Author The Lilly Commercial Team

Brampton Boom: Development Spike Follows New Official Plan

With plans in place to intensify parts of the city, and large parcels of land available in its eastern and western reaches, the Toronto-area City of Brampton has become a hotbed for development.

That’s particularly true in the multiresidential sector, with the city showing increased openness for growth and attracting plenty of attention from builders.

Brampton 2040 Vision is a document created in 2018 to shape the future of the rapidly growing city of almost 700,000, located in the northwest portion of the Greater Toronto Area. It deals with the environment, jobs, urban centres, neighbourhoods, transportation, social matters, health, the arts and culture.

Neighbouring Mississauga, Peel Region’s other major city, has developed or is in the process of developing much of its available greenfield space. That’s not the case in Brampton.

“I look at Brampton as being what Mississauga was 20 years ago. The opportunity here now to provide intensification along major avenues and transit routes is great. Planning staff has come on side with that now. Previously there was more resistance,” National Homes president and managing partner Jason Pantalone, whose company has developed more than 2,000 acres and more than 1,000 homes in Brampton, told RENX.

He credited the current city council with a renewed focus on transit-oriented development.

“Now you can see, from the top down, there is a direction to promote smart development that has good planning behind it. We’re seeing that now, whereas five years ago it was a different municipality and different direction. It was very frustrating to get business done in that municipality.”

That has led to a series of major developments and redevelopments comprising millions of square feet of space and thousands of housing units, plus new commercial, retail, office and infrastructure.

Brampton’s vision and openness

SvN Architects + Planners and BDP Quadrangle are leading the planning, urban design and landscape elements of RioCan REIT’s Shoppers World redevelopment. Principal Shonda Wang is impressed by Brampton 2040 Vision and the way the city is looking toward its future growth.

“I’m encouraged that they’re trying to think boldly and be comprehensive with what their vision is,” Wang told RENX. “They’ve thought very much about all of the supportive infrastructure that’s required to support development. That includes transit.”

City of Brampton officials are also starting to work more closely with the development community, according to Wang.

“Brampton realizes that it’s important to think about public and community requirements, which are always critical, but also what the market requirements are. When you’re able to bring market, technical and community requirements together, that sets up the right conversations and processes for new developments to come online.”

These measures have opened up opportunities developers have been eager to take advantage of.

Shoppers World redevelopment

Shoppers World is comprised of a single-storey enclosed mall and stand-alone box stores encompassing approximately 690,000 square feet on a 53-acre site that will be redeveloped in phases over 20 years.

It could include four million square feet of sustainably focused, mixed-use density when all is said and done.

“The City of Brampton is very enthusiastic about us doing more with that site,” RioCan chief operating officer John Ballantyne told RENX. “Shoppers World is an older asset that’s still a viable part of the community. But, where we can add housing around it, we think that’s critical.”

The property could include up to 4,500 residential rental and condominium units and more than 800,000 square feet dedicated to commercial uses, including retail and office.

It will also include parks, open spaces and new walkable and bikeable streets to transform it from being a car-dominated environment with acres of surface parking. It could also incorporate a school and a community centre.

“Through the public realm and new streets and linear connections, that will create connections deeper into the site and each one of the mixed-use districts that will be introduced over time on the site,” said Wang.

“That mix of uses will include a retail high street that would have a high pedestrian focus and new small-scale retail and commercial opportunities alongside new opportunities for larger-format retail and commercial uses. Then there are a number of types of residential developments, including townhouses, mid-rise buildings and taller buildings.”

The site is bounded by Steeles Avenue West to the south, Main Street South to the east, Charolais Boulevard to the north and Kaneff Park to the west.

Transit hub at Shoppers World

Metrolinx’s 18-kilometre, 19-stop Hazel McCallion Line, a light rail transit (LRT) route that starts in Port Credit near Lake Ontario to the south, will go north along Hurontario Street to terminate at Shoppers World when it’s complete.

There are plans to incorporate an existing bus terminal and the future LRT stop to create a transit plaza surrounded by retail and commercial uses.

The redevelopment project received unanimous approval for rezoning and its master plan in November 2020. The planning and design process continues to move forward.

SvN is working with RioCan, lead architect BDP Quadrangle and a multi-disciplinary consulting team to realize site-plan approvals for Phase 1 on the southwestern corner of the site, which will have two residential towers with extensive landscaping. It won’t affect existing retail.

Additional site-plan approvals will be sought on a district-by-district basis as the project evolves.

RioCan also owns Trinity Common Brampton, Heart Lake Town Centre and other retail and commercial assets in Brampton.

“There are no short-term plans to intensify or redevelop them,” said Ballantyne. “However, they are part of our pipeline that we can reach into over the next 30 or 40 years and do exactly that. In the meantime, they’re wonderful assets and income-producing trophies for RioCan.”

Duo Condos

Duo Condos is a multi-phased development in Brampton, by National Homes and Brixen Developments. (Courtesy National Homes)

Duo Condos is a multi-phased residential community with commercial space at grade from partners National Homes and Brixen Developments at 245 Steeles Ave. W. A Sheridan College campus is to the west and the future LRT line will be to the east.

The first phase consists of 349 units, with the initial release of 300 condos selling out in just a week-and-a-half. The second release is coming this spring and a third release that will include penthouse and townhouse units will follow later.

The smallest units are around 425 square feet and they range up to close to 900 square feet. Prices started around $1,050 a square foot and are now averaging around $1,100 per square foot.

“Being able to offer homes starting in the $425,000 range up to $850,000 or $900,000 provides more affordable product that can’t be found anywhere in the GTA,” said Pantalone. “It was important for us, given the background and our history in Brampton, to be able to bring a product like that which can service the market and that we can be proud of.”

National Homes and Brixen closed on the site in May 2021 for an undisclosed price after conditionally acquiring it from Sundial Homes in October 2020.

Pantalone said land values and unit revenues have increased substantially since then, though he cautioned rising construction costs are impacting the overall feasibility of some projects.

Other Brampton residential developments

Several other high-rise and mid-rise multi-residential projects are at various stages of development in Brampton.

– i-Squared Developments’ Stella at Southside Condos is a sold-out 21-storey, 290-unit project near Steeles Avenue West and Hurontario Street scheduled for completion in 2023. The 40-storey, 450-unit Stella 2 is in pre-construction. Sales haven’t begun yet, but it’s anticipated it will be completed in 2027.

– Boardwalk REIT and Redwood Properties are developing 45 Railroad, a two-tower, 365-unit purpose-built rental apartment on the site of the former Dominion Skate Building at 45 Railroad St. in downtown Brampton. The first tower is slated for occupancy in September and the entire development should be stabilized in 2024.

– Inzola Group’s Symphony Condominiums is a sold-out 21-storey, 182-unit building at 145 Queen St. E. that’s nearing completion. Inzola previously completed the 27-storey, 230-unit Park Place Condominiums at 100 John St.

– The Daniels Corporation’s four-storey OMG 2 Condos, the second phase of the Olivia Marie Gardens master-planned community at Mississauga Road and Olivia Marie Road, is under construction and scheduled for completion next year.

– Daniels MPV is a master-planned condo and townhouse community located just east of Creditview Road on Bovaird Drive, adjacent to the Mount Pleasant GO Transit station. It’s a Daniels-Choice Properties development that’s now under construction.

– Solmar Development Corp.’s Bristol Place is a condo with two 48-storey towers and 1,148 units that’s in the pre-construction phase at 199 Main St. N. Sales are expected to start soon.

Source Real Estate News EXchange. Click here to read a full story

How To Secure True Tenant Representation

As the industrial real estate market continues to break records across Canada, manifesting in a historically low vacancy rate of below 2% across the country, it has never been more challenging for tenants to find space.

This lack of available supply is impacting businesses and forcing them to make tough and quick decisions, otherwise they risk losing locational opportunities. Given current market conditions, it has never been more important to engage real estate expertise and representation. Involving your real estate advisors in strategic planning pertaining to your real estate will allow for better preparation and more effective solutions.

Tenants need total confidence in their real estate partner as they maneuver this landlord-centric market and need to make informed decisions that directly impact their businesses.

How can tenants navigate this new reality and protect themselves in the process?

By understanding that most brokers and major brokerage firms represent clients on both the tenant and landlord side. This leads to inevitable conflicts of interest. In the current market that is so favourable to landlords, where does a brokerage, that is serving both landlords and tenants, place their loyalty?

By outsourcing some or all of your real estate needs to a tenant rep only firm that you trust handling all aspects of your portfolio from the negotiation of leases, real estate accounting, legal support, and more. This level of support is incredibly difficult to replicate in-house and, as an added bonus, it is not vulnerable to employee turnover and loss of legacy knowledge. This is even more critical in today’s labour market, which is proving to be as tight as the industrial real estate market.

By partnering with expert advisors that you can count on and who understand that One size does not fit all. It is of critical importance to tailor services to every client and approach each project with fresh eyes.

Landmark is a client-centric commercial real estate services firm that strives to be different by creating customized and dedicated partnerships. With over 30 years of experience in the Canadian commercial real estate industry, Landmark has developed a unique business model which benefits entirely the tenant and their unique needs, ensuring that there is never a conflict of interest.

This business model has helped Landmark recently secure the renewal of important contracts with Sonepar Canada and Belron Canada, two industry-leading organizations.

Landmark’s integrated service model

Landmark is structured differently from traditional real estate brokerages. Our integrated service model provides clients with access to a multi-disciplinary team, all operating within the same ecosystem.

Our service offering is comprised of lease administration and audit, transaction management, project management, facility maintenance, market intelligence, and legal & advisory services working as a single integrated unit, leveraging the expertise and knowledge of each department to provide greater value to clients for every project all while also leveraging our clients’ strong covenants.

Our teams are not governed by separate hierarchies and P&Ls, conflicting incentive structures, or siloed services deployed from different geographic regions. We are an ecosystem leveraging services and knowledge across the organization, all for a single common purpose: to fully integrate into our clients’ operations and support them as their trusted real estate department.

Landmark’s coverage

Canada is a large country with a myriad of different market types coast-to-coast. Landmark has incredible coverage throughout due to a client base that occupies premises in over 400 Canadian markets, and the ability to partner with best-in-class brokers, when necessary, on each project. Alternatively, larger brokerage firms are constrained to their own networks resulting in more limited coverage.

Landmark can partner with anyone, based on unique market, asset, and project types; major brokerages, local independent firms, and the SIOR and Exis Global networks. This includes access to smaller local independent firms in tertiary markets, which demand a unique, flexible, creative and detailed approach to finding space. All the while, Landmark remains the single point of contact for the tenant.

Finding the best home for your business in a small market can take time due to a lack of inventory and unsophisticated stakeholders. Landmark uses a two-pronged approach that combines a long-term and a short-term strategy, allowing clients to operate their businesses while not compromising on the long-term future needs of their operations.

Contract renewal

Being a tenant-focused alternative to the standard brokerage model with extensive and integrated services has helped Landmark develop long-term partnerships with exceptional companies throughout the country. We are proud and excited to announce that Landmark has signed two exclusive renewal contracts: a four-year contract renewal with Sonepar Canada and a three-year renewal contract with Belron Canada, both effective January 1st, 2022.

Sonepar Canada, is a member of the Sonepar Group, Canada’s largest privately held B2B distribution of electrical products, solutions, and related services. In Canada, they are represented in nine provinces by Dixon Electric, Gescan, Lumen, MGM Electric, Sesco, Texcan and Vallen. Sonepar Canada has over 1800 employees working out of over 100 offices between their distinctive brands. The management of their Canadian real estate portfolio has been performed exclusively by Landmark for more than 28 years.

Belron Canada, an exclusive client of Landmark since 2015, is an industry leader in vehicle glass repair, replacement and recalibration with over 250 locations Canada-wide.

Landmark is excited to continue serving these exceptional clients, amongst our stable of other national and regional clients, and working to protect their real estate interests during these challenging times. These contract renewals are a testament to the strength of Landmark’s unique business model and what it means to ‘Partner Smarter’.

Source Real Estate News EXchange. Click here to read a full story

Liberty Buys $48M Vaughan Assembly For Redevelopment

Liberty Development Corporation has purchased a three-property assembly from three private owners in the rapidly growing Greater Toronto Area City of Vaughan for $48 million.

Vanguard Realty Brokerage Corp. chief executive officer Paul Miceli brokered the deal for 171 Maplecrete Rd., 160 Doughton Rd. and 140 Doughton Rd., which are located south of Highway 7 and east of Jane Street. He said Liberty already owned adjacent land that’s already zoned for high-rise residential and was looking to add to it.

“I approached them (the sellers) because I know some people from Liberty,” Miceli told RENX. “They already owned the front properties and the plan in that area is changing from industrial to residential.

“I had worked with a couple of the sellers on other deals and approached them to see if they would sell. Then I packaged all three properties as an assembly and sold it to Liberty, where I dealt with Marco Filice and president Fred Darvish.”

Liberty’s future plans for Vaughan assembly

Miceli said Liberty doesn’t want to comment on the acquisition, which he estimates took about three years to come together from his first queries until closing.

Each of the three properties in the assembly presently contains an occupied industrial building. The tenants will remain in place to provide income until the proposed development’s zoning and approvals processes move further along.

The area is part of the downtown Vaughan intensification plan and the Vaughan Metropolitan Centre subway station is just a 10-minute walk, which will appeal to potential future residents.

Miceli doesn’t know many details about Liberty’s plans for its Vaughan site, but said it would include at least three high-rise residential towers. He believes the development will beautify the area and bring jobs and opportunities.

Liberty’s expertise and other projects

Markham-based Liberty is a full-service real estate development company involved with commercial, office and residential buildings in the Greater Toronto Area. It has expertise in land assembly, development, design, construction, sales, leasing and property management.

Liberty’s current condominium projects, all in the pre-construction phase, are:

– Joy Station Condos, featuring two 22-storey towers connected by a six-storey podium at 9781 Markham Rd. in Markham.

– Canopy Towers, featuring a six-storey podium that extends around a 34-storey tower at 5081 Hurontario St. in Mississauga.

– Promenade Park Towers Building B, a 30-storey tower at 1 Promenade Circle in Vaughan.

Vaughan high-rise market is hot

Vaughan is located just north of Toronto and its high-rise condo market isn’t showing any signs of a slowdown, according to Miceli.

“Property values in Vaughan aren’t far off from downtown Toronto, especially the ones like in this general area where you’re in close proximity to the subway and can walk to it.

“Anywhere that you can walk to the subway is now selling for $950 a square foot and we think shortly it will be over $1,000 per square foot.”

Vaughan Metropolitan Centre was master-planned to become the city’s downtown core with residential, retail, office, restaurant, green space, recreational and public transit components.

It has seen an explosion of development in recent years and more is still on the way.

RioCan REIT also has major plans nearby with the redevelopment of the 61.7-acre Colossus Centre shopping centre site.

Its long-term plan involves 25 buildings ranging from eight to 55 storeys and includes: approximately 9.47 million square feet of residential space with 13,000 units; approximately 646,000 square feet of non-residential space; and almost 1.08 million square feet of parkland.

“The skyline of Vaughan is going to be very, very different in the next 10 to 15 years,” said Miceli. “Developers today seem to be a lot smarter, where they’re not bringing the buildings out all at the same time.

“One guy goes to market and sells out and then the next guy comes to market a few months later, which is keeping healthy prices because your competition isn’t so direct.

“It’s not a great thing for the consumer, but it’s a pretty good thing for keeping the prices up for developers.”

Source Real Estate News EXchange. Click here to read a full story

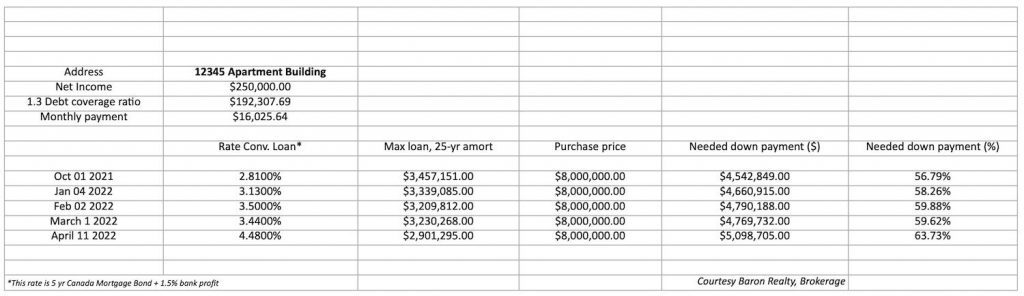

Apartment Buildings: Value Not Immune To Interest-Rate Increases

With governments “printing money” and inflation creeping into all aspects of our daily lives, it was only a matter of time before the federal government increased the interest rate to curb spending.

However, a lot of people were surprised at just how quickly this happened.

Let’s take a fictitious example of an apartment building a broker may have evaluated at $8 million six months ago.

Note the down payment requirement changed by more than $500,000 over the past six months, i.e., the buyer would need to have an additional half-million dollars in non-borrowed funds in order to be able to close this transaction.

Why does this matter?

The down payment requirement is key in successful sales. The rate of down payment used to be 20 to 30 per cent, further increased during the past few years to 40 to 50 per cent, and now an almost impossible 60 per cent plus.

Sure, there are all-cash buyers in the market; these buyers know “their value” and will act accordingly (buying at a discount, because they know the majority of regular buyers will not be able to produce or justify the down payment required today).

Vendors need to be aware that in a fast-shifting interest rate market, deals can fall apart at the financing stage just because the downpayment can increase so drastically from one month to the next.

Hence, if a buyer showed proof of funds with offer in October but had to wait for the vendor to finalize the environmental report until April, the same buyer may not be able to close the deal.

How vendors can navigate the current market:

– Hold on to the asset until a significant interest-rate decrease happens, to maximize the number of buyers available and willing to purchase. Of course, nobody has a crystal ball as to when this will occur; this strategy can be an issue if the building has maximized its value and is now on the decline, or for private owners who are sellers for different reasons (dissolutions of partnerships, changing life directions, no longer being able to manage the building, etc.)

– Be prepared with all the documents needed in the sale process, the most important of which can be environmental reports (which can take six weeks to six-plus months). Without a “clean” environmental report, the buyer will not be able to obtain financing.

– Watch for deal delays and know that short delays are very valuable – as long as you trust the buyer has not simply committed to short delays to tie up the deal with the intention to renegotiate the timelines later (buyer reputation is key).

– Buyers must be willing to commit in writing (at the offer stage) to provide more down payment than is required at offer time.

– The value of an apartment building should always be taken as the value today; in a fast-changing world, even the “safest” real estate investment asset class is not immune. If you have an evaluation from six months ago, it will surely not be accurate today.

– The marketing of a property should keep in line with the changing market dynamic. Based on the asset and timing, a bid process, an asking price process, or a process of no price (just a range with its respective loan potentials) and “offers anytime” may be appropriate. But, the best way to market will be determined at listing time, not based on the broker’s record from last year.

Reputable brokerages custom-tailor each marketing process, and will bring in the right buyers based on the asset and vendor requirements for deal timelines. As an example, we’ve generated from five to 12 offers on each of the listings Baron Realty has taken over the past 18 months.

Source Real Estate News EXchange. Click here to read a full story

How To Know When It’s Time To Go From Coworking Space To An Office

According to a Coworking Resources report, the number of coworking spaces worldwide is expected to more than double by 2024, surpassing 40,000. The report also indicates that nearly 5 million people will be working from coworking spaces by 2024, an increase of 158 percent compared with 2020. Coworking Insights found that startup teams make up 27 percent of the coworking user base, and small and medium-sized businesses make up nearly 38 percent.

Leasing a coworking space for a business has a number of benefits, especially if a company is still young. These turnkey-ready spaces often come with flexible lease terms and reduced capital expenditures. Costs typically range from $500 to $1,500 per desk per month, giving companies the ability to easily scale as their needs change.

One of the clearest signs a company is ready to transition to more permanent office space is when it has outgrown its coworking space. As a general rule, companies should think about moving into a short-term lease or sublease when they have more than 75 employees.

Cost is usually the primary factor that leads companies to seek their own office space. Using average figures for coworking desks and office space square footage, at $1,000 monthly per head, a coworking space would cost $900,000 per year for a staff of 75. Comparatively, with an average asking rent of $45 per square foot per year in major U.S. markets — assuming a firm would need approximately 12,000 square feet for a staff of 75 (160 square feet per employee) — its yearly cost would be $540,000.

Benefits of traditional office space

For companies looking to take the plunge, having their own office space can have a number of benefits. A Facility Executive report found that workers value private spaces where they can get their work done peacefully. In a Clutch survey of 503 full-time employees, more than half said they prefer a private office over the open floor plan or cubicle office style commonly found in coworking spaces.

For a firm, having its own office space provides greater privacy for the company overall, but having consistent access to meeting rooms also provides greater opportunity for collaboration. Though coworking spaces often offer private meeting rooms for members, companies that require these spaces on a more consistent basis might not be able to access them when needed.

Overall, a firm having its own office puts a face on its brand. In a private office, companies are better able to establish company culture and tailor the space to meet their unique needs. It also gives a company a professional client-facing environment, allowing it to maintain confidentiality and privacy when meeting with clients.

Making the transition

Finding an office space once a firm is ready can take time — up to 24 months on average, depending on the scope of the office space needs. Additionally, in competitive markets where space is limited, it might be more difficult to find available space that meets the company’s specifications. Also, in tight markets, expect to find increasing asking rents and fewer concession packages. Once a firm decides it’s time to move out of a coworking space, it needs to start the office search process immediately.

Transitioning into one’s own space is about more than hiring a broker to help find a location and facilitate the transaction. A workplace strategy team acts as a firm’s compass, navigating and reimagining its workplace. They help implement a hybrid workplace, maximizing productivity and navigating the new world of work, through everything from social distancing-minded facility development to virtual wellness programming.

A project management (PM) team is also essential and navigates the special nexus from the moment a deal is closed to the day that clients first step into their office. They manage build-outs for clients from building due diligence through design, technology and outfitting. Fees for project management services are calculated in a transparent manner to suit the specific scope and constraints of each requirement.

Early engagement of a PM team gives the best opportunity for it to anticipate and eliminate unnecessary costs, schedule delays, and process, often resulting in saving far above the initial cost of engagement. Ensuring a firm has an intentional workplace will draw employees into the company’s collaborative space, and attract top talent for the best possible employee experience. A thoughtfully designed space offers the freedom to showcase a unique brand and culture, ensure radical adaptability, and boost employee engagement and satisfaction.

Source Commercial Observer. Click here to read a full story

Should Ontario Businesses Have Rent Control Protections?

A recent study suggests small businesses in Ontario should have the benefit of rent control like residential tenants do, but the feasibility is questionable.

Ahead of the June 2 provincial election, Better Way Alliance, a coalition of progressive entrepreneurs, released a study called Out of Control in which it lobbies Ontario’s Progressive Conservative government to institute rent control for small businesses. Additionally, it wants the creation of tribunal to hear commercial lease disputes similar to the residential Landlord and Tenant Board.

The coalition would also like to see more standardized commercial leases.

Out of Control surveyed and interviewed more than 50 small business owners between 2020 and 2022 in sectors ranging from hospitality to finance and determined that nine in 10 listed rent as one of their three biggest expenses. Over half reportedly spend more than 60% of their overall expenses on rent, and around 75% have experienced rent increases in excess of 10%.

Ten percent said their rent has doubled in a single increase.

“The lack of guidelines for commercial rent increases means rent can double overnight,” the study said. “The majority of business owners have experienced large rent increases. Three quarters of businesses have experienced a one-time rent increase of 10% or more, 17% experienced an increase of 50% or more, and 12% have actually had their rent more than double in a single increase.”

Agreeing to Market Value

However, commercial leases are far more complicated than residential ones, says Ori Grad, a real estate broker and Managing Director of CHI Real Estate in Toronto. Not only do tenants agree to the terms before signing the dotted line, they typically have lawyers scrutinize the contracts first. Moreover, because of the vast natures of commercial enterprises, a one-size-fits-all lease isn’t realistic.

“There is very clear wording in leases that rent is based off of market values, and if they cannot come to an agreement it goes to binding arbitration.” Grad told STOREYS, adding that commercial leases are usually signed for five- or 10-year terms, meaning landlords can’t suddenly hike rents. “Who’s to say landlords can’t adjust rents to market value when the lease runs out? If the government put a restriction in saying you cannot charge market rent, that means the landlord is not able to get what somebody else is willing to pay and that reduces the value of the building.”

The ramifications to realizing Out of Control’s ambitions could be financially ruinous and investors would steer clear of cities with commercial rent control, Grad added.

“Buildings are expensive and have giant mortgages, and you need tenants to pay those mortgages,” he said. “When a tenant’s lease is up for renewal and you were to put restrictions on it and say ‘Your rent is 40% below market value,’ well, should a landlord not be able to charge market value to somebody else? These are investments. If you restrict investing in Ontario, or a city like Toronto, you’ll see investors flood out of this market. Why would they be in Toronto when they could make more money somewhere else? I wouldn’t be buying a building here.”

Ryan Mallough, Senior Director of Provincial Affairs for Ontario at the Canadian Federation of Independent Business (CFIB), is aware of the study and confirms that rent is an issue for some of the organization’s membership.

“It depends on the business. We have heard some horror stories from business owners about rent increasing a fair bit, especially those whose leases have expired or were up during the pandemic period, especially given the [COVID-related] closures in Toronto were a little bit harder than some other jurisdictions in Ontario,” he said.

“I wouldn’t say we’re getting absolutely flooded with calls on it, either. Equally on the commercial side of things, there’s still a lot of property tax frustrations, other property-related costs, energy in particular has been a source of frustration as well, so it’s an issue that’s on our radar but it hasn’t blown up yet.”

While the average COVID debt for small businesses in Ontario has decreased to about $160,000 — it excludes other non-pandemic-related debts — that isn’t to say rents won’t become an issue during the post-pandemic recovery period, Mallough added. The CFIB will survey its members to see if there’s an appetite to put commercial rent control on the provincial parties’ radars prior to the June 2 election, but he noted that some members are landlords and might not be so amendable.

“We’ve also heard the idea that if rent control is in place, then leases become month-to-month, or a year long or a couple of years long, to give the landlord more flexibility,” Mallough said. “Property taxes, and where those are going, will also factor into it; mortgage rates and interest rates, of course, appear to be going up, and are likely going up for the next while too, and that will factor into it, so I think it’s an idea that’s on the table.”

When an idea is on the table, the CFIB goes to its membership for a “temperature check.”

“I’m sure it will pick up steam as we head into the election but we really want to make sure we know how it will work and what the possible consequences of it might be before we go down that road.”

Source Storeys. Click here to read a full story

3 Trends Driving Greater Resilience In Commercial Real Estate

While commercial real estate companies are still dealing with the uncertainties driven by the pandemic, many have found new ways to complete projects and serve clients. Some segments of the industry have even thrived during the pandemic.

This challenging new way of life prompted astute leaders to seize on opportunities. They accelerated the pace of digital innovation, redefined business processes and models, diversified asset classes and leaned into predictive analytics to help guide their decisions. As a result, many are optimistic about their prospects for the new year.

According to Colliers’ 2022 Global Investor Outlook, 87% of investors are optimistic about the economic outlook and “intend to maintain high real estate allocations even though pandemic-related uncertainties have not fully lifted.” That sentiment is buoyed by investor optimism about today’s market liquidity, “with many commenting on the incredible levels currently available. After a record-setting 2021, 2022 is lining up to be even stronger.”

Throughout the pandemic, Capital One’s commercial real estate team has been supporting its clients with financing and asset class investment needs. John Hope, senior vice president and head of originations for the West region at the bank, recently talked with The Business Journals about trends related to industry growth areas and how commercial real estate companies can continue to drive resilience during challenging times.

1. Investors are making choices based on market demand and the need for asset diversification

According to the Colliers report, the top three sectors commercial real estate investors are most likely to target in 2022 are industrial and logistics (67%), multifamily (53%) and office (45%).

The industrial and logistics sector is benefitting from a demand for products, a rise in online shopping and the need to have warehouses and delivery services close to consumers. Multifamily is attractive because of favorable financing and its reputation as one of the safest asset classes. Meanwhile, the office market is also showing signs of stabilization.

The pandemic showed it’s difficult to predict where the next stress or challenge will show up. As the market continues to adapt to this changing landscape, many investors are focusing on balancing their portfolios based on risk appetite and the opportunity for greater returns. For example, Hope said, some asset classes may be considered higher risk but are attractive buying opportunities that present investors with better relative returns, while others may be considered safer investments.

Similarly, the same property could be more or less valuable to individual buyers based on their existing portfolios; even if it’s not the best near-term growth opportunity, it could have the potential to positively impact the total portfolio in the long term.

2. Regional diversification will be important for office investors

As investors eye the office market, Hope said they’ll need to keep tabs on where talent is located and where it is moving. Reports show that big cities such as New York, San Francisco and Los Angeles were the top places people left in 2020 as they took advantage of remote work and moved to locales with fewer people, a lower cost of living and more room to spread out. “Investors should consider that jobs are moving with people these days as opposed to people having to move to take a job,” Hope said.

While investors will always be interested in markets like New York, San Francisco and Los Angeles, regional plays to other target areas are becoming more attractive. Office markets in the Sunbelt like Nashville, Austin, Charlotte and Raleigh are seeing a lot of investor demand, Hope said.

“Are people going to look for value plays in New York? Sure,” Hope said. “Are they also going to look at growth plays in a market like Nashville, too? Yes. We expect flexibility to be baked into any office investment strategy.”

Hope shared that investors’ considerations will include whether it’s a short-term investment or a longer-term investment as well as the expectations and risk appetite of capital partners.

3. Companies are embracing organizational and technology agility

Some commercial real estate companies and investors may have more confidence in 2022 knowing they’ve been able to adapt and persevere through the pandemic-induced disruption, Hope said. On the organizational side, leaders initially focused internally to boost communication, engage teams, keep morale high and make sure operations were sound so the business plan could be executed.

Technology agility came in the form of virtual leasing and construction monitoring, 3D property walkthroughs, digitizing documents and turning to tools like Google Earth for site inspections. Many companies didn’t miss a beat and even became more productive, according to Hope.

“At first, CRE [commercial real estate] companies had to make these changes because it was a matter of functioning or not,” Hope said. “Over time, they saw a huge amount of productivity gains that came out of it. It’s now morphed into, ‘This is something we want to do.’”

As companies continue to stay agile in the face of uncertainty and build upon the resilience they’ve developed over the past two years, Hope said, communication and relationships will continue to be foundational to their success.

“We’re relying on relationships more than we ever have,” Hope said. “CRE companies have demonstrated their agility and flexibility in finding new ways to communicate with employees and engage with clients and still have business success.”

Source The Business Journals. Click here to read a full story

Bluebird Self Storage Building, Buying To Expand Portfolio

Bluebird Self Storage is capitalizing on the growing consumer demand for storage space as it continues building and buying assets to expand its portfolio across Canada.

Reade De Curtins, principal of the Toronto-headquartered company, said Bluebird currently has 28 locations. It plans to grow to 50 locations within 18 to 24 months as the firm builds what he considers Canada’s first nationwide “premium” self-storage concept.

“Within the last year we’ve gone coast-to-coast with locations now in New Brunswick and Nova Scotia,” De Curtins told RENX. “Then, we’ve got a location that’s opening in probably 45 to 60 days in Vancouver.”

The current portfolio includes 2,540,00 gross square feet and 21,440 units. Over its 40-year history, Bluebird has developed over 10 million square feet of self-storage facilities.

“You’ve got a lack of self-storage supply across Canada as a whole and in particular the opportunity we’ve identified is the lack of institutional-quality, class-A self-storage facilities in Canada,” De Curtins explained.

“If you compare Canada to the U.S., in the U.S. you’ve got over nine square feet of self-storage per person in the top-25 most populated markets and here in Canada we’ve got a little over three square feet per person.”

Bluebird focuses on premium self-storage

De Curtins said Bluebird is focusing on that premium market.

“If you dig down to quality class-A product, there’s even greater disparity. . . . There’s not an existing supply of class-A storage to be acquired in Canada.

“Even if an institutional player wants to come along and consolidate and spread a class-A premium brand across Canada, that opportunity does not exist.

“We are developing what we believe to be the first class-A portfolio coast-to-coast.”

De Curtins said the company believes innovation sets it apart in the industry because it provides a consistent customer experience no matter where they are located in Canada.

Bluebird and investment partner Harrison Street have recently acquired two self-storage assets.

One is in Mississauga and is currently under construction. It will be 155,770 gross square feet with 1,074 units. The other is an operating 46,400-square-foot facility in Cochrane, Alta., on five acres of land with room for future expansion.

The company is also opening its new Sheridan store in June in Mississauga, a state-of-the art facility of 169,000 gross square feet with 1,246 climate-controlled units.

“Bluebird strives to be the first national storage company focused on the customer experience. We want each customer to feel secure about their storage decision no matter where in Canada they are located,” said James Bennett, De Curtins’ business partner.

New demographic, new approach

De Curtins said people traditionally have looked to self-storage space as places where they can store possessions if they are in transition in their lives and moving to a different home.

“That’s changed and what we’re experiencing right now is this post-pandemic consumer. We believe that we are seeing a younger demographic these days. We believe younger generations are not prioritizing larger homes and larger mortgages,” said De Curtins.

“Your younger consumer, especially many times in the urban locations where we locate, they’re moving into smaller apartments and condominiums and they need a place to store their stuff, basically.”

People now working from home may have converted spare rooms or areas into offices and therefore need space to store furniture or other items they’ve moved out of those spaces.

“I think there’s some trends right now post-pandemic that are creating an even greater demand for self storage,” added De Curtins.

Bluebird’s ongoing growth

Bluebird is leveraging its owners’ significant experience in the industry to capitalize on those changes.

De Curtins said the ownership team, including Bennett and his father Richard Bennett, have developed more than 100 self-storage locations in North America since 1983 under various strategies and brand names.

“Primarily we had worked in the Southeastern United States, mostly the Carolinas and Florida and Ontario, throughout our history and we’ve had different brand names, different concepts,” he said.

“In 2016, when we rolled out Bluebird Self Storage, that’s when we decided that we’re going to try and get coast-to-coast (with) this premium concept.”

Originally the company’s focus was in the Greater Toronto Area.

“We pretty quickly expanded out West. I moved to Calgary in 2019 and we’ve grown very quickly here. Particularly in Calgary, we’ve got a very strong pipeline right now.

“We’ve got six new locations coming up in Calgary and they’re all very high-profile retail locations.

“We’re really excited about that. The big news for us is our coast-to-coast growth, but there’s still a lot of filling in to do in the middle.

“We’re already working on some sites in the Prairies as well.”

Source Real Estate News EXchange. Click here to read a full story

Influx Of New Space Pushes Canada’s Office Vacancy To 16.3%

The national office vacancy rate in Canada has moved up slightly to 16.3 per cent in the first quarter of this year, but the main cause of that isn’t a lack of demand.

According to a new report by commercial real estate firm CBRE, it’s the amount of new supply that has come onto the market with demand continuing to stay positive. Nationally, there’s 14.7 million square feet of office space under construction with 56.2 per cent of that pre-leased. Tenant demand for modern offices has resulted in all projects underway in Winnipeg, Halifax and the Waterloo Region (Southern Ontario) being 100 per cent pre-leased.

Jon Ramscar, managing director of CBRE’s Toronto downtown office, said the vacancy rate in the last quarter was largely driven by supply.

“We’ve had some natural rollover of supply coming through with some new built development, particularly in the major cities,” said Ramscar.

“It’s the timing of companies that are moving from older products to new build, new development that’s come online. So it’s really a timing of supply-driven fundamentals over the last quarter.”

During the quarter, about 686,000 square feet was delivered to the market with 71.2 per cent of that pre-leased.

Office vacancy has risen steadily

The overall national office vacancy rate was 14.6 per cent in the first quarter of 2021 and rose each of the subsequent quarters last year to 15.3 per cent, 15.7 per cent and 15.9 per cent, respectively.

Across the country, overall office vacancy ranges from a low of 6.9 per cent in Vancouver to a high of 30.9 per cent in Calgary.

CBRE said downtown cores have been reinvigorated by the recent easing of lockdown measures. The outlook is optimistic, with many businesses soon set to more formally return to in-person work.

Markets that recorded positive net absorption include those with earlier provincial reopening guidelines in Western Canada, namely: British Columbia, Alberta and Manitoba. However, overall net absorption was a negative 1.9 million square feet in the first quarter.

The report said the first quarter recorded a first for the Canadian office market with downtown vacancy currently higher than in the suburbs, albeit marginally – 16.6 per cent compared to 16.1 per cent.

Ottawa now outranks Toronto as the second-tightest downtown market in North America, at 10.2 per cent and 11.3 per cent, respectively. Vancouver remains the tightest at 7.7 per cent.

Alberta markets also noted improvement downtown, with Calgary decreasing 40 basis points (bps) to 32.8 per cent and Edmonton holding steady at 21.1 per cent.

Office demand “very robust”

Ramscar said the ultimate crystal ball question is where the vacancy rate will go next.

“The underlying demand has actually been very, very robust over the last quarter and if you look nationally at the Canadian offices we have some positive absorption and vacancy has actually ticked down in those Western markets that have been open and not restricted with lockdowns,” he said.

“We’ve learned a lot in the last two years through the pandemic, that those markets when they’ve opened up have seen a huge level of pent-up demand. So you would anticipate that vacancy will go down going forward if this level of pent-up demand is able to come through and it’s safe to continue without lockdowns.”

Ramscar said there are huge challenges with construction cost increases and access to labour delaying potential development projects. However, pre-leasing of current development projects in Canada is “very strong.”

“There’s a unique fundamental in the Canadian office market from a global perspective, we have kind of a small group of Canadian investors that really own the majority share of the office product in Canada,” Ramscar said.

“So it’s heavily controlled and that means the development supply is heavily controlled and we’ve been very conservative in history in terms of issuing new product into the market, almost to a fault, so we have to catch up to now attract these new larger global occupiers that want to expand and come into Canada.

“They command newer-quality and international-quality office product and so we have to catch up. We’re in a very healthy place in terms of pre-leasing. I look at this going forward, based on the demand that we see coming into the country, and we have to be able to accommodate new organizations with new product.”

The CBRE report said sublets account for 18.7 per cent of vacant office space across Canada, or three per cent of total inventory. This is down from the market high of 22.2 per cent of vacant space recorded a year ago in Q1 2021.

A combination of high demand for quality built-out spaces and users retaining their space should continue to decrease sublet options over the year, it said.

The average class-A net rent has also climbed from $20.68 in Q1 2021 to $20.84 in Q2 2021 , $21.07 in Q3 2021 , $21.47 in Q4 2021 and to $22.00 in Q1 2022.

Industrial sector remains tight

While the office market in Canada has faced some challenges, the country’s industrial real estate market has been on fire.

CBRE said the market hit unprecedented heights in Q1 with the amount of warehouse and distribution space under construction surging to a record 41.7 million square feet nationwide. And 69 per cent of that industrial pipeline is pre-leased.

In the first quarter, 8.6 million square feet of industrial space was absorbed, pushing availability down 20 basis points to a new record low of 1.6 per cent.

“Despite the record levels of industrial construction in response to the overwhelming wave of demand, this forthcoming new supply represents just 2.2 per cent of existing inventory and will not keep pace with the blistering pace of leasing,” CBRE Canada vice chairman Paul Morassutti said in a statement.

“We have effectively run out of available industrial space and many occupiers have no practical present-day options.”

CBRE said Montreal’s availability rate is one per cent, Vancouver is at 0.9 per cent, and Toronto, which saw 2.3 million square feet absorbed in Q1 alone, is at 0.8 per cent — all-time lows for Vancouver and Toronto.

Edmonton (5.9 per cent) and Calgary (4.6 per cent) — which each recorded 1.9 million square feet of net positive leasing activity this quarter — had the largest quarterly decreases in availability rates in Q1, falling 110 bps and 80 bps, respectively.

“Amid skyrocketing demand for industrial space, the national asking net rental rate grew at its fastest pace ever, rising 17.4 per cent year-over-year to a new record high of $11.20 per square foot.

“Vancouver continues to have the highest average asking net rent in Canada of $17.40 per square foot, followed by Toronto ($13.59), Ottawa ($12.70), Montreal ($11.34) and Edmonton ($10.40),” said the CBRE report.

Source Real Estate News EXchange. Click here to read a full story

RioCan Plans Colossal Redev. At GTA’s Colossus Centre

RioCan REIT has ambitious long-term plans to redevelop its 61.7-acre Colossus Centre shopping centre in Vaughan with up to 25 towers and buildings comprising over 10 million square feet of housing and retail.

Colossus Centre is located north of Toronto and surrounded by Highway 400 to the east, Highway 7 to the north, Weston Road to the west and Highway 407 to the south. The existing unenclosed shopping centre has more than 60 units and approximately 570,000 square feet of leasable retail area.

“It’s in a very, very busy node of the city that the city is investing in with all of the work that’s being done along Highway 7 and the VMC (Vaughan Metropolitan Centre),” RioCan (REI-UN-T) development vice-president Anton Katipunan told RENX.

Colossus Centre is most recognizable by the distinctive Cineplex Cinemas Vaughan movie theatre, which is shaped like a flying saucer. Other major tenants include HomeSense, Marshalls, Bed Bath & Beyond, Staples and Golf Town.

It’s shadow-anchored by a Costco and there’s a Petro-Canada gas station at the northwest corner which aren’t part of the 61.7 acres, though they’re thought of by most people as being part of Colossus Centre and are expected to remain.

Redevelopment plans for Colossus Centre

Hariri Pontarini Architects designed the master plan for the Colossus Centre redevelopment project.

RioCan’s long-term vision for Colossus Centre involves 25 buildings ranging from eight to 55 storeys. It would include approximately 9.47 million square feet of residential space with 13,000 units, approximately 646,000 square feet of non-residential space and almost 1.08 million square feet of parkland encompassing three parks and a multi-use trail.

“We’re really excited about converting to the highest and best use,” said Katipunan. “In our opinion that is a retail-focused mixed-use development that we want to work with the city, the community and the retailers that are there to figure out what’s the best solution that will meet the needs of that community.”

Katipunan believes the green space and parkland will appeal to future residents since the site is currently full of asphalt and parking lots. The residential component of Colossus Centre will likely include both purpose-built rental apartments and condominiums.

“As we go through our planning, what we want to do is understand what the market is dictating and what the best outcome is,” said Katipunan. “We’re looking to satisfy what the community is going to benefit from the most as well as from our unitholders’ standpoint.”

Colossus Centre’s location and proximity to major roads and public transit should appeal to retailers, its developer believes, as should plans that will encourage pedestrian movement through the addition of new public and private roads with sidewalks.

It’s still up in the air whether Colossus Centre will also include an office component.

Colossus Centre timelines, phases, partners

RioCan has made an application for an official plan amendment and is hoping to apply for zoning for Phase 1 of the redevelopment sometime this year.

The first phase will include two residential towers with a podium, according to Katipunan.

“We’re hoping that within a five-year time frame we’ll have an idea of when construction will start,” said Katipunan.

These are large and ambitious plans and one might think bringing in partners may be necessary to bring them to fruition, but Katipunan said it’s too far out to think about at this point.

“We always want to make sure that we’re putting our best foot forward, and sometimes that involves bringing in a partner. We’ve been building our team up internally to be able to tackle a project like Colossus. The projects that we’ve achieved over the past several years are testament to what we can produce.

“Colossus, at this scale, is not something that you come across on a regular basis. We’ve been hard at work on building the right expertise in-house and we’re confident that we could approach this project on our own.

“But as the planning process evolves and the market dictates what we want to put there, we would definitely be open to considering partnerships if the timing and situation is right.”

Connection with Vaughan Metropolitan Centre

VMC was created to become Vaughan’s downtown core with residential, retail, office, restaurant, green space, recreational and public transit components. The VMC subway station is approximately 1.6 kilometres east of the Colossus Centre site.

While much of VMC has been completed and it has become a population hub, there’s more development still to come. It’s therefore important to provide better linkage between VMC and Colossus Centre.

“We’re working with the city and the province on building a secondary overpass over the 400 to link to the southern part of the VMC,” said Katipunan.

“The idea is that we’re offering multiple options and access points into the VMC and Colossus Centre. You can use a vehicle, walk or ride a bike, so the interconnectivity between the VMC and Colossus Centre is well-planned out.”

Source Real Estate News EXchange. Click here to read a full story