Suburban office vacancy rates were considerably lower than downtown in many markets across Canada, according to Colliers Canada’s 2022 Q4 National Market Snapshot report, which updates trends and statistics in the office and industrial sectors.

The national downtown office vacancy rate was 14 per cent and trending upward, while the suburban rate was 12 per cent and trending downward from Q3, according to the report.

“Three or four years ago, nobody was talking about the suburbs,” Colliers senior director of research Adam Jacobs told RENX. “Every tenant wanted to be downtown, the rents were going up faster downtown and it had one per cent vacancy.

“Now we’re starting to see a lot more evening out, where everything that used to be an advantage of downtown has turned a little bit more to a liability. Like, it’s connected to transit, but nobody wants to ride transit anymore.”

The average asking net rent was $22.34 per square foot for downtown office space and $17.51 per square foot for space in the suburbs.

Best and worst office markets

Of the dozen cities covered in the report, Vancouver had the lowest office vacancy rate at 5.9 per cent, with sublets accounting for 29.6 per cent of that. The average net asking rent in Vancouver was $34.25 per square foot.

Calgary had the highest office vacancy rate at 27.3 per cent, with sublets accounting for 16.9 per cent of that. The average net asking rent in the city was $14.31 per square foot.

Halifax’s office market was the only one in Canada with an office vacancy rate that decreased in every quarter in 2022. Its overall year-end rate was 13.9 per cent.

In general, office markets less dependent on large occupiers and with smaller cores usually performed better than those in larger population centres with higher dependency on public transit. There’s also less new office development happening in these smaller markets, and therefore fewer concerns about absorption.

Toronto’s return-to-office levels continue to lag, with occupancy levels reaching just 36 per cent in Q4. Toronto’s combined downtown and midtown office vacancy rate was nine per cent while the suburban vacancy rate was 11.4 per cent.

Jacobs said there was a flight to quality among tenants who wanted to be in AAA downtown buildings, and were willing to pay higher rents for those properties, but only certain employers can afford that and the trend has slowed.

Return-to-office momentum still slow

Return-to-office momentum continued to be slow throughout the quarter, with many companies implementing full-time hybrid work models. The federal government — one of the last remaining large occupiers working fully remotely — announced a return-to-the-workplace model of three days per week on site starting this year.

“There’s some momentum now of the banks, the insurance companies, the government and the real mega-occupiers starting to move towards — if not 100 per cent back to the office — at least 60 per cent back to the office,” said Jacobs. “I think that’s maybe less than we expected, but still it’s in the right direction, as far as I see it.”

The office job market remains hot and as long as employees continue to have strong leverage in choosing where and how to work, and who to work for, it seems that pre-pandemic office attendance levels won’t be matched.

Subletting was a major issue through 2021 but had been subsiding during 2022. However, an increasing amount of sublet office space came to market both downtown and in the suburbs in Q4 as companies became more accustomed to hybrid and remote-work models. Subletting was especially pronounced in Vancouver.

Adams expects the office vacancy rate to continue to increase in most cities and nationally, as well as for the rapidly rising interest rates of last year to continue to negatively impact the number of property transactions this year.

Industrial leasing remains strong

Industrial leasing remained strong across the country, with high tenant demand and land-constrained markets fuelling continually increasing asking rents.

Colliers tracked 12 markets across Canada and each had industrial asking net rents above $10 per square foot at year-end, with the average being $12.77. The vacancy rate in those cities averaged 0.9 per cent while the availability rate was 2.2 per cent.

The highest industrial vacancy rate was 4.1 per cent in Edmonton – its lowest year-end rate since 2015 – where the average net asking rent was $10.33 per square foot.

The lowest vacancy rate was 0.1 per cent in Victoria, where the average net asking rent was $18.05 per square foot.

“We’re starting to see people say ‘I’ll just take industrial space in Calgary and truck everything 1,000 miles from the Port of Vancouver,’ ” Adams said. “‘It’s so much cheaper in Calgary that, even though it’s expensive to truck things over the Rocky Mountains, I’m still coming out ahead paying $10 per square foot in Calgary instead of $30 in Vancouver.’”

Calgary’s 11.61 million square feet of industrial space net absorption in 2022 was the highest in the country and pre-leasing activity was high.

Toronto’s industrial vacancy rate was just 0.3 per cent. The market had experienced 20- to 30-per cent year-over-year rent increases since 2019 and, although momentum slowed a bit in the last quarter, the annual growth rate was still 35 per cent.

Demand remains for more industrial space

While e-commerce growth has levelled off, fulfillment centres continue to drive industrial leasing demand. Inventory under construction remains very high but still just represents a small fragment of the overall inventory.

“We could finish every industrial development in the country tomorrow and we’d still have a strong market,” said Adams. “As much as is being built, the markets are so tight.

“We’re just so far from a balanced market in terms of vacancy and rents. I just think it’s going to keep going until something really gives. It’s possible the prices will get too high for some tenants, but we haven’t seen that yet.”

Adams said a lot of major industrial leasing is being driven by large, well-financed tenants such as Amazon, Costco, Walmart and Sobeys that can absorb higher rent costs because they’re a relatively small part of their overall costs.

Industrial transaction volume, however, seems to be slowing down — again influenced by the higher interest rates that are expected to remain through most of the year.

Source Real Estate News EXchange. Click here to read a full story

UPDATED: Sandpiper Group, Artis REIT and embattled First Capital Real Estate Investment Trust (FCR) appear headed for a court hearing to determine the date of a shareholder meeting to decide FCR’s future direction.

A release Monday morning issued by Sandpiper and Artis says the two entities have asked the Ontario Superior Court’s commercial division to compel First Capital to hold the special meeting on March 1, “or as soon as practicable thereafter”.

In response to publicly stated opposition to its management strategy from Sandpiper, Artis, First Capital founder Dori Segal and others, the REIT’s management had scheduled a special meeting on May 16 in conjunction with its annual meeting.

Monday’s release claims that is too long to wait, because the activist shareholders fear management will continue with the REIT’s current business plan, including a publicly stated intention to divest some of the assets it currently holds.

FCR management set May 16 date

First Capital REIT’s management, in announcing the May 16 date, said the timing would allow it to accommodate the annual meeting, normally held in June, so shareholders would not have to take part in two meetings in a short time. It would also provide management time to “consider the implications” of an alternative strategy suggested by the critics in December.

In a response to this latest legal manoeuvre, First Capital stands firmly behind its plan to hold the meeting on May 16 and to move forward with what it calls the REIT’s Enhanced Capital Allocation and Portfolio Optimization Plan.

The plan, which includes an intention to shed up to $1 billion in assets, is one of the key factors which led to the dispute.

First Capital management also takes aim at Sandpiper founder and CEO Samir Manji, who is also the president, CEO and a board member of Artis after his firm led an activist investor campaign which ousted its previous leadership about two years ago.

“FCR will continue to engage constructively with unitholders in a manner that is in the best interests of all unitholders, and not just Samir Manji,” a release issued late Monday states. “First Capital also notes that a significant number of unitholders have expressed their support for the Portfolio Optimization Plan, with numerous sell-side analysts also recognizing its merits in their published research.”

It then states FCR management plans to continue moving forward with the plan.

The critics called for the special meeting in an effort to remove several current board members – chair Bernie McDonell, Andrea Stephen, Annalisa King and Leonard Abramsky – and replace them with trustees of their choosing.

The critics have also called for the resignation or removal of CEO Adam Paul.

The candidates proposed for the FCR board are Sandpiper founder and CEO Samir Manji; K. Adams and Associates Ltd., founder and president Kerry Adams; lawyer and Definity Financial director Elizabeth DelBianco; and Blake, Cassels & Graydon LLP partner Jacqueline Moss.

King High Line a key issue in dispute

Chief among the activists’ concerns are what they call the continued underperformance of the REIT compared to its peers and the markets, and in particular they have criticized the decision to divest a portion of First Capital’s 100 King West high-rise property. That move is part of the optimization plan.

In mid-2022, FCR announced an agreement to divest its interest in the residential portion of the three-tower property, known as King High Line, while retaining the retail and commercial segments. Segal claims the property is a “generational core asset” and has essentially been liquidated at a below-replacement cost for $149 million.

The deal was slated to close in Q4 of 2022.

Sandpiper and its entities have invested about $300 million in First Capital REIT, which Manji said in the release is “almost 30 times more than the cumulative investment held by all nine of the incumbent trustees.” It represents about nine per cent of First Capital units.

Sandpiper has retained Morrow Sodali (Canada) Ltd. as its strategic shareholder services advisor. The Special Situations Group at Norton Rose Fulbright Canada LLP is acting as legal counsel.

FCR has engaged Kingsdale Advisors as its “strategic shareholder advisor”. Gagnier Communications is its communications advisor; Stikeman Elliott LLP is acting as legal counsel to the board; and RBC Capital Markets is its financial advisor.

Source Real Estate News EXchange. Click here to read a full story

The Hamilton-Oshawa Port Authority (HOPA) and Bioveld Canada hope to capitalize on the region’s tight industrial real estate leasing market by adding up to 500,000 square feet at the sprawling Thorold Multimodal Hub, Bioveld Complex.

“We have ways of transloading, we have warehouse storage, we have ship repair and maintenance, and on the original site we have a lot of bulk handling,” said Ian Hamilton, CEO of the Hamilton-Oshawa Port Authority.

The Thorold Multimodal Hub, Bioveld Complex, sits alongside the Welland Canal and is zoned for heavy industrial uses. It currently accommodates units ranging from 5,000 to 100,000 square feet, includes over 100 acres of exterior space and has an on-site water filtration plant.

The former automotive plant sits on 170 acres and offers multimodal services, plus greenfield lands for redevelopment and new construction. Its facilities have access to CN’s rail network via a local railway operator.

HOPA partnered with Bioveld Canada subsidiary BMI Group in its latest acquisition.

HOPA and Bioveld relationship

HOPA is responsible for marketing and leasing the property, and integrating users into the multimodal network. It also offers industrial owners property management resources and expertise in marine and port-related facilities.

Bioveld owns the property and is actively redeveloping and preparing the facilities for modern uses.

“Between the property we owned and Bioveld’s site, we put together a transportation hub that’s multimodal and that would attract industry by leveraging rail, marine and proximity to truck,” Hamilton said. “We’re probably two years ahead of schedule for what we planned, with a dozen tenants on the site.

“We fast approached the realization that the idea had real traction and expanding it would make sense.”

The hub’s proximity to both the Greater Toronto Area and United States makes it especially attractive to industry, Hamilton noted.

He said if the U.S. states bordering the Great Lakes, plus Ontario and Quebec, were a single economy, it would be the world’s third-largest.

Ontario’s Greater Golden Horseshoe

As part of the Greater Golden Horseshoe, the Niagara region was identified in the 18-year-old Places to Grow Act (provincial legislation mandating growth hubs around Ontario) because it’s well-positioned for a population boom.

In tandem with e-commerce’s rapid ascension, establishing an elaborate delivery system for the region is part and parcel of such growth.

“It’s certainly why we chose to partner with Bioveld,” Hamilton said. “The success we have had on existing assets hit home; there was this underlying demand and the Niagara region is so well-positioned for growth to attract modern industry.

“Those indications are why we drove forward with this expansion.”

In leveraging access to a marine property along Lake Ontario, trucking routes and CN-connected rail tracks, the hub handles about $4 billion worth of cargo per year.

That figure will grow as the transportation hub is bolstered by the additions of more industry.

Features of the Thorold Multimodal Hub

All of the site’s buildings have clear heights of 30 to 40 feet, and with the Federation of Metro Tenants’ Association as a partner, HOPA is anticipating its newest addition will begin filling up as early as the first quarter of 2023.

The Thorold Multimodal Hub comprises three distinct properties, offering over 1 million square feet of indoor space – including about 700,000 square feet at the Davis Road site and about 450,000 square feet at the new Hayes Road site.

The third space is located to the north of the other two and primarily handles bulk materials.

Overall, the three sites cover 400 acres of indoor/outdoor space.

HOPA is currently looking to lease 350,000 square feet of indoor space at the Davis Road site (a former paper mill) and all of the indoor space at the new Hayes Road site. This is in addition to outdoor development space/acreage at both sites.

Hamilton explained a major draw for tenants is the ability to customize the types of spaces they want, which the site operators accommodate to the best of their abilities.

Citing another HOPA multimodal property in the City of Hamilton — where over 100 tenants with diverse needs are splayed across 25 acres — he said selling solutions instead of mere plots of land has been a cornerstone of HOPA’s success.

“We build to suit and create the right infrastructure, recognizing that everyone’s demands are going to be different in terms of accessibility to transportation, what kind of coverage space they need, what kind of outdoor laydown space they need, what kind of utilities they need,” he said.

“We’re really open-minded towards creating these customized solutions for them.”

A potential benefit for sustainability

Ontario’s transportation plan was recently announced and, among other things, is intent on reducing greenhouse gasses. Hamilton said the Thorold Multimodal Hub is uniquely positioned to do just that.

In July, Char Technologies announced the first phase of the Thorold Renewable Natural Gas & Biocarbon Project at the hub, which, supported by the Natural Gas Innovation Fund and Bioindustrial Innovation Canada, will help replace fossil fuels and establish a lower-carbon economy.

Northland Power also operates on the site and will contribute to the infrastructure.

Hamilton said a sustainable supply chain would significantly reduce emissions and support Canada’s aspirations to become a net-zero country.

The COVID-19 crisis has also exposed weak links in the supply chain, but the multimodal hub’s expansion should bolster resiliency.

Moreover, Hamilton said each marine vessel removes up to 960 trucks off the roads.

“With shortages in the workforce right now, particularly of drivers in trucking industry, using marine, each vessel is manned by 14 people instead of 940 truck drivers and will help take pressure off truck drivers today and help them focus on that last-mile space,” Hamilton said.

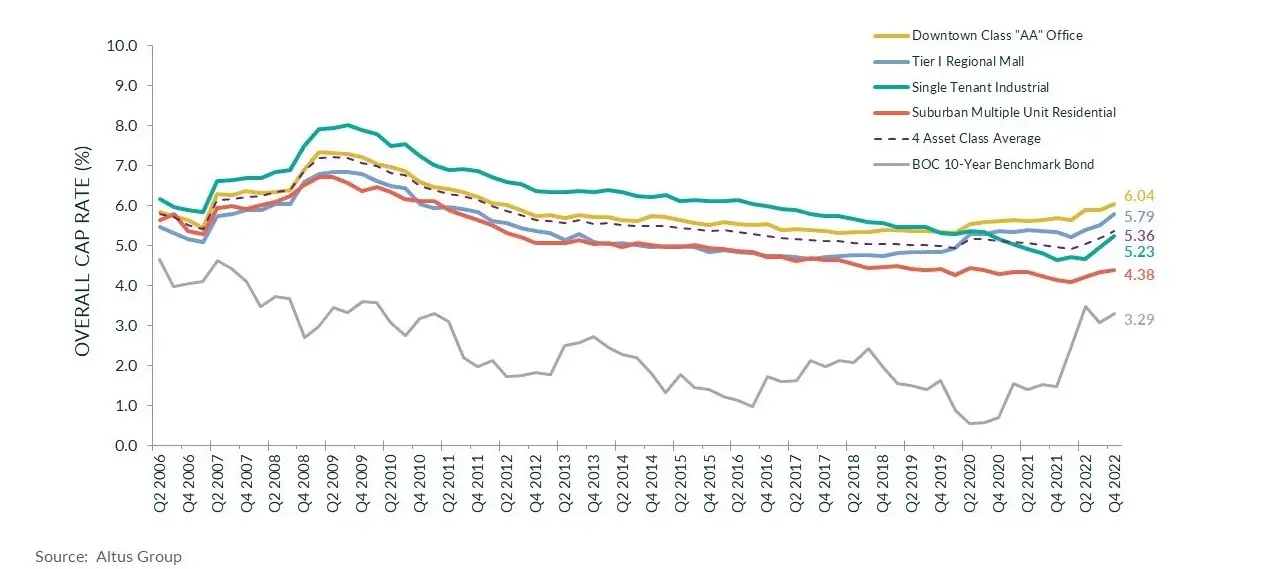

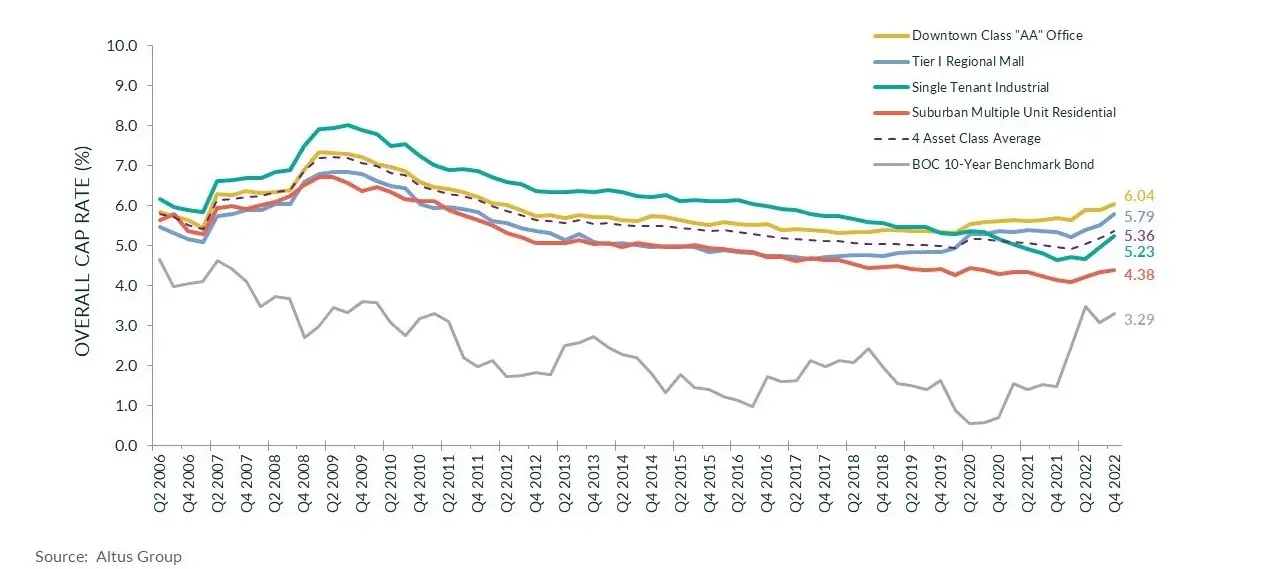

Q4 2022: Rising interest rates prompt continued caution and scrutiny in investor sentiment The latest results from Altus Group’s Canadian Investment Trends Survey (ITS) for the four benchmark asset classes, show that the Overall Capitalization Rates (OCR) rose to 5.36% in Q4 2022. This compares to the previous quarter which was recorded at 5.17% and 4.95% for the fourth quarter of 2021. According to Statistics Canada, the labour market remained unchanged for the most part in November after adding 108,000 jobs in October. The unemployment rate declined slightly from October, sitting at 5.1% as of November 2022. Gains in employment were noted in the finance, insurance, real estate, rental and leasing, manufacturing, as well as the information, culture, and recreation industries. While these industries saw gains, losses in employment were noted in several industries including the construction, wholesale and retail trade sectors. Figure 1

The Bank of Canada bond rate as of December 2022 was recorded at 3.29%, increasing by over 180 bps since Q4 2021. As the central bank continues to focus on inflationary control measures, the average OCR rates were seen increasing the most in the single-tenant industrial asset class when looking quarter-over-quarter. This may be attributed to the potentially falling demand for industrial assets as demand for product housed by these assets may be impacted by the growing unaffordability and the rising cost of borrowing. However, there is also sentiment that industrial assets have done very well for some time, even during the pandemic, and a slowdown in activity and rise in cap rates is inevitable.

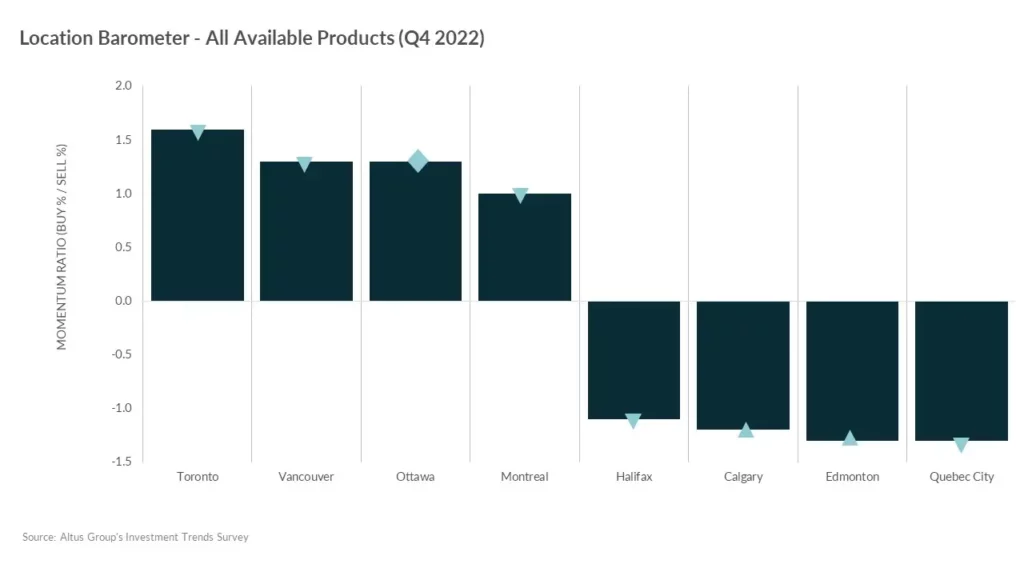

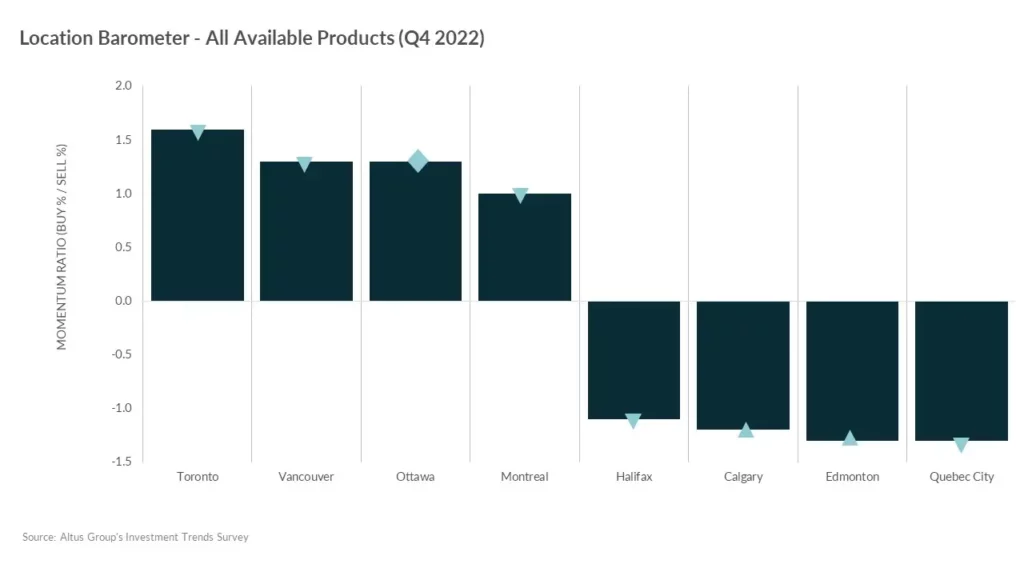

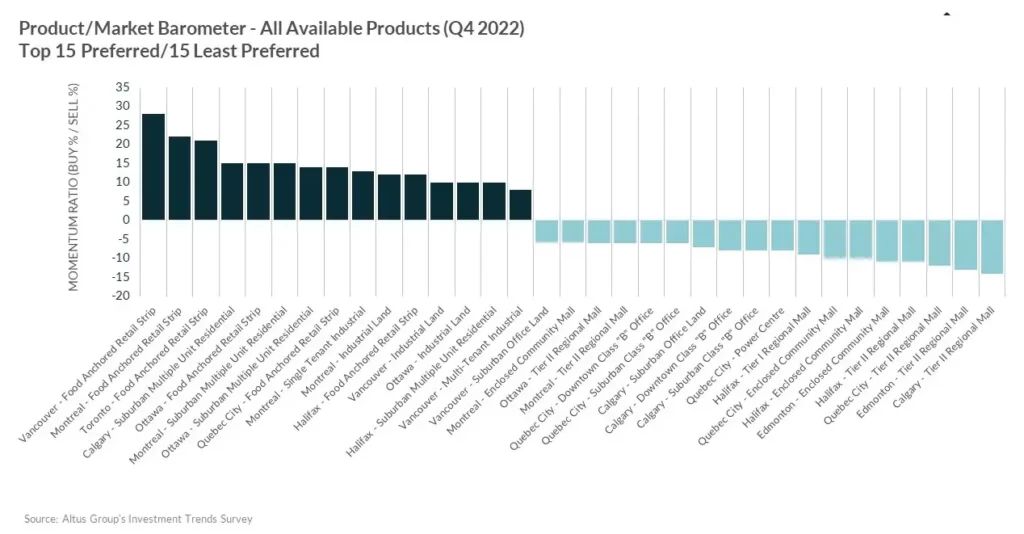

According to Altus Group’s Investment Trends Survey for the fourth quarter of 2022, the three most investor preferred markets across all asset classes were Vancouver, Toronto, and Ottawa (see figure 2) respectively, akin to the previous quarter. Impacted by the anticipation of continually rising interest rates, the location barometer reported a downturn in the momentum ratio (percentage of investors looking to buy/percentage of investors looking to sell) across most markets.

With Q4 concluding, the impact of the rising rates has resulted in a downturn of momentum ratios across all markets except for Edmonton and Calgary, where momentum ratios rose, and Ottawa, which stayed the same as the previous quarter.

Despite a downturn in their momentum ratios, the top four markets, Toronto, Vancouver, Ottawa, and Montreal, have maintained a positive momentum ratio, indicating that investors would prefer to continue buying versus selling in these areas.

Figure 2

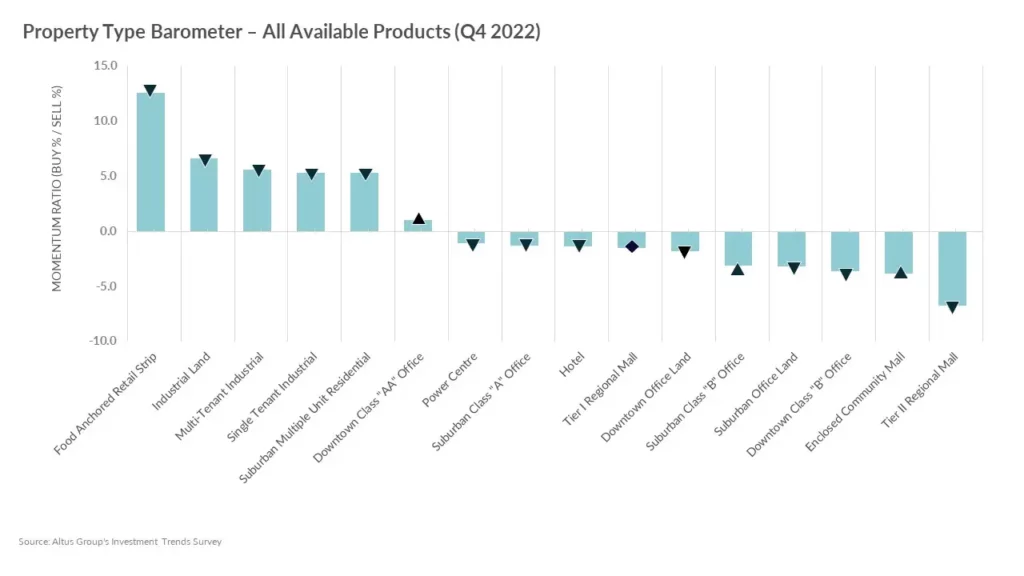

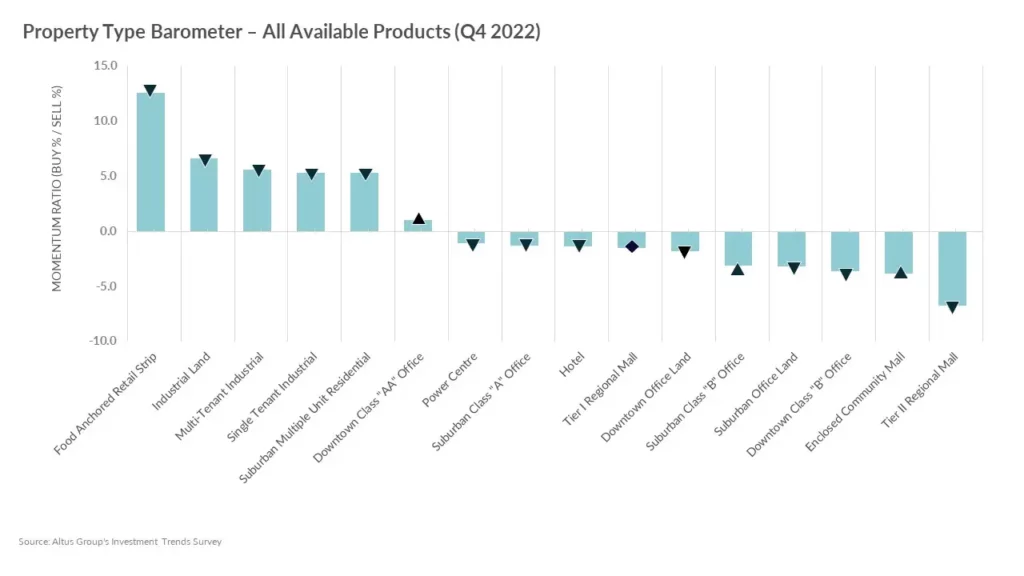

The top three most preferred property types by investors in the fourth quarter of 2022 were food-anchored retail strip, industrial land and multi-tenant industrial assets (see figure 3). Despite being the most investor favoured assets, food-anchored retail strip and industrial assets reported a downturn in their momentum ratio. This is a result of the cautiousness in investor sentiment growing amid the continually rising interest rate environment.

Interestingly, downtown class AA office assets reported an upswing in momentum ratio, with investors preferring to buy instead of sell. This occurs as the office asset has more use with people heading back into the office and investors’ sentiment around the office asset begins to shift.

Tier II regional malls were the least preferred investor product, with enclosed community malls taking the second last spot. This occurs as retail assets were already slightly risky investments, especially with their pandemic highlighted vulnerabilities. However, the high inflation and the rising interest rate environment are factors causing investors to be even more cautious as they evaluate their investment decisions.

Figure 3

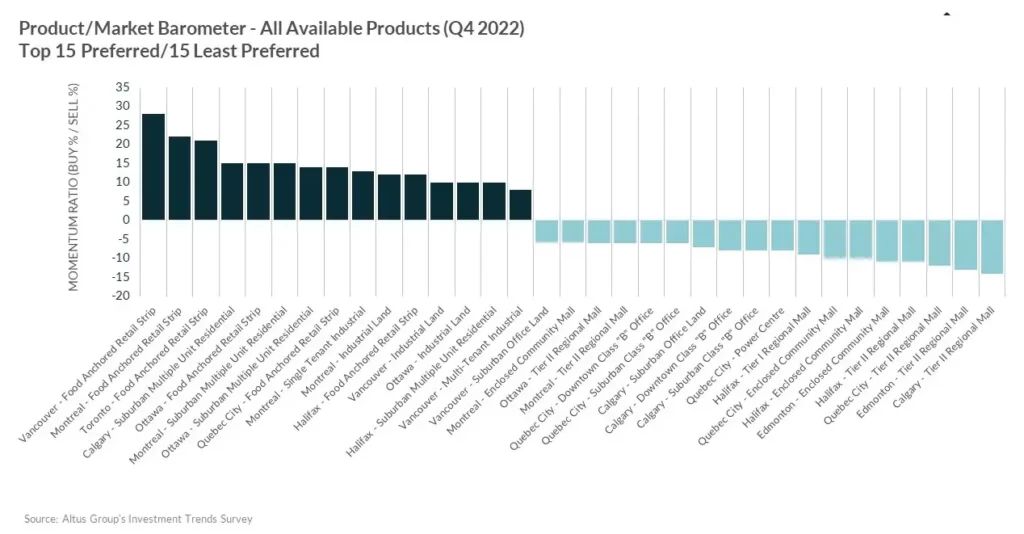

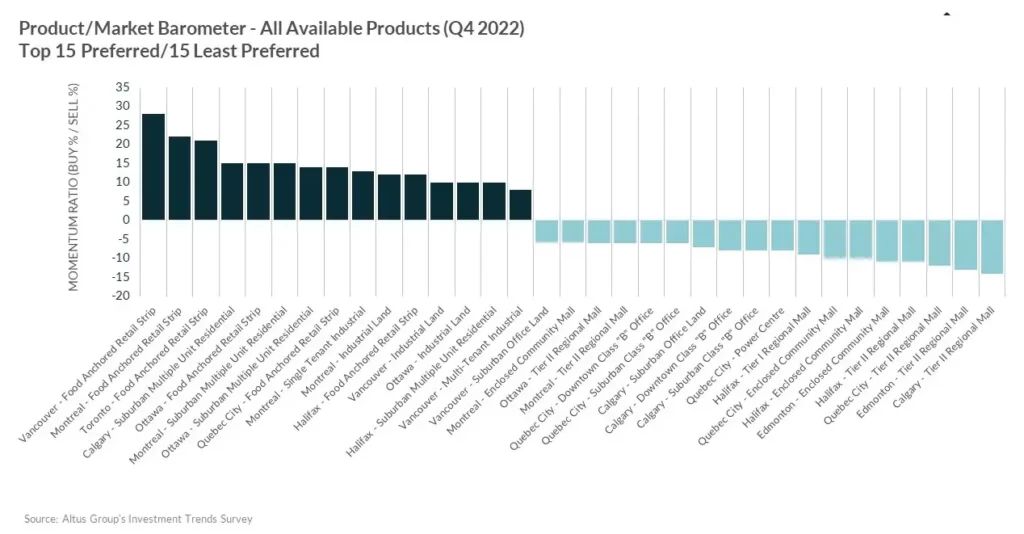

Looking at the Product/Market barometer (see figure 4), the top three preferred combinations were all food-anchored retail strips – with Vancouver taking the top spot followed by Montreal and Toronto. Meanwhile, the least preferred in Q4 2022 was the tier II regional mall product across the Calgary, Edmonton, Quebec City and Halifax markets. Retail assets continue to remain a risky gamble in investors’ eyes, and this has been further exacerbated by the rising interest rates and their anticipated impact on consumer purchasing power, and in turn, the use and demand for retail assets.

With 2022 coming to a close, investors have gravitated towards assets offering minimal risk, adaptability, and stable returns. As a result, food-anchored retail strips, industrial assets and multi-family assets continue to attract investors. With the cost of borrowing speculated to rise further in 2023, cap rates are expected to go up across all major asset classes.

Figure 4

Market highlights for the quarter include

- Downtown class “AA” office cap rates increased over the previous quarter, sitting at 6.04% as of Q4 2022. Quarter-over-quarter, all major markets across the country experienced upward pressure in cap rates apart from the Halifax market, which reported a compression.

- While demand for industrial product remains strong, the cap rate for single-tenant industrial product jumped to 5.23% in Q4 2022. With the cost of borrowing getting higher and construction costs remaining elevated, investors were facing potentially negative leverage when seeking deals in the asset class. As a result, an increase in cap rates was seen across all markets. Industrial assets continue to experience pent-up demand as supply lags, a trend that is expected to continue into 2023. The jump in cap rates for the asset class can be attributed to the anticipation of further increases in interest rates, paired with the perception that these cap rates were too low.

- Tier I regional mall cap rates increased to 5.79% in Q4 2022. Cap rates trended upwards across all major markets. This occurs against a backdrop of interest rate hikes and talks of a possible recession. Retail assets are expected to feel an impact due to concerns of negatively impacted consumer purchasing power.

- Cap rates for suburban multi-unit residential assets increased slightly in Q4 2022 to 4.38%. The multi-family family asset class reported the smallest jump in cap rates owing to factors such as increased immigration and consumers turning towards renting as housing affordability remains a concern, with rising interest rates adding another hurdle to purchasing a home. Cap rates were a mixed bag across the major markets – Toronto, Quebec City and Halifax experienced upward pressure, Montreal was unchanged compared to the previous quarter while compression occurred in Vancouver, Edmonton, and Calgary.

Other highlights include:

- 58 had a “positive” momentum ratio (i.e., a higher percentage of respondents said they were more likely to be a buyer than a seller in that particular segment), a decrease compared to 60 in Q4 2022; and 70 had a “negative” momentum ratio, an increase from 68 in the previous quarter.

The top 15 products/markets, which showed the most positive momentum were:

- Vancouver – Food-anchored retail strip, industrial land, multi-tenant industrial

- Calgary – Suburban multiple unit residential

- Toronto – Food-anchored retail strip

- Ottawa – Food-anchored retail strip, Suburban multiple unit residential, industrial land

- Montreal – Food-anchored retail strip, single tenant industrial, suburban multiple unit residential, industrial land

- Quebec City – Food-anchored retail strip

- Halifax – Food-anchored retail strip, suburban multiple unit residential

Source AltusGroup. Click here to read a full story

Concert Properties’ management will diversify the CREC Commercial Fund LP by adding multiresidential rental properties to its mix of industrial and office assets, and has renamed it Concert Income Properties LP to reflect the shift.

The fund was created in 2016 with a billion-dollar portfolio. It has since grown to 77 assets with nearly 12 million square feet of leasable area valued at more than $2.7 billion and leased to more than 500 commercial tenants.

Seventy per cent of the value is comprised of industrial properties with the remainder being office.

Forty-seven per cent of the properties owned by Concert Income Properties are in Ontario, 37 per cent are in British Columbia, 12 per cent are in Alberta and four per cent are in Quebec.

The industrial and office properties have a combined 97 per cent occupancy, but the fund’s pension plan and institutional investors have been interested in broadening the mandate to include high-rise, purpose-built rental apartments.

“In the long run, we think that makes sense,” Concert Properties chief investment officer and Concert Income Properties managing director Andrew Tong told RENX.

Fund is affiliated with Concert Properties

Concert Income Properties is affiliated with Vancouver-headquartered Concert Properties, a diversified Canadian real estate corporation launched in 1989 and wholly owned by union and management pension plans representing more than 200,000 Canadians.

Concert Properties’ overall portfolio includes condominiums, seniors’ active aging communities, industrial, commercial and residential rental properties, and public infrastructure projects across Canada.

The creation of Concert Income Properties was sponsored by Concert Real Estate Corporation and Concert Properties retains a majority interest in the fund. It’s supported by Canadian pension funds and institutional investors and managed by Concert Realty Services Ltd., a wholly owned subsidiary of Concert Properties.

“Our multifamily rental program will come under the wing of the fund,” said Tong. “The idea is this will be the long-term ownership platform for our multifamily rental moving forward.”

No acquisitions to announce yet

It’s very early days for the diversification strategy and no multifamily acquisitions have been announced, but Tong anticipates at least one apartment building to be purchased within the next 18 months.

Acquisitions could also include mixed-use buildings, combining purpose-built rental housing with office or retail space, according to Tong.

Apartments have remained resilient through the pandemic in the fund’s multifamily target markets of Vancouver and Toronto and Tong said it will be open to acquiring both market-priced and affordable housing rental apartments.

“We can do development, but also we have the other entity, Concert Real Estate Corporation, that could build a master-planned community where there may be a condo and a multifamily rental building,” said Tong. “It’s possible that the fund can be involved with development and we can potentially have the opportunity to purchase the completed rental building, once it’s leased up, from the development side of the company.”

It hasn’t yet been determined what ratio multifamily will eventually comprise in the overall Concert Income Properties portfolio. Tong said those decisions will depend on such factors as available locations, returns and risk profiles.

Open-ended fund with cash to deploy

Concert Income Properties is open-ended and has 30 per cent leverage, which could be increased if required.

“We have a fair amount of cash reserves to deploy and can take advantage of opportunities, which we think is advantageous right now in the market,” said Tong. “Because of our current cash-flow position, we probably need to deploy more of that before we go out for more capital raising.”

Concert Income Properties declared a distribution for investors on Sept. 30 at a time when other real estate funds were discussing halting the payments.

There are no plans for any portfolio dispositions at this point. Tong said the Concert Income Properties is in growth mode and well-positioned to make deals in all three of its preferred asset classes.

He noted the company has almost always grown during downturns in the economy during the 28 years he’s been with Concert Properties, as he said vendors want to do business with companies they can trust.

“We’re prepared to buy something at a certain price. It may not be the highest price, but it’s going to be a very fair price and we’re going to treat somebody fairly,” he said.

“That has worked well in a down market where we’re seeing fewer players at the table and that’s why right now we’re very active on multiple potential opportunities.”

The fund acquired a 90 per cent stake in a 519,000-square-foot Amazon distribution centre in Whitby, Ont. from Broccolini last month. Amazon has signed a 15-year lease at the newly built facility.

Source Real Estate News EXchange. Click here to read a full story

In a long-awaited decision, the Supreme Court of Canada has ruled on de facto expropriation of land.

In Annapolis Group Inc. v Halifax Regional Municipality, the Supreme Court provided guidance for situations in which the government essentially takes away land rights from property owners without formally expropriating the lands.

Although there is still a ways to go before the law in this area is settled, this decision is definitely a positive decision for developers’ and landowners’ rights in general.

Background and facts

Annapolis Group Inc. is a Halifax-based land developer which has been accumulating vacant land since the 1950s.

It had eventually amassed nearly 1,000 acres with the intention of developing it.

The Halifax Regional Municipality set out a new planning strategy in 2006 which identified part of the lands for possible use for a park in the future and denoted them as “Urban Settlement” and “Urban Reserve”, meaning the lands may be developed by the municipality within, or after a 25-year period.

Also, as part of the strategy, Annapolis was prohibited from developing the lands before the municipality adopted a “secondary planning process”.

Annapolis began seeking approvals to start developing the lands in 2007. In response, the municipality passed a resolution stating that it refused to initiate the secondary planning process “at that time”.

In the years that followed, the municipality encouraged the public to use the lands for outdoor activities such as hiking and camping.

Ten years later, Annapolis commenced legal proceedings against the municipality, seeking over $120 million in damages.

Annapolis alleged the municipality had effectively turned parts of the lands into a public park by encouraging members of the public to use them for outdoor purposes and therefore claimed damages based on de facto expropriation, unjust enrichment and abuse of/misfeasance in public office.

The municipality brought a summary judgment motion to dismiss Annapolis’ de facto expropriation claim, which was initially dismissed.

The Nova Scotia Court of Appeal later sided with the municipality and summarily dismissed Annapolis’ claim without allowing it to go to trial.

The court ruled the municipality did not commit de facto expropriation of the lands because no land was actually taken from Annapolis and the municipality therefore did not acquire a “beneficial interest” in the Lands.

It was also ruled that encouraging the public to use the lands and failing to adopt a development plan did not mean the lands were expropriated on a de facto basis.

The new test for “constructive taking” of land

The Supreme Court of Canada, however, saw things differently. The Supreme Court referred to de facto expropriation as “constructive taking”, as it applies to situations where a land owner alleges the state takes its land without formally expropriating it.

In other words, the state does not exercise its statutory authority to acquire an interest in the land and compensate the owner, but it does take steps to claim the land by other means.

In its decision, the Supreme Court held that, in order for “constructive taking” to occur, it is necessary to look at the intention of the government in exercising its regulatory authority and the owner’s loss of the use of the property. As such, the courts must look at what advantage the state obtained by the acquisition of the land and its effect on the property owner.

Therefore, in order for an “acquisition” by the government to occur, the property does not actually have to be acquired. If the government takes steps to acquire a beneficial interest in the property and the owner loses its reasonable use of the land as a result, the land can be deemed to be expropriated on a de facto basis (or “constructively taken”).

In applying the test in the Annapolis case, the Supreme Court held that there were more issues to unravel and therefore the Court of Appeal decision was overturned and the matter is to be determined by trial.

What this means

Although the law in this area is not yet settled, the Annapolis decision is being hailed as great news for developers and property rights holders in general.

It should be kept in mind the test for constructive taking is still onerous.

The court emphasized in this case that in order for it to occur, private property rights must be “virtually abolished”. And even where that is deemed to have occurred, it is not yet clear what it means for the government to gain a beneficial interest in the land.

In the Annapolis case, the court accepted that the government essentially using the land as a public park can constitute such an interest. Therefore if the public benefits from the land, that could be deemed to be a benefit to the state as well for the purposes of the test.

It will be interesting to see what will become of this decision going forward.

But for now developers should take note, as this case is definitely a step in the right direction.

To be clear, governments still have the power to expropriate land if the proper channels are followed. However, the Annapolis case shows courts may not have tolerance for the state using back-door means to deprive property owners of the benefits of their land.

Source Renx.ca. Click here to read a full story

2023 promises to be another year with heightened focus on environmental, social and governance (ESG) compliance. The federal government’s 2050 pledge of achieving net zero status – either generating no greenhouse gas emissions or offsetting such emissions through tree planting or capturing carbon before it’s released into the air – is catalyzing the need for clean technologies and sustainable procurement.

With buildings, including homes, accounting for 12% of Canada’s GHG emissions, many property owners are utilizing ESG strategies to not only align with financial returns but with societal values as well. This behavioural shift will augment the value of ENERGY STAR® and GRESB certifications and industry standards for measuring and benchmarking energy performance across the country. For example, next year British Columbia will require ENERGY STAR certification for commercial buildings.

nvestment and community eyes on ESG

In this environment, tenants and real estate investors are casting an increasingly critical eye on ESG performance and risk. Ratings agencies such as Moody’s and S&P are also assessing corporations’ degree of ESG implementation more deeply. That means the focus on including investor relations because of the connection between ESG performance and capital markets.

“Buildings in several leading markets will need to achieve energy efficiency targets and greenhouse gas emission limits as early as 2024 or face significant fines. As investors increasingly demand newer, greener, and more energy-efficient buildings, particularly offices … older ‘brown’ buildings will see their values discounted, and their owners have trouble selling them,” says PwC and Urban Land Institute in their Emerging Trends in Real Estate 2023 report, which encompasses Canada and the U.S.

Leverage tech for compliance

With the ESG focus expanding beyond building operations to all aspects of portfolio management, many property owners are turning to advanced technology suites to monitor consumption and control costs. Implementation of a viable energy management strategy often begins with understanding and documenting energy consumption across a portfolio.

This is when software solutions that automate the management and analysis of utility expenses, utility bills and energy information deliver value. Property managers and operators can get valuable insight into energy consumption without having to dig through spreadsheets looking for outliers or missing bills.

Energy intelligence technology equally extends this capability, enabling building owners to identify incremental but powerful changes by comparing demand against consumption charges made by their utility providers. Another element of an effective energy strategy involves energy automation technology that detects faults and providing alerts on HVAC systems. Such systems can automate heating and cooling to optimize tenant comfort and minimize unnecessary costs.

The right energy management technology is built to help businesses deliver best-in-class performance.

Portfolio-wide visibility made easy

Energy management platforms are more than a dashboard or app. The solution you implement should seamlessly gather your whole building data and generate full visibility into energy consumption, from the building meter level, property-level analytics and benchmarking, all the way to owners, investors or lenders seeking insight into a portfolio’s energy risk. A site manager, for example, can compare a building’s energy performance against similar buildings in their region in real time, without having to wait for a certification process or energy audit.

The Yardi energy team has seen the benefits of advanced energy management software suites in property management organizations across Canada, including:

- 10-20% portfolio-wide savings, with low upfront costs and minimal tenant disruption.

- Higher property values arising from more efficient energy management

- A better occupant experience and higher retention with heating or cooling controlled with the minimum amount of energy required

- More effective property marketing with demonstrable operational improvements providing a competitive advantage

- Sustainability compliance that satisfies regulators, enables compliance with energy-use disclosure requirements and minimizes risk for potential investors.

As Emerging Trends in Real Estate 2023 notes, “At a time when financing is both less available and more expensive, companies with a strong ESG track record will have an advantage in attracting investment from institutional players and sourcing new forms of capital—such as green bonds and sustainability-linked loans—that continue to grow in Canada.”

Efficient energy management boosts business returns

Every participant in real estate management, from property managers to investors, seeks to reduce risk, increase efficiency, attract tenants and produce returns. A key element to achieving these outcomes is improving ESG performance. Just as a property management organization can’t operate with inadequate financial data, it can’t produce results with antiquated energy data or technology. Advanced energy management technology provides complete visibility and insight, drives informed decision-making, enables efficient portfolio management and adds value while reducing risk.

Source Real Estate News EXchange. Click here to read a full story

Nexus Industrial REIT(NXR-UN-T) is continuing to buy and sell properties to reposition its portfolio and chief executive officer Kelly Hanczyk expects both transactions and development activity to remain brisk through 2023.

“We are continuing to grow an institutional-grade portfolio,” Hanczyk told RENX. “A lot of the products that we have coming on, and with the deals we have, are brand-new products.

“From a quality perspective, I think it will be second to none. Our fundamentals are strong. We have pretty good rental rate increases over the next year. I think everything looks stellar for a pretty solid 2023.”

Oakville-headquartered Nexus owns 113 properties, including two held for development in which the REIT has an 80 per cent interest, comprising approximately 11.1 million square feet of gross leasable area.

Nexus’ portfolio had an occupancy rate of 97 per cent at the end of September, consistent with the previous quarter and 200 basis points higher than Q3 2021.

Windsor and Tilbury acquisitions

Nexus most recently acquired a 435,871-square-foot portfolio of four industrial properties occupied by automotive component provider Plasman for $38.2 million on Nov. 1:

- 5250 Outer Dr., 5245 Burke St. and 418 Silver Creek Industrial Dr. in Windsor; and

- 24 Industrial Park Rd. in the small southwestern Ontario town of Tilbury.

“It was more opportunistic,” Hanczyk said of the acquisition. “We had an opportunity to buy them and the company’s got a pretty good covenant.

“The cap rate was really good and the price per square foot of the assets was really low. The in-place rents are well below market so, while it’s a long-term lease, there’s pretty good downside protection on it just from a market rent perspective.”

Nexus already owned two other properties in Windsor that are doing well and it plans to expand one of them by 65,000 square feet.

Other recent acquisitions

Nexus acquired a 38,400-square-foot industrial property at 605 Boundary Rd. in Cornwall, Ont. for $4.9 million on Sept. 30.

The building was occupied by Seaway Express, which was acquired by Canada Cartage in the fall.

“That was more of a relationship-driven deal,” said Hanczyk. “We wouldn’t usually buy a $5-million building, but it belonged to one of our existing tenants who we have a really strong relationship with and we want to be their landlord of choice.

“It was taking over a company and didn’t want to own the real estate, so we did a quick sale-leaseback with them.”

Hanczyk said Nexus will probably buy an industrial property being built for Canada Cartage in Calgary in 2024.

Nexus acquired a single-tenant 74,681-square-foot industrial property at 21800 Clark-Graham Ave. in the Montreal area for $17.8 million on Sept. 8.

It also acquired a single-tenant 94,000-square-foot industrial property at 50 Rue Lisbonne in the Quebec City area for $18.9 million on July 11.

“They were newer properties and solid assets with long-term, solid tenants,” said Hanczyk.

Development plans

Nexus acquired an 80 per cent interest in land located in Hamilton for $4.8 million on July 18. The REIT anticipates developing a 115,000-square-foot class-A industrial building on the site, with construction completion anticipated for early 2024.

The trust is in negotiations with an existing tenant for a 300,000-square-foot, build-to-suit industrial building on a property it already owns in Regina, where it has 23 acres of excess development land.

Hanczyk is hopeful ground can be broken on the project next spring.

“That would be a very attractive rate of return for us,” said Hanczyk.

Nexus is waiting on permits for a planned 100,000-square-foot addition to one of its properties in London, Ont. It was originally going to be built on spec, but the trust is in final negotiations with a tenant to lease it upon completion.

Hanczyk should know by January whether Nexus can move forward with a 65,000-square-foot expansion of a 130,500-square-foot facility it acquired last year at 70 Dennis Rd. in St. Thomas, Ont.

Selling properties and recycling funds

Nexus sold a retail property in Longueuil, Que. for $11.9 million on Oct. 4. It sold another retail property in Châteauguay, Que. for $8.3 million on Aug. 3.

The trust continues to soft-market several of its retail and office properties, sectors which now represent just 10 per cent of its total portfolio, and has an offer in play for another of its Quebec retail properties.

Nexus also received an unsolicited offer to purchase a small portfolio of industrial properties in Saskatchewan. That deal is now at the due diligence stage.

The REIT will continue to pursue capital recycling opportunities, with proceeds funding development projects expected to generate higher yields and to acquire class-A industrial properties in Ontario and Quebec.

“We are selling stuff, so that gives us free cash,” said Hanczyk. “We have an acquisition pipeline that’s fairly significant, so we’re able to transact if and when we want.

“It will just depend on how fast I can access or recycle that capital to allow me to buy additional product.”

Third-quarter results and stock performance

Nexus began to see the positive impact of rental rate growth in its industrial portfolio in Q3, with approximately 150,000 square feet of renewals and new leases commencing with rents at an average of $1.35 per square foot higher than expiring rents.

It has approximately 250,000 square feet of renewals and new leases starting this quarter with rents at an average of $2.50 per square foot higher than expiring rents.

Nexus had net operating income (NOI) of $24.87 million in Q3, which was $10.77 million higher than Q3 2021. Same-property NOI increased by about $300,000 during the same period.

The REIT had a debt-to-total-assets ratio of 47.2 per cent on Sept. 30. There was $60 million of availability on the REIT’s lines of credit and it had $59.4 million of unencumbered properties.

Nexus’ share price closed at $10.39 on the Toronto Stock Exchange on Nov. 18. That compares to a 52-week high of $14.03 and a 52-week low of $8.15. Its market cap was $608.02 million.

A joint venture between Singapore-headquartered investment firm GIC and Dream Industrial REIT announced on Nov. 7 an agreement to acquire Summit Industrial REITin an all-cash transaction valued at approximately $5.9 billion.

Hanczyk said Nexus’ share price is undervalued, but he believes it will rise and the trust will be the benefactor of exiting Summit unitholders looking to invest in another Canadian industrial REIT.

Source Real Estate News EXchange. Click here to read a full story

Myths are described as either traditional stories of phenomenon, or more commonly, a widely held but false belief or idea.

I’ve tackled commercial real estate myths before but I think it’s due time to add a few more to the list.

Myth #7 – My buddy paid (insert silly value) right down the street for the same thing.

Not all commercial real estate sites are created equal.

Zoning can vary even on the same block as your buddy’s property. This will affect the allowable uses, which then affects the allowable tenants or buyers.

The more flexibility a site offers, the more attractive it can be.

Also, land relative to building structures plays a role in value. The percentage of land required versus the building is tied to use.

Land-shy properties become harder to accommodate business and therefore could be devalued.

There are many reasons why some sites might be worth more or less than their neighbours, so you can’t judge value by address alone.

Myth #8 – I’ve got plenty of time to get a lease in place.

Whatever time frame you’ve set aside for your search and lease negotiation, double it. Searching, viewing, securing and moving into a property can take a lot longer than you realize.

Decision-making timelines are well within your control, but be prepared to wait on the other side. Landlords are eager to lease vacancy, however they often have other businesses and believe it or not, they also have personal lives.

They can be unavailable to make snap decisions or be expedient in responding to offers.

The best way to bust this myth is to find out from the listing agent what kind of response time the landlord requires.

You may also need to engage third parties for part of the transaction and sometimes cannot speed up the wheels of bureaucracy.

Keeping on top of the professionals you’re using for reports or financing does often keep things rolling more smoothly than not.

Patience is a virtue, as they say.

Myth #9 – This building can be repurposed for the next person.

This myth comes with a caveat: while developers are mindful of building new structures that can be used for the most purposes, commercial assets can also have a shelf life.

It’s not uncommon that tenants, or owners, find themselves unable to utilize improvements made by previous tenants. So long as that can be torn out, though, the space can get a new lease on life.

Buildings that have been constructed with a specific use are the most obvious types in this category. A cost analysis could reveal that retrofitting a building might not be feasible.

The same can be said of older, functionally obsolete properties with dimensions that are simply no longer desirable to tenants.

Demolition and redevelopment of the site can be the logical step to recover the highest rents and most functional uses going forward.

Source Real Estate News EXchange. Click here to read a full story

With the real estate market moving from one extreme to another this year, those first couple of frenzied months — when people could actually afford to buy real estate, can you imagine?— are an increasingly distant memory. But as we close out the year, a transaction from back in January remains our pick of 2022’s most notable, earning it the title of STOREYS’ Commercial Real Estate Deal of the Year.

In the fall of 2021, Canadian real estate investment, development, and property management firm Oxford Properties made headlines after listing a gleaming fixture of downtown Toronto, the Royal Bank Plaza, for sale. The iconic, sky-scraping landmark — designed by WZMH Architects, clad in 24-carat gold and reflective glass, and regarded by analysts as one the best pieces of real estate in Canada — was scooped up by Spanish billionaire and founder of international fashion brand Zara, Amancio Ortega, in mid-January for a tidy $1.2 billion.

A statement from Pontegadea — the firm responsible for private investments and institutional relations of Amancio Ortega and his family — explains that the purchase of the Royal Bank Plaza was motivated by the fact that it is “one of the world’s most stable financial institutions” and its “privileged access to the most important commute centre of Toronto.”

“These kinds of properties are an important part of our portfolio,” the statement goes on to say. The transaction is one of several big-ticket commercial purchases under Ortega’s belt, including two office buildings in Seattle, leased to Amazon and Facebook, a hotel in Chicago, and various properties in the UK. Ortega also owns office and retail real estate in Toronto’s Yorkville, so he is no stranger to the city’s real estate realities. “With the acquisition of Royal Bank Plaza, we increase our presence in Canada, one of the most stable countries and real estate markets in the world.”

Pontegadea also shares that there will be some improvements made to the building, including improving its energy efficiency and updating the interior spaces and common maintenance structures.

The sale of Royal Bank Plaza remains the largest Canadian commercial real estate deal — not to mention, among the biggest transactions for an office building globally — since the pandemic began. And as Keith Reading, Director of Research for Morguard, told STOREYS back in January, the purchase was a smart bet by Ortega on the resilience of Toronto’s post-pandemic office sector.

“It’s a world-class global market that’s still got one of the lowest vacancy rates in North America, and the building is fully leased with long-term leases, and one of Canada’s top banks is in there long-term,” said Reading, referring to the long-standing tenancy of Royal Bank of Canada. The company has around 40% of the building leased for the next decade. “It’s a good buy because these assets don’t come along very often; the buyer has secured control of one of Canada’s landmark buildings. It’s a world-class facility at centre ice in the downtown office market of a global city.”

TORONTO, CANADA – JULY 13, 2017: Golden Royal Bank Plaza skyscraper building facades in the Financial District of Downtown Toronto. View from below.

He added that while $1.2 billion is no chump change, Ortega snagged himself something of a once-in-a-blue-moon kind of deal — and rumour has it he was one of only two bidders.

“The price tag would have been north of $1.2 billion if there was no pandemic,” said Reading. “Prior to the pandemic, there was 2% vacancy in downtown Toronto, which put upward pressure on rent, so anybody who would have been looking to buy that asset would have looked at continued peak rent and room to grow, and the price would have been higher. Would it have been significantly higher? Not necessarily. It’s not a troubled asset; it’s a premium asset and this is a landmark acquisition. If people had the financial resources, and if there was no pandemic, you would have seen more bidders.”

Almost a full year after the sale, offices are welcoming employees back, downtown foot traffic has inched up, and the world has largely returned to its pre-pandemic ways, but the office real estate sector is yet to regain its pre-pandemic gusto. Still, Ortega’s investment shows resounding promise. This is something that Ray Wong, Vice President of Data Operations and Data Solutions at Altus Group, predicted with confidence in an interview from January.

“If you’re an employer, for your employees to get to an office across the street from the biggest transit hub in Canada is huge,” said Wong. “The sale is going to be a bellwether of confidence in the office market because it’s a fantastic downtown location and the acquisition price of $1.2 billion is pretty solid. They’re taking a long-term horizon on this asset.”

Wong continued, “It will take time for companies to come back, but there will be a little bit more demand for office space as people reconfigure their space needs and as other tenants begin looking for adjustments.”

In the meantime, the sector’s state of limbo certainly doesn’t take away from the notability of the Royal Bank Plaza deal itself. Pandemic pains aside, the changing of hands at such a monument was — and is — a huge moment in the world of Toronto real estate.

Reading said it best, “There are always new buildings in Toronto, but nobody is building another Royal Bank Plaza.”

Source Storeys. Click here to read a full story