While the Canadian industrial real estate market has slowed a bit after several years of remarkable growth, it remains a favoured asset class for investors.

Colliers vice-chairman Gord Cook moderated a four-person panel that considered the state of the market and where it’s going during the recent Real Estate Forum at the Metro Toronto Convention Centre.

“Industrial has obviously been the darling asset class, probably since 2015,” said Cook in his introduction, pointing out the substantial growth in industrial rents since then — including high single-digit growth in 2023.

Cook also acknowledged industrial transaction volume had been strong during the year, exceeding $8 billion by the end of Q3. While institutional investors have stepped back and real estate investment trusts have been relatively quiet despite strong market fundamentals, private investors picked up the slack.

A number of new developments were delivered and there’s a strong pipeline for 2024, he noted.

So, while vacancy rates remain very low, many in the industry are wondering if we might be getting closer to a balanced market with supply catching up to demand as listings numbers grow and sublet space increases.

“E-commerce spending is slow, which has been a big driver of our industrial base,” Cook said. “And what I think is really interesting is there’s generally a surplus capacity in the global supply chain.”

Oxford Properties Group

Oxford Properties Group has ownership stakes in warehouse, manufacturing and distribution facilities across North America, Europe and Asia-Pacific.

Its Canadian industrial portfolio is heavily weighted in the Greater Toronto Area, but it also owns buildings in Alberta and British Columbia.

While demand for industrial product exploded during the pandemic, Oxford vice-president of industrial Alistair Pickering believes the market has entered a more normalized period.

“There will be a subset of companies who probably overreached and have a little too much space where they were just grabbing whatever they could and if they couldn’t get size-appropriate space they had to take more,” Pickering observed.

“Then we’ve got the effect of safety stock and re-shoring, which I think is a longer-term structural benefit for the industrial market.

“I think the shocks that the supply chain collapse caused have resulted in companies looking at keeping more stock on hand nearby, but also diversifying their supply chains.”

While Pickering said the United States has done a better job of encouraging the re-shoring of manufacturing, Oxford is seeing some manufacturing coming into its portfolio.

“We’re seeing demand be very muted at the moment and I think some of that is just the level of uncertainty,” Pickering said. “I think anyone who can avoid making a decision is avoiding making a decision.

“I don’t think we need to panic about that yet. I think once we start to see some stabilization and people have a reasonable view of what the future looks like, then I think those decisions will flow.”

E-commerce adoption in Canada is behind the U.S., and even further behind other parts of the world, so Pickering thinks there’s still room for growth there that will benefit industrial real estate.

“Demand is going to be tied to consumption,” he noted.

“As GDP starts growing, then people will be consuming goods and they’ve got to be manufactured, stored and distributed from somewhere. So I think the fundamentals are still very good for our industrial business.”

Even if per capita consumption is slightly suppressed, Pickering said that should be offset by Canada’s growing population.

Dream Summit Industrial LP

Dream Summit Industrial LP is owned by a joint venture between GIC and Dream Industrial REIT created through February’s $5.9-billion acquisition of Summit Industrial Income REIT. Singapore-based GIC owns 90 per cent of the venture.

Dream Summit senior VP of asset management Kimberley Hill said tenants are becoming more cautious, taking longer to make leasing decisions, pushing back on annual rent escalators and enjoying a growing number of options on where to lease.

Hill said Dream Summit can still get annual rent escalations of more than five per cent for small-bay buildings.

For larger buildings with leases of 10 years or more they’re trying to get four to five per cent early and taking it down to three per cent at the back end.

Dream Summit has significantly overshot its pro formas in Guelph and it’s seeing increasing interest in its developments from companies that service electric vehicle manufacturers, according to Hill.

Due to the rapid rent escalations of recent years, older buildings are now getting rents just a dollar per square foot less than new, speculatively constructed facilities.

Hill doesn’t think that quality relative to price is being fairly factored in today’s market.

Hill remains bullish on new development, however, because new buildings have a long track record of attracting higher rents and she believes that will continue.

BGO

BGO serves over 750 institutional clients with approximately US$81 billion of office, industrial, multiresidential, retail and hospitality property assets under management in 13 countries.

Managing partner Keith Major said most of 2023’s Canadian industrial rent growth took place in Q1, but tenants looking to renew after coming off of long-term leases are still experiencing “sticker shock.”

There are still good opportunities to get healthy annual rent escalators for small-bay buildings, according to Major, who doesn’t see annual increases ending for any size of facility.

“We need a way to hedge against inflation and we need a way to match up better to long-term yields on bonds and some of the other instruments,” Major said.

New entrants to the market have increased demand for food and food-processing facilities, and Major said some older buildings are being modernized to accommodate this sector.

“We love those tenants because they make a huge investment in the real estate and they’re really committed long-term,” said Major. “They’re very stable from a business perspective.”

Most sublet space is available in large buildings at the moment, but Major expects some tenants that needed 50,000 square feet two years ago, but took 75,000 because that’s what was available, may pull back when their leases expire.

Pure Industrial

Pure Industrial acquires, develops, leases and manages industrial real estate across Canada, including approximately 18 million square feet in the Greater Toronto Area, 17 million square feet in the Greater Montreal Area, four million square feet in the Greater Vancouver Area and four million square feet in Edmonton and Calgary.

President and COO David Owen said tenants are being hit with higher costs across the board and rents remain a relatively small portion of their overall expenses.

Larger buildings generally have longer leases of 10 to 15 years, particularly for new developments, while leases for smaller buildings generally range from three to five years.

Owen said there’s more pushback on annual rent escalators for the longer leases, while they’re still getting north of five per cent for some properties with shorter leases.

While Pure doesn’t have much sublet space in its portfolio, Owen said landlords have become more willing to offer incentives, including free rent and tenant improvements.

Owen doesn’t expect much new industrial product to enter the Canadian market from 2025 to 2028.

Source Renx.ca. Click here to read a full story

International buyers accounted for over half the largest commercial real estate sales: Altus Group

Overall commercial real estate investment in Canada was down by 35 per cent in 2023 versus 2022, the most significant percentage drop since the first year of the pandemic, according to data from Altus Group.

Canadian transactions declined from $79 billion in 2022 to $50.8 billion in 2023, according to Altus’ most recent figures.

The slowdown in activity was largely due to higher interest rates, uncertainty about the economy and a growing bid-ask separation between buyers and sellers, says Raymond Wong, vice-president, data solutions at Altus.

However, the attractiveness of the Canadian market grew to foreign buyers, with foreign investments by dollar value representing just over 50 per cent of the Top-30 Canadian transactions in 2023. Indeed, the top three transactions in 2023 by dollar volume all involved foreign buyers.

“Canada has always been seen as a safe haven for foreign dollars, especially with our population growth based on immigration over the last few years,” Wong says.

Retail prominent in major transactions

Given the reduced number of buyers in the market, it was a good opportunity for some investors to make a move, he adds.

While industrial and multiresidential real estate remains strong with investors because rents in the asset classes continue to rise, several of the Top-15 transactions in Canada in 2023 involved retail properties.

Most of 2023’s Top-15 transactions are in the GTA and in Ontario’s Greater Golden Horseshoe area.

As for a 2024 forecast, Wong expects a slow start in the number of transactions until interest rates begin to drop.

Activity should increase by mid-year as long as rates start to come down, but “I don’t think we’re going to reach the $79 billion we reached in 2022.”

The Canadian Top-15 list

Here are the 15 largest (by dollar value) commercial real estate transactions in Canada in 2023, according to Altus:

1. Allied Properties REIT sold its Toronto-based Canadian data centre portfolio to Japanese telecom firm KDDI Corporation for $1.35 billion. The transaction included freehold interests in 151 Front St. W. and 905 King St. W. and a leasehold interest in 250 Front St. W. KDDI owns and operates data centres in Asia, Europe and the U.S. through its subsidiary Telehouse.

2. Global alternative asset management firm TPG acquired a 75 per cent interest in two Oxford Properties Group industrial business parks in the GTA for $990 million. Oxford has retained a 25 per cent interest in the Brampton Business Park and Vaughan Business Park and will continue to manage the 5.1-million-square-foot, fully leased portfolio. It’s the first JV between TPG and Oxford. Tenants include Mondelez, Best Buy and Campbells, and there are several long-term leases.

3. Ohio-based Welltower expanded its relationship with Cogir Real Estate after spending $885 million to purchase from Desjardins 12 seniors’ residences with 4,173 units in the Montreal and Quebec City areas. Cogir is managing the properties as part of its five per cent stake in the JV deal. Welltower said the buildings have margins of more than 40 per cent and a low need for capital expenditure improvements.

4. U.S.-based REIT W.P. Carey spent $638.3 million to acquire four pharmaceutical R&D and manufacturing campuses in the GTA operated by Canadian global generic drug giant Apotex Pharmaceutical Holdings. The portfolio of 10 properties in the GTA and one in the Golden Horseshoe represents the majority of Apotex’s global operations, comprising 11 properties which cover about 2.3 million square feet of space. Apotex remains as a top tenant.

5. Ivanhoé Cambridge sold a 49 per cent stake of the 1.5-million-square-foot Vaughan Mills regional outlet mall to LaSalle Investment Management as part of a $470.2 million syndication deal. Under the syndication, Ivanhoé Cambridge and LaSalle will serve as co-owners of the more than 20-year-old centre, while Ivanhoé will continue to act as asset manager. Ivanhoé called the retail transaction one of the largest it has made over the past few years. Located at Highway 400 and Rutherford Road in Vaughan, the 250-tenant mall is 97 per cent leased.

6. Pinewood Group invested $425 million to acquire 33.5 acres of land and a 570,000-square-foot building that Pinewood operates as a movie studio at 101 Commissioners St. in Toronto. Build Toronto Inc. was the seller. The Pinewood Toronto Studios facility is the largest of its kind in Canada.

7. Axium Infrastructure and AgeCare Health Services invested $378.7 million to acquire the Chartwell Retirement portfolio in Toronto and Hamilton. The deal, a combination of a share sale and market transaction, included 16 long-term care homes, two of which include retirement residences, with 2,418 beds. AgeCare also operates retirement residences in Alberta and B.C. Axium is an independent portfolio management firm.

8. Primaris REIT purchased the Halifax Shopping Centre for $370 million in an investment the REIT called an attractive one due to the city’s recent population growth. Located in the city’s west end, the Halifax Shopping Centre was operated by Cushman & Wakefield Asset Services Inc., on behalf of OPB Realty Inc., the real estate arm of the Ontario Pension Board. Built in 1962 at 7001 Mumford Rd., the 170-store mall is scheduled for a renovation this year.

9. Montreal-based Groupe Mach and Sarees Investments acquired ONE60 at 160 Elgin St. in Ottawa for $277 million. The million-square-foot downtown complex appealed to Mach for several reasons, including long-awaited average lease terms of just over eight years, credit-worthy large tenants, a vacancy rate of only three per cent, recent renovations that brought it up to par and a selling price that was well below replacement value.

10. The Ontario Pension Board sold the Erin Mills Town Centre in Mississauga for $272 million to the Pemberton Group, Metrus Properties, HBNG Holborn Group, The Remington Group and Condor Properties. Built in 1989, the 850,000-square-foot centre sits on 84 acres of land.

11. Primaris REIT bought the Conestoga Mall in Waterloo from Ivanhoé Cambridge for $270 million. The 585,000-square-foot enclosed mall is located on 49.8 acres of land and has 94.4 per cent in-place occupancy.

12. Dream Unlimited Corp. and Great Gulf Group invested $259 million to buy 259-291 Lake Shore Blvd. E. in Toronto from the Toronto Waterfront Revitalization Corp. The site, covering about 4.6 acres, is zoned for high-density residential. Dream Unlimited is developing the Waterfront Toronto property on Lake Ontario.

13. Swedish lithium-iron battery manufacturer Northvolt spent $240 million to acquire from Quartier MC2 Inc. a 420-acre site in Saint-Basile-le-Grand and McMasterville, Que. Northvolt will build a new multibillion-dollar electric vehicle battery plant about 30 kilometres east of Montreal. The project’s first phase is valued at $7 billion.

14. Walia Group of Companies acquired eight retail properties – four in Calgary and four in Winnipeg – from Artis REIT for $222 million. The four Calgary shopping centres include Crowfoot Corner, Crowfoot Village, Sunridge Pointe and Sunridge Spectrum, totalling 293,660 square feet. The Winnipeg properties are Linden Ridge Shopping Centre, Linden Ridge Shopping Centre II, McGillivray Boulevard and the Shoppes of St. Vital.

15. CentreCourt Developments purchased the 830,000-square-foot Pickering Town Centre from the Investment Management Corporation of Ontario (IMCO) for $203 million. CentreCourt has announced plans to build 10 high-rise condominium buildings around the mall that will include more than 6,000 residences.

Source Renx.ca. Click here to read a full story

Overall commercial real estate dollar values drop from pre-pandemic highs, buyer trend shifts

Commercial real estate investment volume fell to a combined $28.5 billion in the Greater Toronto and Greater Golden Horseshoe regions from a historic high of $41.2 billion in 2022, according to Altus Group data. There was also a significant geographic shift in companies which completed major acquisitions in the regions.

In the individual markets, transactions fell: to $21.5 billion last year from $30.7 billion in 2022 in the Greater Toronto Area (GTA); and to $7 billion from $10.5 billion in the adjoining Greater Golden Horseshoe (GGH) area. Those numbers are perhaps not as low as they may initially appear, however.

Last year’s GTA figure, for example, was in a similar range to the 2017 to 2019 period, before the COVID-19 pandemic dropped volume to about $17 billion in 2020. The rebound from that low pushed record-breaking totals past $30 billion in the next two years, according to data provided by Altus Group.

The Top-10 GTA and GGH transactions represented approximately $5.9 billion in volume and foreign investors were responsible for the Top-5 acquisitions and six of the Top 10.

Altus Group vice-president of data solutions client delivery Ray Wong told RENX the foreign investment trend could continue into 2024 if large, high-quality assets — which is what those types of investors are seeking — are available.

Canadian private investors lead the way

Canadian private investors still accounted for the highest share of acquisition volume, however, at close to 40 per cent with $8.12 billion.

Developers were responsible for $3.84 billion, foreign public investors for $2.08 billion, users for $1.81 billion, foreign private investors for $759 million, institutions for $691.5 million, governments for $574.4 million, builders for $323 million and Canadian public investors for $233.3 million.

Sector-wise, industrial had the highest total at $5.75 billion. It was followed by:

- residential land at $3.6 billion;

- office at $2.92 billion;

- industrial, commercial and investment land at $2.7 billion;

- retail at $1.74 billion;

- apartments at $1.28 billion;

- residential lots at $314.3 million;

- and hotels at $163.3 million.

Wong said retail has remained consistent as purchasers are acquiring properties both for immediate income generation and future intensification through residential or other development.

Office properties have continued to trade and the 2023 dollar amount exceeded the 2021 total despite high vacancy rates.

Some of those transactions have also involved future intensification or redevelopment plans, according to Wong.

2024 transaction forecast

While there are buyers in the marketplace, there are fewer than in 2021 and 2022 as they’re often having difficulty finding the right asset that meets their return expectations and obtaining financing can be difficult — especially for non-income-producing land sites.

“I think there are some opportunities in the marketplace provided you have access to capital,” said Wong.

“There are still some challenges with high interest rates to be able to secure financing for certain properties, but, as interest rates start to come down later this year, we’ll see a little bit more activity.”

Morguard has already sold 14 hotels in the GTA, Halifax, Ottawa and Sudbury, Ont., for $410 million to an unidentified buyer this year.

Wong believes this could be an early indicator of more hotel transaction activity in 2024 as more people are travelling again and room rates have been increasing.

While there weren’t many distress sales in 2023, Wong thinks mortgage renewals at higher interest rates could potentially bring more this year.

The Top 10 transactions

These were the 10 largest (dollar value) commercial real estate transactions of 2023 in the GTA and GGH, according to Altus Group data:

- Japanese telecommunications firm KDDI Corporation acquired three downtown Toronto data centres totalling 1.84 million square feet for $1.35 billion from Allied Properties REIT on Aug. 16.

- San Francisco-based alternative asset manager TPG acquired a 75 per cent interest in Brampton Business Park and Vaughan Business Park, which combine to include 10 buildings totalling 5.11 million square feet on 223 acres, for $990 million from Oxford Properties Group on Dec. 18. Oxford retained a 25 per cent interest in the portfolio and will continue to manage it.

- New York City-based REIT W.P. Carey acquired 10 properties in the GTA and one in the GGH, encompassing 2.3 million square feet on 26.7 acres over four pharmaceutical research and development and manufacturing campuses, for $638.28 million from Apotex Pharmaceutical Holdings Inc. in a sale-leaseback deal on April 3. Apotex signed a triple-net master lease with fixed rent escalations over a 20-year term to remain at the properties.

- Chicago-headquartered LaSalle Investment Management acquired a 49 per cent interest in the Vaughan Mills shopping centre in Vaughan for $470.16 million from Ivanhoé Cambridge on Dec. 20. Ivanhoé Cambridge will continue to act as asset manager.

- London, U.K.-based Pinewood Group acquired Pinewood Toronto Studios, an 11-stage film and television studio encompassing 570,000 square feet on 33.5 acres in Toronto, for $425 million from Build Toronto on May 3.

- Axium Infrastructure Inc. and its affiliates and AgeCare Health Services Inc. and its affiliates acquired 16 long-term care homes with 2,418 beds in the GTA and GGH for $378.7 million from Chartwell Retirement Residences on Sept. 6.

- Pemberton Group, Metrus Properties, HBNG Holborn Group, The Remington Group and Condor Properties acquired Mississauga’s Erin Mills Town Centre, a mall encompassing 898,578 square feet on 85.2 acres, for $272 million from the Ontario Pension Board on Jan. 31.

- Dream Unlimited Corp. and Great Gulf Group acquired 4.6 acres of residential land at 259-291 Lake Shore Blvd. E., 200 Queens Quay E. and 2 Small St. in Toronto for $259.04 million from Toronto Waterfront Revitalization Corporation on March 1.

- CentreCourt acquired the 700,000-square-foot Pickering Town Centre mall and a 130,000-square-foot office building on 55 acres at 1355 Kingston Rd. in Pickering for the future master-planned Pickering City Centre residential and mixed-use development for $203 million from Investment Management Corporation of Ontario (IMCO) on Dec. 15.

- Pontegadea Group, the family office of Spanish billionaire Amancio Ortega, acquired a 422,433-square-foot industrial building on 59.7 acres at 45 Di Poce Way in Vaughan for $198.2 million from Pure Industrial on June 15.

Source Renx.ca. Click here to read a full story

Vacancy has surged in downtown office markets across the country as more new buildings are completed and companies deal with cost cuts as well as combinations of at-home and in-office work.

The real estate company said Toronto offices drove the national downtown vacancy rate to a record high of 19.4% in the fourth quarter, according to a report by CBRE. The downtown vacancy rate in Canada’s largest city rose to 17.4% in the year’s final quarter, up from 15.8% a quarter earlier.

Additional new supply helped to drive downtown Toronto’s vacancy rate, with 624,550 square feet of new office space completed in the fourth quarter. The 1.1 million square feet of new supply in downtown Toronto’s office market in 2023 led to negative absorption, or change in the amount of space occupied, of 2.7 million square feet, the worst result since 2020.

“The office market continues to face challenges, but Toronto’s are particularly acute right now,” said Paul Morassutti, chairman of CBRE Canada, in the report. “Based on global trends, office utilization and demand are picking up. That is helping improve office fundamentals in most Canadian cities. Toronto will also benefit from the overall trends once new construction comes to an end since it is new supply that’s had the biggest impact on the city’s vacancy.”

Once Toronto’s office market performance is factored out, Canada would have had a positive net absorption in the fourth quarter, CBRE said.

The real estate company also said office-to-residential conversion programs such as this one in Calgary have helped the office market and credited those programs with Calgary’s third straight quarter of positive absorption. The oil patch still has a downtown vacancy rate of 30.2%, but that was close to 33% a year ago.

In the capital, CBRE said office-to-residential conversions have helped to reduce the vacancy rate in downtown Ottawa to 14.2%. The downtown vacancy rate peaked above 15% in the second quarter of 2023.

More than 2.5 million square feet of office space, or 0.5% of the total national inventory, was converted to primarily residential use in 2023. CBRE said the number of feasible conversions is limited because of physical requirements, zoning and financial viability.

The rising vacancy rate continues to impact Canada’s office development pipeline, with only 10.9 million square feet of space under construction nationally. That is equal to 2.2% of inventory, with 54.4% of that space preleased.

Construction of new office space is now at its lowest level since the third quarter of 2017. CBRE said only 784,000 square feet of office projects started construction in 2023.

Sam Damiani, an analyst with TD Cowan, said the CBRE report points to signs of stabilization in the office market, with only Toronto’s new towers masking what would have been a positive quarter for demand.

“We believe the report will likely ease some investor concerns over office fundamentals as reflected by the heavily discounted valuation of Canadian Office REITs,” said Damiani in a note that suggests a capitalization rate for offices of an implied annual 8.3% yield with average prices of $305 per square foot. “We do remain cautious on the near-term outlook given the about 7.6 million square feet of deliveries slated for 2024 [versus 2.5 million square feet in 2023] along with a challenging leasing environment.”

Source CoStar. Click here to read a full story

Rexall’s American owner is shopping the pharmacy chain to prospective buyers, according to sources, as McKesson Corp. reconsiders its Canadian footprint after a 15-year expansion.

Texas-based McKesson Corp. is a distribution giant for the pharmaceutical industry, and the company took a particular interest in Canada starting around 2008. Initially, McKesson Corp. expanded by acquiring independently owned pharmacies, but it made a major splash in 2016 with the acquisition of Rexall from the Katz Group Canada Ltd. for $2.9-billion.

Eight years and a pandemic later, McKesson Corp. is looking to unload Rexall and has been in contact with prospective buyers, according to two sources familiar with the sale process. Rexall operates roughly 400 pharmacies and employs around 8,000 people. In an email to The Globe, McKesson said it does not comment on rumours or speculation.

The Globe and Mail is not identifying the sources because they are not authorized to speak publicly about the matter.

Although McKesson Corp. is exploring a sale, there is no guarantee a deal will be completed. The pool of potential buyers includes rival chains who want to expand their footprints as well as private equity firms, many of whom are flush with cash. If a sale is completed, McKesson Corp. could remain a Rexall partner by supplying the chain through its pharmaceutical distribution arm.

The pharmacy business is a challenging one in Canada because governments regulate drug prices, particularly generic versions of medicines that have lost their patents. Operational costs have also jumped because of inflation, and a pharmacist shortage in some parts of the country has created logistical challenges.

McKesson Corp. struggled with Rexall’s profit margins early in its ownership. Shortly after the acquisition closed, Canada implemented new rules that slashed prices on generic drugs, and provinces such as Ontario and Alberta hiked their minimum wages.

In response, Rexall shut nearly 10 per cent of its 450 pharmacies in 2018. The same year, McKesson Corp. warned investors it would take an after-tax asset-impairment charge of between US$600-million and US$1.98-billion, tied partly to the Rexall business.

Because profit margins in the pharmacy business can be so slim, one of Rexall’s best opportunities for growth is in retail. The chain sells everything from cleaning products to cold and pain medications to baby products, and some rivals have found ways to make their retail divisions quite profitable. Chains such as Shoppers Drug Mart Corp., which is owned by Loblaw Cos. Ltd., and Metro Inc.’s Jean Coutu Group (PJC) Inc. have reported strong margins on “front-of store” items such as cosmetics.

McKesson Corp. has tried to retool and beef up Rexall’s retail division over the past few years. In 2019, Rexall partnered with frozen-fare specialist M&M Food Market to put M&M products into freezers. At the time, pharmacy retailers were keen on adding more food offerings in a bid to attract customers who purchase food more than other products, particularly younger demographics. Shoppers, for instance, also added more Loblaw Cos. Ltd. and No Frills products to its shelves.

A year later, in 2020, Rexall launched its own loyalty program, known as Be Well. Until that point, the retailer had partnered with the Air Miles loyalty program, but retailers of all stripes have been launching their own in-house programs, such as Optimum at Loblaw and Triangle at Canadian Tire Corp. Ltd., to get more data on their shoppers and to develop more personalized marketing offers.

Because so many retailers were launching their own programs, Air Miles became a less desirable loyalty program over time, and in 2023 its parent company filed for creditor protection. Bank of Montreal, a long-time credit card partner for Air Miles, now owns the company.

Rexall also tried to retool by emphasizing health products, something it paired with McKesson’s purchase of the Well.ca online drugstore in 2017. Rexall tried to integrate the site, which is popular with women, with its bricks-and-mortar stores, cross-stocking their merchandise and allowing customers to pick up their online orders at Rexall locations. The retailer also dropped its historic Pharma Plus in-house brand, to create a consistent look across the chain.

As McKesson Corp. retooled Rexall, its Canadian leadership faced multiple rounds of upheaval. Domenic Pilla, the former head of Shoppers Drug Mart, was hired to run McKesson Corp. Canada in 2017, but he retired in 2020. The company named Rebecca McKillican, who was previously president of Well.ca, as his successor, but she was replaced last year by Joan Eliasek, who previously held other executive roles within the company.

McKesson Corp. has reconfigured its global footprint in recent years. In 2021, the company sold its European businesses in France, Italy, Ireland, Portugal, Belgium and Slovenia, and also sold its British business, which included LloydsPharmacy.

Source The Globe And Mail. Click here to read a full story

Canadian office tenants have the upper hand when it comes to negotiating with their landlords heading into 2024 after a year in which availability rates stabilized at elevated levels.

According to a new report from Altus Group Ltd., Canada’s national office availability rate remained steady at 17.6 per cent in the fourth quarter of 2023, with sublet space dropping to 17.4 per cent of total available office space.

While the supply of available sublet space declined slightly, Ray Wong, vice-president of data solutions at Altus, said tenants still have an advantage overall because of choices in the market.

Only 11 office buildings were completed across the country in 2023, with Toronto topping the list at four completions totalling 786,135 sq. ft., followed by Vancouver and Montreal. Montreal added the most office space, at 1.32 million sq. ft. However, the pace of new office construction has significantly declined in the last two years.

According to Altus, companies are still determining the optimal amount of space needed for employees based on new hybrid models.

“When you look at the numbers with respect to Toronto, it has an availability rate at 18.1 per cent,” Wong said. “Class-A space, which is the most in demand, tenants still have the upper hand at 15.7 per cent.”

Sublet spaces, where tenants can avoid additional costs such as carpeting, painting, and in some instances, even furniture, which departing companies are leaving behind, are one of those options.

“From a cost advantage standpoint, it makes sense,” he said.

Wong said that rather than putting office space up for sublet, some companies are renegotiating their leases in such a way as to occupy less space while extending their lease terms. That is leading to the decline in available sublet space, but reveals another option available to tenants.

The availability rate, which indicates the amount of space in a market available for immediate or short-term deals, differed across the country to end the year, with Vancouver the lowest at 12.2 per cent, Quebec City at 12.3 per cent and Ottawa at 13.4 per cent. Calgary, with the highest rate at 23.8 per cent, experienced a decline in availability due to the Downtown Calgary Development Incentive Program. The program incentivized the conversion of office spaces into residences, thereby reducing vacant spaces and gradually lowering availability. By October 2023, the program, overwhelmed by demand, halted new applications, the report indicated. It currently has 13 approved and four pending projects.

Remote work arrangements dropped to 12.6 per cent in November 2023 from 24.3 per cent in January 2022, while hybrid work setups tripled, rising to 11.7 per cent from 3.6 per cent during the same period.

Wong said the current market remains somewhat unpredictable because companies are still adjusting their space requirements.

“The challenge with the market right now is a combination of companies sort of right sizing or downsizing or keeping their space and that’s causing the market to be fluid to a certain extent,” he said.

Source Financial Post. Click here to read a full story

TORONTO, Jan. 16, 2024 /CNW/ – Today, the federal government announced $235.9 million to build 494 rental apartments in Toronto. The funding will come as fully repayable low-interest loans through the Apartment Construction Loan Program.

The announcement was made by Yvan Baker, Member of Parliament for Etobicoke Centre, on behalf of the Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities, and by James Maloney, Member of Parliament for Etobicoke—Lakeshore.

Located at 300 the East Mall, the Valhalla Village Phase 1 project is a two-tower development containing 494 rentals for middle class families and individuals. Through geothermal heating, the towers will have net zero carbon emissions once complete. They will also have multiple amenity spaces that are designed to be communal, inclusive, accessible, and suitable for shared use by all residents.

The project is expected to be completed by May 2027.

Canada’s construction of rental homes has not kept pace with the country’s growing cities and population, leading to a decline in the existing and aging rental stock for decades. To tackle this issue, the federal government introduced the Apartment Construction Loan Program to help build more rentals across the country. Increasing the overall supply of rental housing is crucial to creating stronger and more vibrant communities that Canadians can feel proud to call home.

Quotes:

“Too many Canadians are struggling to find somewhere to rent and to call home, especially here in Toronto. That’s why the federal government is seized with reversing this trend, and through the Apartment Construction Loan Program, we are incentivizing the development of much-needed rental units in the whole country. Investments like the one announced today in Etobicoke Centre will help to increase the supply of housing and create a huge difference in strengthening our communities.” – Yvan Baker, Member of Parliament for Etobicoke Centre

“This important investment from the federal government demonstrates our strong commitment to working with all communities to meet the challenge of building more rental housing. This important investment in housing will soon create thousands of safe, well-built homes for hardworking, middle-class Canadians and add much needed supply to the rental market here in Toronto.” – James Maloney, Member of Parliament for Etobicoke—Lakeshore

“The 172 affordable rental housing opportunities at 300-304 The East Mall are a testament to what can be achieved when different orders of government and developers work together. As Mayor, I am determined to create more affordable housing options so more people can continue to call Toronto home.” – Mayor Olivia Chow

“Breaking ground at Valhalla Village is a critical first step in KingSett’s ambitious goal of developing a portfolio of rental housing that leads the industry in terms of depth, product design, and sustainability. The location and scale of Valhalla Village presents a compelling opportunity to create purpose-built affordable housing at a critical time for the local community. We are very excited to be moving ahead with this extraordinary development.” – Jeff Thomas, Group Head, Development at KingSett Capital

Quick facts:

- Through the City of Toronto’s Open-Door program, City Council approved approximately $9.87 million in financial incentives – including property tax and development charge exemptions and permit fee waivers – to support the Valhalla Village project.

- The Apartment Construction Loan Program – previously known as the Rental Construction Financing Initiative (RCFi) – is part of the Government of Canada’s National Housing Strategy (NHS), an $82+ billion plan to give more Canadians a place to call home.

- As of September 30, 2023, the Government of Canada has committed over $38.89 billion to support the creation of over 151,803 units and the repair of over 241,133 units. These measures prioritize those in greatest need, including seniors, Indigenous Peoples, people experiencing or at risk of homelessness, and women and children fleeing violence.

- The Apartment Construction Loan Program provides fully repayable low-interest loans to encourage the construction of more rentals for middle class Canadians. It creates a positive impact to the housing system at minimal cost to taxpayers.

- It is one of many programs and initiatives under the National Housing Strategy designed to help address housing needs across the housing continuum.

- It complements other NHS initiatives that focus on funding affordable housing units for lower-income households.

- Through the program, the federal government is encouraging the construction of more than 71,000 rentals.

- A stable supply of purpose-built rental housing is essential for more people in Canada to have access to housing that meets their needs.

- On December 21, 2023, the Government of Canada announced an agreement of over $471 million with the City of Toronto, to fast-track nearly 12,000 new housing units over the next three years through the Housing Accelerator Fund. The work will also help spur the construction of 53,000 homes over the next decade.

Related links:

- Visit canada.ca/housing for the most requested Government of Canada housing information.

- As Canada’s authority on housing, CMHC contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that everyone in Canada has a home they can afford and that meets their needs. For more information, please visit cmhc.ca or follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

- Progress on programs and initiatives are updated quarterly at www.placetocallhome.ca. The Housing Funding Initiatives Map shows affordable housing projects that have been developed.

SOURCE Canada Mortgage and Housing Corporation (CMHC) Click here to read a full story

Office vacancy rates in Toronto’s downtown show that all office has been affected by the rise in hybrid-work policies.

However, five-star office buildings, with the amenities and accoutrements that make their spaces stand out, are faring significantly better than somewhat older, but still high-quality four-star buildings. The divergence in performance has accelerated since the start of the year. This suggests that some occupiers are choosing to take new space in the highest quality of buildings while reducing or exiting their footprint in older, or lower-quality space. In short, occupiers are increasingly “fleeing to quality.”

Downtown Toronto is Canada’s most important office market, accounting for nearly 100 million square feet or roughly 10% of the nation’s office space. Nearly two-thirds of office space in downtown Toronto submarkets is four- or five-star quality and represents some of the best quality space in North America. Yet, downtown Toronto, like other important office nodes, has been affected by the rise of hybrid work since the pandemic, which have caused many occupiers to rethink their space needs.

In fact, at the beginning of the pandemic, five-star office space was affected more than other classes. Vacancy jumped from 0.7% in the first quarter of 2020 to 4.5% a year later. This increase of 380 basis points in vacancy compares to an increase of 320 basis points for the market overall. The relative underperformance of five-star space was likely affected by the addition of over 2.5 million square feet of new five-star office space in 2020, which proved difficult to lease up during the public health crisis. Yet still, the overall vacancy rate in five-star space remained less than other classes.

Between 2021 and early 2023, the vacancy rate continued to rise across all classes of downtown Toronto office. However, in 2023 a new trend emerged: Vacancy started to decline in five-star offices while continuing to increase across other classes. This likely had something to do with the fact that 2023 — and to a lesser extent 2024 — are years in which a large wave of office lease expiries transpire. This has provided more opportunities for owners of five-star offices to find potential occupiers who may be looking to upgrade their space.

The picture is bleaker for four-star space. Occupiers of this quality Class A space often have the financial means, if desired, to upgrade to five-star space even in the context of a cooling economy. Yet three-star occupiers, who might aspire to four-star space, are more likely to be financially constrained given the slowing economy. In other words, four-star offices risk losing more occupiers to five-star offices than they are likely to gain from three-star offices.

Because of this, at least in the short term, four-star office space is likely to underperform relative to the other categories, especially versus five-star. This suggests that Toronto’s downtown office sector is likely to see a bifurcation in leasing performance in the future, with the best-in-class buildings outperforming the rest.

Source CoStar Click here to read a full story

The real estate business in 2024 is likely to look familiar to those dealing with the dearth of deals in 2023, property professionals say.

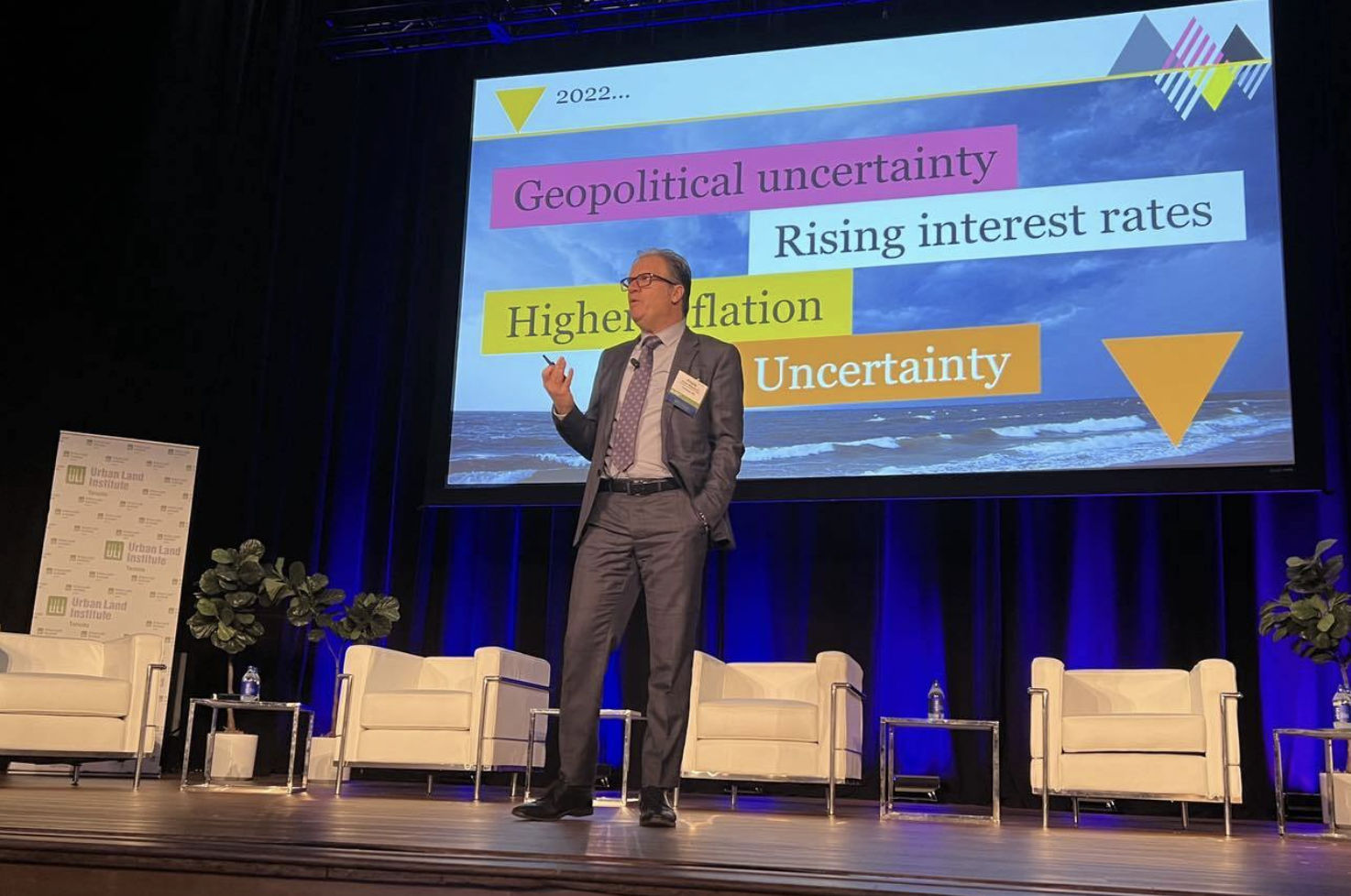

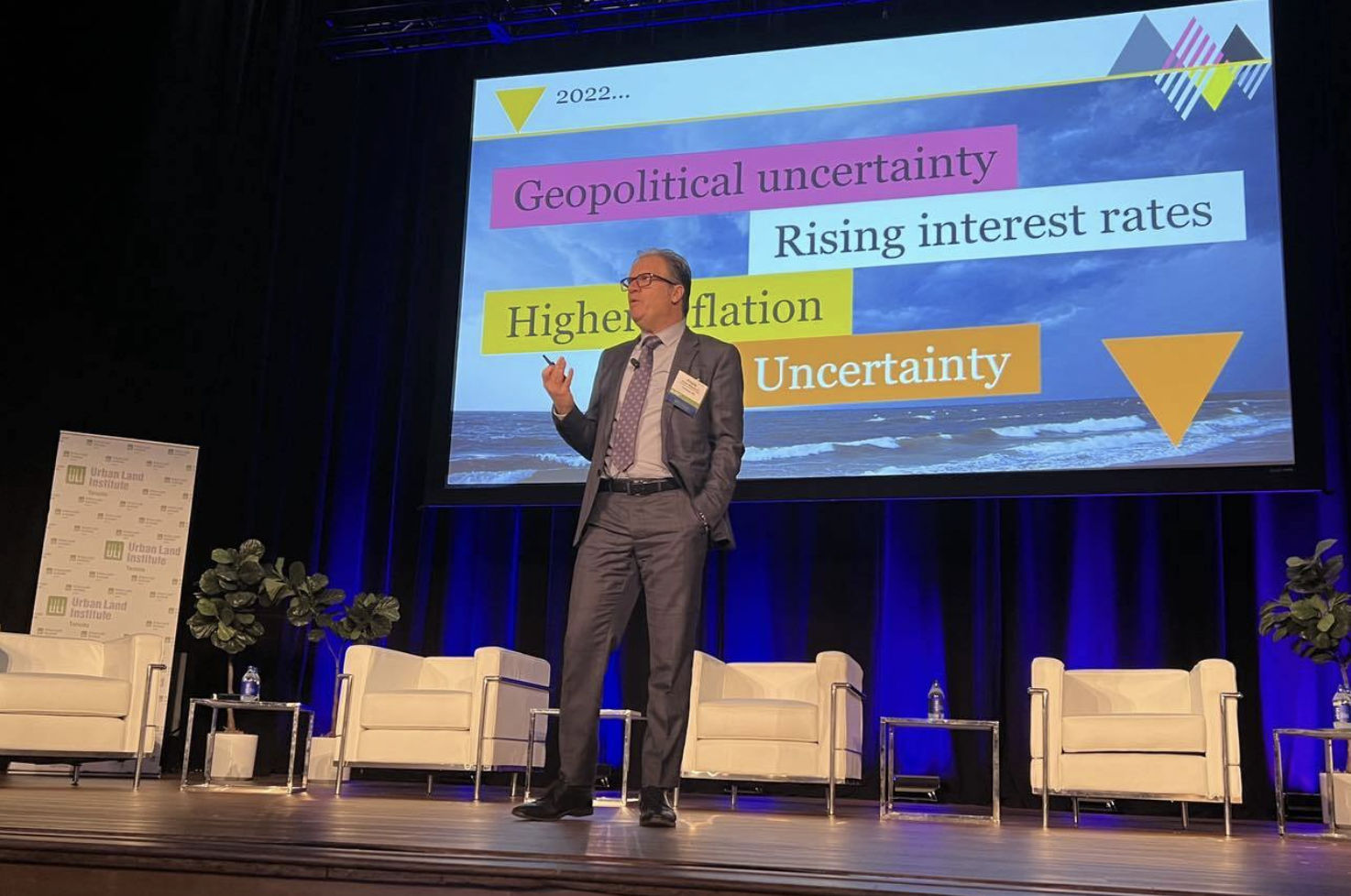

PwC’s “Emerging Trends in Canadian Real Estate,” released this month at the Urban Land Institute’s annual trends program, paints a picture of uncertainty still driving the market.

“This was a very notable trend in last year’s report that reflected a wide gap in valuation expectations between buyers and sellers of real estate assets as rising interest rates began to increase financing costs and put a damper on deal activity,” said PwC in its report.

Flash forward a year later, and little has changed in the sector as price discovery continues.

“Most interviewees believed overall uncertainty about asset prices would remain a key factor in holding back transactions for the time being, while those deals that do proceed will likely be smaller as large investors pull back from the market and the amount of capital available for real estate declines,” according to the report which was based on interviews with 600 executives. The conclusions are also based on 1,200 individuals who responded to a survey.

Frank Magliocco, national real estate leader of PwC Canada, told the Urban Land Institute event, many are gloomy about their near-term prospects.

“The idea the industry is going back to a new normal after the pandemic is about as gone as the optimism we had in 2022. Inflation is settled somewhat but still much higher than we are used to. Many (of those) interviewed wonder if we are on the brink of a recession,” said Magliocco.

Despite the prospect of a recession, the survey found those hoping for bargains may be disappointed. as interviewees tended to believe that opportunistic or distressed deals would remain hard to find.

PwC’s survey found that 57% of those surveyed believe capital will be undersupplied in 2024, a significant increase from 27% in 2023. Only 16% of respondents expect an oversupply of money, with the rest saying the market will be in balance.

“This challenge is compounded by uncertainty about whether investors can count on asset values going up. In struggling asset classes such as offices, interviewees note difficulties securing refinancing because banks are unwilling to renew mortgages without additional equity infusions for some of these properties,” said PwC in the report.

The top economic and financial issue in 2024 is interest rates and the cost of capital. On a scale of one to five, interest rates and cost of capital received a 4.63. Capital availability was second at 4.2. Qualified labour availability was third at 4.1.

“Ultimately, all of these factors are impacting the investment activity outlook for 2024 but also equally impacting the prospects for development in 2024,” Magliocco told the audience.

Respondents rated Toronto as the number one market in the country for investment prospects, but even Canada’s largest city only scored 3.29 out of 5. Vancouver was second at 3.15, and Calgary third at 3.04.

But asset class, the neighbourhood community shopping centre was cited by 65% as a buying opportunity, making it the number one recommended investment subsector. Another 35% had neighbourhood community centres as a hold.

Workplace apartments finished second for a buying opportunity, cited by 58% of respondents. Another 40% had that asset class as a hold, with 2% calling for a sale.

The third was data centres, which 57% had as a buy and 29% had as a hold. Only 14% had the asset class a sell.

“Some of the core assets in funds are being replaced with other assets such as data centres, student housing and medical offices,” said Magliocco.

However, he emphasized that liquidity may be the most critical investment issue in 2024.

“One individual told me he’s investing in the new L Class. He responded liquidity is the most important investment in the coming year,” he said.

Source CoStar Click here to read a full story

Toronto-based Primaris Real Estate Investment Trust has agreed to acquire two Halifax shopping facilities in a $370 million deal, the second major announced transaction of 2023.

The REIT, which started publicly trading just under two years ago, will have a proforma portfolio of 37 properties, or 12.5 million square feet, valued at approximately $3.9 billion, with deals for the Halifax Shopping Centre and the Annex in Nova Scotia.

“Halifax Shopping Centre and the Annex exemplify the quality and market leading nature of Primaris REIT’s target acquisition profile. The shopping complex is extremely well located in central Halifax, adjacent to Halifax Transit’s Mumford Terminal and at the gateway to the Halifax peninsula, with a market leading position in one of Canada’s fastest-growing mid-sized population centres,” said Patrick Sullivan, president and chief operating officer of Primaris, in a statement.

Halifax is experiencing significant population growth, and has been one of Canada’s top five fastest-growing areas for the past four years. The region’s population is expected to grow 18.4% by 2033, outpacing the national average of 13.6% during that time, according to the statement from Primaris.

The deal is the second major transaction for Primaris to announce in 2023 after the REIT paid $270 million to buy Conestoga Mall in Waterloo from the real estate arm of the Caisse de dépôt et placement du Québec.

“Closing this second significant acquisition in 2023 while maintaining industry-leading credit metrics is a testament to the strategic advantages provided by Primaris REIT’s differentiated financial model, including very low leverage, a low payout ratio and significant retained free cash flow,” said Rags Davloor, chief financial officer of the REIT, in the statement.

The Halifax Shopping Centre is the top enclosed mall in Halifax, with 562,000 square feet on 20.9 acres. The mall had $1,012 per square foot of same-store sales and annual all-store sales volume of $260.8 million as of Sept. 30, Primaris said in the statement.

The mall has 69% in-place occupancy and 96.2% committed occupancy, including executed leases commencing over the next few months as part of the Sears redevelopment, including with tenants such as Simons, Winners, Dollarama and PetSmart, according to the statement.

The Annex property is a 412,000-square-foot open-air facility next to the Halifax Shopping Centre, almost 100% currently leased. The site is home to the Halifax Transit Mumford Bus Terminal, one of the city’s busiest terminals. It is designated as a future growth node by the city, with an application for approximately 1,800 residential units with mixed-use components and future phases of roughly 5,500 residential units.

“Primaris is uniquely positioned as a buyer, with institutional scale, as the second largest owner-operator of enclosed shopping centres in Canada,” said Alex Avery, chief executive of Primaris, in a statement on the deal.

The deal, expected to close on Nov. 30, is being funded with $200 million in cash. Another $45 million of units of the trust and $125 million of 6% exchangeable preferred units are being issued.

Brad Sturges, an analyst with Raymond James, said as the dominant mall in one of Canada’s fastest-growing cities, the deal leaves room for future growth and value creation.

“The REIT’s Halifax Shopping Centre and The Annex purchase hits several key investment metrics for Primaris, including strong competitive positioning as the local market dominant mall, significant net operating income growth potential, other avenues available to create value and recent capital improvements completed that reduce near-term, future maintenance expenditure requirements,” said Sturges in a note to investors.

Sturges said the going-in capitalization rate of the deal is expected to be in the low 6% range, while future net operating growth in the next three to five years may push the stabilized yield to over 7%.

Desjardins Capital Markets, TD Securities and CBRE Canada acted as advisers to Primaris REIT on the deal.

Source CoStar Click here to read a full story