Sandpiper Group, Artis REIT And Embattled First Capital Real Estate Investment Trust (FCR) Appear Headed For A Court Hearing To Determine The Date Of A Shareholder Meeting To Decide FCR's Future Direction

Sandpiper Group, Artis REIT And Embattled First Capital Real Estate Investment Trust (FCR) Appear Headed For A Court Hearing To Determine The Date Of A Shareholder Meeting To Decide FCR’s Future Direction

UPDATED: Sandpiper Group, Artis REIT and embattled First Capital Real Estate Investment Trust (FCR) appear headed for a court hearing to determine the date of a shareholder meeting to decide FCR’s future direction.

A release Monday morning issued by Sandpiper and Artis says the two entities have asked the Ontario Superior Court’s commercial division to compel First Capital to hold the special meeting on March 1, “or as soon as practicable thereafter”.

In response to publicly stated opposition to its management strategy from Sandpiper, Artis, First Capital founder Dori Segal and others, the REIT’s management had scheduled a special meeting on May 16 in conjunction with its annual meeting.

Monday’s release claims that is too long to wait, because the activist shareholders fear management will continue with the REIT’s current business plan, including a publicly stated intention to divest some of the assets it currently holds.

FCR management set May 16 date

First Capital REIT’s management, in announcing the May 16 date, said the timing would allow it to accommodate the annual meeting, normally held in June, so shareholders would not have to take part in two meetings in a short time. It would also provide management time to “consider the implications” of an alternative strategy suggested by the critics in December.

In a response to this latest legal manoeuvre, First Capital stands firmly behind its plan to hold the meeting on May 16 and to move forward with what it calls the REIT’s Enhanced Capital Allocation and Portfolio Optimization Plan.

The plan, which includes an intention to shed up to $1 billion in assets, is one of the key factors which led to the dispute.

First Capital management also takes aim at Sandpiper founder and CEO Samir Manji, who is also the president, CEO and a board member of Artis after his firm led an activist investor campaign which ousted its previous leadership about two years ago.

“FCR will continue to engage constructively with unitholders in a manner that is in the best interests of all unitholders, and not just Samir Manji,” a release issued late Monday states. “First Capital also notes that a significant number of unitholders have expressed their support for the Portfolio Optimization Plan, with numerous sell-side analysts also recognizing its merits in their published research.”

It then states FCR management plans to continue moving forward with the plan.

The critics called for the special meeting in an effort to remove several current board members – chair Bernie McDonell, Andrea Stephen, Annalisa King and Leonard Abramsky – and replace them with trustees of their choosing.

The critics have also called for the resignation or removal of CEO Adam Paul.

The candidates proposed for the FCR board are Sandpiper founder and CEO Samir Manji; K. Adams and Associates Ltd., founder and president Kerry Adams; lawyer and Definity Financial director Elizabeth DelBianco; and Blake, Cassels & Graydon LLP partner Jacqueline Moss.

King High Line a key issue in dispute

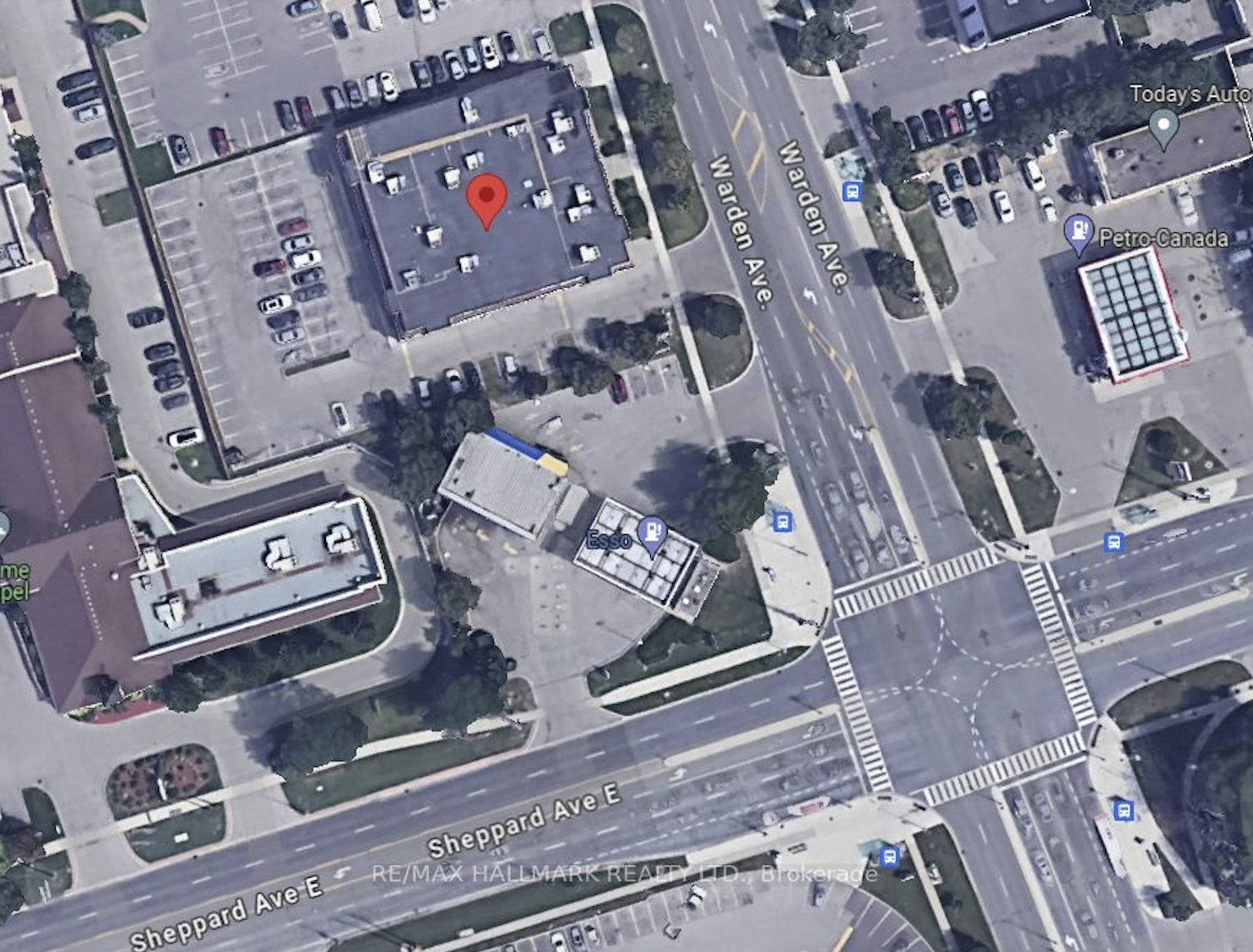

Chief among the activists’ concerns are what they call the continued underperformance of the REIT compared to its peers and the markets, and in particular they have criticized the decision to divest a portion of First Capital’s 100 King West high-rise property. That move is part of the optimization plan.

In mid-2022, FCR announced an agreement to divest its interest in the residential portion of the three-tower property, known as King High Line, while retaining the retail and commercial segments. Segal claims the property is a “generational core asset” and has essentially been liquidated at a below-replacement cost for $149 million.

The deal was slated to close in Q4 of 2022.

Sandpiper and its entities have invested about $300 million in First Capital REIT, which Manji said in the release is “almost 30 times more than the cumulative investment held by all nine of the incumbent trustees.” It represents about nine per cent of First Capital units.

Sandpiper has retained Morrow Sodali (Canada) Ltd. as its strategic shareholder services advisor. The Special Situations Group at Norton Rose Fulbright Canada LLP is acting as legal counsel.

FCR has engaged Kingsdale Advisors as its “strategic shareholder advisor”. Gagnier Communications is its communications advisor; Stikeman Elliott LLP is acting as legal counsel to the board; and RBC Capital Markets is its financial advisor.

Source Real Estate News EXchange. Click here to read a full story