Falling Construction Prices Don’t Translate Into Warehouse Oversupply

Falling Construction Prices Don’t Translate Into Warehouse Oversupply

Higher Rates, Slower Economic Outlook Keeps Supply Growth in Check

The spike in demand for modern logistics space in recent years has led to more projects breaking ground. Yet the new supply pipeline remains disciplined.

In fact, under-construction projects as a percentage of inventory have declined in 2023 relative to last year. This decline occurred even as construction costs for warehouses fell across all Canadian major metropolitan areas. The higher interest rate environment and signs that the country’s economy continues to decelerate likely explain, in part, why new supply growth is moderating. This disciplined supply pipeline should help the sector weather any bumpiness that could occur from a potential recession.

With e-commerce demand pulled forward thanks to the pandemic and more resilient supply chains put in place by many companies to address goods shortages, overall demand for modern logistics space in Canada was exceedingly strong over the past few years. This demand can be seen in the availability rates for industrial space across markets. Although space availability has risen as new supply is delivered to market, it has remained at or below long-term trend levels in most cities.

This strong demand growth and limited availability of modern industrial space led developers to break ground on new projects. In fact, under-construction stock as a percentage of existing inventory increased rapidly across Canadian markets between 2020 and 2022.

This rapid rise in warehouse construction also helped lead to a jump in construction costs. These costs were also affected by a jump in apartment construction activity and a more generalized increase in wage pressures, as labour shortages in many parts of the economy became commonplace. However, since 2022, warehouse construction costs have been falling across all Canadian markets. The fall in prices has been rapid. In Montreal, for example, warehouse construction prices were growing at over 22% annually as of the fourth quarter of 2021; since then, cost growth has fallen to 10% as of the second quarter of 2023.

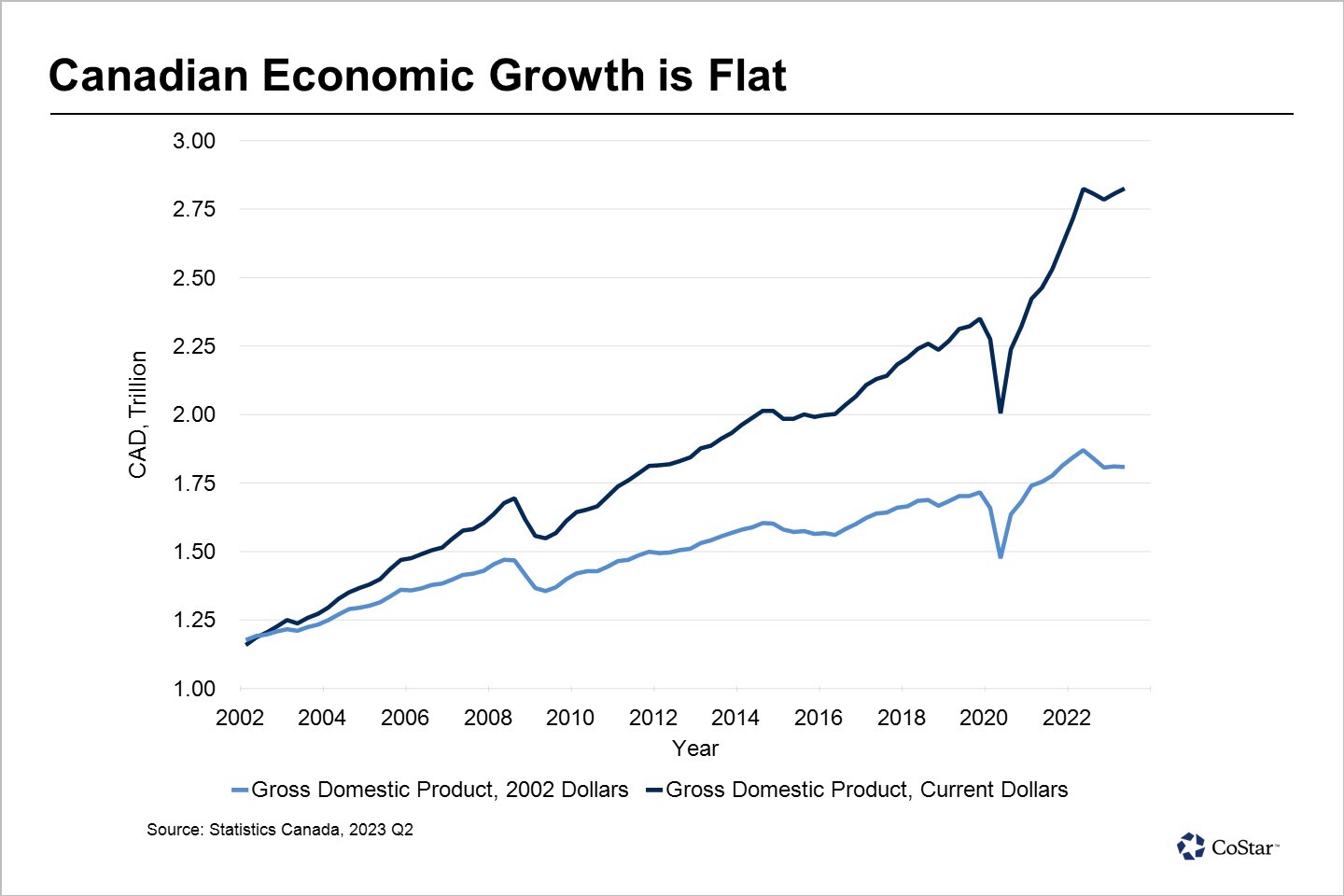

Still, warehouse construction costs remain well ahead of inflation as measured by the consumer price index. At the same time, interest rates remain at elevated levels compared to the recent past, making it harder to finance new projects. This environment is making it more difficult for developers to make their pro forma numbers work. As such, development activity, while still solid, has started to moderate in major markets compared to a year ago. The country’s lackluster economic performance since the rate-hiking cycle began may also be causing some developers to pause. In nominal terms, Canada’s economy has been flat for the last three quarters, although adjusting for inflation, the economy has already started to shrink slightly.

Although construction activity has started to moderate, developers are still obtaining permits to build new warehouses at a faster rate than before the pandemic. For example, in Toronto, around four permits per month are issued to build new warehouse developments as of mid-2023, which is higher than the three permits per month issued before 2021. Still, the level of permitting has declined substantially from the five to seven permits per month that were issued between 2021 and 2022.

Although new supply is controlled in large cities, one area for concern is smaller cities in Ontario, outside of the Greater Toronto Area, or GTA. Permits per month for new warehouse construction are relatively steady in British Columbia, Alberta, and Quebec when comparing current monthly levels to those of 2019. However, permitting in Ontario jumped in 2021 and remains elevated, in contrast to the declining trend for Toronto. This suggests that many smaller cities outside the GTA could see increased levels of warehouse construction in the coming quarters.

Much of this permitting activity is likely in the Greater Golden Horseshoe, or GGH, a large swath of territory that surrounds the GTA on the Southwest, North, and East. Developers have been breaking ground in many smaller cities of the GGH as industrial land availability in the GTA becomes harder to find. This could potentially leave some of these smaller GGH areas at risk of oversupply in the event of an economic downturn.

Despite more affordable construction prices, the industrial supply pipeline remains relatively disciplined, although one area for concern for oversupply could potentially be smaller cities outside of the Greater Toronto Area. This discipline is partly due to higher financing costs related to the rapid rise in the country’s interest rates, coupled with greater caution with respect to Canada’s near-term growth prospects. In addition, although warehouse construction costs have come down, they do remain elevated. Together, these factors help explain why the country’s construction pipeline for new industrial product remains under control. The fact that new supply does not appear to be getting ahead of existing demand suggests that the industrial sector is likely well-positioned to weather an economic downturn when it arrives.

Source CoStar Click here to read a full story