received only half the fiscal stimulus of the U.S. yet still experienced comparable levels of inflation. Why is this?

It’s supply-driven: Too few goods.

I heard economists in early 2022 vigorously debating the topic of inflation. Most thought it was transitory.

Ben Tal of CIBC suggested it was mainly due to supply-chain problems (shipping, China’s zero-COVID policy, the war in Ukraine, etc.). And so, inflation would self-correct.

At the 2022 Canadian Apartment Investment Conference, Tal said 60 per cent of Canada’s inflation arises from supply-chain difficulties. If true, then a prudent approach for central banks would be to wait until these troubles resolve themselves.

But it gets more complicated.

Inflation is part goods and part services. Goods prices can come down (as some already have) but services can stay high (as most are).

Moreover, on the supply side, nothing is simple or predictable. The war in Ukraine is not ending. China relaxed its zero-COVID policy but then saw the ramifications due to a spike in the spread of infections.

We keep looking in the rear-view mirror and trying to find a model to explain what happened. Yet looking forward we keep getting our predictions wrong.

It looks like 2022’s climbing inflation came from both an increase in demand and a decrease in supply. Is it any wonder no one has a good model to make an accurate prediction?

The central bank and rate hikes

The Bank of Canada reversed fiscal stimulus into a tightening policy and rates went up fast. Rate hikes lowered the demand for goods and the expectation is that the supply side will work itself out . . . eventually.

The demand for services, however, has not changed drastically even after the hikes. People still want to travel and enjoy entertainment like concerts and sporting events.

But after interest rates go up, the economy tends to do the opposite. We expect a recession.

We have seen a downward trend in the number of total businesses in Canada and there have been recent tech company layoffs. Yet a net 104,000 jobs created in December shows a different story – the expected number of new jobs was only 8,000.

It’s complicated!

What will the Bank of Canada do on Jan. 25? Raise rates by 0.25 per cent or higher?

Real estate lessons from the 1970s

Reality is always more interesting and complicated than any model can address. But we’d be well-served to substitute complex models for simple heuristics.

For those of us in real estate, what do we know about the 1970s? How was business done back then?

The OPEC oil embargo of 1973–’74 drove oil prices up by almost three times in just a year. The cost of goods went up and with it, inflation.

Labour was unionized and wages went up to keep pace with the cost of living. Federal price controls did nothing and only when Paul Volcker raised interest rates to 20 per cent in 1980 did inflation go back down to 3.2 per cent by 1983.

Let that sink in . . . a 20 per cent federal rate! Eventually, in the 1990s the federal rates were back down to mid-single digits.

The point here is that looking back the rates we see are a shock to our system because we’ve enjoyed declining interest rates for decades.

Valuations of real estate are directly affected by the cost of borrowing. The cheaper the debt, the more people can pay for real estate and prices tend to go up.

But how did people do business in the ’70s when debt became more expensive? For one, high inflation meant no pre-sales or pre-leasing.

Some used seller financing. Others used more equity.

When inflation is high, those with cash do not want to hold cash as it is losing value.

We adjust how we work to match our current reality. Once the “shock to the system” wears off, we’ll adjust again.

Where does that leave us?

The key to doing well in an inflationary “roller-coaster” and ever-changing real estate market is resilience and preparedness.

CRE businesses must be nimble and ready to take advantage of opportunities when they arise and protect themselves from short-term losses by keeping an eye out for danger signs.

- Take advantage of creative acquisition terms such as vendor debt and delayed closing when purchasing.

- Leverage modestly to ensure liquidity if you are forced to own properties for a longer period of time.

- Invest only in the best locations.

- Research, research, research: zoning, environmental, soils, demographics and more.

- Focus on asset classes most in demand with the least supply (today it seems industrial and multiresidential rental).

- Stay informed on the latest industry trends.

Being ready and able to swiftly adapt to the market unpredictability can open opportunities that many overlook.

Like a roller-coaster ride, what goes down will eventually come back up again

Source Real Estate News EXchange. Click here to read a full story

Allied Properties REIT has decided to offer its downtown Toronto urban data centre (UDC) portfolio for sale following a review of options for the three properties.

In an announcement Monday morning, Allied reports “selling the portfolio in its entirety now is optimal financially and operationally.” It has retained Scotiabank and CBRE to market the assets and facilitate any transaction.

“Our principal motivation here is two-fold,” said Michael Emory, Allied’s president and CEO, in the announcement. “First, we want to reaffirm our mission and pursue it over the next few years with low-cost capital.

“Second, we want to supercharge our balance sheet and reduce our dependence on the capital markets going forward.”

Proceeds from a sale would be utilized primarily for debt reduction and to finance its development activity, the release states. The REIT could also use some of the proceeds to repurchase units under its NCIB.

The Toronto data centre portfolio

The network-dense, carrier-neutral data centres are located at 151 Front St. W. and 905 King St. W. (freehold interests) and 250 Front St. W, (leasehold interest) in Toronto.

The portfolio is unencumbered and does not include 20 York St., the site for Union Centre.

The properties are connected via high-count diverse fibre, which Allied claims allows it to support more telecommunication, cloud and content networks than any other Canadian data-centre portfolio.

The trust entered the sector in 2009 when it acquired 151 Front St. W., the largest internet exchange point in Canada and one of the largest in North America. It has expanded the portfolio by retrofitting portions of 905 King St. W. and 250 Front St. W.

Emory confirmed in the announcement Allied wants to stay committed to its main focus as an owner and operator of urban workspace in major Canadian cities.

“Our UDC portfolio was connected to our mission from the beginning, but it is not core to our mission in the way urban workspace is,” Emory said in the announcement. “As a stabilized asset in a currently favoured sector, the portfolio represents a promising and timely monetization opportunity, one that could enable Allied to grow its business going forward in the most flexible and prudent manner.”

Allied wants balance sheet flexibility

The announcement also notes Allied has worked to maintain flexibility in its balance sheet. During the past three years, the trust states, it has funded upgrade and development activity and taken advantage of “compelling in-fill acquisition opportunities that would not have arisen in a stable economic environment.”

During the first three quarters of 2022, Allied reported $845.3 million in acquisitions and had $203.9 million allocated to development.

It remains committed to its strategy, but that activity has pushed its debt metrics to the high end of where management wants it to be – despite an already fairly conservative strategy concerning debt.

The REIT is also now operating in a higher-interest-rate environment, with predictions a recession could be looming.

As of Q2 2022, Allied reported a total indebtedness ratio of 34.3 per cent (interest coverage ratio of 2.9 times; net debt as a multiple of EBITDA 9.6 times). It had about $9.5 billion of unencumbered assets among its $10.8 billion in assets.

The sale of the UDC portfolio would allow it to bring its leverage “squarely within target ranges” and set the table for further growth as development completions over the next few years improve earnings.

Allied management says it expects interest savings from the transaction to offset the decline in earnings which would result from a sale.

About Allied Properties REIT

Allied is an owner and operator of urban workspace in Canada’s major cities and network-dense UDC space in Toronto.

The trust, which is also based in Toronto, has a diverse portfolio of properties across Canada valued at $10.8 billion as of Q3 2022. It has about $1.5 billion in its pipeline of properties under development.

Allied says it mission is “to provide knowledge-based organizations with workspace and UDC space that is sustainable and conducive to human wellness, creativity, connectivity and diversity.”

Source Real Estate News EXchange. Click here to read a full story

Suburban office vacancy rates were considerably lower than downtown in many markets across Canada, according to Colliers Canada’s 2022 Q4 National Market Snapshot report, which updates trends and statistics in the office and industrial sectors.

The national downtown office vacancy rate was 14 per cent and trending upward, while the suburban rate was 12 per cent and trending downward from Q3, according to the report.

“Three or four years ago, nobody was talking about the suburbs,” Colliers senior director of research Adam Jacobs told RENX. “Every tenant wanted to be downtown, the rents were going up faster downtown and it had one per cent vacancy.

“Now we’re starting to see a lot more evening out, where everything that used to be an advantage of downtown has turned a little bit more to a liability. Like, it’s connected to transit, but nobody wants to ride transit anymore.”

The average asking net rent was $22.34 per square foot for downtown office space and $17.51 per square foot for space in the suburbs.

Best and worst office markets

Of the dozen cities covered in the report, Vancouver had the lowest office vacancy rate at 5.9 per cent, with sublets accounting for 29.6 per cent of that. The average net asking rent in Vancouver was $34.25 per square foot.

Calgary had the highest office vacancy rate at 27.3 per cent, with sublets accounting for 16.9 per cent of that. The average net asking rent in the city was $14.31 per square foot.

Halifax’s office market was the only one in Canada with an office vacancy rate that decreased in every quarter in 2022. Its overall year-end rate was 13.9 per cent.

In general, office markets less dependent on large occupiers and with smaller cores usually performed better than those in larger population centres with higher dependency on public transit. There’s also less new office development happening in these smaller markets, and therefore fewer concerns about absorption.

Toronto’s return-to-office levels continue to lag, with occupancy levels reaching just 36 per cent in Q4. Toronto’s combined downtown and midtown office vacancy rate was nine per cent while the suburban vacancy rate was 11.4 per cent.

Jacobs said there was a flight to quality among tenants who wanted to be in AAA downtown buildings, and were willing to pay higher rents for those properties, but only certain employers can afford that and the trend has slowed.

Return-to-office momentum still slow

Return-to-office momentum continued to be slow throughout the quarter, with many companies implementing full-time hybrid work models. The federal government — one of the last remaining large occupiers working fully remotely — announced a return-to-the-workplace model of three days per week on site starting this year.

“There’s some momentum now of the banks, the insurance companies, the government and the real mega-occupiers starting to move towards — if not 100 per cent back to the office — at least 60 per cent back to the office,” said Jacobs. “I think that’s maybe less than we expected, but still it’s in the right direction, as far as I see it.”

The office job market remains hot and as long as employees continue to have strong leverage in choosing where and how to work, and who to work for, it seems that pre-pandemic office attendance levels won’t be matched.

Subletting was a major issue through 2021 but had been subsiding during 2022. However, an increasing amount of sublet office space came to market both downtown and in the suburbs in Q4 as companies became more accustomed to hybrid and remote-work models. Subletting was especially pronounced in Vancouver.

Adams expects the office vacancy rate to continue to increase in most cities and nationally, as well as for the rapidly rising interest rates of last year to continue to negatively impact the number of property transactions this year.

Industrial leasing remains strong

Industrial leasing remained strong across the country, with high tenant demand and land-constrained markets fuelling continually increasing asking rents.

Colliers tracked 12 markets across Canada and each had industrial asking net rents above $10 per square foot at year-end, with the average being $12.77. The vacancy rate in those cities averaged 0.9 per cent while the availability rate was 2.2 per cent.

The highest industrial vacancy rate was 4.1 per cent in Edmonton – its lowest year-end rate since 2015 – where the average net asking rent was $10.33 per square foot.

The lowest vacancy rate was 0.1 per cent in Victoria, where the average net asking rent was $18.05 per square foot.

“We’re starting to see people say ‘I’ll just take industrial space in Calgary and truck everything 1,000 miles from the Port of Vancouver,’ ” Adams said. “‘It’s so much cheaper in Calgary that, even though it’s expensive to truck things over the Rocky Mountains, I’m still coming out ahead paying $10 per square foot in Calgary instead of $30 in Vancouver.’”

Calgary’s 11.61 million square feet of industrial space net absorption in 2022 was the highest in the country and pre-leasing activity was high.

Toronto’s industrial vacancy rate was just 0.3 per cent. The market had experienced 20- to 30-per cent year-over-year rent increases since 2019 and, although momentum slowed a bit in the last quarter, the annual growth rate was still 35 per cent.

Demand remains for more industrial space

While e-commerce growth has levelled off, fulfillment centres continue to drive industrial leasing demand. Inventory under construction remains very high but still just represents a small fragment of the overall inventory.

“We could finish every industrial development in the country tomorrow and we’d still have a strong market,” said Adams. “As much as is being built, the markets are so tight.

“We’re just so far from a balanced market in terms of vacancy and rents. I just think it’s going to keep going until something really gives. It’s possible the prices will get too high for some tenants, but we haven’t seen that yet.”

Adams said a lot of major industrial leasing is being driven by large, well-financed tenants such as Amazon, Costco, Walmart and Sobeys that can absorb higher rent costs because they’re a relatively small part of their overall costs.

Industrial transaction volume, however, seems to be slowing down — again influenced by the higher interest rates that are expected to remain through most of the year.

Source Real Estate News EXchange. Click here to read a full story

UPDATED: Sandpiper Group, Artis REIT and embattled First Capital Real Estate Investment Trust (FCR) appear headed for a court hearing to determine the date of a shareholder meeting to decide FCR’s future direction.

A release Monday morning issued by Sandpiper and Artis says the two entities have asked the Ontario Superior Court’s commercial division to compel First Capital to hold the special meeting on March 1, “or as soon as practicable thereafter”.

In response to publicly stated opposition to its management strategy from Sandpiper, Artis, First Capital founder Dori Segal and others, the REIT’s management had scheduled a special meeting on May 16 in conjunction with its annual meeting.

Monday’s release claims that is too long to wait, because the activist shareholders fear management will continue with the REIT’s current business plan, including a publicly stated intention to divest some of the assets it currently holds.

FCR management set May 16 date

First Capital REIT’s management, in announcing the May 16 date, said the timing would allow it to accommodate the annual meeting, normally held in June, so shareholders would not have to take part in two meetings in a short time. It would also provide management time to “consider the implications” of an alternative strategy suggested by the critics in December.

In a response to this latest legal manoeuvre, First Capital stands firmly behind its plan to hold the meeting on May 16 and to move forward with what it calls the REIT’s Enhanced Capital Allocation and Portfolio Optimization Plan.

The plan, which includes an intention to shed up to $1 billion in assets, is one of the key factors which led to the dispute.

First Capital management also takes aim at Sandpiper founder and CEO Samir Manji, who is also the president, CEO and a board member of Artis after his firm led an activist investor campaign which ousted its previous leadership about two years ago.

“FCR will continue to engage constructively with unitholders in a manner that is in the best interests of all unitholders, and not just Samir Manji,” a release issued late Monday states. “First Capital also notes that a significant number of unitholders have expressed their support for the Portfolio Optimization Plan, with numerous sell-side analysts also recognizing its merits in their published research.”

It then states FCR management plans to continue moving forward with the plan.

The critics called for the special meeting in an effort to remove several current board members – chair Bernie McDonell, Andrea Stephen, Annalisa King and Leonard Abramsky – and replace them with trustees of their choosing.

The critics have also called for the resignation or removal of CEO Adam Paul.

The candidates proposed for the FCR board are Sandpiper founder and CEO Samir Manji; K. Adams and Associates Ltd., founder and president Kerry Adams; lawyer and Definity Financial director Elizabeth DelBianco; and Blake, Cassels & Graydon LLP partner Jacqueline Moss.

King High Line a key issue in dispute

Chief among the activists’ concerns are what they call the continued underperformance of the REIT compared to its peers and the markets, and in particular they have criticized the decision to divest a portion of First Capital’s 100 King West high-rise property. That move is part of the optimization plan.

In mid-2022, FCR announced an agreement to divest its interest in the residential portion of the three-tower property, known as King High Line, while retaining the retail and commercial segments. Segal claims the property is a “generational core asset” and has essentially been liquidated at a below-replacement cost for $149 million.

The deal was slated to close in Q4 of 2022.

Sandpiper and its entities have invested about $300 million in First Capital REIT, which Manji said in the release is “almost 30 times more than the cumulative investment held by all nine of the incumbent trustees.” It represents about nine per cent of First Capital units.

Sandpiper has retained Morrow Sodali (Canada) Ltd. as its strategic shareholder services advisor. The Special Situations Group at Norton Rose Fulbright Canada LLP is acting as legal counsel.

FCR has engaged Kingsdale Advisors as its “strategic shareholder advisor”. Gagnier Communications is its communications advisor; Stikeman Elliott LLP is acting as legal counsel to the board; and RBC Capital Markets is its financial advisor.

Source Real Estate News EXchange. Click here to read a full story

The Hamilton-Oshawa Port Authority (HOPA) and Bioveld Canada hope to capitalize on the region’s tight industrial real estate leasing market by adding up to 500,000 square feet at the sprawling Thorold Multimodal Hub, Bioveld Complex.

“We have ways of transloading, we have warehouse storage, we have ship repair and maintenance, and on the original site we have a lot of bulk handling,” said Ian Hamilton, CEO of the Hamilton-Oshawa Port Authority.

The Thorold Multimodal Hub, Bioveld Complex, sits alongside the Welland Canal and is zoned for heavy industrial uses. It currently accommodates units ranging from 5,000 to 100,000 square feet, includes over 100 acres of exterior space and has an on-site water filtration plant.

The former automotive plant sits on 170 acres and offers multimodal services, plus greenfield lands for redevelopment and new construction. Its facilities have access to CN’s rail network via a local railway operator.

HOPA partnered with Bioveld Canada subsidiary BMI Group in its latest acquisition.

HOPA and Bioveld relationship

HOPA is responsible for marketing and leasing the property, and integrating users into the multimodal network. It also offers industrial owners property management resources and expertise in marine and port-related facilities.

Bioveld owns the property and is actively redeveloping and preparing the facilities for modern uses.

“Between the property we owned and Bioveld’s site, we put together a transportation hub that’s multimodal and that would attract industry by leveraging rail, marine and proximity to truck,” Hamilton said. “We’re probably two years ahead of schedule for what we planned, with a dozen tenants on the site.

“We fast approached the realization that the idea had real traction and expanding it would make sense.”

The hub’s proximity to both the Greater Toronto Area and United States makes it especially attractive to industry, Hamilton noted.

He said if the U.S. states bordering the Great Lakes, plus Ontario and Quebec, were a single economy, it would be the world’s third-largest.

Ontario’s Greater Golden Horseshoe

As part of the Greater Golden Horseshoe, the Niagara region was identified in the 18-year-old Places to Grow Act (provincial legislation mandating growth hubs around Ontario) because it’s well-positioned for a population boom.

In tandem with e-commerce’s rapid ascension, establishing an elaborate delivery system for the region is part and parcel of such growth.

“It’s certainly why we chose to partner with Bioveld,” Hamilton said. “The success we have had on existing assets hit home; there was this underlying demand and the Niagara region is so well-positioned for growth to attract modern industry.

“Those indications are why we drove forward with this expansion.”

In leveraging access to a marine property along Lake Ontario, trucking routes and CN-connected rail tracks, the hub handles about $4 billion worth of cargo per year.

That figure will grow as the transportation hub is bolstered by the additions of more industry.

Features of the Thorold Multimodal Hub

All of the site’s buildings have clear heights of 30 to 40 feet, and with the Federation of Metro Tenants’ Association as a partner, HOPA is anticipating its newest addition will begin filling up as early as the first quarter of 2023.

The Thorold Multimodal Hub comprises three distinct properties, offering over 1 million square feet of indoor space – including about 700,000 square feet at the Davis Road site and about 450,000 square feet at the new Hayes Road site.

The third space is located to the north of the other two and primarily handles bulk materials.

Overall, the three sites cover 400 acres of indoor/outdoor space.

HOPA is currently looking to lease 350,000 square feet of indoor space at the Davis Road site (a former paper mill) and all of the indoor space at the new Hayes Road site. This is in addition to outdoor development space/acreage at both sites.

Hamilton explained a major draw for tenants is the ability to customize the types of spaces they want, which the site operators accommodate to the best of their abilities.

Citing another HOPA multimodal property in the City of Hamilton — where over 100 tenants with diverse needs are splayed across 25 acres — he said selling solutions instead of mere plots of land has been a cornerstone of HOPA’s success.

“We build to suit and create the right infrastructure, recognizing that everyone’s demands are going to be different in terms of accessibility to transportation, what kind of coverage space they need, what kind of outdoor laydown space they need, what kind of utilities they need,” he said.

“We’re really open-minded towards creating these customized solutions for them.”

A potential benefit for sustainability

Ontario’s transportation plan was recently announced and, among other things, is intent on reducing greenhouse gasses. Hamilton said the Thorold Multimodal Hub is uniquely positioned to do just that.

In July, Char Technologies announced the first phase of the Thorold Renewable Natural Gas & Biocarbon Project at the hub, which, supported by the Natural Gas Innovation Fund and Bioindustrial Innovation Canada, will help replace fossil fuels and establish a lower-carbon economy.

Northland Power also operates on the site and will contribute to the infrastructure.

Hamilton said a sustainable supply chain would significantly reduce emissions and support Canada’s aspirations to become a net-zero country.

The COVID-19 crisis has also exposed weak links in the supply chain, but the multimodal hub’s expansion should bolster resiliency.

Moreover, Hamilton said each marine vessel removes up to 960 trucks off the roads.

“With shortages in the workforce right now, particularly of drivers in trucking industry, using marine, each vessel is manned by 14 people instead of 940 truck drivers and will help take pressure off truck drivers today and help them focus on that last-mile space,” Hamilton said.