Author The Lilly Commercial Team

Toronto Isn’t The Only Place That’s Growing in Southern Ontario: Urban Hamilton

Toronto isn’t the only place that’s growing in Southern Ontario… …and in fact, every city and town in the area seems to have a fair share of cranes these days. In this image by UrbanToronto Forum contributor Lachlan Holmes are two of the many projects rising around the Gore Park area in Downtown Hamilton; the Gore Park Lofts in the middle ground, and Cobalt Luxury Residences in the background.

Source Urban Toronto. Click here to read a full story

CRE Investment Outlook is Strong, But Less Capital Available

Despite ongoing economic uncertainty, Canada remains a good place to invest according to senior executives who closed the Sept. 8 RealREIT conference at the Metro Toronto Convention Centre with a panel discussion moderated by RioCan REIT(REI-UN-T) president and CEO Jonathan Gitlin.

Other Western countries are facing similar issues, but Europe also has concerns about an energy crisis resulting from the war in Ukraine. So, Canada still has plenty of appeal despite being a relatively small real estate market with limited opportunities.

“I think that Canada has a unique advantage of being one of the most investable countries on Planet Earth,” said Mark Kenney, president and CEO of CAPREIT (CAR-UN-T), which owns or has interests in approximately 67,000 residential apartment suites, townhomes and manufactured housing community sites across Canada and the Netherlands valued at approximately $18 billion.

“It’s a safe society. We have low environmental impact coast-to-coast. And from a real estate point of view, we’re really a country with three cities: Toronto, Vancouver and Montreal.”

Canada is a safe investment haven

Institutional investors from Canada and Europe have told Kenney they see the world’s second-largest country (by land area) as a safe haven.

“Long-term investment in Canada makes sense; however it could be bumpy for a little while,” said Slate Asset Management founding partner Blair Welch.

“The good news is that there is an enormous amount of capital available for investment,” said Adam Paul, president and CEO of First Capital REIT (FCR-UN-T), which has $10.2 billion of assets under management.

“And that capital has an increasingly higher bias towards alternative investments, like real estate, for its cash-flow characteristics and for its inflation-hedge characteristics.”

A number of non-Canadian entities are investing or laying the groundwork for investing in Canada, according to Paul.

“Canada is an increasingly more attractive place on a relative basis. We complain a lot about a lot of things, but our political stability is a positive factor globally.

“Our social status and quality of life that people afford in Canada is attractive along with the labour pool and the economic growth profile. So I think Canada, really since the the 2008 and 2009 downturn, has elevated its profile on the global stage.”

Disciplined lending environment

RBC Capital Markets managing director of global equity research Pammi Bir said Canada’s disciplined lending environment can also minimize or eliminate excesses that could create potential problems.

“As a foreigner coming in here, there’s not a lot of risk capital,” Welch added. “We have really smart real estate people and massive pension funds globally that dominate.

“It’s not like you can just waltz in here and do whatever you want. Canada is very, very protected because of our system.”

While Welch acknowledged Canada’s controlled capitalism can be protective during times of disruption, it can also limit some potential upside.

Kenney said Canada has a very sophisticated real estate environment that has helped major Canadian REITs and real estate operating companies export their platforms overseas, which their American counterparts haven’t done to nearly the same extent.

REITs trade at a discount to value

Paul pointed out that a basket of two dozen Canadian apartment and commercial REITs are trading at an average 23 per cent discount to their intrinsic value, while a year ago they traded at a five per cent premium to their intrinsic value.

“Public markets don’t respond in a calm fashion when you’re going through a period of change,” said Paul. “Public markets typically get the direction right but the magnitude wrong.”

Kenney said 70 per cent of CAPREIT’s capital stack comes from retail investors, many of whom are stressed, scared and aren’t thinking long-term.

Low share prices offer great opportunities for REITs to purchase their own stock for long-term gain and he thinks other investors should also take advantage.

One of Slate’s current investment strategies is buying global REITs at a discount to net asset value because you’re investing in their skilled management teams as well as their properties.

Welch said there’s very little capital available from lenders for large deals, but there is for smaller ones.

Granite REIT president and CEO Kevan Gorrie talks to institutional investors on a regular basis and said almost all have told him their capital allocations aren’t being impacted by current economic factors. While a lot of capital is on the sidelines now, he thinks it will return.

Granite (GRT-UN-T) owns 139 properties totalling 57.5 million square feet in Canada, the United States, Germany, the Netherlands and Austria.

Differing views on development

Welch said development took off because of the cheap cost of capital and, now that it’s becoming more expensive, Slate is being more selective.

He’d rather lend money or buy a REIT than develop and thinks he can now buy some assets without taking the time risk associated with development.

Industrial yields were very tight in 2021 so Granite decided to embark on an ambitious program to develop 5.5 million square feet. This requires capital expenditures without immediate returns from income, but it adds value for unit holders over the longer term.

Granite has been getting better yields than expected from development because rent growth has been greater than anticipated.

Last year presented a greater challenge for costs than this year because construction materials were harder to come by and container and shipping costs were higher, according to Gorrie.

“We’re in this period now where inflation is hitting us for sure, but cost pressures on the construction side have moderated.”

Source Real Estate News EXchange. Click here to read a full story

REITs Still Upbeat on Canada’s Industrial Real Estate Sector

Despite an unprecedented amount of ongoing industrial facility development, continued strong demand has kept vacancy rates across Canada below two per cent.

A session at Sept. 8’s RealREITconference at the Metro Toronto Convention Centre, moderated by RBC Capital Markets Real Estate Group managing director David Tweedie, featured four executives discussing how recent events have impacted the asset class and their expectations for the future.

Tweedie opened the session with a presentation outlining the state of the market.

“From a fundamentals perspective, we’re sitting at record national-low availability, double-digit rental rate growth continues in most major markets and (there are) record tenant absorption levels,” Tweedie said. “But on the headwind side, we’re facing moderating GDP, elevated inflation, the potential risk of recession in 2023 and continuing rising interest rates.”

Canadian industrial market snapshot

Canada’s nine largest markets have an industrial availability rate of 1.6 per cent, which is down 70 basis points year-over-year and some markets have an availability rate of below one per cent.

Asking rents in the second quarter were 34 per cent higher than a year earlier and have doubled over the past five years.

The price per square foot for industrial space has risen by more than 30 per cent.

There were 37 million square feet of new industrial space delivered in the past year, while there were 44 million square feet of net absorption. An additional 41.6 million square feet is under construction and due to be delivered this year and in 2023 — and about 60 per cent of it is already leased.

There will be about 14 million square feet of industrial space delivered in the Greater Toronto Area (GTA) this year, but the vacancy rate will remain below one per cent.

There was also a record high in industrial transaction value last year and, while there’s been a slowdown in Q3 this year, it’s expected the 2022 total will be close to that of 2021.

Investors and lenders like industrial sector

National Bank Financial director of real estate equity research Matt Kornack, who covers the multiresidential and industrial asset classes, said investors are looking at industrial as the asset class with the most growth and smallest capital expenditures.

However, Kornack said investors are also looking at returns on a one-year basis even though real estate is a long-term business. That has hurt many REITs and caused them to trade at a discount to net asset value.

Kornack expects more targeted lending, with lenders gravitating toward industrial because of its strong fundamentals.

He noted Canada has lagged the U.S. in industrial rent growth trajectory, but he’s bullish about rents continuing to increase and capital continuing to flow into the asset class.

In light of rent growth, Kornack said tenants will need to come up with ways to use their space more efficiently.

Skyline Industrial REIT

Guelph-based and privately held Skyline Industrial REIT owns 57 properties totalling 8.75 million square feet in 33 communities in five provinces valued at $1.25 billion.

Skyline Industrial REIT was previously focused on smaller properties in secondary markets, but moved midway through last year to sell virtually all of its small-bay industrial properties.

It has sold about $450 million worth and is redeploying the capital into newer properties, including a recently announced 16-building, two-million-square-foot, $309.25-million portfolio in Calgary and Edmonton.

Skyline Industrial REIT president Mike Bonneveld said there are just two vacancies in his entire portfolio and the REIT has offers on both.

Bonneveld noted tenants have become more educated and aware of rising rents. Some of the sticker shock has evaporated when they’re faced with doubled or tripled rents upon renewal and there’s nowhere else to go due to a supply shortage.

Skyline Industrial REIT is partnering with other developers, including on a 20-acre parcel of land in Halifax that marks its first foray into the Maritimes, as well as a deal with Montreal-based Rosefellow.

That second partnership includes a 325,777-square-foot, state-of-the-art facility at 151 Reverchon Ave. in the Montreal suburb of Pointe-Claire.

“We’ve just, as of last week, closed on our second fund with them,” Bonneveld said of Rosefellow. “We’ve got about 11 projects underway, with the majority in the GMA (Greater Montreal Area), that will deliver about three million square feet by the time we’re done.”

Some of Skyline Industrial REIT’s developments have been completely pre-leased before construction has started and tenants are committing to buildings that won’t be ready until Q3 or Q4 2023.

“The reason we’re in development is to get the pipeline of assets,” said Bonneveld. “We’re not doing it to build and flip. We’re in it to get very good product in the core markets we want to be in.”

One area of concern is getting product out of industrial properties, as more truck drivers and trucking facilities are needed.

Bonneveld said Skyline Industrial REIT bought a trucking facility as a land development play a year-and-a-half ago and saw its rents triple and its value significantly increase, so it no longer plans to redevelop the site.

PROREIT

Industrial space comprises about 80 per cent of Montreal-based PROREIT’s (PRV-UN-T) gross leasable area.

It owns about seven million square feet across Canada valued at approximately $1 billion. Its stock price is trading at about 28 per cent below net asset value, according to Mark O’Brien, PROREIT’s senior vice-president of leasing, operations and sustainability.

PROREIT was very active on the industrial acquisition front late in 2021.

It created a joint venture with Crestpoint Real Estate Investments Ltd. involving $455 million of mainly industrial properties, including a $228-million portfolio in Halifax’s Burnside Industrial Park, in June.

PROREIT and Crestpoint jointly own a portfolio of 42 properties, 41 in Halifax and one in Moncton, N.B., comprising nearly 3.1 million square feet of gross leasable area. O’Brien said they’ve taken rents from $8 to $12 and potentially $16 in Halifax.

O’Brien said there’s been no slowdown in leasing in any of the markets PROREIT is in and leasing spreads have been accelerating.

While PROREIT is looking at development opportunities as they come along, O’Brien said it’s primarily focused on earning good yields from stabilized assets in secondary markets as development yields compress.

Dream Industrial REIT

Dream Industrial REIT (DIR-UN-T) has about $6.5 billion in assets under management in Canada, Europe and the U.S. It has about three million square feet of space in its development pipeline.

Chief operating officer Alexander Sannikov said Dream Industrial’s priority is to grow the portfolio across geographies and it’s increasingly focused on speculative development. It prefers mid-sized projects over mega-projects.

Dream Industrial continues to sign lease deals in Canada and demand remains high. The REIT is pursuing acquisitions and is interested in strategic joint ventures.

Demand is also strong in Europe, where Dream Industrial signed two large-lease deals in the traditionally very slow month of August. It also had five tenants competing for an industrial development in Germany.

Sannikov said the European industrial market is dominated by merchant developers, whereas there are more build-to-hold developers in Canada.

He thinks returns are currently strongest in development and Dream Industrial can receive significant yield premiums.

Source Real Estate News EXchange. Click here to read a full story

CRE Measures Up as Canadian Economic Driver

Commercial real estate (CRE) is a Canadian economic driver on par with the oil and gas industry, economic analysts conclude. A new report, commissioned by the NAIOP Research Foundation, estimates CRE made a $148.4 billion total contribution to Canada’s gross domestic product (GDP) last year when factoring its direct, indirect and induced impacts, beginning with $78.2 billion of direct GDP output and nearly 373,000 equivalent fulltime jobs within the industry.

That’s derived from six envelopes of economic activity: construction and capital investment in each of the office, industrial, retail and multifamily asset classes; property management and operations within existing CRE inventory; and commercial brokerage services tied to leasing and asset transactions. Researchers with Altus Group Economic Consulting also considered how social and economic trends might affect each of those elements of CRE’s multifaceted whole.

“The commercial real estate sector could be vulnerable to long-term impacts related to the (COVID-19) pandemic such as the demand for office space that will continue to evolve with hybrid work practices and the demand for retail and industrial space that will continue to evolve with shifts in e-commerce trends. High inflation and rising interest rates have also increased costs for new commercial real estate development,” the report notes. “Notwithstanding these risks, non-residential investment is generally holding up and leasing activity related to new buildings is robust.”

Among the CRE asset classes, industrial and multifamily are the predominant economic engines, together accounting for 68 per cent of direct investment in new construction and about 55 per cent of direct investment in renovations and retrofits. On the job front, that translates into 60 per cent of the person years of employment that construction supported in 2021.

More than $16 billion invested in industrial construction last year continued a five-year growth trend in the sector and created 60,630 direct jobs. On the transaction side of the equation, about $16.7 billion worth of deals was a 92 per cent year-over-year increase and accounted for more than 37 per cent of CRE sales value in 2021.

Even more investment went into multifamily construction — exceeding $24 billion — representing 37 per cent of construction spending for the year and directly employing 90,760 workers. Investors also acquired about $13.2 billion worth of multifamily apartments, equating to more than 29 per cent of CRE sales value for the year.

Adding in $12.8 billion in the office sector and nearly $11.8 billion in the retail/hospitality sector, new construction and renovation/retrofit spending surpassed $65 billion in 2021. That was weighted about 55 per cent in favour of new construction, but office stands out for a greater share of renovation/retrofit activity occurring within existing inventory — equating to more than $8 billion in investment.

“Office construction is highly skewed toward renovation/retrofit because of the important contribution of tenant improvements,” the reports states. “The proportion of investment in new buildings has gradually increased since 2018, but will likely subside in the next few years. Post-pandemic trends may decrease the need for new office space at the same time as many office users find that adapting their spaces to emerging new working realities requires capital investment.”

That plays out in job numbers with 29,890 tied to office renovations and retrofits last year versus 17,590 in new office construction. In contrast, new construction generated nearly 115,000 jobs across the three other asset class compared to 80,000 related to renovations and retrofits.

Commercial brokerages enjoyed a 20 per cent year-over-year lift in fee collection last year. Nearly $9.5 billion in earnings — up from $7.9 billion in 2020 — also marked a five-year high. Fees hovered in the $8.1 billion range in 2018 and 2019 and tallied about $7.3 billion in 2017.

“Broker fees are typically generated based on transaction volumes, and the rise in broker fees in 2021 is related to the strong recovery in the number of transactions,” the report advises. That was seen in a 67 per cent year-over-year increase in total sales value, which rose from $26.5 billion in 2020 to $44.5 billion in 2021. Meanwhile, brokerage operations accounted for 48,670 jobs last year.

Management and operations of the existing inventory encompasses the multidisciplinary tracks of property and asset management, involving building operations, finance and investment and tenant-facing pursuits. It is proportionally the biggest spender among the six categories of CRE activity, supports the most employees and makes the heftiest contribution to GDP, which represents the final value of goods produced and services rendered. For 2021, that’s about $72.3 billion in direct spending, $46.3 billion in direct GDP and 81,580 direct jobs.

Compared to construction or brokerage services, property and asset management have a disproportionately positive influence on employment in other sectors from which products and services are procured. That’s estimated at 219,430 indirect jobs — a multiplier effect of nearly 2.7 — representing slightly more than half of all indirect employment attributed to the CRE industry. That flows through to $13.58 billion in indirect labour earnings and nearly $21.5 billion in indirect GDP.

Property/asset management actually spurred better paying indirect jobs, at an average of $61,887 per worker, than within the CRE sector. Looking at direct jobs, average per worker earnings in 2021 were $79,600 in construction/renovation versus $56,877 in management and operations.

CRE construction generated roughly 181,000 indirect jobs or 75 per cent the amount of direct jobs. That represents $12.94 billion in labour earnings or an average of $71,484 per worker.

Source REMINetwork. Click here to read a full story

CentreCourt and Spotlight Propose 60 Storeys at Church and Queen

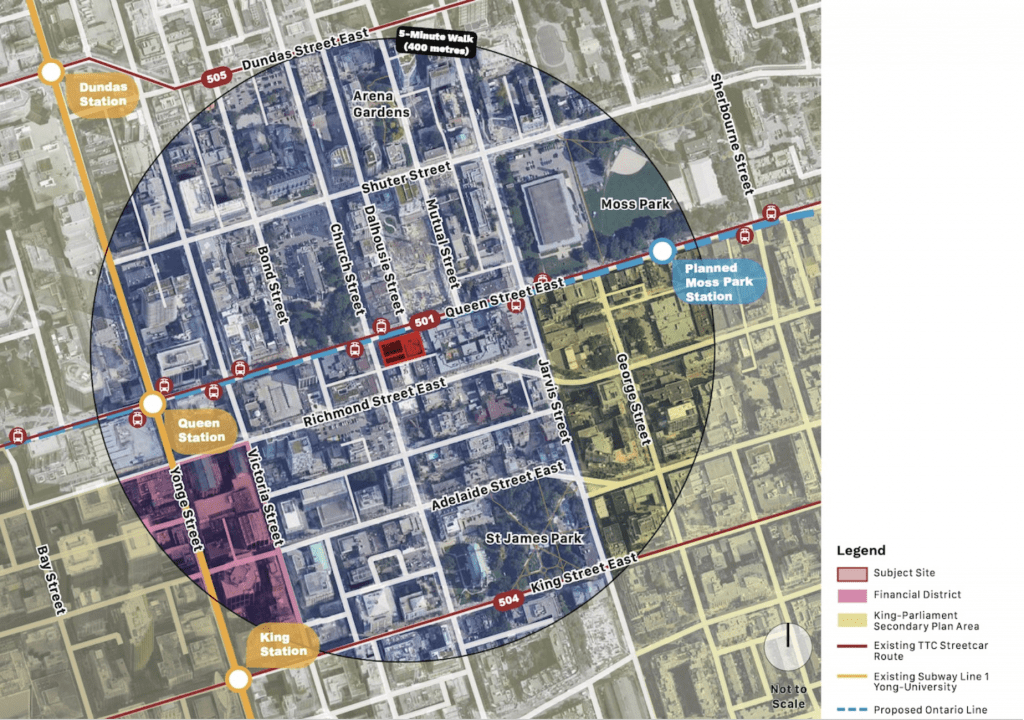

CentreCourt and Spotlight Development are jointly seeking to redevelop a plot in the Old Town area of Downtown Toronto at 85 through 89 Queen Street East and 119 through 127 Church Street (known as the longtime flagship store for Canadian camera chain Henry’s). Zoning By-law Amendment and Site Plan Approval applications submitted by Bousfields Inc for a 60-storey, mixed-use building designed by IBI Group with GBCA Architects handling heritage aspects. The redevelopment would provide the neighbourhood with 583m² of ground floor retail, 17 residential rental replacement units, and 701 condominium units totalling 44,354m² if approved.

Located at the southeast corner of Queen Street East and Church Street, the rectangular 1,594m² plot comprises five low-rise buildings at 119, 121, 123, 125 and 127 Church Street, and 85 through 89 Queen Street East. Ranging from 2 to 4 storeys in height, these brick-built buildings that date as far back as the 1840s have been the subject of numerous alterations to accommodate their current commercial and residential rental uses, with enough change that none of the above properties are listed on the Heritage Register.

The plot is sited along the Church Street corridor in Downtown Toronto and is only 300m east of Yonge Line 1 at Queen Station, which will eventually also be served by Ontario Line 3 running from Exhibition Place through to the Ontario Science Centre. The site is also 500m northeast of King Station, and about that distance from the future Ontario Line 3 station at Moss Park to the east. This site, therefore, falls within the definition of a “Major Transit Station Area” as per the Province’s Growth Plan, making it a prime candidate for redevelopment.

IBI Group have consciously panelized and incorporated the existing brickwork elevations of 89 Queen Street East and 119-123 Church Street into a proposed seven-storey base podium. By recessing the contemporary massing from the historic facades, the architects have been able to preserve the form of some of the original buildings and maintain a somewhat homogenous street frontage.

125-127 Church Street at the Queen and Church intersection would be demolished and replaced with a contemporary clad form that rises to 198.15m. A setback of approximately 2.5m from the northern and western property lines would provide visual relief from the reconstituted facades. The tower element that begins at level 8 is aligned with the outer faces of the newly added podium below. A 10m setback from the centre line of Ditty Lane to the south helps limit shadow impacts on nearby properties and the public realm.

The proposed façade incorporates a combination of three unspecified cladding typologies and extensive clear glazing that are in keeping with the existing and approved high-rise buildings within the east Downtown area. Notably, the northern and southern elevations of the development disrupt the homogenous grid pattern that IBI Group have implemented with a series of chamfered cladding elements that add dynamism to the design as it rises vertically.

The development includes 17 rental replacement units and 701 new condominium units, found at level 4 upwards. The condominium units are comprised of 500 one-bedrooms (71%), 131 two-bedrooms (19%), and 70 three-bedrooms (10%), representing a residential Gross Floor Area of 44,354m². Level two accounts for most of the scheme’s 1804m² of indoor and outdoor amenity space. The limited visitor and accessible vehicle parking spaces are accessed via Ditty Lane to the south of the property line, which leads east off Church Street. A single underground level provides the development with ancillary spaces and 701 bicycle parking spaces that the building requires. A proposed Gross Floor Area of 44,937m² that is inclusive of 583m² of retail space at ground level that predominantly fronts Queen Street East, would give the site a density of 28.2 FSI.

UrbanToronto will continue to follow progress on this development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

* * *

EDITOR’S NOTE: An earlier version of this story erroneously omitted Spotlight Development Inc. as co-developer of the proposal.

* * *

UrbanToronto’s new data research service, UrbanToronto Pro, offers comprehensive information on construction projects in the Greater Toronto Area—from proposal right through to completion stages. In addition, our subscription newsletter, New Development Insider, drops in your mailbox daily to help you track projects through the planning process.

Source Urban Toronto. Click here to read a full story

Despite an Unprecedented Amount of Ongoing Industrial Facility Development, Continued Strong Demand has Kept Vacancy Rates Across Canada Below Two per Cent.

A session at Sept. 8’s RealREITconference at the Metro Toronto Convention Centre, moderated by RBC Capital Markets Real Estate Group managing director David Tweedie, featured four executives discussing how recent events have impacted the asset class and their expectations for the future.

Tweedie opened the session with a presentation outlining the state of the market.

“From a fundamentals perspective, we’re sitting at record national-low availability, double-digit rental rate growth continues in most major markets and (there are) record tenant absorption levels,” Tweedie said. “But on the headwind side, we’re facing moderating GDP, elevated inflation, the potential risk of recession in 2023 and continuing rising interest rates.”

Canadian industrial market snapshot

Canada’s nine largest markets have an industrial availability rate of 1.6 per cent, which is down 70 basis points year-over-year and some markets have an availability rate of below one per cent.

Asking rents in the second quarter were 34 per cent higher than a year earlier and have doubled over the past five years.

The price per square foot for industrial space has risen by more than 30 per cent.

There were 37 million square feet of new industrial space delivered in the past year, while there were 44 million square feet of net absorption. An additional 41.6 million square feet is under construction and due to be delivered this year and in 2023 — and about 60 per cent of it is already leased.

There will be about 14 million square feet of industrial space delivered in the Greater Toronto Area (GTA) this year, but the vacancy rate will remain below one per cent.

There was also a record high in industrial transaction value last year and, while there’s been a slowdown in Q3 this year, it’s expected the 2022 total will be close to that of 2021.

Investors and lenders like industrial sector

National Bank Financial director of real estate equity research Matt Kornack, who covers the multiresidential and industrial asset classes, said investors are looking at industrial as the asset class with the most growth and smallest capital expenditures.

However, Kornack said investors are also looking at returns on a one-year basis even though real estate is a long-term business. That has hurt many REITs and caused them to trade at a discount to net asset value.

Kornack expects more targeted lending, with lenders gravitating toward industrial because of its strong fundamentals.

He noted Canada has lagged the U.S. in industrial rent growth trajectory, but he’s bullish about rents continuing to increase and capital continuing to flow into the asset class.

In light of rent growth, Kornack said tenants will need to come up with ways to use their space more efficiently.

Skyline Industrial REIT

Guelph-based and privately held Skyline Industrial REIT owns 57 properties totalling 8.75 million square feet in 33 communities in five provinces valued at $1.25 billion.

Skyline Industrial REIT was previously focused on smaller properties in secondary markets, but moved midway through last year to sell virtually all of its small-bay industrial properties.

It has sold about $450 million worth and is redeploying the capital into newer properties, including a recently announced 16-building, two-million-square-foot, $309.25-million portfolio in Calgary and Edmonton.

Skyline Industrial REIT president Mike Bonneveld said there are just two vacancies in his entire portfolio and the REIT has offers on both.

Bonneveld noted tenants have become more educated and aware of rising rents. Some of the sticker shock has evaporated when they’re faced with doubled or tripled rents upon renewal and there’s nowhere else to go due to a supply shortage.

Skyline Industrial REIT is partnering with other developers, including on a 20-acre parcel of land in Halifax that marks its first foray into the Maritimes, as well as a deal with Montreal-based Rosefellow.

That second partnership includes a 325,777-square-foot, state-of-the-art facility at 151 Reverchon Ave. in the Montreal suburb of Pointe-Claire.

“We’ve just, as of last week, closed on our second fund with them,” Bonneveld said of Rosefellow. “We’ve got about 11 projects underway, with the majority in the GMA (Greater Montreal Area), that will deliver about three million square feet by the time we’re done.”

Some of Skyline Industrial REIT’s developments have been completely pre-leased before construction has started and tenants are committing to buildings that won’t be ready until Q3 or Q4 2023.

“The reason we’re in development is to get the pipeline of assets,” said Bonneveld. “We’re not doing it to build and flip. We’re in it to get very good product in the core markets we want to be in.”

One area of concern is getting product out of industrial properties, as more truck drivers and trucking facilities are needed.

Bonneveld said Skyline Industrial REIT bought a trucking facility as a land development play a year-and-a-half ago and saw its rents triple and its value significantly increase, so it no longer plans to redevelop the site.

PROREIT

Industrial space comprises about 80 per cent of Montreal-based PROREIT’s (PRV-UN-T) gross leasable area.

It owns about seven million square feet across Canada valued at approximately $1 billion. Its stock price is trading at about 28 per cent below net asset value, according to Mark O’Brien, PROREIT’s senior vice-president of leasing, operations and sustainability.

PROREIT was very active on the industrial acquisition front late in 2021.

It created a joint venture with Crestpoint Real Estate Investments Ltd. involving $455 million of mainly industrial properties, including a $228-million portfolio in Halifax’s Burnside Industrial Park, in June.

PROREIT and Crestpoint jointly own a portfolio of 42 properties, 41 in Halifax and one in Moncton, N.B., comprising nearly 3.1 million square feet of gross leasable area. O’Brien said they’ve taken rents from $8 to $12 and potentially $16 in Halifax.

O’Brien said there’s been no slowdown in leasing in any of the markets PROREIT is in and leasing spreads have been accelerating.

While PROREIT is looking at development opportunities as they come along, O’Brien said it’s primarily focused on earning good yields from stabilized assets in secondary markets as development yields compress.

Dream Industrial REIT

Dream Industrial REIT (DIR-UN-T) has about $6.5 billion in assets under management in Canada, Europe and the U.S. It has about three million square feet of space in its development pipeline.

Chief operating officer Alexander Sannikov said Dream Industrial’s priority is to grow the portfolio across geographies and it’s increasingly focused on speculative development. It prefers mid-sized projects over mega-projects.

Dream Industrial continues to sign lease deals in Canada and demand remains high. The REIT is pursuing acquisitions and is interested in strategic joint ventures.

Demand is also strong in Europe, where Dream Industrial signed two large-lease deals in the traditionally very slow month of August. It also had five tenants competing for an industrial development in Germany.

Sannikov said the European industrial market is dominated by merchant developers, whereas there are more build-to-hold developers in Canada.

He thinks returns are currently strongest in development and Dream Industrial can receive significant yield premiums.

Source Real Estate News EXchange. Click here to read a full story

“The Office is Not Dead”: How the Pandemic Forced an Evolution of Workspace

At the height of the pandemic, strolling through Toronto’s Financial District made for an eerie experience; taking in the silent intersections and shuttered businesses of the underground PATH hit home just how much COVID had impacted the workforce, and our lives.

However, while work-from-home mandates led to an initial hollowing out of downtown cores and ended daily commutes for many, today, the office isn’t obsolete — far from it. Instead, the last two years have spurred an evolution in the concept of the workplace, says John Duda, President of Real Estate Management Services Canada at Colliers.

“The office is not dead, not by a long shot,” he tells STOREYS. “I think that’s going to remain true going forward, but how it gets used is going to be a little bit different.”

Recent polling research compiled by Colliers has found organizations seem to be stabilizing in their “return to office” approach, whether that be fully in-person, remote, or a combination of the two. Office tenants are now less likely to reduce the size of their space, with only 24% of those surveyed indicating they wished to, while 7% of companies said they actually required more square footage.

What is clear is that more people are returning to the office full-time; polling finds employees at 61% of surveyed companies are working hybrid, down 5% from their previous report, while 37% have employees coming in full time, an increase of 4%.

With so much in transition, flex space has become increasingly important; Colliers reports that of those companies considering flex space — roughly half — intend for it to encompass more of their portfolio, at an average of 47% of their total square footage. As well, the impact of the changing desire for flex space has nearly doubled to 13%, up from 6% and 7% in previous surveys.

The challenge for companies, says Duda, is understanding how the needs of those physically present have changed since pre-pandemic; determining a “new normal” is proving to be elusive, and is requiring plenty of trial and error as employers identify friction points.

“The types of things that are getting talked about are, ‘I’m going into the office now to do different types of things. I’m going in to meet, I’m going in to train, I’m going in to talk to somebody; maybe it’s less of a formal meeting but I need to see some people and have some casual conversations,’” he says.

“There’s a lot of simple things that no one’s really figured out yet, and you’d think it would be simple, but for some reason, it’s not. You go into companies and they have monthly parking spaces for staff in these buildings – well, why don’t you just take a group of monthly parking spaces and share them? But, how do you do that? Nobody has an answer.”

As well, demand is booming for agile workspace, Duda says, such as varying types of meeting rooms, increased privacy, and fewer cubicles. Upgraded technology, such as teams-based meeting setups with pivot cameras and instant computer connections, will become the new standard.

“Let’s say I have a meeting, and I have staff right across the country, but there’s a number of people in the office,” poses Duda. “Do I get a room? I don’t know. Who’s here? I don’t know! But the technology should be able to say, ‘There’s three of you sitting in the office together, ok, get a room,’ and do that really easily. I don’t have to walk around, I don’t have to knock on doors, I don’t have to call anyone — but right now it’s actually hard.”

Duda believes these pain points will remain for another year or two and that — though it’s impossible to predict how COVID will evolve — the need for collaboration is too great for some types of workers to remain remote indefinitely.

“The tech companies that we deal with are all saying the same things, ‘I can’t develop product easily with everybody scattered and at home,’” he says. “I’ve dealt with some of the banks and they’re saying their product development teams are a mess — it’s just not going well. There are certain things that just don’t work well.”

Source Storeys. Click here to read a full story

Land Prices for High Density GTA Properties Drops in Q2

The latest stats are in for high density land prices in the Greater Toronto Area (GTA).

Real estate advisory firm Bullpen Research and Consulting Inc. and land use planning and project management firm Batory Management have teamed up to review and provide projections on GTA high-density land sales on a quarterly basis.

In general — not unlike the single-family home market — prices were down for pieces of GTA real estate that will one day house towering structures packed with residents.

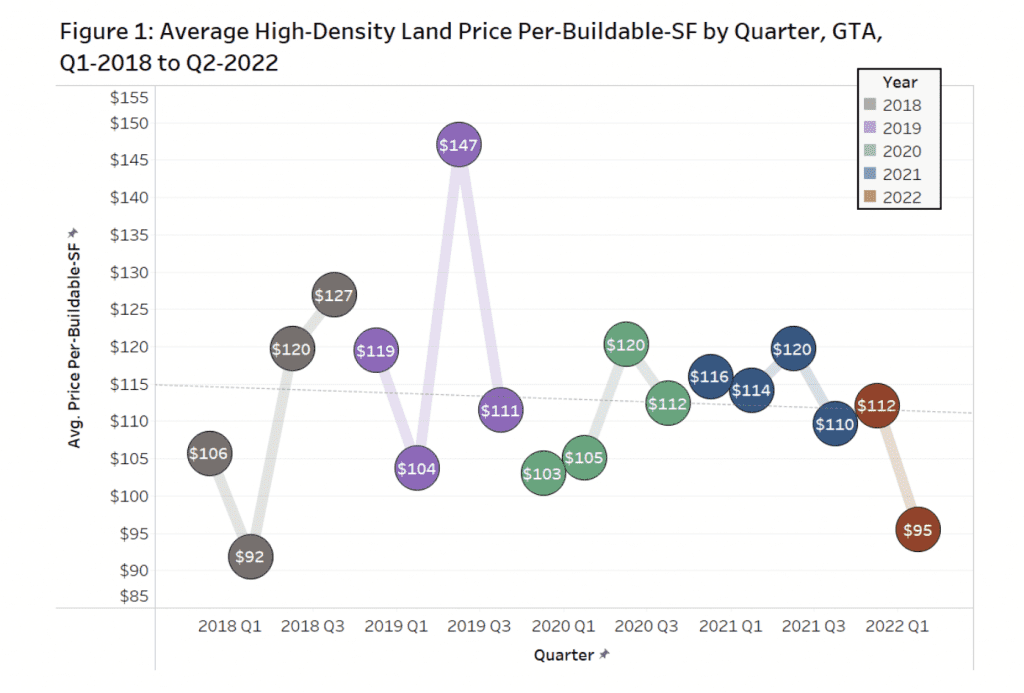

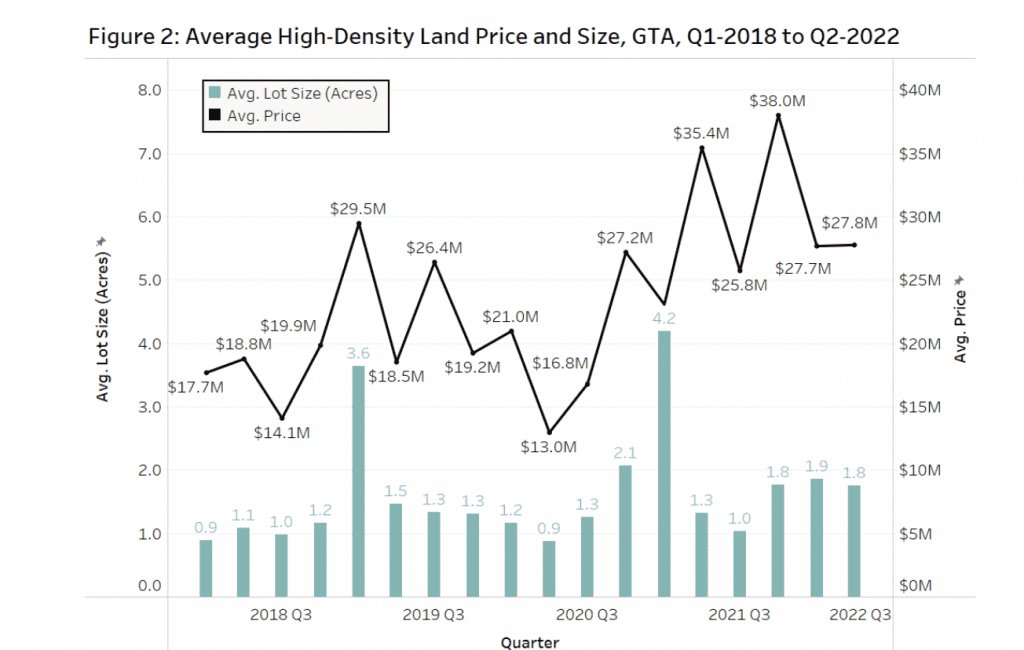

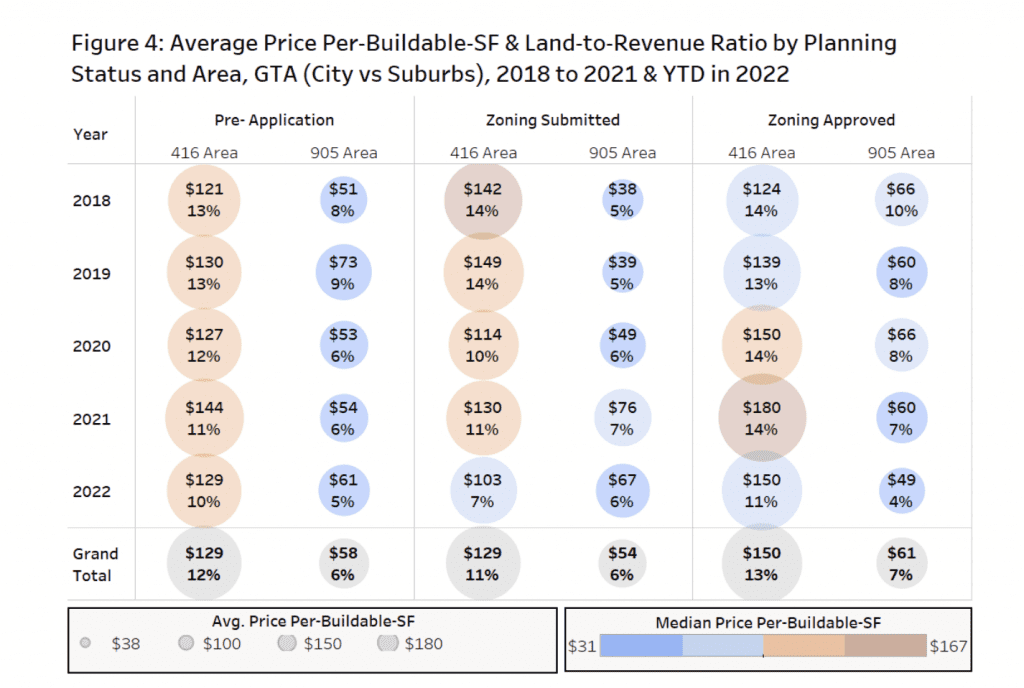

A total of 46 transactions in the GTA were reviewed for the report. It revealed that the properties sold for $95 per buildable square foot (pbsf) on average, down from last quarter ($112 pbsf). The average property sold for $27.8M for 1.8 acres.

In Q2-2022, the average land-to-revenue ratio was 7.2%, compared to 8.8% in Q1-2022.

In Q2-2022, the land-to-revenue ratio in the ‘416’ area lands was 8.1%, with ‘905’ area lands had an average land-to-revenue ratio of 4.9%. These are down from the longer-run average of 11.8% and 6.5%, respectively.

High-density lands sold for $135 pbsf in the former City of Toronto in Q2-2022 (pre-amalgamation boundaries), with North York at $103 pbsf, and Scarborough at $50 psf.

Over the past 4.5 years, the average land sold pre-application had a land-to-revenue ratio of 12% in the ‘416 area’ compared to 13% for zoning approved lands. In the ‘905’ or suburban markets, those numbers at 6% and 7% respectively.

As the report highlights, the drop in land prices comes at a time when developers face a looming nearly 50% increase in development charges and a potential hike in construction costs of 7 to 10% in the next 12 months. “There is worry that developers can no longer shrink unit sizes to further boost revenue-per-square-foot without moving forward with 30-40% more studio apartments, which then puts absorption in jeopardy,” reads the report.

A the same time, sky high interest rates and a softening of the resale market has impacted demand.

The report suggests the developers and vendors will take a “wait and see” approach, resulting in fewer transactions in the second half of the year and a flattening of land prices.

Source Storeys. Click here to read a full story

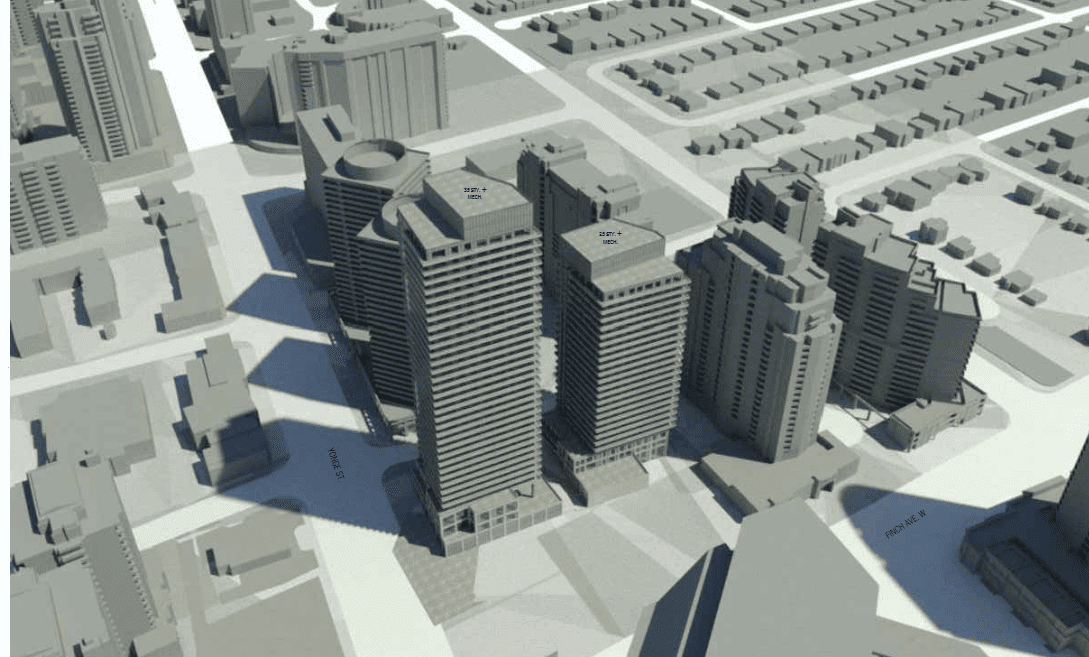

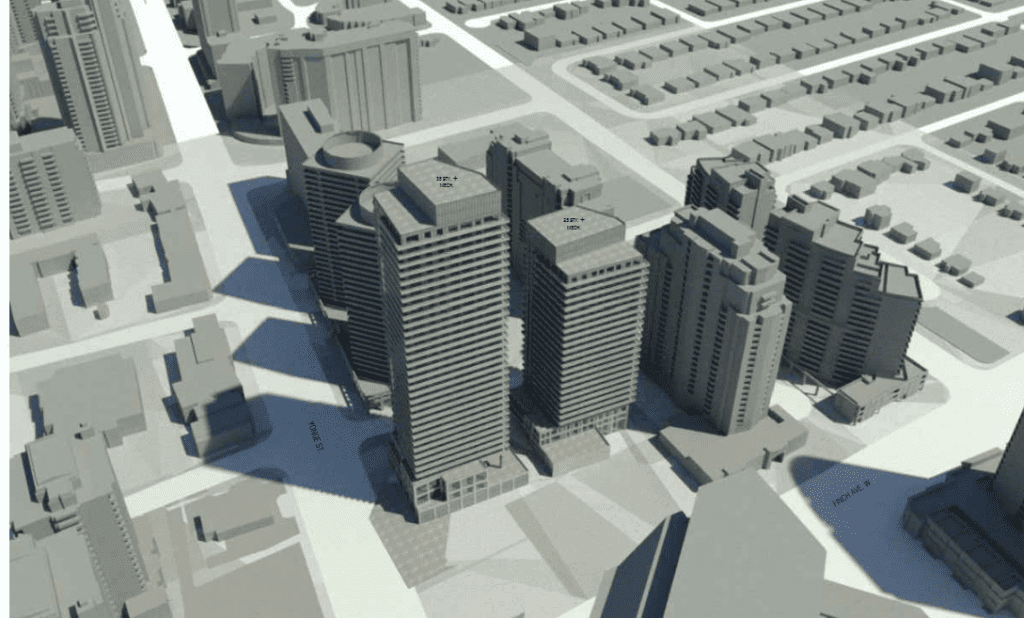

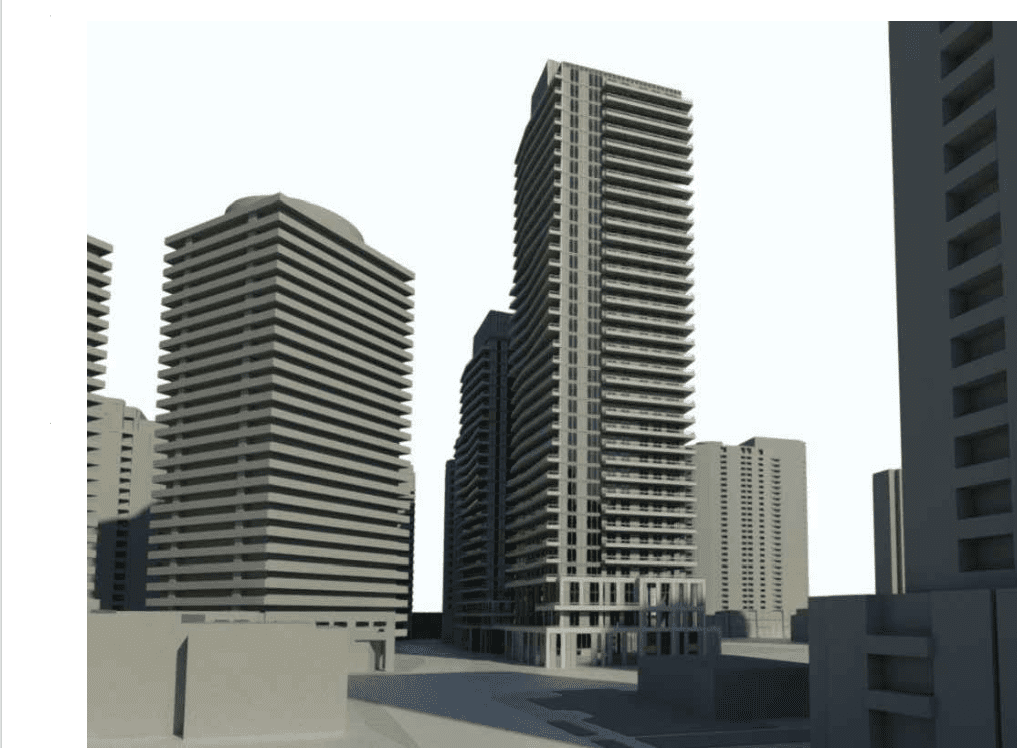

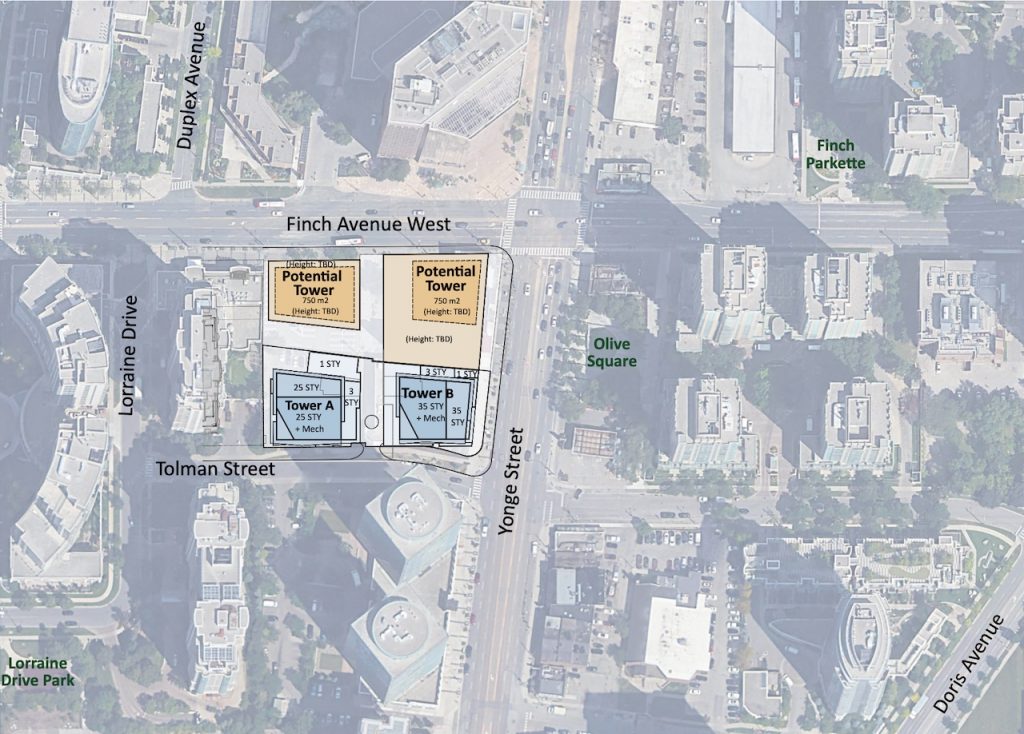

Golfour Proposes High Density Near Finch Station

The MBTW Group have recently submitted Official Plan Amendment, Zoning By-law Amendment and Site Plan Approval applications to the City of Toronto for a 25- and 35-storey pair of mixed-use condominium towers at 5576 Yonge Street. Designed by Graziani + Corazza Architects on behalf of developers Golfour Property Services Inc, the development is located on the northwest corner of Yonge and Tolman streets, just a block south of Finch Avenue in North York City Centre.

Measuring 3,618m² in area, the subject lands are currently comprised of a one-storey commercial building adjacent to Yonge and Tolman intersection and an unaffiliated surface parking lot towards the site’s western perimeter. Being positioned adjacent to two major arterial roads, Yonge Street and Finch Avenue, 5576 Yonge Street benefits from the Finch Subway Station, 400m to the north. This station is served by Yonge Line 1, resultantly designating the plot as a Major Transit Station Area per the Ontario government’s “A Place to Grow” initiative. The site also falls within the North York Centre North zoning as defined by the North York Centre Secondary Plan Area, which sees an abundance of high-rise mixed-use buildings along these arterial corridors.

Graziani + Corazza Architects propose two towers represented by a series of grey massing models. Tower A is situated at the subject site’s western perimeter, and Tower B fronts Yonge Street at the plot’s eastern extent. The proposed development consists of 608 residential units comprising 32 studio units (5%), 366 one-bedroom units (60%), 154 two-bedroom units (25%), and 56 three-bedroom units (9%), which meets the City of Toronto’s requirements for percentages of family-sized unit types. A proposed Gross Floor Area of 41,414m² would give the site a density of 11.5 FSI.

Tower A is 25 storeys (80m) in height and is the smaller of the two buildings; its 3-storey podium abuts the Southern perimeter fronting Tolman Street. A considerate setback of 10m to the northern property line where a municipally owned surface parking lot lies, 9.7m to the western elevation of Tower B’s podium and 3m to the western property line gives adequate space for pedestrianized hard and soft landscaping, prepared by MBTW|WAI. The rectilinear tower isn’t centrally aligned on the podium. Instead, it sits skewed towards the southwestern corner to maintain a 25m separation between Towers A and B.

Tower B is 35 storeys (113m) and again is comprised of a 3-storey podium. It has been designed with a 4.5m setback on Yonge Street. An irregular curved property line fronting Tolman Street means the setback here ranges from 0m to 4m. The podium will adjoin the existing commercial building to the north to create a cohesive street façade strengthened by 507m² of proposed ground floor retail space fronting Yonge Street.

The Planning Rationale documentation makes reference to a conceptual block plan that showcases two future towers in a plot abutting the site to the north. Graziani + Corazza Architects have accounted for a 25m tower separation from the indicative scheme by off-centring the towers towards the south, which provides a rationale for the landscaping towards the northern property line.

Although materiality is unclear on the greyscale massing models, elevations provided as part of this application showcase a series of grey metal cladding, exposed precast concrete columns, light grey spandrel panels, aluminium louvres and clear glass windows and balcony balustrading in an orthodox arrangement.

The proposal features two levels of underground parking that span the entirety of the subject site. This is accessed via a private driveway leading from Tolman Street, serving a dedicated ramp within the single-storey component of Tower A abutting the northern property line. The development will provide 101 vehicle spaces (55 for residents, 40 for visitors, and 6 retail spaces) along with 498 bicycle parking spaces. The Towers will collectively provide 1,260m² of indoor and outdoor amenity space, which exceeds the City of Toronto’s requirements.

UrbanToronto will continue to follow progress on this development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

* * *

UrbanToronto’s new data research service, UrbanToronto Pro, offers comprehensive information on construction projects in the Greater Toronto Area—from proposal right through to completion stages. In addition, our subscription newsletter, New Development Insider, drops in your mailbox daily to help you track projects through the planning process.

Source Real Estate Urban Toronto. Click here to read a full story

28 Storeys Planned on Spadina North of Wellington

Official Plan Amendment, Zoning By-law Amendment, and Site Plan Approval applications submitted to the City by Bousfields Inc.will facilitate the redevelopment of two late 19th / early 20th Century warehouse buildings at 40 through 62 Spadina Avenue and 378 Wellington Street West in Downtown Toronto. The 28-storey mixed-use condominium proposal is designed by Wallman Architects with ERA Architects handling heritage aspects. Developers Forty-Six Spadina Ave Limited and Capitol Buildings Properties Inc. are looking to sympathetically incorporate the existing 4.5-storey structure known as ‘The Systems Building’ into the site’s redevelopment, providing 38,693m² of residential, retail, and office space to the King-Spadina area.

Located on the west side of Spadina Avenue, mid-block between King Street West to the north and Wellington Street West to the south, the 3721m² plot is occupied by two warehouse buildings at 58-62 and 40-46 Spadina Avenue ranging in height from 2 to 4.5 storeys respectively. The site is served by the 510 Spadina streetcar that operates north-south, and the 504 King streetcar that runs east-west. The streetcar stop for these transit services is less than 100m from the site at the intersection of these major arterial roadways. St Andrew station on the University Line 1 subway is also 900m east of the site.

The southern portion of the site contains the 4.5-storey red brick office building constructed in phases from 1908 through 1947. Listed on the City of Toronto’s Heritage Registrar in March, 2016, it is the more notable of the two buildings. As a result, its eastern and southern façades are be retained and incorporated into the proposed development.

The smaller 2 to 3-storey office building fronting Spadina Avenue is towards the site’s northern portion. Constructed in the 1880s, this has also undergone several extensions and renovations but lacks the architectural prowess of its counterpart. A 2.8m driveway between 376 and 380 Wellington Street provides access to a surface parking lot at the rear of the plot, west of the aforementioned buildings.

In most instances, the proposal utilizes the full extent of the site boundary. Noticeable setbacks occur along Spadina Avenue, just north of the conserved heritage façade of 40-46 Spadina Avenue, where a 4.8m recess provides relief from the neighbouring 3-storey building. A second landscaped 6m setback along the western plot perimeter allows for a mid-block pedestrian connection that runs north-south from King Street West to Wellington Street.

The 99.1 metre-tall mixed-use proposal is comprised of 4 distinctive massing components. A 4-storey podium incorporates the east, south, and partial west return of the existing heritage façade of 40-46 Spadina; it will provide covered vehicular access to the north for three levels of underground parking, providing 145 vehicle and 569 bicycle parking spaces, a dedicated residential lobby inclusive of all ancillary spaces, 647m² of ground floor retail space, 5,908m² of office space ,and a majority of the 1,769m² of indoor/outdoor amenity space. The centrally aligned 24-storey tower sited atop the podium will be flanked by two mid-rise elements ranging from 9 to 14 storeys to the north and south, providing 521 dwelling units and additional outdoor amenity space for residents.

Wallman Architects’ sympathetic approach is inspired by the prevalent warehouse vernacular within the King-Spadina district. The existing heritage façade has first and foremost been enhanced by a series of colour-matched brick veneers arranged in horizontal bands that wrap the entire development. These are complemented by a series of light-coloured stone caps, pre-cast colour panels and clear Crittall-style windows with deeply inset balconies which aim to allow the proposal to integrate into the neighbourhood seamlessly.

The proposed development consists of 521 residential units comprising 26 studios (5%), 322 one-bedrooms (62%), 123 two-bedrooms (24%), and 50 three-bedrooms (10%), which meets the City of Toronto’s requirements for percentages of family-size unit types. A proposed Gross Floor Area of 38,692.8m² gives the site a density of 10.37 FSI.

UrbanToronto will continue to follow progress on this development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

* * *

UrbanToronto’s new data research service, UrbanToronto Pro, offers comprehensive information on construction projects in the Greater Toronto Area—from proposal right through to completion stages. In addition, our subscription newsletter, New Development Insider, drops in your mailbox daily to help you track projects through the planning process.

Source Real Estate Urban Toronto. Click here to read a full story