Office Vacancy Has Increased Across All Office Markets In Toronto, But The Financial District And Downtown West Markets Fared The Worst.

Office Vacancy Has Increased Across All Office Markets In Toronto, But The Financial District And Downtown West Markets Fared The Worst.

South Core Becomes Leading Office Node

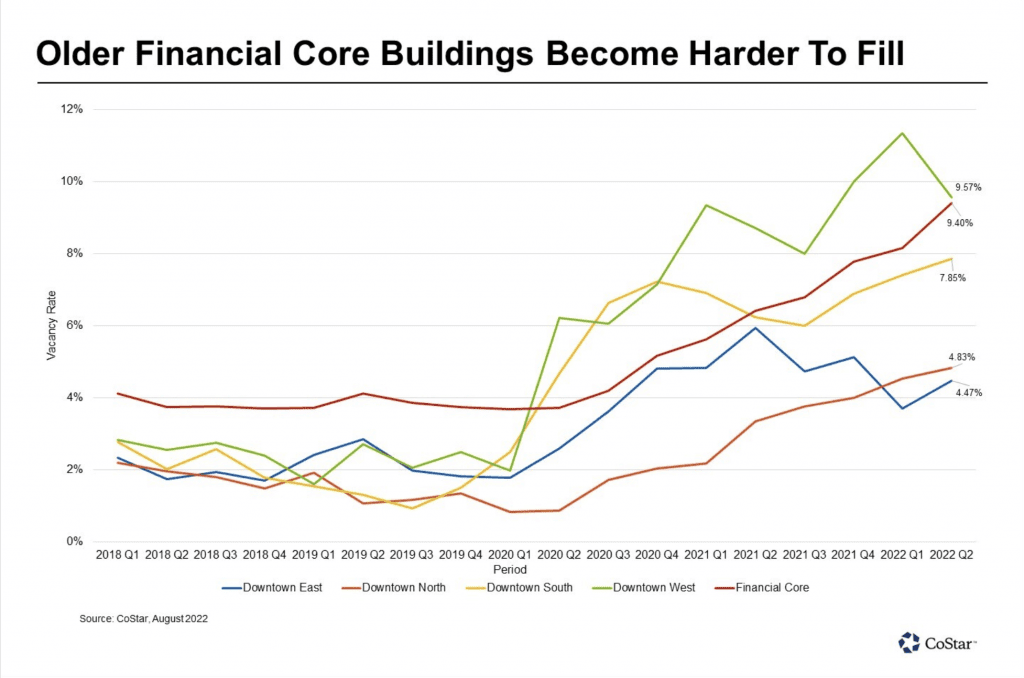

Office vacancy has increased across all office markets in Toronto, but the Financial District and Downtown West markets fared the worst.

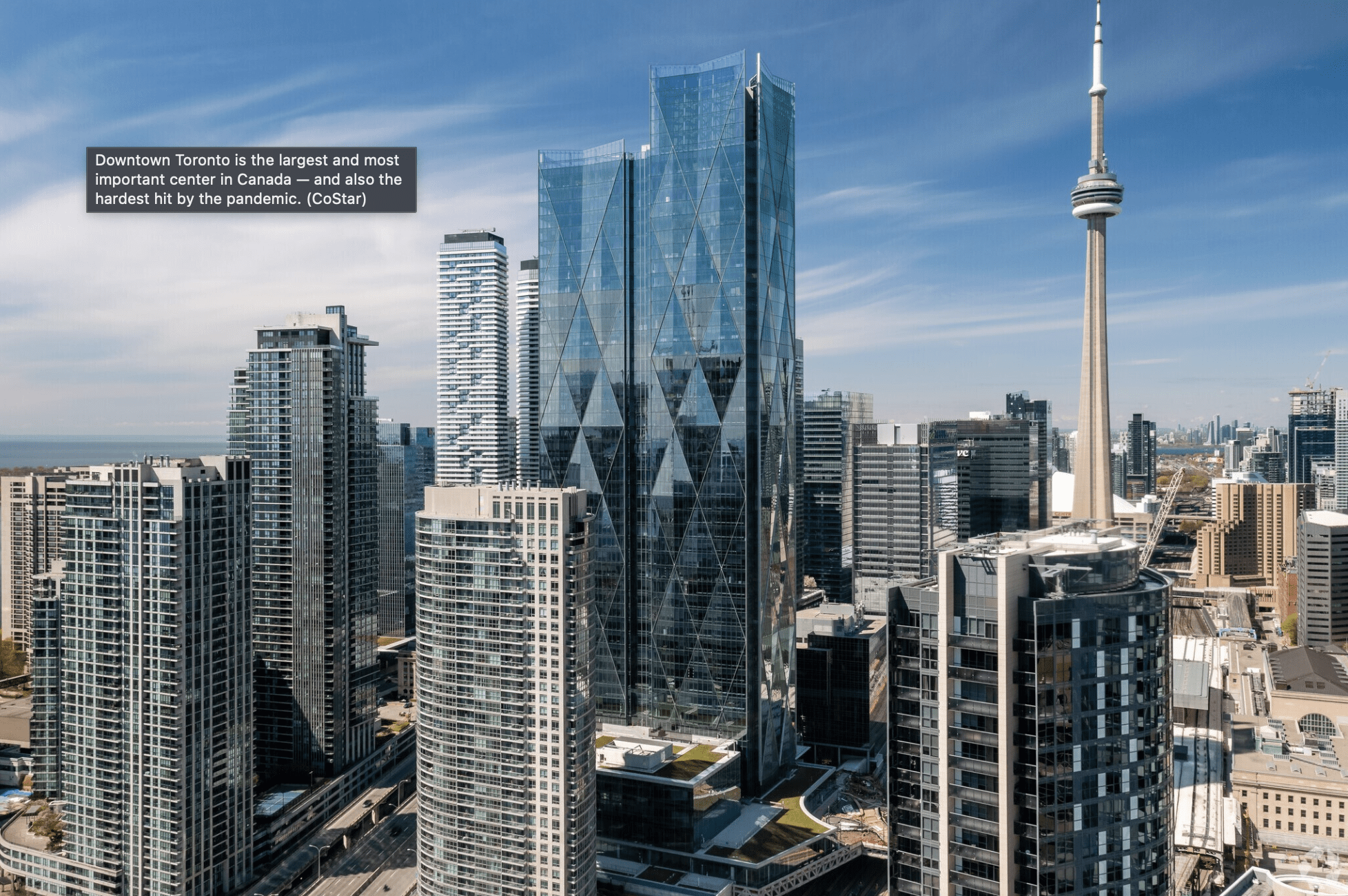

Toronto’s downtown office market is the largest and most important in Canada —and also one of the hardest hit by the pandemic. However, far from a situation of hollowing out, the pandemic has exposed a trend of shifting demand preferences and new development activities outside of the city’s traditional financial core.

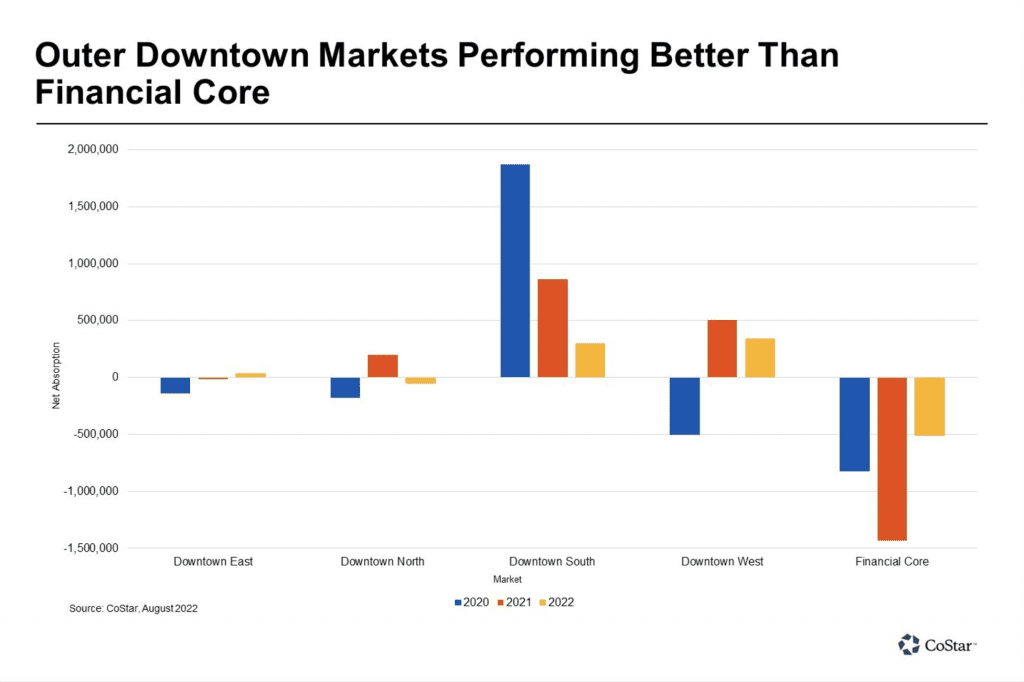

Downtown West is home to many smaller tenants as well as tech startups that readily adopted remote work after the outbreak of the pandemic.

Meanwhile, the Financial District sits in the middle of downtown Toronto and has historically been the home to Canada’s major banks, the Toronto Stock Exchange and the corporate headquarters of many major accounting and law firms. The towers in the district are connected by the PATH, a system of underground walkways filled with shopping and dining options as well as direct connections to the region’s transit system. The market was the most affected during the pandemic, experiencing more sublease availability than any other market. In the initial uncertainty at the peak of the pandemic, several tenants put their empty office space on the sublet market in an attempt to recoup some of their leasing costs while many of their employees worked from home. Some tenants approached landlords for rent relief, but only a few received it.

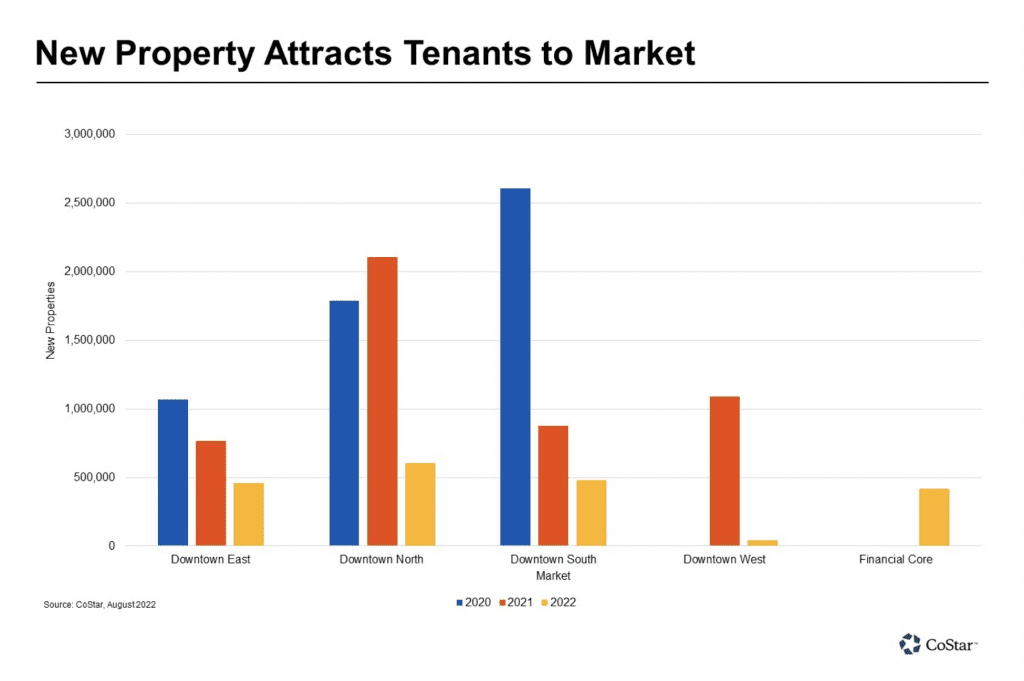

In contrast, demand in other markets such as the South Core remained higher, especially due to the draw of several new buildings. The Gardiner highway at the south end of the Financial District previously demarked the end of the central business district, but with recent upgrades to Union Station providing southern walkway access, developers sought previous industrial land and parking lots primed for redevelopment in the South Core. Advancements to the Toronto transit system spurred developments in the southern area of the city to even expand to add new stations as part of mixed-use development projects in the east and west. With prime access to Union Station, the Downtown South market has brought 3.5 million square feet of new office space to the market since 2020. Noteworthy new construction, such as CIBC Tower I, LCBO Tower, West Block and 16 York have pulled many large and prominent tenants from other markets, leaving those landlords to face the challenge of backfilling vacated space.

The growing need for modern office space — including flexible layouts, connected technology and building apps and improved indoor air quality — has been drawing tenants to newer properties in the South Core for some time now. With the adoption of hybrid work during the pandemic — including highly personalized fit-outs with quality amenities as a way to offset the inconvenience of a commute downtown for their employees — the draw for newer properties compared to more dated layouts in the Financial District only seems to be intensifying.

Newer, state-of-the-art, Class A buildings have been performing well, attracting tenants out of the core and into Downtown South. Examples of this trend are Telus Harbour, RBC Centre and most recently CIBC Square.

Meanwhile the aged buildings in the Financial District are becoming increasingly harder to fill, and available spaces are sitting vacant for nine months on average in a market where blocks of space were previously leased in 4.5 months. To compete with the new construction and address rising vacancies, landlords in the Financial District are increasingly trying to redevelop or reposition properties. The Financial District’s appeal has certainly not gone away. It remains centre ice to amenities that are part of the PATH, TTC and Union Station to the south. So, landlords and owners are busy looking to reinvent some of their dated assets. For example, QuadReal has plans to reinvent its historic Commerce Court. This even includes a proposed new tower at 191 Bay St. on the southeast corner, adding 1.8 million square feet of office space to the core.

Looking ahead as tenants increasingly seek more flexibility and modern amenities in a post-pandemic world, newer towers will likely continue to see the flight to quality. With limited available land in downtown Toronto, areas surrounding the traditional financial core will likely continue to be the location for these new high-quality properties. Meanwhile, the financial core, with its exceptional historical importance and location, will likely continue to see redevelopments and potentially even full-scale new developments, where feasible.

Source CoStar. Click here to read a full story