Author The Lilly Commercial Team

CanFirst Acquires $222.6M GTA Industrial Portfolio

The CanFirst Industrial Realty Fund VII LP has acquired a 13-property, 710,389-square-foot portfolio in Vaughan, Ont. from IG Investment Management for $222.6 million.

“We’re excited to be able to acquire assets in this node in Vaughan,” CanFirst Capital Management executive vice-president Mark Braun told RENX. “It’s always been a challenge to find properties in the area, certainly at a price point that’s competitive or allows us to transact.”

The portfolio encompasses 38.9 acres of land. The deal was brokered by CBRE and attracted interest from several potential purchasers.

The transaction, which closed Monday, represents a price of $313 per square foot.

All of the properties are located within about a kilometre of each other in Vaughan, and CanFirst is interested in acquiring more such locations in the city of approximately 340,000 people located directly north of Toronto.

mall and mid-bay properties

“It’s a mix of small-bay and mid-bay industrial tenancies,” said Braun of the portfolio.

The smaller units are in the 1,000- to 5,000-square-foot range while the largest is just over 50,000 square feet. The portfolio is 99.8 per cent leased, with just one small vacancy, and has an average remaining lease term of 2.5 years.

Braun said existing rents are about 50 per cent of the market rate, so the deal provides a good opportunity for capital growth when leases expire. There’s also potential to convert some units to industrial condominiums and sell them, Braun added.

The properties have been well-maintained and are in good condition and won’t require any major capital expenditures, according to Braun, who said there are no intensification opportunities within the portfolio.

CanFirst has been an active industrial buyer in recent months.

In October it partnered with Colonnade BridgePort to acquire a 50-acre site in the southwest sector of Ottawa. The partners plan to construct up to 900,000 square feet of new space on the land starting in 2024.

That site was acquired on behalf of its CanFirst Industrial Development Fund.

The last major acquisition for the Industrial Realty Fund VII took place in 2021, when it purchased the so-called Dozyn Dezyn portfolio, comprising 11 buildings in the communities of Surrey and Abbotsford, B.C. The small-bay and mid-bay buildings are a combined 412,897 square feet and were fully leased.

The purchase price was $104.5 million.

CanFirst Capital Management

Toronto-headquartered CanFirst was founded in 2002. It co-invests with institutional and private high-net-worth investors in industrial and office properties that have added potential to exploit for growth in major and select secondary Canadian markets.

CanFirst has raised $1 billion in equity and completed more than 16 million square feet of real estate transactions.

CanFirst manages growth-oriented and income-oriented funds. The $250.5-million CanFirst Industrial Realty Fund VII LP closed in July 2020 and is now fully allocated after this latest transaction.

Source Real Estate News EXchange. Click here to read a full story

Supreme Court Limits Governments’ Ability To “Constructively Take” Land

Supreme Court guidance is good news for developers

In a long-awaited decision, the Supreme Court of Canada has ruled on de facto expropriation of land.

In Annapolis Group Inc. v Halifax Regional Municipality, the Supreme Court provided guidance for situations in which the government essentially takes away land rights from property owners without formally expropriating the lands.

Although there is still a ways to go before the law in this area is settled, this decision is definitely a positive decision for developers’ and landowners’ rights in general.

Background and facts

Annapolis Group Inc. is a Halifax-based land developer which has been accumulating vacant land since the 1950s.

It had eventually amassed nearly 1,000 acres with the intention of developing it.

The Halifax Regional Municipality set out a new planning strategy in 2006 which identified part of the lands for possible use for a park in the future and denoted them as “Urban Settlement” and “Urban Reserve”, meaning the lands may be developed by the municipality within, or after a 25-year period.

Also, as part of the strategy, Annapolis was prohibited from developing the lands before the municipality adopted a “secondary planning process”.

Annapolis began seeking approvals to start developing the lands in 2007. In response, the municipality passed a resolution stating that it refused to initiate the secondary planning process “at that time”.

In the years that followed, the municipality encouraged the public to use the lands for outdoor activities such as hiking and camping.

Ten years later, Annapolis commenced legal proceedings against the municipality, seeking over $120 million in damages.

Annapolis alleged the municipality had effectively turned parts of the lands into a public park by encouraging members of the public to use them for outdoor purposes and therefore claimed damages based on de facto expropriation, unjust enrichment and abuse of/misfeasance in public office.

The municipality brought a summary judgment motion to dismiss Annapolis’ de facto expropriation claim, which was initially dismissed.

The Nova Scotia Court of Appeal later sided with the municipality and summarily dismissed Annapolis’ claim without allowing it to go to trial.

The court ruled the municipality did not commit de facto expropriation of the lands because no land was actually taken from Annapolis and the municipality therefore did not acquire a “beneficial interest” in the Lands.

It was also ruled that encouraging the public to use the lands and failing to adopt a development plan did not mean the lands were expropriated on a de facto basis.

The new test for “constructive taking” of land

The Supreme Court of Canada, however, saw things differently. The Supreme Court referred to de facto expropriation as “constructive taking”, as it applies to situations where a land owner alleges the state takes its land without formally expropriating it.

In other words, the state does not exercise its statutory authority to acquire an interest in the land and compensate the owner, but it does take steps to claim the land by other means.

In its decision, the Supreme Court held that, in order for “constructive taking” to occur, it is necessary to look at the intention of the government in exercising its regulatory authority and the owner’s loss of the use of the property. As such, the courts must look at what advantage the state obtained by the acquisition of the land and its effect on the property owner.

Therefore, in order for an “acquisition” by the government to occur, the property does not actually have to be acquired. If the government takes steps to acquire a beneficial interest in the property and the owner loses its reasonable use of the land as a result, the land can be deemed to be expropriated on a de facto basis (or “constructively taken”).

In applying the test in the Annapolis case, the Supreme Court held that there were more issues to unravel and therefore the Court of Appeal decision was overturned and the matter is to be determined by trial.

What this means

Although the law in this area is not yet settled, the Annapolis decision is being hailed as great news for developers and property rights holders in general.

It should be kept in mind the test for constructive taking is still onerous.

The court emphasized in this case that in order for it to occur, private property rights must be “virtually abolished”. And even where that is deemed to have occurred, it is not yet clear what it means for the government to gain a beneficial interest in the land.

In the Annapolis case, the court accepted that the government essentially using the land as a public park can constitute such an interest. Therefore if the public benefits from the land, that could be deemed to be a benefit to the state as well for the purposes of the test.

It will be interesting to see what will become of this decision going forward.

But for now developers should take note, as this case is definitely a step in the right direction.

To be clear, governments still have the power to expropriate land if the proper channels are followed. However, the Annapolis case shows courts may not have tolerance for the state using back-door means to deprive property owners of the benefits of their land.

Source Real Estate News EXchange. Click here to read a full story

Retail Trends Include Downsizing, Outsourcing Packing And Shipping Of Online Orders

Historically, the Canadian retail sector has often been slow to adopt new methods of fulfillment, but that is changing fast.

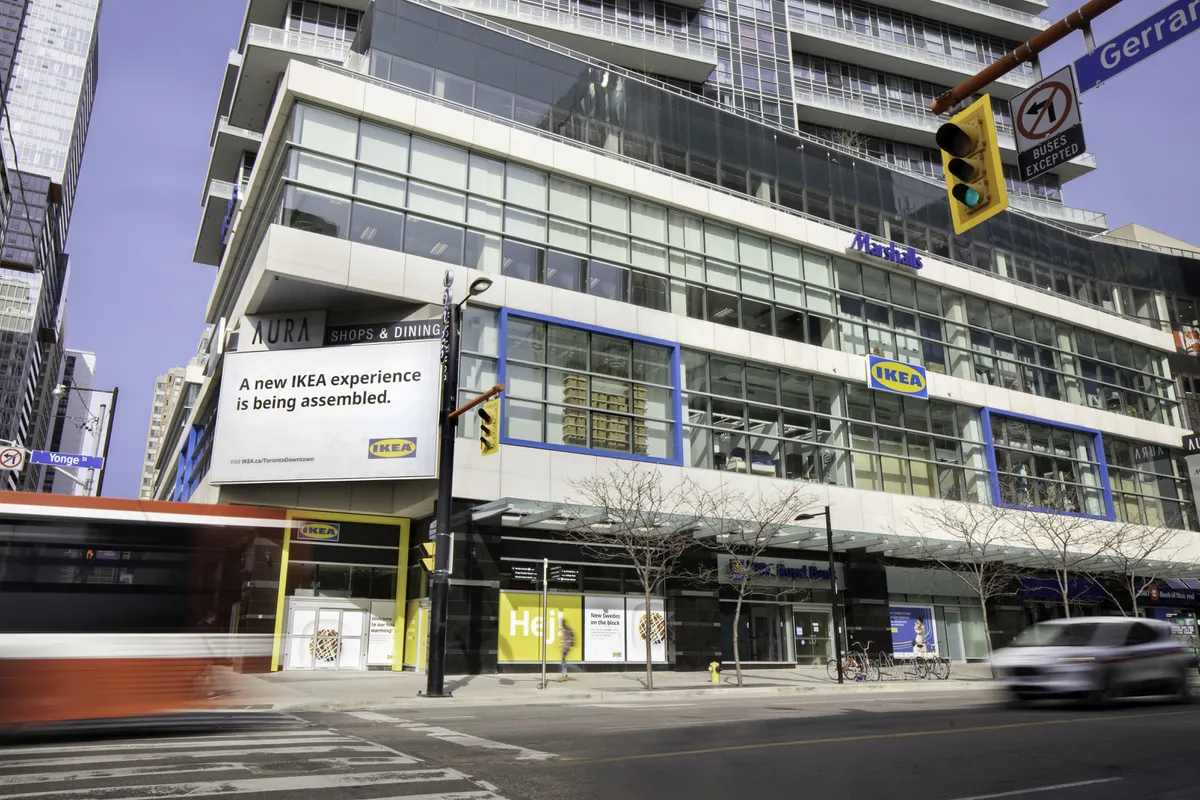

According to Michael Ward, chief executive of IKEA Canada, big box retailers such as IKEA are catching up in part through the establishment of smaller stores in downtown areas and working with third-party providers to handle fulfillment.

“Accessibility is the name of the game,” he says. “The urban strategy is understanding where people are.”

In June, Aura, the company’s “new retail concept” store, opened at the corner of Yonge and Gerrard streets in downtown Toronto. The 66,000-square-foot store – smaller than most regular IKEA stores – is part of the company’s transformation strategy, which brings IKEA closer to where customers live and work, Mr. Ward says.

Also part of the strategy is using the services of third-party fulfillment providers because, unlike big box stores found in less intensified areas, smaller stores don’t have the space for in-house fulfillment centres.

Some retailers are rejigging stores by dedicating front-of-house space for try-on or emergency goods while the rest becomes a warehouse.

“Our stores are 1,500 to 2,000 square feet on average,” says Patrick Jobidon, president of PenguinPickUp, which IKEA uses for order fulfillment. “We are not a warehouse. We are a parcel holding company that has a lot of velocity. About 80 per cent of the orders that we receive will be picked up either that night or next day. With such a small footprint you need velocity.”

Customers who aren’t using home delivery can use the service to do pickups and returns, and after hours, can pick up packages from lockers at PenguinPickUp locations. (The company has 35 locations nationwide, including downtown Toronto, Montreal and Vancouver, with plans to open five more by the end of this year.)

“That’s the challenge for retailers,” Mr. Jobidon says. “The power has shifted to the consumer. They want everything right away. That is adding cost to the retailer, [which] forces them to find other ways to save money. We are one of those solutions.”

Inflationary pressures have increased development costs in areas with a tight supply of quality retail assets, further exacerbating an existing supply and demand imbalance.

— John Ballantyne, chief operating officer of RioCan

Mr. Jobidon predicts that in the next five to 10 years, more companies will be renting space to be used as mini-sortation centres so they can access the downtown more quickly – tough to do now because of volume and road traffic.

The onslaught of delivery orders was in part due to the drastic drop in in-store shopping during pandemic restrictions.

Even boomers, the sector with the highest disposable income who were once hesitant to shop online, are now buying from “e-tailers,” says Kostya Polyakov, Canadian national industry leader for KPMG’s consumer and retail practice.

“The folks with the most money all of a sudden went online.”

The rise of e-commerce and decrease of in-store shopping is not a new trend, it’s just more visible now, says Mr. Polyakov, pointing to recent KPMG research that shows a decrease in the number of retail leases, as well as the value of smaller-footprint retail leases.

“So, what the big box stores are fundamentally asking is: What are you trying to buy online versus why you would come in-store,” he adds.

But consumers still desire in-person interaction, according to John Ballantyne, chief operating officer of RioCan, a REIT that owns, manages and develops more than 200 retail, residential and mixed-use properties.

uct mixes to better meet their demands.

“Physical store networks in well-populated neighbourhoods are forms of last-mile distribution or delivery facilitation centres,” he says.

Mr. Ballantyne says retailers are looking for cost-effective solutions, factoring in Canada’s geography, the high cost of last-mile deliveries and the challenges of setting up distribution centres in urban settings.

“Inflationary pressures have increased development costs in areas with a tight supply of quality retail assets, further exacerbating an existing supply and demand imbalance,” he adds. “Demand for this type of space is growing.”

Meanwhile, Mr. Ward says IKEA is aiming to open similar Aura locations in more Canadian cities to create a network of connected initiatives, as opposed to big box standalone stores.

In essence, Aura offers shoppers the IKEA experience, but on a smaller, more accessible scale that makes it easy for people to pop into a store on their way home from work.

“That’s the genesis of the next level of ideas,” he says. “[Competitors] are experimenting for sure. Everybody’s trying to figure out what the right combination is.

“It’s not about online or bricks and mortar,” he adds. “It’s how those things work together.”

Source The Globe And Mail. Click here to read a full story

Interest on Interest: Rising Rates Lead to Reduced Proposals in UrbanToronto Pro August Report

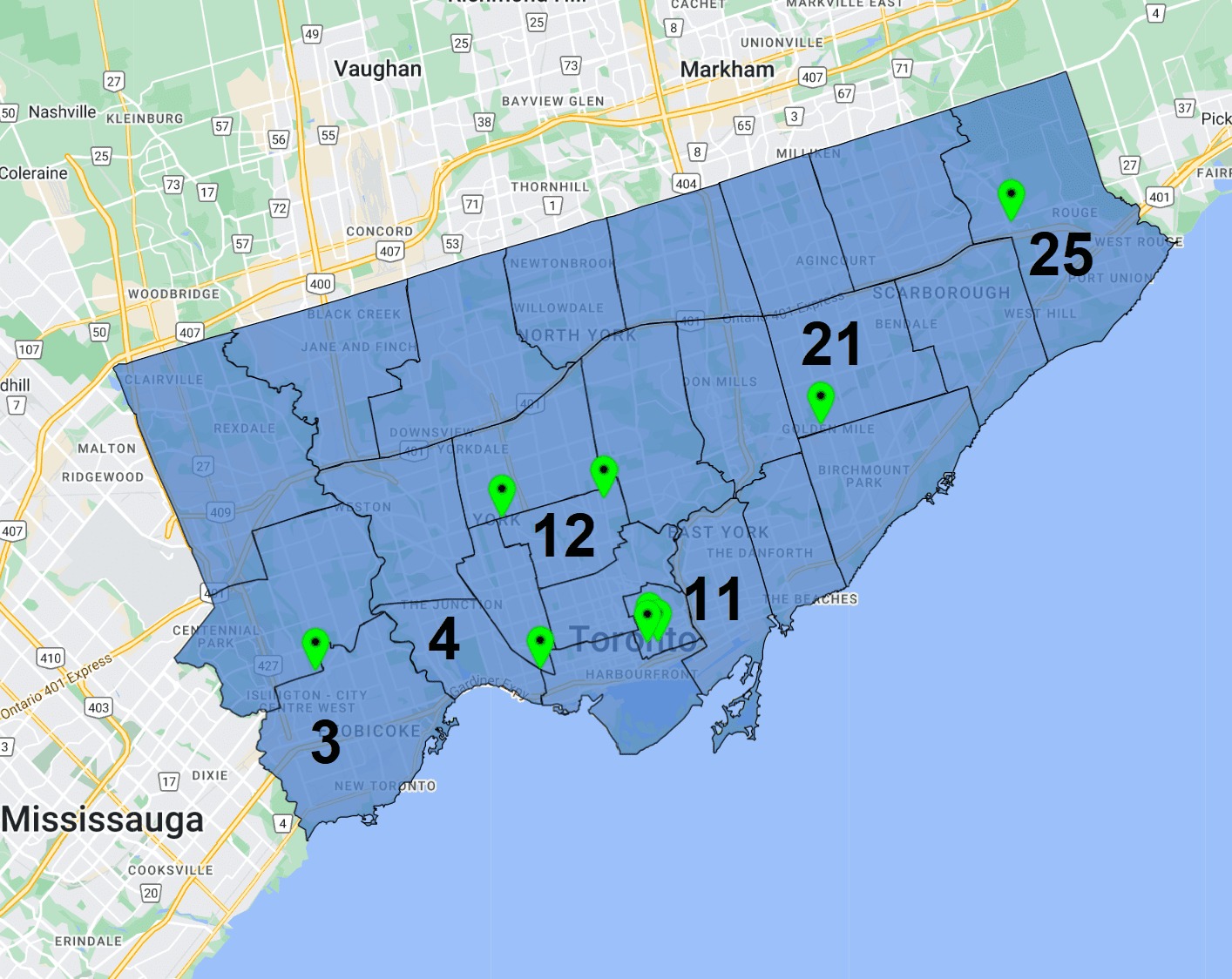

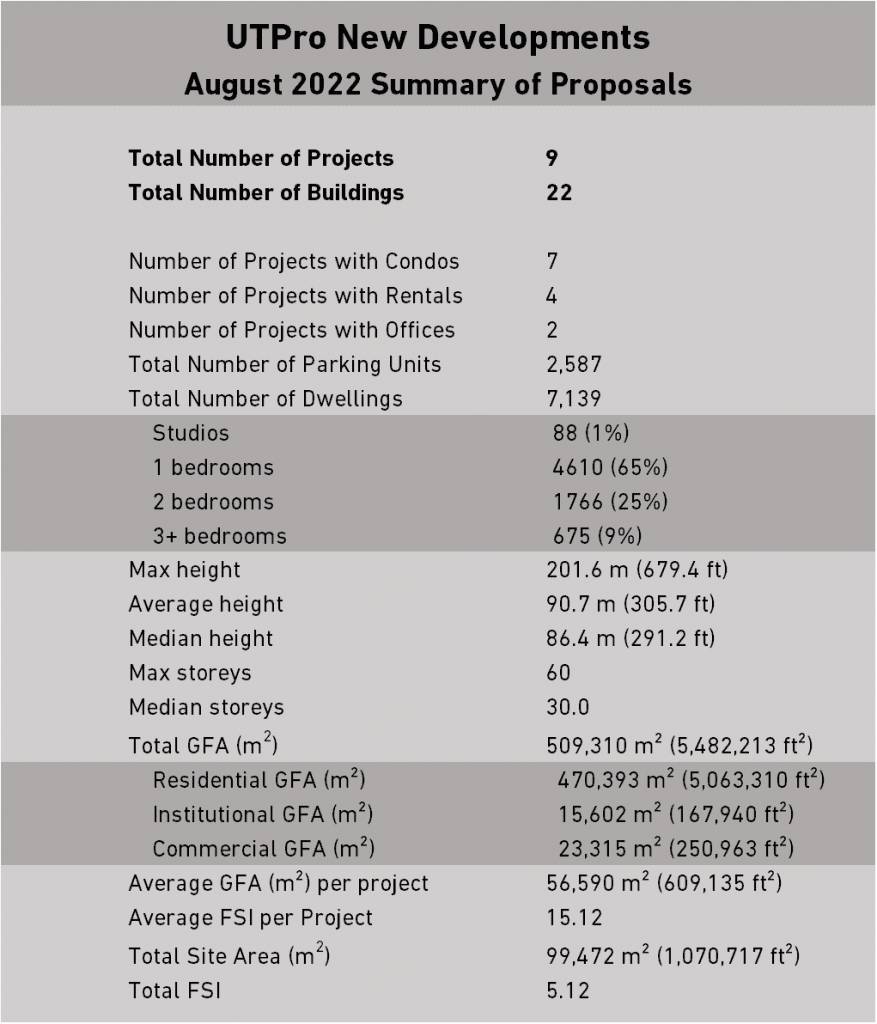

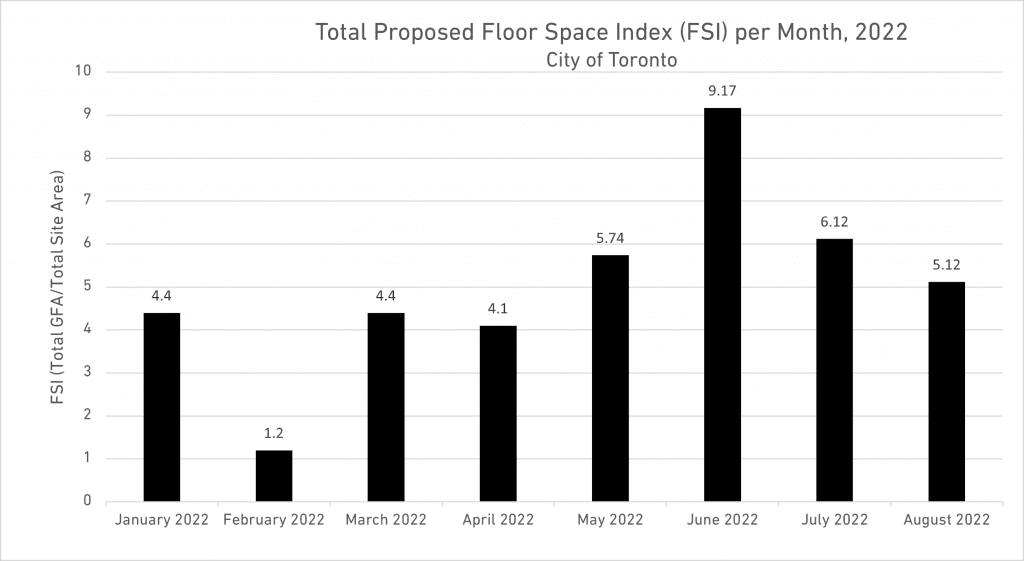

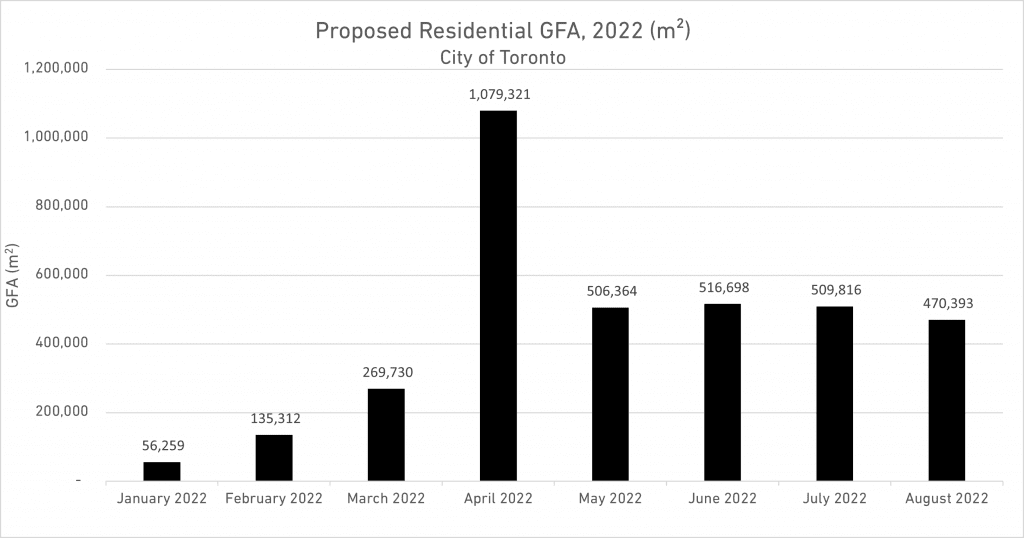

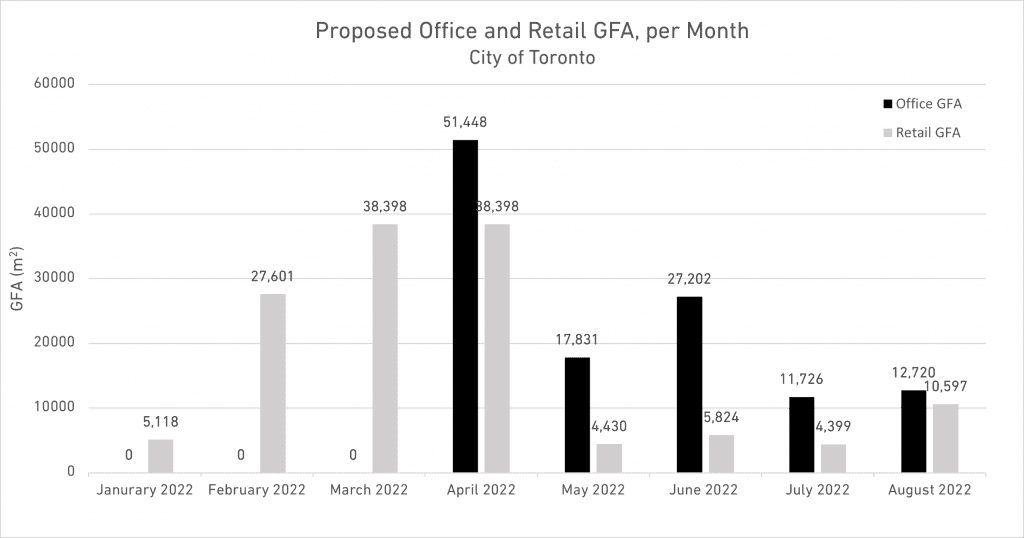

The Toronto real estate market continues to experience low levels of activity, as interest rate hikes, price drops, and policy uncertainty continued in August of 2022.

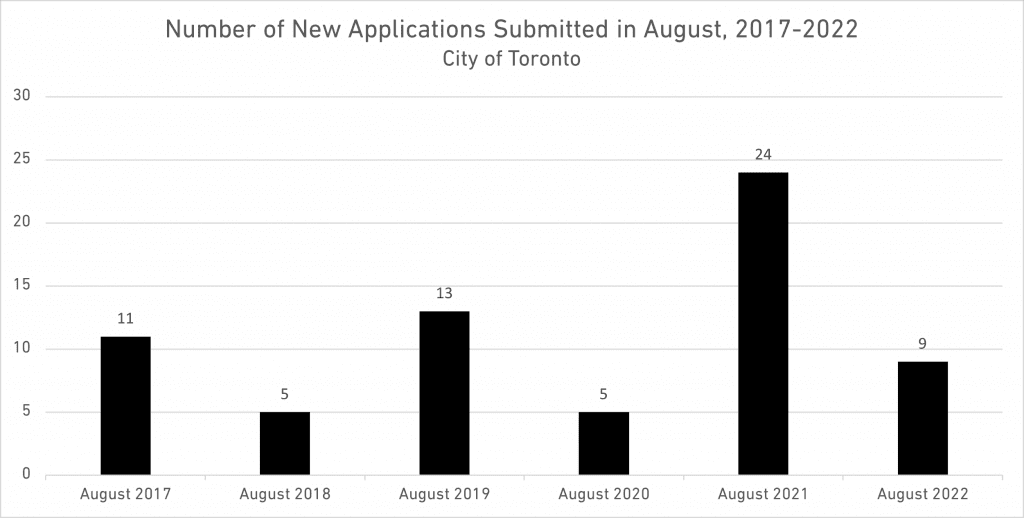

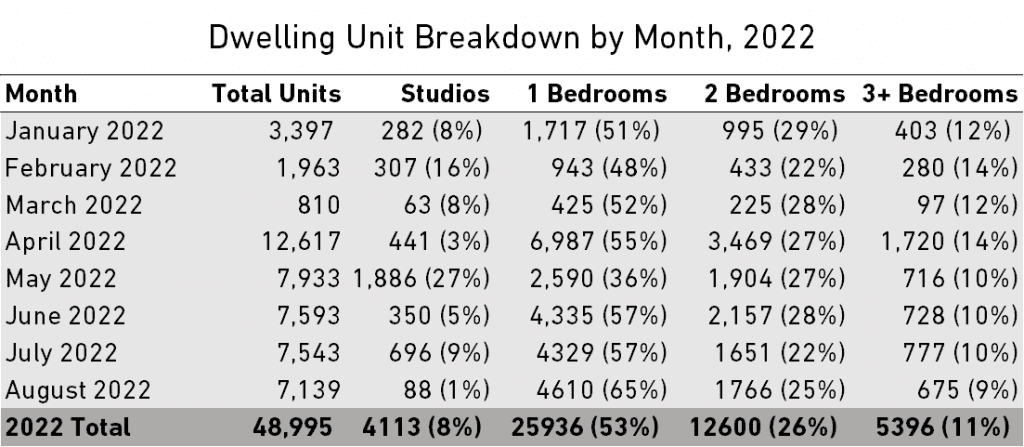

New proposals for development came in at 9 applications, compared to 24 applications in August of last year. This represents a decrease of 62% year-over-year. The number of applications this year was also a disappointment compared to longer historical trends, as the median number of applications submitted in August from 2017 to 2021 was 11.

As the total number of proposed projects decreased, the total proposed gross floor area decreased as well. Developers are asking to build 5.48 million ft² of GFA across 1.07 million square feet of site area. This is 32% less than the 7.25 million ft² of GFA proposed last year, over 1.17 million ft² of site area.

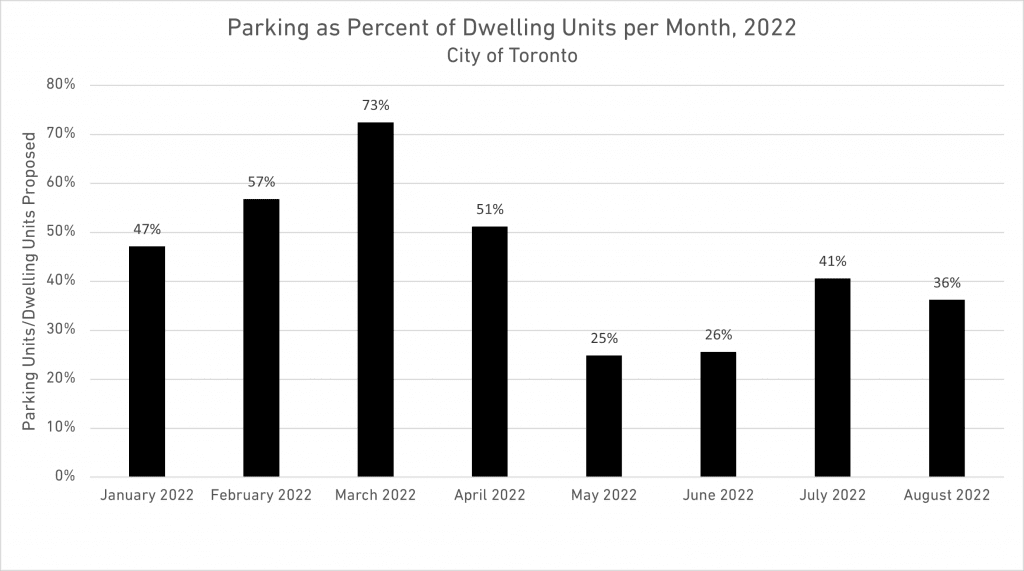

A similar trend can be seen in the number of proposed new dwelling units. 7,139 new units were proposed this month, compared to 8,140 units last year – a decrease of 14%. This relative resiliency is driven by much smaller space for residential purposes: this month’s average residential GFA per unit was 709 ft², while last year’s average was 820 ft².

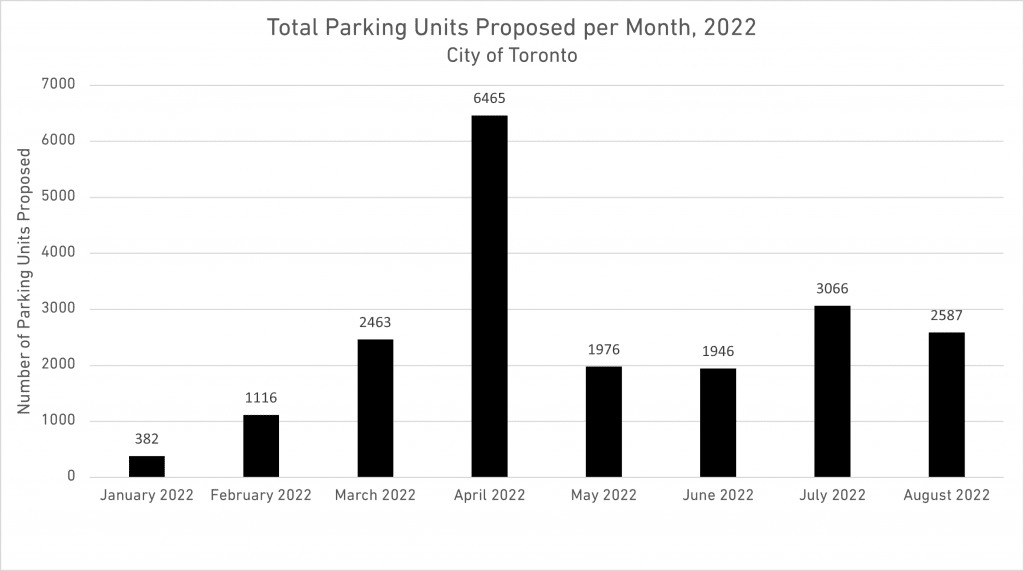

There has been a corresponding decrease in the amount of parking proposed per new dwelling unit. This month 0.36 parking spots were proposed per new dwelling unit on average, compared to 0.65 parking spots per unit last year – a decrease of 80%. It should be noted that this decrease is largely due to one particularly large proposal for 5,000 parking spots. Excluding this proposal, the average number of parking spots per unit would be 0.42, only slightly lower than last year’s figure. Between last year and this year, the City of Toronto dropped minimum parking requirements for new developments.

All in all, these numbers suggest that developers are responding to current market conditions by proposing smaller, lower-density projects. The increased uncertainty about costs and prices is leading to fewer units. The question, however, is why developers are also proposing smaller units as well. One possibility is that developers are anticipating that buyers will be increasingly looking for affordability, and smaller units represent a way to offer more affordable options. Another is that developers are concerned about the difficulty of selling larger units in the current market.

Whatever the reasons may be, it is clear that the current market conditions are having an impact on the types of development being proposed. And with interest rates expected to continue rising and prices remaining unstable, it is likely that this trend will continue in the months to come.

Looking forward, it will be interesting to see if these trends continue or if developers begin to propose larger, more dense projects as the market begins to recover. While this may be negative news for those hoping for a quick rebound in the real estate market, it is encouraging to see that developers are being responsive to changing conditions.

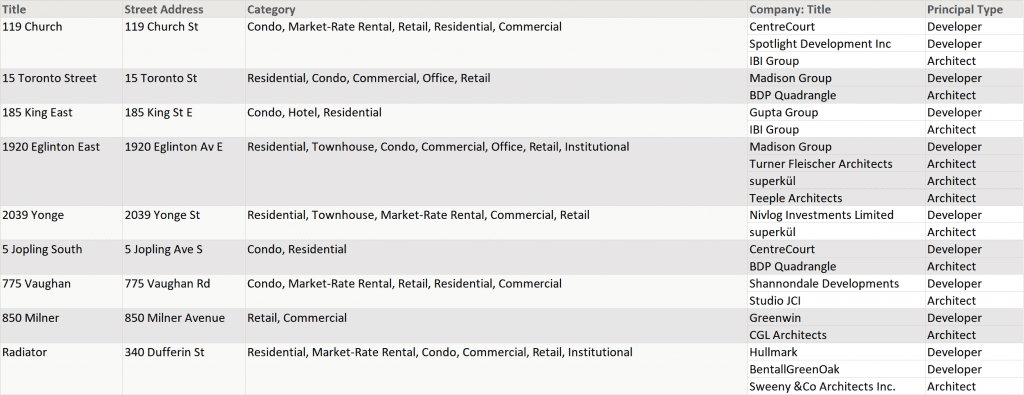

Despite the small number of applications, we have data on 144 companies working to bring these projects to life. Of these, below we list the 22 developers and architects.

Proposals are an indicator of developer confidence for future demand in the city. As the economic environment continues to cast uncertainty about the future of prices, costs, and policies, expect less ambitious developments going forward.

If you want to track all of this information live as it comes in, with your ability to customize reports and maps, set up a call about getting a tour of UTPro.

UT Pro is UT’s premium database service that collects and reports information on development applications across the Greater Toronto Area.

This UTPro New Development Report analyzes new development proposals for large projects submitted to the City of Toronto. (UrbanToronto defines a “large project” as anything larger than a typical detached home.) These numbers are for proposals only, and are subject to change at any time up until (and sometimes even after) completion. Due to the early stage of the development process, some documentation may be missing; the numbers for some components of the data might not add up in some cases.

If you would like to stay updated on the latest development news, sign up for a free trial of the New Development Insider. And if you are interested in the data used to generate this report, you can get more details about the UTPro subscription database service here or on the official UTPro page. If you require an instant report on a specific area in the city, check out our Instant Reports.

For more information about UTPro, contact Edward Skira.

Source Real Estate News EXchange Click here to read a full story

Summit Industrial Buys Second Dev. Site in Kitchener Business Park

Summit Industrial Income REIT is continuing to grow its development pipeline in the area surrounding Toronto. The trust and an unnamed partner will acquire a second plot of industrial land in the Grand River West Business Park in Kitchener.

Summit (SMU-UN-T) and its partner have waived conditions on the 26.5-acre development site and will acquire a 50 per cent interest in the project in an all-cash transaction. They will pay $12.9 million for their stake in the site.

“We are pleased to be adding this site to our existing pipeline of development projects in this region, one of Canada’s strongest industrial markets,” said Summit Industrial REIT chief operating officer Dayna Gibbs in the announcement.

“Not only is this one of Canada’s tightest industrial markets, but we continue to build on our economies of scale in this area while adding to our portfolio of LEED-certified buildings upon completion.”

Summit expects to close on the deal by the end of October.

Three Grand River West Business Park properties

In February, Summit acquired a similar 50 per cent interest in an adjacent 19.5-acre site at the Grand River West Business Park.

Summit intends to acquire the other 50 per cent interest in this property once the development is complete and stabilized.

It also owns another property in the area, giving the trust additional economies of scale.

Grand River West is located in an established business park close to a regional airport, major highway and railway transportation links and a planned GO commuter rail service station.

The 26.5-property is expected to accommodate two buildings totalling approximately 480,000 square feet of class-A space with street exposure, multiple access points, circulation and trailer parking.

Current plans include a 400,000-square-foot building with 40-foot clear ceiling height. Summit intends to have both buildings designated as LEED-certified in keeping with its environmental sustainability mandate.

The 19.5-acre site is expected to accommodate one 360,000-square-foot building with a proposed 40-foot ceiling height, including three road access points and a large area for truck and trailer parking.

Summit will also seek LEED certification for this development.

“The Kitchener, Waterloo, Cambridge market, including Guelph where we own interests in other ongoing development projects, is currently Canada’s tightest industrial market with only a 0.6% availability rate,” Gibbs said in February when the first acquisition was announced.

“The strong demand for industrial space in and around the Greater Toronto Area is driving increased rental rates and strong stable occupancies in this region, making it an attractive development market for the REIT.”

About Summit Industrial REIT

Summit Industrial Income REIT is an unincorporated open-end trust focused on growing and managing a portfolio of light industrial properties across Canada.

Source Real Estate News EXchange Click here to read a full story

Canada’s Third Quarter Office Figures Are In

Canada’s third quarter office figures are in.

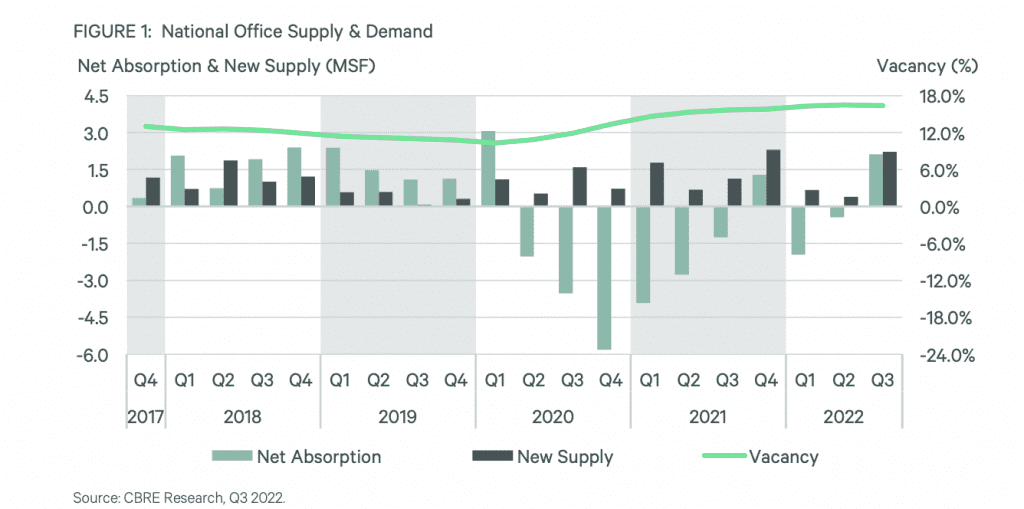

According to a new report from commercial real estate services firm CBRE Canada, while the country’s office markets aren’t as healthy as they were pre-pandemic, they are doing relatively well compared to other nations.

The report’s overarching theme is that the Canadian market is inching closer to equilibrium (albeit slowly).

According to CBRE national managing director Jon Ramscar, while vacancy may still not be at pre-pandemic levels, Canada actually houses three cities with the lowest vacancy rates in North America. In Q3, Vancouver’s rate was at 7.1%, Ottawa’s was 11.5%, and Toronto’s was 11.8%. For comparison, Manhattan saw a vacancy rate of 15.2%, San Francisco’s was 24.2%, and this figure was 32.2% in Dallas. Ramsay says this is due to Canadian cities having lower vacancy rates pre-pandemic and to Canada’s relatively small number of major building owners.

According to the report, 2.1M sq. ft of positive net absorption was recorded this quarter, though much of this was attributed to the delivery of pre-leased new supply. If excluding the gains from new supply, national net absorption would have still remained positive, totalling to 207,000 sq. ft.

Aligned with the four-quarter average of 14.5M sq. ft, the recovery of national sublet space has plateaued, says CBRE.

There is room for optimism on the pandemic recovery front for the country’s offices, even if remote or hybrid work is here to stay. According to the report, overall, minor recovery was noted over the quarter as vacancy decreased 10 basis points to 16.4% — a first since the onset of the pandemic. This was led by further improvement in the suburbs as downtown markets remained stable at 16.9% vacant.

The report reveals that downtown tenants are prioritizing quality over cost. According to CBRE, the national vacancy rate of Downtown Class B office towers is nearly 50% higher than for that of Class A buildings.

Meanwhile, office construction levels have lowered to 12.7M sq. ft with major project deliveries coming to market in downtown Toronto, and suburban Montreal and Halifax this quarter.

Generally speaking, CBRE says most markets were relatively stable, with a few standouts. The report points to Calgary and the Waterloo Region as markets that experienced a pick-up in activity, primarily from engineering, financial services, and creative industry firms. On the other hand, Vancouver and Ottawa saw some softening, with tenants no longer requiring the full extent of their spaces after switching up “business as usual.” In both cases, this resulted in an uptick to sublease offerings, says CBRE.

The reality remains that there are a lot of unused commercial spaces in urban centres throughout the country. “Persistent elevated vacancy could trigger the conversion of outdated properties to other product types and has started to occur in select markets,” highlights the report.

Source Storeys Click here to read a full story

Maple Reinders Overcomes Hurdles to Turn Old Warehouse Into Storage Facility

MAPLE REINDERS – The Vanguard Self-Storage Facility in Richmond Hill, Ont. was transformed from an old warehouse into a brand new facility. The general contractor was Maple Reinders. ADG Architecture was the initial architect but A.W. Trusevych Associates Architect Inc. took over once construction began. Hannigan Engineering Limited was the structural consultant; Tristar Engineering was the electrical and mechanical consultant; Ainley & Associates Limited did the civil design; Applied Fire Technology Inc did the fire protection design; and Brodie & Associates Landscape Architects Inc. did the landscaping.

The transformation of an old warehouse into a new self-storage facility was not an easy task for the Maple Reinders team but after overcoming a number of challenges the project reached substantial completion earlier this year.

Vanguard Self Storage, located at 75 Newkirk Rd. in Richmond Hill, Ont., started out as a one-storey, 2,244-square-metre building with office space on a mezzanine at the front of the building.

“We renovated the building to include for 1,886.5 square metres of rentable area on the ground floor and 1,898.2 square metres of rentable area on the second floor with retail offices on the first floor. The project was estimated at $4.835 million at the start…and finished at $6.04 million,” said Kathy Schaeffer, project manager at Maple Reinders.

Construction was scheduled to begin in January 2021 and be completed by October but was delayed due to the government shutdown for the COVID-19 pandemic. The team mobilized to site but was ordered to shut down again from the middle of April to the end of May 2021.

“The team was able to order and secure all of the structure and locker materials right away and the owner stored everything on site or in some of their other facilities so that we could continue with the project and not have to wait for any materials,” said Schaeffer. “This helped but the project took a huge hit on schedule due to these shutdowns and due to unavailable labour because of COVID-19 illnesses. The project did not get substantial completion until April 2022.”

The shutdowns added a major delay and brought paving and landscaping into winter months, which meant they had to be postponed until the spring to save on money and deficient material, Schaeffer explained.

“Our team was able to procure a lot of the building materials and have them shipped to site regardless of timing,” she said. “Structural steel was put into production immediately and the locker material/doors were as well. This meant that we were able to mitigate supply delays that a lot of other projects were experiencing. It also meant we didn’t get the multiple price hikes that the industry had to go through during this time.”

ADG Architecture was the initial architect on the project but went bankrupt just after the start of construction so A.W. Trusevych Associates Architect Inc. took over, she explained.

“The owner found it hard to find another one to take over so we had a few months where Maple and the owner had to make our own decisions on discrepancies and changes that were needed until a new architect was found,” Schaeffer said.

The team also faced some design challenges.

“We were trying to fit a new structure into an existing one and the old drawings were not as detailed as they are today,” said Schaeffer.

“We found a lot of structure underneath the slab when we pulled it out and had to rework foundations and helical piers to accommodate them. Walls were not straight, which meant the grids had to be reworked in some areas. We found a lot of structural compromises when we did some cutting for openings that had to then be reworked and supported.”

The existing warehouse, built in the 1970s, received an addition on the back in 1980 as well as a front office addition in 1992.

“Due to the different exterior material, the face was very uneven, so we had to use spray applied vapour barrier to ensure proper coverage,” Schaeffer explained. “We also had to use an extensive shoring system at the front of the building where we removed the existing second floor structure to accommodate the new structure but kept the old façade.”

Although the main structure of the building was structural steel, each addition was built with different exterior material. The original building was brick, the first addition was block and the second addition was a mixture of block, brick and then block and glazing. Foundations were also a mix of concrete and block with the various additions.

“When doing the renovations, we added an internal structural steel skeleton to support the second floor mezzanine, complete with decking and a concrete floor,” said Schaeffer.

“We kept the brick and block walls but refinished the building with metal panelling and ACM panels to give it a more clean and consistent finish. Two elevators were added. One was able to fit in the existing high roof at the back of house, but we had to cut the roof and build a higher opening for the other one. The addition of the high tower and curtain wall glazing at the entrance finished the building off really well.”

Source DailyCommercialNews Click here to read a full story

Dream Industrial: 10 Years of Growth, More to Come

Dream Industrial REITchief executive officer Brian Pauls and members of his team rang the bell to open the Toronto Stock Exchange on Sept. 26 and mark the trust’s 10-year anniversary.

Pauls, who assumed his role on Jan. 1, 2018 after leaving a senior executive role with Denver-based real estate firm PaulsCorp, recently spoke with RENX about Dream Industrial’s growth through its first decade as well as its strategies and outlook.

Pauls said Dream Industrial had a market cap of about $800 million and close to $1.5 billion in assets when he joined. Those figures are now approximately $2.82 billion and $7 billion, respectively.

“We’ve got a great team that can identify opportunities in value and a team that can unlock that value,” said Pauls, who noted that has also garnered great investor support.

“We’ve grown our funds from operations, we’ve grown our total portfolio size and we’ve enhanced our yields just through creating value for the properties we have, as well as identifying new opportunities that have been created for the REIT.”

Dream Industrial’s evolution and growth

Dream Industrial has added density to existing properties and undertaken greenfield development in Canada, the U.S. and Europe.

As of June 30, it owned, managed and operated 257 industrial assets comprising approximately 46 million square feet of gross leasable area. In-place and committed occupancy was 99.1 per cent on that same date.

Sixty-two per cent of Dream Industrial’s portfolio is in Canada, largely in Greater Toronto, Greater Montreal and Calgary.

However, it elected to expand into the U.S. almost five years ago to create scale and access more markets and liquidity — which couldn’t have been achieved by remaining solely in the Canadian market.

The American strategy is to pursue long-term growth alongside institutional partners through a retained 25.35 per cent interest in a private open-ended U.S. industrial fund.

A subsidiary of the trust provides property management, construction management and leasing services to the fund at market rates.

“We’d like to see that fund grow and our participation in that continue to grow,” said Pauls.

Dream Industrial’s European expansion was enabled by Blackstone’s late 2019 acquisition of all the subsidiaries and assets of Dream Global REIT for $6.2 billion.

Much of the Dream Global team moved to Dream Industrial and hit the ground running with a pipeline of deals and opportunities that were previously exclusive to the Dream Global platform.

The European portfolio is primarily located in the Netherlands, Germany and France.

Diversification is valued

The move also enabled Dream Industrial to access European-denominated debt, which was quite a bit cheaper than North American debt, and to diversify its risk.

“Now we’ve got a risk profile that spreads across many tenants, many geographies and even different product types,” said Pauls.

“We have urban logistics, which would be considered last-mile properties. We’ve got large distribution facilities and then we’ve got light industrial and light manufacturing, where there’s a lot of tenant investment in those properties.”

Canadian urban logistics properties are the hottest asset class in the portfolio at the moment, according to Pauls, as that is where Dream Industrial sees the highest rent growth, replacement cost and barriers to entry. Such properties in the Greater Toronto Area (GTA) are where it has the highest opportunities for mark-to-market rents.

Development remains important

Dream Industrial prefers to allocate five per cent of its balance sheet to development, which gives it an opportunity to increase yields and create product it otherwise may not have been able to buy.

Pauls said development yields are in the six per cent range, while yields on intensifying properties the trust already owns are in the high single digits. Both numbers are higher than for buying income-producing properties.

Dream Industrial’s net debt-to-asset ratio is under 30 per cent, but Pauls said it would be happy if that number was in the mid-to-high-30s.

Dream Industrial identifies opportunities to recycle assets within its portfolio and reinvest the proceeds into higher-quality properties that are less management- and capital-intensive.

Unit prices are undervalued

There’s a significant disconnect between the valuations of private and publicly owned real estate companies at the moment, as Pauls said the public markets tend to move on momentum and create a herd mentality.

Dream Industrial’s stock price closed at $11.02 on Oct. 5, not too far off its 52-week low of $10.34 and well below the 52-week high of $17.60.

Pauls sees buying Dream Industrial units as a great opportunity to acquire ownership in quality real estate at below replacement cost and net asset value.

“I feel passionate that we’re undervalued,” said Pauls. “What we’re trying to do is run the company well, deliver good results, create value every day and do the best we can from an operations and management standpoint.”

Unlike some other REITs, Dream Industrial hasn’t bought back any of its own units because it’s using capital for development and intensification.

During the second quarter, construction began on a 154,000-square-foot ground-up development in Caledon in the GTA and a 120,000-square-foot expansion in Montreal.

Dream Industrial is under construction on more than 680,000 square feet of projects across Canada and Europe and is in the final stages of advancing the construction of 800,000 square feet of projects in the near term.

The trust’s development and expansion pipeline totals approximately 3.4 million square feet in land-constrained markets in Canada and Europe.

Positive outlook for the future

Pauls believes real estate is a good place to invest in the current economic environment and that industrial is by far the best asset class due to its stability, the long-term nature of its contracts, the underlying health of its tenants and the strength of its demand.

Pauls expects replacement costs and barriers to entry to continue to rise due to increasing demand for industrial space along with land constraints, rising material costs and labour shortages.

“I think it’s hard to say what’s going to happen with inflation, interest rates and the geopolitical factors that influence economies, but we’re very happy with the asset class that we’re in,” said Pauls.

“We think being in real property is a bit of a hedge against inflationary pressures. We’re happy with where we’re at.”

Source Real Estate News EXchange Click here to read a full story

QuadReal Picks Homebuilder for First Phase of Toronto Mall Redevelopment

QuadReal Property Group is teaming up with one of the Greater Toronto Area’s largest homebuilders as part of the first phase of redeveloping a suburban mall once home to U.S. retailer Target.

Vancouver-based QuadReal said it selected Mattamy Homes, which constructs about 8,000 homes annually, to build condominiums on a standalone, 2.3-acre site on The East Mall Crescent that is part of the Cloverdale Mall redevelopment.

Toby Wu, executive vice president of development at QuadReal, said Mattamy’s plans for the site and cultural alignment fit with his company’s vision for the site.

Plans for the larger 32-acre Cloverdale Mall site at the intersection of Highway 427 and Dundas Street West in central Etobicoke include new retail, for-sale condos, apartments, parks and green space, amenities, and below-grade parking.

QuadReal said it has a long-range vision for the site, which is still anchored by Home Hardware, Rexall Drugstore, Winners, Kitchen Stuff Plus and Metro. The mall was first built in 1956.

Plans for the first phase on the 2.3 acres known as the Triangle Site is a 32-storey tower and an 8-storey mid-rise with more than 500 condos and 2,400 square feet of retail.

Mattamy will acquire a partial interest in the site and will be the execution partner for development, construction, and sales and marketing.

QuadReal will be in charge of the overall direction of the district master plan along with maintaining long-term ownership of the retail and purpose-built rental components.

“QuadReal is a key partner in our delivery of 13,000 condo sales within the next five years,” said David Stewart, president of Mattamy’s GTA urban division, in a statement.

Source Costar Click here to read a full story

Company Tied to Former Calgary Flames Captain Scores With Toronto Land Deal

A company associated with former NHL forward Jim Peplinski, who captained the only Stanley Cup win in Calgary Flames history, has sold nearly $117.3 million in land and property in the Toronto region.

CoStar data from land records show a portfolio of three retail and industrial properties sold at the end of August at 56, 58 and 60 Fieldway Road. The deal includes 4.38 acres of land.

Peplinski, also a member of the 1988 Canadian hockey team that competed in the Calgary Olympics that year, has been in the car leasing business for more than 30 years.

Property records indicate the portfolio’s seller was Stowe Holdings Ltd. That company is held in the name of the retired hockey player’s wife, Catherine Peplinski.

“The property was originally bought by my father-in-law to run Jiffy Foods,” said Peplinski in an interview with CoStar News. “It was the early days of catering trucks.”

After Peplinski retired from hockey in 1995, ending a career that included scoring 161 goals with 263 assists, he established a successful car company called Peplinski Leasing.

“I began to develop all sorts of ideas for a business that would be fulfilling. In the fall after the [Stanley] Cup, my father-in-law Stew Esplen called to suggest I look at an ad he saw in the Globe and Mail. Peters and Co., an Alberta-based company, was selling non-core assets that turned out to be a small leasing company called Hartfield Chieftain Leasing,” according to a biography posted on the company’s website.

Peplinski is also chairman and founder of Properly Investment, which acquires, invests and operates in Western Canadian businesses.

His father-in-law’s sons also got into dealerships under the name Humberview Trucks and were operating at the sites being sold. Peplinski said the area the land sits in has turned into a predominantly residential neighbourhood and Humberview has plans to move.

“It’s butting up against houses, so we tried to find somebody who would respect that,” said Peplinski, who wouldn’t confirm the sale price. “There are a lot of moving pieces with respect to density and costs.”

The site was sold to Feldway Road Developments, which is ultimately controlled by EllisDon Developments. Plans for the site posted online include 1,149 residential units.

“Fieldway Road is another example of EllisDon continuing to grow our service offering with our client partners throughout the development process,” said Geoff Smith, EllisDon’s chief executive, in a paid content post online.

Source Costar Click here to read a full story