Author The Lilly Commercial Team

HAVEN, Windsor break ground at Aurora Mills biz park

HAVEN Developments and Windsor Private Capital have broken ground on Aurora Mills Business Park, which will offer more than 392,000 square feet of industrial condominium units for sale over seven buildings.

Aurora Mills Business Park is on 25 acres at the northeast corner of St John’s Sideroad and Leslie Street in Aurora, Ont., just north of Toronto. Its buildings offer 25-foot clear heights, 12-foot-by-10-foot drive-in doors, and modern, high-quality construction and design with environmental and sustainability features.

The first phase is underway, with a 90,000-square-foot building divided into 25 units. Unit sizes start at 3,582 square feet but can be combined to accommodate larger-buyer requirements.

“The project was always earmarked for retail and commercial,” HAVEN chief executive officer Paolo Abate told RENX. “With the advent of the pandemic, we shrunk some of the retail to maximize the amount of industrial.

“We decided on an industrial condo for exit purposes because the market was ripe and certainly getting better with what’s happening in the market in terms of higher sales prices. And we also know that individuals want to own their space.”

Aurora Mills Business Park details

While Aurora Mills Business Park was originally intended to have 95 units, the combination of multiple units will result in the final number being lower.

They should appeal to small- and medium-sized business owners and entrepreneurs — particularly in the trades, construction and manufacturing sectors — who want more cost certainty as rental rates for Greater Toronto Area (GTA) industrial real estate continue to rapidly escalate.

“We’ve designed them in such a way that they could be used for more commercial purposes,” said Abate. “There’s no reason why a lawyer with a sizeable staff wouldn’t want to locate there and work.”

There are 17 grocery stores and retail outlets, 92 restaurants and 21 banks within a five-kilometre radius of the site.

An off-ramp from nearby Highway 404 that would connect to St. John’s Sideroad is expected to be built at some point in the future, which would make access more convenient.

Site needed to be rezoned

The 50-acre site was acquired almost 10 years ago from a family that lived on it for $8.5 million. It was considered agricultural land until HAVEN had it rezoned.

“Our bench strength at HAVEN is taking projects through the planning process,” said Abate.

“So we revel at the opportunity to take this piece of land from agricultural to commercial/industrial to comply with the official and secondary plans of the area for what’s known as the Aurora 2C lands, which is basically everything east of Leslie.”

The northern part of the site is environmentally protected and has been given to local governments to oversee. Trails will be created on the land to connect to neighbouring trails in the area.

Cushman & Wakefield’s Mike Brown and Pete McGoey are marketing the property and the first phase of units is 80 per cent sold. A broker launch event will be held at Market Brewing Company in Newmarket from 2 to 5 p.m. on June 23.

The first block of units is expected to be delivered in late 2023.

HAVEN’s acquisition and development strategies

Toronto-based HAVEN selects GTA locations based on access to public transit and infrastructure.

It seeks properties that it can take through the zoning process to add value and prefers sites where it can develop at least 185,000 square feet of gross floor area for mid- or high-rise multiresidential projects.

HAVEN manages its developments from start to finish and invests along with its partners.

“We find it advantageous to mitigate risk as much as possible, not just from a financial perspective but from a development perspective as well,” Abate said of partnerships.

Toronto-based Windsor Private Capital launched in 1992 and provides structured credit, bridge financing and equity solutions to emerging and middle-market companies, entrepreneurs and high-net-worth individuals.

It has experience in real estate, financial services, technology, telecommunications, manufacturing and retail.

HAVEN and Windsor Private Capital started working together midway through the last decade and the relationship has evolved as they have partnered on a few projects, including Aurora Mills Business Park.

“I would call them a financial partner that does have development expertise and is there to be a great sounding board,” said Abate. “They have some decision-making ability along with us, but HAVEN is leading the development.

“Part of the reason that they have been such a great partner for us is they’re not just capital, they’re sophisticated capital with purpose and expertise.”

Other HAVEN developments

HAVEN has partnered with Canderel on an 11-storey, boutique luxury residential condo with retail on the ground level that recently started construction at 625 Sheppard Ave. E.

HAVEN recently completed two townhome developments, 4Hundred East Mall in Etobicoke and The Clarkson Urban Towns in Mississauga.

The 11-person company is also looking to develop a three-storey, 18,000-square-foot boutique luxury condo on two lots at 101 Heath St. W. in Toronto’s upscale Deer Park neighbourhood. Objections from neighbours have extended the approvals process, however.

“We believe that we’re not proposing anything audacious,” said Abate. “It’s no higher than the neighbouring house and there’s a condo building of three storeys right next door.”

HAVEN owns land around Weston and Black Creek Roads and the Mount Dennis area of Toronto. It acquired a property in Mount Dennis seven years ago and has since assembled more, with plans to build either a purpose-built rental apartment or condo on a site of more than four acres.

HAVEN is looking for more opportunities in Mount Dennis — where a new public transit hub will service the Eglinton Crosstown light rail transit line, Toronto Transit Commission buses, Union Pearson Express trains and GO Transit’s Kitchener line — as well as around Bayview Avenue and Sheppard Avenue East.

While Aurora Mills Business Park shows that HAVEN remains interested in non-residential developments, it has cooled on retail for the moment.

“I think there’s still some pain in that market,” said Abate. “I think it would be difficult for someone going out and trying to fill a 100,000-square-foot retail site in Aurora or anywhere in the GTA right now.”

Source Real Estate News EXchange. Click here to read a full story

Montez Buys Waterloo’s Factory Square Complex for $122.8M

Montez Corporation has acquired the 526,235-square-foot Factory Square office complex in Waterloo, Ont. for $122.8 million as part of its strategy to focus on technology hubs.

CanFirst Capital Management, on behalf of CanFirst Industrial Realty Fund V and CanFirst Industrial Realty Fund VI, sold the buildings at 440, 451 and 455 Phillip St.

The total site size is 34 acres and forms part of Waterloo’s Idea Quarter, a still-evolving district which is planned to offer 3.2 million square feet of space employing 16,500 tech workers and 20,000 co-op students.

Factory Square is 92 per cent occupied and Montez president and chief executive officer Manfred Lau told RENX his company has already signed a lease deal with a new tenant since acquiring the complex in mid-May.

Lau said current Factory Square tenants are involved with server warehousing, advanced lab and manufacturing processes, research and development, artificial intelligence, and managed detection and response, among other tech-related sectors.

Factory Square in major tech hub

There’s a light rail transit line stop adjacent to Factory Square, which is also close to the University of Waterloo, David Johnston Research + Technology Park, Wilfrid Laurier University and Highway 85.

“We really like this asset and it highlights our various investment themes,” said Lau. “The proximity to the University of Waterloo and Wilfrid Laurier University provides the opportunity for activation of the common space, talent recruitment and the continuation in support of various co-op programs.

“This is a really dynamic ecosystem that includes over 150 research centres, accelerators and incubators, with a growing commercialization of its technology, innovation and entrepreneurialism.”

Lau believes Factory Square, Idea Quarter and the surrounding area are becoming an increasingly important part of the economy locally, provincially and nationally.

Montez marks 20th anniversary

Montez is an integrated multi-asset real estate investment firm, developer and asset manager that invests in office, industrial, retail, multiresidential, hotel and mixed-use assets across Canada on behalf of institutional investors.

The Toronto-based company also invests alongside its clients.

This is Montez’s 20th year in business and it has more than 25 million square feet of assets under management across various funds and segregated accounts, valued at just over $7 billion. This includes about 10 million square feet of active development assets.

“Most of our developments and most of our investments try to latch on to some form of what we call infrastructure — such as a university, a major transit investment, a hospital and those types of things — because we see spinoff activity off of that,” said Lau.

Land holdings, development pipeline

Montez has an active development pipeline in various asset classes across multiple projects. It also owns urban land for future multiresidential developments and suburban land for future industrial developments. Some sites are going through the entitlement process.

Lau said Montez has annually averaged around $500 million to $600 million in combined acquisitions and dispositions over the past 10 years.

With Montez’s interest in tech-related spaces, it’s no surprise Toronto, Vancouver, Montreal, Ottawa and Waterloo are among its key markets.

As with many commercial real estate companies, Lau said Montez has become more active with industrial and multiresidential assets in the past couple of years.

Montez also has a small but growing interest in alternative real estate assets, including film studios and cold-storage facilities.

Source Real Estate News EXchange. Click here to read a full story

Nation’s Biggest Pension Fund Records a 10.2% Annual Gain on Real Estate

Canada’s largest pension plan said its real estate holdings climbed to $49 billion at the end of its fiscal year, 9% of the total $539 billion held by the Canada Pension Plan Investment Board.

The pension fund said the one-year return for real estate for the period ended March 31 was 10.2%, up from a 4.5% negative return a year earlier. The overall fund returned 6.8% in the fiscal year.

“Real estate investments had modest value-add contributions as they suffered from the impact of the pandemic lockdown measures on the retail and office sectors in fiscal 2022 and 2021,” the pension fund said in its annual report.

Overall, CPPIB saw a $42 billion increase in net assets made up of $34 billion in net income and $8 billion in net transfers from the Canada Pension Plan.

The five-year annualized return for the total fund was 10% but real estate lagged at 5%.

“We believe broad asset class labels such as ‘equities’ ‘real estate’ do not sufficiently capture the underlying factors that influence the risks and returns of investments. Accordingly, we analyze the fundamental and more independent return-risk factors that underlie each asset class and strategy,” the pension fund said in its annual report. “Armed with this understanding, we can more accurately achieve our preferred mix of global exposures designed to maximize returns at our targeted market risk level.”

The pension said real estate’s 5% return was affected by downward pressure on returns driven by lowered tenant demand in the office and retail sectors as pandemic-related isolation measures between fiscal 2020 and the first half of fiscal 2022 were implemented.

“However, real estate performance was positively impacted by increased demand for industrial assets, particularly in the Asia Pacific region,” said CPPIB.

Source CoStar. Click here to read a full story

RioCan Looks to Rising Rents as Interest Rates Climb

One of Canada’s oldest real estate investment trusts says today’s borrowing rates are beyond any internal forecast by executives, but RioCan believes rental increases will mitigate the damage from a rising interest rate environment.

“With the reopening of the nation, Canadians look forward to putting the pandemic well behind us. However, we’re now facing different challenges. We’re facing rising interest rates, global economic uncertainty based on more tensions, trade disruptions and unprecedented inflation,” Jonathan Gitlin, chief executive of RioCan, founded in 1993, said on a conference call with analysts last week.

The CEO said RioCan, which still gets the bulk of its income from retail despite a growing presence in the multifamily segment of the market, said the REIT’s tenant mix is evolving to include more essential retailers.

Dennis Blasutti, chief financial officer of the REIT, said RioCan had anticipated higher interest rates and locked in some debt while hedging some of its other debt.

“Our well-staggered debt ladder ensures that only a relatively small portion of our refinancing activities will take place at any given point in the economic cycle,” said the CFO on the call.

“As our tenant revenue grows, we expect to capture some of this in the form of rent increases. At the same time, rising replacement costs are supportive of the value of our well-positioned retail and mixed-use real estate as either revenues will increase to support the development or new supply will be constrained,” Blasutti said.

Jenny Ma, an analyst with BMO Capital Markets, asked how RioCan was dealing with the inflationary market when signing leases.

“Are there any changes that you’re making in terms of your ability to chargeback certain expenses or rent increases that are more closely tied to CPI or just anything that may have shifted because of what we’ve seen on the inflation front and how you write up your leases?” the analyst said on the call.

Gitlin said the company has always tried to get consumer price index provisions into its leases and noted all of RioCan’s leases are triple net, so the tenant takes the risk of rising expenses related to property including real estate taxes, building insurance, and maintenance.

Jeff Ross, senior vice president of leasing and tenant construction with RioCan, told analysts the market is seeing pre-pandemic conditions where there are multiple offers on the same units.

“We’re also seeing an influx of Americans starting to kick tires again. We’ve got a RECon conference coming up in a couple of weeks. We are solidly filled on both days with no Canadians by design. Very much we’re dealing with the American-based tenants that we have, but there’s a whole lot of new tenants from Europe as well,” said Ross, referring to the upcoming International Council of Shopping Centers event in Las Vegas.

Tal Woolley, an analyst with National Bank Financial, asked what type of tenants are “coming out of the woodwork” from America and Europe.

“The smaller fashion boutique guys are looking for more high street locations, but the guys that are really pushing in hard are the food and beverage guys. So there’s a lot of both fast-food and full-service sit-down restaurants. We’re seeing a lot of that. And certainly, on the entertainment side, we’re seeing a lot of those starting to press in,” said Ross, referring to a deal with Arcadia Earth, an immersive augmented reality exhibit that has locations in New York and Las Vegas and plans to open in RioCan’s site known as The Well in downtown Toronto.

Sourse CoStar. Click here to read a full story

Slate plans up to 12M sq. ft. of industrial on Hamilton Stelco land

Slate Asset Management has closed on the $518-million acquisition of approximately 800 acres of industrial development land and buildings from Stelco Inc. in Hamilton. The firm said it plans to develop up to 12 million square feet of new industrial on the lands, which is already zoned for a wide range of uses.

The industrial park could create up to 23,000 new jobs across the Greater Toronto and Hamilton area, and inject up to $3.8 billion into the economy according to an economic study conducted by Ernst & Young.

The sale closed this morning, although local media reports disclosed several months ago Slate would become the new owner.

The scope of Slate’s plans for the site, however, were not previously known.

“Having grown up in the area, (co-founding partner/brother) Brady (Welch) and I understand first-hand the history and significance this site has had in the Hamilton community and in broader Ontario for well over a century,” Blair Welch said in the announcement Wednesday morning.

“Our vision is to restore this site to its highest potential, reimagining it as a world-class industrial park that will continue to play a crucial role in the economy of the city and our province long into the next century.”

“One-of-a-kind” development opportunity

The site’s strategic location presents what Slate considers a “one-of-a-kind industrial development opportunity in North America.”

It is located adjacent to Hamilton’s waterfront and harbour on the Great Lakes and the St. Lawrence Seaway.

It also offers access to the U.S. land border, Ontario’s highway system, on-site rail connecting to Ontario’s greater Golden Horseshoe network and to the nearby Hamilton international airport, which is one of Canada’s key cargo hubs.

“This project represents a defining opportunity to reactivate a massively under-utilized parcel of land that has global industrial relevance,” Brady Welch said in the release.

“We are committed to working in close partnership with local institutions, government, and community groups to deliver a state-of-the-art industrial park that is modern and sustainably developed, attracting world-class tenants and restoring economic vitality to the area.”

Slate has agreed to a long-term sale-leaseback of 75 acres of land and two million square feet of buildings for 35 years to Stelco, a major North American steelmaker whose operations have long been synonymous with Hamilton.

The remaining 725 acres and any other remaining buildings will be prepared by Slate for development into “highly coveted, class-A industrial product.”

The development potential for the site will be a major boost for a region where industrial vacancy is running around (or below, depending on the district) one per cent. A Slate spokesperson told RENX this morning the firm is not releasing any timelines for development at this point.

Asking rents in the Toronto area have jumped 30 per cent year-over-year according to Colliers’ most recent Q1 2022 data.

The region saw 13.7 million square feet of absorption over the past year and an additional 10.3 million square feet is under development.

Site remediation and the environment

Slate also plans to invest into the environmental protection and remediation of the site. As part of that responsibility, it will “reactivate” the 3,400 metres of waterfront along Lake Ontario.

“By incorporating best practices around sustainable infrastructure, construction and social value across the lifetime of this project and its end use, we can redefine the legacy of this site and reintroduce it as a new standard-bearer for modern industry,” said Bozena Jankowska, global head of ESG at Slate, in the release.

“We look forward to collaborating with local and global organizations to raise the bar for this industrial redevelopment in every sense and demonstrate that we can drive economic growth while ensuring environmental and social sustainability.”

The Greater Toronto & Hamilton Area is located at the western end of Lake Ontario within the Golden Horseshoe, an industrialized region of nearly 10 million people surrounding the city of Toronto, which accounts for 20 per cent of Canada’s GDP.

The Golden Horseshoe also has strategic access to major U.S. markets, with a population of 130 million people within a 500-mile radius.

The region has two international airports (in Toronto and Hamilton) serving 200 destinations in 55 countries.

About Slate Asset Management

Slate Asset Management is a Toronto-based global alternative investment platform targeting real assets.

Slate’s platform has a range of real estate and infrastructure investment strategies, including opportunistic, value-add, core-plus, and debt investments.

Source Real Estate News EXchange. Click here to read a full story

Dream Industrial Buys Cambridge Site Home to Amazon Delivery Station in $31.8 Million Deal

Two of Canada’s largest industrial real estate players are swapping a 136,000-square-foot property about 100 kilometres southwest of Toronto that is leased to Amazon.

Dream Industrial Real Estate Investment Trust paid $31.8 million at the end of April for the facility at 125 Maple Grove Road in Cambridge that houses an Amazon delivery station, according to property records obtained by CoStar. The station serves as a last-mile facility where packages are loaded onto vehicles for delivery.

The seller was Pure Industrial, which is two-thirds owned by New York City-based Blackstone. Pure Industrial, which has been looking to expand in Canada, would not comment on the deal. Toronto-based Pure Industrial said on its website the property is on a 12.5-acre lot, was constructed in 2001 and expanded in 2003.

As of March 31, Toronto-based Dream Industrial REIT owns, manages and operates a portfolio of 244 industrial assets comprising 358 buildings and 44.4 million square feet of gross leasable area across Canada, Europe and the United States.

Last month, Dream Industrial said it was teaming up with its parent Dream Unlimited Corp. and an unnamed global sovereign wealth fund to create a new $1.5 billion joint venture. The joint venture is initially looking to buy $500 million of development sites in the Greater Toronto Area and other select markets within the Greater Golden Horseshoe Area, which surrounds the GTA.

Source CoStar. Click here to read a full story

Cadillac Fairview Teaming Up With Vancouver Real Estate Company on New Plan for Toronto Mall

The real estate arm of one of Ontario’s largest pension funds has unveiled plans to transform one of Toronto’s most notable suburban malls, creating a plan for an initial 1.1 million-square-foot mixed-use development at CF Fairview Mall.

Opened in 1970, Fairview Mall at 1800 Sheppard Ave. E, with almost 900,000 square feet, was Canada’s first two-storey mall.

Cadillac Fairview, the wholly owned subsidiary of the Ontario Teachers’ Pension Plan, said that together with its partner Vancouver-based development and management company Shape, it had made a joint submission for the first phase of a master plan for the regional shopping mall.

“For more than 50 years, CF Fairview Mall has been a community hub in North York, serving the evolving retail, transit, entertainment and service needs of the local area residents and businesses,” said Wayne Barwise, executive vice president of development with Cadillac Fairview, in a statement. “As our longest operating shopping centre in the Greater Toronto Area, the master plan redevelopment extends our long-term vision.”

The first development phase is located next to Don Mills Subway station, on the south side of the shopping centre fronting Sheppard Avenue East. The plan calls for 1.1 million square feet of mixed-use, including three new buildings, two condominiums and one residential rental building, with retail and amenities.

Shape has previously worked with Cadillac Fairview as the residential development partner on CF Richmond Centre, where 2,000 new homes were added.

“Following our incredible success with RC at CF Richmond Centre, we’re ready to raise the bar, engage the local community and set a new standard for urban living with the complete reimagination of CF Fairview Mall,” said John Horton, president and chief executive of Shape, in a statement.

The plan at CF Fairview Mall follows an announcement by the real estate company in 2019 that it was spending $80 million to renovate 230,000 square feet of existing department store and other retail space, including a T&T Supermarket outlet. The mall renovation is expected to be completed by late 2022.

Source CoStar. Click here to read a full story

Choice Properties REIT Has Acquired A 75 Per Cent Interest In 154 Acres Of Development Land In East Gwillimbury

The property is located at the corner of Hwy. 404 and Green Lane East, giving it close access to the Greater Toronto Area’s network of major highways.

Rice Group is the vendor and will also remain involved in the project.

In Friday’s announcement, Choice Properties REIT said the initial investment in the development is about $170 million, including the land and site preparation.

“This development is a unique opportunity for Choice Properties to scale its existing industrial portfolio and further demonstrates the benefits of our strong and strategic relationship with Loblaw,” said Rael Diamond, president and chief executive officer of Choice Properties, in the announcement.

“The development is a significant opportunity in a key market to develop industrial land alongside the Rice Group, who is a long-standing development partner of ours.”

Choice acquired the 75 per cent interest via a previously arranged “equity conversion right” with Rice Group.

Choice to develop multi-phase industrial park

The development plan is for the trust to build a multi-phase industrial park with the potential for approximately 1.8 million square feet of logistics space. Choice and Loblaw entered into an approximately 100-acre land lease for the first phase at the property.

Preparation of the site is anticipated to take place over during the next 15 months.

The cost of the distribution facility is accounted for in Loblaw’s capital planning and projections. Loblaw expects to bring the facility into its operations in the first quarter of 2024.

“This new facility reflects our continued drive to advance our supply chain to better serve our customers and meet their evolving needs,” said Robert Sawyer, chief operating officer, Loblaw.

“This is also a strong demonstration of the benefits of our strategic relationship with Choice Properties.”

The project is one of several developments Choice now has underway across Canada.

As noted in its Q1 2022 financial results, projects include:

– high-rise residential projects in Brampton, Ont., next to the Mount Pleasant GO Station and the other in the Westboro neighbourhood in Ottawa.

– two active industrial projects expected to deliver about 600,000 square feet of new generation logistics space, at Horizon Business Park in Edmonton, and in Surrey, B.C.

Choice is also continuing to advance rezoning for 11 mixed-use projects representing over 10.5 million square feet.

It recently received zoning amendment approval for a significant mixed-use project at Grenville and Grosvenor Streets in Toronto.

About Choice, Loblaw and Rice Group

Choice Properties owns, operates and develops commercial and residential properties.

The REIT currently holds 114 industrial properties totalling 17.2 million square feet and has approximately 6.5 million square feet under development or in various stages of the rezoning and planning process.

Loblaw is Canada’s largest retailer, operating in the food and pharmacy, health and beauty, apparel, general merchandise, financial services and wireless mobile products and services sectors.

It has more than 2,400 corporate, franchised and associate-owned locations, employing more than 190,000 full- and part-time workers.

Rice Group is a vertically integrated retail, industrial and infrastructure developer supporting and providing site works, servicing, construction management and design and approval for internal projects and partnerships.

The company manages the development of a portfolio in excess of 1,200 acres primarily in the GTA.

The portfolio consists of approximately five million square feet of industrial and commercial space, with more than 10 million square feet in the pipeline.

Source Real Estate News EXchange. Click here to read a full story

Lash Proposes 44 Storeys at Planned BRT Stop in Scarborough

On the southeast corner of Markham and Ellesmere roads in Scarborough, the site of 1151 Markham Road has recently seen a Zoning By-Law Amendment application submitted to the City of Toronto by the Lash Group Of Companies. Proposed by the developer is a 44-storey building designed by Turner Fleischer Architects that would be comprised of 440 residential units and 223m² of retail gross floor area located next to a planned stop on the Durham-Scarborough Bus Rapid Transit (DSBRT) corridor.

The site is currently occupied by a single-storey commercial building and its associated surface parking lot, which is being used as a presentation and sales centre for the company’s multi-phase ME Living condominium development currently mid-construction at the south end of the same block.

The new proposal comprises a total of 31,349m² of gross floor area, resulting in a density of approximately 15.89 times the area of the lot. According to its architects, the eight-storey-tall podium of the proposed building has been designed to achieve an “appropriately scaled street wall condition” with a “unique base building design” that features a rounded corner, with a step-back above the sixth storey.

The tower element of the proposal runs from level 9 to 44, plus its mechanical penthouse. The curved wall at the northwest corner of the building continues from the base of the building, remaining constant throughout the tower’s rise to the very top. The architects suggest this provides for unique architecture which gives emphasis to the intersection.

The residential lobby would be accessed via Ellesmere Road on the north side of the building. The ground floor would also be the home of a mail/parcel room, retail and residential garbage rooms, stairwells, and bicycle storage.

Above the ground floor, all levels with the exception of Levels 2, 9 and 38 have been designed to exclusively with residential units. A total of 440 units are proposed in a mix of 305 one-bedrooms (69%), 88 two-bedrooms (20%), and 47 three-bedrooms (11%).

Level 2 would include indoor amenity space and bicycle storage, while Level 9 would exclusively offer both indoor and outdoor amenity, and Level 38 would be used for indoor and outdoor amenity space in addition to residential units. There is a total of 1,760m² of residential amenity space proposed, 1,497m² of it interior and 263m² of it exterior. The programming of the amenity areas has not yet been decided on.

There would be four levels of below-grade parking beneath the building. The parking garage would have a total of 149 spaces, 147 of which would be reserved for residential units, and two of which would be provided for retail parking. A total of 367 bicycle parking spaces are also proposed, of which 324 are proposed for long-term use and 43 spaces are proposed for short-term use.

The proposal for the new development also includes new STUDIO tla-appointed landscaping and streetscape improvements at grade along Markham and Ellesmere roads, and would expand the proposed 823m² public park next door to the east through an on-site dedication of around 72m².

The site is located approximately two kilometres east of the McCowan RT station located on TTC Line 3, while bus routes ply both Ellesmere and Markham roads. The RT station will be closed by the time this building could be built, but work is underway on the Scarborough Subway Extension to replace it with a Line 2 station, opening around 2029-2030.At the same time, plans are advancing for a Bus Rapid Transit line along Ellesmere Road between Scarborough Town Centre and the cities of Durham Region to the east, which would have a stop located beside this proposal.

More information on the development will come soon, but in the meantime, you can learn more from our Database file for the project, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread, or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

West Don Lands Sees A Unique 31-Storey Residential Proposal

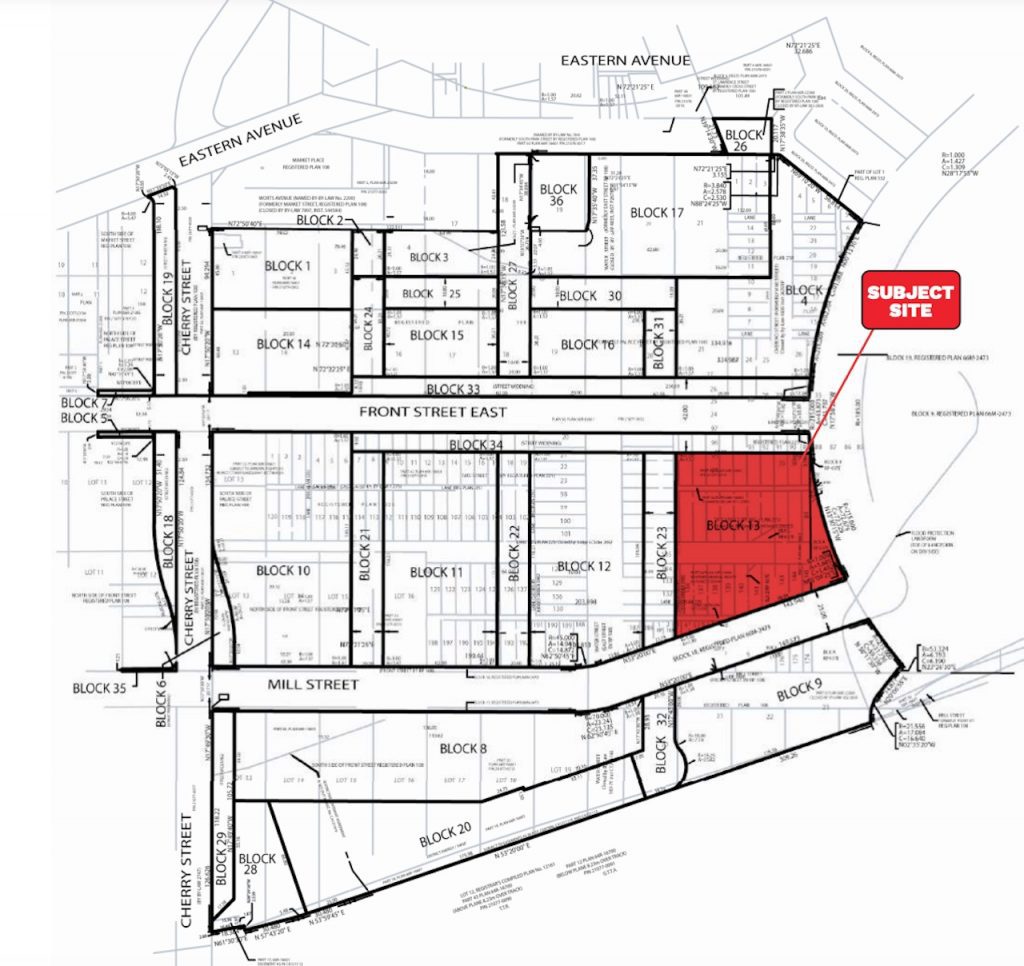

The Canary District was initially the home of the Pan/Parapan Athletes’ Village of the PanAm Games that took place in Toronto in 2015, with a half dozen blocks developed with buildings that have since become condos, apartments, and a George Brown College campus. Since then, the more blocks have gradually been developed, or are under construction now, or have seen proposals submitted to the City for their redevelopment. Most recently, Block 13 – the last development site within the original village north of Mill Street – has seen Zoning By-law Amendment and Site Plan Approval applications submitted by Dream Unlimited and the Kilmer Group, proposing an architecturally distinct, mixed-use building designed by Henriquez Partners Architects of Vancouver, whose major Toronto work is Mirvish Village, now in the late stages of construction at Bloor and Bathurst.

Located at 495 Front Street East, the site is vacant and currently being used as a construction staging area for other developments in the Canary District and West Don Lands.

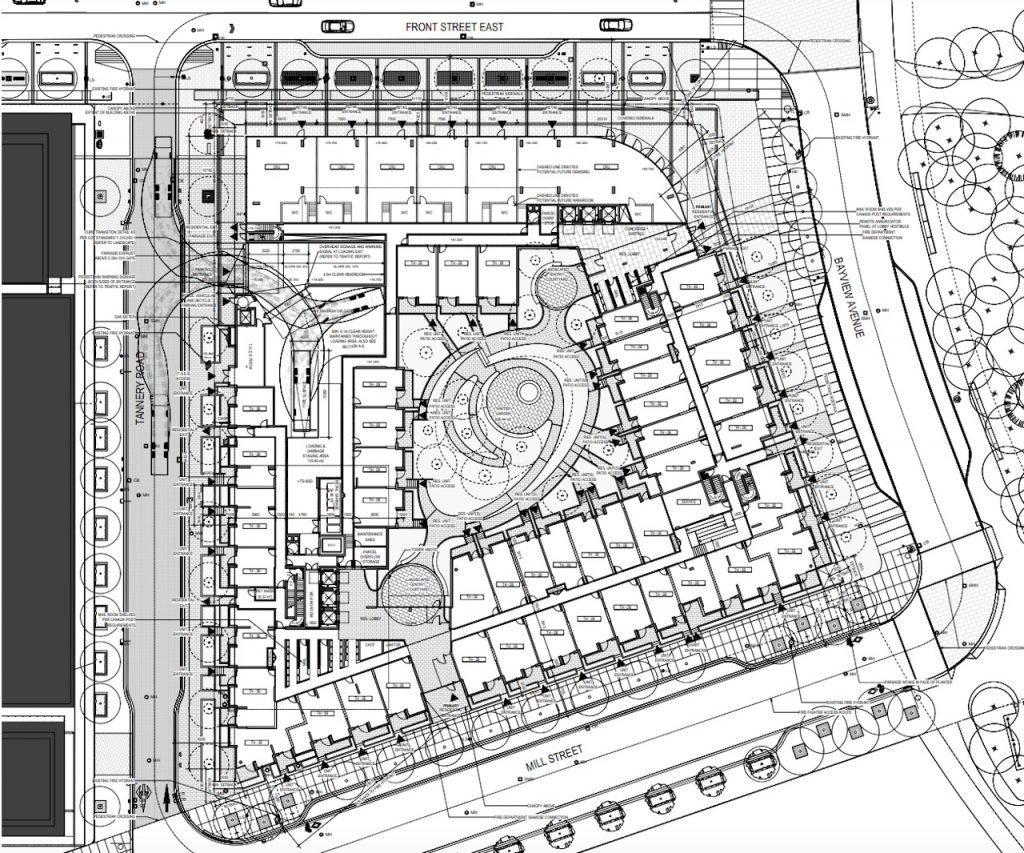

The proposal has a total gross floor area of 63,944m², resulting in a density of 8.46 FSI. Approximately 963m² of that area consists of retail uses along the entirety of its Front Street East frontage, contributing to a pedestrian-friendly public realm, in addition to space provided through setbacks that make way for additional areas for outdoor patios, landscaping, and a potential public art feature at the main intersection with Bayview Avenue.

The massing of the building has been highly articulated to visually break down its scale. The proposal includes a mid-rise base building that gradually steps up from 7 storeys at the corner of Mill Street and Tannery Road up to 13 storeys at the corner of Front and Bayview, creating a “gateway” to Front Street along with the 16-storey Canary Park Condominium that is located to the north.

The proposal also includes a 24-storey tower above the 7 storey podium – reaching a total 31 storeys – that has been located on the southwest corner of the site in an effort to respond to adjacent taller buildings, and minimize shadows on the Corktown Common Park that is located across Bayview from it.

A unique approach to the arrangement of balconies and balcony “wings” in addition to an ombré type brick pattern that fades from pink to beige as it ascends, works to distinguish the proposed building from other buildings within the Canary District of the West Don Lands.

A total of 859 residential units are proposed, 333 – almost 40% – of which would be family-sized two- or three-bedroom units, including 45 two-storey townhouse units that would have sidewalk access from Bayview, Mill, or Tannery.

The proposed unit mix is 35 studios (4%), 491 one-bedrooms (57%), 213 two-bedrooms (25%), 33 two-bedroom townhouses (4%), 75 three-bedrooms (9%), and 12 three-bedroom townhouses (1%). The majority of units above (except on the third floor) will have balconies, many of which are designed with screens for weather-protection. A number of units on the third floor would have private terraces facing towards the northwest corner of the courtyard, situated above the townhouses.

In the centre of the site would be an interior courtyard which would be accessed from the two ground floor lobbies and would provide an amenity space for the residents of the building. Other building amenity spaces would total 4,959m² and be dispersed around the entire development, comprising 1,429m² of indoor amenity space along with 3,530m² of outdoor amenity space. Programming has not yet been determined.

Within two parking levels, a total of 279 parking spaces are proposed, including 157 resident spaces, and 122 visitor spaces which are to be shared with the commercial uses. A total of 898 bicycle spaces are proposed, including 806 resident spaces, 86 visitor spaces, and 6 retail spaces.

Existing transit routes within the vicinity of the site include three streetcar routes that run along King and Queen streets, as well as two bus routes, one travelling north-south, and the other travelling east-west.

There is also significant transit planned for the area, including the Cherry Street LRT Extension, which will connect with the Waterfront East LRT Extension, running from Union Station to the foot of Bay Street, and along Queens Quay East to the Distillery Loop. In the future, the LRT is planned to be extended south along Cherry Street over the Keating Channel to serve the westerly portion of the Port Lands. Also planned in the area is the Ontario Line, a 15.6 kilometre-long subway line running from the Ontario Science Centre in the northeast to Exhibition Place in the southwest via Downtown. A Corktown station is planned nearby the proposed development.

More information on the development will come soon, but in the meantime, you can learn more from our Database file for the project, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread, or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story