Land Prices for High Density GTA Properties Drops in Q2

Land Prices for High Density GTA Properties Drops in Q2

The latest stats are in for high density land prices in the Greater Toronto Area (GTA).

Real estate advisory firm Bullpen Research and Consulting Inc. and land use planning and project management firm Batory Management have teamed up to review and provide projections on GTA high-density land sales on a quarterly basis.

In general — not unlike the single-family home market — prices were down for pieces of GTA real estate that will one day house towering structures packed with residents.

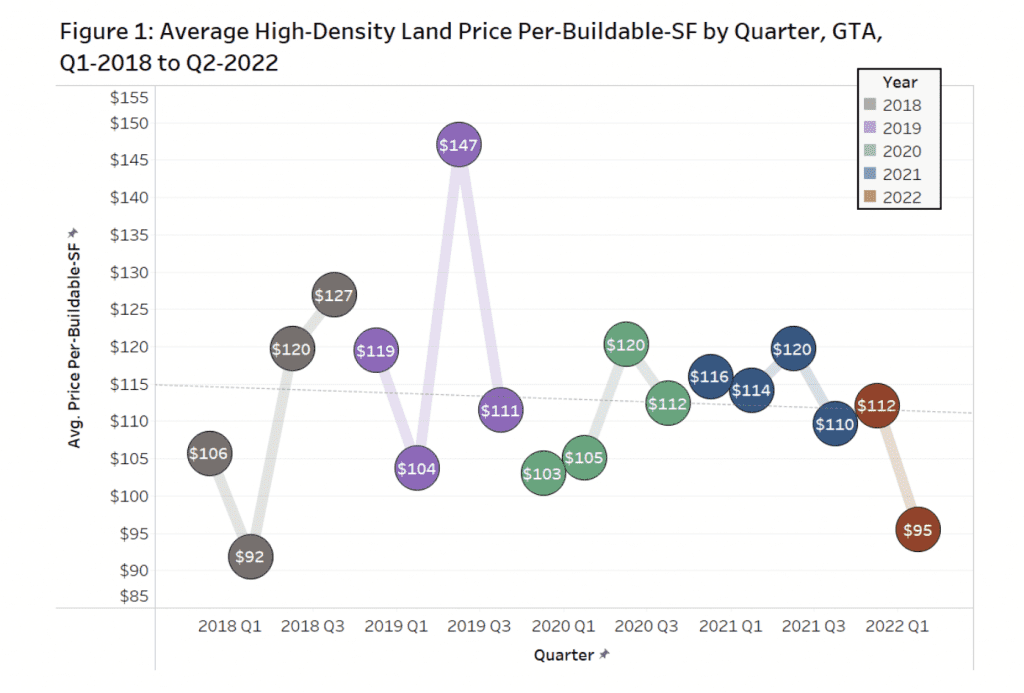

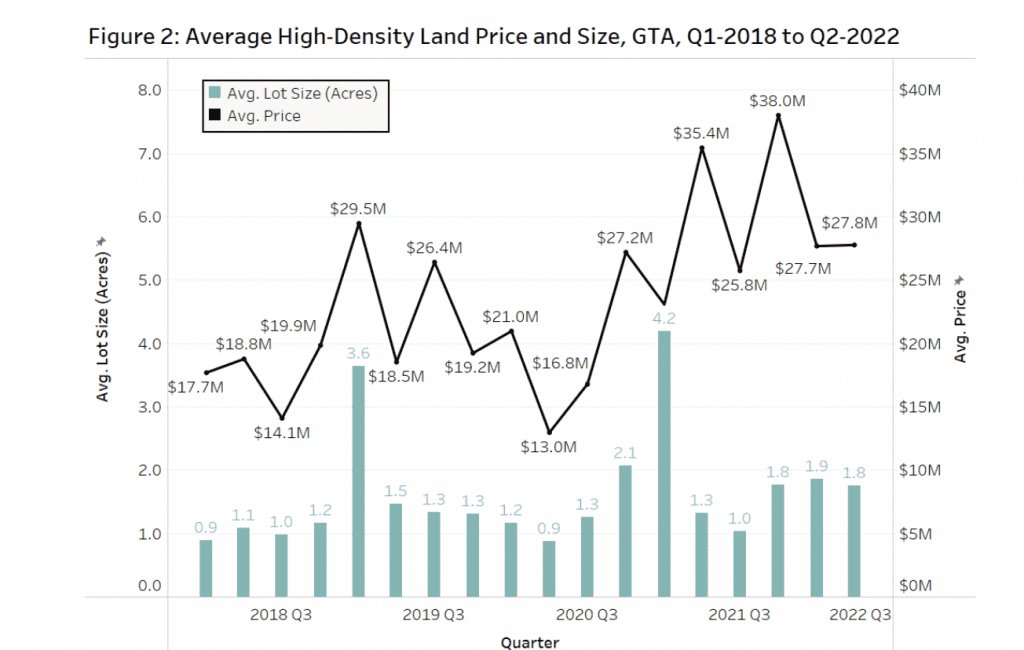

A total of 46 transactions in the GTA were reviewed for the report. It revealed that the properties sold for $95 per buildable square foot (pbsf) on average, down from last quarter ($112 pbsf). The average property sold for $27.8M for 1.8 acres.

In Q2-2022, the average land-to-revenue ratio was 7.2%, compared to 8.8% in Q1-2022.

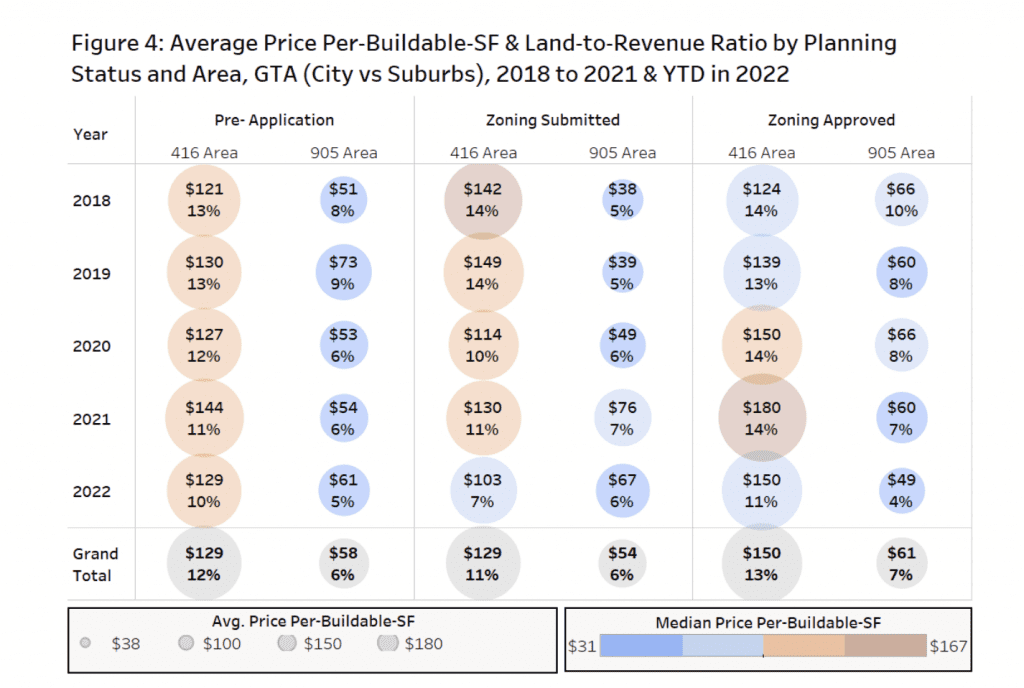

In Q2-2022, the land-to-revenue ratio in the ‘416’ area lands was 8.1%, with ‘905’ area lands had an average land-to-revenue ratio of 4.9%. These are down from the longer-run average of 11.8% and 6.5%, respectively.

High-density lands sold for $135 pbsf in the former City of Toronto in Q2-2022 (pre-amalgamation boundaries), with North York at $103 pbsf, and Scarborough at $50 psf.

Over the past 4.5 years, the average land sold pre-application had a land-to-revenue ratio of 12% in the ‘416 area’ compared to 13% for zoning approved lands. In the ‘905’ or suburban markets, those numbers at 6% and 7% respectively.

As the report highlights, the drop in land prices comes at a time when developers face a looming nearly 50% increase in development charges and a potential hike in construction costs of 7 to 10% in the next 12 months. “There is worry that developers can no longer shrink unit sizes to further boost revenue-per-square-foot without moving forward with 30-40% more studio apartments, which then puts absorption in jeopardy,” reads the report.

A the same time, sky high interest rates and a softening of the resale market has impacted demand.

The report suggests the developers and vendors will take a “wait and see” approach, resulting in fewer transactions in the second half of the year and a flattening of land prices.

Source Storeys. Click here to read a full story