Author The Lilly Commercial Team

Toronto Retail Seeing Increasingly Robust Leasing Activity as Workers Return to Offices [Report]

A retail report by commercial real estate firm JLL says retail leasing activity in Toronto should remain robust after a strong push in the second quarter of this year.

Both enclosed and open-air Toronto retail properties have attracted new concepts, with a special attention from first-to-market. Combining a dip in Q1 and the subsequent rebound in Q2, on balance the first half of the year remained on par with the first halves of 2021 and 2019, it said.

“Foot traffic is catching up, interest in in-store purchases remains high, and pent-up demand for travel and services is leading to new openings, especially restaurants. Many retailers and food-services operators have concluded that this is a window of opportunity they shouldn’t miss, and some are willing to absorb the current high construction costs ‒ even building entirely new spaces ‒ in order to capitalize,” said JLL.

“Increasing demand for retail space, fewer available spaces, and rising inflation and interest rates are among the primary contributors to the acceleration of rents in Q2. Rates went up by seven per cent year-over-year, which is in sync with the current inflation rate in Canada.

“On the supply side, overall retail inventory is expected to remain constrained as construction activity fell over the past few quarters and fewer deliveries are anticipated. Investment in retail construction has consistently contracted while investment in warehouses has accelerated. More recently, investment to build hotels and restaurants has rebounded.”

Paul Ferreira, Senior Vice President of Retail with JLL, said all signs for the most part indicate things are improving from retail sales, retail traffic, and rents stable or going up.

“I think all the metrics we would typically look at for how things are going with retail and retail real estate are improving coming out of the pandemic. The area of concern I would still have is traffic and footfall in the downtown urban core as most employers are still waiting out to see what the ultimate workplace presence ends up being in our downtowns,” he said.

The number of employees returning to the downtown core has gradually improved since February, and office occupancy should surpass 30 per cent before the fall, explained the JLL report, adding that a recent study from the University of California shows that this past spring Canadian downtowns lagged most U.S. downtowns in terms of economic and social activity (as measured by mobile phone data). Toronto and Montreal downtowns had similar rankings.

“As the number of COVID-19 infections in Ontario peaks and trends down, it’s less likely that the seventh wave will derail the momentum, prompt a stiffening of measures, or slow business activity again. Toronto’s public transit ridership continues to recover. Toronto Transit Commission (TTC) ridership reached 57 percent of pre-COVID levels in late June, from 34 percent in the beginning of February. With the resumption of in-person classes in the fall and more workers returning to the office, ridership should continue to make significant progress,” said JLL.

“TTC forecasts that overall ridership will approach pre- pandemic levels by the end of 2023, with the complete return of students and resumption of discretionary travel, but a significant gap from office workers. The return of office workers will be continual and gradual, as major employers have announced the transition to return-to-work using a hybrid working model.”

Ferreira said the hybrid work arrangement is likely here to stay.

“What we’re seeing in downtown Toronto I’d say in the last number of weeks the presence in downtown Toronto is greater than I’ve seen it through the pandemic, since the pandemic started. The GO trains are all busier. Transit, subway, when you talk to people who are taking it seems to be full again at rush hours. But it’s not consistent on the days,” he said. “Everybody seems to be focused on the Tuesday, Wednesday, Thursday. So what does that mean for the retail and the businesses in our downtowns?”

JLL said retail sales in Toronto have been increasing since January (based on seasonally-adjusted numbers), despite Omicron. For the remainder of the year, sales should remain robust. Businesses and consumers are fairly confident about shopping due to the ongoing post-pandemic rebound, and this should last for some time.

“There have been several major retail events in downtown Toronto this year. First, IKEA opened its first urban format in Canada on Yonge Street, backfilling Bed Bath & Beyond. Second, the renovation of Union Station is near completion, and retail spaces there are in process of being occupied by several brands including Sephora and Decathlon. Third, The Well mixed-use development is set to open its retail component in early 2023,” said JLL.

“In addition, several international concepts plan to open their first location in the market. Recently, U.S. fitness Alo Yoga, Spanish fashion Mango, and Brazilian steakhouse Fogo de Chão have indicated Toronto as one of their key markets. After being largely closed during the pandemic for more than six months altogether, shopping malls are now able to breathe and operate under more normal conditions. Some days of the week are recovering faster than others. Overall, sales and foot traffic will continue to recover and approach pre-pandemic levels by the end of 2022.

“Over the long term, asset-management teams have accelerated densification plans to turn malls into mixed-use developments. Several malls have made their plans public and started to execute them.

Toronto malls have seen vacancy rates decline as more retailers feel compelled to expand in enclosed spaces. Shopper hesitancy has decreased, and masking is no longer mandatory. EV, athletic, and luxury have notably expanded across the major malls.”

Source Retail Insider. Click here to read a full story

Canada’s National Office Vacancy Rate Dips in Q3: CBRE

The office markets in Canada’s major cities aren’t as buoyant as during pre-pandemic days, but are still doing relatively well in comparison to those in other countries.

CBRE just released a report that examines the Canadian office market during Q3 2022, and national managing director Jon Ramscar shared his views on the current climate, and what to expect in the coming quarters, with RENX.

Though office vacancy remains elevated compared to before the COVID-19 pandemic, Canada still boasts three of the five lowest downtown vacancy rates in North America.

Vancouver was at 7.1 per cent, Ottawa at 11.5 per cent and Toronto at 11.8 per cent. That compares to Manhattan at 15.2 per cent, San Francisco at 24.2 per cent and Dallas at 32.2 per cent.

Ramscar attributes those differences to Canadian cities having lower vacancy rates before the pandemic, and to the stability of the country’s relatively small number of major building owners.

Downtown and suburban vacancy rates

The national vacancy rate decreased by 10 basis points to 16.4 per cent in the third quarter, which was a first since the onset of the pandemic. This was led by further improvement in the suburbs, as downtown markets remained stable with 16.9 per cent vacancy.

Ramscar said an exodus from downtown to suburban offices which had been predicted by some observers early in the pandemic hasn’t materialized. He did note, however, that physical occupancy as opposed to contractual occupancy is higher in the suburbs, even though it is now also starting to rise in downtown buildings.

While Toronto remains behind global competitors London and New York City for physical office occupancy, largely because it had longer and more severe lockdowns due to COVID-19, Ramscar said it’s gradually making up ground.

The Toronto office market is also heavily influenced by major banks and insurance companies and, once they start to enact wide-scale back-to-the-office mandates, Ramscar expects occupancy numbers to increase even more as they have in London and New York.

Calgary, Waterloo Region and Toronto were the only markets to report decreases across both their respective downtown and suburban regions.

Some companies that have been expanding have moved from suburban to downtown offices as part of a flight to quality to attract and retain talent and enhance branding, according to Ramscar.

Class-A vs. class-B office performance

As downtown tenants prioritize quality over cost, the national vacancy rate of downtown class-B office towers (21.4 per cent) was nearly 50 per cent higher than for downtown class-A product . Downtown class-B vacancies are at a national all-time high.

That trend began early during the pandemic and the gap has continued to widen.

“What companies, investors and occupiers are betting on is high-quality, well-located buildings or built-out space where they’ve got an option to get a deal and upgrade as part of the war for talent,” said Ramscar.

Demand for quality space has kept downtown class-A vacancy under or around 10 per cent in Vancouver (6.7 per cent), Ottawa (eight per cent) and Toronto (10.2 per cent).

Toronto and Vancouver have become cities where global companies want to locate and expand, with technology-based firms leading the way.

“We’ve got great talent and are reasonably cost-effective,” said Ramscar. “We’re very liberal, open and welcoming and offer a great quality of life.”

While more occupiers are solidifying their remote and hybrid work models, new supply is expected to have the largest impact on vacancy rates moving forward. Backfill spaces due to tenant relocations into new builds are expected to come to market over the coming quarters in Vancouver, Toronto and Montreal.

Positive office absorption and declining sublets

There was 2.1 million square feet of positive net absorption recorded in the third quarter, with much of it attributed to the delivery of pre-leased new supply. Excluding the new deliveries, absorption was 207,000 square feet.

Calgary and Waterloo Region experienced a pick-up in absorption activity, primarily from engineering, financial services and creative industry firms.

Vancouver and Ottawa saw some softening as some tenants decided they no longer required as much space, which resulted in an uptick in sublease offerings. Halifax had the largest increase in sublet space at 43 per cent, while Montreal, Toronto and Winnipeg had much smaller increases.

Sublet activity has declined significantly since early in the pandemic, however.

Calgary, which is typically known for having a higher share of sublet space, has seen these offerings decline for five consecutive quarters to 16.9 per cent of vacant space — a seven-year low in absolute terms. Sublease decreases were also noted in Edmonton and London.

Subleases accounted for 18.2 per cent of total vacancy nationally in Q3 and maintained the Q2 total of three per cent of existing inventory.

With occupiers remaining focused on quality, amenity-rich spaces to draw employees back to the office, built-out sublet offerings are presenting enticing ready-to-occupy options.

Office development activity and pre-leasing

Office construction levels declined to 12.7 million square feet, with major project deliveries coming to market in downtown Toronto as well as suburban Montreal and Halifax during the third quarter.

Suburban office development activity is led by Vancouver, where the suburban vacancy rate has remained under seven per cent during the past four quarters and is the lowest of the major markets.

The active development pipeline is equal to just 2.6 per cent of inventory. It is 54 per cent pre-leased.

Pre-leasing rates have remained stable because a lot of this activity took place pre-pandemic and was already committed.

There were some large office lease deals signed in the third quarter, including:

- Microsoft completing a deal for approximately 400,000 square feet at the under-construction B6 at 1090 W. Pender St. in Vancouver;

- medical technology provider PointClickCare expanding its presence by taking 90,000 square feet over three floors at The Well in Toronto;

- and India-based information technology provider Mphasis signing up for 26,160 square feet for its new Canadian headquarters at First Tower in Calgary.

Optimism still remains

Despite uncertainty about future office demand — combined with a near-term economic slowdown, rising financing and construction costs, and labour shortages — Ramscar said no developments have paused construction and landlords remain committed and optimistic.

“I think, with interest rates rising, we have choppy, choppy seas ahead,” said Ramscar.

“But I think we’re well-placed with the fundamentals we have. We don’t have a lot of stock to play with, and it’s so controlled, and we’ve got huge demand fundamentals.”

Source Real Estate News EXchange. Click here to read a full story

Offices, Condos, Towns: Checking In On Recently Completed Projects in the GTA

Since the end of the summer, a new class of developments have graduated from the construction phase into completion. We track all of this information on a daily basis with UrbanToronto Pro, and with this article we’re summarizing the projects which we have switched to completed in our database files. We should note that by completed, we mean substantially completed, to the point that the buildings have generally allowed occupation to begin, even if there are some loose ends to still take care of! Scotiabank North Tower at Bay Adelaide Centre Lights are turning on in the Scotiabank North Tower, the final piece of the Bay Adelaide Centre complex developed by Brookfield Property Partners located in the heart of Toronto’s Downtown Core. The 32-storey tower brings more than 800,000ft² of commercial office space to the sprawling complex, and achieves AAA class through a high standard of technological design in construction and operation.

This residential condominium from iKore Developments began welcoming occupancy in late August after two and a half years of construction that began in the early half of 2020. The 21-storey tower, designed by Richmond Architects, will deliver 216 units to the southwest corner of Lawrence Avenue West and Keele Street in Toronto’s Amesbury neighbourhood.

Avenue & Park

Up in the Ledbury Park neighbourhood, between Lawrence Avenue West and the 401, Avenue & Park, a luxury 7-Storey mid-rise from Stafford Developments and Greybrook Realty Partners, has marked the end of major construction. The exclusive 35 units were nearly sold out before demolition of the existing building began in 2017, and with doors open officially, the wait for occupancy is ending.

BT Modern Towns

In mid-September, a block of 3-storey stacked townhouses was completed and has now opened doors to 24 units in the on Dervock Crescent, located just south of Sheppard Avenue East, between Bayview Avenue and Leslie Street. From developers Buildcrest and Algar Developments Inc, the modern build features a mix of brick, wood, and metal finishes, while rooftop terraces offer private outdoor space.

2Fifteen

The southwest corner of Avenue Road and Lonsdale Road is now the home of a luxury residential building from Preston Group and DBS Developments. Reaching 20-storeys, the building accounts for 177 units in the Forest Hill neighbourhood, and includes 44 rental replacement units along with 133 new ones.

Effort Trust Building (Hamilton)

On the Hamilton counterpart of King Street East, a 5-storey office building with an angular design from Eposto Architects is being opened by developers Effort Group. Clad in dark tinted window-wall, the sleek building is a new asset in a rapidly redeveloping city centre.

Bianca Condos

This 9-storey mid-rise development from Tridel is part of a string of similarly scaled projects spanning from Ossington Avenue to Spadina Road that are bringing a spike in density to Dupont Street. Located just west of Spadina Road, Bianca benefits from the neighbourhood quality of The Annex while delivering a dynamic design that enables 216 units to enjoy a wealth of outdoor terrace space.

Erin Square Condos (Mississauga)

The end of the summer marked the completion of a 2-tower residential development on Metcalfe Avenue in the Erin Mills area of Mississauga that has now started occupancy for 408 units. The two towers from Pemberton Group are 21 storeys each, and are built above a shared podium where residents will find a mix of indoor and outdoor amenity space.

UrbanToronto will continue to follow progress on construction and development in the GTA, you can learn more about other projects from our Database. If you’d like, you can join in on the conversation on any project in the associated Project Forum thread.

Source Urban Toronto. Click here to read a full story

22 Storeys Proposed on Yonge Opposite Summerhill Subway Station

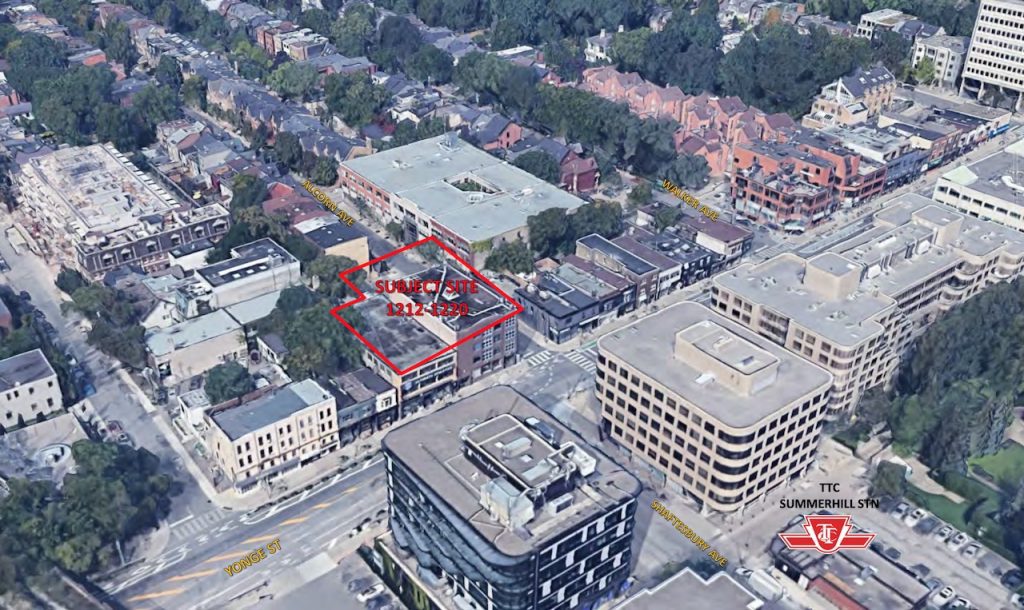

Zoning By-law Amendment and Site Plan Approval applications submitted to the City of Toronto on behalf of Trinity Point Development by the Goldberg Group showcase prospective renderings of Brisbin Brook Beynon Architects’ design for a 22-storey residential mixed-use building.

Located at 1212 through 1220 Yonge Street, at the southwest corner of Alcorn Avenue and across from Shaftesbury Avenue and its entrance to Summerhill subway station, the application seeks to demolish a series of existing low-rise commercial buildings on a 1,365m² assembled plot in favour of an organic tower inspired by the developments that line Yonge Street’s Summerhill neighbourhood. These existing three to four storeys buildings currently provide retail uses at grade and commercial offices above, typical of this stretch of Yonge Street.

Designated as a Mixed Use Area ‘C’ in the Yonge-St Clair Secondary Plan and defined within a Strategic Growth Area according to the City of Toronto’s Growth Plan, the subject site’s centrality and immediate proximity to higher order transit and surface transit outline its potential for growth and intensification. A ‘Major Transit Station Area’ can be defined as an “area within an approximate 500 to 800 metre radius of a transit station, representing about a 10-minute walk.” 1212-1220 Yonge Street is approximately 90 m from Summerhill subway station, 625 m from St Clair subway station, and 600 m from Rosedale subway station, further emphasizing its appeal.

The 22-storey mixed-use proposal has a four-storey podium fronting Yonge Street and Alcorn Avenue. Rising to a total of 80.3m, the development has a Gross Floor Area of 13,862m², which includes 13,360m² of residential and 502m² of non-residential, which will give the site a density of 9.9 FSI.

The curved, more organic tower form that Brisbin Brook Benyon Architects have elected for is meant to appear less intrusive within the Yonge-St Clair neighbourhood. The softer edges provide fluidity to the slender tower helping to define the Yonge Street and Alcorn Avenue intersection.

The staggered filleted edges fronting Yonge Street — clad in limestone panelling and clear glass — define the grade-level retail units whilst improving the public realm through carefully curated hard and soft landscaping proposals. Set back 5.4m from the northeast property line at its greatest, this outdoor space is protected by an overhanging upper floor that shelters pedestrians accessing the double height, 7.1m tall residential lobby and retail units below. At ground level, 3.5 levels of underground parking are accessed via a laneway leading off Alcorn Avenue to the site’s western perimeter providing 66 vehicle parking spaces and a portion of the scheme’s 193 bicycle parking spaces

Horizontal bronze colour metal channels pragmatically define each level and expertly wrap around the protruding balconies to give the scheme a sense of harmony. The expansive clear glazing abundant in 21st-century condominiums offers up views of the neighbourhood for residents and seemingly reduces the overall mass of the proposal.

In total, the development consists of 185 residential units comprising 65 one-bedroom units (35%), 99 two-bedroom units (54%), and 21 three-bedroom units (11%), which exceeds the City of Toronto’s requirements for percentages of unit types. A total of 302m² of indoor amenity space and 351m² of outdoor amenity space are also provided for residents.

UrbanToronto will continue to follow progress on this development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

Menkes Propose Three Towers on Brownlow Avenue near Eglinton and Mount Pleasant

Planners Goldberg Group have recently resubmitted Zoning By-law Amendment (ZBA) and Site Plan Approval (SPA) applications on behalf of Developers Menkes Brownlow Inc. for three residential towers rising to 35, 40 and 45 storeys in height atop two 6-storey podiums designed by Turner Fleischer Architects at a site municipally known as 55 through 75 Brownlow Avenue in Toronto’s Midtown.

An original submission from August, 2021 occupied 61 through 75 Brownlow Avenue and facilitated the site’s redevelopment with a single 35-storey residential tower containing 384 residential units. Since then, the application lands have expanded to include 55 Brownlow Avenue, a plot to the immediate south currently occupied by a 15-storey building containing 121 rental units. Menkes Brownlow Inc. seeks to provide full rental replacement while delivering an additional 1,041 residential units, an increase of 778 units from the previous application.

Located on the east side of Brownlow Avenue, 70m south of Eglinton Avenue East and 50m West of Mount Pleasant Road, the now 5,752m² rectangular plot is part of the Mount Pleasant West neighbourhood, sited within the Yonge-Eglinton Centre of the Yonge-Eglinton Secondary Plan. As such, it is considered an Urban Growth Centre within the Growth Plan, an area designated for significant development and population growth over the coming years.

Brownlow Avenue’s adjacency to two major arterial roads, Eglinton Avenue East and Mount Pleasant Road, running east-west and north-south, respectively, means the site is well served by existing TTC bus routes with stops no greater than 800m away. Yonge Line 1 is also accessible via Eglinton station 750m to the west and served by the aforementioned bus routes. The site is also strategically positioned 100m from the soon-to-open Mount Pleasant station on Eglinton Line 5, further increasing accessibility to the site.

By detaching the two podiums on the expanded site and offsetting them 20m from one another, Turner Fleischer Architects are proposing a new public park measuring 426m² in size fronting Brownlow Avenue. The 6-storey podium of Tower A is also setback 9m from the northern property line allowing for a midblock connection and access to three levels of underground parking with 217 vehicle parking spaces and 1,285 bicycle parking spaces. This setback increases to 10m along the eastern perimeter for both podiums to introduce a 22.5m separation distance from an approved 35-storey mixed-use building at 744-758 Mount Pleasant Road that, according to the proponents, meets the intent of the City’s Tall Building Guidelines.

A striking utilitarian red brickwork façade delineates the first three storeys of the two 6-storey detached podiums abutting the western property line fronting Brownlow Avenue. This abruptly transitions into white brickwork for the remaining three podium levels and subsequent three towers above. Bronze-finished architectural fenestrations harmoniously tie all levels together and are defined by chamfered brickwork columns.

The three distinctive towers gradually cascade in height from 151m at the northern perimeter to 121m at the southern perimeter and collectively provide 88,538m² of Residential Gross Floor Area, representing a Floor Space Index of 15.02. These will provide 1,162 residential units, inclusive of the 121 rental replacement units, comprising 870 one-bedrooms (75%), 175 two-bedrooms, (15%) and 117 three-bedrooms (10%), along with total combined indoor and outdoor amenity spaces of 3,272m² located on the ground and 7th floors.

UrbanToronto will continue to follow progress on this development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

Aoyuan Selects H-Mart Supermarket as Anchor Tenant for Retail Space in M2M Condos

With construction of M2M Condos proceeding as planned, Aoyuan International, the developers of the 8.6-acre master-planned community development in North York, has announced which grocery retailer will be occupying the development’s 36,000ft² retail space. In keeping with the community focussed approach that has guided the project thus far, M2M will welcome the Korean-American supermarket chain H-Mart for the opening of their flagship Toronto store.

Designed by Wallman Architects, the 5-tower M2M community is being brought to life gradually through a phased approach. The first phase consists of two towers, soaring 34 and 38 storeys, built above a shared podium on the southern portion of the site. Phase 1 has been under construction since 2019 and, as of July, had over 40 storeys of progress between the two buildings to show for it.

The announcement of the opening of H-Mart in the M2M Condos is notable for several reasons, beginning with the sheer size of the 36,000ft² store. A supermarket is a practical tenant for the space, especially in a complex that will soon be welcoming residents to 810 new dwelling units – and that’s only the first phase. But beyond that, selecting H-Mart as an anchor tenant is also a way of recognizing and celebrating the multicultural character that is embedded in the fabric of North York.

A high-end market with an extensive inventory of Asian and international foods offered alongside commonly found western food, is better positioned to serve a diverse population, and reflects Aoyuan’s goal of aiming to build a community that has access to the essentials for a healthy, wellness-oriented lifestyle; for many, this lifestyle begins with food.

As a company, H-Mart has earned recognition internationally for its fast growing business model and progressive approach to grocery, with accolades like ranking 13th on the National Retail Federation’s Hot 100 creating a buzz around the brand. With nearly 100 locations in the U.S and 18 locations already active across Canada, the company’s flagship store at M2M will be a demonstration of the standards they have set for themselves. With a mix of eye-catching design characteristics like curved light fixtures and brick columns, the store will also feature one of H-Mart’s signature food halls, that have excited foodies with a selection of multicultural offerings.

With the promise of 180,000ft² of total retail and commercial space in M2M over phases one and two, the development will also further its commitment to creating a vibrant and well served community through the construction of a community centre and a public park.

UrbanToronto will continue to follow progress on this development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

Sawtooth-Edged 50-Storey Proposal Would Replace St Clair-Yonge Office Building

The Deer Park sector of Midtown Toronto is in the headlines again with more planning news, this time coming from Manulife Investment Management. Earlier this month, the insurance company’s real estate division submitted a proposal to redevelop the site of 45 St Clair Avenue West with a 50-storey mixed-use residential/commercial building reaching a height of 167m. Designed by Sweeny &Co Architects, the tower grabs attention with its sawtooth-edged treatment of the exterior, while the promise of 629 new dwelling units with 6,106m² of replaced office space and retail at grade speaks to the development’s considerable scale.

The site, located just west of Yonge Street on the south side of St Clair Avenue West, is currently occupied by a 14-storey office building with a concrete character reminiscent of brutalist style, built in 1969. The building houses a total of roughly 11,000m² of office space, with repeating floor-plates of about 945m², a relatively small size by downtown office building standards. With a surface parking lot occupying the southern portion of the site behind the building and an 11m setback from the St Clair avenue frontage, the 3,134m² property is left with a total site coverage just above 30%.

The proposal for redevelopment uses this fact to characterize the site as under-utilized, propelling the proponents’ pursuit of an Official Plan Amendment and Zoning By-law Amendments. They have also submitted an application for Site Plan Approval. The submissions make reference to the provincial policy surrounding development in Major Transit Station Areas (MTSAs), which applies to this site based on its closeness to St Clair station on Yonge Line 1, located less than 200m away. The site is also located halfway between stops on the 512 St Clair streetcar route at the intersections with Deer Park Crescent and Yonge Street.

Beyond the MTSA designation, the site is also considered to be a Protected MTSA (PMTSA), another level to the designation that allows the City to implement inclusionary zoning standards for proposed developments. Inclusionary zoning requires developers to ensure that affordable units are created within new developments, encouraging more mixed-income housing situations throughout the city.

The proposal begins with a 4-storey base building that attempts to set the tone for the building’s massing and scaling with a streetwall that is sensitive to the pedestrian. The base building’s height of 19m is unimposing, and is consistent in scale with the streetwalls of similar buildings in the surrounding area. A total of 567m² of retail space is shared between two units at grade, both fronting onto St Clair Avenue West, while floors 2 through 4 house the entirety of the building’s 6,106m² of office space. The shape of the base building features a cutout section at the northeast corner that sets the building back 15m from the street, creating a square patio area for the eastern retail tenant.

The patio ties in closely with the proposal’s plans to reinvent the site’s public realm, with a focus on encouraging the use of the space in front of the building in meaningful ways. The patio mentioned above would be furnished with table seating and benches, while another bistro-style patio would occupy the 4m wide space between the streetwall and the sidewalk. The proposal also intends to oversee the planting of nine new trees and planters along the sidewalk to provide shade and greenery for anyone moving through the public space.

The massing of the base building introduces the sawtoothed character of the proposal at a large scale, featuring angled volumes that protrude out from the rectangular body to set up the smaller, more pronounced triangular volumes above. Above the base building, triangular balconies continue the sawtoothed motif, while more triangular protrusions wrapping around all faces of the tower create the appearance of chamfered corners.

An outdoor terrace appears on the roof of the base building, and wraps around the tower on all sides but the south, creating 904m² outdoor amenity space that is accessed from an indoor amenity level occupying the full floor plate of the tower’s initial level (the fifth storey). From that point on, the remainder of the tower is residential, with a total of 37,953m² of residential floor space divided between a mix of studio to 3-bedroom units. Of the 629 total layouts there are 44 studios, 418 are single-bedrooms, 101 two-bedrooms, and 66 three-bedrooms, slightly bettering the City’s 10% minimum requirement for family-sized suites.

UrbanToronto will continue to follow progress on this development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

* * *

UrbanToronto’s new data research service, UrbanToronto Pro, offers comprehensive information on construction projects in the Greater Toronto Area—from proposal right through to completion stages. In addition, our subscription newsletter, New Development Insider, drops in your mailbox daily to help you track projects through the planning process.

Source Urban Toronto. Click here to read a full story

TAKOL, CMCC Buy Land to Develop GTA Industrial Condos

TAKOL Real Estate Inc. has specialized in selling industrial condominiums in the Greater Toronto Area (GTA) since its inception in 2015 and is now moving on to its first ground-up development.

To this point the private Canadian boutique commercial real estate investment and asset management company has largely been buying small bay, multi-tenant industrial buildings constructed in the 1970s and ’80s, converting their titles to condo, then selling individual units within the properties.

The bulk of TAKOL’s investment has been in Brampton and Mississauga based on decisions revolving around demographics, immigration and population growth.

“The growth of the GTA has been phenomenal and no one’s built small-bay industrial in almost 40 years,” TAKOL principal of investments Daniel Kolber told RENX.

“The supply-and-demand equation has skewed and we’ve seen tremendous growth in industrial rents in the GTA in the last five to eight years — effectively a tripling of rent.

“I think that tremendous growth in rents has driven a desire for people to own their own real estate. Why keep paying higher rents to a third-party landlord when you can pay yourself and hedge yourself against further rent inflation?”

Off-market acquisition in Milton

TAKOL and partner CMCC Capital Funds have acquired 19 acres of land in the Derry Green Corporate Business Park, a bit further west in Milton, for $27.7 million from a private vendor in an off-market deal.

The TAKOL/CMCC plan is to build 67 small-bay industrial condo units in a 420,000-square-foot development called Milton Gates Business Park.

It’s the same area where Oxford Properties just announced it has started construction on its massive, 3.3-million-square-foot James Snow Business Park, but the first phase of that project is focused on larger bay product.

Kolber believes that, had the TAKOL property been widely marketed, it could have sold for close to double the price. While the majority of TAKOL’s acquisitions have been made off-market, they’ve all been brokered through an agent.

“We’re deep-value investors in terms of our strategy, we’re not cap-rate buyers,” said Kolber. “We’re delivering very strong double-digit internal rates of return to our investors deal after deal after deal.

“We may not always be the highest bidder on a widely marketed deal and we’re fine with that. I’d rather not beat out 20 other people and say, ‘I paid more than 20 other people and I won this project.’ We’re not Blackstone.”

CMCC focuses on residential and commercial developments in major Canadian centres. Since 2011, it has formed five private real estate funds totalling in excess of $400 million in committed capital in addition to more than $100 million in parallel investments.

The company has generated consistent annualized returns of 18 to 25 per cent across more than 50 investments.

TAKOL and CMCC have partnered on a half-dozen deals and both thought working together on the Milton Gates Business Park development would be a good fit.

Milton Gates Business Park plans

The proposed Milton Gates Business Park development is going through the approvals process.

The municipality wanted small-bay industrial at the gateway site at the corner of Derry Road and Sixth Line, so it was a good fit for TAKOL’s 10-person team.

All approvals and permits should be in place next year and it’s hoped the first industrial condo units will be delivered in 2024.

Units will range in size from approximately 3,000 to 12,000 square feet, including a small office component, and those looking for more space can buy multiple units.

Marketing and sales will begin soon and pricing will be in the $450-per-square-foot range.

“There will be a base building condition and then if people want some further work we can do some fit-up on a case-by-case basis,” said Kolber. “But I suspect most buyers will want to do their own fit-up.”

TAKOL’s founders

Kolber is also the president and broker of record at TAKOL’s affiliate, KOLT, Keller Williams Real Estate Associates, Brokerage, the real estate brokerage that handles all of the company’s sales and leasing.

He’s also president of KOLT Management Inc., TAKOL’s affiliate property and condo management company.

TAKOL co-founder Takashi Yamashita, the Toronto-based company’s principal of development, has a diverse background as an architect (Smith Carter Architects and Engineers Incorporated), a private equity developer (The Rose Corporation) and a commercial real estate lender (GE Capital Real Estate).

Kolber said TAKOL considered getting into the residential condo market but has, at least for now, backed off due to rising construction costs, increased interest rates and supply chain issues.

Kolber has a background in retail real estate as the former vice-president of asset management for OneREIT.

He would like to find a value-add shopping plaza in which to invest, but the returns from small-bay industrial have been so good it will remain TAKOL’s near-term focus.

Looking ahead at TAKOL

The company is working on another off-market acquisition, this one for 25 acres in the western GTA, and is trying to tie up another half-dozen condo conversion sites with funds from earlier industrial condo sales.

“Between September and March, we’ve got about $100 million worth of condos that we’ve pre-sold that are getting registered and that will be closing,” said Kolber.

TAKOL has partnered with family offices, public companies and high-net-worth individuals, using a special purpose vehicle for each investment.

The appetite for more deals is strong at the moment and Kolber said the company is always looking to work with new investment partners, agents and brokers.

“We’ll always give people a quick yes or no. We don’t like dragging people along if we’re not serious on something. If people want to show us something, I hope they’ll reach out and see if we can do some business.”

Source Real Estate News EXchange. Click here to read a full story

Oxford Building Phase 1 at $825M GTA Industrial Park

Oxford Properties has broken ground on the $825-million James Snow Business Park in the Greater Toronto Area town of Milton, where it plans to build a highly sustainable logistics hub of up to 3.3 million square feet.

The master-planned project is planned to contain 14 buildings and will be developed in phases at the 180-acre site. The initial phase now under construction comprises four buildings and about 1.55 million square feet of space, and is being built on spec.

Oxford has developed other industrial projects of this scale, but the firm’s head of industrial for North America, Jeff Miller, told RENX this is its first in the GTA.

“It’s very exciting. We’ve done a bunch of these across Canada and in the U.S. through our U.S. companies, so we are pretty excited to kick off a master-planned park in the Toronto area,” Miller said. “As we know it’s going to satisfy a huge need on the supply side; there really is a massive lack of real estate infrastructure right now.

“Toronto has got the lowest vacancy rate of major markets in North America . . . I think GTA just hit 0.3 per cent, not availability but just vacant. It is flat out nothing available.”

James Snow Business Park’s scale, flexibility

He said the scale of the James Snow Business Park also increases the flexibility of the types of product it can deliver for prospective tenants.

This phase, for example, includes state-of-the-art buildings ranging from about 75,000 square feet (two buildings) through 300,000 square feet and up to a million square feet of leasable space.

“We almost view these master-planned parks like an ecosystem where we can accommodate all kinds of different sizes and different types of industry and business for employers,” he explained.

“Over time they kind of interweave and work with each other, is the intent, if we have (unit) sizes from 15,000 square feet to over a million.

“To be able to create this product but to do it in a sustainable way is so important for us and increasingly important for our customers as well.”

Oxford builds in sustainability features

On the sustainability front, Oxford is incorporating solar power systems into the design of a spec project for the first time.

The four buildings include 400,000 square feet of solar photovoltaic arrays to provide 3.8 million kWh of renewable energy annually.

The James Snow park will target LEED certification and includes what Oxford calls “substantial work to preserve, restore and enhance the local natural heritage system.”

The design was created in collaboration with Denmark’s ak83 architects and local firm Glenn Piotrowski Architect.

“Advancing the sustainability initiative in industrial is a key priority for Oxford. We have historically on the construction side achieved LEED – it’s kind of the price of admission almost, where we are going to get base LEED environmental certification.

“The real question is how do you get beyond that. How do you install solar? Can we move to net-zero for industrial? So it’s been super important for us to incorporate this across the park.

“We are now going to incorporate the solar as part of the base building infrastructure no different than the dock equipment, the lights and the roof. It is going to be part of the use building so our tenants will have clean energy from Day One.”

Two years of site preparation work

Oxford acquired the property about four years ago as a greenfield site in an area which was already designated by the town for future growth.

It’s part of the Derry Green Secondary Plan, Miller said, and Oxford then worked to take it through the various approvals and entitlements.

For the past two years, a massive amount of site work and preparation has been underway.

“We’ve had two years of infrastructure where we’ve had to build two roads, the pond, the greenspace,” Miller said. “We’ve imported a million cubic metres of fill, a hundred thousand truckloads of fill.”

The decision to move ahead on spec reflects the extended period of tight industrial availability across the GTA – currently well below one per cent – and what Oxford is hearing from its own existing tenants across the region.

Essentially, there is a strong belief demand will continue.

“We own eight million square feet in this market (essentially the Metro West submarket) and we know through our existing customer base the inherent demand that’s there,” Miller said, noting inquiries from prospective tenants generally start once a building is actually being raised.

“We definitely have a strong belief that it’s there, and it’s going to continue to be there. And, it could actually be from our own portfolio.”

Tailwinds for light industrial sector

Despite some pullback in the e-commerce sector by companies such as Amazon (though much of that has been focused in the U.S.), Miller said there are many components to the light industrial boom.

“One of the things about industrial that I still believe in is just the huge variety and the breadth of companies that occupy facilities around an 800-million-square-foot market,” he said.

“There literally is every type of business under those roofs.”

Global instability and supply chain issues continue to be a factor as well. He said third-party logistics companies, needs- and tech-based firms and other light manufacturers are continuing to expand and consider on-shoring more of their operations.

Milton itself has seen a flurry of industrial land trades and development starts over the past year or two as demand has spilled over from the urban core areas.

Miller said there are several reasons for this.

“I’d say a combination of a couple of things. First of all it’s availability of land and it’s also the proximity to one of the largest markets in North America.

“It is really part of the fabric of industrial logistics,” he observed, noting that in the U.S., emerging light industrial hubs “can be an hour outside of the core. Milton is five minutes away. It’s not out there by any means.”

Oxford plans to deliver the four Phase 1 buildings during the latter part of 2023. At that point, Miller said, decisions will be made about the second phase.

Source Real Estate News EXchange. Click here to read a full story

Madison Group’s Submitted Plans for a Two-Tower Mixed-Use Development on Eglinton East

Toronto’s ever-evolving Eglinton Avenue has become so familiar with construction and development in recent years that any breaking news in the sector has a tough assignment when it comes to standing out. Still development continues, like Madison Group’s recently submitted plans for a two-tower mixed-use development located at 110 Eglinton Avenue East, between Yonge Street and Mount Pleasant Road, with a plentiful gross floor space area (GFA) of 94,903m².

Designed by Turner Fleischer Architects, the towers sit atop a 9-storey mixed-use podium and soar to 59 and 57 storeys, reaching heights of 207 and 201m respectively. Interestingly, the entire development is defined visually by a prominent curved recession on the south elevation, reminiscent of a tuning fork, that hopes to strike a chord with prospective renters. But beyond the 1,116 new dwelling units the proposal offers, a wealth of retail and office space in the podium add another level of depth to the pending development.

With applications for Official Plan Amendment (OPA), Zoning By-law Amendment (ZBA) and Site Plan Control submitted last month, the proposal hopes to be approved because of its alignment with the guidelines of different planning policies including the Yonge-Eglinton Secondary Plan. The case is supported by the site’s location within the Yonge-Eglinton Urban Growth Centre, which also meets the criteria of a major transportation station area, with Eglinton subway station within a 250m walk.

The mostly rectangular site has a total area of 5,450m², with a 91m frontage along Eglinton Avenue East. Two buildings occupy the site currently: a 9-storey office building with retail at grade at 90 Eglinton Avenue East and a 7-storey mixed-use building with retail, commercial, and office space, at 110 Eglinton Avenue East. The proposal would see both buildings demolished in favour of a development that responds not only to the planned and existing context of the area, but also to the changing needs of an increasing population.

The proposal intends to accommodate all the building’s non-residential programming in the 9-storey podium section while providing space on the ground level for two residential lobbies — one for each tower. The ground level would also be occupied by the office entrance and lobby, as well as two retail spaces, both with access from the Eglinton Avenue frontage. On the second level, the entire area of the 3342m² floor plate is reserved for retail purposes, while the subsequent levels 3-6 would house the entirety of the development’s office space in a similar layout.

At the seventh level, the first residential units appear, along with a long and narrow outdoor amenity space in the form of a terrace stretching the width of the building’s northern border. Units at this level will also enjoy private terraces that wrap around the east, west, and south faces of the building. The subsequent levels are all residential, with a mix of one- to three-bedroom options amounting to 76,632m² of total residential floor space area.

Another significant outdoor amenity space is found on the roof of the podium, on the 9th level, which also marks the beginning of the towers, bordering the east and west edges of the podium with a separation of roughly 15m between them. From that point on, the floor plan remains generally consistent, with the proposal’s 3,700m² of total amenity space already laid out below and no further stepbacks.

As previously noted, the building’s massing is characterized by the curved recession that emerges at the base of the towers and extends up their entire southern elevations. Additionally, the massing of the structure changes significantly between the first and second storeys to effectively facilitate loading and back-of-house services in a non-disruptive manner. While the building takes on its full form at the second level, large cutouts appear on the north side of the site to accommodate a loading and staging area, and the ramp leading to underground parking. The ramp leads to three levels of underground garage space, with a total of 366 vehicle parking spaces and 1,242 bicycle spaces.

UrbanToronto will continue to follow progress on this development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story