Author The Lilly Commercial Team

Toronto Industrial Market Has Millions Of New Sq. Ft. On The Way

Industrial real estate transactions in the Greater Toronto Area (GTA) may have slowed in Q3 and developers and landlords may be becoming more cautious in response to current economic conditions, but the outlook remains positive for the approximately 840-million-square-foot and growing market during the next year.

Rents continued to rise, the vacancy rate was at a record low 0.9 per cent during the quarter and demand continues to outpace supply, so the pieces are in place for continued activity.

“The fundamentals are still strong,” JLL executive vice-president and managing director of GTA office and industrial Jonathan Peretz told RENX. “Overall, the industrial market is still historically very active and demand is still very strong. That gives me a sense of optimism for the development community.”

There were 17.77 million square feet of space under construction, with 6.4 million of the total expected to be completed by the end of the year, according to a new JLL report.

“The rates of new supply and delivery slowed down a bit this year, but that’s because there was just a big surge of construction after the construction stoppages over COVID,” Avison Young research manager for suburban markets Warren D’Souza told RENX.

Third-quarter construction starts included Pure Industrial’s sites at 10 and 20 Whybank Dr. in Brampton – at more than 600,000 square feet – and BentallGreenOak’s sites at 1352 and 1362 Tonolli Rd. in Mississauga combining for 516,375 square feet.

Third-quarter completed projects

The largest completion of the third quarter was a 445,100-square-foot distribution facility at 1655 Reading Ct. in Milton built by Orlando Corporation and fully leased by Rockwool.

That was followed by a 216,100-square-foot building for Canadian Appliance Source at 27 Director Ct. in Vaughan, and a 139,000-square-foot building at 675 Harwood Ave. N. in Ajax owned by Triovest that was 60 per cent leased.

Although the GTA saw 1.8 million square feet of deliveries during the third quarter, according to JLL, 79.9 per cent of that was pre-leased.

“Developers, regardless of the economic headwinds, are still not running for the hills,” Avison Young principal of industrial and capital markets real estate Ben Sykes told RENX.

“No one is in a rush to do a deal. Groups are still being very selective on covenant and use, and a lot of groups do not want to split larger tracts and space.”

New developments coming soon

Orlando has a new 569,083-square-foot cross-dock distribution centre at 1890 Reading Ct. in Milton that will be available for occupancy in March. Sykes said a number of groups are looking at that site.

Sykes said Panattoni will deliver a 485,485-square-foot, spec-built facility at 100 Ace Dr. in Brampton in Q1 2023 and noted there are indications a transaction could be in the offing with a multi-national manufacturer.

Menkes is nearing completion of a fully leased 377,254-square-foot warehouse at 8205 Parkhill Dr. in Milton.

Sykes said Crestpoint Real Estate Investments Ltd. and Alberta Investment Management Corporation are delivering a 630,000-square-foot, spec-built facility at 3160 Derry Rd. E. in Mississauga and are in active negotiations with a potential tenant.

Oxford Properties broke ground on its 180-acre, 3.3-million-square-foot master-planned James Snow Business Park greenfield development in Milton in the third quarter.

The first phase will comprise nearly 1.6 million square feet and include 400,000 square feet of solar panels as part of its sustainability commitment.

Canada Post will become the owner of the largest industrial building in Canada to meet standards for net-zero emissions. The 585,000-square-foot processing centre at 1395 Tapscott Rd. in Scarborough is expected to open in March.

Toromont Industries announced plans to build a 137,000-square-foot remanufacturing facility on 30 acres in Bradford West Gwillimbury.

Leasing demand remains strong

Nine leases of more than 100,000 square feet were signed during the third quarter, including:

• Samsung’s renewal of 435,000 square feet at 8041 Fifth Line in Halton Hills;

• Traffic Tech’s renewal of 249,500 square feet at 550 Matheson Blvd. E. in Mississauga;

• Shein’s new lease of 166,700 square feet at 10 Canfield Dr. in Markham;

• Ontario Power Generation’s renewal of 158,200 square feet at 2555 Forbes St. in Whitby;

• Portside Warehousing’s new lease of 141,399 square feet at 3430 Harvester Rd. in Burlington;

• and Probus Logistics’ new deal for 122,900 square feet at 53 Mobis Dr. in Markham.

While new lease deals of more than 50,000 square feet declined 53.3 per cent quarter-over-quarter, several large pending deals are still in the works.

“We’re still seeing incredibly strong pre-leasing demand,” said Peretz, “and a portion of the space that’s not currently leased is conditionally leased. So I think what you’re going to see is more announcements over the next couple of months going into Q1 where deals will get finalized.”

H&M has leased all of a new 716,838-square-foot building in the GTA East Industrial Park at Salem Road and Kerrison Drive in Ajax.

Pet Valu has leased a 670,485-square-foot cross-dock distribution centre in Orlando’s new BramEast Business Park at 10750 Hwy. 50 in Brampton. It’s scheduled for completion next year.

“We’re not seeing any meaningful givebacks or large spaces coming back to the market with the current tenant demand,” said Peretz.

The largest pre-leasing project to come to market in the third quarter is Pure Industrial’s 1.2-million-square-foot Lakeridge Logistics Centre at 537 Kingston Rd. E. in Ajax.

Billed as the largest spec-built industrial building in Canadian history, it’s expected to be completed by Q4 2024.

Avison Young is representing the property and Sykes said it’s receiving inquiries from various groups. He believes the entire building will be leased to one tenant.

Different users driving demand

A new report from Avison Young says leasing demand over the past five quarters for spaces of 10,000 square feet and greater has been dominated by logistics and distribution (37 per cent), retail/e-commerce (20 per cent), manufacturing (17 per cent) and consumer goods and services (12 per cent) tenants.

Most of the investor demand for spaces of 10,000 square feet and up during the same time frame was driven by private investors (35 per cent), followed by private equity (23 per cent) and institutional investors (19 per cent).

Twenty-eight per cent of the buildings under construction are design-build while 72 per cent are speculative developments, according to Avison Young.

Despite Avison Young’s report noting the GTA market has 67 million square feet under construction and pre-construction, new deliveries will continue to be in short supply.

“We’re operating in such an undersupplied market across the board and specifically on small- and mid-bay space,” said Sykes. “The inventory that’s been added is all formatted to the larger 100,000-square-foot-plus marketplace.”

While industrial rents have risen dramatically, Sykes said high development costs would mean smaller spaces would have to charge rents of up to $25 per square foot to be feasible — and the market for that price isn’t there yet.

A more strategic approach could be taken

A slowdown in speculative construction, particularly by merchant developers and for projects that don’t have permits in hand, may be the result of higher interest rates and economic uncertainty now and going forward.

“Developers understand their supply chain and they understand timing,” said Peretz. “Looking at the market, I think you’re going to see landlords and developers take everything under a strategic approach.”

Peretz said tenants are paying for occupancy certainty and asking landlords and developers to provide construction schedules to demonstrate they can deliver projects on time.

“It’s more of a partnership than ever before,” said Peretz.

“If anything, we’ll start to see a little bit of product come back or be delivered that doesn’t get absorbed,” Sykes said of what could happen if economic headwinds persist.

“But that’s not necessarily a bad thing and kind of takes the market back from an undersupplied landlord market to more of a balanced market.”

Source Renx.ca. Click here to read a full story

Suburban Toronto Records First Period Of Positive Net Absorption Since Pandemic

Commercial real estate firm CBRE says for the second quarter in a row, the country’s suburban office vacancy level was lower than the rate seen for downtown regions.

The firm says the national suburban office vacancy rate was 16 per cent in its most recent quarter, while national downtown office vacancy sat at 16.9 per cent.

During the second quarter of 2022, seven out of 10 Canadian markets recorded tightening suburban vacancy, most often in larger magnitudes than were seen downtown.

Positive shift does not necessarily herald a recovery

The suburban Greater Toronto Area office market recorded roughly 457,000 square feet of positive net absorption over the quarter, CBRE’s report stated. This marks the first instance since Q1 2020 that net absorption has been overall positive.

These encouraging results were primarily driven by the Markham North and Richmond Hill submarket in the east and the Airport Corporate Centre submarket in the west, where 123,000 and 185,000 square feet of positive net absorption were recorded, respectively.

As the flight-to-quality trend seen throughout various markets in previous quarters continues, 60.2 per cent of the overall net absorption in the market was also accounted for by class-A space.

While this quarter’s uptick in leasing activity is encouraging and might signal a start of recovery from the effects of the pandemic, current economic uncertainty and a looming recession are likely to deter occupiers’ confidence in the market for a little while longer.

Suburban construction activity

Development in the suburban office market is slowly gaining traction. The total space under construction in the market has more than doubled year-over-year, with 675,000 square feet currently in progress.

The east market leads construction activity, with an estimated 473,000 square feet of class-A office space in the pipeline.

Metrus, which is currently developing the largest of the four eastern sites, continues construction of The Crosstown Place at 844 Don Mills Rd.

The 265,000-square-foot office tower has approximately 55 per cent of its space still available, as anchor tenant Celestica pre-leased the top three floors.

Construction at 60 Mobile Drive continues as well, with 76 per cent of the 124,000-square-foot redevelopment pre-leased to anchor tenant OSSTF.

Veering to the north market, G Group Developments is constructing the third-largest office project across the suburban markets, having broken ground late last year.

The 10-story mixed-use office tower is located at 5250 Yonge St. and will add 119,000 square feet of office space to the market, plus another 80,000 square feet of retail below.

The west market is trailing slightly behind the north and east in terms of the size of projects under construction.

However, it is the only suburban market to see new supply this year and is still expected to receive an additional 83,000 square feet of new supply over the next two quarters.

Suburban office summary

Despite uncertainty about future office demand – combined with a near-term economic slowdown, rising financing and construction costs and labour shortages – no developments have paused construction and landlords remain committed and optimistic.

Source Renx.ca. Click here to read a full story

How Much Warehouse You Can Buy Today Vs. 2021: Sellers, Take Note

GUEST SUBMISSION: The year was 2022 and it had been a relatively steady 40 years of declining interest rates from the peaks of 1981 where the Bank of Canada rate reached a whopping 21.46 per cent.

Many (most) of the current workforce had only ever seen downward-trending interest rates, with the youngest generation of adults viewing rates at historical lows as the “norm”. However, the time came to pay the piper for years of unsustainably cheap money when the global economy careened into increasing and relentless inflationary levels.

This prompted fiscal measures (a.k.a. rate hikes) in an attempt to control the effects of years of unwavering fiscal stimulus and heedless spending.

While the transitions through business cycles can affect consumer confidence and create uncertainty in the financial markets, it’s important to realize we are still a long way from 20 per cent interest rates, and remain, at present, in historical low territory.

Having said this, it’s obvious that a 3.25 per cent increase in the BOC benchmark rate over just a six-month period will have some tangible consequences.

I am going to outline the facts behind affordability in the commercial real estate sphere compared to 12 months ago.

We’ll also examine how this is affecting our owner/user clients (who would occupy their own building) and our investor clients (who are looking for tenanted assets with a return on their money). Spoiler alert . . . property values are (gradually) eroding.

I like flow charts, so I’ve provided a simplistic analysis through flow to outline some of the big-picture elements affecting the commercial real estate market in Alberta and more broadly across borders.

The aforementioned factors are affecting both owner/user businesses as well as investors who have been extremely active in recent years through the acquisition and sale of commercial real estate assets across the province.

Each purchaser is analyzing the current market fundamentals uniquely to their goals of ownership.

I’ll outline below the effect current market conditions are having on each group.

Owner/user perspective

The year was 2021 and business had been good!

You (business owner) were willing and able to put down 20 per cent equity on the purchase of a commercial real estate asset for your operation.

You had been quoted a monthly payment of $40,000 for a $10 million facility but, for reasons out of your control, could not close on that specific property. Fast forward 12 months – what could you buy today for the same payment?

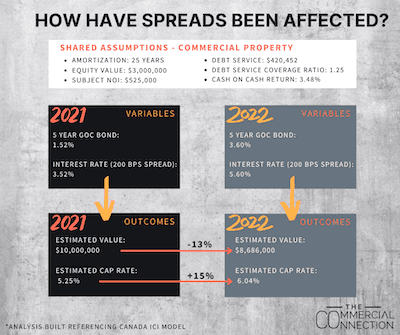

Generally speaking, spreads on five-year debt are about 200 bps over the five-year GOC Bond (up from 180 bps last year). This correlates to an estimated two per cent increase in interest rates in the past 12 months which seems minimal, but as you see from the image, can correlate to massive differences in affordability for a business owner.

Unfortunately, many industrial businesses in Alberta, particularly in the manufacturing sector, have been battling debilitating federal energy policies for the past seven years. This has prevented them from taking advantage of the low interest rates due to other market factors (even though most major markets in North America were on a 15-year tear).

While the above comparison is simple in nature, it highlights why so many deals have died over the past six months as purchasers on the cusp of affordability have had to transition back to the leasing market. It also highlights why there is heightened competition for smaller, lower-valued facilities.

Higher-priced buildings will be competing over a much smaller pool of qualified buyers as the interest rates continue to increase.

Investor perspective

Investors have been purchasing income-producing assets for record-setting low capitalization rates in recent years because the low debt costs allowed for return requirements to still be achieved.

It wasn’t uncommon for class-A multifamily assets to trade in the low four per cent cap rate range and commercial assets to trade low five per cent cap range, on average.

We’re currently sitting in a transition period where the mortgage interest rates have increased over two per cent in the past 12 months. However, seller cap rate expectations have lagged, overvaluing assets.

In fact, according to Brandon Kot, managing partner at Canada ICI: “If you indexed cap rates in Q3/Q4 2021 against interest rates during that period, values in multifamily assets would need to correct north of 20 per cent and commercial assets north of 15 per cent today in order to maintain the same levered returns. This doesn’t even take into consideration that yield expectations on the cost of equity have drastically changed in the last 12 months which would make a correction in asset values that much more acute. (The assumption on the level of value erosion is magnified in multifamily assets because of the prevalence of longer amortization periods (40 years plus).”

Looking at the following simple case study, I’ve compared an asset achieving an NOI of $525,000 in 2021 to today. In order for this asset to maintain the same DSCR and cash-on-cash return variables, the current value would reflect these downward pressures.

Ultimately, the market will dictate the price corrections that will take hold in the coming months, but it is important for building owners considering a sale of their properties to realize that these are the metrics purchasers are dealing with when determining today’s values.

The silver lining for some building owners is that if they have rollover or vacancy they may see improvements in their NOI due to increased market activity and competition for space. This improvement in rents and income could potentially increase in line with the upward adjustment of cap rates.

E.g. $525,000 NOI becomes $600,000 NOI on a 65,000-square-foot building. This $75,000 increase correlates to a $1.15-per-square-foot increase (from $8.08 to $9.23 per square foot), which is realistic in Alberta’s current industrial market. If cap rates were 5.25 per cent with $525,000 NOI, a $10-million valuation would be achieved. If cap rates increased to six per cent with $600,000 NOI, a $10-million valuation could still be achieved.

For those not experiencing these improvements in NOI, first, call an expert to assess the situation. Second, these assets do present a high probability of devaluation.

Source Renx.ca. Click here to read a full story

CanFirst Acquires $222.6M GTA Industrial Portfolio

The CanFirst Industrial Realty Fund VII LP has acquired a 13-property, 710,389-square-foot portfolio in Vaughan, Ont. from IG Investment Management for $222.6 million.

“We’re excited to be able to acquire assets in this node in Vaughan,” CanFirst Capital Management executive vice-president Mark Braun told RENX. “It’s always been a challenge to find properties in the area, certainly at a price point that’s competitive or allows us to transact.”

The portfolio encompasses 38.9 acres of land. The deal was brokered by CBRE and attracted interest from several potential purchasers.

The transaction, which closed Monday, represents a price of $313 per square foot.

All of the properties are located within about a kilometre of each other in Vaughan, and CanFirst is interested in acquiring more such locations in the city of approximately 340,000 people located directly north of Toronto.

Small and mid-bay properties

“It’s a mix of small-bay and mid-bay industrial tenancies,” said Braun of the portfolio.

The smaller units are in the 1,000- to 5,000-square-foot range while the largest is just over 50,000 square feet. The portfolio is 99.8 per cent leased, with just one small vacancy, and has an average remaining lease term of 2.5 years.

Braun said existing rents are about 50 per cent of the market rate, so the deal provides a good opportunity for capital growth when leases expire. There’s also potential to convert some units to industrial condominiums and sell them, Braun added.

The properties have been well-maintained and are in good condition and won’t require any major capital expenditures, according to Braun, who said there are no intensification opportunities within the portfolio.

CanFirst has been an active industrial buyer in recent months.

In October it partnered with Colonnade BridgePort to acquire a 50-acre site in the southwest sector of Ottawa. The partners plan to construct up to 900,000 square feet of new space on the land starting in 2024.

That site was acquired on behalf of its CanFirst Industrial Development Fund.

The last major acquisition for the Industrial Realty Fund VII took place in 2021, when it purchased the so-called Dozyn Dezyn portfolio, comprising 11 buildings in the communities of Surrey and Abbotsford, B.C. The small-bay and mid-bay buildings are a combined 412,897 square feet and were fully leased.

The purchase price was $104.5 million.

CanFirst Capital Management

Toronto-headquartered CanFirst was founded in 2002. It co-invests with institutional and private high-net-worth investors in industrial and office properties that have added potential to exploit for growth in major and select secondary Canadian markets.

CanFirst has raised $1 billion in equity and completed more than 16 million square feet of real estate transactions.

CanFirst manages growth-oriented and income-oriented funds. The $250.5-million CanFirst Industrial Realty Fund VII LP closed in July 2020 and is now fully allocated after this latest transaction.

Source Renx.ca. Click here to read a full story

44 Storeys Proposed Beside Eglinton GO Station

Like many of Toronto’s quieter neighbourhoods, Scarborugh’s Woburn is a lower density area amongst busier and and higher-density main streets. Now, MHBC Planning has submitted Official Plan Amendment and Zoning By-law Amendment applications that would result in the tallest building yet in this area, 44-storeys at 2941 Eglinton Avenue East, just east of McCowan Road at Eglinton GO Station. The proposal, designed by Kirkor Architects Planners for Achille Developments and 2941 Eglinton East Limited Partnership, would be in sharp contrast to the smaller buildings of the surrounding area.

The proposed design is 143.8m in height, with 555 residential units occupying the 44 floors of the structure. Residents would have access to 2,236m² of amenity space, of which 1,097m² would be outdoors. The gross floor area would total about 37,419m², with 288m² at grade being allocated to non-residential use. Below that, three levels of underground parking would house 278 spaces for vehicles and 416 for bicycles, of which 39 of the latter would be for short-term use.

There is currently a one-storey commercial building and parking lot on the site. The property is abutted by commercial and light industrial properties, some of it abandoned, with commercial strip buildings across Eglinton to the north. South of the GO corridor and north of Eglinton are neighbourhoods of apartment buildings, townhomes, and single-detached houses. Only a couple hundred yards from Eglinton GO station, the proposal is in a proposed Protected Major Transit Station Area (PMTSA), with the GO train allowing for access to Downtown Toronto and Durham Region.

The developer’s stated intent for the project is to complement the area and future potential developments. The building would feature step-backs throughout, with part of the goal being to act as a transition to the adjacent low-density area; this would include by the main entrances allowing pedestrians easy access to sidewalks.

Proposed landscaping incorporates planting beds and trees, with the intention being to create a comfortable public realm next to the building. Step-backs from the podium levels to the tower itself are designed to limit the impact of shadows on the immediate surroundings.

UrbanToronto will continue to follow progress on this development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

OPG Sells Kipling Facility to Kinectrics and City of Toronto

TORONTO, Nov. 7, 2022 /CNW/ – Ontario Power Generation Inc. (OPG) has completed the sale of its Kipling site in Etobicoke to Kinectrics and the City of Toronto.

Sold through a competitive process, the 800 Kipling Avenue site measures approximately 76 acres and includes approximately 750,000 square feet of buildings. As part of the sale, the site has been severed to accommodate uses for both purchasers. The sale closed Oct. 31, 2022.

Kinectrics, a growing electricity life-cycle management solutions company, will continue to operate and grow its business at the site. The City of Toronto will utilize the southern parcel for the Toronto Transit Commission’s (TTC’s) future electric bus facility. The City will also take ownership of lands to the north of Kinectrics parcel for future City services.

- The Kipling complex currently houses offices, records storage and training spaces.

- The total selling price is $200 million.

- In an effort to save costs and promote collaboration and innovation, OPG is consolidating all non-station-based staff at a corporate headquarters in Durham Region.

- OPG will lease back a portion of the space to accommodate employees until the new consolidated campus is ready for occupancy. Other existing leases at Kipling will transfer to the new owners of the properties.

- OPG subsidiary PowerON Energy Solutions and the TTC are working together to decarbonize Toronto’s bus fleet. Learn more.

- Kinectrics’ acquisition and continued use of the Kipling site eliminates the need to rebuild facilities for the foreseeable future and facilitates significant growth opportunities.

- The TTC’s 2021-2035 Capital Investment Plan and Real Estate Investment Plan identified a tenth garage and maintenance facility as being required within the next 10 to 15 years. That facility will be home to TTC’s expanding battery electric bus fleet. In the shorter term, this property will allow the TTC to accommodate its industrial warehousing space needs and reduced operating costs as existing leases expire.

“The Kipling Avenue site has served our employees and company well,” said Ken Hartwick, OPG President and CEO. “We are pleased it will be home to businesses focused on transportation electrification and nuclear technology, as both will be critical to growing a clean economy.”

“The acquisition of the 800 Kipling Avenue site will serve as the City’s ongoing commitment to its wider climate action goals,” said Mayor John Tory. “The future TTC electric bus facility aligns with the City’s TransformTO Net Zero Strategy and is an investment in the future of our city.”

“The purchase of 800 Kipling is a decisive action confirming the company’s long-term commitment to providing expert services that are enabled by world class facilities to the utility industry, minimizing disruption to employees and establishes a clear vision for a long future at this site.” said David Harris, President and CEO of Kinectrics. “This allows Kinectrics to continue investing in state-of-the-art facilities, allowing for ease of expansion and an incubator for growth.”

“I want to thank our partners at OPG, CreateTO, the City of Toronto’s Corporate Real Estate Management division and Kinectrics, as well as all the TTC staff involved in making this deal happen,” said TTC Chair Jaye Robinson. “As our bus fleet continues to grow, the facility at 800 Kipling will be essential for the TTC’s maintenance and storage needs. It will also support our expanded electric bus fleet as we work towards our ambitious goal to become 100% zero emissions by 2040.”

Source Toronto Star. Click here to read a full story

Push to Curb Inflation Has CRE Ramifications

Deputy Prime Minister Chrystia Freeland is not an outlier in asserting that Canada is well positioned to curb inflation and recover from a downturn. Nick Axford, chief economist with Avison Young, concurs — predicting that a likely “technical recession” will be less severe than the prospects in Europe and that inflation will be on a downward trajectory by the spring of 2023.

“I think we’ll see inflation easier to tame in Canada,” he hypothesized during an online presentation last week. “Canada will probably be seeing declining GDP toward the end of this year and into the early part of next year, but we are not, in North America, expecting to see a really, really hard decline coming through. We are not expecting to see mass unemployment and business failures, but we will see some stress coming through in the economy.”

Real estate is in line for a share of the fallout, which has already taken form in a drop-off in investment transactions over the past couple of months. That’s in contrast to the first two quarters of 2022 and much of 2021, during which deal volume surpassed pre-pandemic levels. However, the steepest and most rapid rise in interest rates thus far this century has undermined that momentum.

“What we’re seeing at the moment is many investors stepping back and just waiting for the adjustment in pricing that they see coming to materialize in the market,” Axford said.

Looking at current economic dynamics — inflation, rising interest rates and the spectre of recession — he reiterated that inflation is the underlying ailment, while interest rates are the medicine with discomforting side effects.

Central bankers are attempting to reintroduce some slack into the system to avoid scenarios like the wage-price spiral of the 1970s. In doing so, they’re closing out an unparalleled era of low government bond rates and upending some comfortable assumptions. Axford characterized the years since the financial crisis as a “gravy train” in which real estate and other asset classes were benchmarked against rates of return that even fell into the negative zone in some countries.

“We need to start thinking about the fact that we are entering a different era in which interest rates are certainly going to be higher than the ultra-low, free-money level of rates that we got used to over much of the last 10 years,” he submitted. “What we’re heading back into is not an unusual blip that is likely to be quickly corrected. Interest rates as low as they have been over the last 10 years is actually the thing that is unusual.”

Uneven impacts foreseen, but with generally rising cap rates

In the months ahead, he expects a recession could diminish tenant demand, particularly for Class B office and assets in secondary and tertiary markets, while inflation could improve real estate’s profile for some types of investors planning to hold it for the long term. He also foresees rising cap rates across all property types as lower demand, higher financing costs and changing perspectives on risk and returns relative to other asset classes filter through to values.

“We are absolutely going to see cap rates coming under upward pressure,” Axford maintained. “The implication is that we’ll see, on average, 100 basis points minimum likely to be added to the benchmark cap rates that we’re thinking about for real estate, which a) will take some time to come through and, b) will come through unevenly. Some sectors will be more affected than others.”

Among those potentially harder hit, he cites a trifecta of challenges shaping investors’ outlook on Class B and aging Class A office buildings including climbing vacancy rates, more difficulty obtaining financing and higher costs (due to inflation) for required capital upgrades. On the flipside, he credits the trophy assets for bolstering market-wide average occupancy rates.

Avison Young’s proprietary Vitality Index — which tracks visits to locations via mobile phone data — shows a steadily growing influx into urban cores and downtown office buildings. Axford suggests the balance will continue to shift in favour of formal offices as each new wave of returnees exerts more pull on colleagues working from home. The shadow of job uncertainty in an economic downtown could also boost employees’ desire to be seen in the workplace.

“Broadly speaking, our cities are coming back to life and they’re coming back to life to the same level, if not more, than the period before the pandemic,” he observed. “The high-quality assets with great sustainability credentials and attractive, amenity-rich, accessible locations, I think they’re going to thrive. I think they are going to outperform. If I was buying anything, they would be very high on my list.”

Bank of Canada regarded as an early mover

Nevertheless, buyers are expected to be hesitant at least until the spring. A further 50 or 75 basis point boost in interest rates is also anticipated.

Axford noted that the Bank of Canada was the global frontrunner in raising interest rates — perhaps swaying both the Bank of England and the U.S. Federal Reserve to follow suit — and is a good bet to take the lead on cutting them again. However, given that the impact of interest rate adjustments typically take 12 to 24 months to work through the economy, he advises that central bankers are also in watch-and-wait mode.

“We expect to see that inflation is less endemic in Canada. They’ll be able to start cutting probably by the end of 2023, which isn’t something that we’re likely to see in many other parts of the world,” Axford said. “That said, don’t expect them to drop rates back to 1 per cent or below. The cuts are going be a quarter point and they are going to be largely symbolic to start with. It’s going to take some time to get back to what they reckon is a neutral rate, which is somewhere around 2 to 3 per cent.”

Source Toronto Star. Click here to read a full story

Discount Retailers, Grocers Driving Occupancy Rates up: RioCan CEO

TORONTO – RioCan Real Estate Investment Trust says retailers offering essential and discount goods are driving growth in its occupancy rates.

“We are certainly seeing growth in grocery, pharma and discount as well as the TJX banners (Winners, HomeSense and Marshalls) and Dollarama,” said Jonathan Gitlin, the Toronto-based realty company’s chief executive on a Friday call with analysts.

“Then we are also seeing in this kind of environment a significant return to service providers, whether they are nail salons, hair salons or medical uses, they are definitely net growers of space and certainly looking to occupy more and more of our existing space.”

Gitlin’s remarks came after RioCan said Thursday that occupancy across its commercial portfolio increased to 97.3 per cent in its most recent quarter, up from 96.4 per cent at the same time last year.

Retail occupancy for the real estate trust’s third quarter increased by 20 basis points from the prior quarter to reach 97.8 per cent.

Analysts have been watching occupancy rates closely over the last few years as retailers have adjusted to shifting health measures triggered by the COVID-19 pandemic and changing consumer habits amid high inflation rates.

While some retailers shrank their footprints coming out of the health crisis, others have seen demand for their goods and services surge and are on the hunt for new spaces.

RioCan’s portfolio is largely skewed toward necessity-based retailers like grocers, pharmacies and liquor stores seeking more space, but it’s also benefiting because there is a scarcity of some properties, said chief operating officer John Ballantyne.

Properties measuring between 1,858 and 2,322 square meters are in high demand as are smaller units between 139 and 185 square meters, he said.

But Gitlin pointed out that inflation has not eased to comfortable levels yet and a recession seems imminent, so “there is an elevated risk of tenant failure.”

Properties measuring between 1,858 and 2,322 square meters are in high demand as are smaller units between 139 and 185 square meters, he said.

But Gitlin pointed out that inflation has not eased to comfortable levels yet and a recession seems imminent, so “there is an elevated risk of tenant failure.”

Gitlin called it “a huge step in the right direction” because there is a supply crisis in markets in Toronto.

“It has been a frustrating process for RioCan, as a willing and able provider of housing both affordable and market in the last five years to go through all the hurdles we have gone through to get limited product in the ground,” he said.

“I can only imagine how difficult it is for groups that are less sophisticated and less well-capitalized than RioCan.”

On Thursday, RioCan reported a net income of $3.2 million, down from $137.6 million the year before.

Its property net operating income grew by 5.1 per cent, driven by increases in occupancy, rent growth and increases, and a lower pandemic-related provision.

Revenue totalled $305.3 million for the quarter ended Sept. 30, up from $264.1 million a year earlier.

Funds from operations totalled $134.8 million, or 44 cents per diluted unit, up from $126.9 million or 40 cents per unit the year before.

This report by The Canadian Press was first published Sept. 4, 2022.

Source Toronto Star. Click here to read a full story

CRE Bears Brunt of Property Tax Burden: Canada-Wide Update

Seven of the 11 major Canadian cities surveyed by Altus Group have a commercial tax rate more than double the residential tax rate, according to the 2022 Canadian Property Tax Rate Benchmark Report.

Altus Group released the annual report in conjunction with the Real Property Association of Canada (REALPAC). It’s intended to create dialogue with taxing authorities, influence public policy and to attempt to promote a healthy and competitive business environment for the commercial real estate sector.

Residential property tax rates in the cities surveyed ranged from a low of $2.69 per $1,000 of assessment in Vancouver to a high of $11.95 per $1,000 of assessment in Winnipeg in 2022. Corresponding commercial property tax rates ranged from a low of $9.31 in Vancouver to a high of $35.30 in Halifax.

“I think you’re always going to see the commercial property owners carry the heaviest burden,” Kyle Fletcher, president of Property Tax Canada at Altus Group, told RENX. “But, I think municipalities are recognizing the heavy loads commercial taxpayers are carrying.”

Business properties generally use fewer of the services paid for by property taxes, and business property owners don’t have the same voting clout as homeowners when it comes to impacting municipal governments.

However, business property owners may base decisions on whether to locate or expand in a municipality based on comparative property tax rates.

Quebec has highest commercial-to-residential ratios

Montreal’s commercial property tax rate was $34.66 and its residential rate was $8.23.

Montreal reduced both residential and commercial tax rates from 2021 to 2022, but the greater reduction to residential property owners resulted in a commercial-to-residential ratio increase of 1.08 per cent to 4.21.

That was the highest of the cities surveyed.

Quebec City’s commercial property tax rate was $35.28 and its residential rate was $10.05.

Quebec City raised commercial rates slightly while dropping the residential rate, increasing its ratio by 1.3 per cent to 3.51.

Vancouver’s taxes are lowest

Vancouver saw decreases in both residential and commercial tax rates.

However, the rate of taxation for residential properties dropped further than the commercial rate, so its commercial-to-residential tax ratio increased by 1.35 per cent to 3.46, ranking it third-highest in Canada.

The relative strength of the property market in a city has a bearing on its residential and commercial property tax rates.

“Vancouver has the lowest tax rates in both residential and commercial, and that’s really a reflection of the strength of that market — in particular the residential market,” said Fletcher, who noted the city’s higher property values can derive the revenues needed to meet the municipality’s requirements even with lower rates.

“Compare that against areas like Saskatchewan and Manitoba, where the average house prices are some of the lowest in the country, and you’re going to end up with higher rates.

“And wherever there’s a lower proportion of commercial property in one municipality to another, that can have an effect as well.”

Ontario keeps postponing reassessments

Ontario properties are in the second year of an assessment freeze following the last four-year assessment cycle and assessments continue to be based on values as of Jan. 1, 2016.

Any changes in the commercial-to-residential tax ratios in the province are the result of tax policies.

“The trend is positive for commercial buildings in Ontario,” said Fletcher. “So we would hope that, once they finally reassess in Ontario, that the trend will continue — but that will be really hard to judge.”

Toronto continued to move toward tax equity, increasing the tax rate for residential properties by a higher percentage than commercial.

As a result, the commercial-to-residential ratio continued its 18-year downward trend and dropped by 2.42 per cent — the most substantial reduction in the survey. However, the 3.36 ratio was still fourth-highest in the country.

Ottawa raised its commercial rate by a greater percentage than residential, resulting in a 0.95 per cent increase to its ratio, which now sits just below the national average of 2.8 at 2.39.

Fletcher is unsure why Ontario keeps postponing its property tax reassessments, but said it’s causing increasing problems — especially with the post-pandemic variability in assessments for various property classes and types.

“The assessed values are so outdated that the apportionment of property tax in that province is no reflection of where the market is today,” said Fletcher. “The biggest losers, in our opinion, are office and retail properties.

“From a relative perspective, those markets have been much weaker than industrial over that time period. So, industrial is stuck with a lower proportion of tax than it should in the current market conditions.”

Calgary and Edmonton face similar pressures

Calgary had the largest commercial-to-residential ratio increase of the cities surveyed, climbing 10.27 per cent to 3.07.

Continuing a trend in place since 2015, the commercial assessment base contracted year-over-year due to declining office assessment values, while the residential assessment base experienced an eight per cent increase due to a surging single-family market.

Edmonton faced similar pressures as Calgary as a result of the latest reassessment, causing its ratio to increase by 6.5 per cent to 2.68.

Fletcher believes commercial property tax rates can have a significant impact on companies in deciding where to open, expand or relocate — particularly when it comes to the outskirts of major cities.

“I don’t know that the property tax question is enough to drive a decision on if you’re going to build a warehouse in Saskatchewan versus Calgary necessarily,” said Fletcher.

“But definitely, when it comes to decisions of if you’re going to be inside the city limits or on the outskirts, that’s a big issue in all the major cities in Canada.”

Fletcher noted communities just outside of Calgary have much lower commercial property tax rates, so there’s been much more industrial development in those municipalities to take advantage of lower overall costs — which include taxes.

Halifax, Winnipeg, Saskatoon and Regina

The Halifax Regional Municipality increased the commercial tax rate and dropped the residential rate, resulting in a 7.16 per cent increase in its commercial-to-residential ratio to 3.06.

Winnipeg’s ratio dropped slightly from 1.93 to 1.92 – but it would have been above 2.2 if the school rebate and business tax were considered.

It’s anticipated the school rebate will be increased for 2023, which will further widen the gap between commercial and residential taxes.

Saskatchewan is in the second year of its four-year assessment cycle and values haven’t shifted.

Saskatoon and Regina continued a six-year trend of posting a ratio below two and remained static between 2021 and 2022 at 1.61 and 1.51, respectively.

Those two ratios were the lowest in the survey.

Source Real Estate News EXchange. Click here to read a full story

CRE’s ‘Amazing Run’ Hits Roadblocks: PwC/ULI Trends Report

The “amazing run” for Canada’s real estate industry has come to an end, a PwC executive told participants at the 44th annual Emerging Trends in Real Estate report event.

Held at The Carlu in Toronto on Nov. 1, the well-attended breakfast event was sponsored by PwC and the Urban Land Institute to offer insights and commentary into the annual report.

The just-released report provides an outlook on real estate investment and development trends, finance and capital markets, property sectors, metropolitan areas, and other real estate issues throughout the United States and Canada.

It reflects the views of individuals who completed surveys or were interviewed as part of the research process, including investors, fund managers, developers, property companies, lenders, brokers, advisors and consultants.

Things are less positive than they were

“Canada’s real estate industry has been on an amazing run,” said PwC Canada partner and national real estate leader Frank Magliocco, who presented an overview of the Canadian portion of the report. “Capital was plentiful and rents, valuations and returns were all going up across the country.

“There was stability, along with immigration trends, that continued to make Canada an attractive place to invest.”

While the COVID-19 pandemic created uncertainties, the real estate industry got through it without as much damage as some may have initially feared.

This year, however, has brought a mix of interest rate increases, high levels of inflation and a geopolitical environment that has created uncertainty throughout the global economy. The result has been a significant disruption to the Canadian real estate market.

Magliocco said in 2021 there was too much available capital, which created more competition for deals and pushed prices higher and higher.

“Fast forward to 2023 and the opposite is true,” he added, noting that successive interest rate increases by the Bank of Canada and cautious lenders are decreasing competition for deals and making it harder for real estate companies to raise capital and move projects forward.

Three major trends

According to the report, there are three trends that are expected to be particularly salient as we head into 2023 and, likely, a recession:

• navigating a period of price discovery amid rising challenges around costs and capital availability;

• addressing urgent imperatives around environmental, social and governance (ESG) matters;

• and finding meaningful solutions to escalating concerns about housing affordability.

Rising labour wages and a shortage of workers, along with issues regarding material pricing and availability, have contributed to higher construction costs, project delays and budget overruns.

According to Statistics Canada, residential building costs were up 22.6 per cent on a year-over-year basis in Q1 2022. Cost increases for non-residential construction were 12.8 per cent.

This has led to a pause in both developments and transactions, according to Magliocco, because it’s difficult to make numbers work financially in the current environment.

This period of price discovery has led to buyers and sellers having differing expectations and views of valuations, leading to a slowdown in deal activity.

While challenging, the report says an environment like this also presents opportunities. Companies with less leverage may be able to secure assets at more reasonable prices and, while some sources of financing may not be as readily available, the private debt market could step up and help fill some of the gaps.

ESG considerations growing in importance

At a time when financing is both less available and more expensive, companies with a strong ESG track record will have an advantage in attracting investment from institutional players and sourcing new forms of capital.

There’s also growing evidence that companies with strong ESG commitments are expected to be more profitable in the medium to long term through getting higher sale prices and rents for green buildings, reducing operating costs and increasing operational efficiency.

“The ESG journey, if done well by organizations, will not only preserve value but it will also create value through improved operating cash flows and more attractive capital from lenders and investors,” said Magliocco.

While climate change is a major focus of the ESG agenda, concerns about social issues — including inclusion, diversity and pay equity — are also on the rise.

Housing affordability crisis

Canada needs to build 5.8 million homes between 2021 and 2030 to restore housing affordability, according to the Canada Mortgage and Housing Corporation, but there were only 271,000 housing starts in the country last year.

While people are leaving Toronto and Vancouver due to high housing prices and rents, as well as the growth of remote working, the unaffordability issue is following them to smaller markets due to a lack of supply. The problem is only likely to worsen as Canada increases the number of immigrants it allows into the country.

Increasing development charges and approval times are adding to home-building costs and to the affordability crisis.

Despite these issues and concerns, industry members interviewed for the report are optimistic about the long-term outlook because the fundamentals of the Canadian property market remain strong.

Asset class outlooks

Magliocco also provided brief outlooks for a variety of real estate asset classes in Canada.

While there are some concerns the industrial market may be overheated as vacancy rates hit all-time lows and rents and property valuations explode upward, it continues to have strong demand and people remain bullish on the sector.

Purpose-built rental apartment demand has recovered from 2020 lows and vacancy rates have tightened, but higher rents are also impacting overall housing affordability. Valuations for multiresidential remain strong, as do the supply and demand fundamentals.

There’s uncertainty in the office market and some organizations are moving forward with plans to offload significant amounts of space. This includes the federal government, which Magliocco said is looking to shed 15 to 20 per cent of its 42 million square feet.

Retail is continuing to rebound from the effects of pandemic lockdowns and vacancy rates are starting to recover as shoppers return to brick-and-mortar stores and become somewhat less reliant on e-commerce.

Condominiums continue to be a growing part of the housing market and the outlook remains positive for the asset class. There’s also a desire from some buyers for bigger unit sizes to accommodate home offices.

Single-family housing has a mixed outlook as high prices and interest rates are putting a damper on the market. There has, however, been increased interest in more affordable types of single-family homes, such as duplexes and townhouses.

Magliocco said the life sciences asset class follows only industrial and multiresidential as a best bet for investment success in 2023.

Source Real Estate News EXchange. Click here to read a full story