Author The Lilly Commercial Team

H&R Sells $167.8 Million of Retail and Office Real Estate in Calgary, Toronto and Kingston

Toronto-based H&R REIT has sold a quartet of office and retail properties for $167.8 million as it looks to “simplify” its portfolio and pivot to multifamily and industrial real estate.

The real estate investment trust said it had sold a Rona Home Improvement Centre at 2665 32nd St. in Calgary, an Altalink office at 2767 2nd Ave. also in Calgary, a Bell data centre at 100 Wynford Drive in Toronto and another Rona storefront at 2342 Princess St. in Kingston.

“The retail and office dispositions that closed today are moving H&R REIT closer to achieving our portfolio simplification strategy goals,” Thomas Hofstedter, executive chairman and chief executive, said in a statement.

H&R said in October 2021 that it planned to reposition itself as a multifamily and industrial REIT, creating a publicly traded spinoff called Primaris for its retail properties.

H&R said the sale price for its latest deal was based on a weighted 6.9% capitalization rate and was closed to that value as of June 30, based on International Financial Reporting Standards.

The REIT has the option to repurchase 100 Wynford for approximately $159.6 million in 2036 or earlier under certain circumstances.

“The option to repurchase 100 Wynford Drive will allow us to capture any development upside created through our continuing rezoning efforts. We are very confident in our plan, which we believe is driving growth and creating value for our unitholders,” said Hofstedter.

H&R said property sales for 2022 are now $406 million. The REIT has also entered into a binding agreement to sell two of its retail properties in America let to automotive tenants for 17.0 million U.S. dollars, or 22.3 million Canadian dollars, at a weighted average cap rate of 5.8%.

H&R’s units were trading as much as 26% below the net asset value the Bank of Montreal has placed on the REIT’s properties and 38% below International Financial Reporting Standards, according to Jenny Ma, an analyst with BMO Capital Markets.

“Management continues to make progress on its strategic repositioning plan, which should help narrow the gap to NAV,” said Ma in a report issued last month.

Source Costar Click here to read a full story

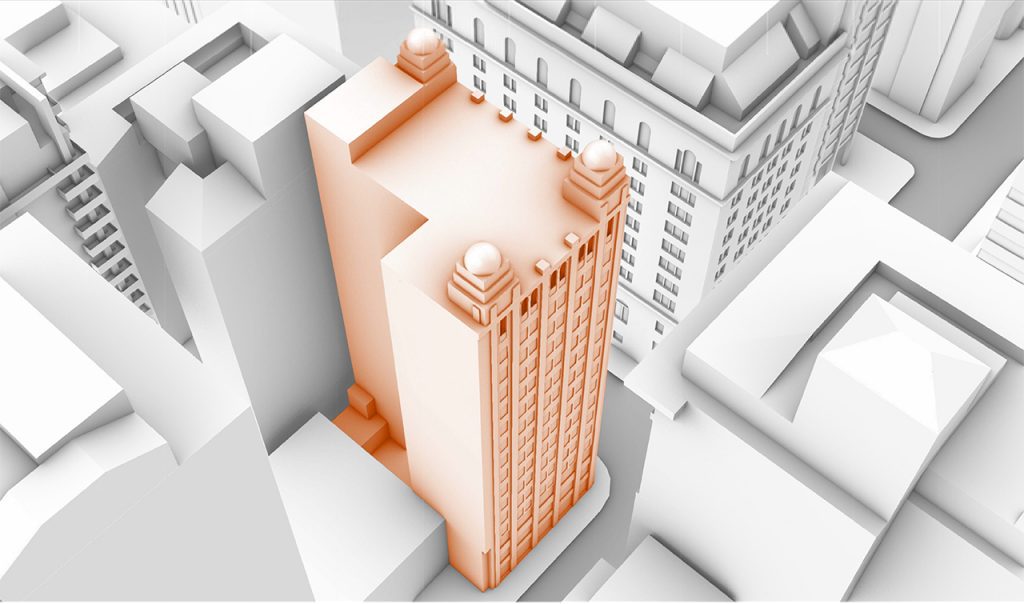

Residential Conversion, Infill Proposed for Financial Core Heritage Building

In the midst of a transitional period of the workforce towards remote work and flexible employment situations, the traditional office building has been sent spiralling into an identity crisis. While debates play out over managing the future of the office building, some savvy developers are hoping to get ahead of the curve, and guide the industry towards the repurposing and adaptive reuse of these buildings, especially older ones that are harder to retrofit for the demands of today’s businesses. In the Toronto context, this conversation has been circulating for some time, and an interesting proposal from H&R REIT for the redevelopment of the registered heritage building at 69 Yonge Street would bring such plans into practice.

The proposal hopes to convert a 15-storey Beaux Arts era office building in the Financial District into a mixed-use residential tower and, working with PARTISANS and heritage consultants ERA Architects, construct an infill addition that would increase the size of the floor-plate while adding another five storeys above the existing building. With the infill addition, the building would reach 21 storeys (including the existing 16th storey mechanical attic) with a total height of 89m, and deliver 127 new dwelling units as well as a new restaurant unit in the basement, while maintaining the existing retail space at grade.

The existing building, located at the southeast corner of Yonge and King Streets, is referred to as the Canadian Pacific Building and was built in 1913 as the headquarters for the Canadian Pacific Railway Company. While the base is built to the property line on all sides, the building takes on an inverted L-shape from the third storey upwards, resulting in an irregular floor-plate dimension for the entirety of the building’s commercial area. Additional factors like lack of parking, amenity space, and no connection to the underground PATH system, have been cited as aspects that contribute to decreasing the building’s value to commercial tenants, and support the case for redevelopment.

The proposal documents also reference the current housing crisis as an underlying force that justifies a conversion of this nature. In the eyes of the proponents, meeting the growing demand for housing is more critical than “replacing office space that no longer suits the needs of the modern tenant.” This argument is made along with reference to the planning policies surrounding development in Major Transit Station Areas (MTSAs), which this site exists firmly within, to assert that a residential conversion is not only possible, but advised based on the City’s own targets for growth.

Looking at the renderings for the proposal, it is difficult to evaluate the changes made within the heritage building when our focus is directed to the star of the show, the infill addition. While symmetry and order, pillars of the Beaux Arts style, make themselves known throughout the existing exterior, the Partisans design takes a different approach. Elongated vertical segments of curtain wall climb up the east elevation at different lengths and widths, and are topped off with arches that create a randomized display of curves and angles running up the tower. One could argue that, if any reference to the Beaux Arts style is found in the addition, it is in the grandiosity of the volume as a whole, rather than in any specific formal representations.

Inside the building, a demolition plan is outlined for all existing floors. In the 2-level basement, significant reconfiguration is required to create a commercial floorspace of nearly 4,000ft², while minimal work is required on the grade/mezzanine level retail unit. For the residential section of the building, a bike parking and amenity level occupies the second floor, and the subsequent floor-plan is relatively consistent from level 3 to 14, comprising 8 units each.

The penthouse at level 15 features the building’s only 2-storey units that enjoy a loft space on the 16th floor, while the next floor above marks the first level of the 5-storey addition. At level 17, the suites have unique access to the roof of the heritage building in the form of a private terrace. Interestingly, the three copper domes at the corners of the building, referred to as cupolas, would be repurposed into additional habitable space for the corner units.

As for the heritage work, the proposal outlines a plan for the rehabilitation and restoration of the Canadian Pacific Building on site. The majority of the work to rehabilitate the primary elevations (north and west) involves recreating the entrances on Yonge and King Streets in a style that is true to their original form. The rehabilitation also involves installing new double-glazed windows with louvres for increased thermal performance. Restoration would be focussed on repairing the original stone and masonry, and reinstating the original “Canadian Pacific Building” signage with new metal letters

UrbanToronto will continue to follow progress on this development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

Source UrbanToronto Click here to read a full story

DUO Condos Breaks Ground in Brampton

BRAMPTON, Ontario–(BUSINESS WIRE)–Capping the remarkable sales success at DUO Condos in Brampton by National Homes and Brixen Developments Inc, the construction phase of this important new two tower condominium has officially begun.

Brampton’s 2040 Vision addresses the environment, jobs, urban centres, neighbourhoods, transportation, social matters, health, arts and culture. Offering residents forward-thinking, new highrise communities that are focused on transit accessibility is a major part of that vision.

Officiated by Brampton Councillor Medeiros, the ceremony included guests from each developer. National Homes President & CEO Jason Pantalone, Managing Partners Deena Pantalone and Matthew Pantalone as well as Brixen Developments Inc. Principals Alexander D’Orazio and Andrew Iacobelli were in attendance as well as the DUO team of consultants and trades.

“DUO Condos will be a model for thoughtful communities, offering much needed housing options and amenities that cater to the evolving demographics of the city,” says Andrew Iacobelli, co-founder of Brixen Developments Inc.

The 2.6-acre transit-oriented community, situated at the corner of Steeles Avenue and Malta Ave, just west of Hurontario, will consist of two towers and over 800 units connected by an outdoor Euro-inspired piazza and courtyard. Sheridan College is close by, and the Brampton Gateway Terminal and the new Hazel McCallion LRT Station are only minutes away from DUO and slated for completion in 2024. The LRT will connect residents to Mississauga with 19 stops on the way to the Port Credit GO Station.

“Since 1992, we have had the great privilege of contributing to Brampton’s growth and evolution, including the development of over 1,850 homes in eight communities,” says Jason Pantalone, president and managing partner with National Homes. “We’re proud that with DUO, we are reaching new heights with one of the City’s first high rise condos. It’s a stunning architectural design, and a new landmark address in Brampton.”

For further information on DUO, visit duocondos.ca.

ABOUT NATIONAL HOMES

At National, we’re committed to changing the way people think about homes. We believe that the needs of the customer should be the driving force behind every home we build.

So, before we put pencil to paper, we ask questions… a lot of questions. Of our customers. Of focus groups. Of ourselves. We think about how people are actually going to live in our homes. Then we design them… from the inside out. It’s a different way of thinking. But then, we don’t measure ourselves against what other builders have always done. Because, at National, YOU ARE THE BLUEPRINT™.

ABOUT BRIXEN DEVELOPMENTS INC

Brixen Developments Inc. was formed in 2019 By Alexander D’Orazio and Andrew Iacobelli. The partnership confirmed their common values – commitment to quality, desire to build communities, and the underlying belief that people come first.

Alexander and Andrew hold over 20 years of residential development and construction knowledge. They are determined to integrate their company values into every project. Each of their developments are delivered within budget and within promised schedules without sacrificing their core values.

Source BusinessWire Click here to read a full story

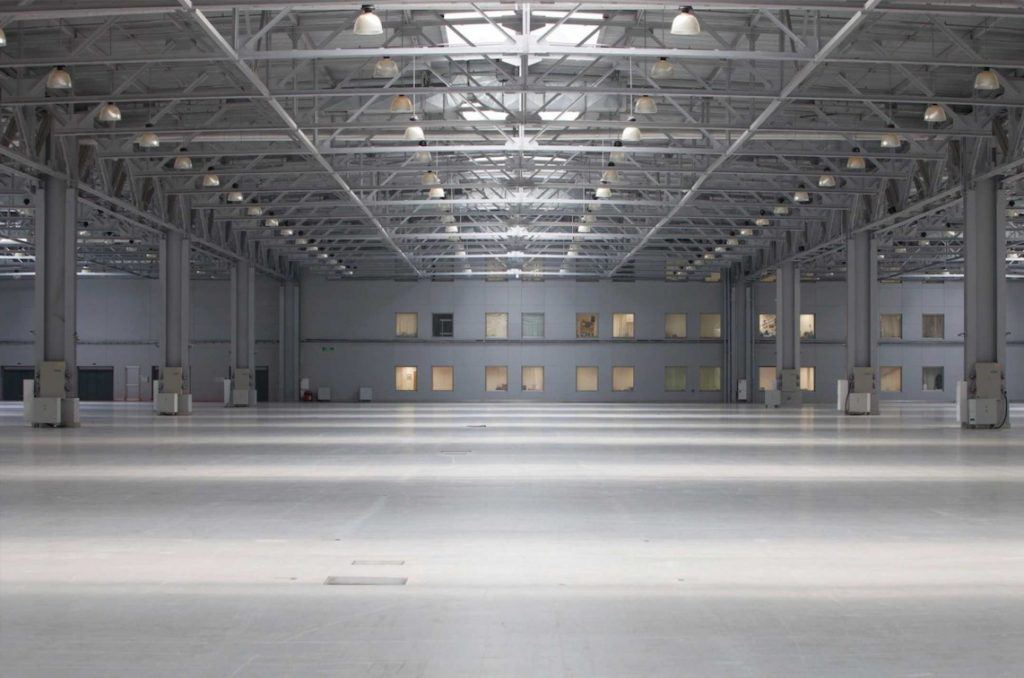

Walmart Dist. Centre to be Harden’s First Industrial Build

UPDATED WITH CEO INTERVIEW: Harden is expanding into industrial development and has a heavyweight tenant, Walmart Canada, for its initial project in the Greater Montreal city of Vaudreuil-Dorion.

The Montreal real estate investor, builder and operator will construct a 457,000-square-foot fulfillment centre at its new Le Campus Henry Ford. The development is part of Walmart’s plan to spend $1 billion on its Canadian infrastructure during the coming year.

The more-than-$100-million Walmart facility will anchor the Henry Ford industrial park, at the intersection of Harwood and Henry Ford Streets along the Hwy. 30 corridor. Harden has plans to construct up to five additional buildings at the park, for a total of almost a million square feet of mainly logistics space.

“This announcement is very important for the history of our company,” Harden co-CEO Tyler Harden told RENX in an interview. “We feel that with our retail experience we are well-positioned to get into industrial.

“That basically is due to the longstanding relationships we’ve had for a very long time in the markets. That’s why we decided to make the leap into industrial.”

Le Campus Henry Ford in Vaudreuil-Dorion

The property was acquired by Harden in 2017 and the firm has been waiting for the right moment to take it to market. It offers excellent access to Hwys. 20, 30 and 40 to serve both the Quebec and Atlantic Canada markets, as well as reaching the U.S. border region.

Site work is underway and the facility is to be turned over to Walmart in February 2024. Harden’s in-house construction division will manage the project.

“They will fixture it with their (Walmart) technology and robotics that will be housed in the premises,” Harden explained. “Our intention is to hold that for the long term.”

Plans and specifications are being finalized, Harden said, but a portion of the building will have a green roof and it will be LEED certified – though the level is yet to be determined.

The building will have about 45 per cent site coverage and offer 225 vehicle parking stalls in addition to accommodating over 100 trucks. It will offer 40-foot clear heights in the single-storey warehouse portion, while the office area will be two storeys.

Harden’s move into industrial development

In Montreal’s burgeoning light industrial sphere this is only the beginning for Harden, which has a long history in the retail and retail CRE sectors, and also has multiresidential holdings.

The firm has about two million square feet of industrial capacity in its development pipeline (including Le Campus Henry Ford) and Harden said it plans to grow the sector.

“Our vision is to continue to grow in the industrial-asset class and more specifically in logistics uses. This is a sector which we feel very strongly and bullish about,” he explained.

“It’s one where we feel it’s a natural fit to complement our current model from a retail perspective.”

The firm has long-established contacts with many retailers. And, it will also soon manage one of Walmart’s other Canadian stores.

As part of its facilities management agreement with RioCan REIT in Quebec, it will assume responsibility for La Gappe in Gatineau on Oct. 1. Walmart anchors the shopping centre.

“We feel with the industrial, we are able to help (retailers) out with their existing store networks, so it’s essentially extending our market intelligence further from not only existing store networks, future store networks, but also how that impacts their online presence and how an omni-channel presence and synergy can be created.”

Walmart’s $1-billion infrastructure plans

The investment is also significant for Walmart, being its first fulfillment centre in the province.

“This important investment is the latest example of Walmart’s commitment to Quebec,” said Cyrille Ballereau, Walmart Canada regional vice-president for Quebec, in a release.

“We are investing for growth in Quebec and creating jobs for Quebecers to better serve our customers. Quebecers will see refreshed stores, quicker service and more options available in-store and online.”

The facility will have the capacity to store a half-million items to fulfill direct-to-home and in-store pickup orders and be capable of shipping 20 million items annually.

Walmart says its $1-billion investment across Canada includes updating and remodelling a record 80 stores this year from Port Alberni, B.C., to Carbonear, N.L.

“These projects are all part of Walmart Canada’s multi-year $3.5 billion investment to make the online and in-store shopping experience simpler, faster and more convenient,” a Walmart release states.

About Harden, Walmart

Established in 1985, Harden is a second-generation family-owned real estate company whose primary objective is to own and operate commercial, residential and industrial properties in communities throughout the provinces of Québec and Ontario.

Its vertical integration allows it to specialize in all facets of the real estate development process, including development, construction, leasing and property management.

Walmart Canada operates a chain of more than 400 stores serving 1.5 million customers each day. Walmart Canada’s flagship online store, Walmart.ca, is visited by more than 1.5 million customers daily.

With more than 100,000 associates, Walmart Canada is one of Canada’s largest employers and is ranked one of the country’s top 10 most influential brands.

Source Real Estate News EXchange. Click here to read a full story

Podcast: Investing in Commercial and Industrial Real Estate

Steffany Boldrini, principal at Monte Carlo Real Estate Investments, joins host Chad Griffiths to explore a variety of investment topics including some niche sectors.

Among the topics they discuss are a market overview and outlook, investing in car washes and self-storage, and tips and strategies for investing.

This interview was conducted live, so comments and questions from viewers will be visible in the chat window.

Boldrini began her commercial real estate investing career in her spare time by taking on a mentorship program with an experienced retail investor who gave her an extremely valuable early education in the world of commercial real estate.

Through this mentorship she began to make offers on both retail and office properties and began her journey as a full-fledged real estate investor.

Through her exposure to multiple real estate asset classes via her mentor, and due to the volatility and “bubble-like” state of some major markets, Boldrini began to explore other asset classes in which she could invest.

She discovered the self-storage asset class while listening to a podcast and decided to take a closer look.

During her initial investigation, Boldrini found this asset class suited her desire for long-term passive income without high levels of maintenance or management, offering more personal and financial freedom.

Even more importantly, she believes self-storage is an asset class which is, for all intents and purposes, “recession-resistant.”

Boldrini hosts the Commercial Real Estate Investing from A-Z podcast. The show focuses on investing in retail, office, industrial and self-storage properties.

Source Real Estate News EXchange. Click here to read a full story

Dream Industrial: 10 Years of Growth, More to Come

Dream Industrial REITchief executive officer Brian Pauls and members of his team rang the bell to open the Toronto Stock Exchange on Sept. 26 and mark the trust’s 10-year anniversary.

Pauls, who assumed his role on Jan. 1, 2018 after leaving a senior executive role with Denver-based real estate firm PaulsCorp, recently spoke with RENX about Dream Industrial’s growth through its first decade as well as its strategies and outlook.

Pauls said Dream Industrial had a market cap of about $800 million and close to $1.5 billion in assets when he joined. Those figures are now approximately $2.82 billion and $7 billion, respectively.

“We’ve got a great team that can identify opportunities in value and a team that can unlock that value,” said Pauls, who noted that has also garnered great investor support.

“We’ve grown our funds from operations, we’ve grown our total portfolio size and we’ve enhanced our yields just through creating value for the properties we have, as well as identifying new opportunities that have been created for the REIT.”

Dream Industrial’s evolution and growth

Dream Industrial has added density to existing properties and undertaken greenfield development in Canada, the U.S. and Europe.

As of June 30, it owned, managed and operated 257 industrial assets comprising approximately 46 million square feet of gross leasable area. In-place and committed occupancy was 99.1 per cent on that same date.

Sixty-two per cent of Dream Industrial’s portfolio is in Canada, largely in Greater Toronto, Greater Montreal and Calgary.

However, it elected to expand into the U.S. almost five years ago to create scale and access more markets and liquidity — which couldn’t have been achieved by remaining solely in the Canadian market.

The American strategy is to pursue long-term growth alongside institutional partners through a retained 25.35 per cent interest in a private open-ended U.S. industrial fund.

A subsidiary of the trust provides property management, construction management and leasing services to the fund at market rates.

“We’d like to see that fund grow and our participation in that continue to grow,” said Pauls.

Dream Industrial’s European expansion was enabled by Blackstone’s late 2019 acquisition of all the subsidiaries and assets of Dream Global REIT for $6.2 billion.

Much of the Dream Global team moved to Dream Industrial and hit the ground running with a pipeline of deals and opportunities that were previously exclusive to the Dream Global platform.

The European portfolio is primarily located in the Netherlands, Germany and France.

Diversification is valued

The move also enabled Dream Industrial to access European-denominated debt, which was quite a bit cheaper than North American debt, and to diversify its risk.

“Now we’ve got a risk profile that spreads across many tenants, many geographies and even different product types,” said Pauls.

“We have urban logistics, which would be considered last-mile properties. We’ve got large distribution facilities and then we’ve got light industrial and light manufacturing, where there’s a lot of tenant investment in those properties.”

Canadian urban logistics properties are the hottest asset class in the portfolio at the moment, according to Pauls, as that is where Dream Industrial sees the highest rent growth, replacement cost and barriers to entry. Such properties in the Greater Toronto Area (GTA) are where it has the highest opportunities for mark-to-market rents.

Development remains important

Dream Industrial prefers to allocate five per cent of its balance sheet to development, which gives it an opportunity to increase yields and create product it otherwise may not have been able to buy.

Pauls said development yields are in the six per cent range, while yields on intensifying properties the trust already owns are in the high single digits. Both numbers are higher than for buying income-producing properties.

Dream Industrial’s net debt-to-asset ratio is under 30 per cent, but Pauls said it would be happy if that number was in the mid-to-high-30s.

Dream Industrial identifies opportunities to recycle assets within its portfolio and reinvest the proceeds into higher-quality properties that are less management- and capital-intensive.

Unit prices are undervalued

There’s a significant disconnect between the valuations of private and publicly owned real estate companies at the moment, as Pauls said the public markets tend to move on momentum and create a herd mentality.

Dream Industrial’s stock price closed at $11.02 on Oct. 5, not too far off its 52-week low of $10.34 and well below the 52-week high of $17.60.

Pauls sees buying Dream Industrial units as a great opportunity to acquire ownership in quality real estate at below replacement cost and net asset value.

“I feel passionate that we’re undervalued,” said Pauls. “What we’re trying to do is run the company well, deliver good results, create value every day and do the best we can from an operations and management standpoint.”

Unlike some other REITs, Dream Industrial hasn’t bought back any of its own units because it’s using capital for development and intensification.

During the second quarter, construction began on a 154,000-square-foot ground-up development in Caledon in the GTA and a 120,000-square-foot expansion in Montreal.

Dream Industrial is under construction on more than 680,000 square feet of projects across Canada and Europe and is in the final stages of advancing the construction of 800,000 square feet of projects in the near term.

The trust’s development and expansion pipeline totals approximately 3.4 million square feet in land-constrained markets in Canada and Europe.

Positive outlook for the future

Pauls believes real estate is a good place to invest in the current economic environment and that industrial is by far the best asset class due to its stability, the long-term nature of its contracts, the underlying health of its tenants and the strength of its demand.

Pauls expects replacement costs and barriers to entry to continue to rise due to increasing demand for industrial space along with land constraints, rising material costs and labour shortages.

“I think it’s hard to say what’s going to happen with inflation, interest rates and the geopolitical factors that influence economies, but we’re very happy with the asset class that we’re in,” said Pauls.

“We think being in real property is a bit of a hedge against inflationary pressures. We’re happy with where we’re at.”

Source Real Estate News EXchange. Click here to read a full story

Summit Industrial Buys Second Dev. Site in Kitchener Business Park

Summit Industrial Income REIT is continuing to grow its development pipeline in the area surrounding Toronto. The trust and an unnamed partner will acquire a second plot of industrial land in the Grand River West Business Park in Kitchener.

Summit (SMU-UN-T) and its partner have waived conditions on the 26.5-acre development site and will acquire a 50 per cent interest in the project in an all-cash transaction. They will pay $12.9 million for their stake in the site.

“We are pleased to be adding this site to our existing pipeline of development projects in this region, one of Canada’s strongest industrial markets,” said Summit Industrial REIT chief operating officer Dayna Gibbs in the announcement.

“Not only is this one of Canada’s tightest industrial markets, but we continue to build on our economies of scale in this area while adding to our portfolio of LEED-certified buildings upon completion.”

Summit expects to close on the deal by the end of October.

Three Grand River West Business Park properties

In February, Summit acquired a similar 50 per cent interest in an adjacent 19.5-acre site at the Grand River West Business Park.

Summit intends to acquire the other 50 per cent interest in this property once the development is complete and stabilized.

It also owns another property in the area, giving the trust additional economies of scale.

Grand River West is located in an established business park close to a regional airport, major highway and railway transportation links and a planned GO commuter rail service station.

The 26.5-property is expected to accommodate two buildings totalling approximately 480,000 square feet of class-A space with street exposure, multiple access points, circulation and trailer parking.

Current plans include a 400,000-square-foot building with 40-foot clear ceiling height. Summit intends to have both buildings designated as LEED-certified in keeping with its environmental sustainability mandate.

The 19.5-acre site is expected to accommodate one 360,000-square-foot building with a proposed 40-foot ceiling height, including three road access points and a large area for truck and trailer parking.

Summit will also seek LEED certification for this development.

“The Kitchener, Waterloo, Cambridge market, including Guelph where we own interests in other ongoing development projects, is currently Canada’s tightest industrial market with only a 0.6% availability rate,” Gibbs said in February when the first acquisition was announced.

“The strong demand for industrial space in and around the Greater Toronto Area is driving increased rental rates and strong stable occupancies in this region, making it an attractive development market for the REIT.”

About Summit Industrial REIT

Summit Industrial Income REIT is an unincorporated open-end trust focused on growing and managing a portfolio of light industrial properties across Canada.

Source Real Estate News EXchange. Click here to read a full story

Relief for Commercial Tenants in the Age of COVID-19: Courts Once Again Side With Landlords

In yet another chapter in the pandemic-fueled commercial tenancy battles, Ontario’s highest court has set out the limits on relief from forfeiture of a commercial lease. This time, a major anchor tenant in a shopping mall asked for help after getting pummeled by COVID-19. The courts again sided with the landlord.

The case

In Hudson’s Bay Company ULC Compagnie de la Baie D’Hudson SRI v. Oxford Properties Retail Holdings II Inc., the Ontario Court of Appeal made an important ruling on the rights of a commercial tenant when a lease is terminated. Specifically, the court ruled on a tenant’s rights under section 20 of the Commercial Tenancies Act, which states that when a landlord terminates a lease and takes over the premises, the tenant can apply to the court for “relief from forfeiture” to gain re-entry.

In that case, the tenant, Hudson’s Bay Company (“HBC”) sought relief from the court following a protracted battle with its landlord during the pandemic.

HBC was the main anchor tenant at Hillcrest Mall in Richmond Hill, Ontario. Like many other shopping mall tenants, HBC’s business was greatly affected by COVID-19.

In April 2020, it stopped paying rent and tried to negotiate a deal with Oxford Properties (“Oxford”), the landlord and owner of the shopping mall. The negotiations broke down and in September 2020, HBC accused Oxford of failing to take necessary health and safety measures at the mall which were necessitated by the pandemic.

As a result, in September 2020, HBC accused Oxford of breaching its obligations under the lease by failing to operate the mall in accordance with “first-class shopping centre standards”. In response, Oxford served HBC with a notice of intention to forfeit its lease, due to the fact that HBC was in arrears of seven months’ rent, which totaled over $13 million.

HBC then commenced a court action against Oxford, seeking an order confirming that Oxford acted in breach of the lease and that it was not required to pay rent until the breach was remedied. Oxford, in turn, sought a court order for unpaid rent and a declaration that it did not breach the lease.

The Ontario Superior Court of Justice decision

The Ontario Superior Court of Justice decided the matter and held that Oxford did not breach the lease. Even if it did not comply with government-imposed standards from COVID-19, this alone did not amount to a breach of the terms of the lease. However, HBC was granted relief from forfeiture of its lease on the condition that it paid all arrears of rent. The court gave HBC several months to pay its rent arrears on a deferred payment schedule. Also, the interest rate payable on the rent arrears was reduced from the amount of prime plus 4 per cent, as specified in the lease to prime plus 2 per cent, even though HBC didn’t ask for this.

HBC and Oxford both appealed the decision. Neither side took issue with the court granting relief from forfeiture, but they both argued that the motion judge did not go far enough in making the order. HBC argued that its rent owing should have been abated indefinitely until the economic consequences of the pandemic subsided.

Oxford, on the other hand, argued that HBC was fully able to pay the arrears, and the judge should therefore have ordered it to pay within 10 days, rather than on a deferred schedule.

The Court of Appeal for Ontario decision

The Court of Appeal sided with Oxford. It was noted that relief from forfeiture under section 20 of the Commercial Tenancies Act, does not give the courts discretion to alter the terms of a lease. This holds true even in unforeseen situations like a pandemic, where circumstances are unfair to the parties. The court stated that if HBC’s position were to be accepted, it would compromise the certainty that exists in commercial leases and “would inevitably encourage litigation as a means of redefining a tenant’s obligations under a lease in response to unforeseen changed economic circumstances.”

It was therefore held that the motion judge was wrong to allow HBC to pay its rent arrears on a deferred schedule. Not only did the terms of the lease not allow this, but the remedy of relief from forfeiture provides that a tenant must rectify its lease default in a reasonable amount of time, otherwise it should not be granted.

In this case, given that HBC was fully able to pay the arrears, there was no need to allow it to pay on a deferred basis. The circumstances created by COVID-19 may have made in unfair to HBC, but the court held that a deferred payment schedule should only have been granted if HBC needed for time to pay arrears, which was not the case.

The Court of Appeal also disagreed with the motion judge reducing the interest rate payable by HBC on its outstanding arrears. It was held that there was no basis to change the terms of the lease in this regard, as reducing the interest rate was really no different from changing the amount of rent payable under the lease.

Commercial tenants the legal losers in the wake of COVID-19

The key takeaway from this decision is that commercial tenants will be granted relief from forfeiture when it is fair to do so. However, the remedy is limited insofar as it does not give courts free reign to rewrite the terms of a commercial lease.

This case may also be the final word in the tumultuous saga of commercial tenancies in the age of COVID-19. The pandemic has wreaked havoc on commercial tenants and the courts have been merciless in refusing to grant them any recourse, even though the difficulties they faced were from circumstances outside of their control.

Please note that I have moved my practice to the litigation group at the Toronto office of Dickinson Wright LLP.

Source Real Estate News EXchange. Click here to read a full story

Slate Office Sells Two-Tower Toronto Office Building for $97M

Slate Office REIT has sold a two-tower office property at 95-105 Moatfield Dr. in Toronto for $97 million to an undisclosed purchaser.

The two towers combined have 405,407 square feet of office space with three levels of underground parking. The property is located close to the York Mills exit on the Don Valley Parkway and the busy east- west highway 401 corridor.

The building at 95 Moatfield is fully leased to Kraft Canada Inc. and 88 per cent of 105 Moatfield is leased to Thales Rail Signaling Solutions.

The sale price works out to approximately $239 per square foot, at a 6.4 per cent in-place capitalization rate according to a release on the sale.

The sale represents a five per cent increase to the REIT’s June 30, 2022 IFRS value.

Funds from the sale will go toward immediately reducing the REIT’s (SOT-UN-T) indebtedness and and will enable it to use capital for accretive opportunities.

“The strategic disposition of the property at 95-105 Moatfield Drive is a testament to our team’s ability to unlock value for the REIT’s unitholders in all market conditions,” CEO Steve Hodgson said in a statement on the sale.

“The sale price at a significant premium to purchase price further validates the REIT’s net asset value and the upside potential of the REIT’s stock and unlocks equity capital for the REIT to redeploy into more modern, high-quality assets with stable cash flow.”

The REIT originally acquired the properties as part of a portfolio of seven from Cominar REIT in March 2018 for $191.4 million.

The REIT’s 2022 transactions

In February, the REIT acquired Yew Grove REIT plc in Ireland for $254.8 million — which included its portfolio of 23 properties concentrated in technology, life sciences and other essential industries.

Yew Grove is dual-listed on Euronext Dublin and the AIM market of the London Stock Exchange.

In January, it was first announced that Yew Grove CFO Charles Peach would become the new CFO of Slate Office REIT, replacing Michael Sheehan. Peach first joined Yew Grove as a director in April 2018.

Slate Office REIT owns and operates a portfolio of workplace real estate assets in North America and Europe with offices in Toronto, Chicago and Dublin.

While it owns 54 assets globally, a majority of its portfolio is comprised of government or high-quality credit tenants.

Source Real Estate News EXchange. Click here to read a full story

Transforming Office Buildings to Livable Spaces

The pandemic has been a key driver for reimagining our relationship with the built environment and is presenting new opportunities across portfolios and sectors.

With a surplus of office space resulting from evolving workplace strategies, owners in conjunction with teams of developers, city planners, architects and engineers are actively managing a variety of complex conversions of these commercial building types into viable living spaces.

But not all office buildings are candidates for conversion. A feasibility study is required to assess the economic, aesthetic, environmental, structural, engineering and market viability for a successful conversion. Consideration must also be given to livable residential uses that range from apartment rentals and condos to attainable housing and hotels.

In this Insight Article, we provide our perspective on key drivers and considerations that are shaping the transformation of commercial office buildings into livable spaces based on our experience leading multiple projects in Canada, the US and the UK.

1. Economic viability

The staying power of hybrid and remote work is presenting a real challenge for commercial office owners and developers. While the world learns how to manage post-pandemic, the reality remains that a percentage of existing office buildings may find economic renewal in converting to livable or mixed-use spaces.

Eroding tax bases due to vacant office buildings can be a lightning rod for adaptive reuse in downtown cores. City planners and local municipalities often greenlight office conversions far faster than new builds to secure a stable tax base. Tax incentives for market-rate and attainable housing also contribute to the benefits of repurposing commercial space and offer developers more avenues to realize economic viability.

These measures help municipalities realize their ultimate goals of returning residents to the city’s most vibrant places. Activating dormant commercial neighbourhoods and reigniting downtown cores only happens with more densification. Existing office buildings are often near transit hubs and retail centres, making them an attractive option for livable use. Location is key and walkability is high on the list to command desirable units for future tenants.

While each region and municipality has planning approvals and guidelines for such conversions, Canadian cities such as Calgary launched the Downtown Calgary Development Incentive Program and recently announced the first round of funding for three adaptive reuse projects to drive economic recovery in the core.

2. Environmental and carbon considerations

Converting existing office space to residential-type units often requires adapting existing plumbing, electrical, mechanical and building systems – and in some cases, an entirely new building envelope. Not only do these enhancements improve the energy performance of the existing building, but they help to lower the operational carbon over time, therefore reducing the carbon footprint of the building.

The carbon-reduction effect on the environment by repurposing rather than demolishing or rebuilding cannot be overstated. As architects and engineers, we have a great responsibility for a sustainable future. With aligned interests, a carbon emission analysis at the start of a project informs decisions to reduce both embodied and operational carbon. As energy costs increase in response to climate change the repurposing of existing structures begins to make greater economic sense.

3. Location, characteristics and structural integrity

The location of the target building will have a dramatic effect on its suitability for conversion. The neighbouring infrastructure is critical to the initial selection of a suitable conversion.

Many office buildings are simply not suited for residential adaptation. Large commercial office floor plates (10,000 SF2 / 1000 SM2 or greater) result in lightless cores, outdated electrical, plumbing and HVAC systems – all contributing to a costly and exhaustive undertaking. These buildings may be suitable for other adaptive uses with more open floor plan characteristics. However, if development proformas pencil-out, creative solutions are available for most repositioning challenges. Often, smaller and older buildings offer more manageable space for conversions and come equipped with features like higher ceilings and larger windows that are highly desirable for residential use. Hotels are arguably even more appropriate for conversion to senior residences or attainable housing models.

Historically significant buildings may also be able to take advantage of preservation funding which will assist the economics of the conversion and add to the urban fabric of older neighbourhoods.

Preparation and pre-analysis of the existing structure are imperative. Once the basics are understood it is a matter of building flexibility into the design layout, ensuring minimal shifts to the core to avoid compromising the structural integrity. Post tension structures can be particularly challenging as are several other systems including clay tile slabs and other older structures. An integrated design approach with a deep knowledge of the systems and understanding of the market conditions of residential planning metrics is paramount to a repositioning success.

Modern technologies like laser scanning and 3D point-cloud modelling mean a faster, less intrusive way to work with existing structures. As we continue to find new ways to repurpose buildings for multiple sectors, the lessons learned are transferable from each conversion project.

4. Market trends and social impact

Residential design excellence provides personalization and pride of place, and the flexibility for different living patterns and household demographics. Premium amenity spaces must be designed to be integrated using open areas with direct connections to circulation spaces (stairs, elevators, entrance lobbies, mailrooms, etc.). Fortunately, many older office buildings have amenity spaces that can easily be converted for residential users and may be conveniently located to other neighbourhood amenities. This is very much about supporting and fortifying the idea of a 20-minute neighbourhood as urban cores continue to repopulate creating livable, walkable, sustainable neighbourhoods.

It is incumbent of any conversion project to respect the adjacent neighbours, yet firmly establish itself with the ideals of its new identity, knitting itself into the existing architectural characters of the streetscape and surrounding fabric. Fostering diversity and inclusion of tenants and space types will support thriving micro-communities and evoke an excitement that will draw people in. Developments have not been without their controversy when space standards, amenities and quality of space are not properly considered. When approached responsibly, conversations can provide an answer to what to do with unoccupied buildings, how to reduce the use of embodied carbon and help provide a solution to the shortage of quality housing within our urban centres.

The conversion of commercial buildings can be viewed as filling the gap, or could be a trend that advances livable communities, but it is a reminder that flexibility is needed to respond to our evolving world. As long as the need for housing abounds, we all have accountability to investigate existing opportunities.

Source Real Estate News EXchange. Click here to read a full story