Author The Lilly Commercial Team

Live-Work Park Community Reimagines A Legacy Office Complex

Despite becoming one of the most transportation-connected locations in Toronto, the northwest corner of Sheppard Avenue and Leslie Street has been an underutilized commercial zone of empty lots and aging commercial buildings. That’s about to change in grand style with the development of Central Park, a live-work community just north of the Leslie station on the Sheppard subway line.

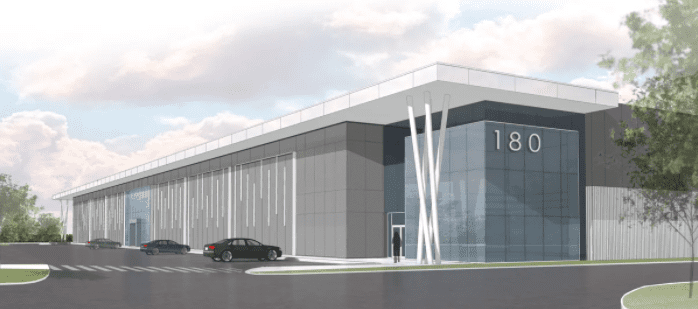

The 12-acre site that skirts the East Don Parkland will be redeveloped with five new residential towers. Two existing office buildings on the site will become key components of the new community as they’re upgraded and reclad with energy-saving glass and steel fins that create a visual effect that resembles movement when viewed from different angles.

The forested setting on a protected ravine and convenience as a transportation hub inspired the concept of a master-planned live-work community, says Jason Shiff, sales manager for Amexon Development Corp., which is breaking ground on the project this spring for occupancy in 2025.

The pair of 30-year-old buildings are rectilinear and dated but still solid, so it’s much more sustainable to upgrade them rather than tear them down and put the material into landfill.— Deni Poletti, partner of CORE Architects Inc.

The complex will have direct connections to the Leslie subway station and a relocated Oriole station on the Richmond Hill GO line, that provides non-stop service to Union Station. By car, it’s 500 metres to the Leslie Street interchange with Highway 401 and three kilometres to the Sheppard interchange with Highway 404/Don Valley Parkway.

According to Mark Fieder, president of Avison Young Canada, the project is part of an intensification trend that’s seeing large-scale residential developments incorporate legacy commercial buildings to create live-work districts.

“In many cases, it’s economically viable to retain a structure that’s in good condition and fits existing plans,” Mr. Fieder explains. “In other cases, a building may be designated historical; or if the planned community is large in scale, a phased approach may see some office and commercial buildings continue to bring in revenue during redevelopment. As the community takes shape, those commercial spaces may become more attractive, and the developer may revisit the plan to replace them.”

At Central Park, “the pair of 30-year-old buildings are rectilinear and dated but still solid, so it’s much more sustainable to upgrade them rather than tear them down and put the material into landfill,” says Deni Poletti, partner of CORE Architects Inc., which is designing the buildings at Central Park that will feature interiors by II By IV Design.

Upgrading office façades while tenants still occupy the space is becoming more common throughout Canada to improve energy efficiency, Mr. Poletti says. CORE recently designed the recladding of an office tower at Dundas Street and University Avenue while office tenants continued to work inside. The project added floors of condominiums on top to create the 55-storey Residences at 488 University.

Central Park in Sheppard-Leslie development will feature cafes. retail and markets.

All commercial buildings can lend themselves to such extensive upgrades while still in use, Mr. Poletti says; it just takes co-ordination and working with the tenants to make sure vibration is kept to a minimum as well as scheduling most of the work outside of office hours.

“Typically, what happens to protect the users inside, we put up hoarding around the perimeter with sufficient space for workers to access the skin and do the proper detailing and tying in of membranes,” he explains. “Depending on the type of work that has to be done, there may be situations where tenants have to move temporarily. At 488 University, that was not the case, but some cases may require areas be cleared for staging mechanical or electrical equipment.”

Renovating the Central Park office buildings will be a significant project. The four- and eight-storey buildings, which are connected by a two-storey link, total 325,000 square feet of space and have multiple tenants. Services in the commercial buildings include a privately operated daycare and an outdoor playground.

The concept for the reclad exteriors was envisioned to compliment the forested landscape of the Don River ravine, Mr. Poletti says. “We’re creating an optical illusion, with subtle waves in the skin of the building, and depending on where you stand, the look constantly changes. The idea is to transform these rectilinear objects into something more organic and interesting.”

The curving fins that create the fluidity will be made of enamelled steel. “We’re looking at something finished with a white enamel that has a reflective quality to add more pronunciation to the waves.”

All the glass is going to be replaced with more energy-efficient full-height windows, providing more light into the offices than does the current glazing, which is substandard by today’s norms, he says.

The next-generation mechanical systems to be added provide enhanced air flow and HEPA filtration systems and intelligent LED lighting systems and solar panels. The buildings will get energy-saving green roofs that will also enhance the view from the residences, Mr. Poletti adds.

Adding to the amenities for both residents and office tenants, the entire site will connect to the recreational trail in the Don River ravine and the Central Park, which gives the community its name, that includes a landscaped three-acre common, surrounded by cafés, bistros and a central market. Parking will be underground, with 2,000 spaces in a garage that extends beneath the entire site, and each will have a plug for electric vehicle charging, he adds.

The newly built glass-clad presentation centre on the west side of Old Leslie Street will remain a private events space and restaurant. A rooftop between two of the towers will contain part of the 55,000-square-foot Park Club for residents and guests, which includes a health club and saltwater pool.

It’s been a long process to finally break ground on the site Amexon originally acquired in 1995 and received zoning for in 2013, Mr. Shiff says. A small commercial building on the site that will become the residential zone was demolished 10 years ago and the office tenants were relocated to the other Amexon properties, and a rezoning process began.

“The development will transform the underutilized site from single-purpose daytime office use to a vibrant round-the-clock use within a community where people can live, work and play,” he says.

Source The Globe And Mail. Click here to read a full story

Office Leasing Begins For Toronto’s Canary Landing

Avison Young has begun marketing six floors and 251,552 square feet of boutique office space as part of the Canary Landing mixed-use development at 125 Mill St. on the eastern edge of downtown Toronto.

Canary Landing is being developed by Kilmer Group, Dream and Tricon Residential, with Dream acting as the office building’s property manager.

“You’re putting a new office development in a really cool and happening area with lots of retail and visitors,” Avison Young sales representative and principal Brett Armstrong told RENX.

“It’s something very different from what an office user typically gets from an office building. It’s more and more important now, as companies are looking at where to lease their office space and how to energize their employees and bring employees back to the office, to look at things outside of the physical office space like amenities and green space.”

What Canary Landing has to offer

The second through sixth floors at Canary Landing will have floorplates averaging around 50,000 square feet and there will be six rooftop terraces, each comprising approximately 1,000 square feet. There will be 4,200 square feet of retail at ground level, residential units above the office space and underground parking.

Canary Landing will provide: an enhanced, high-powered heating, ventilation and air-conditioning system; ultraviolet air purification and MERV 16 filters; access to natural light with 11-foot floor-to-ceiling windows; a raised floor system; touchless entry and destination dispatch elevators; real-time energy metering and smart enabled indoor air quality sensors; and mobile phone-enabled entry and integration to a building management application.

The building is targeting LEED Gold and WELL Core and Shell certifications.

Canary Landing will have direct access to 24 acres of dedicated parkland at Corktown Common. It’s directly adjacent to the Cherry Street Toronto Transit Commission streetcar loop and in the future will offer easy access to an Ontario Line subway stop and a GO Transit stop.

Since it’s not far from the Great Lakes Waterfront Trail, Canary Landing will offer secure bicycle parking and shower facilities for those who prefer to bike, jog or walk to work. It will have a Walk Score of 90, a Transit Score of 96 and a Bike Score of 100.

The Canary District, The Distillery Historic District and Riverside neighbourhoods surround Canary Landing, making a variety of retail and entertainment options, restaurants, bars, the Cooper Koo Family YMCA, parks and open spaces easily accessible.

There are more than 6,100 new residential units within a 500-metre radius of the rapidly growing area and about 22,000 people live within a kilometre.

“I think adding office will be important because, as everyone has been working from home over the past few years, it’s going to change the way companies evaluate the locations of their office space,” said Armstrong.

“Putting offices in a neighbourhood like this could be something really cool and make it a true mixed-use neighbourhood.”

Plenty of interest expected

Armstrong anticipates a high level of interest and activity for Canary Landing and Avison Young has already had preliminary talks with a number of groups. He expects a variety of tenants to be interested, led by the technology sector but also including professional services and financial services companies.

Armstrong surmises Canary Landing will attract a few tenants looking to take an entire floor or more. He doesn’t want to consider splitting up full floors this early in the leasing process.

“A lot of the deals that have been happening throughout the pandemic, and especially in 2022, have been in new developments,” he said.

The retail component of Canary Landing will likely act as an amenity for building occupants and could possibly include quick-service retail, a coffee shop or a bank branch. Armstrong said it’s too early to start leasing that aspect of the building.

Tenants are expected to begin fixturing their spaces in the third quarter of 2025 and Canary Landing should be fully occupied and operational in early 2026.

New office space is coveted

Armstrong said competition for premium downtown Toronto office space has been heating up and driving up rents, particularly in new developments, which have been beneficiaries of a flight to quality by companies.

Armstrong cited The Well, 16 York, 100 Queens Quay East and Waterfront Innovation Centre as examples of new office developments with high leasing activity and interest.

“It’s not the same activity level as it was pre-pandemic, but it’s certainly getting to a point where we see that happening toward the end of this year,” said Armstrong.

Source Real Estate News EXchange. Click here to read a full story

Spillover Effect From Toronto Heats Up Industrial Land Demand In Waterloo Region

This fall, Angstrom Engineering Inc., of Kitchener, Ont., will move into a 53,000-square-foot building in a new tech-oriented business park 10 kilometres away, ending a prolonged effort by the fast-growing company to buy industrial property.

Rising demand and shrinking supply of serviced industrial land in the Waterloo Region (which includes Cambridge, Ont.) have tested companies such as Angstrom and others competing for property in one of the country’s hottest industrial markets. The COVID-19 pandemic, supply chain disruptions and dwindling inventory of municipal industrial parks contribute to the current squeeze.

Three years ago, Angstrom officials looked for 20,000- to 30,000-square-foot buildings but, with company growth, broadened their search to facilities of 50,000 square feet. What they found, says Angstrom president David Pitts, was “almost nothing in that 30,000- to 50,000-square-foot size … It was challenging.”

If you can attract the best talent to the area, you will attract very good corporations. That war for talent has come to the industrial marketplace, especially in advanced manufacturing.— Mark Kindrachuk, president of Intermarket Properties

His experience is familiar to Waterloo Region realtors.

“I joke that over the 30 years of my career, for the first 25 to 27 years, I was trying to drag people out of Toronto to look at Kitchener-Waterloo, saying, ‘Please come and have a look and buy something,’ ” quips Karl Innanen, managing director of Colliers International in Kitchener. Given “the spillover effect” from Toronto-area demand, he says, “for the last two to three years, I’ve felt like a bouncer at a big party trying to keep them out.”

In the fourth quarter of 2021, industrial vacancy in the Waterloo Region fell to 0.7 per cent, according to a report by Colliers, given demand from local and out-of-town land buyers. Average asking net rents increased to a record $8.51 per square foot in the final quarter of last year (up 23.5 per cent over the same period in 2020).

Last fall, for the first time, the cost of some industrial land crept above $1-million per acre, spurred by COVID-19 disruptions, causing manufacturers and suppliers to relocate some of their production from abroad back to Canada.

At Angstrom, which designs and builds machines that create nano-film materials used to research the evolution of everyday products such as cellphones and batteries, as well as high-technology products, the search for new quarters predated the pandemic.

“The main driver was growth, and we needed more space,” Mr. Pitts says.

As the company outgrew its 15,000-square-foot facility in Kitchener, Mr. Pitts says Angstrom was determined to stay in the area for its existing work force and its links to skilled graduates from the region’s postsecondary institutions.

In early 2021, Angstrom purchased a five-acre parcel in Cambridge IP Park, an industrial campus developed by Toronto-based Intermarket Properties to attract companies in advanced manufacturing, research, distribution and logistics.

Unlike some newcomer developers, Intermarket Properties president Mark Kindrachuk dates his involvement in the Waterloo Region to 2001. Over a 12-year period, he and business partner Sandy Acchione assembled 400 acres of land for their industrial park in the north end of the city.

Over the past two years, Intermarket sold a significant portion of its 400-acre IP site to various developers, including the Healthcare of Ontario Pension Plan, Montreal-based Broccolini, and First Gulf, of Toronto. Intermarket retained 85 acres to develop and lease buildings for smaller-scale industrial users, not planning further property sales.

However, Angstrom purchased five acres in IP Park because Mr. Kindrachuk saw a fit with his plans for an amenities-rich industrial campus for high-tech and related firms. Those amenities include green space, walking trails and bike trails integrated into existing woodlots and creeks, key features of a master plan developed by Intermarket and the city of Cambridge.

“Our position is that if you can attract the best talent to the area, you will attract very good corporations,” Mr. Kindrachuk says. “That war for talent has come to the industrial marketplace, especially in advanced manufacturing.”

Given low vacancy rates, Mr. Kindrachuk is so confident he can bring in the firms he wants that his company will begin construction in May on a 100,000-square-foot building, possibly for a data centre, without signed tenants yet. Other buildings are scheduled for construction later this year.

Meanwhile, the pandemic-fuelled land squeeze led some companies to modify their acquisition strategies.

Eclipse Automation, based in Cambridge but also with operations in the United States and Europe, designs and builds complex automated systems for a variety of medical, transportation and clean-energy products.

Land was readily available when Eclipse opened in 2001, says president and co-founder Steve Mai, who made regular purchases in the Cambridge area to keep pace with company growth.

But escalating land prices over the past three years made it difficult to buy or lease the right buildings in a timely manner. “We have to fight for our real estate now,” says Mr. Mai, whose new strategy is to buy property well head of immediate needs.

“I have to entertain whatever comes available in the market at an inappropriate time for my business but appropriate for my [company’s] future,” he says.

The supply-demand pressure comes as municipalities no longer buy land for industrial parks. Cambridge, for example, sold its last inventory of industrial lands two years ago with no plans to acquire new supply, says economic development director James Goodram.

“The private sector is doing that now and they have really come in [to the region],” he says.

Mr. Goodram says municipalities now play a supporting role by installing water, waste and other services for privately held industrial lands, recouping those costs through development charges.

Currently, the city is assisting in the development of 400 acres of employment lands in north Cambridge and in Waterloo. Half of the developer-owned acreage is already serviced, with the other half expected to be ready later this year, says Mr. Goodram.

For Angstrom’s Mr. Pitts, relief is in sight. “We are looking forward to getting into the new space that is purpose-built for us.”

Source The Globe And Mail. Click here to read a full story

Core Development Group Proposes Rental at Queen East and Leslie

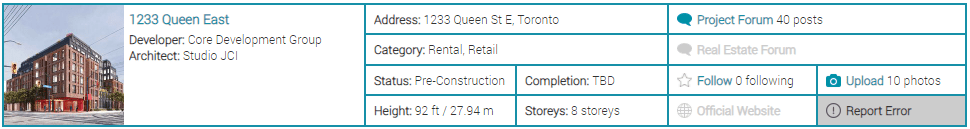

A mid-rise, mixed-use, mostly residential rental building could replace vacant industrial buildings at 1233 Queen Street East and Leslie Street in the Toronto neighbourhood of Leslieville. Core Development Group has submitted OPA, ZBA and SPA applications to the City for a proposed development that knits into the largely low-scale residential built fabric of the area. The brick-clad corner structure features step-backs, vertical articulation, and a recessed POPS (Privately Owned Publicly accessible Space) in the northwest corner of the site.

The half-acre lot is located on the southeast corner of the Queen and Leslie intersection. The two low-rise buildings that currently exist on the site are vacant, and until 2020 contained production facilities for Lee’s Food Products, a manufacturer of soya sauce. They were built in 1921 and converted into a factory in 1947, with additions built between 1948 and 1970. According to ERA Architects’ reports, there are no significant physical heritage resources on the site, and the buildings are not included on the City of Toronto’s Heritage Register.

The low-rise primarily residential neighbourhood also has a mix of commercial and industrial buildings. Across the street to the north is a 4-storey retirement home, and to the west, across Leslie Street, is the Duke of York Hotel, an historic Italianate-style hotel built in 1870. Several existing, proposed, and under construction mixed-use buildings will bring +6-storey developments to the nearby properties.

For this corner lot, Studio JCI has designed a stepped 8-storey purpose-built rental building in keeping with the emerging character along Queen Street and reflects the future planned features for “main street”. The total GFA of 8,906m² represents a density of 4.2 times the area of the lot.

A POPS is proposed to enhance the northwest corner in the form of a covered through-way for pedestrians on the ground floor, protecting the residential entrance and showcasing a feature wall and canopy. Adjacent to it, and fronting onto Queen Street East, is a 250m² space for retail. Directly behind that, an internal amenity courtyard serves as an extension of the ground floor commons and brings natural light to the units above.

The proposed eight-storey height with varied step-backs at the fifth and sixth floors is designed to reflect, and be compatible with, the one to five storey building heights in the general context. The use of step-backs, fenestration, and different cladding on the principle facades facing Queen and Leslie streets is meant to visually break the structure into narrower components to be compatible with the fine grained character of Queen East.

The total 132 apartments are broken down into 84 studios (64%), 1 two-bedroom (1%), 12 three-bedrooms (9%), and 35 four-bedrooms (27%), the latter a rarity in Toronto residential buildings.

Outdoor amenity space is provided through a courtyard on the ground floor, a terrace on the second floor, and a larger terrace space on the rooftop. Indoor amenity space is provided contiguous to the exterior spaces.

Vehicular access to the building is at the rear of the building, to/from Memory Lane which is oriented in the east-west direction. Ground floor vehicular parking accommodates 10 spaces, which include 2 car-share and 8 visitor parking spaces. A total of 160 bicycle parking spaces (144 long-term, 16 short-term), are also proposed. Queen is served by a TTC streetcar line; Riverside-Leslieville station on the Ontario Line subway is targeted for opening nearby in 2030.

West elevation along Leslie Street, image by Studio JCI

Overall, the proposal seeks to redevelop and intensify a portion of the south side of Queen Street East, while integrating with the existing and planned developments in the surrounding area. The potential impact of the proposed development on adjacent heritage resources is mitigated through various urban design elements: brick cladding that is compatible with the adjacent heritage resources; building step-backs to reduce visual impact; maintaining a low-rise streetwall through massing and design; and, detailing that references the area’s historic context, including vermillion red building accents that pay homage to the China Lily factory.

Source Urban Toronto. Click here to read a full story

The Rush Is On For Industrial Land, And Space, In SW Ontario

Industrial land acquisitions and development continue at nearly breakneck speed in Southwestern Ontario as prices and rents keep rising and pushing investors farther west from the Greater Toronto Area (GTA).

“Volumes are very, very high relative to historical numbers,” Joe Benninger, vice-president with CBRE’s Southern Ontario investment team, told RENX. “It’s extremely tight out there. In 2021, the vast majority of opportunities, both large and small, were gobbled up.”

According to CBRE, 12,496 acres of industrial, commercial and investment (ICI) and agricultural land worth $837 million traded hands in Waterloo Region, Wellington County and Brant County last year. That’s 95 per cent more than in 2020.

Benninger said in Waterloo Region, lands came on stream after a long period of no new serviced land being available, a major reason for the dramatic jump.

“There are lands that have come on stream in the Sportsworld/Maple Grove area of Kitchener and Cambridge that were a very long time coming. There are more lands downstream that are in the official plan. The planners need to figure out a way to accelerate getting those serviced.”

Waterloo Region industrial land deals

Major industrial land deals that took place in Waterloo Region last year included:

– Broccolini purchasing an aggregate of 105 acres on Old Mill Road and Allendale Road in Cambridge for $55.24 million from different sellers;

– Crestpoint Real Estate Investments Ltd., in partnership with Perimeter Development Corporation, purchasing a 38-acre site that was part of the former Budd Automotive lands at Homer Watson Boulevard and Bleams Road in Kitchener for $21.15 million;

– office and health-care furniture designer and manufacturer Krug acquiring a 23.7-acre site on Pearson Street, which was also part of the former Budd Automotive lands, for $14 million;

– and Dream Industrial REIT acquiring a 28.5-acre site on Maple Grove Road for $26 million.

Benninger said numerous potential tenants are competing to land space in Crestpoint and Perimeter’s project, where existing buildings were torn down to make way for new construction.

“That’s indicative of most of these planned developments. They’re leased up before a shovel ever hits the ground.”

The price for the Dream acquisition was almost $1 million an acre.

“Those are lands that could have been bought at any time over the last decade or so, probably for about $500,000 an acre,” said Benninger. “They certainly had interest, but no one stepped up to the plate to meet the seller’s expectations. In 2021, the seller ran a marketing process and ended up with five or six bids and achieved just under $1 million (an acre) for them.

“I think you’ll see Dream service those lands and move forward with some development there. That site’s a little bit challenged in terms of its shape. It’s not the perfect shape and size, so it probably would have gone for more than that if it was.

“There are (also) other parcels in that area where you’ll see some other groups move forward with development.”

Land prices and rents continue to climb

The price of ICI land in Southwestern Ontario has traditionally been a bargain compared to the GTA, but it’s been rising quickly as a result of surging demand.

While industrial land prices drop west of Toronto, Benninger said properties have still sold for more than $2 million an acre in Milton and for $1 million-plus further west. He expects prices will continue to rise.

“Institutional industrial developers are buying for both short- and longer-term pipelines for construction,” said Benninger. “The underlying fundamentals for industrial throughout Southwestern Ontario really make it favourable for industrial development and construction.”

Waterloo Region’s construction pipeline is expanding and new buildings are slated for development, including iPort Cambridge, a 300-acre logistics and industrial campus which will deliver more than four million square feet across several phases.

Brantford, which offers good accessibility to the GTA and Hamilton, has seen considerable industrial development activity as well.

Two Fiera Real Estate funds acquired five industrial buildings comprising about 940,000 square feet of space in Brantford for about $118 million from local developer and property manager Vicano Construction Ltd. last spring.

The properties ranged in size from about 12,000 square feet to a 530,000-square-foot, one-tenant distribution centre completed in 2020.

Vicano continues to build industrial facilities in Brantford and has more land in the city and elsewhere in Southwestern Ontario where it can construct future projects.

All of this new development activity still isn’t enough to meet demand, however, and very low availability rates in Southwestern Ontario continue to drive industrial rents up.

“We’re seeing industrial rents right now of $12 (a square foot) and even higher,” said Benninger. “Given the lack of trading space, I think there’s still upward pressure on rents and they’ll continue to increase.”

Source Real Estate News EXchange. Click here to read a full story

Mixed-Use Change To Commercial Lands. Cambridge Councillor Behind Task Force’s

The provincial government has an answer to housing issues, including those in Cambridge, and it just needs to pull the trigger, according to Coun. Nicholas Ermeta.

The Ward 8 representative pointed to the recent Ontario Housing Affordability Task Force report recommendation of permitting the “as of right” conversion of underutilized commercial properties to mixed use. The recommendation would “limit exclusionary zoning,” states the report, and bring a wider variety of residences.

“This to me is a no-brainer, can be done swiftly and isn’t overly controversial,” Ermeta said.

“It would open up a lot of land right away and in areas that need an upgrade where servicing already exists.”

Ermeta said the issue with current zoning in many municipalities is they haven’t updated its bylaws. While cities encourage mixed-use zoning, lands along arterial roads are only zoned commercial. He said getting land rezoned can sometimes take up to two years.

“As of right mixed-use zoning would significantly reduce the time frame and could see housing built much sooner. A builder would only have to go through site plan approval, which is a much shorter time frame than a rezoning,” he said.

Sections of Cambridge that would benefit from the change would be Hespeler Road and Dundas Street, Ermeta said. He can envision the same returns in the areas of King, Weber and Victoria streets in Kitchener, as well as Barton and Upper James streets in Hamilton.

“We need to embrace the missing middle, which creates more housing variety and more unique developments, taking the pressure off of detached homes,” he said.

One of the parameters perceived for the change would be allowing up to four units and up to four storeys on a residential lot.

“Market research also states that people overwhelmingly want to live in low-rise and mid-rise forms of housing over high-rise any day.”

Ermeta feels this change can avoid a mess of towering buildings in town. One of those developments he cites as an example is the Georgian Square Condominiums, on Wellington Street between Commonwealth Lane and Bruce Street. That type of medium density should “win the day” and would preserve the character in the city, he said.

While the provincial recommendations would bypass municipal approval, Ermeta wants cities to retain the ability to determine the amount of density and number of units that would be most appropriate for their community.

He felt a good starting point was four to six storeys.

Some of the other provincial recommendations include permitting “as of right” for secondary suites and multi-tenant housing, as well as allowing unlimited height and density for “as of right” zoning in “immediate proximity” of transit stations and no minimum parking requirements for six to 11 storeys.

Also, to rezone all land along transit corridors as mixed use and encourage municipalities to increase density in areas with excess school capacity.

Val Brooks, president of the Cambridge Association of Realtors, agreed with Ermeta that rolling back exclusionary zoning would “go a long way in in providing more affordable choices for families.”

“As of right zoning also allows more type of housing that is accessible to a larger group of people. This makes neighbourhoods stronger, richer and fairer and most importantly, allows housing to be built more quickly to alleviate the current supply issue,” she said.

“Far too much time and unnecessary expenses are spent reviewing and holding consultations for large projects which conform with the city’s official plan or zoning bylaws and small projects which would cause minimal disruption.”

Brooks noted with Cambridge’s core areas filled with businesses and commercial real estate, and the LRT on the horizon to provide a major transit corridor through the city, it is important to ensure people live close to those areas.

“Increasing density within Cambridge and around major transit routes would help reduce commute times, thus, reduce emissions, encourage tourism, support the economy and, most importantly, provide housing options for the large group of real estate clients wanting to enter the housing market,” Brooks said.

While Ermeta believes the recommendations could easily be implemented for the provincial election in June, he’s not dismissing the idea of putting a resolution forward to city council asking the province to work with the cities in implementing the recommendations.

“A major benefit to having mixed-use development across many commercial corridors is that spreading the growth in different areas might keep land costs in check,” Ermeta said.

“If you have too much development at once in one area, land values there will rise exponentially, which hinders affordability. So, by having other areas to choose from, investors can rotate throughout the city keeping the cost of future development land at a more reasonable price.”

Source The Record. Click here to read a full story

Developers Submit New Proposal For Site Where Toronto Had Planned Rail-Deck Park

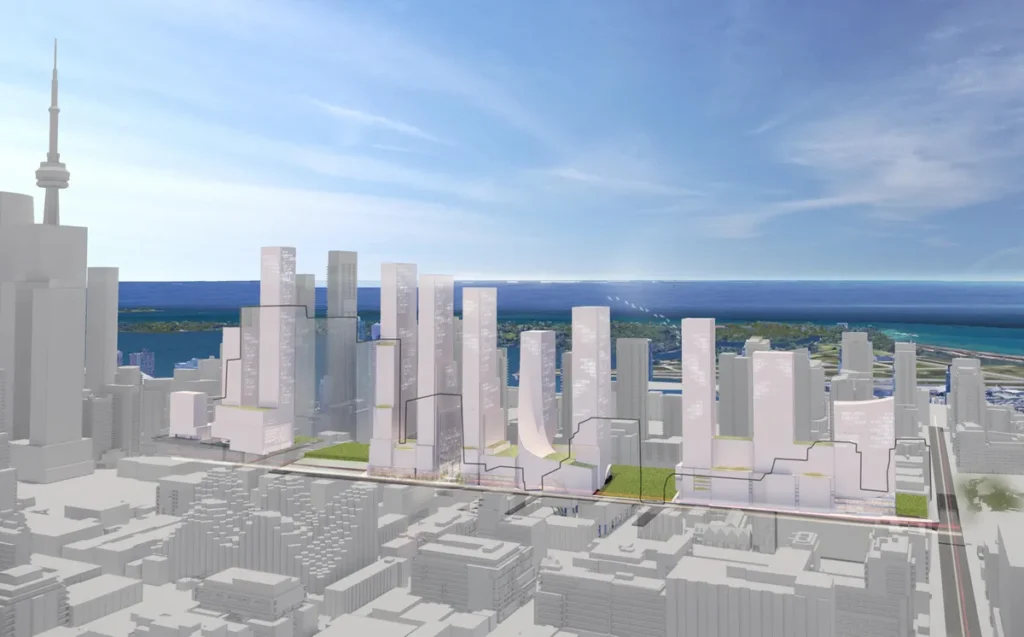

Downtown Toronto’s rail-deck development is moving forward. This week, developers submitted a formal application to the City of Toronto to build 11 towers – with 5,750 homes, 11,000 square metres of retail space and a hotel – above the rail corridor.

This would come instead of the proposed Rail Deck Park – but could provide as much as 4.45 hectares of parks (11 acres). The project’s lead architect says the proposal is just a “starting point” for negotiations.

If that’s true, a six-year debate over the future of downtown Toronto could wind up in a good place.

Since winning a planning dispute with the city last year, the development team has radically altered its plans, now overseen by Dermot Sweeny and his firm Sweeny&Co Architects.

“We’ve been working to make sure that this development will accommodate a great park,” Mr. Sweeny said recently, “and it will engage with the park and make it a great place.”

The new design places the towers in a strip along Front Street, lining it with shops and a sidewalk. A park at the foot of Portland Street would cut south between two towers, with a mild slope up from the street that is in places fully accessible. Privately owned public space would fill two more spaces to the east – and if Toronto wants to make a deal, a much larger area could become park.

Mr. Sweeny’s clients are a partnership of CRAFT Development Corporation, the Kingsmen Group, Fengate Asset Management and LiUNA Pension Fund of Central and Eastern Canada. This is largely the same group that, in 2013, locked up the air rights over the tracks that cut through downtown Toronto. It obtained rights to the area from Bathurst Street to east of Spadina Avenue.

This stretch of air has been a legal and political battleground ever since. After the developers approached city hall with this idea, the municipal planning department decided to plan for a park, with a construction cost most recently estimated near $2-billion. Local councillor Joe Cressy and Mayor John Tory advocated forcefully for the park, albeit without ever fully explaining how it could be paid for.

Last year, the developers won. Ontario’s Local Planning Appeal Tribunal approved a version of their project, which involved the prominent architect Moshe Safdie.

But as city planners pointed out, this project had serious design problems.

One: It lifted the project high up above the street. This meant stairs, escalators and elevators were needed to get people into the public spaces; this is an unacceptable condition in terms of accessibility and urban design.

Two: The architecture included a large shopping mall, which would have taken the street life and commercial activity indoors. As I wrote last year, this was terrible urbanism.

The new proposal solves most of those problems. The design team includes architect Peter McMillan, who had consulted on the city’s park proposal. The “deck” structure is now considerably thinner and the park space is now at a level modestly above the street. The design shows several routes from the street up into the park on modest slopes; the main passageway, at the foot of Portland Street, would be fully accessible to people with disabilities.

And the shopping mall has gone away. Instead, the developers are now proposing retail stores on Front Street. Mr. Sweeny argues – correctly – that this area of Front Street is inhospitable to pedestrians and far too wide a road.

The secret sauce here is that they’re asking to use public land: a strip about four metres wide along Front Street. That would allow them to make a gentler slope between street and park, and provide well-proportioned storefronts facing the street.

For this and other public land they are willing to pay the city. However, to build the full 4.45-hectare park, they want a gross contribution from the city of roughly $670-million. This is a large number.

On the other hand, the city’s own park proposal would cost three times as much for twice the park – and the city still has to buy out the developers to do it. This warrants a haggle.

Two issues remain.

One: Is this an actual project, and not just an attempt to squeeze money out of the city? It’s hard to say for sure, given the technical and financial complexities. However, there is reason to believe a rail-deck development like this one is feasible. Major development company Allied Properties REIT recently acquired a patch of air rights above the tracks for roughly $50-million.

The rail-deck partners and architects say they’re for real. “One hundred per cent, absolutely,” said Joseph Mancinelli, chair of the LiUNA Pension Fund, which is the newest partner in the project. “This will create a return, and a tremendous amount of work for our members.” LiUNA represents concrete trades. “It is a legacy project.”

Two: Can a deal be made here? Probably. The developers express an eagerness to collaborate with the city. But they also say they’re ready and willing to build just their towers and a small park, leaving the rest of the air over the rail corridor unbuilt.

Some Torontonians will paint this as a loss for the public realm. But I am skeptical that the city – which has been ruled by austerity for a generation now – will find the political and financial capital to build a Rail Deck Park by itself. A development and park is better than a pie in the sky. With the right design, it could even be great.

Source The Globe And Mail. Click here to read a full story

InterRent Acquired A Record Number Of Units, Rising Revenues In 2021

InterRent Real Estate Investment Trust acquired a record number of units and saw both its occupancy rate and rents increase last year.

The Ottawa-based REIT (IIP-UN-T) released its fourth-quarter and year-end results on March 8 and its top executives hosted a webcast presentation and conference call to discuss the performance and some of the trust’s business initiatives.

“We’ve really held fast on keeping our rents and not worrying about occupancy,” chief executive officer Mike McGahan said during his opening remarks. “We’ve actually utilized that time to make upgrades for units.

“We felt that, in the long run, that was the better move. We felt a lot of pain for a couple of years over it, but I feel very confident that it’s the right move and I think we’re all going to see some good things coming forward for the company.”

InterRent’s strategy is to: expand its portfolio primarily within markets that have exhibited stable vacancies and have sufficient units available to attain the critical mass necessary to implement an efficient portfolio management structure; and offer opportunities for accretive acquisitions.

Record year for acquisitions

InterRent acquired 1,829 units at a total purchase price of $727.3 million (at 100 per cent share) during 2021, including its first properties in Vancouver.

McGahan said it’s difficult to acquire scale in Vancouver, but once you have it you can add to it. InterRent acquired 50 per cent shares in 19 properties with 809 units valued at $382.9 million through four Vancouver transactions in 2021.

InterRent also acquired a 50 per cent stake in two Vancouver properties with 57 units that had a combined price of $25.6 million earlier this year.

“We’re one of the few players that do have a platform there and I think it’s going to work incredibly well,” said McGahan.

InterRent’s other 2021 acquisitions were:

– six properties with 574 units valued at $234.5 million in Toronto, Oakville and Mississauga;

– two properties with 169 units valued at $52.5 million in Montreal and Westmount, Que.;

– two properties with 272 units valued at $53.4 million in St. Catharines, Ont.;

– and one property with five units valued at $4 million in Ottawa.

The Mississauga acquisition was a 50 per cent stake, while InterRent fully owns the rest of the properties.

“It’s competitive out there and there’s lots of capital chasing our asset class,” said president Brad Cutsey. “We aren’t willing to get caught up in the frenzy at any price.

“We have not relaxed our underwriting requirements or our internal return hurdles. We’ll continue to only pursue deals that make sense and will create value over the long term.”

The InterRent portfolio performance

InterRent’s occupancy rate was 95.6 per cent in December, an improvement of 120 basis points from September and 430 basis points from a year earlier.

While occupancies improved in all of the REIT’s core regions, it was most pronounced in Vancouver, where the vacancy rate at its newly acquired properties dropped from 16 per cent in the first quarter to 3.7 per cent by the end of 2021.

“We still have some vacancy in the cores in our markets,” said McGahan. “Montreal is where we’ve had the hardest time, but I truly believe that once immigration and international students come back that that will come back, too.

“We’ve seen it in Ottawa and also in Toronto in the cores. I have to tell you I’m surprised that Ottawa has held in as well as it has, especially because we’re not seeing as many people as we would like to in our downtown core.”

Financial performance

Operating revenues grew 20.1 per cent to $50.3 million in the fourth quarter, finishing the year with a 15.8 per cent improvement over the previous year at $185.1 million. Occupancy gains, a five per cent increase in average rent per unit and successful acquisition activity are credited with the improvement.

Same-property net operating income rose 3.1 per cent from 2020 to $102.8 million. Net income increased to $369.7 million from $219 million.

Funds from operations of $72.8 million translated to 15.8 per cent growth overall and 9.4 per cent on a per-unit basis compared to 2020.

InterRent had a debt-to-gross-book-value ratio of 36.7 per cent at the end of 2021, when it had mortgages of $1.4 billion. It has $450 million in mortgages maturing in 2022, with much of that coming in the first half of the year.

The average term to maturity for InterRent’s mortgages is 3.6 years, with a weighted average interest cost of 2.38 per cent.

Sixty-three per cent of mortgages are Canada Mortgage and Housing Corporation-insured. Chief financial officer Curt Millar expects that to return to historical norms in the 80 per cent range while increasing the average term to maturity to about six years by the end of 2022.

The weighted average interest cost is expected to rise by 15 to 20 basis points.

Capital expenditures

Maintenance capital expenditures have remained consistent on a per-unit level for the past few years, at close to $1,000, according to Cutsey.

Increased spending on the non-repositioned portfolio and on value-enhancing initiatives for the repositioned portfolio combined for a total of $71 million. That puts it back in line with 2019 spending of $70 million, after dipping to $45 million in 2020 due to an initial slowdown when the pandemic first hit.

“About a third of our portfolio is at various stages in our repositioning program,” said Cutsey. “We see great value-creation potential in the years ahead. These properties will undergo work in a couple of years, with individual suite upgrades following the cadence of natural resident turnover.

“Our approach is to apply repositioning expertise to create beautiful, safe and quality communities for residents to call home by simultaneously extending the useful life of the existing housing supply and creating value for all stakeholders.”

InterRent believes this is a win-win strategy for all stakeholders as well as a climate-conscious option, since the program extends the benefit of the embodied carbon in existing structures while also loading up on energy-saving measures and fixtures.

“We’re not a short-term results company,” said McGahan. “We’re building this for the long run.”

Development pipeline

InterRent is adaptively reusing obsolete office stock at 473 Albert St. in Ottawa. It expects to complete 158 residential units in Q4 2022 after a total investment of $73 million. It is forecasted to offer a yield of 4.4 per cent.

InterRent’s development pipeline also includes:

– a 47.5 per cent share of a property at 900 Albert St. in Ottawa that’s in the planning stages. It’s anticipated to have 1,241 residential units and approximately 510,000 square feet of commercial space, with the earliest start date in early 2023;

– a 100 per cent share of a property at Richmond Road and Churchill Avenue North in Ottawa. Also in the planning stages, it’s anticipated to have 180 residential units and approximately 19,000 square feet of commercial space, with the earliest start date later in 2022;

– and a 25 per cent share of GO Transit land in Burlington that’s in the planning stages and is anticipated to have 2,514 residential units and approximately 40,000 square feet of commercial space. It could also start as early as later this year.

There are also intensification opportunities at existing InterRent properties, according to McGahan.

Source Real Estate News EXchange. Click here to read a full story

Vaughan Adds Its Voice To Those Calling For Ontario Land Tribunal To Be replaced

Vaughan joins dozens of Greater Toronto Area municipalities in wanting to reclaim their urban planning power as the province gradually trims municipal clout amid the affordable housing crisis and ahead of elections, a councillor said.

On March 22, Vaughan councillors approved a resolution by Coun. Alan Shefman and Coun. Marilyn Iafrate calling on the province to replace the Ontario Land Tribunal as the appeal body for municipal official plans.

The two are asking the province to establish a fair and efficient process for such appeals.

“I can tell you that about 23 municipalities have endorsed replacing the Ontario Land Tribunal as it currently only serves the development community,” Iafrate said, alluding that the figure could balloon especially since Toronto is speculated to be passing a similar resolution.

Iafrate dubbed the current system as “broken and not serving the public good.”

“Councillors from all municipalities are talking about this issue and are very motivated to send a message to Queen’s Park that we want changes,” Iafrate added.

The request to the province aims to protect the interests of any municipality’s decision-making process and that of local communities, which are “completely disadvantaged at fighting the developers at the Tribunal.”

“We simply ask for a level playing field,” Iafrate summarized the resolution’s ethos.

While municipalities are creatures of the province and only have the powers the province grants them, cities such as Vaughan argue that they spend millions in taxpayers’ money and other municipal resources to develop their official plans.

And Vaughan is already on point with meeting its official plans’ requirements and its councillors and staff are expressing their support for growth.

Not only that, Vaughan councillors also have a problem with the province’s housing affordability task force they say is further eroding their power.

Haiqing Xu, deputy city manager, expressed alarm in his March 22 report over the province’s encroachment, saying there are complex causes behind the housing crisis, and at times the province’s complicated process makes it hard to expediently plan.

“Municipalities have a significant role to play to help increase the supply of new homes through expediting planning approvals, infrastructure developments and issuance of building permits,” Xu wrote.

Xu also flagged parts of the 55 recommendations Ontario had in its housing affordability task force’s draft report published on Jan. 25 that could significantly impact land-use planning at the municipal level.

Xu is alarmed over these “as-of-right” developments and approvals:

1 – Up to four units and up to four storeys on a single residential lot

2 – Secondary suits, multi-tenant housing, conversion of underutilized or redundant commercial properties to residential or mixed residential and commercial use

3 – Zoning up to unlimited height and unlimited density in the immediate proximity of individual major transit stations within two years if municipal zoning remains insufficient to meet provincial density targets

4 – Zoning of six to 11 storeys with no minimum parking requirements on any streets utilized by public transit, including streets on bus and streetcar routes

“These recommendations would lower design standards and allow intensification to spread to existing neighbours where there is no major infrastructure to support such growth,” Xu said.

If these recommendations go through, municipal councils will no longer have the authority to decide on these developments, he added.

“Instead, they will receive all complaints about the reduced quality of life, e.g. lowered water pressure, excessive street parking and shadowed backyards.”

The resolution and Xu’s report come after regional and local councillor Mario Ferri alongside his colleagues questioned what was the city’s communication strategy as a response to these recommendations.

“People out there need to understand and know what is being proposed so that they can address that as the election comes closer,” he said.

These recommendations will “basically obliterate any role that we have” as well as that of the public, Ferri added, echoing other councillors’ sentiments.

Source Toronto Star. Click here to read a full story

Geothermal Rental at 252 Parliament Applied by Core Development Group Approved by City

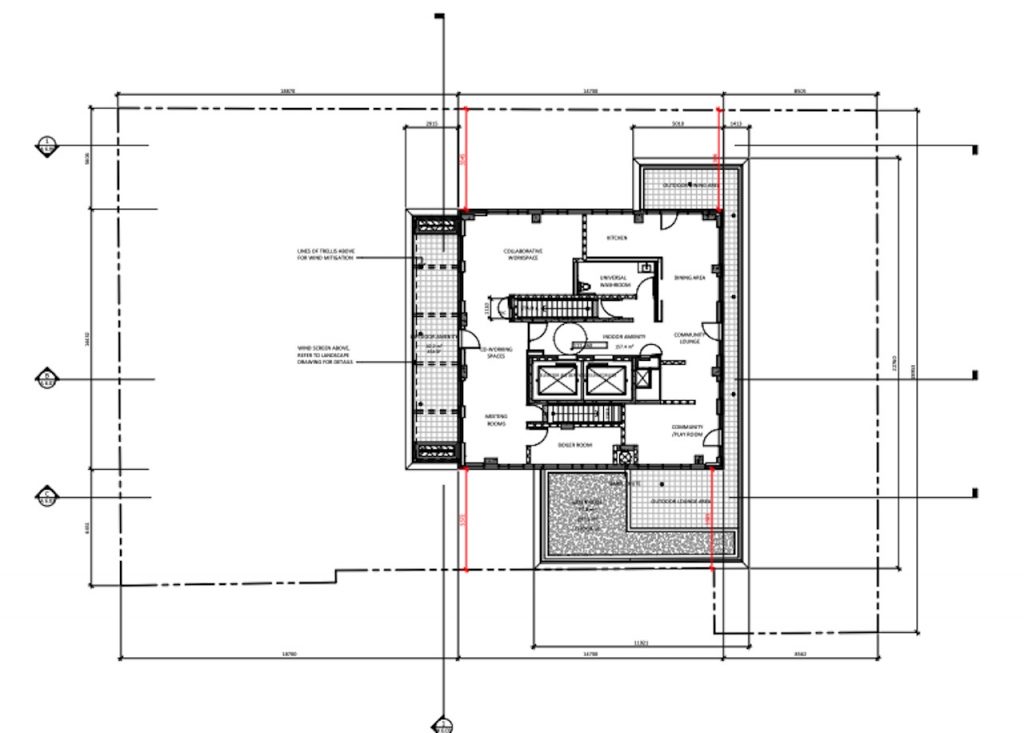

The City of Toronto recently approved an application for the rezoning of 252 Parliament Street. Originally applied for in 2020 by Core Development Group, the Studio JCI-designed, 9-storey, mixed-use building was proposed to bring 71 rental units with 140m² of at-grade retail and office space to the property. A particularly enticing feature of the proposal is its geothermal heating and cooling component.

Located mid-block between Shuter Street and Dundas Street East, the revised proposal incorporates numerous changes from the original application. The residential gross floor area (GFA) increases from 4,958 to 5,121m², despite which the number of units drops from 71 to 69. At the same time, the commercial/retail GFA drops from 140 to 129m², still leaving most of the building frontage on Parliament Street occupied by commercial/retail space. The remainder of the Parliament Street frontage is allocated for a residential entrance and mail-room. Floors 2 to 9 remain dedicated to residential uses.

While the proposal has maintained a building height of 9-storeys, (31 metres high including the mechanical penthouse), now that the mixed use building consists of 69 dwelling units, the unit breakdown has been readjusted to include 35 studios (51%), 10 three-bedrooms (14%), and 24 four-bedrooms (35%), an unusually high number of larger units.

The proposal’s indoor amenity space, of which a total of 163m² is offered, is to be located on the 9th floor, except for a pet wash room on the ground floor. The outdoor amenity space, which increases from 227 to 250m², is in the form of terraces on the 9th floor, and two courtyards located at the north and south sides of the building, on the ground floor and 2nd floor respectively. The amenity space has been designed so that the indoor space is adjacent to the outdoor space.

With the changes to the suites, other changes to the building also include a decrease in the number of vehicle parking spaces from 20 to 10, as well as a decrease in the number of bicycle parking spaces from 88 to 78.

The Planning Department applauded the work on the project, saying in their final report, “the proposal has also adapted to provide a better quality of life within the development, including relocating bicycle parking spaces closer to the bicycle stair ramp, and allocating a greater proportion of the outdoor amenity space towards usable and programmable space instead of landscaped area.”

The non-residential component of this proposal is subject to a 2% parkland dedication while the residential component is subject to a 10% dedication, which the developer is planning to satisfy through a cash in-lieu payment. The money is meant to be used by the City within the surrounding community within six months, or if a suitable site cannot be found in that time, to be retained for another place of need. Parks, Forestry and Recreation staff have also commented on the need to provide onsite dog relief stations to help alleviate the pressure on neighbourhood parks; as you can see in the image below, the site is some distance from a park, but is across the street from a fenced off property where the TDCSB is considering that a school be potentially built.

Finally, the site is within a 500 metre radius of the planned Ontario Line subway station at Moss Park, which should bring significant growth to the community. For the moment, the property is within walking distance to streetcar routes on Queen and Dundas streets

Source Urban Toronto. Click here to read a full story