Author The Lilly Commercial Team

63-Storey Tower Proposed Atop Brutalist Mid-Rise on Bloor East

Osmington Gerofsky Development Corporation have submitted Official Plan Amendment and Zoning By-law Amendment applications to the City of Toronto to build a tower that would rise to 63 storeys and 209 metres atop a 6-storey Brutalist building on the northeast corner of Bloor Street East and Mount Pleasant Road.

Designed by Hariri Pontarini Architects, precast cladding is proposed for the residential tower that would complement the exterior of the 1968 to 1970-built 350 Bloor East, currently occupied by and branded with the Rogers logo. Heritage specialists ERA Architects are handling restoration of the exterior of the existing John B. Parkin Associates-designed office building, the interiors of which would be demolished and replaced with a contemporary structure.

A restaurant/retail area is proposed to be constructed within the western portion of the ground floor, overlooking Mount Pleasant Road and the Rosedale Ravine. Only the east wall of the existing building, which faces the blank wall of the residential condo building to the east, would be replaced by new construction, with then north, west, and south walls and their wedged precast concrete pillars maintained.

UrbanToronto will continue to follow progress on this development, with a more fully detailed story soon, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

* * *

UrbanToronto’s new data research service, UrbanToronto Pro, offers comprehensive information on construction projects in the Greater Toronto Area—from proposal right through to completion stages. In addition, our subscription newsletter, New Development Insider, drops in your mailbox daily to help you track projects through the planning process.

Source Urban Toronto. Click here to read a full story

Major Lease In Hand, Granite Kicks Off Brantford Biz Park

The first major tenant, global chocolate maker Barry Callebaut, has committed to the Granite Telephone City Logistics Centre which is now under development in Brantford.

Granite REIT’s (GRT-UN-T) 1.7-million-square-foot business park, located an hour’s drive west of Toronto, used the resources of JLL to pre-lease a 409,000-square-foot building to Barry Callebaut that will become a specialty chocolate production facility.

Granite acquired the 92.2-acre Brantford site along the Hardy Road-Oak Park Road corridor for $62.2 million last August.

“We were drawn to Brantford largely by its compelling relative value proposition presented to industrial users and developers,” Granite executive vice-president of global real estate and head of investments Michael Ramparas told RENX.

“It was a node that I considered emerging compared to a lot of the other suburbs around the GTA that were getting a lot of institutional investment. We really saw a value opportunity and that’s what drew us to the region.”

Barry Callebaut will invest heavily in building

Zurich, Switzerland-based Barry Callebaut will invest more than $130 million into its Brantford building, making it its largest capital investment in a North American production facility.

“It will be a somewhat generic facility, but once the tenant is done with their outfit it will be very specific to it, as you can tell by the amount of capital they’re investing in it,” said Ramparas.

Barry Callebaut Group runs more than 60 production facilities worldwide and employs a workforce of more than 13,000. The manufacturer of chocolate and cocoa products had sales of about $7.9 billion US in its fiscal year ending in 2021.

The Brantford factory will create approximately 200 jobs after it’s delivered, which is expected in the first quarter of 2024.

“We’re very excited to be working with a tenant of this calibre and building its new home in Brantford,” said Ramparas. “It’s an obvious location as it relates to Brantford’s strategic strengths in the food and beverage manufacturing and distribution area.”

Granite Telephone City Logistics Centre is targeting a two Green Globes certification, which demonstrates a significant achievement in resource efficiency, reducing environmental impacts and improving occupant wellness.

Ramparas said efficiency and sustainability are very important factors in all buildings Granite either acquires or develops.

Brantford growing and attracting interest

The REIT plans to fill out the rest of Granite Telephone City Logistics Centre with what Ramparas called “modern, state-of-the-art distribution facilities.” He said there’s been plenty of interest from potential tenants for the site.

“We are seeing a number of larger distribution-based tenants coming out of the Toronto market,” JLL executive vice-president of sales and leasing Mitchell Blaine told RENX. “It’s relatively value-priced compared to Toronto.”

Brantford is located along Highway 403, just beyond the western edge of the Greater Toronto Area in the so-called Greater Golden Horseshoe, and has been designated an urban growth centre in the provincial growth plan.

The city’s population is approximately 100,000 and is projected to reach 163,000 by 2041.

“With the pandemic, we definitely saw a dispersion of the labour pool from the surrounding markets into Brantford and the Brant County area,” said Blaine. “We’ve seen some pretty exceptional population growth and projections.

“A real focus for the chocolate folks was access to the labour pool. When the Granite team could match that labour access and value proposition with modern, state-of-the-art facilities along a highway, it was checking a lot of the boxes. That has been a big driver.”

Brantford has a diversified manufacturing sector and a post-secondary education presence via Wilfrid Laurier University and Conestoga College campuses.

Granite is a Toronto-based real estate investment trust engaged in the acquisition, development, ownership and management of logistics, warehouse and industrial properties in North America and Europe. It owns 139 investment properties representing approximately 57.5 million square feet of leasable area.

One of those properties is a 32-acre site occupied by a 398,080-square-foot food manufacturing and distribution facility at 115 Sinclair Blvd. in Brantford that’s completely occupied by Aspire Bakeries.

That site and Granite Telephone City Logistics Centre comprises Granite’s industrial real estate presence in Brantford, but Ramparas said it’s looking at other properties in the area and called it “a big acquisition target for us.”

Other Brantford industrial development activity

There’s been plenty of industrial real estate development and transaction activity in and around Brant County over the past couple of years.

Panattoni Development Co. Canada acquired a 423-acre tract of industrial development land for $290 million in April after purchasing 100 acres along Rest Acres Road the previous year.

Two Fiera Real Estate funds acquired five industrial buildings comprising about 940,000 square feet of space for about $118 million from local developer and property manager Vicano Construction Ltd. last year.

The properties ranged in size from about 12,000 square feet to a 530,000-square-foot, one-tenant distribution centre completed in 2020.

The Lasalle Canada Property Fund bought the 527,568-square-foot Procter & Gamble national distribution centre from GWL Realty Advisors last year.

Paris, Ont.-headquartered 214 Carson Co., which focuses on mid-sized industrial developments in Southwestern Ontario, owns 26 acres of industrial land in Brant County.

It’s developing a 125,000-square-foot building and a 51,000-square-foot building, and adding 50,000 square feet to an existing building in the county.

Blaine said Brantford’s industrial availability rate was an extremely low 0.95 per cent in Q2 and the local industrial market was performing “incredibly well.”

The biggest challenge is getting facilities built and to market, but Blaine still foresees future growth.

“Servicing, timing and availability of trades still pose challenges. Will there be growth? Absolutely,” he said.

“Can it get here quick enough? Not as fast as anybody, tenants and landlords alike, would like to see.”

Source Real Estate News Exchange. Click here to read a full story

GTA Commercial Real Estate Investment Remains Strong in Q2

Commercial real estate investment in the Greater Toronto Area (GTA) saw another strong quarter, continuing the high-performing streak that began in the second half of last year.

According to Avison Young’s most recent Commercial Real Estate Investment Review, buyers’ willingness to invest in capital during the second quarter of the year “is a testament to their confidence in the market’s stability and prospects for the future amid the constantly shifting post-pandemic landscape.”

Industrial trades led the pack with $2.6B in investment activity — a full $1B more than was seen during the first quarter of the year and $1.2B more than the same time one year prior. This accounted for 36% of overall GTA commercial real estate investment volume. The GTA is well on track to obliterate pre-pandemic industrial investment volumes, with more than $4.1B in trades taking place in the first half of the year. In 2019, the full-year total was $4.3B.

Office and retail sales, on the other hand, were both down quarter over quarter. The report notes that during the previous quarter, office sales were boosted by the sale of Toronto’s Royal Bank Plaza, which was picked up by Zara founder Amancio Ortega for $1.2B. On an annual basis, however, the $1.1B in office investment seen during the second quarter of the year is up substantially from the $349M seen during the same time in 2021.

“With almost $3B in assets changing hands through the first half of 2022, the sector has already eclipsed the annual results recorded in 2020 and 2021 — and the all-time high of $4.3B set in 2019 may be within reach by year-end,” the report says.

Retail was the only sector to fall short of $1B in trades during Q2, and was not only down quarter over quarter, but year over year as well with $696M worth of assets sold. This marks a 30% decline from Q1 investment.

“At this pace as of mid-year, the retail sector’s full- year investment total may fall short of the $3.6-B result achieved in 2021,” the report reads. “Despite being the second-most active asset type by number of trades (trailing only the industrial sector), large deals were mostly absent this quarter, and the average transaction volume of $3.7M was the smallest among all asset types by a wide margin.”

Industrial commercial investment land and multi-residential properties were both up slightly on a quarterly and annual basis. ICI land hopped up 5% from the previous quarter to $1.7B, bringing the yearly total to $3.3B which exceeds every full-year total prior to 2021’s record-breaking $5.8B. Of note, the second quarter numbers were propped up by the $480M sale of 194 acres of agricultural land in Caledon to logistics operator Prologis.

Multi-residential sales grew 10% quarter over quarter to $1B, bringing the 2022 total to $1.9B. With that in mind, the report notes that the GTA is on track to meet or exceed the $3.8B investment high set in 2019. Portfolio sales accounted for 65% of the sector’s total dollar volume during Q2, with four of the five largest transactions being portfolios.

Source Storeys. Click here to read a full story

Office Vacancy Has Increased Across All Office Markets In Toronto, But The Financial District And Downtown West Markets Fared The Worst.

South Core Becomes Leading Office Node

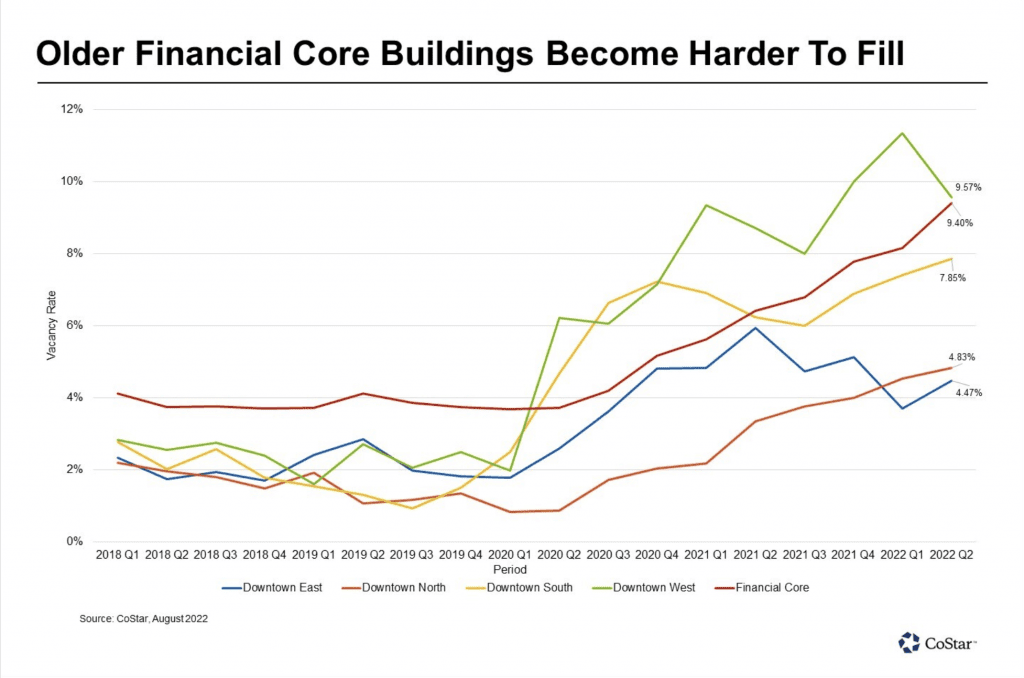

Office vacancy has increased across all office markets in Toronto, but the Financial District and Downtown West markets fared the worst.

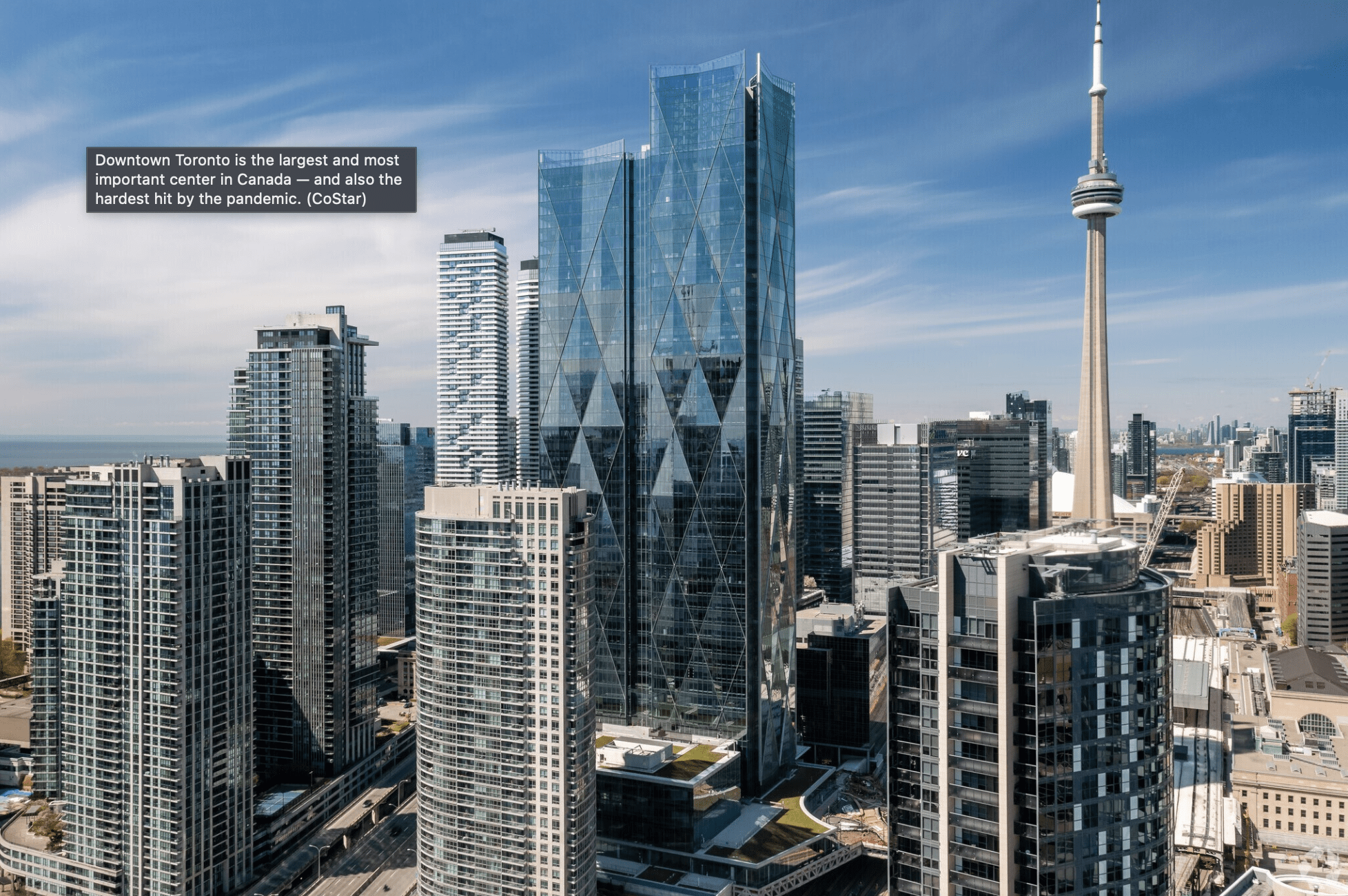

Toronto’s downtown office market is the largest and most important in Canada —and also one of the hardest hit by the pandemic. However, far from a situation of hollowing out, the pandemic has exposed a trend of shifting demand preferences and new development activities outside of the city’s traditional financial core.

Downtown West is home to many smaller tenants as well as tech startups that readily adopted remote work after the outbreak of the pandemic.

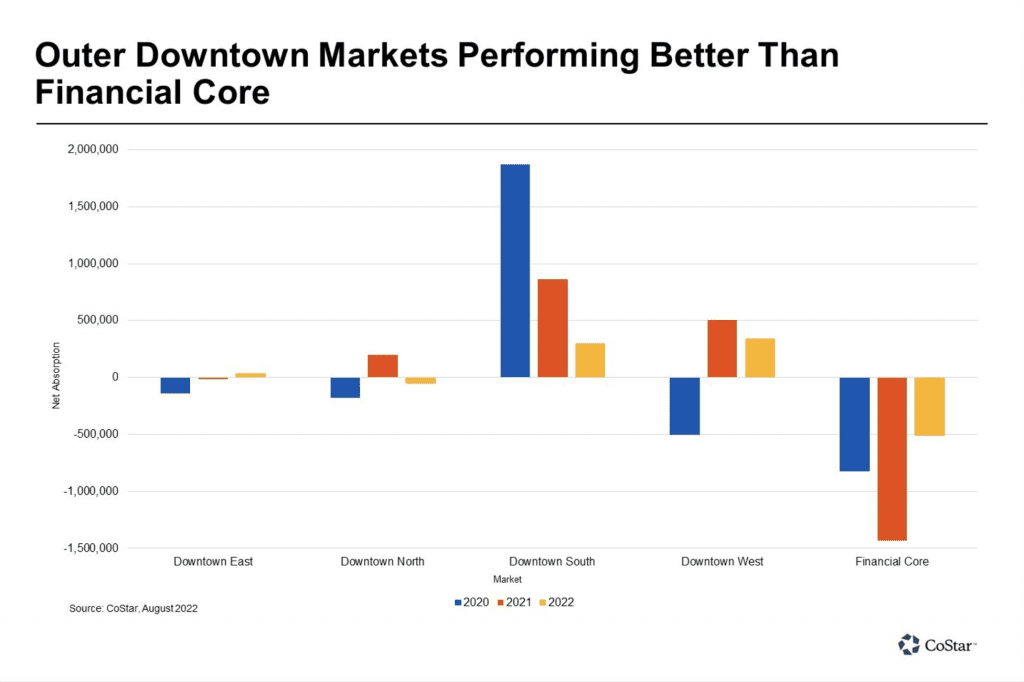

Meanwhile, the Financial District sits in the middle of downtown Toronto and has historically been the home to Canada’s major banks, the Toronto Stock Exchange and the corporate headquarters of many major accounting and law firms. The towers in the district are connected by the PATH, a system of underground walkways filled with shopping and dining options as well as direct connections to the region’s transit system. The market was the most affected during the pandemic, experiencing more sublease availability than any other market. In the initial uncertainty at the peak of the pandemic, several tenants put their empty office space on the sublet market in an attempt to recoup some of their leasing costs while many of their employees worked from home. Some tenants approached landlords for rent relief, but only a few received it.

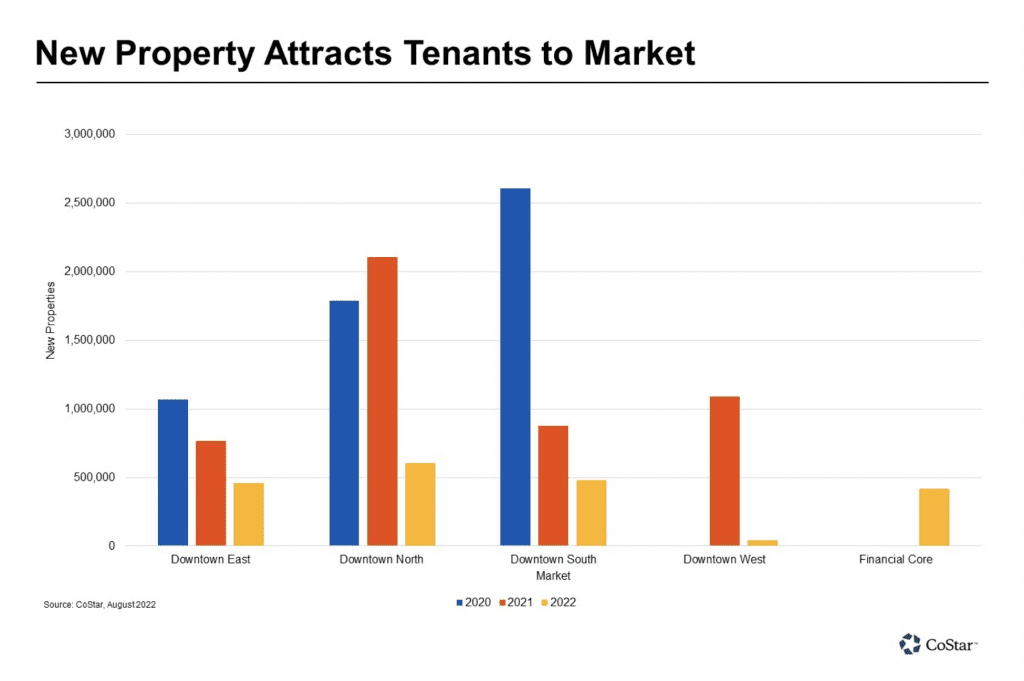

In contrast, demand in other markets such as the South Core remained higher, especially due to the draw of several new buildings. The Gardiner highway at the south end of the Financial District previously demarked the end of the central business district, but with recent upgrades to Union Station providing southern walkway access, developers sought previous industrial land and parking lots primed for redevelopment in the South Core. Advancements to the Toronto transit system spurred developments in the southern area of the city to even expand to add new stations as part of mixed-use development projects in the east and west. With prime access to Union Station, the Downtown South market has brought 3.5 million square feet of new office space to the market since 2020. Noteworthy new construction, such as CIBC Tower I, LCBO Tower, West Block and 16 York have pulled many large and prominent tenants from other markets, leaving those landlords to face the challenge of backfilling vacated space.

The growing need for modern office space — including flexible layouts, connected technology and building apps and improved indoor air quality — has been drawing tenants to newer properties in the South Core for some time now. With the adoption of hybrid work during the pandemic — including highly personalized fit-outs with quality amenities as a way to offset the inconvenience of a commute downtown for their employees — the draw for newer properties compared to more dated layouts in the Financial District only seems to be intensifying.

Newer, state-of-the-art, Class A buildings have been performing well, attracting tenants out of the core and into Downtown South. Examples of this trend are Telus Harbour, RBC Centre and most recently CIBC Square.

Meanwhile the aged buildings in the Financial District are becoming increasingly harder to fill, and available spaces are sitting vacant for nine months on average in a market where blocks of space were previously leased in 4.5 months. To compete with the new construction and address rising vacancies, landlords in the Financial District are increasingly trying to redevelop or reposition properties. The Financial District’s appeal has certainly not gone away. It remains centre ice to amenities that are part of the PATH, TTC and Union Station to the south. So, landlords and owners are busy looking to reinvent some of their dated assets. For example, QuadReal has plans to reinvent its historic Commerce Court. This even includes a proposed new tower at 191 Bay St. on the southeast corner, adding 1.8 million square feet of office space to the core.

Looking ahead as tenants increasingly seek more flexibility and modern amenities in a post-pandemic world, newer towers will likely continue to see the flight to quality. With limited available land in downtown Toronto, areas surrounding the traditional financial core will likely continue to be the location for these new high-quality properties. Meanwhile, the financial core, with its exceptional historical importance and location, will likely continue to see redevelopments and potentially even full-scale new developments, where feasible.

Source CoStar. Click here to read a full story

One of Canada’s Largest REITs Pauses Spending, Suspends Talks to Buy CBC’s Headquarters

Toronto-Based Allied Properties Plans to Focus on Its Existing Operations

One of Canada’s largest real estate investment trusts is hitting the pause button on acquisitions in a decision that extends to Allied Properties’ interest in CBC’s headquarters in downtown Toronto.

Michael Emory, chief executive of Toronto-based Allied, said rising interest rates and inflation have created uncertainty for many businesses but the impact on Allied’s operations have been negligible. Still, the REIT is no longer in talks to buy CBC’s headquarters at 250 Front St.

“We don’t expect material impact over the remainder of the year,” said Emory on a call with analysts. “The impact of acquisition activity has been significant with the result we don’t expect to pursue new acquisitions of consequence in the near term.”

CoStar News reported previously that CBC had hired CBRE to value the 250 Front St. property and that Allied had the right of first refusal on any offer.

“We have suspended discussions indefinitely with respect to the possible acquisition of 250 Front Street in Toronto,” said Emory, noting the company still has rights to match any offer should it come up. “We are intent on growing our business, not shrinking it.”

The current uncertainty has Allied focusing on existing operations and developments for the remainder of the year. Allied owns about 14 million square feet of mostly office and retail properties across Canada.

Allied’s pause in acquisitions comes as some investment banks are factoring in higher cap rates for the valuations of REITs, with CBRE saying this month’s report of soaring inflation and interest rate hikes finally drove the commercial real estate investment market to a tipping point in the second quarter.

“Cap rates rose across nearly all sectors and geographies in the second quarter, driving up the national average cap rate figure to its highest level since before the pandemic,” said CBRE.

In the markets where Allied has operations — Canada’s six largest cities — Emory said he has not seen any evidence of declining valuations.

“We see no evidence of that whatsoever,” Emory said. “The intensity of interest on the part of vendors to transact now has diminished. All the vendors who own assets that could be of interest to Allied are very strong. They are not under any kind of financial pressure, and they are not about to succumb or capitulate to the fear in debt and equity capital markets.”

While some REITs have lowered the book value of their assets, Allied has no immediate plans to do so.

“We don’t expect there to be transactions in our markets that would signal the need for the cap rates applicable to our properties,” said Emory. “There are no trades of concern in our marketplaces at the point in time.”

Even Ottawa-based Shopify’s plans to lay off 10% of staff have not crossed over to Allied’s portfolio, which counts Shopify as a tenant. Shopify is finalizing its office space at Allied’s property at The Well in Toronto, Emory said.

Jenny Ma, an analyst with BMO Capital Markets, asked on the investors call what it would take to get Allied back into acquisition mode. Emory said more macro-certainty.

“If I’m honest, I expected stability [as the pandemic slowed],” said Emory.

Source CoStar. Click here to read a full story

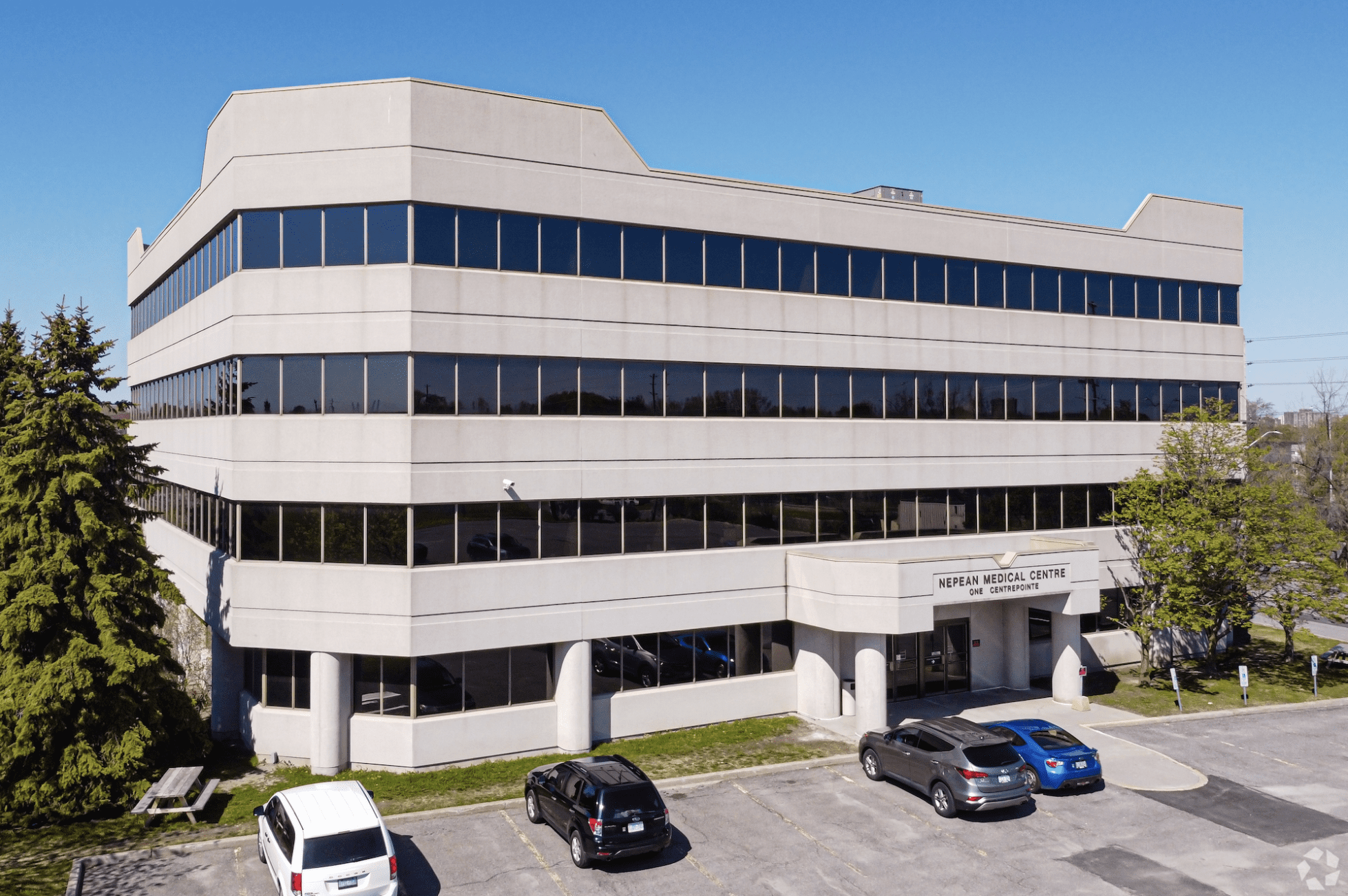

Invesque Sells Canadian Medical Office Portfolio To Focus on Private Senior Housing Assets

Appelt Buys Nine-Building Portfolio That Is 70% Leased

Property owner Invesque, which is based in the United States but trades on the Toronto Stock Exchange, is selling more of its non-core assets, including its nine medical office buildings in Canada for 94.3 million Canadian dollars to Appelt Properties, as it focuses on private senior housing assets.

For Appelt, which owns and operates healthcare real estate across Canada, the deal adds 357,000 square feet to a portfolio of 750,000 square feet under management. The portfolio was acquired through a venture with Toronto-based Centurion Asset Management and includes seven Ontario properties with 280,000 square feet and two in Alberta with 77,000 square feet.

“As active managers who know the medical space well, we believe that finding a value-add opportunity like this is extremely rare. As a company, we are well positioned to unlock significant value in the current vacancy as well as prime development lands,” said Greg Appelt, CEO of Kelowna, British Columbia-based Appelt, in a statement. He founded the company in 2010.

The portfolio is 70% leased to medical and healthcare tenants, including general practitioners, specialists, radiology, laboratory uses and ancillary healthcare service providers.

For publicly traded Invesque, the Canadian properties were part of its reduction in assets that included the separate sale of a medical office building in Orlando, Florida, for US$9.85 million and its equity interest in two 55-and-older developments in Wheatfield, New York, that it sold for US$10 million.

On the CA$94.3 million sale in Canada, Indiana-based Invesque said the pricing was $265 per rentable square foot and represented a 5% cap rate based on trailing net operating income.

“We have been very active over the past year executing on our strategy to simplify our story, simplify our portfolio, and simplify our balance sheet,” said Scott White, chairman and chief executive of Invesque, in a statement. “The recently closed transactions allow us to continue de-levering and simplifying the balance sheet and further positions the Invesque portfolio toward being predominantly private pay seniors housing.”

Invesque’s portfolio now comprises 83 properties with 5,700 units, 7,800 beds, and 190,000 square feet of medical office buildings across 18 states and one Canadian province.

“We view positively on these dispositions as Invesque continues to progress on its portfolio optimization while deleveraging its balance sheet to focus on value creation through private pay seniors housing communities,” said Jenny Ma, an analyst with BMO Capital Markets, in a note to investors.

For the Record

BMO Capital Markets acted as financial adviser to Invesque in connection with the sale of the Canadian medical office properties.

Source CoStar. Click here to read a full story

Toronto Landlord Cancels Dividend Reinvestment Plan as Unit Price Dips Below Net Asset Value

Toronto Landlord Cancels Dividend Reinvestment Plan as Unit Price Dips Below Net Asset Value

One of Canada’s largest real estate investment trusts is canceling its dividend reinvestment plan because its unit price is too low and it’s become difficult for Summit Industrial to find accretive deals.

Toronto-based Summit suspended its dividend reinvestment plan on Friday until further notice, noting the REIT is well capitalized and has a strong balance sheet with significant financial flexibility and liquidity.

“In the best interests of the REIT and unitholders, the REIT wishes to avoid issuing equity at a discount to net asset value per unit, something that can occur from time to time under the DRIP. The suspension of the DRIP at this time is intended to preserve value and eliminate dilution,” said the REIT in a statement.

Paul Dykeman, chief executive of Summit, said the REIT would be issuing equity below net asset value, so it didn’t want to continue with the dividend reinvestment plan with about 15% to 20% unitholder participation.

“It wasn’t a small thing. It was a couple of million a month,” said Dykeman, about shares being issued for distributions. “I think it will be put back in place, but you never know.”

CBRE reported Monday that Canadian commercial real estate investment activity reached a quarterly record of $19.9 billion over 2,631 transactions in the first quarter. The industrial asset class was the most active in the quarter at $6.4 billion in deals.

Summit did a $200 million equity issue in March at $22.15 per share but its unit price has been dropping since and was barely above $16 earlier his month.

“We are sitting on some cash,” said Dykeman, who expects a $60 million deal in the Greater Toronto Area to close this week and another deal in Montreal expected to close soon.

“We don’t anticipate we will be very active beyond our development programs. We might buy some more land but are not going [to buy] until we get a better understanding of where the market is going,” said Dykeman. “We don’t want to issue debt where the market is right now. We are happy to sit on our hands for what hopefully is only a few quarters.”

He said deals are happening in Alberta, where cap rates are higher, but Dykeman believes people still like the fundamentals in industrial.

“Most of our new deals are at $14 [per square foot] or above, and Montreal is migrating to the same place,” said Dykeman. “There is a huge amount of upside in cash flow [on renewal]. The thing no one knows is where inflation will be and how long interest rates will rise. But with only 1% availability in Toronto and Montreal, we will have to have a significant downturn for a prolonged period to change that.”

Source CoStar. Click here to read a full story

Soneil Investments Bucks Fears of Inflation and Buys Properties in Greater Toronto Area

Investment Company Targets ‘Large Pieces of Land in Great Locations,’ Founder Says

Present market conditions aren’t scaring Soneil Investments off from acquisitions as the Toronto-based company pulls the trigger on $86 million in deals the founder hopes will one day benefit his heirs.

Privately held Soneil Investments paid $46 million for a Mississauga industrial portfolio comprising five properties with almost 140,000 square feet of space on nine acres at Dixie Road and Eglinton Avenue, just west of Toronto. The portfolio includes 1331 Crestlawn Drive, 1330 Eglinton Ave. E, and 4700, 4800, 4900 Dixie Road.

“In a high inflation and rising interest rate market, strategically acquiring properties becomes even more difficult,” said Neil Jain, president and CEO of Soneil Investments, in a statement. “We saw immense potential in the opportunity to fill vacancies, raise below market rents, and most importantly, capitalize on the location with a better use in the long-term.”

Canada’s central bank surprised the market last month with a 100 basis point increase in its overnight lending rate. The Bank of Canada is poised to raise rates again at its Sept. 7 meeting, with commentators expecting anywhere from a 50- to 75-basis point increase.

“Markets and policymakers were clearly caught off guard by this year’s inflation spike,” said Avery Shenfield, chief economist with CIBC, in a note issued Monday.

“Our own forecast for Canadian real gross domestic product growth has inflation coming down, and staying down, only because growth slows to well below what used to be considered its noninflationary potential,” Shenfield said.

Soneil’s industrial asset purchase comes with Avison Young describing the Greater Toronto Area as a hotbed of activity with the availability rate down to 0.9% in the second quarter.

“The majority of investor demand for spaces 10,000 square feet and greater during the same time frame was driven by private investors (51%), followed by users (31%) and institutional investors (9%),” said the real estate company in a report.

Soneil Investments has also been embracing the office market in the GTA, having paid $40 million for a 150,000-square-foot multitenant office asset located on six acres at 2233 Argentia Road in Mississauga in May. The company has purchased more than $180 million of assets so far this year.

“Both Dixie-Eglinton and Argentia have the same qualities that drew us to them – large pieces of land in great locations,” said Sach Jain, founder and chairman of Soneil Group of Cos., in a statement. “When the time comes for development, hopefully, my grandchildren will say that we made the right calls.”

Source CoStar. Click here to read a full story

Canadian Grocery Retail Head Touts Low Rents Driving Portfolio Valuation

Cap Rates ‘Somewhat Useless’ To Describe US Portfolio, Says Slate Grocery REIT CEO

The Canadian head of a real estate investment trust focused on U.S. grocery-anchored malls believes it is time to forget traditional capitalization rates or valuations when it comes to his properties.

Blair Welch, chief executive of Toronto-based Slate Grocery REIT, which owns 121 locations in 23 U.S. states, fired back at analysts asking how his company can grow in value even as cap rates continue to rise.

“I think a cap rate is somewhat useless if you don’t know what rate you’re capping. We believe at Slate Grocery REIT, with our rents at $11.82 [per square foot], we estimate that’s probably half of the market. At our existing cap rate, there is tons of room to run,” said Welch.

“You’re buying a significantly discounted rent that should grow your topline revenue. Last time I checked, the only way to make money in real estate is compression of cap rates or growing your rents. I think we all know that cap rates are going up. But Slate Grocery REIT has positive leverage because we can still buy wide cap rates, but we can get significant revenue growth because of our low in-place rents.”

Welch, a founding partner of Slate Asset Management, which owns almost 6% of the REIT, stepped into the top job at Slate Grocery on an interim basis in January of this year. The REIT announced a significant expansion in June when it agreed to purchase a 2.5 million-square-foot portfolio for 425 million U.S. dollars, or 543 million Canadian dollars, a move funded through an agreement with Slate North American Essential Real Estate Income Fund, which Slate Asset Management manages.

The deal with the North American fund brought some of the largest investors in the world into supporting the Slate strategy, Welch said.

Welch said investors need to know where rents are compared to the market and new supply. “I think the neighbourhood-anchored grocery space is extremely compelling because of that,” said Welch.

Jenny Ma, an analyst with BMO Capital Markets, said in an investment note that she believes there is still strong demand for essential retail.

“Notwithstanding our recent downgrade, which was mostly a valuation call, we believe the REIT’s grocery-anchored essential retail portfolio should remain resilient even in a challenging economic environment,” said Ma, who has said she is taking a more cautious view generally on strategies that are heavily reliant on acquisitions and dispositions because of market activity slowing down over the near term amid rising interest rates.

First American Financial Corp., a provider of title, settlement and risk solutions for real estate transactions, predicted at the end of June that slowing asset price growth would push cap rates higher.

“Given decelerating price growth in the first quarter and continued upward movement of interest rates, the potential cap rate is expected to increase in the second quarter,” the company said, noting performance will differ based on the asset class.

“It’s worth noting that decelerating CRE price growth was not distributed evenly across asset classes. Multifamily and industrial assets set first-quarter price growth records, increasing at a faster rate than any other first quarter in the past 20 years, while office and retail assets were a drag on overall CRE price growth in the first quarter.”

Source CoStar. Click here to read a full story

Lease Expiries Creep Up Much Faster Than Most Tenants Expect.

Lease expiries creep up much faster than most tenants expect.

Committing to a five-year term can seem like a lifetime for a business, but that deadline moves up in the blink of an eye.

For a tenant considering renewing or triggering an option to renew, taking care of this impending task is best handled early.

A tenant with no option to renew can approach the landlord at any time to commence early renewal.

Part of that strategy, for the tenant, is catching the landlord prior to them beginning to market the space. The tenant may be in a favourable position to negotiate their best terms before the landlord has to put too much effort forward.

Tenants with an option to renew must be mindful of the notice trigger date. Barring any conflict, there’s nothing to say a landlord wouldn’t renew after a notice to renew has passed, but they are no longer obligated to do this.

For tenants with substantial investment into their leasehold improvement, this could prove a risky mistake.

Tenants backing themselves into corner

Tenants considering a relocation will often ask how much time they need to plan ahead. Sometimes business owners do not want to end up paying rent at two locations, so they put off this task until it’s too late.

Tenants should leave at least a one- to two-month window from offer stage to executed lease, then possession to obtain a new location.

Summer months can take longer for responses to offers if decision makers are holidaying. The same can be said of school holidays as many people choose to take their vacations when their children are off.

The world is hyper-connected but that does not mean that everyone wants to work while on holiday.

The listing agent should know the reasonable time frame for an expected response on any listing, so it is best to ask them for what is achievable.

This is assuming the market has availability, which our current industrial market, for example, does not.

As a result, budgeting for overlap on locations may be necessary to ensure there is no disruption to the business.

Building in buildout time

Municipal permitting for any new improvements can take considerably longer than expected. Between quoting contractors to official approval, this process may take several weeks before work can commence.

Asking a landlord for a fixturing or a rent-free period may be necessary. However, in a market with low inventory they may not be willing to negotiate long timeframes for either of these things.

Budgeting appropriately for all potential expenses and putting in the planning time will place tenants into a much safer position to open their doors to business.

Source Real Estate News EXchange. Click here to read a full story