Property Professionals Prepare for More of the Same in 2024

Property Professionals Prepare for More of the Same in 2024

The real estate business in 2024 is likely to look familiar to those dealing with the dearth of deals in 2023, property professionals say.

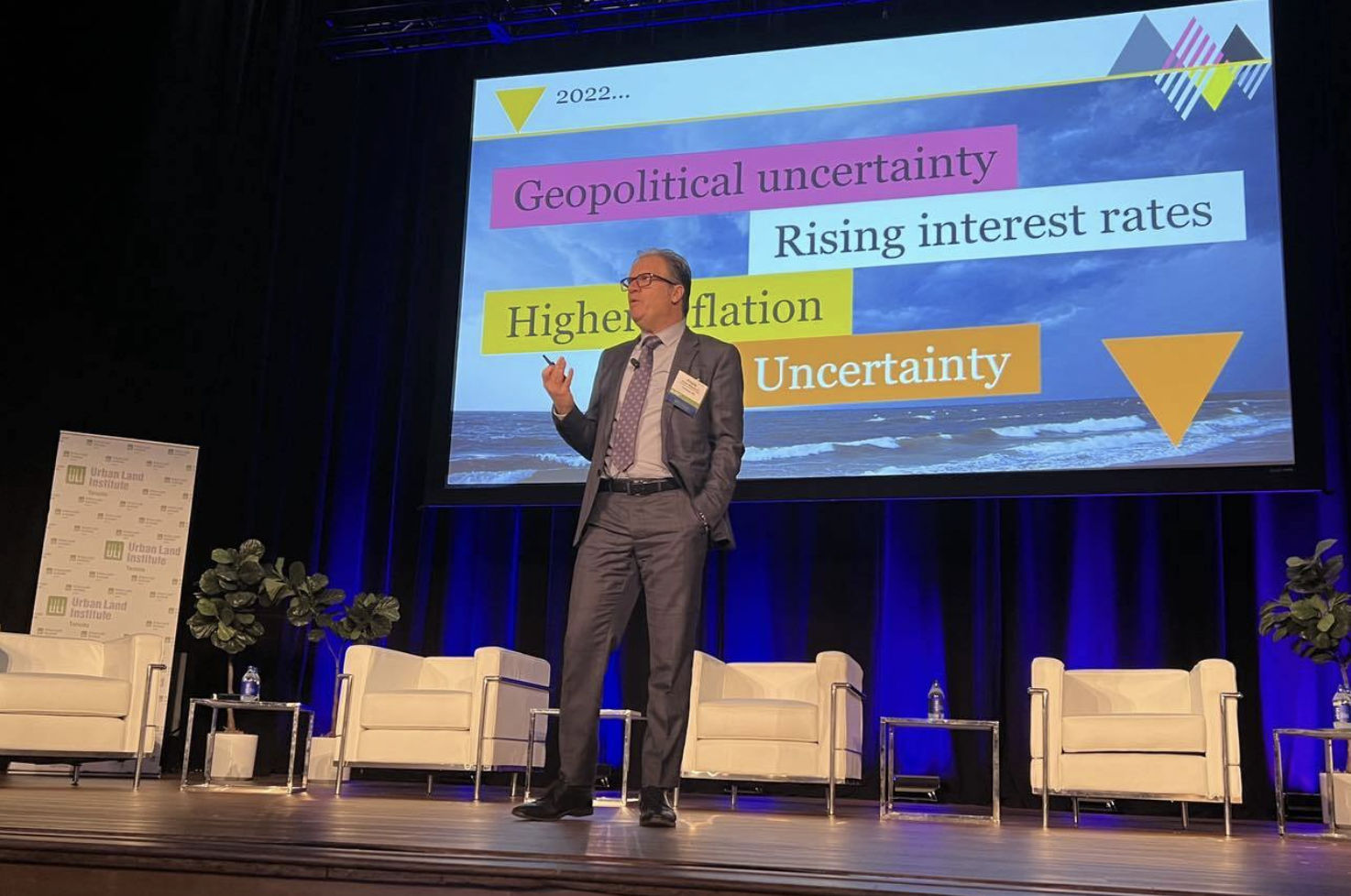

PwC’s “Emerging Trends in Canadian Real Estate,” released this month at the Urban Land Institute’s annual trends program, paints a picture of uncertainty still driving the market.

“This was a very notable trend in last year’s report that reflected a wide gap in valuation expectations between buyers and sellers of real estate assets as rising interest rates began to increase financing costs and put a damper on deal activity,” said PwC in its report.

Flash forward a year later, and little has changed in the sector as price discovery continues.

“Most interviewees believed overall uncertainty about asset prices would remain a key factor in holding back transactions for the time being, while those deals that do proceed will likely be smaller as large investors pull back from the market and the amount of capital available for real estate declines,” according to the report which was based on interviews with 600 executives. The conclusions are also based on 1,200 individuals who responded to a survey.

Frank Magliocco, national real estate leader of PwC Canada, told the Urban Land Institute event, many are gloomy about their near-term prospects.

“The idea the industry is going back to a new normal after the pandemic is about as gone as the optimism we had in 2022. Inflation is settled somewhat but still much higher than we are used to. Many (of those) interviewed wonder if we are on the brink of a recession,” said Magliocco.

Despite the prospect of a recession, the survey found those hoping for bargains may be disappointed. as interviewees tended to believe that opportunistic or distressed deals would remain hard to find.

PwC’s survey found that 57% of those surveyed believe capital will be undersupplied in 2024, a significant increase from 27% in 2023. Only 16% of respondents expect an oversupply of money, with the rest saying the market will be in balance.

“This challenge is compounded by uncertainty about whether investors can count on asset values going up. In struggling asset classes such as offices, interviewees note difficulties securing refinancing because banks are unwilling to renew mortgages without additional equity infusions for some of these properties,” said PwC in the report.

The top economic and financial issue in 2024 is interest rates and the cost of capital. On a scale of one to five, interest rates and cost of capital received a 4.63. Capital availability was second at 4.2. Qualified labour availability was third at 4.1.

“Ultimately, all of these factors are impacting the investment activity outlook for 2024 but also equally impacting the prospects for development in 2024,” Magliocco told the audience.

Respondents rated Toronto as the number one market in the country for investment prospects, but even Canada’s largest city only scored 3.29 out of 5. Vancouver was second at 3.15, and Calgary third at 3.04.

But asset class, the neighbourhood community shopping centre was cited by 65% as a buying opportunity, making it the number one recommended investment subsector. Another 35% had neighbourhood community centres as a hold.

Workplace apartments finished second for a buying opportunity, cited by 58% of respondents. Another 40% had that asset class as a hold, with 2% calling for a sale.

The third was data centres, which 57% had as a buy and 29% had as a hold. Only 14% had the asset class a sell.

“Some of the core assets in funds are being replaced with other assets such as data centres, student housing and medical offices,” said Magliocco.

However, he emphasized that liquidity may be the most critical investment issue in 2024.

“One individual told me he’s investing in the new L Class. He responded liquidity is the most important investment in the coming year,” he said.

Source CoStar Click here to read a full story