Q1 2022: Investor Demand Continues To Be Strong With Heightened Investor Scrutiny

Q1 2022: Investor Demand Continues To Be Strong With Heightened Investor Scrutiny

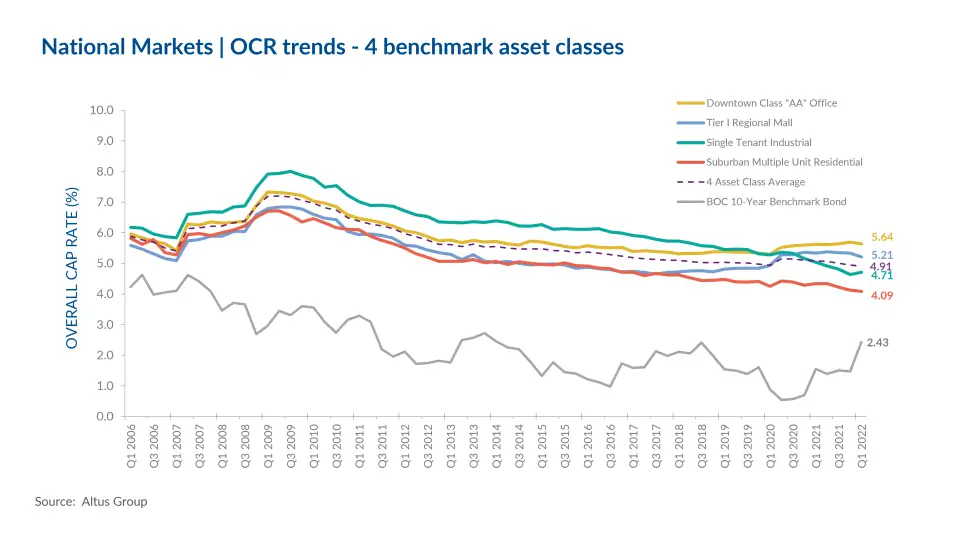

The latest results from Altus Group’s Canadian Investment Trends Survey (ITS) for the four benchmark asset classes show that the Overall Capitalization Rates (OCR) dropped to 4.91% in Q1 2022 compared to the previous quarter which was at 4.94%, and from 5.08% in Q1 2021, with cap rates remaining mostly steady. With the Omicron Variant and a lockdown in the second part of Q4 2021 slowing activity, the first quarter of 2022 has seen boosted activity levels.

Employment in February climbed by 337,000, more than compensating the losses seen driven by the tighter public health measures in the fourth quarter of 2021. This addition in jobs has dropped the unemployment rate to 5.5%, beating pre-pandemic levels for the first time since February 2020. With new jobs being created, the number of vacancies can also be seen dropping. According to Statistics Canada, job vacancies were down 5.4% from the beginning of December 2021, but up 62% as compared to the first quarter of 2020, prior to the onset of the pandemic. The sectors hardest hit in terms of job vacancy declines were the food and accommodation services sector and the arts, entertainment, and recreation sectors. Meanwhile, the construction sector and professional, scientific, and technical services sectors noted increases in employment. With vacancies dropping in the construction sector, investment in non-residential building construction continues to rise, up by 1.5% in January 2022 from the previous month reaching the $5 billion dollar mark for the first time since June 2020. The drop in vacancies along with the increase in non-residential building investment is reflective of the increase in activity in the commercial sector. After a tough year riddled with volatility, lockdown measures, and labor shortages, 2022 has begun with recovery on the horizon, and expected to continue the momentum throughout the year.

The Bank of Canada bond rate as of March 2022 was reported to be 2.43%, continuing its upwards trend from the 147-bps recorded in the fourth quarter of 2021. As the Bank of Canada continues to focus on inflationary control measures, the average internal rates of return were seen increasing the most in the Downtown Class “AA” Office asset class and dropping the most in the Suburban Multiple Unit Residential asset class. Overall, the Internal Rate of Return was 616-bps, rising from the 478-bps seen in the fourth quarter of 2021.

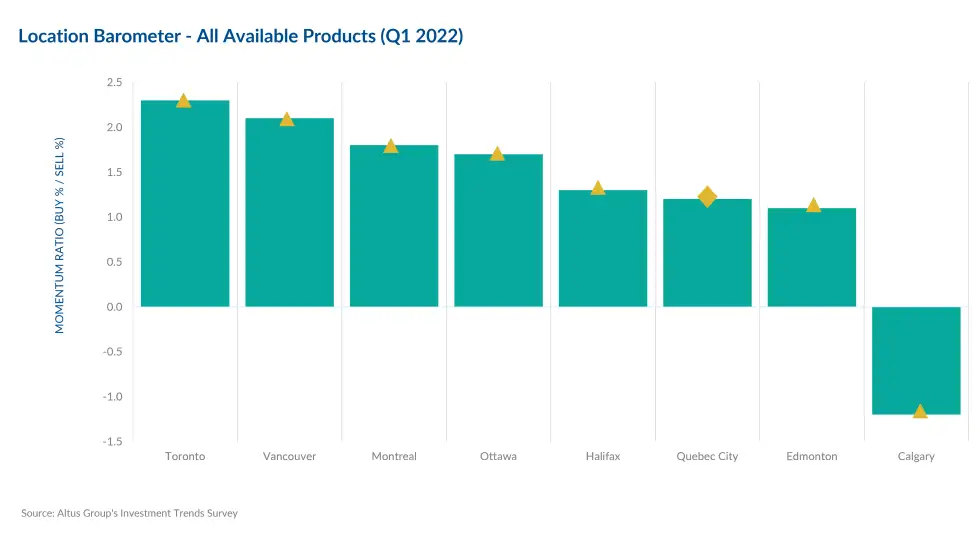

The Canadian commercial real estate space has faced many challenges as the pandemic has highlighted vulnerabilities and catalysed shifts in demand for typically high yielding assets such as office and retail. Compared to the previous quarters, the location barometer for available products in the third quarter showed an increase in all markets except for Calgary, which reported a downturn. According to Altus Group’s Investment Trends Survey for Q1 2022, the top three markets preferred by investors, Toronto, Vancouver, and Montreal, respectively (Figure 2), were also the most active in investment volume as of the 2021-year end. Still, many other regions have remained resilient and managed to grow in the first quarter of 2022, primarily due to pent up demand and lack of investment product amongst other macroeconomic challenges.

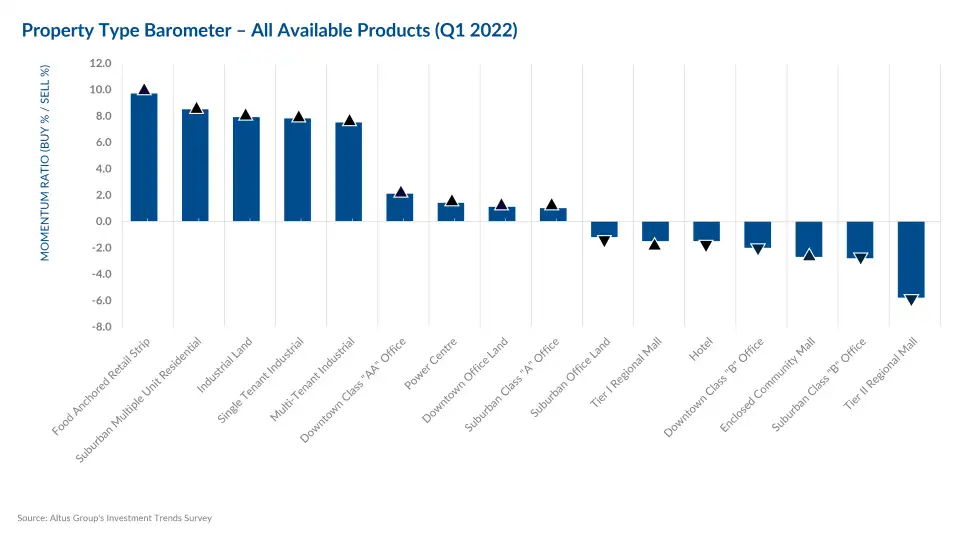

The top assets preferred by investors this quarter were Food Anchored Retail Strip, Suburban Multiple Unit Residential, and Industrial Land, with Suburban Multiple Unit Residential assets reporting the largest upswing in momentum ratio (Figure 3). These products have generated great investor interest due to their essential nature, and flexibility for redevelopment. These characteristics are increasingly vital to investors due to the rapid shift in consumer preferences as we weather the loosening of restrictions and sixth wave. While activity in the first quarter of 2022 reported an uptick with some deals from the previous year going through, and renewed optimism catalyzed by loosening restrictions, a note of cautiousness is retained in the market with persistent inflation and the Bank of Canada raising interest rates within the quarter with highly likely more increases throughout the year.

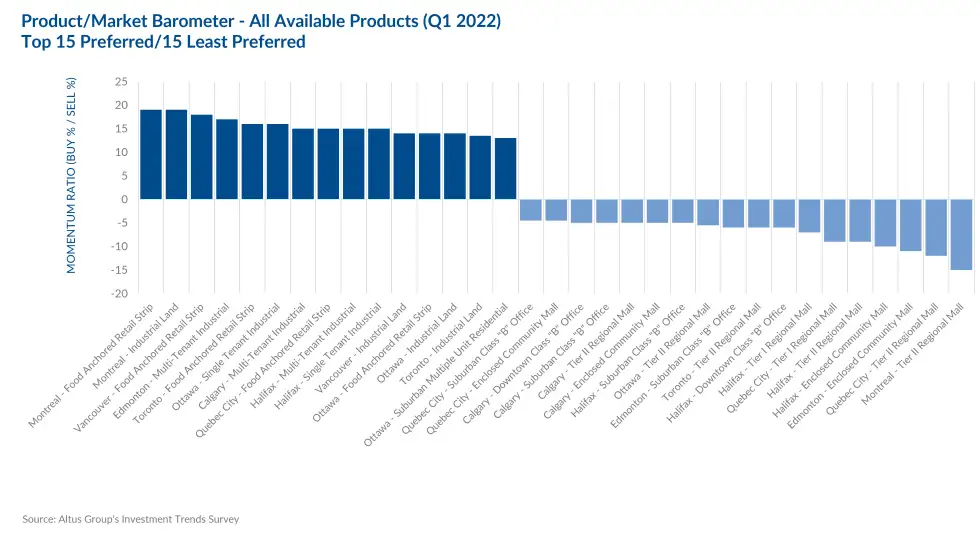

The assets with an increase in investor momentum were also some of the less preferred products, with the least preferred product this quarter being Tier II Regional Malls. When looking at the Product/Market Barometer, the bottom three least preferred assets were all retail. Enclosed Community Mall in Edmonton, Tier II Regional Mall in Quebec City, and Tier II Regional Mall in Montreal were the least preferred, with Montreal Food Anchored Retail Strip and Industrial Land ranking first and second as most preferred by investors (Figure 4). Retail has continued to struggle, especially owing to the changes in public health measures, and with investors trying to figure out and meet consumer needs, assets in secondary markets with prime locations are likely to be those positioned for potential redevelopment.

While 2022 is poised for growth and recovery as the commercial real estate space stays resilient, market impacts of the current geopolitical climate, the sixth wave, and economic challenges will become slowly apparent as the year progresses.

Market highlights for the quarter include:

- The office sector has continued to face volatility as employers continue to redefine their return to office plans and better accommodate employee needs. Downtown Class “AA” Office cap rates decreased slightly from 5.69% in the previous quarter to 5.64% in the first quarter of 2021. Quarter-over-quarter, the Vancouver, Edmonton, Toronto, and Ottawa markets saw a compression in cap rates. Meanwhile, Quebec City and Halifax saw an increase, with the Calgary and Montreal markets remaining the same.

- The demand for industrial product remains strong with the cap rate for Single-Tenant Industrial product increasing slightly and going from 4.64% in the previous quarter to 4.71%. While a compression in cap rates was seen in the Vancouver and Calgary markets, they stayed the same in the Edmonton, Toronto, and Ottawa markets. Meanwhile, the Montreal, Quebec City, and Halifax markets saw an increase in cap rates.

- Tier I Regional Mall cap rates continued to compress dropping from 5.34% in Q4 of 2021 to 5.21% in Q1 of 2022. While cap rates rose stayed the same in the Toronto market, they trended downwards across all other major markets, further attesting to the recovery seen in the asset class. With malls and other retailers opening with restrictions easing has brought a fresh sense of renewed optimism to the retail sector.

- In the first quarter of 2022 cap rates for Suburban Multi-Unit Residential assets continued to compress, dropping slightly from the 4.13% seen in the previous quarter to 4.09% in Q1 2022. A compression in cap rates was seen across Edmonton, Calgary, Halifax and Quebec City, whereas an increase was seen in the Vancouver and Toronto markets. The Ottawa and Montreal markets continued to remain steady.

Source Altus Group. Click here to read a full story

20bet | Sep 20,2023

Your article gave me a lot of inspiration, I hope you can explain your point of view in more detail, because I have some doubts, thank you.