Author The Lilly Commercial Team

Sprawling Industrial Campus Coming to Brampton in Q1-2023

A sprawling, two-phase industrial condo development is coming to Brampton’s Highway 410 corridor, and given the scarcity of available space in the GTA, the site should be well coveted.

Comprising approximately 750,000 sq. ft across five buildings — including 106,000 and 317,000 in the first two buildings of phase 1 — the Heart Lake Business Park will be well situated indeed, a major selling point. The site, which is a co-development between Fiera Real Estate and Berkshire Axis, has access to Highway 410, and — should it become green lit — the controversial Highway 413 is to be located about 10 km to the north, connecting it to the 427 as well as the eastern GTA.

According to Fraser Plant, Executive Vice President at Cushman & Wakefield, which has been responsible for finding Heart Lake Business Park’s tenants, the site is one of the last greenfield developments of such scale in the regional market.

“It’s also situated in an area with a large labour force and it’s a few minutes from Caledon in the heart of Brampton,” Plant said. “Brampton has been a well-established industrial pocket for the last 15 or 20 years, and intensification along Queen Street definitely helps. This site could be used as last-mile hubs servicing a dense, urban, suburb with a large concentrated pool of residents.”

“It’s definitely one of the fastest growing areas residentially. Lots of big homebuilders have land in the area — the Matamys, Greenparks, Country Homes — and there are thousands of homes in the area,” said Frank Tullio, Sales Representative with commercial brokerage Spear Real Estate. “There will be a fantastic labour force here once it fills in, plus with the highway access you can draw upon people from Brampton, Caledon, York Region, who won’t have trouble accessing this industrial area.”

An auspicious future lies ahead, he added, given low vacancies throughout the GTA.

“North Peel is really on the rise, with a lot of development and industrial and residential pockets. It will be a very busy area within the next 10 years.”

The units are described as industrial condos and come as small as 3,000-5,000 sq. ft or as large as 40,000-60,000 sq. ft. According to Cushman & Wakefield Executive Vice President Michael Yull, firms in the e-commerce field will drive tenancy, especially in the larger units, and the company has mandates to secure long-term leases typical of the industrial space.

“Were going to do longer leases of 10-15 years, depending on the type of use going into the building.”

The first phase is slated for delivery during the first quarter of next year.

Source Storeys. Click here to read a full story

Retail Rental to Hit Pre-COVID Rates Within 2 Years

A year after COVID-19 vaccines were rolled out, Toronto’s retail vacancy should continue tightening amid increasingly propitious market conditions this year, said a report from Jones Lang LaSalle (JLL).

Developers are emphasizing essential-oriented retail properties now, as well, after retail demand plummeted in the wake of the pandemic two years ago, causing retailers to pause expansion plans. It also didn’t help that COVID-induced supply chain bottlenecks caused construction costs to escalate. Amid federal and provincial government restrictions imposing capacity limits or outright lockdowns, most recently compounded by the Omicron wave, retail absorption is consequently lagging pre-pandemic levels.

JLL nevertheless anticipates that the retail sector will rebound through the remainder of the year, now that mandates have been lifted across Canada. Asking rents in Toronto’s retail sector increased in Q1 from the fourth quarter of last year, partly as a result of fewer retail completions creating inventory pressure and there being more retailers looking to move into physical stores than move out, mirroring robust consumer demand in 2021, which retailers expect will continue through this year.

Retailers with outdoor access, and that are close to shoppers’ homes, are seeing especially strong revenues. In the last 12 months, power centres, neighbourhood centres, and general retail were retailers’ choice spaces. Moreover, shopping malls have also witnessed some stabilization in the past year, according to JLL, with vacancy bottoming out amid increased leasing activity. Retailers are also taking advantage of pandemic-induced vacancies in the sector.

High Construction Costs Limiting Movement

Construction in the Toronto market still decelerated because material costs rose significantly. In fact, Toronto was one of the metropolitan regions most affected by construction costs escalating last year — the construction price index for non-residential building increased by 15%. Materials weren’t the only expenses that increased in price: skilled labour shortages resulted in upward pressure on wages, JLL noted. Many retailers resultantly opted to stay put than incur higher fees moving into new spaces.

Retail sales in Toronto rebounded strongly in 2021, increasing by 4% over 2019. Not even Omicron could put a damper on retail revenues, either. However, Toronto trails other major Canadian markets to the extent that it was the country’s worst performer last year. Following government strictures that resulted in closing to the public, labour shortages and a sputtering supply chain are causes for concern in 2022.

According to a Bank of Canada survey, a third of Canadian firms said capacity constraints are stunting their sales targets, and now, because of the Russia-Ukraine war, exorbitant fuels costs have made transporting goods more expensive. Food sales in Ontario recovered in 2021 and that trend hasn’t dissipated this year, although they remain 16% below pre-pandemic levels, as a result of indoor dining capacity limits. Still, food services sales are expected to recover this year and peak in August.

But JLL says central provinces’ major cities, including Toronto, lag both Atlantic and western cities when it comes to retail and recreational foot traffic. Still, increased traffic on Bloor Street has put so much upward pressure on rents that they are close to 2019 levels, albeit below $300 per sq. ft. JLL postulated that landlords will achieve pre-COVID rental rates within two years.

Source Storeys. Click here to read a full story

London’s Iconic Cherryhill Village Sells For Record $571M

One of Canada’s most iconic apartment and mixed-use communities, the Cherryhill Village in London, Ont., has been sold in a record-setting $571-million transaction.

Ottawa-based Minto, KingSett Capital and a private partner sold the community, which includes 12 concrete construction apartment towers, a shopping mall and office space, to Toronto’s Park Property Management.

“Based on Altus Group sales records commencing in 1995, the sale of Cherryhill Village will be the largest reported single multiresidential asset transaction in Canada both in terms of number of suites (2,114) and dollar value,” said TD Securities managing director David Bloomstone in an exchange of emails with RENX.

Bloomstone and the TD Securities team brokered the transaction on behalf of Minto, which had owned/managed the properties for over a decade.

The purchaser, Park Property Management, is a Canadian-based entity owned by the Otto family of Germany. Founded in the 1960s by Werner Otto, who died about a decade ago, the firm is still operated by family members.

Park Property Management has about 300 employees.

Major GTA industrial transaction

This is the second major transaction involving Otto family holdings in Canada in recent days. The family’s industrial division, Sagitta Development and Management, closed on the sale of a $461-million Greater Toronto Area industrial portfolio to two KingSett Capital funds on Friday.

“That’s a big acquisition by Canadian standards (Cherryhill). It doesn’t happen very often,” said Park Properties president Gerd Wengler in an interview with RENX.

He said Sagitta is being wound down as a result of the industrial divestment and the business will now focus on Park Property’s multiresidential portfolio in Canada. He noted that it’s actually a return to the company’s roots.

“Werner Otto, the founder of the company, started buying real estate in Canada in the 1960s. First it was all residential rental buildings, but then they expanded into industrial. They developed and bought industrial buildings,” Wengler explained.

“The residential rental apartment part has grown much further and for at least 20 years we really haven’t bought any industrial.”

Park Property Management and Cherryhill Village

Park Property Management now owns 10,141 apartment units in Canada and manages a total of 11,275 rental units.

Wengler said this portfolio is attractive for several reasons, including a potential future value-add on excess land at the 40-acre property.

“It’s in pretty good shape, but since we’re long-time holders and a family business, we will make sure that everything’s in good shape and will stay that way for many decades to come,” Wengler said. “There’s also an opportunity to develop and build even more apartments, which is something we will look into in the future.”

Bloomstone said there is capacity to essentially double the amount of apartments in the community, with up to 2,050 new units in multi-phased developments.

The commercial aspects of the property are an add-on for Park Property. The shopping centre has 22 tenants and the office building is focused on health-related businesses. Together they comprise about 190,000 square feet of space.

“When we acquire apartment buildings there are sometimes small office or retail components that come with them, but they’re nothing that we’re really interested in (buying as standalone assets),” he explained.

Cherryhill Village has a history which stretches back almost 60 years.

“Cherryhill Village is a landmark, master-planned residential community which has been a part of London’s history since the 1960s,” Bloomstone noted. “It is a well-known and respected community both within London and Ontario.”

Cherryhill Village history

Derek Lobo, the CEO of SVN Rock Advisors in Burlington, said the community was built between 1965 and 1975 by European immigrants Sam Katz and Ewald Bierbaum.

His firm brokered the 2011 transaction to Minto (for $215 million, also a record for a single apartment property transaction at the time) and was an advisor to TD Securities for the latest sale.

“We initially sold the property in 2011, and it was the largest single apartment transaction in Canada at the time,” Lobo wrote in an email exchange. “It’ll likely be the largest again this year.”

Lobo believes Cherryhill Village remains the second-largest single apartment community in Canada.

“What makes Cherryhill unique (is) not just its size, but it’s a naturally occurring retirement community,” he added.

Such communities aren’t originally designed for seniors, but due to local conditions, the neighbourhood and amenities will attract these types of residents over a period of time.

The London apartment sector

Bloomstone said the timing for such a transaction in London is opportune.

“The opportunity to acquire scale in a singular transaction that has both upside in rents and densification opportunities was attractive to a wide range of investors both public and private,” Bloomstone wrote.

Long known as a city with a significant apartment market, London has plenty going for it, including a rising population and strong local economy.

Its population is expected to grow by almost 12 per cent during the next decade, which would push it to over 600,000 residents.

“Given the low vacancy rates, growth of new industries such as agri-food, digital media and technology, along with the stability of the health and education sectors, London is well-positioned to continue to support strong rental dynamics including the construction of purpose-built rentals,” Bloomstone wrote.

Source Real Estate News Exchange. Click here to read a full story

KingSett Capital Closes One of the Largest Industrial Deals Ever in the GTA

KingSett Capital has beat out some hefty competition to close one of the most significant real estate deals in the GTA in recent memory.

KingSett has acquired 21 strategically located industrial properties from Sagitta Development & Management for $461M, which is believed to be the second largest deal in the local sector’s history. Seventeen of the properties are located in Mississauga and were so coveted that KingSett was bidding against heavy hitters, including REITs and institutional funds, but unlike its competition, it was able to tap different funds to source the purchase capital.

“We can do a few things most others can’t do, if not anyone else can do, and that is having multiple funds participate in the same transaction. We can take a portfolio that’s quite disparate, buildings that are quite different from one another and don’t really share many characteristics, we can take that portfolio of disparate assets and marry them to various funds,” said Rob Kumer, President and Chief Investment Officer of KingSett Capital.

“The location is hyper-compelling. These are, for the most part, centre-ice Mississauga locations, but also the price is well below replacement cost. They’re just not building these buildings anymore. To buy land — if you can find the land, which you can’t — in these locations, you’d be paying $4-5M an acre, which, at 40% coverage, gives you a land cost per buildable square foot of $250. To buy this land and recreate what’s there would be $400-450 per sq. ft. We bought the buildings for $330 per sq. ft.”

The buildings are approximately 1.47M sq. ft and 99% leased, and while just over half of the tenants pay below-market rents, which create very tight cap rate conditions, the average lease term is below three years and will allow KingSett to capitalize on market rates fairly frequently. Industrial real estate in the GTA is arguably the hottest segment of Canada’s entire real estate market, with supply severely constricted and demand so strong that companies are advised to give themselves 18-month search buffers.

“In a land-constrained market and inflationary environment where creation costs are accelerating, that’s a pretty compelling value proposition,” Kumer said. “Part of the value proposition is buying things below replacement costs. A lot of the other buyers are focused on large bay distribution industrial, which have great operating fundamentals as well, but we’re focused on buying things below replacement cost in locations that are irreplaceable.”

That construction costs are increasing across the board is ameliorating the values of existing assets because the economics of tearing them down and building brand new, in many cases, don’t make sense Kumer added.

In the GTA, non-residential construction development charges grew by 54% between 2018 and 2021, while the permitting and approvals processes are slow and therefore expensive. A Building Industry and Land Development Association benchmarking study found that official plan amendments in Toronto take an average of 32 months, while receiving site plan approvals takes 30 months, and rezoning 25 months.

Then, there are the land costs — even in the GTA’s remote reaches like Bradford, the approximate cost of an acre has swelled to $1.5M from $600,000 a few years ago. Diana Hoang, Founder and Managing Director of Spear Realty, says a lot of industrial landlords in the GTA realize they’re bargaining from places of strength and are trying to take advantage of conditions.

“A lot of owners are taking closer looks at the value of their buildings because this is definitely a high point,” she said. “To date, groups are saying, ‘Wow, this is the time to sell,’ and we’re seeing more product come on stream. More owners are definitely exploring the possibility now.”

Source Storeys. Click here to read a full story

AY CEO Talks Office, Retail, Stay-At-Home Economy At World Forum

From the metaverse to office occupancy, bricks-and-mortar shopping to the dramatic rise in quasi-retail fulfillment centres, Avison Young chair and chief executive officer Mark Rose had a lot on his mind as he prepared for a presentation this week at the World Economic Forum in Switzerland.

Rose was among a group of international experts who spoke about the rise of the stay-at-home economy at the forum and shared some of his ideas with RENX.

Rose said office occupancy is between 30 and 50 per cent of where it was pre-pandemic, but noted that in years past when people were generally at the office five days a week, they were often only sitting at their desks 40 per cent of the time.

Today, he believes most office workers would prefer to be in the office from Tuesday to Thursday but work from home other days, which would significantly cut down on their commuting times.

However, he expects it will take another two years before there’s a firmer handle on office occupancies and the issues surrounding return-to-work. He believes there are benefits to employees interacting with their colleagues and superiors in an office environment.

“More people will come back because there’s a little bit of fear of missing out, fear of not being promoted or fear of not hearing something that might help to develop them.”

Rose thinks companies may still need as much office space as in the past, but that it will be utilized differently.

“It means the office needs to be a bit more experiential and give people a reason to be there. But today, workers have the upper hand. They’re dictating their wants,” he said.

“Now, I hope we don’t see this, but if it does change and if there are recessions and people need jobs, I think employers will probably make this part of their offers: folks are going to need to come to the office a bit more.”

Impact on retail

It’s acknowledged that fewer people going to offices has also negatively impacted surrounding retail businesses, due to lower foot traffic and a wider embrace of online shopping.

Rose said having fewer people on the streets has also led to concerns about safety and rising crime in some cities, particularly in the United States. Criminals may feel they can get away with more if there are fewer witnesses around.

“I think we’re starting to see most people in the office in Vancouver and I think they’re starting to come back in Toronto, but until we get the safety of numbers in cities, it feels a little different,” said Rose. “It feels a little more unsafe.”

Rose frequently travels as part of his job and said it has broken his heart to see homeless people lying in front of closed-up stores in places including San Francisco, Austin, Denver and New York City.

He’d like to see public-private partnerships created to deal with housing, livability, safety and security issues.

Rose said peers who declared the death of traditional retail early in the pandemic had it wrong, as people want to get out of their homes to shop and interact. Some data shows online shopping is decreasing in some markets and people are returning to malls, he said.

To illustrate this, Avison Young’s Retail Vitality Index for the week ending May 8 showed foot traffic in Canadian malls was up 102 per cent since Boxing Day in 2020.

Rose also believes that a distinction must be made between retail properties that act as showrooms and retail fulfillment centres.

“We have never seen this level of explosion of retail real estate in the history of the world,” said Rose. “It just happens to be called industrial or fulfillment.

“Distribution retailers didn’t go away. Buying got bigger, warehousing and logistics got bigger. It didn’t get smaller and retailers are behind it. It’s not just Amazon.”

Grocery-anchored retail also remains strong, according to Rose, as people want to look at and choose their produce and other items before buying it.

The role of the metaverse

Rose believes the metaverse — a virtual-reality space in which users can interact with a computer-generated environment and other users — will play a key role in the evolution of retail.

“We’re going to move from Oculus (virtual reality) glasses to holograms over the next three to 10 years,” said Rose.

“You walk into the metaverse store, take a box off the shelf where the shoes are and use the hologram to put them on your feet to see what they look like. And I can almost guarantee you that they’re going to be able to give you the sensation of what you’re trying on.”

The environment and sustainability

Rose said the United Kingdom has mandated all properties be graded to rate their environmental performance. If the building doesn’t meet certain standards, in the future the owner won’t be allowed to lease it.

He envisions similar policies being instituted in Canada, as tenants prioritize being in efficient, healthy and environmentally friendly buildings.

Some retail and office landlords have experienced hardships due to the pandemic as they were initially forced to close, or open with limitations, and rent collections were sometimes impacted.

Those who own older and less efficient buildings were often hit harder and now face significant choices.

“If you had a C-class mall in a small city that is running off of fossil fuels, you had a problem in the first place,” said Rose. “It has nothing to do with the pandemic.”

Rose said building owners who can’t afford, or aren’t interested in, upgrading or redeveloping such properties, should consider divesting to those that have the finances and ability to do it.

He also believes there should be more conversations involving governments and the private sector regarding infrastructure investment to help make buildings cleaner and more efficient.

Source Real Estate News Exchange. Click here to read a full story

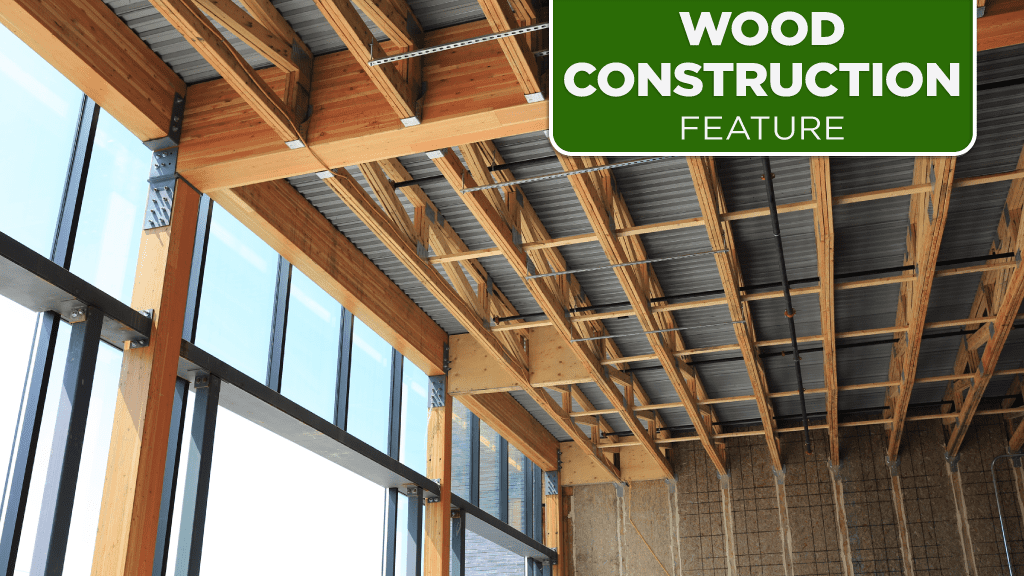

Welland, Ont. Commits To Wood Construction In Drive For Sustainability

As part of its commitment to sustainability, the City of Welland, Ont. has embraced the use of timber in a big way in the construction of two emergency services buildings not normally associated with wood.

The buildings are the Welland Fire and Emergency Services Headquarters and Fire Station # 2.

“This was the time to do it (the projects) as our existing stations were well past their time,” says Welland Mayor Frank Campion, explaining upgraded services are needed to meet the demand of a growing city.

Rising on the remediated site of an old streel plant at 400 East Main St. E., the new energy efficient fire and emergency service headquarters uses exterior structural insulated panel (SIP) walls with glulam beams and columns as the primary structural support for the four-bay apparatus bay and the administration wing, and prefabricated light wood frame trusses as the secondary support.

Being built right behind the current headquarters—which will eventually be demolished—at 636 King Street East, the new Fire Station # 2 features a steel-frame apparatus bay, but with prefabricated light frame wood trusses supported by structural insulated panels. The exterior wall cladding is metal panels.

Site remediation began in January 2021, with concurrent construction starting the following April.

The projects were designed and are being delivered under an Integrated Lean Design and Construction project system. METTKO is the project integrator and constructor and it is using, for the most part, the same team of consultants on both projects.

This includes Moses Structural Engineers, Quasar Consulting Group, the mechanical and electrical consultant, and civil engineer consultant MGM Consulting Inc.

However, there are two different architects. The headquarters building was designed by DPAI Architecture Inc., while Kearns Mancini Architects is the architect of Fire Station # 2.

“This (the two architects) was to give the city maximum creativity,” says Mettko senior consultant Mo Ettehadieh on the reasons for the two architects.

Design work started in the fall of 2019, was briefly derailed with the outbreak of the COVID epidemic in March 2020, but then got back on track, says Ettehadieh.

Under Lean Integrated Project Delivery, a collaborative approach among all the partners, there is a principle titled Design by Alternatives and that’s what drove the design process, he says.

“We were looking concurrently at a range of possible building materials and systems and ultimately wood was chosen as prime material. It was the most advantageous to the client,” says Ettehadieh, explaining that analysis also included all the buildings’ components such as the windows and mechanical systems.

About June or July of 2021, lumber prices started to dramatically escalate and that was the catalyst for a “sudden study” which validated the use of wood, he says. “Steel prices were also going up, but even more so.”

A major driver in the selection of the wood was the City of Welland objective to exceed National Building Code energy efficient standards by 40 per cent, he says.

The two projects are expressions of the city’s commitment to sustainability and revitalization, especially in the case of the fire and emergency service headquarters, as it is located in the downtown core. A major remediation of the old steel plant property was required because the plant owner had only demolished the above ground steel sections.

“There was plenty of rubble on the site and buried below the surface.”

As part of the remediation, Mettko crushed the old concrete pieces into Granular B gravel which will be used on the property. Most of the other material was also recycled and, to reduce offsite trucking costs, the impacted soil was encapsulated within a berm, which will eventually be landscaped with natural materials by Niagara College.

A similar, although much smaller remediation was conducted on Fire Station # 2 site, as it was once the location of a swimming pool which later closed and filled with rubble, says Ettehadieh.

Although fire stations are traditionally brick structures, the city selected wood as a prime material after a careful evaluation, says Fire Chief Adam Eckhart

Both buildings are scheduled for completion by this July and, once that happens, the Welland fire and emergency services department will relocate to its new location will be used to consolidate three existing fire stations.

“It will be quite an attractive building,” says the fire chief, explaining that wood in the apparatus building will be illuminated at night.

An RFP for the design and construction of, what will be Welland’s third new fire station, has been issued, says Eckhart.

Source Daily Commercial News. Click here to read a full story

‘When All Of This Is Said And Done, 80 Per Cent Of Durham Region Remains Green’ — Durham Council Approves Plan To Develop 9,300 Acres Of Farmland

After a decision by council that goes against expert advice, Durham Region will shift gears and plan to urbanize thousands more acres of farmland than what staff had recommended.

“Despite warnings from Durham Region’s own staff and advisory committees, Regional Council has endorsed a developer-recommended growth scenario to urbanize more than 9,000 acres of farmland,” Mayor Shaun Collier said in a statement following the May 25 council meeting that lasted 10 hours.

Durham Region is undergoing a municipal comprehensive review to address growth targets handed down by the provincial government: 1.3 million people and 460,000 jobs by 2051.

As part of the exercise, staff provided different land needs scenarios and recommended one to the planning and economic development committee earlier in May. However, the committee went in a different direction and at the May 25 meeting, council endorsed, in a recorded vote of 16 in favour and 11 against, Scenario 2A, which includes 9,300 acres of farmland development.

Staff had recommended Scenario 4, which includes 2,348 acres of new land for housing and 3,338 acres for employment. It also had called for a unit mix consisting of 28 per cent low-density units, 28 per cent medium density and 41 per cent high density.

Instead, the approved scenario calls for 33 per cent low-density units, 38 per cent medium density and 29 per cent high density.

The day before the May 25 meeting, commissioner of planning and economic development Brian Bridgeman sent councillors a supplemental report outlining his concerns with 2A.

These include: it overstates the land need; it detracts from the achievement of regional sustainability policies and obligations; and it de-emphasizes regional priorities to focus growth in existing communities, where services and infrastructure are either already in place or can be provided more efficiently.

Ultimately, Bridgeman recommended “that council revise committee’s recommendation to support staff’s recommendation of Community Area Alternative Scenario 4.”

Whitby Coun. Steve Yamada said he did not appreciate the late memo, and noted lands that will be expanded are within the whitebelt, which he described as a “future urban area.”

When he questioned the legality of the direction council chose to go following some comments made at the meeting, director of legal services Jason Hunt indicated Scenario 2A is not necessarily illegal, but there is concern that “it may not conform with the province’s expectations under the ‘growth plan.’”

He said Scenario 4 conforms with the growth plan and would survive any scrutiny or challenge from the province.

Pickering Mayor Dave Ryan said, “When all of this is said and done, 80 per cent of Durham Region remains green.”

He said Durham is vibrant and people want to move there, and there must be a range of housing options available from high rises to ground-level homes.

A number of residents spoke against 2A at the meeting — many asking for no urban boundary expansion — as well as local groups.

Stop Sprawl Durham made its opinion on the decision clear in a Facebook post after the decision.

“Ignored staff, community stakeholders, regional advisory committees and the #ClimateEmergencyDeclaration,” the post said. “It’s a sad day for #DurhamRegion and the #EnvisionDurham work.”

The post also lays out who voted for which scenario.

Collier shared his concerns how this new plan could impact an area of land that’s been a big topic of discussion this year.

“This short-sighted decision makes the urbanization of the Carruthers Creek headwaters not only possible, but likely,” he said. “Leapfrogging the Greenbelt to develop a community of 60,000 people in northeast Pickering greatly increases the risk of downstream flooding in Ajax. To date, developers have proposed only the minimum measures to mitigate the negative impacts.”

Source Storeys. Click here to read a full story

RE/MAX Canada Says Demand For Industrial, Multi-Unit Residential And Farmland Was Unprecedented In The First Quarter Of 2022

Stock markets might be tumbling and housing markets cooling, but this volatility is driving interest in Canadian commercial real estate as investors look for a hedge against inflation, a new report by a major broker says this morning.

RE/MAX Canada says demand for industrial, multi-unit residential and farmland was unprecedented in the first quarter of 2022. Values hit record levels and even retail and office space, devastated by the pandemic, are beginning to show signs of growth.

Eleven out of the 12 major markets studied reported extremely tight market conditions for industrial real estate in the first quarter.

So tight that realtors are recommending tenants start looking for new premises at least 18 months before their leases come up in eight of those markets — Vancouver, Edmonton, Calgary, Winnipeg, Ottawa, the Greater Toronto Area, Hamilton-Burlington-Niagara and London.

“The overall strength of the Canadian economy continues to propel massive expansion in commercial markets across the country in 2022,” said Christopher Alexander, president of RE/MAX Canada.

“What began as heightened demand for industrial space to accommodate a growing e-commerce platform during the pandemic has blossomed into a full-blown distribution and logistics network that encompasses millions of square feet in markets across the country. Recent volatility in the stock markets has also prompted a shift to greater investment in the commercial segment as investors look to real estate as a hedge against inflation.”

Larger portfolios of 10 properties or more are attracting the most interest from institutional and private investors, said RE/MAX.

Businesses are finding it challenging to expand because of land constraints and shortages, especially in Vancouver, the GTA and Regina, and this is leading to creative solutions, says the report.

In Metro Vancouver, the first multi-storey industrial/commercial space is nearing completion and has been leased to Amazon. A second such development planned for False Creek Flats has already sold out its first and second phase and a third phase is selling at $725 per square foot, said the broker.

Farmland is another hot commodity as inventories shrink and prices per acre rise. In Saskatoon, where 300 grain farms up for sale is typical at this time of year, available properties have dropped to 90.

“The soaring price of commodities has bolstered Western Canadian markets, with resource-rich provinces such as Saskatchewan, Alberta, and Manitoba experiencing unprecedented growth as industries emerge from their slumber,” said Elton Ash, executive vice-president, RE/MAX Canada.

“Saskatchewan, in particular, is reinvigorated, with the economic engine just heating up in agriculture, mining, forestry, and potash.”

Retail is on the rebound in 75% of the markets studied, said RE/MAX, a trend it expects will strengthen as society moves beyond pandemic constraints.

Interesting side note on retail: the broker has noticed a high concentration of cannabis outlets in major city centres (who hasn’t?) and expects an influx of empty stores to come on the market over the next 12 to 18 months as that industry consolidates.

RE/MAX expects commercial real estate markets in Canada to remain strong, supported by population growth and economic expansion.

Despite all the uncertainty out there these days, RBC economists expect Canada’s GDP to climb 4.3% this year, led by B.C., Saskatchewan and Alberta.

Source Financial Post. Click here to read a full story

The GTA’s Industrial Real Estate Sector, With A 0.9% Vacancy Rate, Is One Of The Tightest Markets In North America

Analysis from Avison Young notes the region’s vacancy rate has been sideways since the last quarter of 2021, but has declined rapidly over the short term, coming in at 7.1% as early as Q1-2010, signifying voracious appetite from industrial tenants. Logistics and distribution firms, in particular, have been the largest occupants of industrial spaces with at least 10,000 sq. ft — according to the report, 31% of users over the past five quarters are in the sector, followed by 20% in manufacturing, and 18% in retail and e-commerce. Unsurprisingly, investors have been especially active in the sector, 51% of which are private, while 20% are institutional, and 17% are owner-occupiers.

Industrial Rents on the Rise Due to Tight Supply

Avison Young noted that severely constricted supply relative to elevated demand caused rents to increase by 16% to $13.65 per sq. ft in Q1 from the fourth quarter of last year. That growth, while significant, is nothing compared to rents rising by 104% during the last five years alone, the report said. Rents are also offsetting high land costs.

In Q1, there were 11 new building completions, totalling 1.8M sq. ft, while 16M more across 76 buildings was under construction at the conclusion of the quarter, of which 48% is pre-leased. However, the new construction only comprises 1.8% of the GTA’s total industrial stock. There are also 145 buildings comprising 51M sq. ft of industrial space in pre-construction across the metro region, with 63% concentrated in the GTA West.

Toronto is the GTA’s Most Coveted Destination

Rents in Toronto averaged $16.46 per sq. ft last quarter, the highest in the Central GTA, while Scarborough, despite having a 0.4% vacancy rate, had the most tenant-friendly rents at $10.55 per sq. ft. On a quarterly basis, vacancy in the Central market was flat at 0.8% in Q1, however, compared to the first quarter of 2021 it declined by 80 basis points. Etobicoke’s vacancy rate was slightly higher at 1.3% last quarter.

The Central GTA’s average asking net rental rate rose to $13.02 per sq. ft in Q1, surging by 40% year-over-year, by 76% over the last three years, and by an astounding 141% over the last five years.

Although there were no new completions in the Central GTA last quarter, 15 buildings carrying 2.8M sq. ft are under construction, 39% of which is already leased. Fifty-eight percent of the Central market’s new construction is located in Etobicoke and 37% is in Scarborough, while just 5% is in North York.

GTA East Has Low Vacancy, Cheaper Rent

The eastern portion of the GTA had a vacancy rate of 0.5% in Q1, down 10 basis points from the previous quarter, as rent rose to $10.96 per sq. ft, a 48% year-over-year increase — rents have also grown by 97% in the last half decade. Avison Young’s report said the GTA East has among the region’s cheapest industrial rents.

The industrial market is growing in the GTA East, with two major companies, FGB Brands and HiTech Bay, moving in. The former, which just bought Weston Foods, will be acquiring 149 acres of a manufacturing campus and will create 1,200 new jobs, while the latter is moving to Pickering’s Innovation Corridor from Scarborough.

Availability in GTA North Tightens

The vacancy rate declined by 10 basis points to 0.6% in Q1, as the GTA North continues commanding the region’s highest industrial. At $14.24 per sq. ft, the average asking net rental rate is 4.4% above the GTA average, as it increased by 26% year over year and by 107% in the last five years. Rents range from an average of $12.89 per sq. ft in Aurora to $15.79 per sq. ft in Richmond Hill, Avison Young reported.

Three buildings with about 193,200 sq. ft were completed last quarter, while 22 more comprising 4.1M sq. ft were under construction at the beginning of Q2. Thirty more buildings, which will eventually provide nearly 10M sq. ft of additional space, were also in pre-construction. A massive 1M sq. ft logistics and distribution centre is also being built at Highway 404 and East Gwillimbury.

GTA West Vacancy Rate Fell to 1% in Q1

Availability dropped by 10 basis points from the fourth quarter of last year and by 0.60% from Q1-2021. The average asking net rent in the GTA West increased by 43% year over year to $13.85 per sq. ft — which is 105% higher than it was in Q1-2017.

There were eight building deliveries during the first quarter, which provided the market with 1.7M sq. ft of new space, including a 457,000 sq. ft distribution centre in Milton. Moreover, of 7.4M sq. ft across 31 buildings under construction last quarter, of which 3M sq. ft is in Mississauga, 47% is pre-leased.

The Avison Young report also said Bolton has become a popular destination for industrial users, prompting Oxford Properties to invest $210M in a 65-acre industrial property in Caledon.

GTA Industrial Investment Declined in Q1

Although there was still $1.6B of investment in the GTA in Q1, it declined by 30% quarter over quarter. Despite the decrease, activity was still frenetic, increasing by 10% year over year, thanks to robust leasing market fundamentals. While investor activity in the industrial sector doesn’t appear to be waning, they nevertheless began putting their money in other asset classes last quarter.

There was $538M of industrial sales in the City of Toronto last quarter, followed by Peel Region with $449M. The average cap rate for single-tenant properties was flat on a quarterly basis at 3.8%, but decreased by 0.30% from Q1-2021, while multi-tenant property cap rates, at 4%, saw no change from Q4-2021 but dropped by 30 basis points year over year.

Source Storeys. Click here to read a full story

Malls Are Increasingly Becoming Mixed-Use Spaces

Reports of a “retail apocalypse” don’t tell the whole story about what’s happening in Canadian shopping malls. The truth is more complex, with wins and losses leading to a revolution in retail.

Malls were already feeling the pressure before the pandemic. Foot traffic among Canada’s top shopping complexes was down 22 per cent in 2019 compared to 2018, according to Deloitte’s report, The Future of the Mall. Developers and owners were already aware that changes were necessary as more Canadians bought goods online. The pandemic has highlighted the urgency for change, and carefully laid-out five-year plans have turned into planning strategies for the here and now.

“The retail apocalypse is a myth, as were predictions about the death of the mall,” says Michael LeBlanc, senior retail advisor, Retail Council of Canada, and producer/host of The Voice of Retail podcast. “But there’s no question that there’s tremendous transformation happening.”

Large spaces are being divided up into smaller stores, or food destinations, or repurposed into condominiums— Michael LeBlanc, senior retail advisor, Retail Council of Canada

While e-commerce has been a catalyst for change, it hasn’t meant the end of retail stores.

Customers are using malls for curbside pickups and inspirational window shopping to get ideas about what they want to buy online. And more online retailers could be opening return centres in retail complexes to make it more convenient for customers to send back merchandise. “What we are seeing now is harmonized retail,” Mr. LeBlanc notes. “The connection between e-commerce and physical stores is a very intimate one.”

This hybrid model with a blurring of the line between online and in-store experiences is being adopted by what Mr. LeBlanc calls “digitally native vertical brands,” which had previously been living only on the web. Examples include Warby Parker, a retailer of prescription glasses and contact lenses that now has more than 160 physical stores across Canada and the United States, and Allbirds, a maker of sustainable shoes and clothing. He says some of those players are doing IPOs to raise capital so they can create brick-and-mortar retail locations.

Product tests at pop-up stores

For some retailers, having a store gives them visibility and prestige as brands seek to be where the action is with throngs of shoppers buying, browsing and dining in a trendy environment – such as Toronto’s Yorkdale Shopping Centre, one of North America’s most successful malls. It’s not uncommon for the mall’s parking lot to be jammed to the max (prompting a valet parking service) and for customers to be lined up outside of high-profile retailers such as Chanel.

Pop-up stores have become more popular in malls as retailers test out concepts before rolling them out on a large scale. In September, 2021, Zellers, which largely disappeared from the retail landscape in 2013, returned for a limited time inside a Hudson’s Bay in the GTA’s Burlington Centre.

The company hinted more pop-up shops could be opened in the future. At Square One Shopping Centre in Mississauga, a special three-day pop-up market stocked with everything needed for Ramadan shows that mall owners are willing to be more flexible about leasing and offer shorter-term rentals.

Then there’s the Swedish furniture and homewares retail giant IKEA, which has always had its own sprawling, stand-alone stores. The company recently turned a British shopping complex with a 25-per-cent vacancy rate into its new Livat concept. Located in the former King’s Mall in Hammersmith, West London, Livat (which means “lively happening” in Swedish) features a smaller-format IKEA store (about one-quarter of the size of its usual footprint) that has 1,800 items available for purchase and another 4,000 on display to be ordered in-store for delivery or bought later online. Next, IKEA has set its sights on downtown Toronto and San Francisco as it expands this concept into other markets.

Some car companies have opted to open showrooms in malls to take advantage of the foot traffic. Up until recently, Tesla had “galleries” in a number of Canadian shopping centres meant for browsing and ogling. And last year, Toyota opened a full-service dealership in the West Edmonton Mall, occupying the space left vacant by Sears.

Mixed-use properties

Necessity is the mother of reinvention in the mall world. “They were just too big,” Mr. LeBlanc says. “Very few retailers can take on that kind of physical footprint any more. Those large spaces are being divided up into smaller stores, or food destinations, or repurposed into condominiums.”

As more people adopt a hybrid work model, the live-work-play lifestyle trend is taking off as they seek easy access to shopping, services and entertainment close by. Malls are benefiting when they create living spaces for the same customers that will support retailers on the premises.

The concept of “de-malling” has been catching on: taking boxed-in retail complexes and reinventing the rules. That has meant adding green spaces, putting stores outdoors, making them pedestrian-friendly, creating mini streetscapes and generally throwing out the rule book about what constitutes a mall.

David Ian Gray, a retail consultant, strategist and principal of DIG360 Consulting Ltd., based in Vancouver, says the trend around 2010 was for retailers to be in large-scale power centres.

“Shoppers liked that they were one-stop shops, but they didn’t really enjoy the experience of these cavernous places,” he explains. “They tolerated them, but it was the accountants that caused the trend to wane. Those big-box formats required a large inventory of stock, a significant number of staff and the space was expensive to lease. There came the realization that physical retail as we knew it just wasn’t working and things had to change.”

Malls are increasingly becoming mixed-use spaces. Mr. Gray points to Brentwood Town Centre (rebranded as The Amazing Brentwood) in Burnaby, B.C., as one that has made the transition well. Once a typical cookie-cutter mall, it began a major renovation in 2014 to become a curated “master-planned neighbourhood,” with retail space, offices, a fitness centre, movie theatre, medical centre and three residential high-rise towers, plus a food court focused on local West Coast cuisine. “What we’re headed to is a very hybridized integrated world,” he says.

One thing is clear. Malls aren’t disappearing from the retail landscape any time soon. They will just look and feel different. “Shopping malls matter, but how they function and bring people in just got harder,” Mr. LeBlanc says. “It will be very interesting days ahead. Mall owners are smart, innovative people, so I’m excited to see what happens next.”

Source The Globe And Mail. Click here to read a full story