Author The Lilly Commercial Team

Hamilton’s Waterfront Development Expected to Generate Millions in Tax Revenue — Eventually

Once completed, the project will have generated $1B in private investment

Nexus Industrial: $316M in Acquisitions Lined Up so Far in 2023

Nexus Industrial REIT had a busy and successful 2022 and isn’t slowing down in 2023. One major acquisition is complete and other purchases and developments are in the works, as it continues to increase the industrial weighting of its portfolio.

“It was a tough year in the capital markets on the equity raise, so that kept growth smaller,” Nexus chief executive officer and trustee Kelly Hanczyk told RENX. “But coming into this year we’ve put a real emphasis on high-grading this portfolio to make it institutional quality.

“So I think at the end of the day, when you look at it as a whole, our portfolio is looking extremely attractive and has pretty good growth potential from both in-place and below market rents, and the amount of land that we’re able to develop on.

“When you’re developing and not purchasing land, your returns are much higher. So it looks like 2023 will be a good, solid year for us.”

Oakville-headquartered Nexus (NXR-UN-T) was formed in 2013. It owns 113 properties comprising approximately 11.6 million square feet of gross leasable area.

Recent and upcoming acquisitions

After making $316.8 million in industrial property acquisitions in 2022, Nexus closed on a 532,000-square-foot, new class-A distribution centre in Casselman, Ont. (just east of Ottawa) for $116.8 million from developer Rosefellow on March 7.

The property is leased long-term to Ford Motor Company of Canada and features 36-foot clear heights, 43 dock-level doors and two drive-in doors.

Nexus also has these four industrial properties under firm contract that have an aggregate purchase price of $199.5 million at a weighted average capitalization rate of five per cent:

- A new, approximately 140,000-square-foot single-tenant distribution property under construction in Burlington, Ont. features 32-foot clear heights, 28 loading doors and two dock doors. Its lease has a seven-year term, starting upon completion. The acquisition is to close July 4.

- A new, approximately 190,000-square-foot single-tenant distribution property under construction in the Greater Montreal Area features 32-foot clear heights, 28 truck-level doors and one drive-in door. Its lease has a seven-year term, starting upon completion. The purchase is set to close June 1.

- A new, approximately 83,000-square-foot single-tenant distribution property in the Calgary area is expected to close in the first half of 2024.

- An approximately 325,000-square-foot industrial property in London, Ont., including an under-construction 175,000-square-foot addition, is expected to close in August.

Nexus also has an approximately 305,000-square-foot single-tenant distribution property in London under diligence.

The property includes an under-construction 160,000-square-foot expansion and features 32-foot clear heights, 45 truck-level doors and eight drive-in doors. Its lease has a 10-year term, starting upon completion.

That purchase is expected to close on May 1. It will, subject to Toronto Stock Exchange approval, be funded by the issuance of approximately $24 million of Class B LP units at $10.30 per unit and the assumption of existing mortgage financing.

Nexus’ unit price closed at $9.66 on April 12. That’s near the lower end of its respective 52-week high and low prices of $14.03 and $8.15. The REIT had a market cap of approximately $664 million.

Development activity

This will also be a busy year on the development front.

Nexus acquired 80 per cent interests in two development sites in Hamilton for $22.6 million in 2022. It anticipates being able to develop approximately 358,000 square feet of class-A industrial space, with construction completion anticipated for early and late 2024.

The REIT will break ground in April on a 312,000-square-foot industrial building on 23 acres of land it owns in Regina. It has secured a tenant that will take a minimum of 205,000 square feet.

Nexus will also break ground in April on a 100,000-square-foot addition to a property in London, with plans to lease it to an existing tenant.

“We have a ton of land attached to the properties that we have and London has less than one per cent vacancy and not really anything coming out of the ground, so from a rental standpoint the fundamentals are really strong,” Hanczyk said.

Nexus is the most active developer in London, according to Hanczyk, who expects the REIT’s performance in the Southwestern Ontario city to remain strong.

The trust is also looking to expand industrial buildings with existing tenants in St. Thomas and Windsor this year and has identified about 550,000 square feet of potential additional expansion for existing buildings for 2024.

Retail dispositions

Nexus sold off two small properties for $12.8 million in Q4 2022. One was a retail/office building in Longueuil, Que. and the other a bank branch in Prince Edward Island that was the first property purchased by the REIT.

“It goes along with our continuing drive to be 100 per cent industrial in a couple of years,” Hanczyk said. “We’re repurposing and recycling capital out of retail to put into industrial.”

Nexus has a firm offer to sell an unenclosed shopping centre in Victoriaville, Que.

The deal for its largest wholly owned stand-alone retail property is expected to close this month.

The sale of the unenclosed mall — which includes Metro, Canadian Tire and Dollarama stores — will increase the trust’s industrial weighting to more than 90 per cent of net operating income (NOI).

Eighty-eight per cent of NOI came from industrial properties in Q4 2022, up from 81 per cent a year earlier.

Nexus received an unsolicited offer to purchase a small portfolio of industrial properties in Saskatchewan last year. It made it to the due diligence stage before talks ended.

“We’re finding a lot of the smaller buyers are having trouble getting the proper debt leverage that they need to close, so we pulled it from them,” Hanczyk said.

The Saskatchewan properties have “nice rental rate increases over the next several years,” according to Hanczyk, so it was decided to keep them for now.

Increased net operating income

Nexus’ NOI rose 71.2 per cent to $95.8 million in 2022, while fourth-quarter same-property NOI rose 2.2 per cent to $17.7 million from a year earlier.

The trust had an occupancy rate of 97 per cent to close 2022, up from 96 per cent a year earlier.

Nexus had a debt-to-total-assets ratio of 43.7 per cent on Dec. 31. Its lines of credit had $97.5 million of availability and it had $84.7 million of unencumbered properties.

“We’ll close what we have under contract with the cash that we have on hand and using our units as currency for this year, and I think we’ll start to focus on the outsized returns from the development side that will really boost things in 2024,” Hanczyk said.

Source Real Estate News EXchange. Click here to read a full story

Canadian Retail Performance Over the Last Two Years Has Been Surprisingly Resilient

The pandemic year of 2020 was obviously tough but also transformative, forcing many retailers across the country to transform into omni-channel sellers to survive amid intermittent lockdowns and uncertainty.

Then, in 2021, Canadian retail sales broke a new record, hitting nearly $700 billion in total sales, according to Statistics Canada figures cited in the Tenant Survey Report 2023 by Colliers Real Estate Management Services (REMS). Retail sales in 2022 also broke a record, reaching almost $735 billion.

When asked to rank their 2022 profitability on a scale from 1 to 5 (one being extremely unprofitable and five being extremely profitable), retailers reported an average of 3.1 (and 3.6 so far in 2023). With consumer confidence declining today amid rising interest rates, expanding household debt and increasing recession worries, the resilience — and profitability — of Canadian retail is about to get tested again.

What does 2023 have in store?

Colliers is expecting a more normalized sales increase in 2023, despite the aforementioned economic challenges. These challenges are in addition to the recent tremors in global finance caused by the first serious U.S. banking failures we’ve seen since the 2008 financial crisis.

If Canadian retailers are going to remain resilient (and more importantly, profitable), it’s not going to happen by accident; rather, it will take concerted effort, strategy and innovation.

Mostly, success will be born out of a renewed sense of harmony that can be distilled into five lessons that emerged from Colliers REMS’ 2023 survey of various retailers across the country.

The five lessons from profitable Canadian retailers

Have physical stores

Eighty-seven per cent of the retailers we surveyed indicated that in-store shopping remains the most profitable type of shopping. Brick-and-mortar sales hit $693 billion in 2022, representing a nine percent increase over 2021.

It’s a no-brainer benefit to online retailers to have a brick-and-mortar presence.

And it’s a benefit for brick-and-mortar retailers to have an online presence. The two formats work symbiotically, and it’s all about market share — and capturing the most market share together.

Don’t forget about your e-commerce platform

This became an obvious necessity during the pandemic when, for certain periods of time, people couldn’t go into many stores around the country.

Fast forward to 2022, retailers with an e-commerce platform were almost twice as likely to be profitable, Colliers’ survey found. Indeed, in 2020, online sales ballooned to nearly 12 per cent.

But since then, those online sales have normalized to pre-pandemic growth levels and now sit at roughly six per cent. That number is expected to climb to eight per cent by 2025.

Following the initial spike in adoption, the percentage of retailers with an e-commerce platform has stabilized at just over 50 per cent. That number should be higher for retailer profitability and success.

Connect the physical store with the e-commerce platform

Retailers that connected their physical store with their e-commerce platform were 35 per cent more likely to be profitable in 2022.

Finding ways to synergize the in-person and online shopping experience is an important way to boost sales and profitability. This could involve using the same supply chain internal processes, training employees to improve sales techniques, and performing additional market research to better understand customers.

Buy online and pick up in-store

Retailers report some customers spend up to 35 per cent more than their original online purchase when they pick up their purchases in the store.

The reasons are kind of obvious. If you show up at the store to pick up say, a coat or blazer you ordered, your visit with a salesperson provides the opportunity for them to mention the matching pants, blouse or shirt for that blazer.

Moreover, you might just happen to browse around, finding other items you’d like to buy.

The retailer has not only captured the online market, but also expanded that market share to the physical space.

Share the cost of returns with customers

This has been one of the sticky, hairy issues with the rise of e-commerce in Canada.

What happens when the item you buy online doesn’t fit, or doesn’t match your expectations? Most people send it back or return it to the store. This is a profitability killer for retailers.

This situation requires some re-education of the online consumer. We know that retailers who shared the cost of returns with customers were 40 per cent more likely to be profitable in 2022.

Unlimited free returns of items that can’t be re-entered into the supply chain is a worst-case scenario and a persistent problem.

Retailers must have clearer, well-communicated return policies. There must be a cost associated with a return, and items must be returned in a condition and package ready to be sold again and not to enter the secondary marketplace. This alternative is costly and wasteful.

The key to achieving this is clarity and convenience around the return.

Helping retail landlords and their tenants achieve this harmony

If we think about these lessons as a continuum of behaviour, what emerges is a sense of harmony that results in efficiency and profitability. But this labour and the strategic thinking requirement must be shared by the retailers and their landlords.

Retail tenants must fulfill their side of the arrangement by having strong sales teams; attractive, well-stocked stores; and an omni-channel sales strategy. The hybrid model must motivate customers to shop in-store and online in a way that doesn’t create a tidal wave of costly returns and un-sellable items.

For many retailers, it can all start with simply setting up a functional website.

Landlords also have a part to play in nurturing this harmony. It’s their job to help bring people to the shopping centre, high street or property. That means having a sound marketing strategy, a sensible location with convenient access, transportation networks and parking, and a thoughtful tenant mix that creates excitement, convenience and a reason for people to make the trip to the property.

While 2023 represents a new period of uncertainty for consumers, retailers and landlords, there’s a shared responsibility in the pursuit of harmony that will drive an important pair of byproducts: more sales and a higher level of profitability.

Source Real Estate News EXchange. Click here to read a full story

More Growth on Way in Ontario’s Surging Self-Storage Sector

Ontario’s 37.3-million-square-foot self-storage sector has grown by more than 4.2 million square feet during the past three years and more space is coming.

“Some of that is helping to support what we’re seeing in terms of small dwellings that are being built,” said Greg Martino, vice-president and chief valuation and standards officer for the Municipal Property Assessment Corporation (MPAC), an independent, not-for-profit corporation funded by Ontario’s municipalities.

MPAC is accountable to the province, municipalities and property taxpayers through its 13-member board of directors.

“Other factors that are contributing (to the growth in self-storage) are: more people working from home looking to store items that have accumulated in their spaces; they’re downsizing; or they’re doing some renovations to the homes that they currently live in and they require some place to store their personal belongings,” Martino told RENX.

The role of MPAC, which recently released data on self-storage space in Ontario, is to assess and classify all properties in compliance with the Assessment Act and regulations set by the Government of Ontario. It’s the largest assessment jurisdiction in North America, responsible for more than 5.5 million properties with an estimated total value of more than $3 trillion.

Condominium and self-storage growth are connected

Data released by MPAC in 2022 showed Ontario condominiums are 35 per cent smaller on average than they were 25 years ago.

The growth in self-storage has been especially pronounced in Toronto, Ottawa and Mississauga, Ontario’s most densely populated cities with the largest concentrations of condos.

Here are the 10 Ontario municipalities with the most self-storage square footage, according to MPAC:

- Toronto – 8,337,098 square feet;

- Ottawa – 3,065,090 square feet;

- Mississauga – 2,098,770 square feet;

- Hamilton – 1,049,608 square feet;

- London – 989,410 square feet;

- Brampton – 898,925 square feet;

- Oshawa – 845,045 square feet;

- Burlington – 791,740 square feet;

- Markham – 619,943 square feet; and

- Windsor – 580,320 square feet

While self-storage growth in Ontario might not increase at the same high rate as it has over the past three years, Martino expects it to keep increasing along with the high-density residential construction sector.

A Self-storage operator’s perspective

Bluebird Storage Management operates 30 self-storage facilities in six provinces, has about a dozen under construction and has almost 10 more under contract to acquire, according to chief executive officer Jason Koonin, who told RENX in a separate interview that he sees no signs of the sector slowing down.

The Greater Toronto Area (GTA) is the most mature self-storage market in Canada. Bluebird has been active in the GTA and will continue to be, but it’s also expanding outwards from there — including in other provinces.

Self-storage need is far in excess of supply, according to Koonin. He believes even more self-storage space would be under construction in Ontario but for the length it takes for projects to be approved. Other factors which are holding the industry back include high land costs, taxes and development charges, he noted.

Self-storage facilities becoming more modern

While traditional suburban, low-rise, mini-warehouse structures are still common, more sophisticated facilities are increasingly being built in urban locations.

These are typically larger, fully enclosed, multi-storey, climate-controlled structures that offer flexible spaces, 24-hour access, drive-in bays and enhanced security.

Koonin said these modern self-storage facilities are becoming relatively familiar sights in the GTA, but are still uncommon in many other parts of Canada.

He thinks just a few percentage points of the self-storage facilities across the country could be considered class-A.

“Take Quebec, for example,” said Koonin. “Much of the storage there is in old industrial buildings.

“There’s a lot of redevelopment work, but not really purpose-built stuff from the ground up. So we see tremendous opportunity in places across Quebec, across Alberta and Nova Scotia to build class-A facilities, which there are very few of.

“Part of our strategy is to grow through acquisition, but there’s not much class-A product to buy meaning heated, air-conditioned, multi-storey.”

Potential for building conversions

Some office and retail properties that have struggled with high vacancy rates could be considered for redevelopment by their owners and transformed into self-storage facilities, though Koonin said that may not be as easy as some might think given the design and structural integrity of some buildings.

Bluebird is in the process of converting a vacant four-storey office building in the United States into a self-storage facility.

“We may see self-storage as a potential alternative use for some of these sites where the buildings and locations are conducive to that sort of use,” said Martino, “but we’re also starting to see a few development proposals where a self-storage aspect is being built into mixed-use developments.”

Increasing investor interest in self-storage

Self-storage is also attracting more attention from institutional investors that might have previously put their money into office or retail properties but are now seeking alternatives that can deliver higher returns.

“The amount of capital trying to be redeployed is quite large, so we’re getting a lot of calls from people who are experienced commercial real estate investors who haven’t been in storage and they’re sort of shifting from other commercial asset classes,” said Koonin.

“I think it bodes well for storage.”

Koonin said the market in the United States is much bigger and more mature than in Canada and, due to a slowing economy and the large amount of self-storage space available, rent per square foot collected by operators there has fallen.

Conversely, Bluebird’s rent per square foot collected in Canada in February was eight per cent higher than a year earlier.

Source Real Estate News EXchange. Click here to read a full story

W.P. Carey Pays $468M US to Acquire Apotex GTA Properties

U.S.-based REIT W.P. Carey (WPC-N) announced this morning it will invest $468 million US to acquire a “critical portfolio of four pharmaceutical R&D and manufacturing campuses” in the Greater Toronto Area operated by Canadian global generic drug giant Apotex Pharmaceutical Holdings Inc.

The portfolio represents the majority of Apotex’s global operations, comprising 11 properties which cover about 2.3 million square feet of space. It is being acquired as a sale-leaseback.

The lease is structured as a triple-net master lease with rent payable in U.S. dollars and fixed rent escalations over a 20-year term. The sale-leaseback transaction closed April 3, concurrently with private equity firm SK Capital’s majority buyout of Apotex, financing a portion of the buyout.

Financial terms of SK Capital’s buyout of Apotex have not been released.

“We’re thrilled to close this sale-leaseback and welcome Apotex as a top tenant. In addition to its existing scale, we believe Apotex will continue to benefit from the deep expertise of its private equity sponsor in the pharmaceutical manufacturing sector,” Tyler Swann, managing director of W. P. Carey, said in the announcement. “This investment is a great example of our ability to partner with private equity firms to leverage sale-leaseback proceeds to optimize the capital stack for new acquisitions. We look forward to growing our partnership with Apotex and SK Capital alike.”

W.P. Carey a major net lease REIT

W. P. Carey is a major net lease REIT specializing in corporate sale-leasebacks, build-to-suits and the acquisition of single-tenant net lease properties. The firm has made significant investments in industrial assets so far in 2023, with this transaction bringing its total year-to-date investment volume to approximately $650 million – most of it in industrial assets.

W. P. Carey reports an enterprise value of approximately $24 billion, holding a diversified portfolio of commercial real estate which includes 1,449 net lease properties covering approximately 176 million square feet, and a portfolio of 84 self-storage operating properties, as of Dec. 31, 2022.

With offices in New York, London, Amsterdam and Dallas, the company’s focus remains investing primarily in single-tenant, industrial, warehouse and retail properties located in the U.S. and Northern and Western Europe, under long-term net leases with built-in rent escalations.

Apotex was founded in the mid-1970s by Barry Sherman, a billionaire who was found murdered in his Toronto home with wife Honey in 2017. The future of the company has since been uncertain, and embroiled in controversy.

Apotex has also been the subject of legal action including a price-fixing scandal in the United States.

At the time of Sherman’s death, the company was considered to be worth about $3 billion.

Source Real Estate News EXchange. Click here to read a full story

Office Market Sees First Quarterly Net Rent Decline In Years

While it was less than one per cent, the Canadian office market saw its first quarterly asking net rent decline in years in Q1 2023, according to Colliers’ new “National Market Snapshot” report.

The overall average asking net rent across the country is $20.37 per square foot. It’s $22.79 downtown and $17.37 in the suburbs.

Colliers senior national director of research Adam Jacobs told RENX the Canadian office market was hit by a double whammy of more people working from home due to the COVID-19 pandemic and a record amount of construction, but that cycle is coming to a close.

“I don’t see this situation in the future where we have rising vacancy and we’re still adding millions and millions of square feet of office space to downtown,” said Jacobs. “I think we’re going to get back to a situation where there’s a lot less construction going forward and we’re just going to deal with the stock that we have.”

The national office vacancy rate is 13.3 per cent, including 14.7 per cent downtown and 12 per cent in the suburbs.

A recent survey of Colliers-managed buildings showed that small businesses are more committed to having employees in the office than large corporations. However, Jacobs thinks more major occupiers will follow RBC’s recent lead and become more demanding when it comes to having more employees in the office.

National industrial overview

While Canada’s industrial vacancy rate is one per cent, each of Colliers’ tracked markets with a vacancy rate below one per cent in Q4 2022 saw increased vacancy in Q1 2023. It’s still a landlord’s market, however, despite record high construction.

National average industrial asking net rents continue their steady climb, sitting at $13.81 per square foot, which represents a 32 per cent annual increase. Affordable prices relative to Toronto and Vancouver can be found in the Prairie markets, none of which are above $12 per square foot, but these areas are also experiencing rapid rent growth.

“We’re building more and more and more industrial and yet, no matter how much we build, it doesn’t slow the market down or flood the market or drive the vacancy up,” said Jacobs. “It feels like we’re building so much, but it’s really not that much relative to how much is probably needed.”

Jacobs pointed out that, despite these steep increases, industrial rents are still lower than in markets including California and New Jersey. Large corporations looking for distribution and warehouse space aren’t overly rent-sensitive either, he added.

While industrial rents will likely keep rising, the rate of increase is expected to taper off since Jacobs said the recent pace can’t keep going.

“The sales side has really slowed down and the leasing side hasn’t, and I’m not sure if those have to come in line or if it will just stay that way,” said Jacobs.

British Columbia

Vancouver and Victoria’s office markets have continued to do relatively well, with respective 6.5 and 6.4 per cent vacancy rates and average asking net rents of $34.67 and $24.01 per square foot. With their reliance on technology companies, Jacobs said those office markets could take a bit of a hit.

“Tech has really driven things and it’s been an incredibly positive driver, but we’re now hearing the news that there’s a pretty big pullback in tech and people are holding their breath a little bit.”

This quarter delivered the largest amount of new office supply in seven years in Vancouver. The Post’s south and north towers’ more than one million square feet were fully pre-leased to Amazon, and Bosa Waterfront added 355,000 square feet of space.

Vancouver’s suburban office vacancy rate is five per cent, compared to 8.4 per cent downtown, and Jacobs said there’s huge demand for space in Burnaby and Richmond. Downtown average net asking rent remains much higher, however, at $39.91 per square foot compared to $27.01 in the suburbs.

Vancouver’s industrial vacancy rate is 0.6 per cent despite more than 710,000 square feet of space being added to the market, and the average asking net rent rose to $22.09 per square foot. Some businesses have started decreasing their footprint to maintain similar operating costs.

Victoria’s Plexxis Tower was completed this quarter and is ready for occupancy. The five-storey building provides 67,074 square feet of office space and 10,298 square feet of retail space to the suburban market.

Victoria’s industrial vacancy rate rose slightly to 0.4 per cent while its average asking net rent increased to $18.13 per square foot. Industrial product remains highly sought after by both owner-users and investors, but supply limitations have been a barrier.

Alberta

Calgary’s 27.7 per cent office vacancy rate is the highest of the 12 markets included in Colliers’ report, well above Edmonton’s second-place 20.1 per cent. Calgary’s average asking net rent is $14.39 per square foot and Edmonton’s is $16.65.

“Usually downtown still commands higher rents, but I think Calgary is the exception where you’re actually paying higher rents in the suburbs,” said Jacobs.

Calgary is offering incentives and looking to convert certain office buildings into residential spaces, vertical farms or other uses. Half-a-million square feet of office inventory were removed from the market in this quarter.

After a record-breaking year for Calgary’s industrial market, there was some cooling in this quarter when it had a 1.8 per cent vacancy rate.

Leasing activity continues to be solid and dwindling available inventory is putting upward pressure on asking net rental rates, but it’s still comparatively much cheaper to occupy space in the city than in other major industrial markets across Canada.

Edmonton’s industrial vacancy rate dipped to 3.8 per cent, the first time it fell under four per cent in nearly eight years. The average asking net rent is $10.47 per square foot.

Construction volume remains high in Edmonton, with more than four million square feet being built and more than three million expected to be delivered within the next six months.

This large influx should help alleviate the perpetual demand for newer and larger distribution centres and warehousing space along major traffic routes.

Saskatchewan and Manitoba

Saskatoon has an office vacancy rate of 11.9 per cent and average asking net rent of $19.96 per square foot.

Saskatoon’s industrial sector is still short on smaller-bay warehousing spaces, but availability is opening in larger speculative builds in the BizHub Industrial Park. It has a two per cent vacancy rate and the average asking net rent continued to rise to $11.58 per square foot.

Regina’s office vacancy rate rose slightly to 17.9 per cent while the city’s average asking net rent rose to $15.86 per square foot.

Regina’s industrial market started 2023 off well, recording positive absorption, a decrease in its vacancy rate to 1.4 per cent and an increase in asking net rent to $11.42 per square foot.

While Winnipeg’s suburban office market had previously been outperforming downtown, with higher absorption and lower vacancy, it also saw an increase in vacancy to start this year. The suburbs has an 11.3 per cent vacancy rate, while it’s 14.9 per cent downtown.

A significant number of spaces came back to the market, which caused negative absorption, and the average asking net rent dropped to $16 per square foot.

Winnipeg’s industrial leasing activity remains strong. While the vacancy rate increased quarter-over-quarter to 1.5 per cent, this can be attributed to larger blocks of older inventory coming back to the market, including 156,715 square feet at 1555 Buffalo Place.

Ontario

Existing downtown Toronto office tenants continue to downsize their locations in proximity to the financial core, and the vacancy rate rose to 10.4 per cent — the same as in the suburbs. The average asking net rent is $34.98 per square foot in downtown and midtown and $17.80 in the suburbs.

“Toronto is the extreme case where downtown has just suffered so much because it’s so dependent on big business and riding the subway and riding the GO Train and all that,” said Jacobs.

Office spaces under 10,000 square feet are seeing more activity and landlords are building out model suites to attract tenants looking for simple solutions. Tenants looking for 20,000 square feet and above are being more calculated with their timing and decision making.

Despite rising vacancy rates in central Toronto, Jacobs said there’s been no movement to repurpose office buildings to other uses.

While Toronto industrial lease rates remain high across the board, with an average asking net rent of $18.01 per square foot, the market is beginning to see the flight to quality experienced in the office market during the course of the pandemic.

Facilities built within the last 10 years are achieving the highest rental rates, while less contemporary buildings are sitting on the market longer.

Ottawa’s office market continues to soften, with its vacancy rate rising to 12.3 per cent. Still, the average asking net rent increased to $17.24 per square foot. Sublet space continues to rise, with approximately 65 per cent of sub-lease availabilities in the suburbs.

Ottawa’s industrial vacancy rate is 1.1 per cent and the average asking net rent has risen to $16.14 per square foot as demand continues to increase.

Nine industrial projects totalling 622,912 square feet are under construction in Ottawa. Another 30 are in the planned or pre-leasing development stage. With perpetually low vacancy rates and the upcoming addition of modern facilities, rental rates are expected to continue to climb.

Waterloo Region’s office vacancy rate is 10.4 per cent and its average asking net rent fell to $16.63 per square foot.

Waterloo Region’s industrial office vacancy rate is 0.7 per cent and its average asking net rent dropped to $11.89 per square foot. Close to 20 million square feet of new space is either planned or under construction.

Montreal

Montreal’s office vacancy rate is 14.5 per cent and its average asking net rent is $18.68 per square foot. Subleases are rising and AAA- and A-class spaces are being absorbed at a higher rate and at the expense of B- and C-class spaces downtown.

Montreal’s industrial vacancy rate is 0.9 per cent and its average asking net rent rose to $16.71 per square foot. Jacobs said industrial rents were increasing by more than 50 per cent annually, but that can’t be maintained.

There’s still demand for high-quality industrial assets and Alberta Investment Management Corporation (AIMCo) and Montoni acquired a property at 3400 Raymond-Lasnier from TD Asset Management for $108 million during the quarter.

Halifax

Halifax’s office vacancy rate increased slightly to 14.1 per cent, which is mostly attributable to an influx of sub-lease space in the suburbs. The average asking net rent is $16.43 per square foot.

While the industrial vacancy rate rose to 2.4 per cent, that can be attributed to two newly built properties totalling more than 140,000 square feet.

Demand for space remains strong and more than 530,000 square feet of product is under construction. About 480,000 of that is expected to be completed by year-end.

The average asking net rent increased by four per cent quarter-over-quarter to $12.42 per square foot and is expected to continue to rise over the course of this year.

Source Real Estate News EXchange. Click here to read a full story

ULI Meeting To Bring 5,000 CRE Professionals To Toronto

COVID-19 put a halt to Toronto’s plans to host the 2020 Urban Land Institute(ULI) Spring Meeting, but it’s now all systems go for ULI Toronto to bring the event to the city May 16 to 18.

Close to 5,000 real estate professionals from a wide variety of sectors are expected to attend the ULI Spring Meeting, which will be based at the Metro Toronto Convention Centreand feature more than 100 speakers, over 30 sessions and 29 tours around the city.

ULI is the oldest and largest network of cross-disciplinary real estate and land-use experts in the world, with more than 45,000 global members. Its mission is to shape the future of the built environment for transformative impact in communities worldwide.

ULI Toronto is supported by more than 2,600 public and private sector members.

ULI Toronto executive director Richard Joy told RENX the last international ULI event of any magnitude to be held in Toronto was in 1985, so a return to the city was long overdue considering it’s “arguably the most dynamic real estate market on the continent, with growth that is unprecedented.”

Since such large events have to be scheduled and planned well ahead of time, Denver hosted a hybrid live-virtual ULI Spring Meeting in 2021 and it returned to a more traditional live format in San Diego last year.

Toronto took the first available opening after 2020’s cancellation and it’s expected to be the best-attended spring meeting in ULI history.

Toronto has a lot to offer

“It’s very significant in the sense that it’s an opportunity to showcase a real estate development story and its many dimensions — with the economic and business story being one of them, but also the social stories, the environmental stories, the way we’re approaching issues like truth and reconciliation, and the way we’re approaching diversity, equity and inclusion,” Joy said.

“There are just so many dimensions to our real estate story and they’re not all good. I don’t think this is an opportunity to simply showcase what we think is the best of the city, but it’s also to showcase some of the great challenges we face.”

Joy expects about 85 per cent of ULI Spring Meeting attendees to be American, many of whom probably aren’t aware of the size of Toronto and its ever-growing real estate market.

He thinks many attendees may also be surprised to discover how many real estate-related companies that do business internationally are headquartered in Toronto.

“They’re going to see some incredible best practices around things like transit-oriented development, the densification of suburbs, green infrastructure and developing in complex urban geographies,” Joy said.

Local and Canadian attendees will also be exposed to American and international best practices and have the chance to network and lay the groundwork for business opportunities with people and companies they might not normally have contact with.

ULI Spring Meeting components

ULI Spring Meeting sessions will deal with: building healthy places; infrastructure; data; equitable development; 15-minute communities; retail challenges; homelessness; building materials; legal issues; flexible office space; mall redevelopment and densification; workforce housing; proptech; the urbanization of suburbs; development financing; high-rise towers; institutional capital; smart buildings; office conversions; life sciences facilities; housing affordability; economic forecasting; health-oriented communities; climate disclosure mandates; achieving net zero buildings and communities; retrofitting historic buildings; district energy; and more.

Among the areas covered by the tours will be: the eastern waterfront; the St. James Town and St. Lawrence neighbourhoods; the ravine system; Don Mills; Yonge Street retail; the Regent Park and Alexandra Park neighbourhoods; Downsview; post-secondary institutions; the financial district; Humber Bay Shores; cultural hubs; sports and entertainment venues; and Yorkville.

“Toronto has been notoriously shy about holding larger international events,” Joy said. “Montreal is much more wired into celebrating its international stature than we are, so I think this is going to be an interesting opportunity for Torontonians to take stock of our place in the world — which is no small place.”

Source Real Estate News EXchange. Click here to read a full story

Canada’s CRE Industry Lags Global Peers on Data Science: Altus

Canada’s commercial real estate firms lag well behind global peers in adopting, and adapting, data science into their investment strategies, according to Altus Group’s The State of Data Science in Commercial Real Estate Investing report.

“Ninety-three per cent of Canadian firms use analytics, but only 35 per cent use data science,” Heidi Learner, head of innovation at Altus Lab, told RENX. “If we look at Canada as a proportion of samples relying on data science, albeit differently, the Canadian response rate is the lowest.”

Data science unearths meticulous information traditional statistics, which Learner described as comparatively static, aren’t capable of interpreting.

For example, the latter will reveal a neighbourhood’s vacancy rates going back five years, but data science could instead shed light on who lived in that neighbourhood during the corresponding period as well as how much money those residents earned, their age profiles and who among them have children.

“All of these variables potentially interact. Use of data science allows us to extract the variables that are the most important drivers of rent to come up with fair value assessments of what rents should be going forward,” Learner said.

“The data science approaches are more robust than some of the prior approaches that rely on purely statistics relationships.”

Data science adoption a matter of time

Learner added Canadian firms are more likely slow adopters, rather than Luddites.

After all, Canada’s real estate market has long had an unflattering reputation for trailing its southern neighbour when it comes to innovation and technology, but she noted demand for data science is hearty in the Great White North, even if roughly only a third of the country’s commercial real estate industry presently uses it.

For perspective: 56 per cent of U.S.-based commercial real estate firms employ data science in their operations, while adoption percentages range from the 40s to 50s in Europe. Among Asia Pacific countries — which include Oceania — it’s about 50 per cent.

Learner remains optimistic Canadian firms will follow suit.

“Canadian firms are relying less on data science techniques than their global peers and it suggests there’s further adoption to come as investors become more comfortable with these techniques and realize that, if they don’t have the capability to develop these technologies in-house, they can hire third-party providers,” she said.

The reason it could become necessary is the data can be highly intricate, unlike the preponderant wholly stats-based method that relies on static information, which can result in missed opportunities.

Canada’s largest CRE firms aware of deficit

Colliers is one of the largest commercial real estate companies in Canada and, as such, releases a host of reports throughout the year for the office, retail, industrial and multiresidential sectors.

According to Adam Jacobs, Colliers’ senior director of research in Canada, the firm uses data science for mapping and geographical information system purposes, which has helped it ascertain, for clients, things like whether their commercial enterprises should be set up near particular universities or in downtown cores instead.

“One other thing that comes to mind is we have models that look at traffic — ‘How crowded will (a certain) intersection be on Monday morning?’ ” he said.

“We have historical data, then we assume there will be ‘this much’ population growth and new cars on the road, so we’re also modelling on that side.”

Colliers has kept abreast of the ways in which data science is slated to evolve, which could entail estimating building sale prices when, or if, they hit the market.

Such determinants are, however, convoluted in the commercial sphere at present — one painstakingly unclear factor is employees’ post-COVID-19 return to offices.

Jacobs said forecasting is the next, maybe even final, frontier for data science.

However, that could require accurate population projections that themselves are conditional upon myriad variables, including unemployment rates across various industries (which is no small task in a city like Toronto that has the most diversified economy in the country).

Another factor would be hybrid work configurations and whether employees tend to be in their offices on certain days of the week over others. If so, which ones and why? It’s too early today for such data sets, but Jacobs believes they’re coming.

“The predictive side is the final frontier and I don’t know we necessarily, as a company, are there yet,” Jacobs said, adding, “that’s probably coming for the industry in the next five years.

“These are things we didn’t consider five years ago when it was just based on real estate fundamentals.”

Urgency bucked by simplicity

Unlike the United States, the world’s third-largest country by population which has an abundance of sub-markets, Canada’s commercial real estate market has been relatively easy to predict and, COVID-19 notwithstanding, the industry hasn’t had to contend with many hurdles.

A combination of rising interest rates and contracting credit markets globally, as well as, on the domestic front, inert post-pandemic recovery, are now creating uncertainty for the next few years.

However, that might expedite urgency for more intricate data to allow firms to edge out their competition.

“I think it’s just a little harder at the ground level of brokerages, where it’s a big investment and they only operate in, say, five markets, so they don’t see the reward in the same way as in the U.S., where it’s maybe 12 times the size and there’s more of an immediate benefit because there are more competitors,” Jacobs said.

“The impetus is there with us and it’s there with our competitors.”

Source Real Estate News EXchange. Click here to read a full story

Dream, PaulsCorp Invest in CRE Financing Venture Avrio

Dream Unlimited Corp., along with PaulsCorp LLCand U.S.-based financing veteran Vicky Schiff have partnered to launch Avrio Real Estate Credit, which plans to offer short-term, first mortgage debt and other structured finance products.

Those offerings are to include B notes, mezzanine debt and preferred equity for the acquisition, refinancing and recapitalization of commercial real estate assets, with loans ranging from $25 million to $150 million.

Avrio, which will maintain a Toronto office but be based in Denver, represents Dream’s entry into the U.S. credit market.

“Given the current supply gap of available debt to meet the needs of real estate operators and developers in the U.S, Avrio will play a critical role in bringing flexible and creative debt funding to developers searching for this type of instrument,” said co-founder and Dream’s (DRM-T) chief responsible officer Michael Cooper in a statement.

“Dream places a strong emphasis on sustainability across all of our strategies and Avrio fits well within our goals of building better communities in our markets.”

Dream has over 600 employees and 12 offices across Canada, the U.S. and Europe with over $23 billion in assets under management throughout North America and Europe. Dream also develops land and residential assets in Western Canada.

Avrio

In addition to Denver and Toronto, Avrio also has offices in New York and Los Angeles.

According to a release, the venture will use a process developed in conjunction with Dream’s sustainability and ESG team to collect, analyze and report on ESG data “in a streamlined manner, intended to help external partners and borrowers improve their assets ESG scores, attributes and their overall impacts on their communities and the environment.”

Schiff, who sits on Dream’s board of trustees, was most recently the co-founder and managing partner of Calabasas, Calif.-based Mosaic Real Estate Investors.

She has an extensive background in the real estate and financing sectors stretching back to 1989, has founded or co-founded a number of ventures and has public and private board experience.

“We believe with the current real estate capital markets experiencing some dislocation, now is an opportune time,” Schiff, who is Avrio’s CEO, said in a statement.

“In addition to financing new development and value-add projects that utilize energy-efficient and green construction materials, methods, or systems, we want to work with borrowers who create jobs, encourage education and employee engagement and who are dedicated to building projects that help expand the inventory of workforce, affordable and transitional housing.”

PaulsCorp is a family-based real estate investment, development and management company.

With over 230 employees, the company has developed or managed over $6.5 billion in real estate assets including approximately 15,000 single-family homes, multiresidential units, townhomes and condominiums.

PaulsCorp currently has over $2 billion in assets under management and $825 million under development.

Kyle Geoghegan, previously the managing director for Trez Capital, has also joined Avrio as U.S. head of originations.

Source Real Estate News EXchange. Click here to read a full story

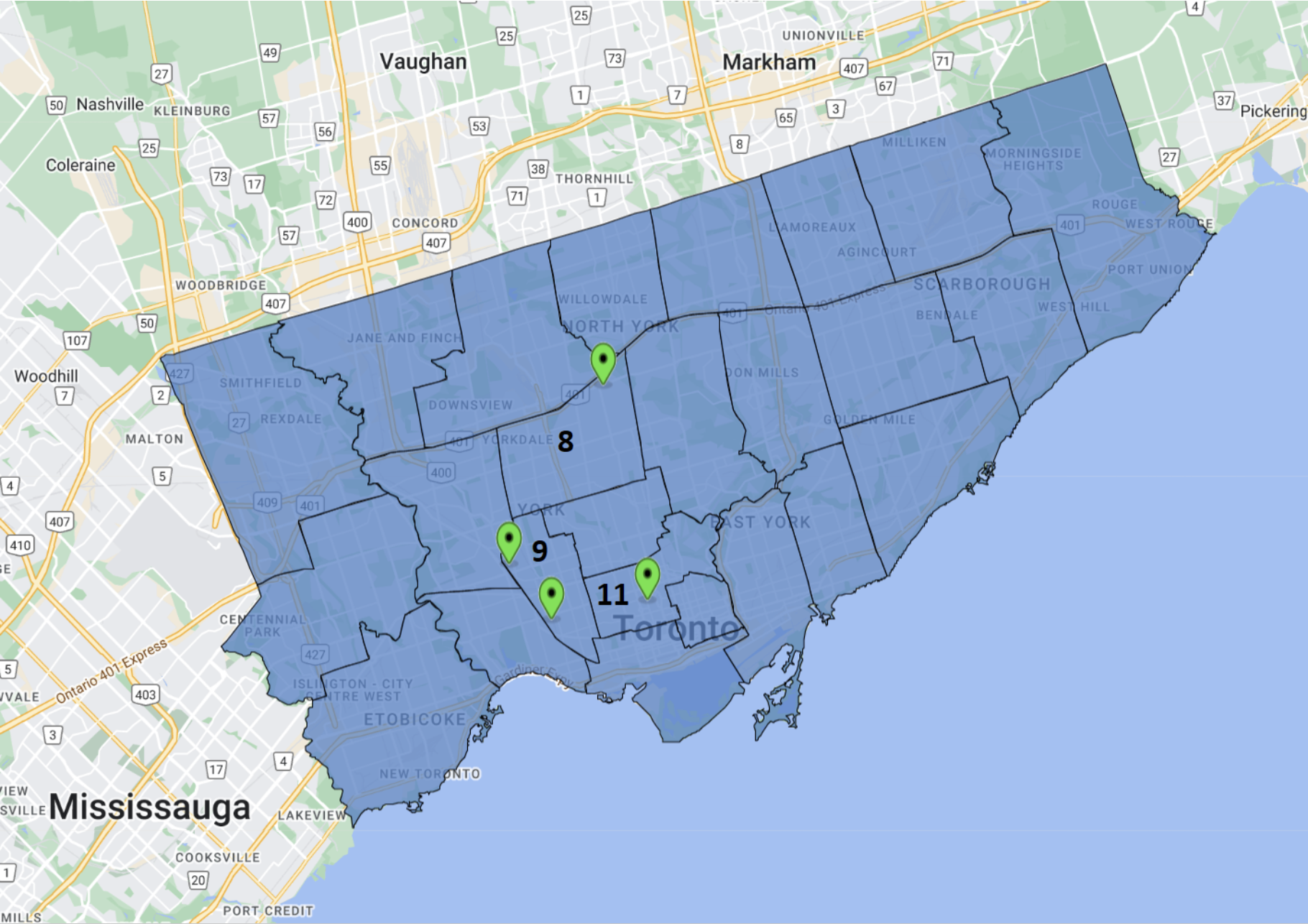

UrbanToronto Pro Report Shows Slow Month in Development Applications

The Toronto planning landscape has seen a dramatic shift from January, 2022 to January, 2023. Between the planned introduction of inclusionary zoning, rising interest rates, falling housing prices, inflation, the introduction of Bill 23, a new City Council, and more, developers had a lot to consider when it came to proposing new projects in the city.

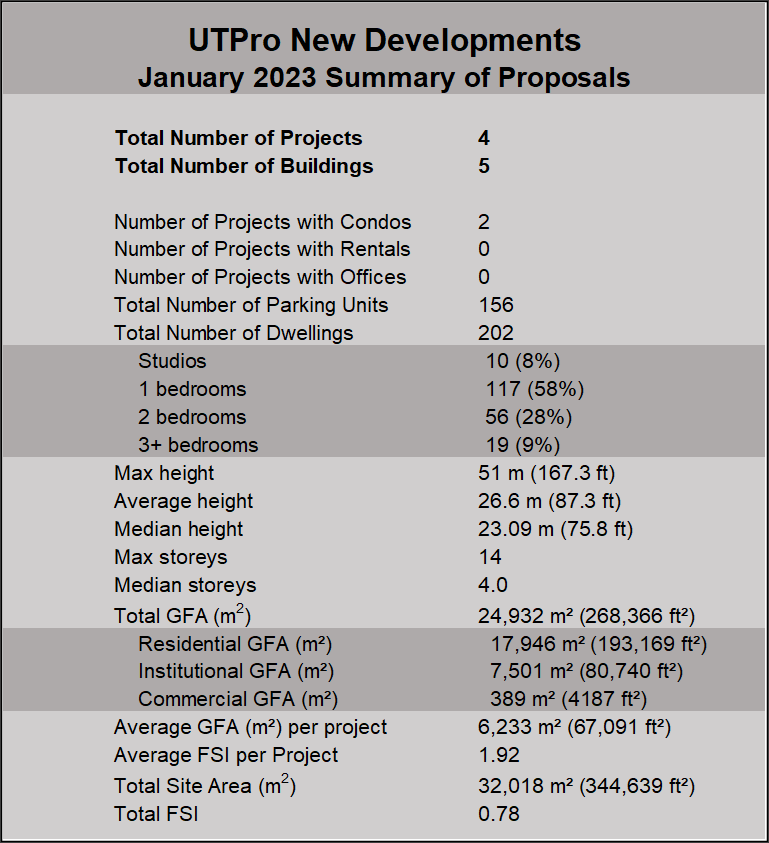

That said, January is usually a quiet month in terms of new applications, and this year was no exception. In January, 2023, only 4 applications were proposed, for a total of 5 buildings. However, compared to 2022 (which had 5 applications proposing 10 buildings), the ambition of the proposals was much more constrained. As this year only 2 of these projects were residential, smaller than usual numbers should be anticipated.

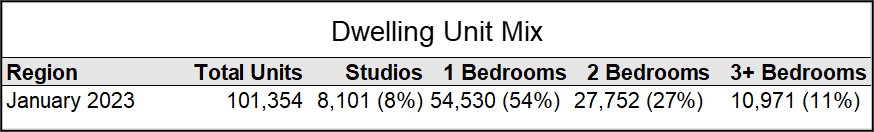

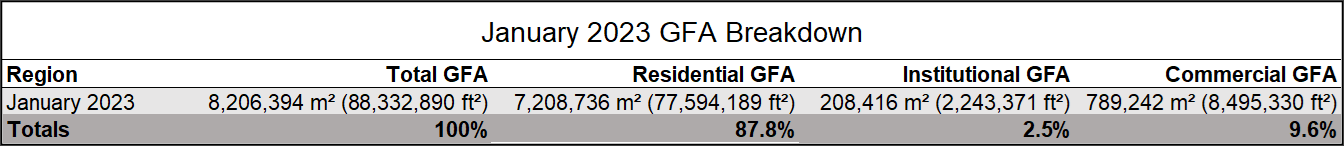

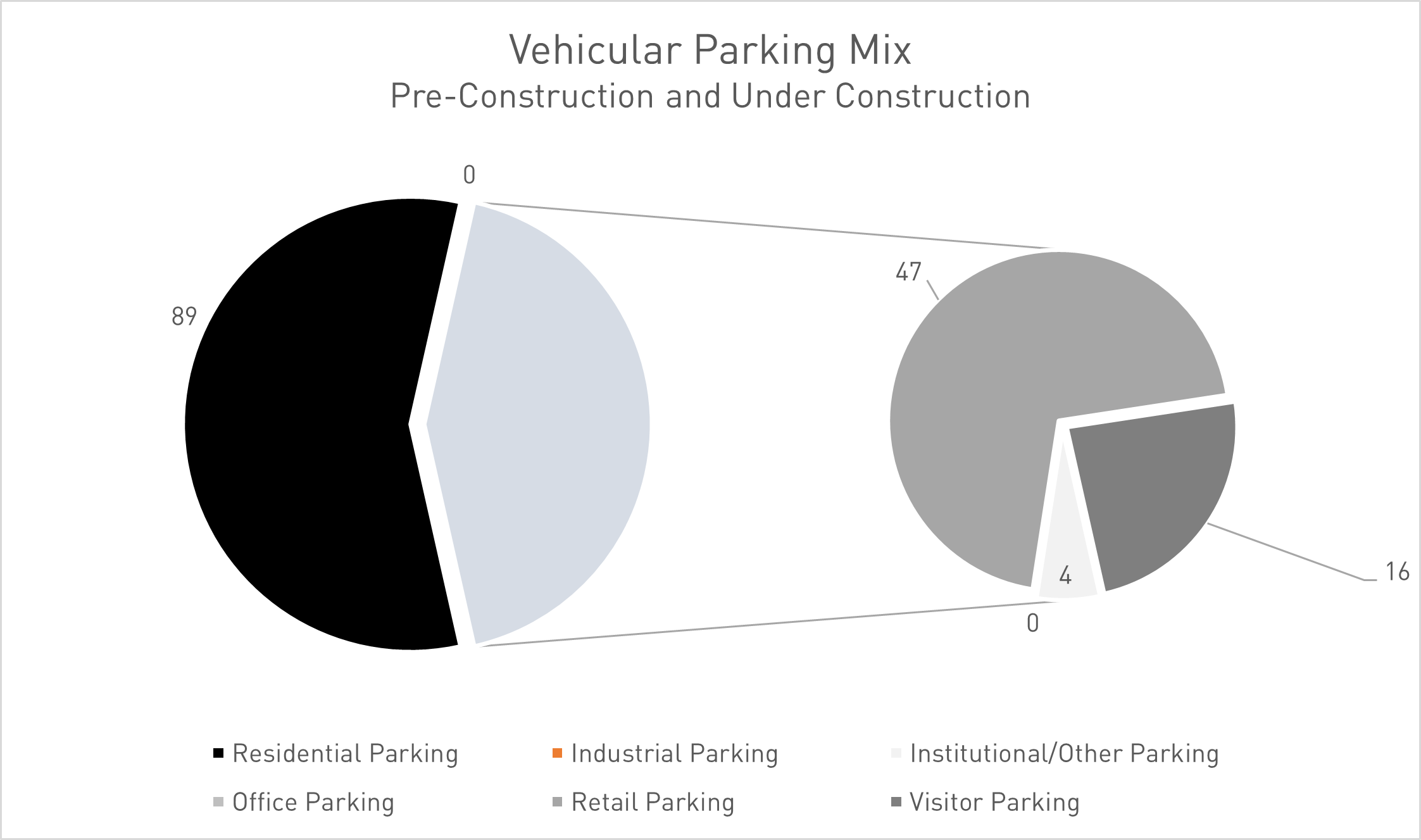

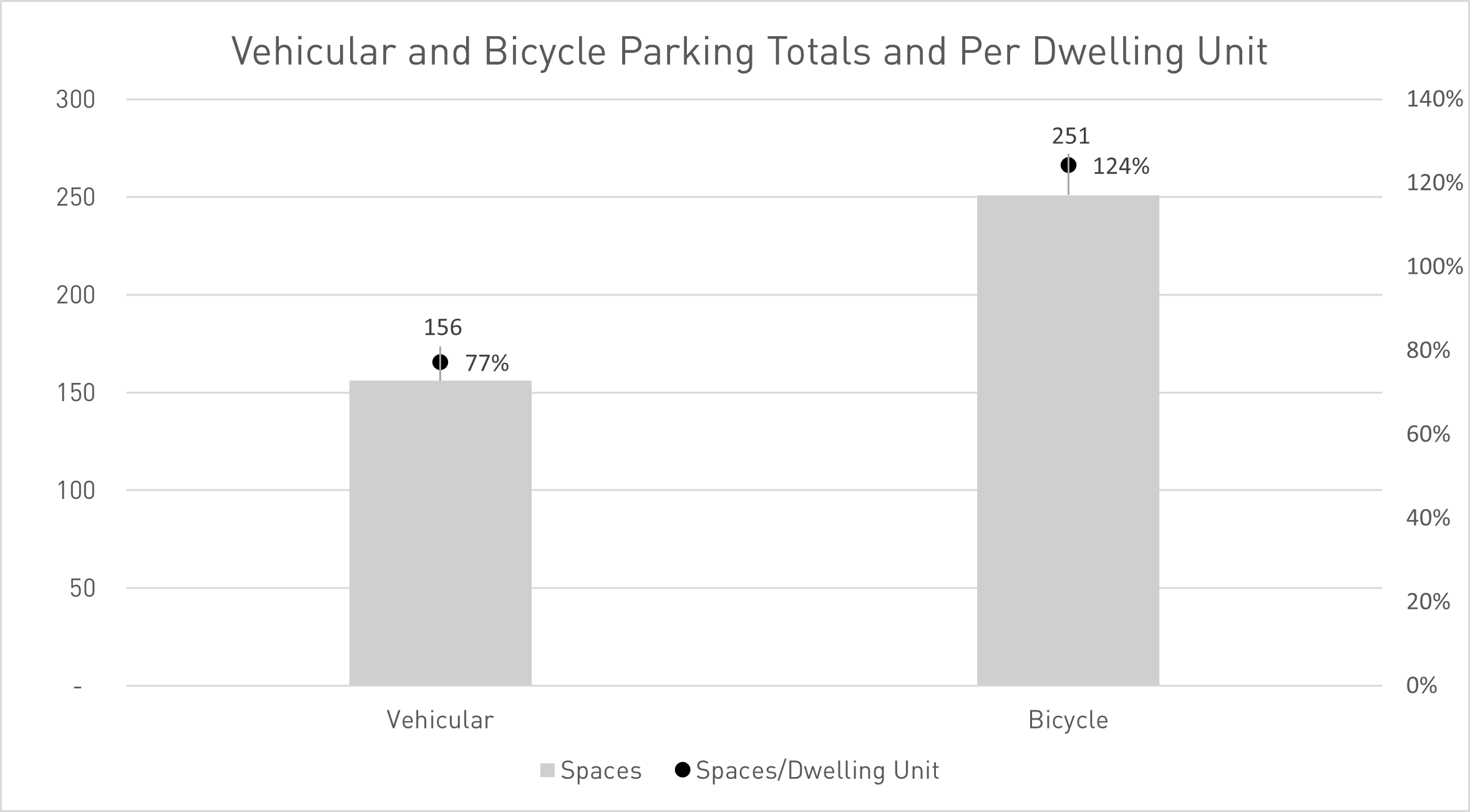

This year saw 202 dwelling units and 156 vehicular parking spots, as opposed to 810 dwellings and 382 parking spots proposed in January, 2022. The GFA proposed decreased significantly to ~268,000 ft², from ~671,000 ft² the year prior. However, the site area of the proposals increased this January to ~345,000 ft², up from ~154,000 in the same month last year. As a result, this year’s FSI is an unusually low 0.78, compared to 4.36 in January, 2022.

Unit sizes are likely to be bigger for projects proposed this month, as the residential GFA was at 956 ft² per unit, an increase of 27% over the 748 ft² last year. Since there are only 2 condo projects (190 Ridley and 150 Sterling), this is too small a sample to consider indicative of a trend.

Greater uncertainty continues to weigh a heavy burden on development applications, and — for the moment — on the future of growth in Toronto. Looking forward the rest of 2023, while the economic headwinds are certainly a challenge, navigating the new political landscape has uncertainties with it as well. Not only with respect to handling by new councillors and soon a new mayor, but also with the new “strong mayor” powers coupled with other changes re: how planning decisions get made. These changes could result in much faster planning reviews, thus lowering the cost somewhat for developments. However, how the changes end up being implemented remains to be seen.

Summary of applications submitted in January, 2023. Data from UTPro.

Summary of applications submitted in January, 2023. Data from UTPro.

The mix of dwelling units for development applications submitted to the City of Toronto in January, 2023. Data from UTPro.

The mix of dwelling units for development applications submitted to the City of Toronto in January, 2023. Data from UTPro.

The GFA mix for development applications submitted to the City of Toronto in January, 2023. Data from UTPro.

The GFA mix for development applications submitted to the City of Toronto in January, 2023. Data from UTPro.

The mix of vehicular parking for development applications submitted to the City of Toronto in January, 2023. Data from UTPro.

The mix of vehicular parking for development applications submitted to the City of Toronto in January, 2023. Data from UTPro.

Bicycle vs vehicular parking units for development applications submitted to the City of Toronto in January, 2023. Data from UTPro.

Bicycle vs vehicular parking units for development applications submitted to the City of Toronto in January, 2023. Data from UTPro.

Source Urban Toronto. Click here to read a full story