Office Market Sees First Quarterly Net Rent Decline In Years

Office Market Sees First Quarterly Net Rent Decline In Years

While it was less than one per cent, the Canadian office market saw its first quarterly asking net rent decline in years in Q1 2023, according to Colliers’ new “National Market Snapshot” report.

The overall average asking net rent across the country is $20.37 per square foot. It’s $22.79 downtown and $17.37 in the suburbs.

Colliers senior national director of research Adam Jacobs told RENX the Canadian office market was hit by a double whammy of more people working from home due to the COVID-19 pandemic and a record amount of construction, but that cycle is coming to a close.

“I don’t see this situation in the future where we have rising vacancy and we’re still adding millions and millions of square feet of office space to downtown,” said Jacobs. “I think we’re going to get back to a situation where there’s a lot less construction going forward and we’re just going to deal with the stock that we have.”

The national office vacancy rate is 13.3 per cent, including 14.7 per cent downtown and 12 per cent in the suburbs.

A recent survey of Colliers-managed buildings showed that small businesses are more committed to having employees in the office than large corporations. However, Jacobs thinks more major occupiers will follow RBC’s recent lead and become more demanding when it comes to having more employees in the office.

National industrial overview

While Canada’s industrial vacancy rate is one per cent, each of Colliers’ tracked markets with a vacancy rate below one per cent in Q4 2022 saw increased vacancy in Q1 2023. It’s still a landlord’s market, however, despite record high construction.

National average industrial asking net rents continue their steady climb, sitting at $13.81 per square foot, which represents a 32 per cent annual increase. Affordable prices relative to Toronto and Vancouver can be found in the Prairie markets, none of which are above $12 per square foot, but these areas are also experiencing rapid rent growth.

“We’re building more and more and more industrial and yet, no matter how much we build, it doesn’t slow the market down or flood the market or drive the vacancy up,” said Jacobs. “It feels like we’re building so much, but it’s really not that much relative to how much is probably needed.”

Jacobs pointed out that, despite these steep increases, industrial rents are still lower than in markets including California and New Jersey. Large corporations looking for distribution and warehouse space aren’t overly rent-sensitive either, he added.

While industrial rents will likely keep rising, the rate of increase is expected to taper off since Jacobs said the recent pace can’t keep going.

“The sales side has really slowed down and the leasing side hasn’t, and I’m not sure if those have to come in line or if it will just stay that way,” said Jacobs.

British Columbia

Vancouver and Victoria’s office markets have continued to do relatively well, with respective 6.5 and 6.4 per cent vacancy rates and average asking net rents of $34.67 and $24.01 per square foot. With their reliance on technology companies, Jacobs said those office markets could take a bit of a hit.

“Tech has really driven things and it’s been an incredibly positive driver, but we’re now hearing the news that there’s a pretty big pullback in tech and people are holding their breath a little bit.”

This quarter delivered the largest amount of new office supply in seven years in Vancouver. The Post’s south and north towers’ more than one million square feet were fully pre-leased to Amazon, and Bosa Waterfront added 355,000 square feet of space.

Vancouver’s suburban office vacancy rate is five per cent, compared to 8.4 per cent downtown, and Jacobs said there’s huge demand for space in Burnaby and Richmond. Downtown average net asking rent remains much higher, however, at $39.91 per square foot compared to $27.01 in the suburbs.

Vancouver’s industrial vacancy rate is 0.6 per cent despite more than 710,000 square feet of space being added to the market, and the average asking net rent rose to $22.09 per square foot. Some businesses have started decreasing their footprint to maintain similar operating costs.

Victoria’s Plexxis Tower was completed this quarter and is ready for occupancy. The five-storey building provides 67,074 square feet of office space and 10,298 square feet of retail space to the suburban market.

Victoria’s industrial vacancy rate rose slightly to 0.4 per cent while its average asking net rent increased to $18.13 per square foot. Industrial product remains highly sought after by both owner-users and investors, but supply limitations have been a barrier.

Alberta

Calgary’s 27.7 per cent office vacancy rate is the highest of the 12 markets included in Colliers’ report, well above Edmonton’s second-place 20.1 per cent. Calgary’s average asking net rent is $14.39 per square foot and Edmonton’s is $16.65.

“Usually downtown still commands higher rents, but I think Calgary is the exception where you’re actually paying higher rents in the suburbs,” said Jacobs.

Calgary is offering incentives and looking to convert certain office buildings into residential spaces, vertical farms or other uses. Half-a-million square feet of office inventory were removed from the market in this quarter.

After a record-breaking year for Calgary’s industrial market, there was some cooling in this quarter when it had a 1.8 per cent vacancy rate.

Leasing activity continues to be solid and dwindling available inventory is putting upward pressure on asking net rental rates, but it’s still comparatively much cheaper to occupy space in the city than in other major industrial markets across Canada.

Edmonton’s industrial vacancy rate dipped to 3.8 per cent, the first time it fell under four per cent in nearly eight years. The average asking net rent is $10.47 per square foot.

Construction volume remains high in Edmonton, with more than four million square feet being built and more than three million expected to be delivered within the next six months.

This large influx should help alleviate the perpetual demand for newer and larger distribution centres and warehousing space along major traffic routes.

Saskatchewan and Manitoba

Saskatoon has an office vacancy rate of 11.9 per cent and average asking net rent of $19.96 per square foot.

Saskatoon’s industrial sector is still short on smaller-bay warehousing spaces, but availability is opening in larger speculative builds in the BizHub Industrial Park. It has a two per cent vacancy rate and the average asking net rent continued to rise to $11.58 per square foot.

Regina’s office vacancy rate rose slightly to 17.9 per cent while the city’s average asking net rent rose to $15.86 per square foot.

Regina’s industrial market started 2023 off well, recording positive absorption, a decrease in its vacancy rate to 1.4 per cent and an increase in asking net rent to $11.42 per square foot.

While Winnipeg’s suburban office market had previously been outperforming downtown, with higher absorption and lower vacancy, it also saw an increase in vacancy to start this year. The suburbs has an 11.3 per cent vacancy rate, while it’s 14.9 per cent downtown.

A significant number of spaces came back to the market, which caused negative absorption, and the average asking net rent dropped to $16 per square foot.

Winnipeg’s industrial leasing activity remains strong. While the vacancy rate increased quarter-over-quarter to 1.5 per cent, this can be attributed to larger blocks of older inventory coming back to the market, including 156,715 square feet at 1555 Buffalo Place.

Ontario

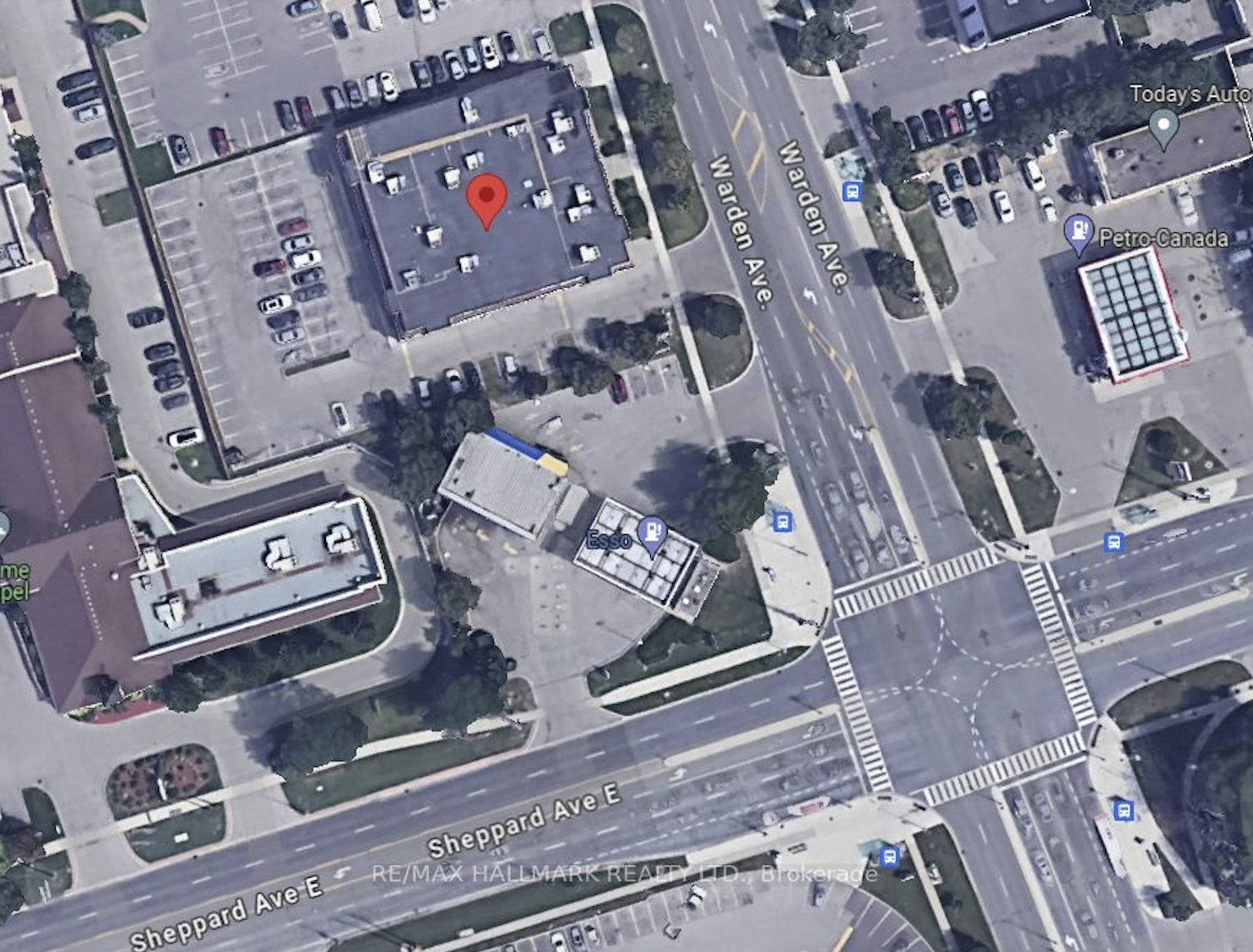

Existing downtown Toronto office tenants continue to downsize their locations in proximity to the financial core, and the vacancy rate rose to 10.4 per cent — the same as in the suburbs. The average asking net rent is $34.98 per square foot in downtown and midtown and $17.80 in the suburbs.

“Toronto is the extreme case where downtown has just suffered so much because it’s so dependent on big business and riding the subway and riding the GO Train and all that,” said Jacobs.

Office spaces under 10,000 square feet are seeing more activity and landlords are building out model suites to attract tenants looking for simple solutions. Tenants looking for 20,000 square feet and above are being more calculated with their timing and decision making.

Despite rising vacancy rates in central Toronto, Jacobs said there’s been no movement to repurpose office buildings to other uses.

While Toronto industrial lease rates remain high across the board, with an average asking net rent of $18.01 per square foot, the market is beginning to see the flight to quality experienced in the office market during the course of the pandemic.

Facilities built within the last 10 years are achieving the highest rental rates, while less contemporary buildings are sitting on the market longer.

Ottawa’s office market continues to soften, with its vacancy rate rising to 12.3 per cent. Still, the average asking net rent increased to $17.24 per square foot. Sublet space continues to rise, with approximately 65 per cent of sub-lease availabilities in the suburbs.

Ottawa’s industrial vacancy rate is 1.1 per cent and the average asking net rent has risen to $16.14 per square foot as demand continues to increase.

Nine industrial projects totalling 622,912 square feet are under construction in Ottawa. Another 30 are in the planned or pre-leasing development stage. With perpetually low vacancy rates and the upcoming addition of modern facilities, rental rates are expected to continue to climb.

Waterloo Region’s office vacancy rate is 10.4 per cent and its average asking net rent fell to $16.63 per square foot.

Waterloo Region’s industrial office vacancy rate is 0.7 per cent and its average asking net rent dropped to $11.89 per square foot. Close to 20 million square feet of new space is either planned or under construction.

Montreal

Montreal’s office vacancy rate is 14.5 per cent and its average asking net rent is $18.68 per square foot. Subleases are rising and AAA- and A-class spaces are being absorbed at a higher rate and at the expense of B- and C-class spaces downtown.

Montreal’s industrial vacancy rate is 0.9 per cent and its average asking net rent rose to $16.71 per square foot. Jacobs said industrial rents were increasing by more than 50 per cent annually, but that can’t be maintained.

There’s still demand for high-quality industrial assets and Alberta Investment Management Corporation (AIMCo) and Montoni acquired a property at 3400 Raymond-Lasnier from TD Asset Management for $108 million during the quarter.

Halifax

Halifax’s office vacancy rate increased slightly to 14.1 per cent, which is mostly attributable to an influx of sub-lease space in the suburbs. The average asking net rent is $16.43 per square foot.

While the industrial vacancy rate rose to 2.4 per cent, that can be attributed to two newly built properties totalling more than 140,000 square feet.

Demand for space remains strong and more than 530,000 square feet of product is under construction. About 480,000 of that is expected to be completed by year-end.

The average asking net rent increased by four per cent quarter-over-quarter to $12.42 per square foot and is expected to continue to rise over the course of this year.

Source Real Estate News EXchange. Click here to read a full story