Author The Lilly Commercial Team

Construction Supplier Buys Facility in the Vaughn Industrial Park

Oxford Properties Group Sold Building on Royal Group Crescent to Newmar Alpa Lumber Group for $81.5 Million

Alpa Lumber Group, one of the largest suppliers and manufacturers of construction products distributed across Canada and within the United States, accomplished a rare feat by acquiring a 281,265-square-foot industrial building in Oxford Properties’ Vaughan Industrial Park for $81.5 million in an off-market transaction.

Oxford rarely parts with properties in the industrial park, according to local brokers. The building at 81 Royal Group Crescent is located in Concord, north of Toronto. The sale was arranged by Lennard Commercial Realty broker Jonathan Gorenstein, MBA, SIOR, and reported earlier by Real Estate News Exchange.

The property, which occupies a 10-acre parcel and was built in the late 1990s, is currently tenanted by automotive supplier Martinrea, with five years remaining on its lease. A previous furniture supplier tenant went out of business and vacated the property earlier this year.

The Vaughan Industrial Park encompasses 3 million square feet situated around the Royal Group Crescent, and is owned and managed by Oxford.

Source CoStar. Click here to read a full story

Investors Seek Retail Centres in Emerging Markets With Opportunities To Densify

Retail Investors Favour Secondary Markets Near Toronto

With retail properties performing well in the Greater Golden Horseshoe, investors bet on two malls in emerging urban centres with plans to densify. The sale of two super regional malls — Conestoga Mall in Waterloo and White Oaks in London, Ontario — signals confidence in outer retail markets near Toronto.

In recent years, a total of 15 malls across the Greater Toronto Area have proposed plans to add residential towers on their properties to create larger consumer populations surrounding their shopping centres.

This trend has expanded out into the Greater Golden Horseshoe and beyond into London, Ontario. In August, Westdell Development Corp. added White Oaks to its commercial holdings and plans a new to rejuvenate the center by renovating the facade, adding new stores on pads separate from the mall, and residential towers on-site. Westdell purchased the 698,500 square foot super regional mall from BentallGreenOak for $141 million or $202 per square foot. The site sits on 46 acres, translating to 35% coverage, lending to the new redevelopment plans by allowing plenty of land for intensification.

London, Ontario — a smaller city 200 kilometres west of Toronto — offers affordable urban living while still being in proximity to larger metropolitan centres accessible by major highways and transit. The city of London is investing more than $200 million in renewing aging infrastructure with projects focused on supporting growth, including two rapid transit projects. London is one of Canada’s fastest-growing cities and these investments will facilitate the city’s expansion and recent boom in population growth boosted by immigration and inter-provincial migration.

Similarly, the purchase of Conestoga Mall by Primaris Real Estate Investment Firm from Ivanhoe Cambridge for $270 million conveys assurance in Waterloo’s retail market. Conestoga Mall recently underwent a significant $46 million redevelopment in 2018 under its former owners. The mall was the first Canadian shopping center outside a major metropolitan region to see annual sales per square foot surpass $1,000 in 2018, according to the Canadian Shopping Centre Study 2018. At the time of sale, the mall was 94% leased and sits on 49.78 acres, covering just 31% of the property, leaving the potential for intensification. Conestoga Mall is a major transit hub connecting to the route of Waterloo’s new ION LRT, which was completed in 2019, making the site ideal for residential development.

Retail leasing picked up in 2021 in the Greater Golden Horseshoe, backfilling most of the spaces that were vacated during the pandemic, and many retail landlords are adapting to changing consumer behaviours. With a marked increase in online shopping, the amount of space required by retailers has decreased as consumers shift to an omni-channel approach to shopping. Brick-and-mortar locations are serving as showrooms for consumers to see products that they can purchase online and conveniently have delivered to their homes.

Overall retail leasing has since dropped by 17% year to date from the five-year quarterly average of 400,000 square feet and 83% down in the third quarter to date. Net absorption within shopping malls in the Greater Golden Horseshoe over the past 12 months slowed by 47% in the second quarter from a high of 165,000 square feet in the first quarter of 2023. Since the beginning of 2022, when adding the London CMA to the Greater Golden Horseshoe region, leasing activity increased by 22%, nearing 3 million square feet.

This elevated leasing activity bodes well for emerging retail markets surrounding the Greater Toronto area even as the market experiences a slowdown through the latter half of 2023.

Source CoStar. Click here to read a full story

Slate Prepares to Launch Steelport, Corktown in Hamilton

Corktown to comprise 2 condo towers; Steelport a huge 800-acre industrial development

Slate Asset Management is bullish on the Hamilton market as it launches two major projects in the city – the two-tower Corktown condos and its 800-acre Steelport industrial development.

Corktown is Slate’s vision for a design-forward residential 27-storey tower and 14-storey mid-rise, with retail spaces at the ground level. It will have more than 700 condos on completion.

Steelport, on the historic harbourfront of Hamilton, was acquired from Stelco Inc. in 2022.

Slate has introduced the new name, along with a new identity and preliminary vision for the industrial lands and buildings. Its vision is to reshape the underutilized property into one of the largest, state-of-the-art intermodal industrial hubs in the country.

The redevelopment will bring new industry to Hamilton, create up to 23,000 jobs and inject up to $3.8 billion into Ontario’s economy over the next decade, according to an economic study conducted by EY.

Slate considers Hamilton a growth market

Brandon Donnelly, managing director of development for Slate, said the two projects are part of the company’s broader long-term commitment to Hamilton.

“We think of ourselves as city-builders, meaning we think beyond each of our individual projects and more about what we can give back to the communities we invest in,” Donnelly told RENX.

“With Corktown, not only are we bringing quality architecture and design to the region, but we are investing in jobs, economic development and the greater Toronto housing market. We think this commitment to the City of Hamilton is really the beginning of a renaissance and we’re excited for what’s to come.”

Slate is a Toronto-based global alternative investment platform targeting real estate assets. Its platform has a range of real estate and infrastructure investment strategies, including opportunistic, value-add, core-plus and debt investments.

Steven Dejonckheere, senior vice-president at Slate, said the company’s thesis for a while has been that Hamilton is primed to evolve and grow in a big way.

“I think that’s based on a number of things. Of course there’s the spillover from demand and affordability in the GTA,” he said. “But I think beyond that we’ve always seen Hamilton as the first major municipality outside the GTA that is kind of its own city. It has its own history, its own infrastructure, it’s less dependent on being a bedroom community of the GTA.

“I think along with that there’s all the underlying fundamentals of a growth story there from first-class universities that are bringing in high talent, to sophisticated medical systems, to a thriving arts and cultural system, to the affordability factor that’s bringing in a lot of young professionals. We felt that all of those elements sort of set up Hamilton to really grow when we’re looking out for the next decade or two.”

A “revolution” in the steel industry, which has been Hamilton’s calling card for decades, is opening up further opportunity.

“You fold into that all the changes happening to the steel industry and the fact that it is getting completely revolutionized over the next decade and really changed the image of the heavy industry that has been in Hamilton . . . we know that of course will continue to be part of Hamilton’s story but it’s going to evolve and change and open up room for a lot of new, exciting manufacturing and logistics industries and jobs that come along with that,” Dejonckheere said.

“That’s a complete picture of good momentum that we believe is going to be long-lasting in Hamilton and we believe makes it a good investment for all of our projects.”

Corktown a two-tower development

Corktown is a full city block development in the downtown. The first phase will be the 27-storey Corktown East tower.

Corktown West will be a 14-storey mid-rise building – an L-shaped building fronting on John Street. The first tower will include 372 condo suites and the second phase, which is yet to launch, will likely be about the same unit count.

Donnelly said the mix of units includes about 60 per cent one-bedroom and one-bedroom-plus-den and the remaining 40 per cent are larger suites including two and three bedrooms. The first phase launched in May.

“We’ve seen really great response to the offering, so we’re close to 60 per cent sold in that first phase,” he said. “We plan to start construction on that tower next year and then we’ll also launch sales in the future for the second phase.”

The first phase has a target completion of 2028 with the mid-rise completing later in 2028 or 2029.

The development is two blocks south of the Hamilton GO station and transit hub.

“That’s really something that we look for in all our development projects, especially our residential projects,” he said. “We’re focused entirely on infill projects. We look for existing urban centres where we can build on top of existing infrastructure like transit.

“We like transit. We like walkable communities, urban amenities. Those are the types of things we look for when selecting sites.”

Steelport to become major multi-modal hub

Dejonckheere said Steelport will be a state-of-the-art intermodal and industrial hub second to none in Canada.

“It has north of 3.4 kilometres of actual water frontage. Half of that is deep-water dock wall,” Dejonckheere said. “From our knowledge, it’s the longest deepwater port on the Canadian Great Lakes. So really this is going to be a world-class manufacturing and logistics hub.”

Stelco will continue to operate a cold-roll steel mill on 75 acres near the centre of the site.

“That will open up a little more than 700 acres of new development surrounding that and we foresee it being a wide range of industrial and manufacturing uses,” Dejonckheere said..

“We’re anticipating somewhere between 11 and 12 million square feet of new industrial uses, everything from your large-scale big-box logistics uses down to new-age technologies and manufacturing, energy production, logistics that are associated with the port and the rail connectivity.”

He said the development will be interwoven with retail offerings and areas for use by residents and visitors.

“It really is the majority of the Hamilton waterfront,” Dejonckheere said. “So, interwoven through all the development we’re planning is a pretty extensive public realm network that will help bring people out to the waterfront and also currently is envisioning proposing retention of some of the steel manufacturing structures and potentially repurposing them into public amenities as well.”

Steelport will be a 10-plus-year project. Officials anticipate it will house everything from one-million-square-foot distribution centres to smaller unique spaces.

“We’ve designed the plan to centre the larger structures and locate those at the centre of the plan and urbanize the edges of the site some more,” Dejonckheere said. “What I mean by that along the waterfront for instance, which is pretty unique, we anticipate more flex office, small-bay industrial, perhaps opportunities to work with institutions for some sort of innovation, or knowledge or bio-tech based campus setups.

“We’ve also seen interest from creative industries and the film industry.”

Donnelly said Slate believes Steelport is the largest private investment in Hamilton, with a total investment of more than $3 billion when all the buildings and infrastructure are built.

The site is so large Donnelly said Steelport comprises three times the total area of downtown Hamilton.

Source Renx.ca. Click here to read a full story

Commercial Title Insurance: How Are You Managing Risk?

Title insurance protects you and your portfolio from the hard-to-anticipate risks present on every property.

As a successful commercial real estate investor, you know how to assess and manage your risk as you grow your portfolio. But not all risks on a deal are apparent.

Every transaction comes with unknowns, and those unknowns can come with price tags. Title insurance protects you and your portfolio from the hard-to-anticipate risks present on every property. As your portfolio expands, those risks compound. Here are three examples:

1. Title fraud

Purchasing title insurance as part of closing lets you move forward knowing that, if the worst happens, your investment is protected. The seller may not be who they say they are, and not every discharge on the title may be legitimate. Every deal carries the risk of substantial losses, because ID theft and title fraud in Canada are getting more sophisticated.

But so are we. FCT is the leader in fraud detection and prevention among title insurers in Canada. Our ability to react to new fraud trends, techniques and technology lets us keep your protection up to date. FCT’s underwriters monitor deals we receive for signs of fraud, and step in to inform buyers and lenders of red flags.

Fraud continues to pose risks to your investment long after point of sale. That is why FCT’s commercial title insurance covers up to $5 million in post-policy losses from fraud. Without that protection, it can be difficult or even impossible to recover any part of your loss from a fraudster registering a mortgage on your property or transferring its ownership.

2. Gap coverage

Even the most straightforward deals have gap periods—points in a transaction where an intervening interest can, even unintentionally, cause losses. Two gaps in particular pose risks for investors:

The work order gap

When you purchase a commercial property, your lawyer will submit municipal searches to check if any work orders have been issued. While the search is in progress, a new work order could be submitted, and you might not find out about it until after the closing date. FCT’s commercial coverage includes an endorsement to protect against losses from work orders submitted after your lawyer’s search and before your closing date.

The title registration gap

When your lawyer submits your transaction documents to a Land Titles Office (LTO), you are still at risk until those documents finish certification. If there are issues with the documents themselves, or worse, an intervening registration is submitted before certification completes, the LTO can reject those documents. Depending on your jurisdiction, this can happen even after you have transferred the funds and received the keys. This is why registration gap coverage is included in every FCT title insurance policy.

3. Errors in government responses

Your lawyer conducts thorough searches on the titles of the properties you purchase. They protect you by conducting due diligence, writing to applicable authorities to verify status and reviewing all the documents attached to your new property’s title to ensure you are aware of potential risks.

If government responses contain any errors, you could take on significant losses without warning, following closing or even years later when you sell. To help prevent this from happening to you, FCT’s commercial policies include a government response endorsement that provides coverage for losses from errors in written off-title responses from government that deal with deficiency notices, outstanding work orders or zoning.

It’s our duty to defend you

Title fraud, gap coverage and errors in government responses are not the only risks you face on every property you purchase—you may also have to defend your title, when the time comes. Your title insurance policy outlines dozens of covered risks, and FCT’s underwriters work to find new ways we can protect our insureds. Defending your interests is an important part of that protection, separate from coverage itself.

Every title insurance policy from FCT carries a duty to defend. That means that if someone claims an interest in your property, we take on the costs of defending your title, even going to court if necessary.

Title insurance is valuable because it can cover losses thousands of times higher than what you paid for the protection. It helps de-risk your position, letting you deploy more capital, with lower reserves. But, possibly most importantly, it provides peace of mind. It lets you focus on what really matters: growing your portfolio. Unexpected risks can always arise—FCT will be there to meet them with you.

Source Renx.ca. Click here to read a full story

Some of Canada’s Top CRE Execs Examine Industry Trends

Industrial and office portfolios

While Diamond said the rapid industrial rent escalations of the past five years weren’t sustainable, the sector still offers good margins. He doesn’t believe there will be a major slowdown with the asset class.

Developers can still profitably build industrial facilities as long as their land costs are reasonable, according to Diamond.

More employees have returned to offices in Asia and Europe than in Canada and the United States and, while Canada is going through a period of adjustment with hybrid work models and some people working from home at least a few days a week, Welch believes that offices still have a major role to play in society.

Diamond said Choice itself uses a hybrid model. He said its offices are 80 to 90 per cent full from Monday to Thursday, but that number drops down to 20 per cent on Friday.

RioCan has a mandatory three-days-per-week in the office policy for its over 600 employees, and Gitlin said it’s working reasonably well.

He feels real estate companies should be leaders in office attendance, however, since their business is based on getting people into buildings.

Source Renx.ca. Click here to read a full story

Transforming Office Buildings To Livable Space

Key considerations for office-to-residential and office-to-hotel conversions.

The pandemic was been a key driver for reimagining our relationship with the built environment and is presenting new opportunities across portfolios and sectors.

With a surplus of office space resulting from evolving workplace strategies, owners in conjunction with teams of developers, city planners, architects and engineers are actively managing a variety of complex conversions of these commercial building types into viable living spaces.

But not all office buildings are candidates for conversion. A feasibility study is required to assess the economic, aesthetic, environmental, structural, engineering and market viability for a successful conversion. Consideration must also be given to livable residential uses that range from apartment rentals and condos to affordable housing and hotels.

In this Insight Article, we provide our perspective on key drivers and considerations that are shaping the transformation of commercial office buildings to livable spaces based on our experience leading more than 20 completed, under construction and in-design projects in Canada, the US and UK.

1. Economic viability

The staying power of hybrid and remote work is presenting a real challenge for commercial office owners and developers. While the industry is managing a post-pandemic era, the reality remains that a percentage of existing office buildings are finding economic renewal in converting to livable or mixed-use spaces.

Eroding tax bases due to vacant office buildings can be a lightning rod for adaptive reuse in downtown cores. City planners and local municipalities often greenlight office conversions far faster than new builds to secure a stable tax base. Tax incentives for market-rate and affordable housing also contribute to the benefits of repurposing commercial space and offer developers more avenues to realize economic viability.

These measures help municipalities realize their ultimate goals of returning residents to the city’s most vibrant places. Activating dormant commercial neighbourhoods and reigniting downtown cores only happens with urban regeneration strategies and densification. Existing office buildings are often near transit hubs and retail centres, making them an attractive option for livable uses. Location is key and walkability is high on the list to command desirable units for future tenants.

While each region and municipality has planning approvals and guidelines for such conversions, most cities in North America, including Toronto and Calgary, are offering incentive programs to drive economic recovery in the core. These incentive programs vary based on specific goals.

The UK announced a provision through Class O Permitted Development Rights. This provision removes the requirement to make a formal planning application as development is automatically deemed approved, with the exception of listed buildings of historic interest. These projects are provided with a certificate of lawfulness, usually prior to development, which enables them to be funded or mortgaged, and work can progress in very short timeframes.

2. Environmental and carbon considerations

Converting existing office space to residential-type units often requires adapting existing plumbing, electrical, mechanical and building systems – and in some cases, an entirely new building envelope. Not only do these enhancements improve the energy performance of the existing building, but they help to lower the operational carbon over time, therefore reducing the carbon footprint of the building.

The carbon-reduction effect on the environment by repurposing rather than demolishing or rebuilding cannot be overstated. As architects and engineers, we have a great responsibility for a sustainable future. With aligned interests, a carbon emission analysis at the start of a project informs decisions to reduce both embodied and operational carbon. As energy costs increase in response to climate change the repurposing of existing structures begins to make greater economic sense.

3. Location, characteristics and structural integrity

The location of the target building will have a dramatic effect on its suitability for conversion. The neighboring infrastructure is critical to the initial selection of a suitable conversion.

Many office buildings are simply not suited for residential adaptation. Large commercial office floor plates (10,000 SF2 / 1000 SM2 or greater) result in lightless cores, outdated electrical, plumbing and HVAC systems – all contributing to a costly and exhaustive undertaking. These buildings may be suitable for other adaptive uses with more open floor plan characteristics. However, if development proformas pencil-out, creative solutions are available for most repositioning challenges. Often, smaller and older buildings offer more manageable space for conversions and come equipped with features like higher ceilings and larger windows that are highly desirable for residential use. Hotels are arguably even more appropriate for conversion to senior residences or affordable housing models.

Historically significant buildings may also be able to take advantage of preservation funding which will assist the economics of the conversion and add to the urban fabric of older neighborhoods.

Preparation and pre-analysis of the existing structure is imperative. Once the basics are understood it is a matter of building flexibility into the design layout, ensuring minimal shifts to the core to avoid compromising the structural integrity. Post tension structures can be particularly challenging as are several other systems including clay tile slabs and other older structures. An integrated design approach with a deep knowledge of the systems and understanding of the market conditions of residential planning metrics is paramount to a repositioning success.

Modern technologies like laser scanning and 3D point-cloud modeling mean a faster, less intrusive way to work with existing structures. As we continue to find new ways to repurpose buildings for multiple sectors, the lessons learned are transferable from each conversion project.

4. Market trends and social impact

Residential design excellence provides personalization and pride of place, and the flexibility for different living patterns and household demographics. Premium amenity spaces must be integrated using open areas with direct connections to circulation spaces (stairs, elevators, entrance lobbies, mailrooms, etc.). Fortunately, many older office buildings have amenity spaces that can easily be converted for residential users and may be conveniently located to other neighborhood amenities. This is very much about supporting and fortifying the idea of a 15-minute neighborhood as urban cores continue to repopulate creating livable, walkable, sustainable neighbourhoods.

It is incumbent of any conversion project to respect the adjacent neighbours, yet firmly establish itself with the ideals of its new identity, knitting itself into the existing architectural characters of the streetscape and surrounding fabric. Fostering diversity and inclusion of tenants and space types will support thriving micro-communities and evoke an excitement that will draw people in. Developments have not been without their controversy when space standards, amenities and quality of space are not properly considered. When approached responsibly, conversations can provide an answer to what to do with unoccupied buildings, how to reduce the use of embodied carbon and help provide a solution to the shortage of quality housing within our urban centers.

The conversion of commercial buildings can be viewed as filling the gap, or could be a trend that advances livable communities, but it is a reminder that flexibility is needed to respond to our evolving world. As long as the need for housing abounds, we all have accountability to investigate existing opportunities.

Source Renx.ca. Click here to read a full story

Feel Like Toronto Has Way More Cranes Than It Used To? That’s Because They’ve Doubled

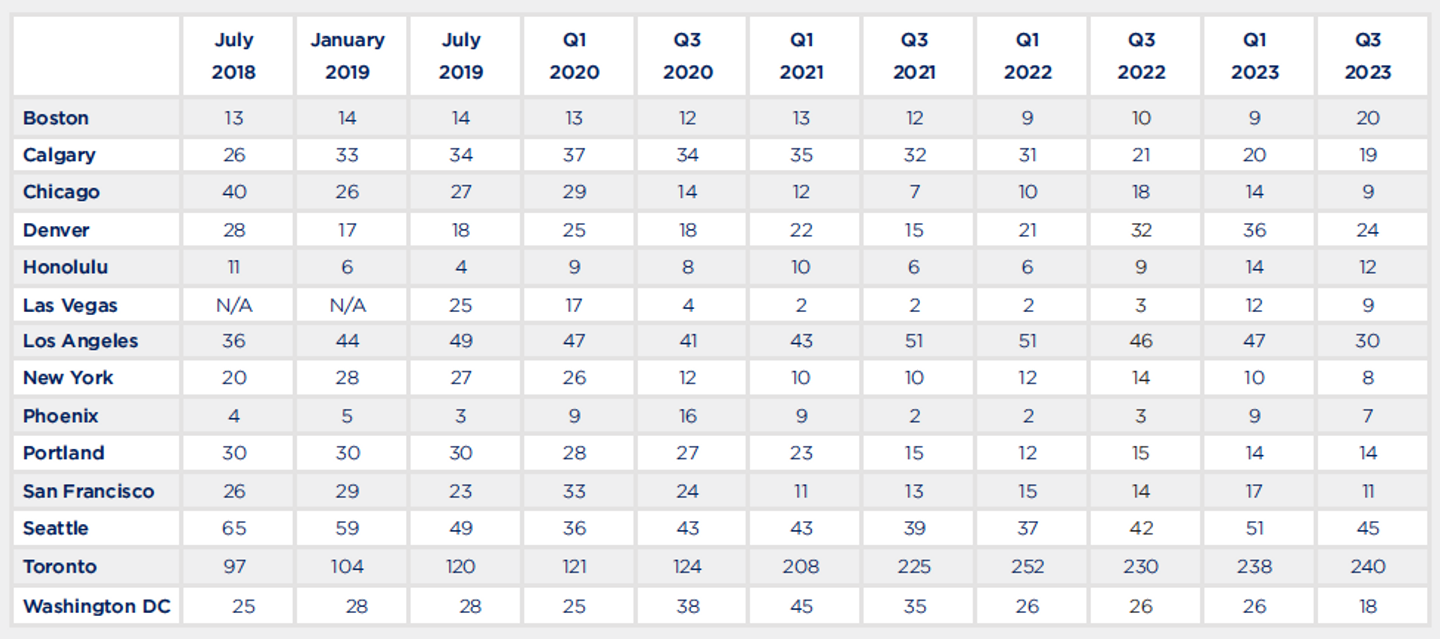

Toronto once again has, by far, the most cranes out of any city in North America, according to a new report.

Whether you’re for it or against it, every Torontonian can agree it feels like there’s now a new towering development going up on every block. As it turns out, that sense of increased high-rise development is entirely justified, as Toronto has now doubled its number of cranes compared to before the pandemic.

A new Crane Index report from Rider Levett Bucknall found that in the third quarter of 2023, Toronto had a staggering 240 cranes in the city. Not only is this the most out of all other North American cities measured — well outpacing second-place Seattle’s 45 cranes — but it’s about two times the 121 cranes seen in the first quarter of 2020.

The number of cranes in Toronto really took off in the first quarter of 2021, jumping to 208. It’s continued to grow fairly consistently since then.

“The residential sector continues to see the most consistent growth in crane count, up seven more cranes this quarter, however, the hospitality sector has dropped by four cranes in the past six months,” the report says of Toronto. “It’s worth noting that behind the relatively consistent crane counts, there’s been a very active ongoing construction scene, with over 50 new projects introducing cranes in the past six months.

“Of these new construction projects, 41 are residential projects, 7 are commercial projects, and the remaining three are institutional projects.”

The State of Housing Starts

Just last month, the Canada Mortgage and Housing Corporation (CMHC) reported a 28% increase in year-to-date housing starts in Toronto, which came even as starts across the country dipped. However, zooming into just the latest available data, there’s actually been a decline in housing starts in Toronto, falling from 7,171 in June to 5,200 in July to 4,137 in August, making the increase in crane numbers during that time a somewhat surprising one.

The construction of apartments has led the way in Toronto this year, with starts of this housing type jumping up 58% in the first half of 2023, according to CMHC.

The government of Ontario has been laser-focused on getting municipalities to increase their housing starts, implementing some often-contested tactics to do so. From holding forced refunds of application fees over the heads of municipalities for not approving development applications quickly enough to unveiling the Building Faster Fund — a $1.2B incentive program to reward municipalities for hitting or exceeding their housing targets — the Province has made clear that it sees cutting municipal red tape as a key in solving the housing crisis.

It doesn’t help, however, that at the same time a number of developers, both in Toronto and otherwise, have had to pause, postpone, or even cancel development plans as rising interest rates and fewer interested buyers have made projects less financially viable.

In an October report, CMHC noted that sales of new condos were down 52% between January and June of this year compared to the same time period in 2022.

“This has made it more difficult for developers to achieve the sales necessary to access construction financing,” CMHC said, also noting that “elevated construction costs and interest rates likely present challenges for future projects.”

Source Storeys. Click here to read a full story

Toronto Restaurant Real Estate Putting A Squeeze On Owners

With today’s climate of sky-high interest rates, pricey lease costs and lingering pandemic recovery, being a Toronto bar or restaurant owner isn’t for the financially faint of heart.

Running a restaurant in Toronto is no easy feat – it never has been. Add today’s climate of sky-high interest rates, pricey lease costs and lingering pandemic recovery to the mix, and being a Toronto bar or restaurant owner isn’t for the financially faint of heart.

With the city bustling back to life post-pandemic, however, a healthy handful of buzzed-about new restaurants open their doors each month throughout the Greater Toronto Area (GTA). And many – from Dundas West to King Street and Yorkville – are packed with patrons. Some older spots, however, are still feeling the pinch of the pandemic.

Rob Eklove, Vice President of Urban Retail at The Behar Group Realty Inc., owned a handful of popular former Toronto bars (Supermarket, Tempo, and Lava) and now specializes in helping chefs and owners find real estate for restaurants. He says the general consensus is that Toronto’s restaurant sales are down 30% compared to pre-pandemic levels.

“But that’s dependent on the market you’re looking at,” explains Eklove. “In the Financial District’s core, they may be suffering more than that because office attendance is nowhere near where it was prior to the pandemic. The suburban markets may fare better because people are working from home and staying there.”

In the years rife with pandemic-inspired lockdowns and restrictions, Toronto’s beloved bars and restaurants took a major beating, resulting in the fight of their lives for countless owners. Of course, some didn’t survive. So, the reawakening of Toronto’s restaurant scene – complete with this slew of new additions – is cause for celebration. But that doesn’t mean life’s any easier for the city’s restaurant and bar owners.

A High Price With Little Wiggle Room

Rents for commercial real estate – especially in the downtown core – remain costly. According to the most recent figures from the Toronto Regional Real Estate Board, the average commercial/retail lease rate in Toronto is $26.32 per sq. ft.

Eklove lays out the math with a real estate acronym: GROC (Gross rent occupancy cost). “In a restaurant setting, you want your gross rent to be 10% or less of your sales, in terms of a business model,” says Eklove. “If you’re paying $100K in gross rent annually, you need to be doing $1M+ in sales. So, if you signed a lease where you were paying $300K in gross rent annually, but pre-pandemic, you thought, ‘No problem, I can do $5M in sales,’ then you’ve got it made in the shade. But, post-pandemic, your sales are $2.5M, then you’re getting squeezed.”

As he highlights, some Toronto restaurant owners locked into leases made pre-pandemic may indeed be in a particularly vulnerable spot. “I think that some restaurant groups downtown that did deals at premium rates pre-pandemic are feeling the pressure,” says Eklove. A handful of restaurants throughout the city have subsequently made headlines as of late for their closures due to their inability to afford rent.

For those entering the bar and restaurant market, while rent costs may be down in some cases, Eklove says that deals are harder to come by these days.

“There has been an uptick in activity; there has been an uptick in people engaging landlords and figuring out if deals are possible,” he says. “But, with borrowing costs up and construction costs up, deals are very hard to come by — that’s the bottom line. People have to have a very sharp pencil when it comes to figuring out whether deals make sense. You’d assume that landlords would be more flexible with lease rates rather than continuing to have vacancies, but that’s not always the case. There are other metrics involved that have an impact on the valuation of particular properties. So, landlords are reluctant to do deals because it could adversely impact the valuation of their property.”

Chef Roberto Marotta, who owns downtown Toronto restaurants ARDO and DOVA with his wife, Jacqueline Nicosia, says that something shifted with the pandemic and its devastation on the city’s food and beverage industry when it comes to commercial real estate. “Following COVID, more than ever, the restaurant industry is seen as high-risk,” says Marotta. “It’s extremely challenging to secure a new location because property owners and managers are looking for significant collateral. If you are new to the industry, it can be an extreme challenge to negotiate and secure the property you are interested in.”

The pair have experienced opening a restaurant both pre and post-pandemic. They opened ARDO in 2015, and DOVA in 2021. “Prior to the pandemic there were far less vacancies, so landlords were more willing to negotiate with you on the terms of the lease,” adds Nicosia. “The real estate market took a huge hit during the pandemic so landlords became incredibly strict on their terms for restaurants. Interestingly, despite the pandemic, rental costs have remained high and insurance costs continue to mount. We recently secured the space for our fourth business and third restaurant and these challenges continue.”

Location, Location, Location

For what would become DOVA, Nicosia says she and Marotta were drawn to the private patio of the real estate at 229 Carleton Street, as well as the opportunity it offered to have a unique private dining room. “They were both features our first restaurant, ARDO, didn’t have,” says Nicosia. “We could see the potential in each space and picture what it could become. We took our time looking as it had to feel right and tick all of the boxes.”

The spot is located in the city’s rapidly up-and-coming Cabbagetown neighbourhood. “We wanted to bring something new to the Cabbagetown area that was missing,” says Marotta. “We love the east end of Toronto and wanted to stay in that neighbourhood. We saw DOVA’s current location a few years prior and when it came on the market again the timing was right.”

Local entrepreneur and beverage expert Evelyn Chick, on the other hand, wasn’t looking for bar space at all when she stumbled upon the Parkdale spot that would later become Simpl Things Cocktail & Snack Bar. “I was actually looking for a secondary event space, but Simpl Things came along and it was such a unique space and my vision was so clear as to what I can do with it – to span across two different addresses, with a massive footprint for a patio that will double the size of the restaurant,” says Chick. “The area is difficult because it’s Parkdale, which to some can be rough around the edges, but with the right aesthetics, unique concept, and good hospitality it can be a destination spot. It is a bit tucked away from the chaos of Queen Street, so often people refer to it as a ‘hidden gem.’”

Securing a place to call home is just the first of many challenges for restaurant and bar owners. “It’s challenging in terms of everything being extremely expensive to maintain, including labour, maintenance, insurance…even if the base rent is ‘cheaper,’” says Chick. “New restaurant owners may find a property that they like, but once they get into the build-out stage, budgets are tight as the cost of materials start to increase rapidly and it’s much harder to make your investment back.”

Preparing For An Ever-Changing Market

Eklove calls it “a wash” when asked whether the GTA is gaining or losing wining and dining spaces. “We are losing some spaces downtown, and gaining some spaces in the suburban markets,” says Eklove. “I think we’re in the middle of some uncertainty, but in the long term, there’s no doubt that we’re going to gain more food and beverage spaces.”

Along with this, commercial rents and property values will continue to rise, says Eklove. “It may not be in the foreseeable future, but long-term, I’m confident this is the case.” For those currently in the market for restaurant or bar space, available supply varies throughout the GTA, says Eklove.

“Supply is limited, especially in the suburban markets, because construction costs and borrowing costs have increased significantly, so builders are not building new plazas,” says Eklove. “So, there’s certainly a shortage of supply in the suburban markets, where landlords are getting multiple offers for 1,200-sq.-ft USR space. In the downtown core, there are more options, but people are still quite nervous. The population in the downtown core is nowhere where it was pre-pandemic. People are being careful; they don’t know if a recession is going to hit, and lending and construction costs have increased, so people are being judicious.”

For those looking to secure bar or restaurant real estate, doing the research is key. “Do your homework, research the market, have a solid concept and stick with it, even if small parts of it need to be flexible,” says Chick. “Think about variables and costs involved, as it’s often much more than anticipated. Go through the proper channels, cover your bases, and don’t be frugal with things that have to be done properly – like licensing, plumbing, electrical etc. It will save you a lot of headache in the long run.”

Hiring an in-the-know professional or two also doesn’t hurt. “Hire a seasoned lawyer who is an industry expert and don’t be afraid to push back to secure terms that make sense for you and your business,” says Nicosia. “Know what terms you are willing to negotiate and ones that are off the table because they will directly affect your business. The terms you are able to negotiate will make or break your success.”

Marotta also stresses the importance of finding a strong real estate agent that you trust completely and who has dealt with restaurant locations and negotiations before. “You need to find the right person you can count on,” says Marotta. “We are so grateful we have found the right fit. Finally, don’t be afraid to reach out to industry peers. It will surprise you how much anyone in the hospitality field wants to see fellow restaurateurs thrive.”

For diners, today’s uncertain culture may mean higher food prices – something patrons are just going to have to accept (or stay home). But at the end of the day, most of the city’s restaurant owners are driven by passion over profit. And, if we have to dish out a few more dollars to experience their culinary creations, so be it.

“Despite the uncertainty, I’m very bullish about Toronto,” says Eklove. “It’s a great city. I think with all the immigration that the government is promising, the city is going to continue to explode. So, although there are some short-term growing pains in the food and beverage industry, I’m very optimistic about the city in the long term.”

Source Storeys. Click here to read a full story

RioCan, Allied Announce Retail Tenants Coming To The Well

The joint venture partners unveiled the initial roster of retail on Friday, and said that retail tenants from Structube to Sephora are expected to “physically open in phases” through 2023 and into 2024.

Ten years after construction kicked off at The Well — a 7.75-acre mixed-use development coming to Toronto’s King West district — RioCan and Allied Properties have unveiled the initial roster of retail tenants set to open up in the space.

The joint venture partners announced the roster on Friday and said that retail tenants are expected to “physically open in phases” through 2023 and into 2024.

In the coming months, The Well will welcome recognizable brands like Adidas, Indigo, Structube, The Bone & Biscuit, Bailey Nelson, Le Creuset, Sephora, Frank & Oak, and Shoppers Drug Mart.

Meanwhile, boutique retailers like Black Rooster Décor, Design Republic, Giotelli, Gotstyle, Groovy Shoes, and Suetables will lean into the area’s “King West character.”

As well, three new Oliver & Bonacini restaurants will open doors at The Well, including Aera restaurant, La Plume, and The Dorset.

The Wellington Market (with a diverse assortment of 55 vendors), National (a beer market “inspired by North American tastes”), and a variety of “new concept” restaurants and bars (including Bridgette Bar, Mandy’s Gourmet Salads, L’Avenue, and LuLu Bar) will also be joining the dining mix.

In the health and wellness niche, The Well will welcome fitness and wellness boutique Sweat and Tonic and a full-service medical clinic HealthOne Medical & Wellness.

Finally, a number of cafés (De Mello Coffee, Fix Coffee + Bikes, and Quantum Coffee), bank branches (Bank of Montreal, Royal Bank, and Scotiabank), and beauty and salon services (Etiket, Room1six, Vie Nail & Beauty Salon) — as well as a fully automated, cashier-less grocery store, known as Aisle 24 — will help establish The Well as something of a one-stop shop.

“As we finalize additional lease deals, more announcements of exciting retailers opening at The Well are forthcoming,” said Friday’s announcement. “To celebrate the openings, a ribbon cutting event is scheduled for November 17, 2023 at The Well.”

RioCan and Allied also gave an update on the office and residential components of The Well on Friday, saying that 98% of the 38-storey, 1.2-million-sq.-ft office space is presently leased.

FourFifty The Well — one of three residential rental buildings in the development — commenced pre-leasing in March 2023 and is currently 21% occupied and 30% leased. The remaining rental buildings have achieved 65% leased in aggregate.

Occupancy also commenced for two of the three condominium buildings that will be encompassed in The Well.

Source Storeys. Click here to read a full story

Million-Square-Foot Ontario Industrial Portfolio For Sale

Eight properties spread across the Greater Toronto Area being marketed by RBC, CBRE

CanFirst Capital Management has put eight Ontario logistics and industrial assets totalling 1.05 million square feet on the market through RBC Capital Markets Real Estate Group and CBRE.

The properties are in key transportation corridors near 400-series highways, and in close proximity to good labour pools in Burlington, Mississauga, Scarborough, Etobicoke, Markham and Cambridge.

There are four single- and four multi-tenanted properties and 89 per cent of the warehouse space is mid- and large-bay.

The properties have extensive shipping and receiving capabilities, clear heights providing ample warehousing capacity, and varying unit configurations to accommodate a variety of occupier types.

Good income growth opportunities

The portfolio is 99 per cent leased to a high-quality and diverse tenant roster representing the energy, transportation and logistics, construction and building materials, and chemical technology sectors, among other industries.

Average in-place minimum rents across the portfolio are $12.51 per square foot, approximately 55 per cent below market rates.

The properties have a relatively short weighted average lease term (WALT) of 2.5 years, allowing a future owner to drive meaningful net operating income growth in the near term as leases expire and rents are rolled to market.

The Greater Toronto Area’s industrial leasing market continues to experience historically high average net rents and had a vacancy rate of just 0.8 per cent in the second quarter.

These factors are expected to spur strong interest in the properties from different types of investors. The preference is to sell the portfolio in its entirety, but consideration may be given to the right offers for either individual properties or clusters.

No bid deadline has been announced for the properties.

The eight properties

Here’s a rundown of the eight properties:

- 71 Maybrook Dr. in Scarborough is a 44-year-old, 136,340-square-foot building on a 7.19-acre site that’s fully occupied by one tenant with a WALT of 4.5 years. Its clear height ranges from 18 to 60 feet and it has three truck-loading dock doors and eight drive-in doors.

- 81 Maybrook Dr. in Scarborough is a 37-year-old, 72,721-square-foot building on a 3.66-acre site that’s fully occupied by two tenants with a WALT of 1.5 years. It has a 22-foot clear height, six truck-loading dock doors and two drive-in doors.

- 400 Cochrane Dr. in Markham is a 39-year-old, 187,204-square-foot building on a 7.5-acre site that’s fully occupied by two tenants. Its clear height ranges from 18 to 25 feet and it has 12 truck-loading dock doors and two drive-in doors.

- 71, 81 and 91 Kelfield St. in Etobicoke is a 63-year-old, 113,178-square-foot complex on a 6.84-acre site that’s 96 per cent occupied by 10 tenants with a WALT of 2.2 years. It has a 14-foot clear height, 22 truck-loading dock doors and five drive-in doors.

- 6811 Goreway Dr. in Mississauga is a 48-year-old, 107,000-square-foot building on a 4.85-acre site that’s fully occupied by one tenant with a WALT of 0.9 years. It has an 18-foot clear height, 12 truck-loading dock doors and two drive-in doors.

- 1180 Corporate Dr. in Burlington is a 36-year-old, 70,639-square-foot building on a 4.35-acre site that’s fully occupied by one tenant with a WALT of four years. It has a 20-foot clear height, four truck-loading dock doors and one drive-in door.

- 1121 Walkers Line in Burlington is a 65-year-old, 288,161-square-foot building on a 14.87-acre site that’s fully occupied by two tenants with a WALT of two years. Its clear height ranges from 24 to 36 feet and it has 17 truck-loading dock doors and six drive-in doors.

- 400 Jamieson Parkway in Cambridge is a 20-year-old, 75,072-square-foot building on a 5.02-acre site that’s fully occupied by one tenant with a WALT of 1.1 years. Its clear height ranges from 22 to 40 feet and it has eight truck-loading dock doors and one drive-in door.

CanFirst and its funds

Toronto-based CanFirst, founded in 2002, is a commercial real estate private equity company that co-invests with institutional and private high-net-worth investors in industrial and office properties that have growth potential.

It’s involved with development, redevelopment, asset and property management, financing, leasing and construction.

The properties in the Ontario industrial portfolio that’s on the market were acquired through CanFirst’s closed-ended CanFirst Industrial Realty Fund (CIRF) program.

Seven CIRF funds have closed and CanFirst has recently been fundraising for CIRF VIII.

Source Renx.ca. Click here to read a full story

Featured Properties

FOR LEASE – Retail Space – Toronto

Available area: 595 SF Lease rate: $1,800.00 Net Lease Located in Toronto’s upscale Leaside ne ...

BUSINESS FOR SALE – Sports Equipment Shop – Peterborough

Available area: 783 Sq Ft Asking Price: $300,000.00 An exclusive business opportunity awaits in Pete ...

FOR LEASE – Office Space – Toronto

Available area: 1,124 SF Lease rate: $17.00 Net Lease Perfectly located near the 401 with easy trans ...

FOR LEASE – Office Space – Toronto

Available area: 755 SF Lease rate: $1,800 Gross Lease CLICK HERE TO DOWNLOAD THE BROCHURE Prime Scar ...

FOR LEASE – Office Space – Toronto

Available area: 638 SF Lease rate: $1,700 Gross Lease CLICK HERE TO DOWNLOAD THE BROCHURE Prime Sc ...

FOR LEASE – Office Space – Toronto

Lease price: $23.50 Sq Ft Net + $17.68/2023/T.M.I. Available area: 3,901 Sq Ft 1,820 Sq Ft Elevate y ...

FOR SALE – Development Site – Woodstock

Size: 0.9 acres The two building lots are designed to be mixed-use, with commercial spaces on the gr ...

FOR SALE – Development Site – Woodstock

Size: 1.14 acres Currently has a commercial building whihc is built out for Resteraunt/Banquethall/ ...

Toronto Commercial Properties

Stephen & Mariya Lilly

Brokers

Office: 416-494-7653

Mariya Cell: 416-824-5078

Stephen Cell: 416-802-4228

Locations

RE/MAX Hallmark Realty Ltd., Brokerage

685 Sheppard Avenue East Suite 401, Toronto

Riverdale Office

RE/MAX Hallmark Realty Ltd.

630 Danforth Ave

Toronto, ON M4K 1R3

Office: (416) 462-1888

Fax: (416) 462-3135

Leslieville Office

RE/MAX Hallmark Realty Ltd.

785 Queen Street East

Toronto, ON

M4M 1H5

Office: (416) 465-7850

Fax: (416) 463-7850

Bayview Village Office

RE/MAX Hallmark Realty Ltd.

685 Sheppard Avenue East

Suite 401

Toronto, ON

M2K 1B6

Office: (416) 494-7653

Fax: (416) 494-0016

The Beach Office

RE/MAX Hallmark Realty Ltd.

2277 Queen Street East

Toronto, ON

M4E 1G5

Office: (416) 699-9292

Fax: (416) 699-8576

College Street Office

RE/MAX Hallmark Realty Ltd.

968 College Street

Toronto, ON

M6H 1A5

Office: (416) 531-9680

Fax: (416) 531-0154

Merton Office

RE/MAX Hallmark Realty Ltd.

170 Merton Street

Toronto, ON

M4S 1A1

Office: 416-486-5588

Fax: 416-486-6988

Richmond Hill Office

RE/MAX Hallmark Realty Ltd.

9555 Yonge Street, Suite 201

Richmond Hill, ON

L4C 9M5

Office: (905) 883-4922

Fax: (905) 883-1521

Newmarket Office

RE/MAX Hallmark York Group Realty Ltd.

25 Millard Ave West Unit B

Newmarket, ON

L3Y 7R5

Office: (905) 727-1941

Fax: (905) 841-6018

Ajax Office

RE/MAX Hallmark First Group Realty

314 Harwood Ave. South, Suite 200

Ajax, ON

L1S 2J1

Office: (905) 683-5000

Fax: (905) 619-2500

Pickering Office

RE/MAX Hallmark First Group Realty

1154 Kingston Road

Pickering, ON

L1V 1B4

Office: (905) 831-3300

Fax: (905) 831-8147

Whitby Office

RE/MAX Hallmark First Group Realty

304 Brock Street South, 2nd Floor

Whitby, ON

L1N 4K4

Office: (905) 668-3800

Fax: (905) 430-2550

Oakville Office

RE/MAX Hallmark Realty Ltd.

515 Dundas Street West

Oakville, ON

L6m 4M2

Office: 905-257-7500

Bayfield Head Office

RE/MAX Hallmark Chay Realty

152 Bayfield Street

Barrie, ON

L4M 3B5

Office: (705) 722-7100

Toll Free: (866) 606-2429

Fax: (705) 722-5246

Caplan Office

RE/MAX Hallmark Chay Realty

112 Caplan Avenue

Barrie, ON

L4N 9J2

Office: (705) 722-7100

Toll Free: (866) 606-2429

Fax: (705) 735-6980

Caplan Office

RE/MAX Hallmark Chay Realty

112 Caplan Avenue

Barrie, ON

L4N 9J2

Office: (705) 722-7100

Toll Free: (866) 606-2429

Fax: (705) 735-6980

Innisfil Office

RE/MAX Hallmark Chay Realty

2095 Thompson Street

Innisfil, ON

L9S 1T1

Office: (705) 431-7100

Toll Free: (888) 822-2606

Fax: (705) 431-7667

Alliston Office

RE/MAX Hallmark Chay Realty

20 Victoria St W Box 108

Alliston, ON

L9R 1T9

Office: (705) 435-5556

Toll Free: (866) 936-3500

Fax: (705) 435-5356

Tottenham Office

RE/MAX Hallmark Chay Realty

22 Queen St S Box 636

Tottenham, ON

L0G 1W0

Office: (905) 936-3500

Toll Free: (866) 936-3501

Fax: (905) 936-5356

Bradford WG Office

RE/MAX Hallmark Chay Realty

4-450 Holland Street

Bradford, ON

L0G 1W0

Office: (905) 778-0292

Toll Free: (866) 606-2429

Fax: (705) 722-5246

Innes Office

RE/MAX Hallmark Realty Group

Unit# 200 4366 Innes Road

Ottawa, ON

K4A 3W3

Office: (613) 590-3000

Carling Office

RE/MAX Hallmark Realty Group

Unit# 101 2255 Carling Avenue

Ottawa, ON

K2B 7Z5

Office: (613) 596-5353

Ottawa Downtown Office

RE/MAX Hallmark Realty Group

344 O'Connor Street

Ottawa, ON

K2P 1W1

Office: (613) 563-1155

Ottawa Central Office

RE/MAX Hallmark Realty Group

610 Bronson Avenue

Ottawa, ON

K1S 4E6

Office: (613) 236-5959

Kanata Office

RE/MAX Hallmark Realty Group

700 Eagleson Road

Ottawa, ON

K2M 2G9

Office: (613) 663-2720

Fax: (613) 592-9701

Richmond Office

RE/MAX Hallmark Realty Group

6159 Perth Street

Ottawa, ON

K0A 2Z0

Office: (613) 838-4040

Fax: (613) 596-4495

Greenbank Office

RE/MAX Hallmark Realty Group

100-1073 Greenbank Rd

Ottawa, ON

K2J 4H8

Office: (613) 596-5353

Fax: (613) 596-4495

Ajax

513 Westney Road South

Ajax, ON

L1S 6W8Office: 905-683-5000

Fax: 905-619-2500

Alliston

20 Victoria St W Box 108

Alliston, ON

L9R 1T9Office: 705-435-5556

Fax: 705-435-5356

Angus

2 Summerset Place

Angus, ON

L0M 1B2Office: 705-424-7200

Fax: 705-424-6940

Re/Max Hallmark Trends Group Realty

15004 Yonge Street

Aurora, ON

L4G 1M6Office: 905-727-1941

Fax: 905-841-6018

Aurora

15004 Yonge Street

Aurora, ON

L4G 1M6Office: 905-727-1941

Fax: 905-841-6018

Re/Max Hallmark Lind Group Realty Ltd.

15105 Yonge Street

Aurora, ON

L4G 1M3Office: 905-841-0000

Fax: 905-727-2230

Re/Max Hallmark Peggy Hill Group Realty

374 Huronia Rd.

Barrie, ON

L4N 8Y9Office: 705-739-4455

Fax:

Bayfield

152 Bayfield Street

Barrie, ON

L4M 3B5Office: 705-722-7100

Fax: 705-722-5246

Caplan

112 Caplan Avenue

Barrie, ON

L4N 9J2Office: 705-722-7100

Fax: 705-735-6980

Chilton Team

152 Bayfield Street

Barrie, ON

L4M 3B5Office: 705-722-7100

Fax: 705-722-5246

Bradford WG

450 Holland Street Unit 4

Bradford, ON

L3Z 0G1Office: 905-778-0292

Fax: 705-722-5246

Innisfil

2095 Thompson Street

Innisfil, ON

L9S 1T1Office: 705-431-7100

Fax: 705-431-7667

Re/Max Hallmark Ciancio Group Realty

190 Main Street Suite 203

Markham, ON

L3R2G9Office: 647-247-6000

Fax: 647-429-6100

Bayview Village

685 Sheppard Avenue East, Suite 401

North York, ON

M2K 1B6Office: 416-494-7653

Fax: 416-494-0016

Innes

4366 Innes Road Suite 200

Ottawa, ON

K4A 3W3Office: 613-590-3000

Fax: 613-590-3050

Carling

2255 Carling Avenue Suite 101

Ottawa, ON

K2B 7Z5Office: 613-596-5353

Fax: 613-596-4495

O'Connor

344 O'Connor Street

Ottawa, ON

K2P 1W1Office: 613-563-1155

Fax: 613-563-8710

Bronson

610 Bronson Avenue

Ottawa, ON

K1S 4E6Office: 613-236-5959

Fax: 613-236-1515

Richmond

6159 Perth Street

Ottawa, ON

K0A 2Z0Office: 613-838-4040

Fax: 613-596-4495

Greenbank

100-1073 Greenbank Rd

Ottawa, ON

K2J 4H8Office: 613-596-5353

Fax: 613-596-4495

Kanata

105-700 Eagleson Rd.

Ottawa, ON

K2M 2G9Office: 613-663-2720

Fax: 613-592-9701

RE/MAX Hallmark Pilon Group Realty

4366 Innes Road Suite 200

Ottawa, ON

K4A 3W3Office: 613-909-8100

Fax: 613-590-3079

RE/MAX Hallmark Jenna & Co. Group Realty

2255 Carling Avenue, Suite 101A

Ottawa, ON

K2B 7Z5Office: 613-596-4300

Fax: 613-596-4495

Re/Max Hallmark Jacki Lam Group Realty

1154 Kingston Road

Pickering, ON

L1V 1B4Office: (905) 831-3300

Fax: (905) 831-8147

Pickering

1154 Kingston Road

Pickering, ON

L1V 1B4Office: 905-831-3300

Fax: 905-831-8147

Richmond Hill

9555 Yonge Street, Suite 201

Richmond Hill, ON

L4C 9M5Office: 905-883-4922

Fax: 905-883-1521

Riverdale

724 Pape Avenue

Toronto, ON

M4K 3S7Office: 416-462-1888

Fax: 416-464-3135

The Beach

2277 Queen Street East

Toronto, ON

M4E 1G1Office: 416-699-9292

Fax: 416-699-8576

Yonge

3434 Yonge Street

Toronto, ON

M4N 2M9Office: 416-489-3434

Fax: 416-489-5445

College

968 College Street

Toronto, ON

M6H 1A5Office: 416-531-9680

Fax: 416-531-0154

Mount Pleasant

723 Mount Pleasant Road

Toronto, ON

M4S 2N4Office: 416-486-5588

Fax: 416-486-6988

Leslieville

785 Queen Street East

Toronto, ON

M4M 1H5Office: 416-465-7850

Fax: 416-463-7850

Re/Max Hallmark Batori Group Inc.

357 Eglinton Ave W

Toronto, ON

M5N1A3Office: 416-485-7575

Fax: 416-484-4448

Re/Max Hallmark Ari Zadegan Group Realty

3434 Yonge Street Suite 101

Toronto, ON

M4N2N9Office: 416-489-4287

Fax: 416-352-0118

Re/Max Hallmark Estate Group Realty Ltd

2277 Queen Street East Suite A

Toronto, ON

M4E1G5Office: 416-699-2992

Fax: 416-699-8576

Re/Max Hallmark Bibby Group Realty

723 Mount Pleasant Road Suite 105

Toronto, ON

M4S2N4Office: 416-481-0888

Fax: 416-486-6988

Re/Max Hallmark Corbo & Kelos Group Realty Ltd

785 Queen St. East Suite 301

Toronto, ON

M4M1H5Office: 416-462-4787

Fax: 416-463-7850

Re/Max Hallmark Elite Group Realty

685 Sheppard Avenue East, Suite 401-11

Toronto, ON

M2K1B6Office: 416-494-8557

Fax: 416-494-7653

Re/Max Hallmark Emerson Group Realty Ltd

2277 Queen Street East Suite 104

Toronto, ON

M4E1G5Office: 416-690-2727

Fax: 416-699-8576

Re/Max Hallmark Francis Group Realty

785 Queen St. East Suite 7

Toronto, ON

M4M1H5Office: 416-466-1888

Fax: 416-463-7850

Re/Max Hallmark Fraser Group Realty

685 Sheppard Avenue East, Suite 401-47

Toronto, ON

M2K1B6Office: 416-494-7686

Fax: 416-494-0016

Re/Max Hallmark Joy Verde Group Realty

723 Mount Pleasant Road Suite 104

Toronto, ON

M4S2N4Office: 416-481-5666

Fax: 416-486-6988

Re/Max Hallmark Kathy McLachlan Group Realty Ltd

723 Mount Pleasant Road Suite 103

Toronto, ON

M4S2N4Office: 416-486-6565

Fax:

Re/Max Hallmark Montano Group Realty

785 Queen St. East Suite 201

Toronto, ON

M4M1H5Office: 416-424-3038

Fax: 416-465-7850

Re/Max Hallmark Pierre Carapetian Group Realty

785 Queen St. East

Toronto, ON

M4M1H5Office: 416-424-3434

Fax: 416-465-7850

Re/Max Hallmark Richards Group Realty Ltd

2241 Queen Street East

Toronto, ON

M4E1G1Office: 416-699-0303

Fax: 416-699-8576

Re/Max Hallmark Yu Group Realty Ltd

685 Sheppard Avenue East, Suite 401-19

Toronto, ON

M2K1B6Office: 416-494-9858

Fax: 416-494-0016

Muskoka

C/O Yonge St. Office (3434 Yonge Street)

Toronto, ON

M4N 2M9Office: 416-489-3434

Fax: 416-489-5445

Re/Max Hallmark Jamie Dempster Group Realty

685 Sheppard Avenue East, Suite 401

Toronto, ON

M2K1B6Office: (416) 494-7653

Fax: (416) 494-0016

Tottenham

22 Queen St S Box 636

Tottenham, ON

L0G 1W0Office: 905-936-3500

Fax: 905-936-5356

Re/Max Hallmark Lino Arci Group Realty

3420 Major Mackenzie Dr Suite 103

Vaughan, ON

L4H4J6Office: 416-479-1550

Fax: 416-913-2044

Whitby

304 Brock Street South

Whitby, ON

L1N 4K4Office: 905-668-3800

Fax: 905-430-2550

Terms & Conditions and Privacy Policy

All information displayed is believed to be accurate but is not guaranteed and should be independently verified. No warranties or representations are made of any kind. Not intended to solicit properties currently listed for sale. The trademarks REALTOR®, REALTORS® and the REALTOR® logo are controlled by The Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA. The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by CREA and identify the quality of services provided by real estate professionals who are members of CREA.