Invesque Sells Canadian Medical Office Portfolio To Focus on Private Senior Housing Assets

Invesque Sells Canadian Medical Office Portfolio To Focus on Private Senior Housing Assets

Appelt Buys Nine-Building Portfolio That Is 70% Leased

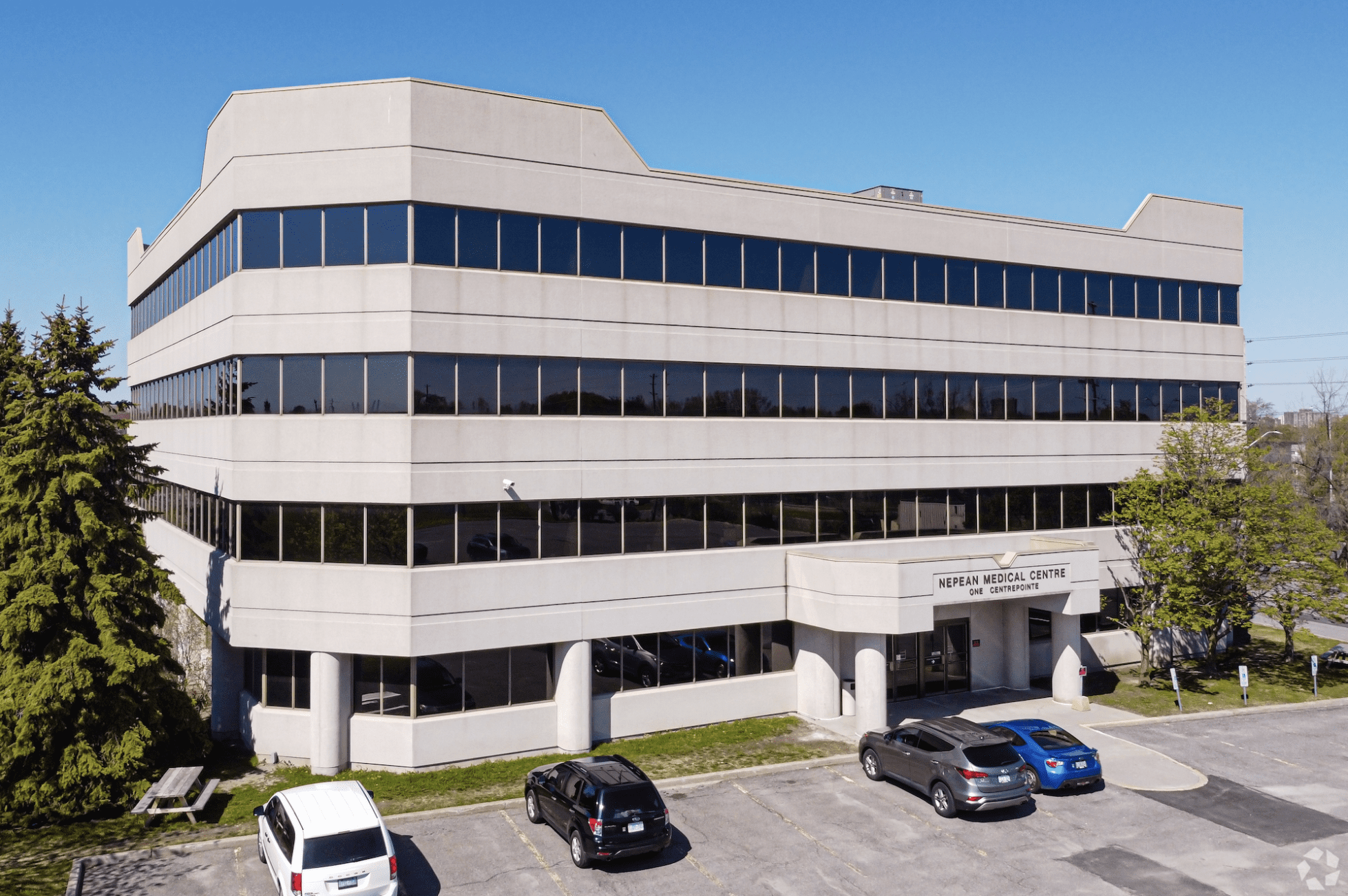

Property owner Invesque, which is based in the United States but trades on the Toronto Stock Exchange, is selling more of its non-core assets, including its nine medical office buildings in Canada for 94.3 million Canadian dollars to Appelt Properties, as it focuses on private senior housing assets.

For Appelt, which owns and operates healthcare real estate across Canada, the deal adds 357,000 square feet to a portfolio of 750,000 square feet under management. The portfolio was acquired through a venture with Toronto-based Centurion Asset Management and includes seven Ontario properties with 280,000 square feet and two in Alberta with 77,000 square feet.

“As active managers who know the medical space well, we believe that finding a value-add opportunity like this is extremely rare. As a company, we are well positioned to unlock significant value in the current vacancy as well as prime development lands,” said Greg Appelt, CEO of Kelowna, British Columbia-based Appelt, in a statement. He founded the company in 2010.

The portfolio is 70% leased to medical and healthcare tenants, including general practitioners, specialists, radiology, laboratory uses and ancillary healthcare service providers.

For publicly traded Invesque, the Canadian properties were part of its reduction in assets that included the separate sale of a medical office building in Orlando, Florida, for US$9.85 million and its equity interest in two 55-and-older developments in Wheatfield, New York, that it sold for US$10 million.

On the CA$94.3 million sale in Canada, Indiana-based Invesque said the pricing was $265 per rentable square foot and represented a 5% cap rate based on trailing net operating income.

“We have been very active over the past year executing on our strategy to simplify our story, simplify our portfolio, and simplify our balance sheet,” said Scott White, chairman and chief executive of Invesque, in a statement. “The recently closed transactions allow us to continue de-levering and simplifying the balance sheet and further positions the Invesque portfolio toward being predominantly private pay seniors housing.”

Invesque’s portfolio now comprises 83 properties with 5,700 units, 7,800 beds, and 190,000 square feet of medical office buildings across 18 states and one Canadian province.

“We view positively on these dispositions as Invesque continues to progress on its portfolio optimization while deleveraging its balance sheet to focus on value creation through private pay seniors housing communities,” said Jenny Ma, an analyst with BMO Capital Markets, in a note to investors.

For the Record

BMO Capital Markets acted as financial adviser to Invesque in connection with the sale of the Canadian medical office properties.

Source CoStar. Click here to read a full story