Author The Lilly Commercial Team

Why Toronto’s Office Sector May Be Less at Risk Than New York City’s

Hybrid work has negatively affected the office leasing business across North America, including in Toronto and New York, the largest office markets in both Canada and the U.S., respectively.

However, Toronto is dominated by well-capitalized institutional owners who are better able to withstand market corrections relative to other property owner types, such as developers, who are prominent in New York. This difference in ownership composition is one reason why capitalization rate movements tend to be less pronounced in Toronto. While certainly not immune from the effects of hybrid work, Toronto’s institutionalized office market is better able to withstand the current market turbulence, making it a less risky market than New York.

The North American office market has been affected by the adoption of hybrid work policies as well as slowing office-using employment growth. In both Toronto and New York, the average office vacancy has climbed by roughly 500 basis points compared to pre-pandemic levels. Moreover, major Class A office nodes, such as Downtown New York City and the Financial Core in Toronto, have witnessed weaker leasing fundamentals relative to their respective markets.

Despite these similar trajectories in leasing fundamentals, the ownership composition in both markets for large office assets differs in a meaningful way. In Toronto, a quarter of all downtown office assets that are three-star-rated or higher and with a rentable building area of greater than 200,000 square feet, are partially or fully owned by institutional entities, such as insurance companies, pension funds or sovereign wealth funds. This contrasts with downtown and midtown New York, where partial or full institutional ownership is less than 5%. Also, while developer-owners are important in both cities, they are more prominent in New York.

Institutional owners tend to be well-capitalized and better able to weather risks related to rising interest rates. Developers tend to be more exposed to risks related to leverage and debt. Although Toronto is not immune from development or construction loan risks, the office sector is less exposed than New York. In downtown Toronto, developer-owners account for one in three partial or full owners of large mid-to-high-quality office assets, as opposed to over 50% in downtown and midtown New York. Given the current macroeconomic environment, this suggests that the Toronto office market is less exposed to risks associated with higher interest rates.

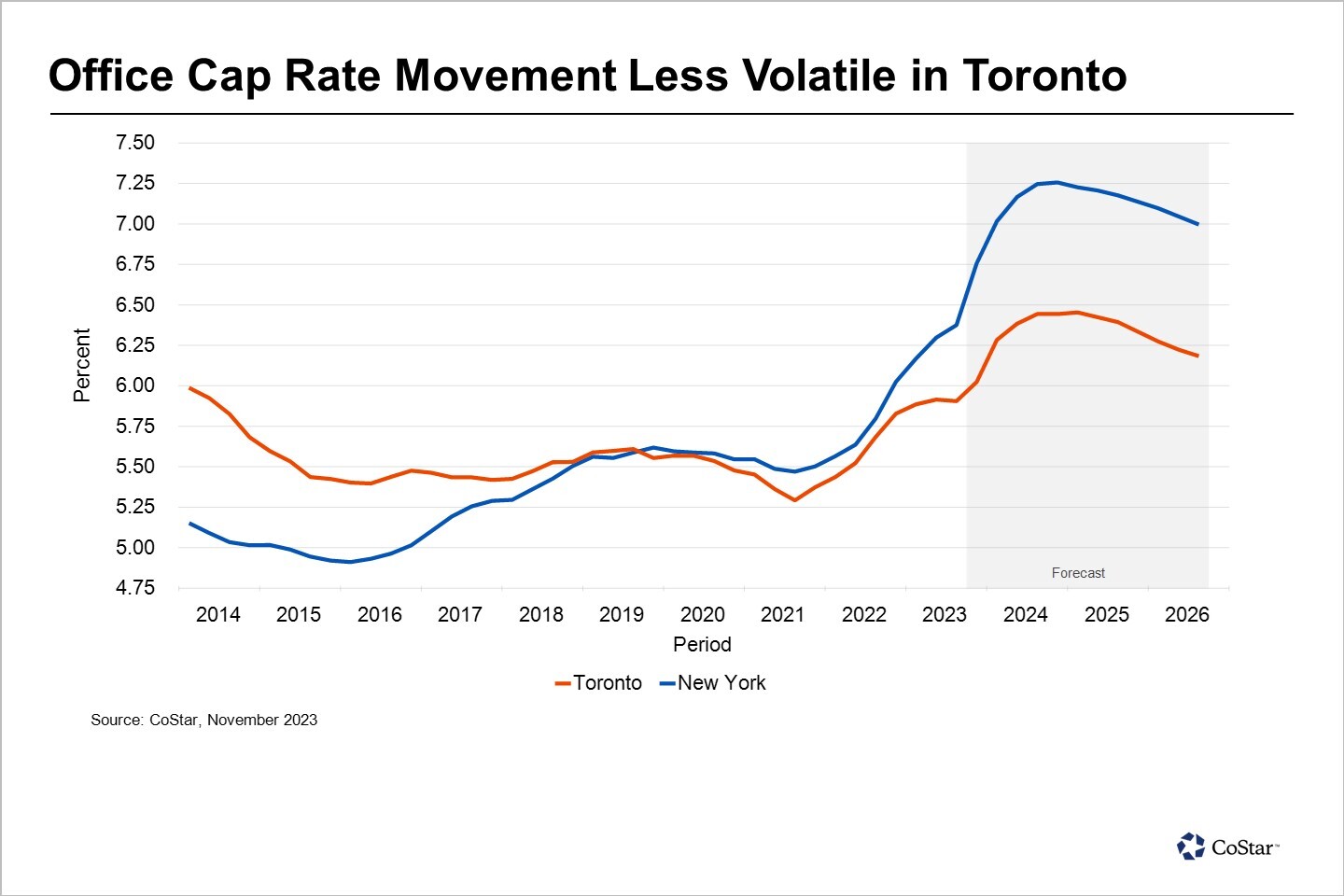

This difference in ownership types helps explain why, despite similar fundamentals, office cap rate movements in Toronto are less volatile compared to New York. In fact, despite witnessing a similar increase in vacancy levels since early 2020, office market cap rates in Toronto currently are 50 basis points less than in New York.

The higher number of developer-owners in New York and the low number of institutional owners suggest that the New York office market is at greater risk of seeing more assets repriced in the event of a significant downturn. The Toronto office market, with fewer developer-owners and more institutional owners, is likely better positioned to ride out any future market turbulence. The prominence of developers as owners in New York suggests that this city could offer more future distressed office opportunities than Toronto if market conditions in both cities continue to deteriorate.

Source Renx.ca Click here to read a full story

Slate Office REIT Cuts Distribution To Improve Liquidity

Toronto-based Slate Office REIT, which has holdings in Canada and Chicago, has become the latest publicly traded real estate investment trust to ditch its distribution to improve liquidity issues.

The REIT, which is dealing with an occupancy level of 78.6% across its portfolio, said the decision to eliminate the distribution gives Slate an additional CA$10.2 million of cash annually, which will be used to pay debt and fund ongoing business operations.

“We have made steady progress over the last quarter toward shoring up the REIT’s balance sheet, completing over CA$577 million of refinancings and loan amendments to preserve liquidity and financial flexibility for the REIT,” said Brady Welch, interim chief executive of Slate Office REIT, in a statement. “We have also maintained stable portfolio occupancy, supported by our positive leasing momentum at longer lease terms. Through the portfolio realignment plan we are introducing this quarter, we believe we can improve the REIT’s liquidity, strengthen its balance sheet through reduced debt, and improve portfolio composition to position the REIT for long-term stability and performance.”

Earlier this month, a different Toronto-based REIT, True North Commercial, said it would cut its distribution completely.

Slate has identified non-core assets in specific Canadian markets it plans to sell to use the cash to repay debt and provide general liquidity for the REIT. The assets make up 40% of the REIT’s total gross leasable area.

CoStar News first reported that the REIT was selling three assets in New Brunswick in early November.

The REIT said that as of Oct. 31, approximately two-thirds of the planned dispositions are either listed for sale, under discussions, or at varying contract negotiation stages. Depending on local market conditions, the remainder of the disposition assets will be put on the market in 2024.

Slate Asset Management, an external manager to the REIT, said it had expanded its investment in Slate Office to 10% to reflect its confidence in capital allocation decisions and strategy.

The moves did little to appease investors following the distribution cut as shares dipped to 77 cents this week, well below their 52-week high of $4.67.

Jonathan Kelcher, an analyst at TD Securities, expressed concern about Slate Office’s high financial leverage in the current interest rate and transaction market environment.

“Although we expect improvements in leverage as dispositions are completed, we see potential challenges on timing, coming from a more difficult financing environment and overall slower transaction market,” said Kelcher in a note to investors.

Source CoStar Click here to read a full story

Canadian Office Trends Suggest Some Difficulties in 2024

Like its southern neighbour, Canada’s office sector is confronted with several trends that are likely to shape occupancy patterns in 2024 and beyond.

These trends include the staying power of hybrid workplace strategies and weakening office sector employment growth, which are both combining to weigh on leasing fundamentals already. In addition, Canada’s office buildings under construction as a percent of existing inventory is at 2.8% — over double that of the U.S. at 1.3% — and much of this construction is concentrated in downtown centres that were hit hard from hybrid work.

This new supply risks further aggravating leasing fundamentals in the near term, especially in the context of a slowing economy.

The first trend facing Canada’s office sector, like in the U.S., is the staying power of hybrid workplace strategies. Many companies had adopted these policies that allowed office workers to telecommute during the pandemic. Yet six months after the World Health Organization declared an end to the pandemic health emergency, many employees are still working remotely several days a week. In fact, the latest office occupancy and mobility data for downtown Toronto shows that the new hybrid workplace is here to stay for many office workers, who likely prefer commuting less.

Even for the overall Toronto Census Metropolitan Area, or CMA, mobility remains well below where it was pre-pandemic. This indicates that suburban office submarkets, which often employ more people locally, have also been affected by the growth in hybrid workplace trends, although less so than their downtown counterparts. Although the below data is for Toronto, Canada’s largest office market, similar trends exist in other Canadian cities.

The second structural trend affecting the country’s office market is the slowdown in office employment growth. Office employment growth in Canada averaged 2.35% per year between 2001 and 2022. Excluding the volatility around 2020 through 2022, in which employment growth cratered and then rocketed to recovery, the country’s most robust office employment growth appeared between 2001 and 2008. During this period, Canada’s office employment growth regularly exceeded the long-term average of 2.35%.

In the years following the Great Recession, office employment growth tended to be spotty, with a brief outperformance occurring between 2017 and 2019. Moreover, Oxford Economics forecasts that office employment growth will decelerate over the coming decade.

These twin trends of greater workplace flexibility and a downshift in office employment growth already appear to be taking a toll on the country’s office leasing sector. Occupiers are signing fewer new office leases and taking less space when they do sign. In fact, nearly a third fewer new office leases deals were signed in the first 10 months of 2023 compared to the first 10 months of 2019.

When occupiers are signing new leases, it is for 20% less space. This combination of fewer leases being signed coupled with smaller lease sizes translates into a total leasing volume that is nearly 45% below pre-pandemic levels.

At the same time, Canada’s office sector is building more stock relative to its inventory than the U.S. Although in pre-pandemic times, this construction pipeline was seen to help restore some balance in Canada’s office market given tight conditions, in the context of hybrid work and structurally lower office unemployment growth, the delivery of new space is likely to add to current leasing headwinds. This is especially so for older office stock, which will be competing with new buildings, as certain occupiers will likely be inclined to take space in newly delivered Class A product as opposed to staying in their existing older space.

The structural rise of hybrid work, coupled with a decline in office employment, are weighing on Canadian office leasing fundamentals. New office deliveries over the coming quarters will further weigh on leasing fundamentals, especially for older office stock. Overlaid across all these trends is a weakening economic outlook for the country, which is likely to slow the office sector’s recovery even further as businesses increasingly cut back on investment and trim expansion plans. Taken together, these trends suggest that next year is likely to be a another difficult one for Canada’s office sector.

Source CoStar Click here to read a full story

Top Sales and Leases Recognized in Canada

The $1.35 billion sale of three urban data centres in Toronto by publicly traded Allied Properties Real Estate Investment Trust was Canada’s largest real estate transaction during the third quarter, making it one of the top deals recognized in the latest CoStar Power Broker quarterly awards.

The Toronto-based landlord said the sale of the locations at 151 Front St. W, 250 Front St. W and 905 King St. W to a subsidiary of Japanese telecommunications giant KDDI allowed it to focus on its core business of “distinct urban workspace” and pursue continued growth in net operating income and creating value for its properties.

The REIT used $755 million of the proceeds from the sale to repay all amounts drawn on its unsecured credit facility, set aside $200 million of the proceeds to repay a secured promissory note payable on December 31, 2023, and another $49 million to repay its remaining first mortgages on fully owned properties next year. Allied will use the rest of the proceeds to fund its development and upgrade activity over the remainder of 2023 and into 2024.

The Japanese company created a new subsidiary for the deal called KDDI Canada.

“The global data business is accelerating, and the need for data centers is increasing,” said the Japanese company when it first announced a deal in June.

The deal closed on Aug. 16. Peter Senst of CBRE and, Justin Bosa and Peter Zorbas of Scotiabank were the listing agents.

There was no buying agent.

Here’s a look at other top deals during the third quarter:

Top Office Lease

Learningwise Education Signs Lease in Vancouver

The quarter’s top office lease was in British Columbia’s largest city, where Learningwise Education Inc. signed a 90,000-square-foot lease in Vancouver.

The educational company subleased a 90,000-square-foot location at 1090 W Pender Street in BentallGreenOak’s downtown Vancouver office building.

Learningwise Education Inc., the parent company of University Canada West, will occupy floors from the third to seventh under the lease signed Sept. 6. The company plans to move in on April 1, 2024.

Jeffrey Lin, vice-president of leasing, acted for BentallGreenOak, which is known as BGO.

No tenant representative was listed.

Top Retail Lease

Home Société Signs Largest Lease of the Quarter.

The largest retail lease of the quarter space was in the Toronto submarket of Moss Park/Regent Park.

Home Société signed a lease on July 1 for the first and second floors of a residential project by Great Gulf and Hullmark at 48 Power Street. The deal is for the retailer’s MUST division, which describes itself as selling “distinctive decor elements” including armchairs for your living room and rustic wood headboards for the bedroom.

The lease for 43,000 square feet is for 10 years. Jonathan Weinberg of First Gulf was the leasing representative on the deal. The tenant contact is Home Société.

Top Industrial Lease

Lactalis Canada Inks Lease for Environmentally Friendly Industrial Space

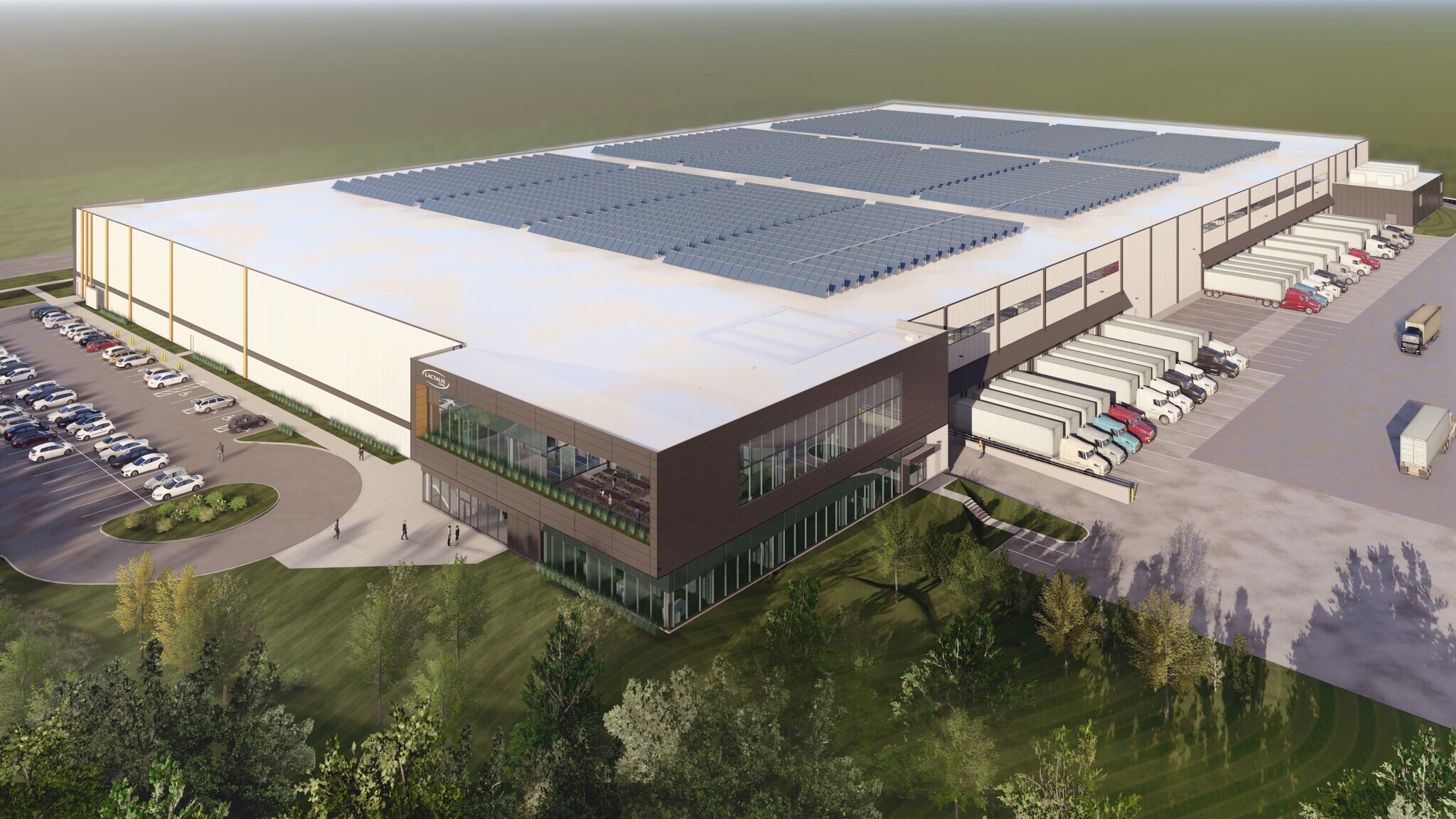

A proposed property at 1680 Thornton Road North in Oshawa, about 60 kilometres east of Toronto, is the largest industrial lease of the quarter.

Leased by Lactalis Canada, the 379,000-square-foot facility would be located in the growing Northwood Business Park. The building would be able to store up to 60,000 pallets in both cooler and freezer environments while being zero-carbon ready, potentially being zero-carbon building certified.

The energy source would be entirely on the Ontario power grid with no additional reliance on non-renewable energy sources. The heat created from refrigeration systems is being designed to be reclaimed so it can heat the facility’s offices and warm the truck apron to melt snow.

A white roof would help would help reflect heat from the sun. Solar panels on the top in a future phase would provide renewable power to partially or wholly offset reliance on the power grid under certain conditions.

Kyle Hanna and Fraser McKenna of CBRE were the tenant representatives on the deal signed on September 19, which kicks in on January 1, 2024. Tenants are expected to move on October 1.

Source CoStar Click here to read a full story

Top Retail Leases Recognized for Toronto

Prominent retail leases signed by SportChek, Home Société and A Plus Sport negotiated by top dealmakers from SmartCentres Real Estate Investment Trust, First Gulf, CBRE and MQ Real Estate Team are among the third-quarter retail leases recognized by CoStar.

As big-ticket items involving sizable investments, commercial property transactions often have a wider impact within the community. CoStar will recognize the largest leases completed each quarter and the dealmakers who made them happen in their respective markets.

Here are the Toronto retail leases selected as the third-quarter 2023 winners of the CoStar Power Broker Quarterly Deal Awards:

Space Leased: 45,000 SF

Deal Type: New Lease

Size: 87,977 SF

Tenant: SportsChek

Brokers Involved: Luke Moore of SmartCentres Real Estate Investment Trust represented the landlord.

Deal Commentary: SportsChek struck a deal in the third quarter to occupy half of this former department store building, which is part of the Walmart-anchored SmartCentres Etobicoke Index at 162 Queen St N. The former Sail location will be occupied by SportChek along with an updated and expanded Mark’s, both of which are part of the Canadian Tire Corp. retail group. SmartCentres Etobicoke and SmartCentres Etobicoke Index shopping centres consist of approximately 624,000 square feet of open-air retail space across 54 acres. The centres straddle North Queen St. at Highway 427 and The Queensway beside Sherway Gardens within Toronto West’s southern Etobicoke retail node. Both retail properties are owned and managed by SmartCentres Real Estate Investment Trust.

Space Leased: 43,500 SF

Deal Type: New Lease

Size: 460,620 SF

Tenant: Home Société

Brokers Involved: Jonathan Weinberg of First Gulf represented the landlord.

Deal Commentary: Home Société’s lease for a large block of retail space on the first and second floors of this Toronto office building for its MUST furniture division qualified as a top retail deal of the third quarter. The furniture design company’s new store space in downtown Toronto is part of a new condominium complex in the Moss Park/Regent Park neighbourhood known as Home Power and Adelaide managed by Great Gulf Group.

Space Leased: 30,311 SF

Deal Type: New Lease

Size: 537,085 SF

Tenant: A Plus Sport

Brokers Involved: Phillip Cheung and Evan S. White of CBRE represented the landlord. Mya Qi of MQthe Real Estate Team represented the tenant.

Deal Commentary: In one of the quarter’s largest retail leases signed in an enclosed mall, A Plus Sport committed to opening a new location spanning over 30,000 square feet at the Sheridan Centre in Mississauga. The new facility will be a hybrid recreational centre, featuring badminton and volleyball courts, golf simulators and general recreational facilities for children, as well as retail space dedicated to sporting goods. The lease marks the first retail concept for A Plus Sport in the Toronto market. The mall is owned by Dunpar Homes, which focuses on master-planning commercial and industrial sites in prime areas in the Greater Toronto Area into vibrant, livable communities.

Space Leased: 25,000 SF

Deal Type: New Lease

Size: 87,977 SF

Tenant: Mark’s Work Wearhouse

Brokers Involved: Luke Moore of SmartCentres Real Estate Investment Trust represented the landlord.

Deal Commentary: In a second top third-quarter deal for SmartCentres Etobicoke retail complex, an updated and expanded Mark’s Work Wearhouse will join SportsChek in reactivating this former department store building.

Space Leased: 13,200 SF

Deal Type: New Lease

Size: 90,000 SF

Tenant: Greta Bar

Brokers Involved: Brandon Gorman, Graham Smith and Matthew Marshall of JLL represented the tenant.

Deal Commentary: Greta, which has locations in Calgary, Edmonton and Vancouver, is bringing its arcade bar street food concept to Toronto after signing a lease in the third quarter at 590 King Street West in Toronto. Located in the King West and Bathurst area, the office building is owned by YAD Investments, a private Canadian-owned company headquartered in Toronto.

Source CoStar Click here to read a full story

Two of Canada’s Largest Retail REITs Report Supply Crunch Amid Rising Construction Costs

Higher interest rates are top of mind for two of Canada’s largest retail REITs reporting earnings this month, with both RioCan and First Capital saying they expect those costs will keep the supply of available retail space tight.

Toronto-based RioCan, Canada’s oldest real estate investment trust with a portfolio of 200 buildings across the country, told analysts it does not expect retail vacancy to change much in the coming years.

“All indicators are that the type of space RioCan offers will continue to be in short supply and high demand. But our operating results are rooted in factors far more deep-seated than favourable supply-demand dynamics,” said Jonathan Gitlin, chief executive of RioCan, in a conference call with analysts last week.

For the third quarter that ended Sept. 30, the REIT reported a net loss of $73.5 million compared to a profit of $3.2 million last year.

The decrease was mainly attributed to fair value losses of $199.5 million on investment properties in the third quarter compared to $118.8 million in the third quarter of 2022, primarily from increasing capitalization rates to reflect current market conditions resulting from higher interest rates.

“Who knows if interest rates will move up, down or stabilize? What I do know is that at times like these, RioCan is fortunate to be operating a best-in-class retail portfolio in the major markets of this great country,” said Gitlin.

Higher Construction Costs

Retail committed occupancy for RioCan reached an all-time high of 98.3%, and the REIT’s average rent per square foot for new deals was $27.02, more than the average net rent for the portfolio at $21.39.

However the reality of present market conditions and construction costs has RioCan opting to slow down on new projects.

“Just to clarify, we’re pulling back on construction, not development, which means that we continue to move the needle forward on getting properties entitled, getting them free of tenant obligations and things of that nature so that they are shovel-ready. So it’s construction that we’re pulling back on,” said Gitlin.

At rival First Capital REIT, which has property interests in 143 Canadian neighbourhoods with 22.3 million square feet of gross leasable space, Chief Executive Adam Paul had the same type of message.

“Starting with inflation, concerning replacement costs as well as tenant sales, replacement costs have escalated significantly over the past few years,” said Paul on a call with analysts.

He said replacement costs for the retail space the REIT owns are almost 50% higher than the market value of the properties today. “This dynamic will continue to keep new supply effectively muted as has been the case for several years,” said Paul.

For the third quarter, First Capital recorded a loss of $327.5 million compared to a loss of $204.7 million a year earlier. Included in that loss was a $434.1 million writedown on the value of its properties compared to a $271 million writedown a year earlier.

Retail Demand Strong

Mark Rothschild, an analyst with Canaccord Genuity, the global capital markets division of Canaccord Genuity Group Inc., issued a report this week saying he agreed that demand for retail space should remain strong, resulting in continued low availability rates.

“We do note, however, that potential slowing economic growth could moderate rent growth. Tight availability for retail space in Canada has led to upward pressure on market rents,” Rothschild said in the note.

JLL Canada’s fall retail report noted that the continued demand for physical space and a shortage of new space is keeping the Canadian retail market tight with availability at historically low levels.

“After the surge in e-commerce during the pandemic, Canadians have returned to brick-and-mortar stores, shopping centres, restaurants, and airports. Demand for retail space continues to outpace supply this year, although this demand is now easing and expected to align with supply in the coming quarters,” said the real estate company.

The company added a slowdown in housing construction could also affect demand for retail.

“The slowdown in housing construction is impacting the retail sector, especially now that retail is increasingly built with residential. The decline in investment in building construction, including both commercial and residential projects, creates a challenging environment for retailers and will have implications for the growth and expansion of retail spaces in coming years,” said JLL.

Source CoStar Click here to read a full story

Top Office Leases Recognized for Greater Toronto

Prominent office leases signed by Celestica, H.H. Angus and Payment Solutions Providers Services negotiated by top dealmakers from Metrus Properties are among the third-quarter office leases recognized by CoStar.

As big-ticket items involving sizable investments, commercial property transactions often have a wider impact within the community. CoStar will recognize the largest leases completed each quarter and the dealmakers who made them happen in their respective markets.

Here are the Greater Toronto office leases selected as the third-quarter 2023 winners of the CoStar Power Broker Quarterly Deal Awards:

Space Leased: 56,350 SF

Deal Type: New Lease

Size: 454,301 SF

Tenant: Celestica

Brokers Involved: Gabrielle Mair of Metrus Properties represented the landlord.

Deal Commentary: After Toronto-based electronics manufacturing services firm Celestica Inc. entered into an agreement earlier this year to sell its Don Mills property, which includes the site of its corporate headquarters and its Toronto manufacturing operations to a special purpose entity formed by a consortium of three real estate developers, Diamond Corp., Lifetime Developments and Context Development Inc. The consortium plans to work with Toronto officials to win approval for a mixed-use redevelopment that includes office, retail and residential uses, Celestica entered into an interim lease for its existing head office and manufacturing premises on a portion of the real estate for an initial two-year term on a rent-free basis subject to certain payments including taxes and utilities. In the third quarter, the tech firm secured replacement space by signing a long-term lease for the 8th and 9th floors in a new office tower at Don Mills and Eglinton to be developed by Metrus near a Metrolinx Station in Crosstown Place, a new master-planned encompassing 60 acres. However, on the day it leased the space, Celestica subleased it to H.H. Angus, which leads us to the next deal.

Space Leased: 56,350 SF

Deal Type: New Lease

Size: 454,301 SF

Tenant: H.H. Angus

Brokers Involved: Gabrielle Mair of Metrus Properties represented the landlord.

Deal Commentary: Celestica subleased the two floors it had in a soon-to-be-completed office building at 1176 Eglinton Ave. The space is expected to serve as a head office for H.H. Angus, an employee-owned, independent consulting firm of engineers, technical specialists and project managers.

Space Leased: 39,913 SF

Deal Type: Renewal

Size: 193,638 SF

Tenant: Payment Solutions Providers Services

Brokers Involved: Gabrielle Mair of Metrus Properties represented the landlord.

Deal Commentary: Payment Solutions Providers Services, which assists clients to design, deploy, and manage secure networks and transaction routing for processing online transactions, renewed its lease to occupy just under 40,000 square feet of office space at 400 Applewood Crescent in Vaughan. The office building is owned by Concord, Ontario-based Metrus Properties.

Space Leased: 34,975 SF

Deal Type: Renewal

Size: 759,528 SF

Tenant: Koskie Minsky

Brokers Involved: David Fullerton, Allen Brusilow and Matthew McCusker of JLL represented the landlord.

Deal Commentary: Law firm Koskie Minsky LLP renewed its lease for two full floors in the Cadillac Fairview Tower in a third-quarter deal. This Cadillac Fairview-owned office property in downtown Toronto is located near the CF Eaton Center shopping center.

Space Leased: 17,647 SF

Deal Type: New Lease

Size: 445,000 SF

Tenant: Swift Offices

Brokers Involved: Patrick Langdon of Langdon Partners Limited represented the landlord.

Deal Commentary: In a top third-quarter deal, Swift Office signed a lease in the Madison Executive Centre. The 24-storey office property situated in downtown North York is owned by Europro, a commercial property management company that has expanded to managing real estate assets in 10 cities province-wide.

Falling Construction Prices Don’t Translate Into Warehouse Oversupply

Higher Rates, Slower Economic Outlook Keeps Supply Growth in Check

The spike in demand for modern logistics space in recent years has led to more projects breaking ground. Yet the new supply pipeline remains disciplined.

In fact, under-construction projects as a percentage of inventory have declined in 2023 relative to last year. This decline occurred even as construction costs for warehouses fell across all Canadian major metropolitan areas. The higher interest rate environment and signs that the country’s economy continues to decelerate likely explain, in part, why new supply growth is moderating. This disciplined supply pipeline should help the sector weather any bumpiness that could occur from a potential recession.

With e-commerce demand pulled forward thanks to the pandemic and more resilient supply chains put in place by many companies to address goods shortages, overall demand for modern logistics space in Canada was exceedingly strong over the past few years. This demand can be seen in the availability rates for industrial space across markets. Although space availability has risen as new supply is delivered to market, it has remained at or below long-term trend levels in most cities.

This strong demand growth and limited availability of modern industrial space led developers to break ground on new projects. In fact, under-construction stock as a percentage of existing inventory increased rapidly across Canadian markets between 2020 and 2022.

This rapid rise in warehouse construction also helped lead to a jump in construction costs. These costs were also affected by a jump in apartment construction activity and a more generalized increase in wage pressures, as labour shortages in many parts of the economy became commonplace. However, since 2022, warehouse construction costs have been falling across all Canadian markets. The fall in prices has been rapid. In Montreal, for example, warehouse construction prices were growing at over 22% annually as of the fourth quarter of 2021; since then, cost growth has fallen to 10% as of the second quarter of 2023.

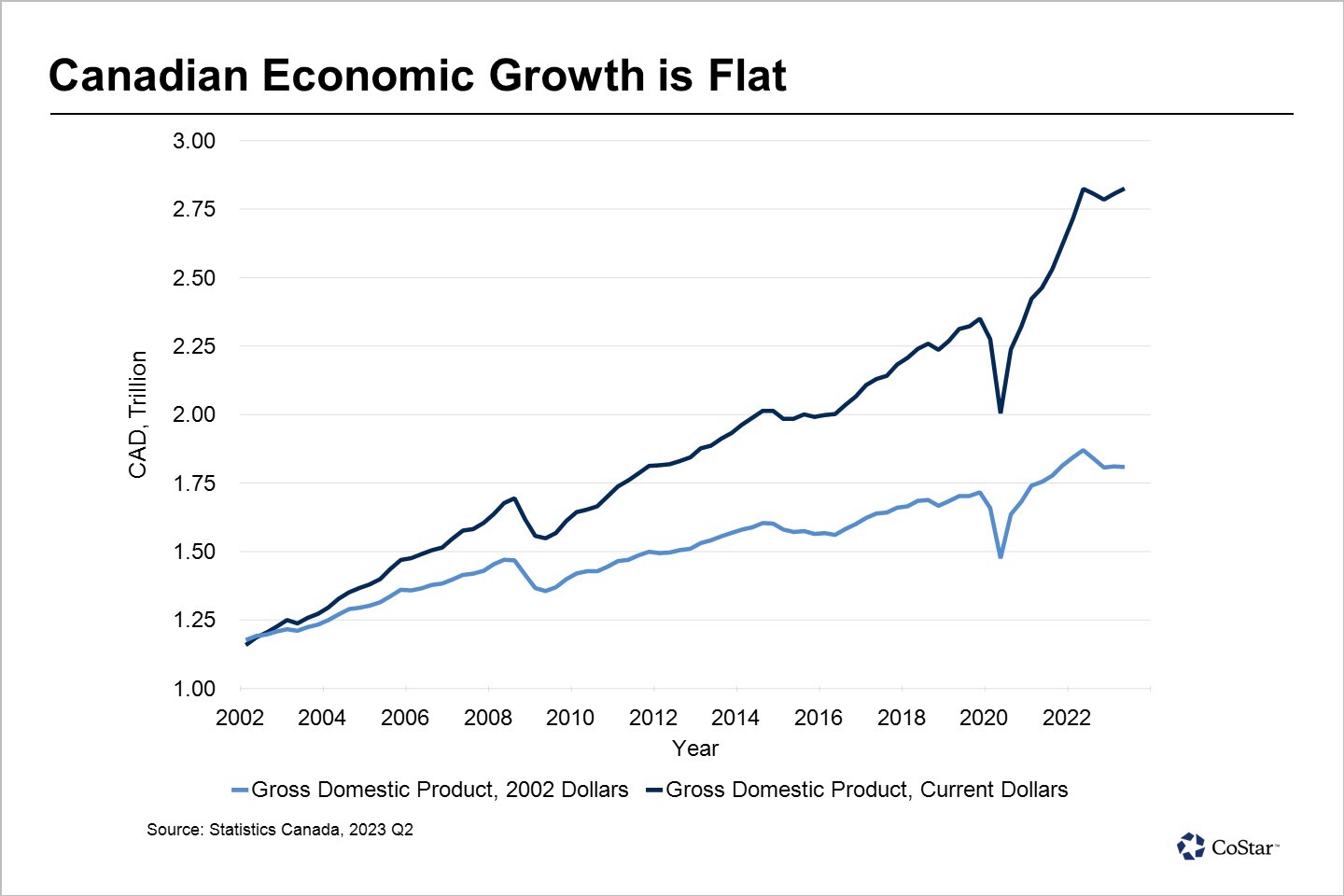

Still, warehouse construction costs remain well ahead of inflation as measured by the consumer price index. At the same time, interest rates remain at elevated levels compared to the recent past, making it harder to finance new projects. This environment is making it more difficult for developers to make their pro forma numbers work. As such, development activity, while still solid, has started to moderate in major markets compared to a year ago. The country’s lackluster economic performance since the rate-hiking cycle began may also be causing some developers to pause. In nominal terms, Canada’s economy has been flat for the last three quarters, although adjusting for inflation, the economy has already started to shrink slightly.

Although construction activity has started to moderate, developers are still obtaining permits to build new warehouses at a faster rate than before the pandemic. For example, in Toronto, around four permits per month are issued to build new warehouse developments as of mid-2023, which is higher than the three permits per month issued before 2021. Still, the level of permitting has declined substantially from the five to seven permits per month that were issued between 2021 and 2022.

Although new supply is controlled in large cities, one area for concern is smaller cities in Ontario, outside of the Greater Toronto Area, or GTA. Permits per month for new warehouse construction are relatively steady in British Columbia, Alberta, and Quebec when comparing current monthly levels to those of 2019. However, permitting in Ontario jumped in 2021 and remains elevated, in contrast to the declining trend for Toronto. This suggests that many smaller cities outside the GTA could see increased levels of warehouse construction in the coming quarters.

Much of this permitting activity is likely in the Greater Golden Horseshoe, or GGH, a large swath of territory that surrounds the GTA on the Southwest, North, and East. Developers have been breaking ground in many smaller cities of the GGH as industrial land availability in the GTA becomes harder to find. This could potentially leave some of these smaller GGH areas at risk of oversupply in the event of an economic downturn.

Despite more affordable construction prices, the industrial supply pipeline remains relatively disciplined, although one area for concern for oversupply could potentially be smaller cities outside of the Greater Toronto Area. This discipline is partly due to higher financing costs related to the rapid rise in the country’s interest rates, coupled with greater caution with respect to Canada’s near-term growth prospects. In addition, although warehouse construction costs have come down, they do remain elevated. Together, these factors help explain why the country’s construction pipeline for new industrial product remains under control. The fact that new supply does not appear to be getting ahead of existing demand suggests that the industrial sector is likely well-positioned to weather an economic downturn when it arrives.

Source CoStar Click here to read a full story

Top Industrial Leases Recognized for Toronto

Prominent industrial leases signed by Lactalis Canada, The ProLift Rigging Company Canada and Stage Windows and Doors negotiated by top dealmakers from CBRE and Colliers are among the third-quarter industrial leases recognized by CoStar.

As big-ticket items involving sizable investments, commercial property transactions often have a wider impact within the community. CoStar will recognize the largest leases completed each quarter and the dealmakers who made them happen in their respective markets.

Here are the Greater Toronto industrial leases selected as the third-quarter 2023 winners of the CoStar Power Broker Quarterly Deal Awards:

Space Leased: 379,000 SF

Deal Type: New Lease

Size: 379,000 SF

Tenant: Lactalis Canada

Brokers Involved: Kyle Hanna and Fraser McKenna of CBRE represented the tenant.

Deal Commentary: In one of the largest industrial deals of the third quarter, Canadian dairy product producer Lactalis Canada Inc., the company behind such popular brands as Cracker Barrel, Black Diamond, Balderson, Astro and Lactantia preleased a new distribution facility in Oshawa, east of Toronto. The company, a subsidiary of France-based Lactalis Group, signed a long-term lease for a new 379,000-square-foot distribution centre at 1680 Thornton Road North that is set to open in the fourth quarter of 2024 being developed by Montreal-based Broccolini and designed by GKC Architecture and Design. “Lactalis Canada’s new facility in Oshawa will become the largest distribution centre, from a capacity standpoint, for Lactalis Group globally,” said Mark Taylor, president and CEO of Lactalis Canada, in a statement. “This bold step exemplifies Lactalis Canada’s growth ambitions in Canada as a dairy leader and, more importantly, reinforces our continued commitment and investment in the country and communities in which we operate.” The new facility will be used to consolidate multiple shipping locations the company operates serving its cheese and tablespreads category, including an internally operated centre in Belleville, Ontario.

Space Leased: 162,500 SF

Deal Type: New Lease

Size: 162,500 SF

Tenant: The ProLift Rigging Company Canada

Brokers Involved: Kyle Hanna, Pat Viele and Frank Protomanni of CBRE represented the landlord. Colin Alves of Colliers represented the tenant.

Deal Commentary: In another large industrial prelease signed in the third quarter, a rigging company agreed to prelease a new warehouse under construction in Brampton set to reach completion in March 2024. The tenant, ProLift Rigging, is based in Lynchburg, Virginia, and provides lifting, rigging, and relocation services.

Space Leased: 126,785 SF

Deal Type: New Lease

Size: 178,303 SF

Tenant: Stage Windows and Doors

Brokers Involved: David Hoffman and George Siotas of Colliers represented the landlord.

Deal Commentary: Stage Windows and Doors, a company that manufactures energy-efficient windows and doors, struck a deal in the third quarter to lease more than 126,000 square feet in this warehouse facility in Vaughan, Ontario, owned and managed by Manulife Financial Corp.

Space Leased: 67,373 SF

Deal Type: New Lease

Size: 67,373 SF

Tenant: Stephenson’s Rental Services

Brokers Involved: Fraser McKenna and Mike McFarlane of CBRE represented the landlord.

Deal Commentary: Stephenson’s Rental Services, a fast-growing equipment rental services company, struck a deal in the third quarter to lease Amdev Property Group’s manufacturing building at 35 Bertrand Ave. in eastern Toronto.

Source Renx.ca Click here to read a full story

Pricing Uncertainty Rules CRE Markets

Uncertainty about asset prices is expected to remain a key factor limiting transaction volumes, while deals that do proceed will likely be smaller as large investors pull back from the market and less capital is available for real estate acquisitions.

That was one of the major observations featured in PwC and Urban Land Institute’s just-released 2024 Emerging Trends in Canadian Real Estate report, which was augmented by a presentation from PwC Canada national real estate leader Frank Magliocco and a panel discussion involving industry leaders at Toronto’s The Carlu on Nov. 14.

The findings came from interviews with 209 Canadian real estate executives, who by and large weren’t as optimistic as those who had contributed to the previous year’s report.

A prevailing theme was that companies will be cautious and move slowly, with some pauses in investment and development, over the next year or two until they see more certainty in the market.

Allied and Fengate being cautious

Allied Properties REIT (AP-UN-T) is one of those cautious real estate owners. So far in 2023 it has sold data centres, paid down debt and invested in its core portfolio as it maintained liquidity of between $800 million and $900 million.

President and chief executive officer Cecilia Williams, one of the panellists, said Allied doesn’t plan to allocate any incremental capital to acquisitions next year.

“Our focus in 2024 will be to complete development activities currently underway, complete upgrade activities and lease-up vacant space,” said Williams.

“We’ve repositioned our balance sheet for strength and flexibility, and we are in capital and liquidity preservation mode.”

“When we get into a project, we always make sure that we have the equity available for it,” said another panellist, Fengate managing director and group head of real estate Jaime McKenna.

“So we’re not in a position where we need to raise capital to actually execute on the transaction.”

The rising cost of debt, however, has put Fengate in a position where it’s either pausing on making moves or taking longer to make decisions.

Optimizing portfolios and operations

“In times like this with capital scarcity, people want to ensure that they have the best positioned portfolios that are operating in the most efficient way,” Magliocco observed.

“Most leaders don’t believe that we can actually wait this out and instead we need to start to rebalance and reposition and optimize portfolios to focus on what lies ahead.

“That’s going to be critically important to position themselves as they emerge from this period of uncertainty in a much stronger form.”

Assets that were once considered core may no longer be and some owners are looking to pivot with their asset mixes or look to niches including data centres, student housing and medical offices to generate higher returns.

Panellist and Starlight Capital CEO and chief investment officer Dennis Mitchell believes most large Canadian real estate developers, managers and owners have great relationships and deep pools of capital.

Thus, he expects real estate will continue to appeal to source capital as long as returns justify it.

Mitchell would like to see more innovation in the Canadian real estate market, including the creation of pure-play data centre and cellular tower real estate investment trusts, as well as a larger focus on student housing.

Magliocco said generative artificial intelligence — which can generate high-quality text, images and other content based on data received — “has the potential to really revolutionize the rules of the game and could have a pretty profound impact on the overall strategy in achieving portfolio and operational optimization.”

Bigger emphasis on ESG

Environmental, social and governance (ESG) considerations have become critical levers as building owners and investors realize they can help preserve long-term asset values while also creating value through improved operating cash flows and more attractive capital from lenders and investors.

Panellist and Infrastructure Ontario chief ESG officer Toni Rossi said people have to stop thinking about ESG as a cost and consider it an investment.

Institutional real estate investors have traditionally been more focused on ESG than private developers and owners, but the tide appears to be turning.

“We get pressures from institutional capital, which wants ESG to be at the forefront, so we adapt our products and our policies and our investment criteria to achieve what they’re looking for,” McKenna said, adding that enables Fengate to apply similar pressure to its private partners.

“Once you get your house in order, that puts you in a power position with your partners to say ‘We’re going to expect more from you.’ ”