Q4 2022 Canadian CRE Investment Trends

Q4 2022 Canadian CRE Investment Trends

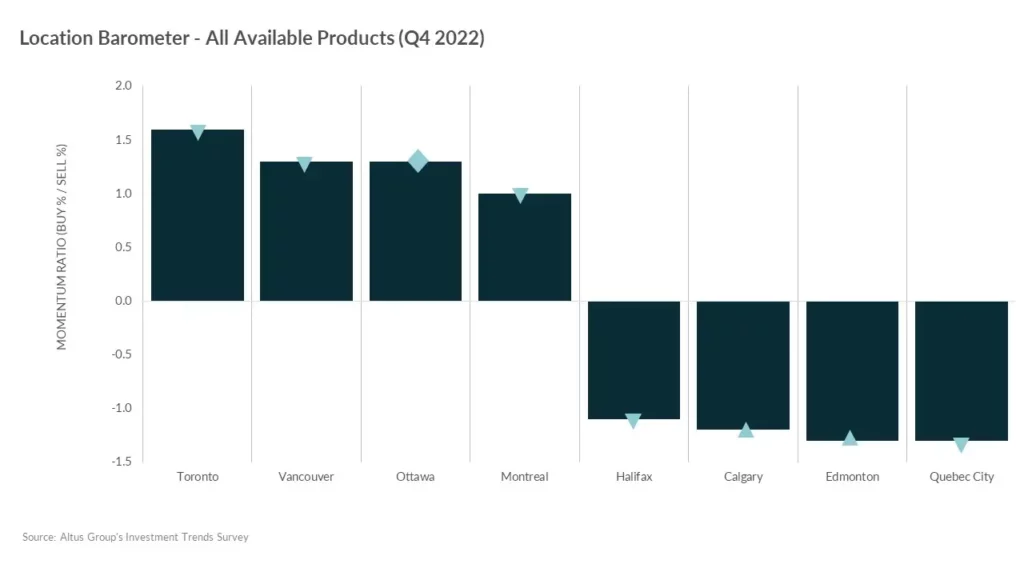

Q4 2022: Rising interest rates prompt continued caution and scrutiny in investor sentiment The latest results from Altus Group’s Canadian Investment Trends Survey (ITS) for the four benchmark asset classes, show that the Overall Capitalization Rates (OCR) rose to 5.36% in Q4 2022. This compares to the previous quarter which was recorded at 5.17% and 4.95% for the fourth quarter of 2021. According to Statistics Canada, the labour market remained unchanged for the most part in November after adding 108,000 jobs in October. The unemployment rate declined slightly from October, sitting at 5.1% as of November 2022. Gains in employment were noted in the finance, insurance, real estate, rental and leasing, manufacturing, as well as the information, culture, and recreation industries. While these industries saw gains, losses in employment were noted in several industries including the construction, wholesale and retail trade sectors. Figure 1

The Bank of Canada bond rate as of December 2022 was recorded at 3.29%, increasing by over 180 bps since Q4 2021. As the central bank continues to focus on inflationary control measures, the average OCR rates were seen increasing the most in the single-tenant industrial asset class when looking quarter-over-quarter. This may be attributed to the potentially falling demand for industrial assets as demand for product housed by these assets may be impacted by the growing unaffordability and the rising cost of borrowing. However, there is also sentiment that industrial assets have done very well for some time, even during the pandemic, and a slowdown in activity and rise in cap rates is inevitable.

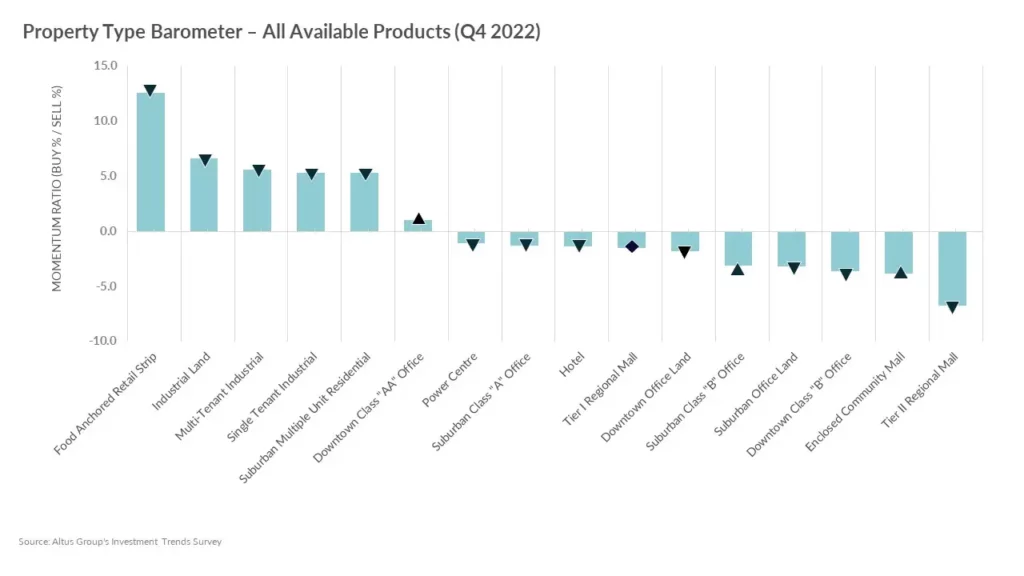

According to Altus Group’s Investment Trends Survey for the fourth quarter of 2022, the three most investor preferred markets across all asset classes were Vancouver, Toronto, and Ottawa (see figure 2) respectively, akin to the previous quarter. Impacted by the anticipation of continually rising interest rates, the location barometer reported a downturn in the momentum ratio (percentage of investors looking to buy/percentage of investors looking to sell) across most markets.

With Q4 concluding, the impact of the rising rates has resulted in a downturn of momentum ratios across all markets except for Edmonton and Calgary, where momentum ratios rose, and Ottawa, which stayed the same as the previous quarter.

Despite a downturn in their momentum ratios, the top four markets, Toronto, Vancouver, Ottawa, and Montreal, have maintained a positive momentum ratio, indicating that investors would prefer to continue buying versus selling in these areas.

Figure 2

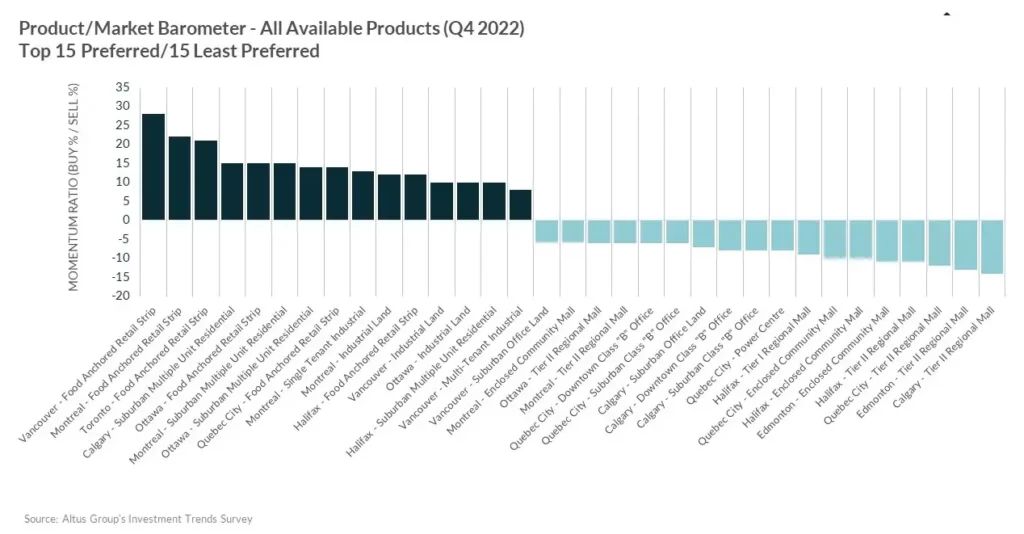

The top three most preferred property types by investors in the fourth quarter of 2022 were food-anchored retail strip, industrial land and multi-tenant industrial assets (see figure 3). Despite being the most investor favoured assets, food-anchored retail strip and industrial assets reported a downturn in their momentum ratio. This is a result of the cautiousness in investor sentiment growing amid the continually rising interest rate environment.

Interestingly, downtown class AA office assets reported an upswing in momentum ratio, with investors preferring to buy instead of sell. This occurs as the office asset has more use with people heading back into the office and investors’ sentiment around the office asset begins to shift.

Tier II regional malls were the least preferred investor product, with enclosed community malls taking the second last spot. This occurs as retail assets were already slightly risky investments, especially with their pandemic highlighted vulnerabilities. However, the high inflation and the rising interest rate environment are factors causing investors to be even more cautious as they evaluate their investment decisions.

Figure 3

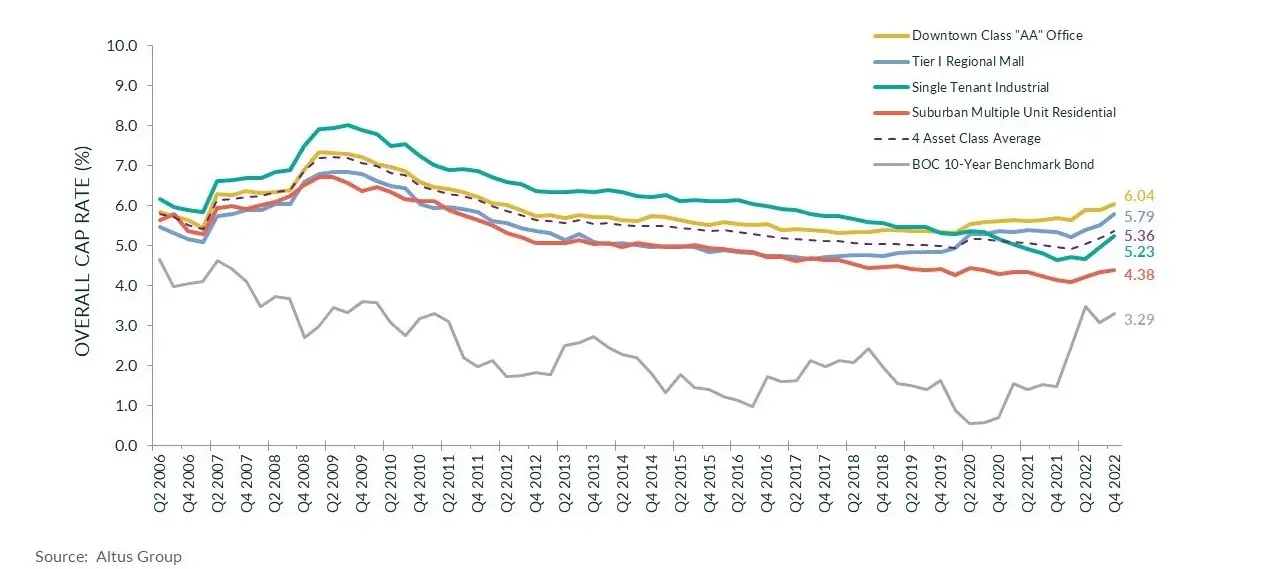

Looking at the Product/Market barometer (see figure 4), the top three preferred combinations were all food-anchored retail strips – with Vancouver taking the top spot followed by Montreal and Toronto. Meanwhile, the least preferred in Q4 2022 was the tier II regional mall product across the Calgary, Edmonton, Quebec City and Halifax markets. Retail assets continue to remain a risky gamble in investors’ eyes, and this has been further exacerbated by the rising interest rates and their anticipated impact on consumer purchasing power, and in turn, the use and demand for retail assets.

With 2022 coming to a close, investors have gravitated towards assets offering minimal risk, adaptability, and stable returns. As a result, food-anchored retail strips, industrial assets and multi-family assets continue to attract investors. With the cost of borrowing speculated to rise further in 2023, cap rates are expected to go up across all major asset classes.

Figure 4

Market highlights for the quarter include

- Downtown class “AA” office cap rates increased over the previous quarter, sitting at 6.04% as of Q4 2022. Quarter-over-quarter, all major markets across the country experienced upward pressure in cap rates apart from the Halifax market, which reported a compression.

- While demand for industrial product remains strong, the cap rate for single-tenant industrial product jumped to 5.23% in Q4 2022. With the cost of borrowing getting higher and construction costs remaining elevated, investors were facing potentially negative leverage when seeking deals in the asset class. As a result, an increase in cap rates was seen across all markets. Industrial assets continue to experience pent-up demand as supply lags, a trend that is expected to continue into 2023. The jump in cap rates for the asset class can be attributed to the anticipation of further increases in interest rates, paired with the perception that these cap rates were too low.

- Tier I regional mall cap rates increased to 5.79% in Q4 2022. Cap rates trended upwards across all major markets. This occurs against a backdrop of interest rate hikes and talks of a possible recession. Retail assets are expected to feel an impact due to concerns of negatively impacted consumer purchasing power.

- Cap rates for suburban multi-unit residential assets increased slightly in Q4 2022 to 4.38%. The multi-family family asset class reported the smallest jump in cap rates owing to factors such as increased immigration and consumers turning towards renting as housing affordability remains a concern, with rising interest rates adding another hurdle to purchasing a home. Cap rates were a mixed bag across the major markets – Toronto, Quebec City and Halifax experienced upward pressure, Montreal was unchanged compared to the previous quarter while compression occurred in Vancouver, Edmonton, and Calgary.

Other highlights include:

- 58 had a “positive” momentum ratio (i.e., a higher percentage of respondents said they were more likely to be a buyer than a seller in that particular segment), a decrease compared to 60 in Q4 2022; and 70 had a “negative” momentum ratio, an increase from 68 in the previous quarter.

The top 15 products/markets, which showed the most positive momentum were:

- Vancouver – Food-anchored retail strip, industrial land, multi-tenant industrial

- Calgary – Suburban multiple unit residential

- Toronto – Food-anchored retail strip

- Ottawa – Food-anchored retail strip, Suburban multiple unit residential, industrial land

- Montreal – Food-anchored retail strip, single tenant industrial, suburban multiple unit residential, industrial land

- Quebec City – Food-anchored retail strip

- Halifax – Food-anchored retail strip, suburban multiple unit residential

Source AltusGroup. Click here to read a full story