Author The Lilly Commercial Team

It’s Now Tougher to Find Office Space in the Suburbs Than Downtown: Report

For the first time in history — and in a clear sign the in-person workspace is here to stay — vacancies for suburban commercial office space continue to be tighter than their downtown counterparts.

This past quarter marks the second consecutive period where vacancy remained lower in markets outside of city cores at 90 basis points, reports CBRE’s Q2 2022 Office Figures report, compared to the national downtown vacancy rate of 16.9%. Seven out of 10 Canadian markets reported declining vacancy rates, officially minting a trend as the sector recovers post-pandemic.

“Canadian office markets are still trying to find their footing in the new world of hybrid work. Suburban office strength shows how habits and business are in flux. While there is good news, economic instability is adding to the challenges facing businesses as they attempt to map out their office requirements for the future,” says CBRE Canada Vice Chairman Paul Morassutti. “To the doomsayers out there, it is increasingly clear that office real estate still has a core purpose and value to businesses, or else we would see a far worse dynamic playing itself out by now.”

However, some downtown markets retained their ranking as office hotspots; conditions cooled in the City of Toronto with a vacancy rate of 11.9% (mainly due to the influx of 612,000 sq. ft of new inventory this year), while Vancouver experienced extraordinarily tight conditions, with the downtown rate squeeze by 50 bps to 7.2%. In all, half of all Canadian markets experienced decreased vacancy including Halifax (-80 bps), Montreal (-20 bps), Ottawa (-20 bps), and Waterloo Region (-10 bps).

Another sign that the commercial office space sector is stabilizing is that the number of sublets — which can indicate companies changing their office use or rightsizing — also fell in the second quarter. In fact, the total amount of sublet space available is the lowest since the fourth quarter of 2020, at 14.3M sq. ft. According to CBRE, this is “an indication of growing confidence among businesses using office space.”

Construction levels have also been on the rise in the early part of the year to meet demand, with over 15.1M sq. ft under development across the nation. New projects are launching with gusto in the suburbs of Vancouver and Calgary, not to menton nearly half that inventory amount also underway in the downtown Toronto core.

Class A buildings (those with premium amenities in the most central locations) were in highest demand, outperforming lower-quality and older-aged space, as employers value these features despite the drawback of a downtown commute.

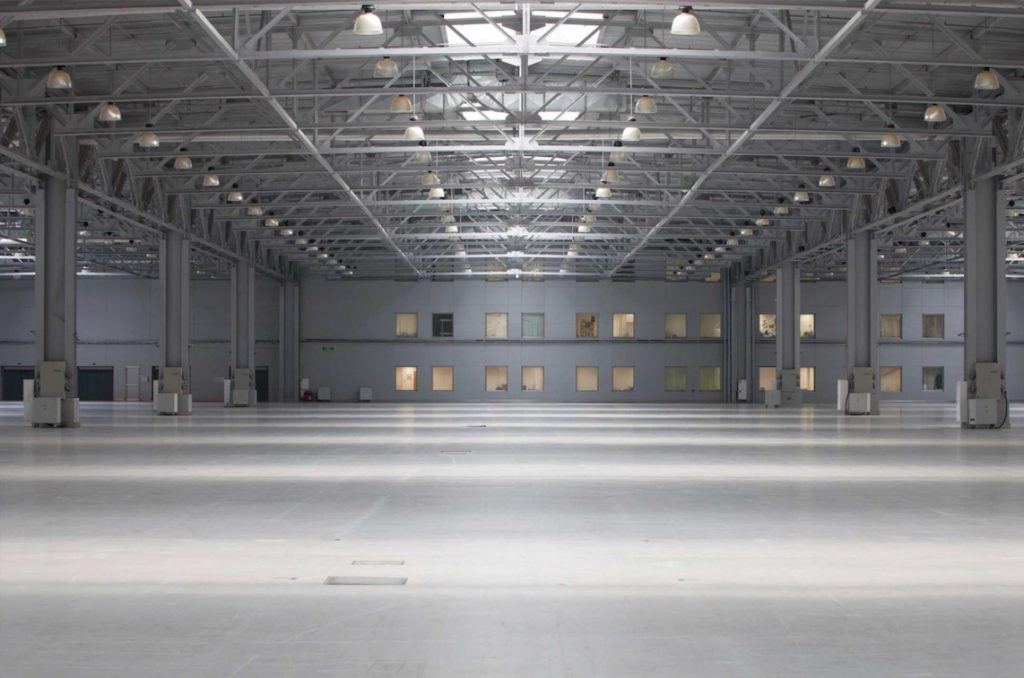

Industrial Office Space Supply Hits Record Low

Meanwhile, CBRE reports, the stock of industrial space remains remarkably scarce; the national availability rate had a record — though steady — low of 1.6% last quarter, even though 6.1M sq. ft of new supply came to market. In fact, national construction levels hit a new high, with 43.9M sq. ft of new supply; however, that represents just 2.3% of total available inventory. Large bay facilities are in particularly high demand due to their dearth of supply with more than three-quarters of the existing development pipeline attempting to alleviate the crunch with projects 200,000 sq. ft or larger.

With the exception of Calgary and Edmonton, all Canadian industrial markets now have availability rates of 2% or lower.

The challenges of finding space hasn’t dampened demand, however. Leasing activity was robust, with 7.2M sq. ft of positive net absorption. Toronto saw the largest amount of leasing activity, with 2.6M sq. ft accounted for, followed by Calgary at 2M, and Edmonton at 1.1 — a testament to the strong demand and available space in the Alberta markets.

According to the report, new leases were predominantly driven by third-party logistics, accounting for 4.4M sq. ft in the first half of the year, after a strong second half of 2021, with 5.2M sq. ft.

Source Storeys. Click here to read a full story

Fengate acquires Toronto Adelaide St. high-rise dev. site

A Toronto high-rise development property at the intersection of Adelaide Street West and Charlotte Street has been acquired by Fengate Asset Management following a receivership sale.

Fengate announced the acquisition of 46 Charlotte St., 16 Oxley St., and 355 Adelaide St. W. on Tuesday morning. The 13,725-square-foot property in the Entertainment District currently contains a heritage-listed six-storey building and the most recent development proposal for the site includes retaining portions of the structure.

Zoning and site plan applications are “in progress” according to Fengate.

The most recent proposal for the site is to redevelop it with a 48-storey tower which would include about 400 multiresidential units, as well as commercial and retail space.

In an email exchange with RENX, Fengate managing director and group head of real estate Jamie McKenna said the firm is reviewing the proposal.

“We are reviewing opportunities to enhance the existing proposal to maximize the positive impact of the development to the surrounding community,” she wrote.

The current project would include a podium incorporating some aspects of the existing 28,000-square-foot structure and comprise about 328,000 square feet of floor space. The existing building links back to the expansion of Toronto’s garment industry in the 1920s and 1930s, which drove the revitalization of the area, according to information from Fengate.

“On behalf of our investors, Fengate is pleased to acquire this centrally located, historic site in downtown Toronto. The project will offer future residents contemporary living spaces and modern amenities right in the heart of the Entertainment District,” McKenna said in the announcement.

“This acquisition is aligned with Fengate’s highly focused investment strategy to develop large urban residential sites that support the growth of communities in transit-oriented nodes.”

No financial details about the transaction were released.

The Adelaide/Charlotte/Oxley location

Fengate is managing the investment and development on behalf of its investors, including the LiUNA Pension Fund of Central and Eastern Canada.

“The site on Charlotte and Adelaide is a unique opportunity to simultaneously pay homage to Toronto’s entrepreneurial history and address the future housing needs of our growing city,” said Andrew Konev, Fengate’s senior vice-president, development, in the release.

“The proposed development will introduce new clients to businesses in the area and will provide housing options to a talent pool looking for convenient access to the world-class employment opportunities in the nearby Financial District and the expanding tech node of the area.”

He told RENX no timeline is available for the development.

The property has strong walk, transit and bike scores, which will be enhanced by the construction of the future Queen and Spadina station on the Ontario Line rapid transit line a short walk away from the proposed development.

Currently, the Osgoode and St. Andrew subway stations are both less than 800 metres from the site. There is also access to the dining, retail, entertainment, fitness and lifestyle amenities along nearby King and Queen Streets.

This acquisition expands Fengate’s downtown Toronto development portfolio, which also includes Natasha The Residences and a proposed development for the Rail Deck District.

The Charlotte/Adelaide site was one of eight potential development locations across the Greater Toronto Area and Southern Ontario, formerly owned by Go-To Developments Holdings, which had been listed for sale after being placed into receivership in December 2021.

This property was listed by Colliers, while the other seven sites scattered across the GTA, St. Catharines, Hamilton and Niagara Falls were listed through CBRE’s Land Services Group.

KSV Restructuring is the court-appointed receiver for the proceedings.

About Fengate Asset Management

Fengate Asset Management is an alternative investment manager focused on real estate, infrastructure and private equity strategies.

With offices in Canada and the U.S., Fengate is one of the most active real asset investors and developers in North America. Fengate Real Estate, a division of Fengate Asset Management, has been developing and managing real estate assets since 1974.

Source Real Estate News EXchange. Click here to read a full story

Downtown Toronto Foot Traffic Has Surged By 62% Since March

Toronto is back in business.

As a loud and clear sign of the pandemic recovery times, downtown Toronto’s foot traffic has surged by 62% since March.

Global commercial real estate advisor Avison Young has released its latest Toronto office market report, which reveals a re-emergence of life and activity to Toronto’s streets. Avison Young’s Vitality Index tracks foot traffic using cell phone pings in 23 downtown cores across North America, including six cities in Canada.

According to the report, Toronto recorded its highest volume of downtown foot traffic since March 2020 during the week of June 13, 2022 (volume for the week ending July 17, 2022 is only slightly lower). Across North America, average downtown foot traffic volume is at the highest level for the week of ending July 17, 2022, since March 2020.

According to the report, the Greater Toronto Area (GTA) saw positive absorption for the third straight quarter –following six negative quarters during the pandemic — as occupied area increased by 443,000 square feet. Downtown Toronto’s positive absorption reflected 1.5 million square feet, the highest positive absorption since before the pandemic.

In the downtown core, an 8.3% downtown office vacancy ticked up from 8.0% due to new product entering the market. This figure is up from 2.1% in the first quarter of 2020. In the pricey city, some companies see opportunities to grow or move to better-located or higher-quality premises, while others see options to downsize or sublet.

“While some companies continue to consider downsizing or subletting a portion of their office space, others are seeing opportunities to grow or move to better-located or higher-quality premises, and new occupiers entering the Toronto market for the first time continue to make headlines,” reads the report.

Availability of space in the GTA office market held steady in the second quarter of 2022, after the rapid rate of increase seen during the pandemic had begun to level off in recent quarters, according to the report. “The market remains active as a greater range of available options offers tenants the chance to explore alternatives that best suit their evolving needs, amid the ongoing changes in workplace strategy sparked by the pandemic,” it reads.

The GTA office market continues to be “characterized by sound fundamentals,” with availability remaining flat at 15.5% quarter-over-quarter, while vacancy climbed 80 basis points (bps) to 10%. For the third straight quarter, absorption was in positive territory (following six negative quarters during the pandemic) as occupied area increased by 443,000 square feet (sf) across the GTA. Gains in the downtown market were offset by losses in midtown and the suburbs, according to Avison Young.

Total available sublet space was essentially flat for the second consecutive quarter in the GTA, inching up 1% to 6.3 million square feet (msf). Nearly 8.2 msf of new office space was under construction across the GTA at the end of the first quarter (66% preleased / equal to 4% of inventory).

As with the GTA overall, the availability rate remained flat quarter-over-quarter in the downtown Toronto market at 14.1%, representing an increase of 130 bps year-over-year. Vacancy continued to edge upward, rising 30 bps to 8.3% during the second quarter. This is despite positive absorption of more than 1.5 msf, by far the market’s best result since before the pandemic.

The increase in occupied area was localized in downtown south, as tenants began to take occupancy of new buildings completed in recent quarters, with King and Dufferin the only other downtown node to post positive absorption during the second quarter.

The midtown market posted rising availability (up 30 bps to 14.3%) and vacancy (up 210 bps to 10.1%) quarter-over-quarter. The jump in vacancy resulted primarily from significant negative absorption in the Bloor node, where occupancy decreased by more than 340,000 sf during the quarter — the losses mostly occurring in class B buildings.

Overall availability in the Toronto north and east markets rose 50 bps during the second quarter to 16.5%, while vacancy climbed 80 bps to 10.2%. Occupancy gains in the east were offset by losses in the north, says Alison Young — particularly the north Yonge node, where negative absorption can be partially attributed to tenants taking advantage of the increased range of available options in the downtown market.

No new supply deliveries have added to the north and east inventory so far in 2022; however, two new construction projects are under way in the east market totalling nearly 166,000 sf (82% pre-leased), while in the north, a total of nearly 647,000 sf is under construction across four projects (59% pre-leased).

The return to life as we knew it pre-pandemic is not only reflected in things like rising foot traffic and the return of employees to the office, but also in the return of Toronto’s maddening traffic (not that we’re complaining; we’ll take that over lockdowns any day).

Source Storeys. Click here to read a full story

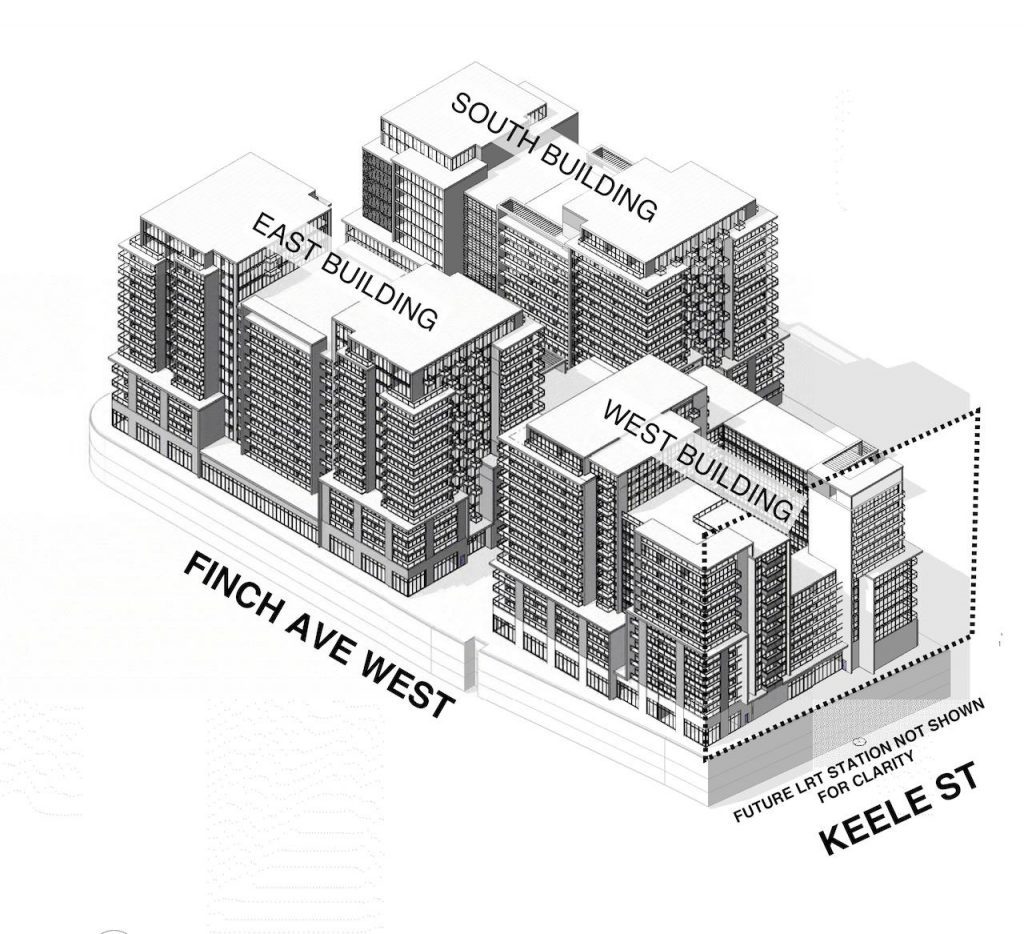

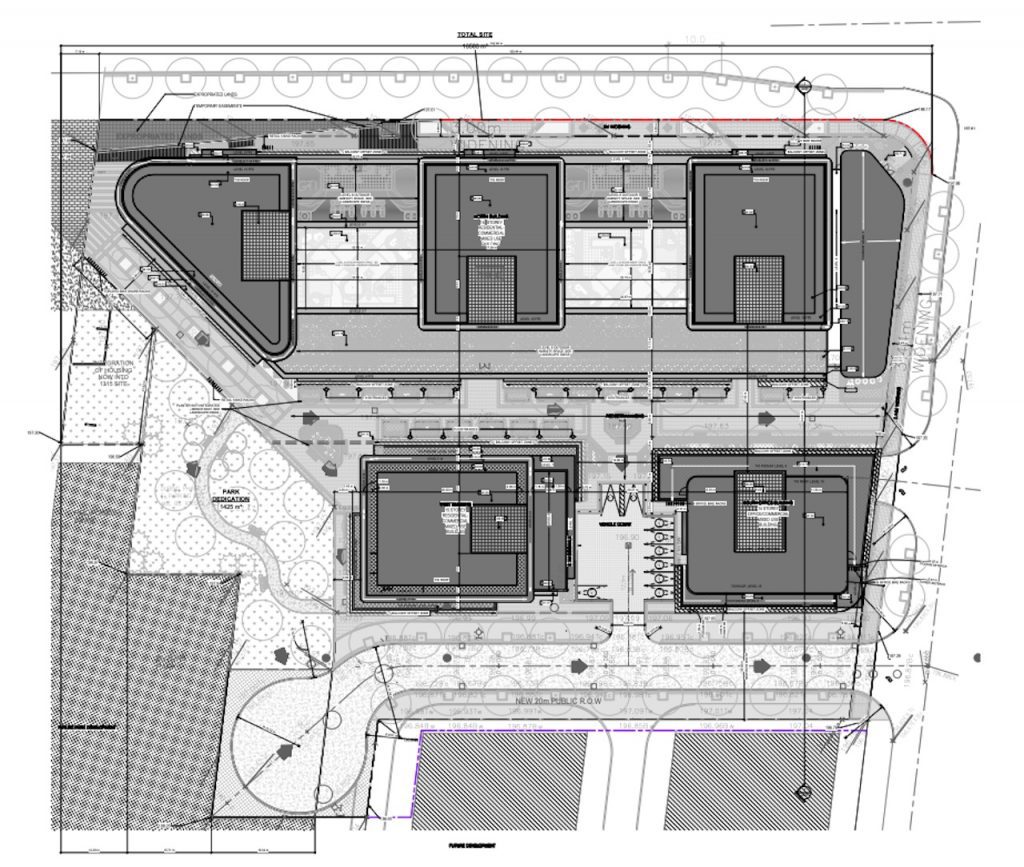

Proposal For 1315 Finch Reconfigured And Resubmitted To The City

A resubmission has been made to the City of Toronto by CTN Developments for the property located at 1315 Finch Avenue West, just east of Keele Street. The developer previously submitted rezoning and subdivision approval applications in February of 2020 to construct a mixed-use development that would bring four towers to the site, which is currently occupied by a five-storey medical building.

The rezoning and subdivision applications were deemed completed in 2020, although there is a new Site Plan Approval application that has been submitted, which completely changes plans for the AAA Architects-designed development. Between the previous submission and now, CTN has worked with City Staff to develop a revised site layout to address concerns identified as part of the initial review.

As a result of the efforts, the new application submitted this May offers a new east-west oriented public right-of-way extending from Tangiers Road along the east side of the site, new public parkland, mixed-use towers connected by a shared podium oriented along Finch, a new office building located at the intersection of the future east-west road and Tangiers Road, and an apartment building internal to the property that would be adjacent to the future east-west road and the parkland.

The number of buildings in the proposal changes from four to three, although the largest of the buildings includes three towers rising from a shared podium. Heights move upwards marginally from 13 and 14 storeys to 14 and 15. The new total gross floor area of the proposal is 66,702m², consisting of approximately 10,248m² of office space, and 3,630m² of retail space, with a resulting FSI of 4.03 on the lot. The new office building would replace what is currently within the existing building and expand upon it.

The total residential unit count is reduced slightly from 818 to 803 units, with the breakdown now proposed as 45 studios (6%), 557 one-bedrooms (69%), 121 two-bedrooms (15%), and 80 three-bedrooms (10%). The proposed three-bedroom units include 24 townhouse style units that would front onto an internal POPS (Privately Owned Publicly accessible Space) and the proposed parkland.

The mews/POPS area would provide direct connections between the new public right of way, Tangiers Road, the proposed public park, and the Finch West station (combined Line 1 subway and Line 6 LRT) and plaza at the corner of Keele Street and Finch Avenue West. Unit entrances and building lobbies would front onto the outdoor space, with opportunities for public art, plantings, and public seating areas.

A shared underground structure would provide a total of 553 parking spaces over three levels, which has been reduced from the perviously proposed 821 spaces of the former application. Bicycle parking of 888 spaces is to be provided, including 775 long-term spaces, and 113 short term spaces.

Just steps from rapid transit, the new development has been reconfigured to offer connectivity within and through the property to the adjacent subway and LRT station and plaza.

The proposed phasing has also been modified. Phase 1 would include construction of the new right-of-way, public parkland, and proposed office building; Phase 2 would bring the proposed three-tower, mixed-use building along Finch; and finally, Phase 3 would see the proposed apartment building constructed.

UrbanToronto will continue to follow updates for this development, but in the meantime, you can learn more from our Database file for the project, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread, or leave a comment in the space provided on this page.

UrbanToronto’s new data research service, UrbanToronto Pro, offers comprehensive information on construction projects in the Greater Toronto Area—from proposal right through to completion stages. In addition, our subscription newsletter, New Development Insider, drops in your mailbox daily to help you track projects through the planning process.

Source Real Estate News Exchange. Click here to read a full story

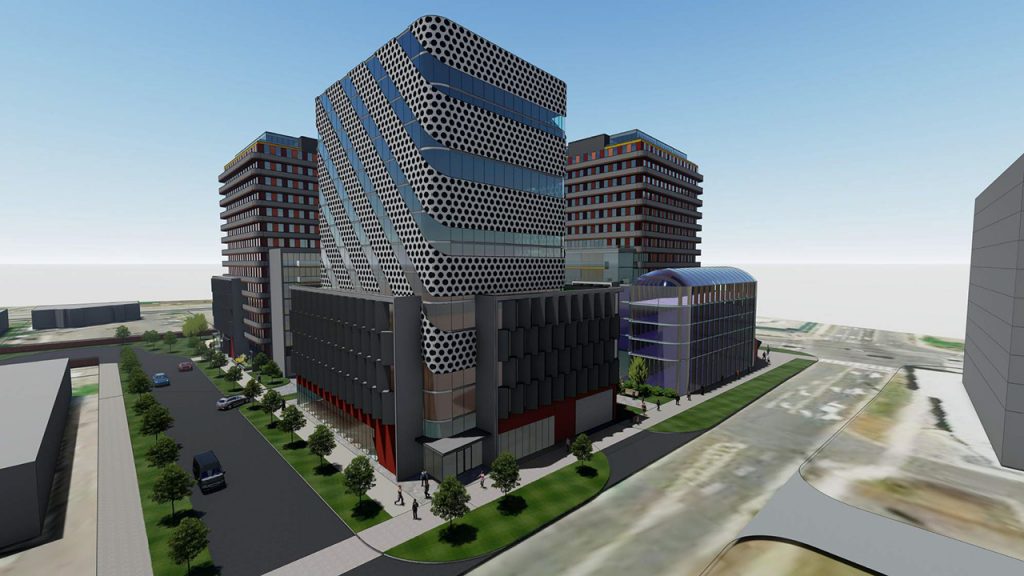

Concert’s CREC Fund Buys Another Mississauga Office Bldg.

Concert’s CREC Commercial Fund LP has acquired a second boutique-type office property in a Greater Toronto Area west submarket in Mississauga.

The fund now owns the 99,828-square-foot, four-storey 6750 Century Ave. property in Meadowvale. The class-A building was constructed in 2009 and was acquired from Artis REIT, which has been undergoing a major strategic and portfolio reorganization during the past year or so.

“This is an exciting acquisition as it represents an excellent opportunity for the fund to deepen its holdings in the Meadowvale submarket with a quality office property while supporting Concert’s continued growth and expansion,” said David Podmore, Concert’s chairman, president and chief executive officer, in Tuesday’s announcement.

Concert paid $30 million for the property.

The 6750 Century Ave. property

6750 Century Ave. is a LEED- and Energy Star-certified office building on approximately 3.46 acres of land adjacent to a linear park system. It has 336 surface parking spaces, 20 of which are covered.

Concert says it is continuing to see strong demand for “high-quality, well-located suburban offices, where tenants benefit from decentralized office footprints that promote better work-life balance and offer shorter commute times for both staff and visitors, thereby helping to attract the best talent.”

The building currently has three vacancies comprising a total of about 20,000 square feet, which had been listed for lease by Artis. In an exchange of emails, Concert’s director of corporate communications John Corry said efforts will continue to onboard new tenants.

“We think there is an opportunity to launch a strong marketing and leasing program and appeal to a wide variety of tenants who can benefit from the already built-out and demised space,” he wrote.

The building is in an area which is already home to several multi-national companies and head offices including McKesson, Novo Nordisk, RBC, BMO and Intact, along with other financial, technology and pharmaceutical companies.

The tenant list at 6750 Century includes a diverse set of national and global companies including Whirlpool Canada’s head offices. It is already demised to accommodate a wide variety of tenants with unit sizes ranging from under 5,000 square feet to about 25,000 square feet.

Concert and Mississauga

It has easy connectivity to the 400 series highways and is located 18 kilometres from Toronto Pearson International Airport. Transit access is provided through the MiWay bus system and the Meadowvale GO Station, both within one kilometre.

“We are pleased to acquire another exceptional office building that enhances the ongoing investment and growth of our fund which is supported by our dedicated pension and institutional fund investors,” says Andrew Tong, managing director of the CREC Commercial Fund LP.

The property also adds to Concert’s Mississauga holdings. The firm also owns 2476 Argentia Rd., a 100,000-square-foot class-A building very close to the Century Avenue property, as well as several other GTA West office and industrial properties.

With its modern construction and and sustainability certifications, Concert’s initial focus will be to transition management of the building and integrate it into the fund’s holdings.

“Our current focus is to ensure that there is a smooth transition operationally,” Corry wrote. “Our goal is to provide an exceptionally high level of service to our existing tenants.

“Longer-term, this asset will be viewed as a hold for our Commercial Fund generating income for our pension and institutional investors.”

About Concert and CREC Commercial Fund LP

Concert has been involved in developing, acquiring and managing Canadian real estate since 1989. With over $8 billion in assets, Concert’s portfolio is backed and owned by over 200,000 Canadians, represented by union and management pension plans.

The firm is involved with rental apartments, condominiums, seniors’ active aging communities, industrial and commercial properties, and public infrastructure projects.

The fully subscribed CREC Commercial Fund LP is a diversified Canadian portfolio. With ongoing plans to expand, this open-ended, limited partnership fund invests in, and actively manages, industrial and office real estate in Canada.

The portfolio is managed by Concert Realty Services Ltd. and serves as Concert’s exclusive commercial platform.

The fund is supported by multiple Canadian pension funds and institutional investors.

The portfolio has an asset value in excess of $2.4 billion and over 11.6 million square feet of leasable area.

Source Real Estate News Exchange. Click here to read a full story

Dealpath Opens T.O. Office To Expand Canadian Client Base

Dealpath, a cloud-based real estate investment management platform, has added a Toronto office to its existing dual headquarters in New York City and San Francisco.

“We are building out this command centre that provides centralized data that’s globally accessible and high-performing,” Dealpath co-founder and chief executive officer Mike Sroka told RENX. “We provide flexible workflows that enable teams to work effectively from wherever they might be working and provide the enterprise data security that these leading institutions require.

“We believe that investment decision glory is when these investment managers can see the performance of their portfolio in real time, overlaid with every opportunity that they’re seeing in the market and the comps of every asset and deal they’ve ever looked at or worked on.”

The Toronto office is led by strategic account director Stephanie Gaty, who joined Dealpath in May after nearly three years as a senior sales executive at CoStar Group. The McGill Universityand New York University graduate previously had roles at Altus Group and AP Capital.

Dealpath is in the midst of hiring people for a number of different roles in the Toronto office, located at 240 Richmond St. W.

Toronto a “key market” for Dealpath

The location will assist Dealpath in expanding its Canadian client base, tap into Toronto’s hub of skilled talent and provide access to core institutional capital invested in real assets.

“We’ve always viewed Toronto as one of our key markets,” said Sroka. “We view it as a global office not just for Canada, but for our broader business.”

The firm’s Canadian clients include Oxford Properties, First Capital, Fiera Real Estate, Manulife Investment Management, Healthcare of Ontario Pension Plan, CentreCourt Developments, Hopewell Development, Crestpoint Real Estate Investments and Le Groupe Maurice.

Dealpath was founded in March 2014 and provides a platform for clients to operate at scale with speed and precision to deliver optimal risk-adjusted returns.

Commercial real estate uses decentralized data, which can be timely and costly to access from different sources, to compile and glean insights. Dealpath helps real estate private equity firms, public and private real estate investment trusts, banks, life insurance companies and specialty lenders accomplish this so they can make informed acquisition, development and financing decisions.

Dealpath offers its services under annual and multi-year contracts comprised of per-user subscription fees and a one-time implementation fee.

The company says it has supported more than $10 trillion in transactions globally, with international customers including Blackstone, Nuveen, AEW, Principal Real Estate, MetLife and Bridge Investment Group.

Dealpath has been financed by a combination of venture capital firms, including 8VC and Greensoil PropTech Ventures, as well as strategic real estate operators, including Blackstone and JLL.

The company isn’t just expanding in Canada.

“We’re really excited to be on a growth trajectory and trying to build out our teams and programs to support a broader business,” said Sroka. “We have been experiencing strong growth and see an enormous opportunity in front of us.”

Source Real Estate News Exchange. Click here to read a full story

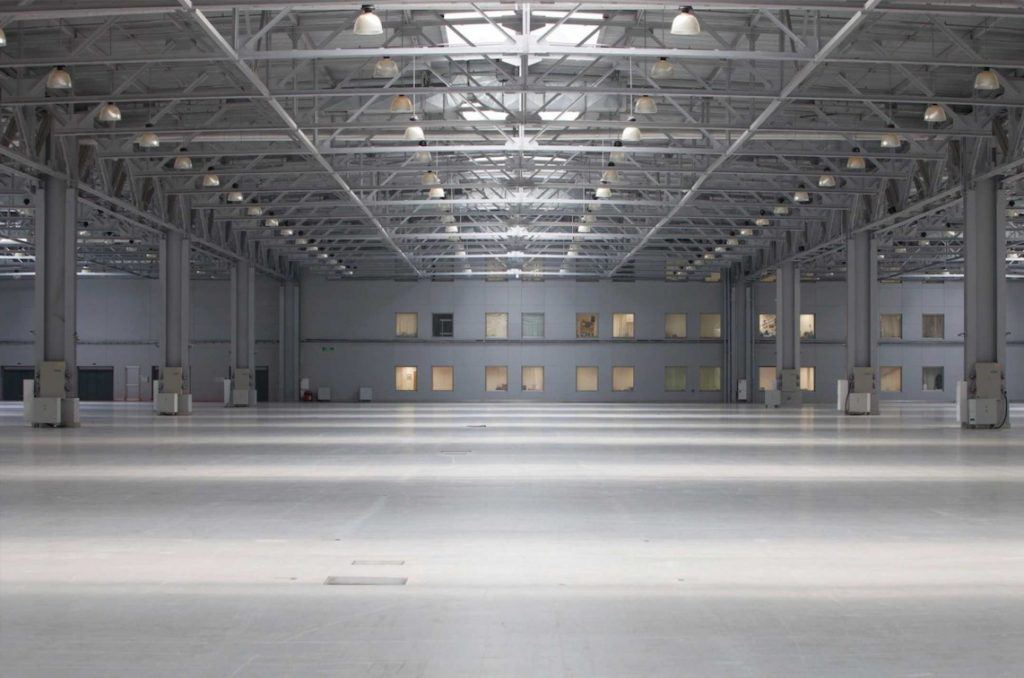

Can Residential And Industrial Land Uses Co-exist?

The Greater Toronto and Hamilton Area’s (GTHA) residential construction boom is increasingly pushing into historic industrial and employment lands, and a recent online Urban Land Institute Toronto panel looked at some of the issues and strategies which have arisen from the situation.

Stikeman Elliott partner Calvin Lantz provided an overview to kick off the event and observed that residential and industrial land uses aren’t always compatible. He said this can depend on: the type of industry involved; the industry’s emissions, including noise, vibrations, dust and odours; and the built form and intensity of the proposed residential land use.

Stikeman Elliott partner Calvin Lantz provided an overview to kick off the event and observed that residential and industrial land uses aren’t always compatible. He said this can depend on: the type of industry involved; the industry’s emissions, including noise, vibrations, dust and odours; and the built form and intensity of the proposed residential land use.

“Is it a single detached home that’s being introduced or is it a tall tower next to an industrial operation with overlook and exposure to the emissions?” Lantz asked.

“We’re dealing with infill development. We’ve got under-utilized sites that have no hope of ever attracting industrial development. And we have under-utilized sites that are adjacent to, or are in proximity to, active industrial operations.

“We clearly have a need for more housing. And we have a need to protect employment lands and jobs and make use of the infrastructure that’s existing. And we want to protect employment opportunities and attract more employment opportunities in the future.”

The Greater Toronto and Hamilton Area has a limited supply of land due to Lake Ontario and the Greenbelt that limits expansion into farmland and natural areas.

Within these boundaries are historic land designations and existing infrastructure with roads and public transit lines that dictate site usage. A growing population has increased the potential for conflict.

Lantz stressed the importance of compatibility being considered through comprehensive municipal planning processes, and with each development approval sought.

Hamilton-Oshawa Port Authority

City of Hamilton Municipal Land Development Office manager Chris Phillips, who facilitated the discussion, then introduced three other panelists who joined Lantz.

Hamilton-Oshawa Port Authority president and CEO Ian Hamilton said he oversees 650 acres that contains 135 tenants. More than $4 billion worth of goods travel through the port annually, supporting 28,000 jobs in Ontario.

Hamilton said there are 17 port authorities in Canada, and all face compatibility challenges balancing their mandates with the residential and recreational aspirations of their home cities.

“In most cases cities were built because of access to water and then, in a lot of cases, the city is outgrowing itself and surrounded the ports and made it sometimes awkward to be compatible and work together,” said Hamilton.

“But I certainly believe that it is possible, and it requires a fair amount of transparency and open communication and recognition of what the two parties’ specific needs are.”

Housing crisis could change policies

While Bousfields Inc. partner David Huynh said government policies protecting industrial and other employment lands are probably the strongest they’ve ever been, things may change somewhat due to the growing housing crisis in the GTHA.

“But at least there’s a realization and acknowledgement that I think staff have to consider more than the protection of employment, and that means thinking more about housing and thinking more about the different types of employment that they’ll accept or they can consider.”

“Industries need to step up on their own to defend their own territory,” said Lantz. “It’s not enough for them to stand up and say ‘We were here first.’ That works in a sandbox, but that doesn’t work here when you’re dealing with politics and limited rights of appeal.”

Truck routing and transportation

Phillips raised the issue of truck routing in neighbourhoods where there are both industrial and residential uses. Products need to be transported from one location to another, but safety concerns must also be considered.

“It’s one thing to protect the land and transition to these large warehouses along our highways,” said Huynh. “But as logistic networks kind of permeate into our communities, companies are looking at smaller satellite facilities with smaller trucks.

“The negative thinking is to worry about the noise and pollution that the smaller facilities will add to our communities, but an optimist might see this as an opportunity to properly plan for them and mitigate them and perhaps there’s a way we can co-exist or harmonize with these uses.”

Marlin Spring land development director Andrea Oppedisano was asked about the mitigation strategies she’s employed when residential developments are located close to existing industrial facilities.

Oppedisano emphasized the importance of early and frequent communication between a residential developer, an industrial land owner and other neighbours so everyone is aware of what’s happening now and what’s anticipated in the future.

Source Real Estate News Exchange. Click here to read a full story

PROREIT, Crestpoint Form $455M Industrial JV

PROREIT (PRV-UN-T) and Crestpoint Real Estate Investments Ltd. have created a joint venture involving $455 million of mainly industrial properties, including a $228-million portfolio which they are acquiring in the Halifax Burnside Industrial Park.

On closing of the transactions, Montreal-based PROREIT and Toronto-headquartered Crestpoint will jointly own a portfolio of 42 properties, 41 in Halifax and one in Moncton. They will comprise nearly 3.1 million square feet of gross leasable area.

“This joint venture is a unique opportunity for PROREIT to increase its footprint in Halifax’s Burnside Industrial Park, one of Canada’s strongest industrial nodes,” said James W. Beckerleg, president and chief executive officer of PROREIT, in the announcement Tuesday morning.

“By joining forces with Crestpoint, a high-profile institutional real estate investor, collectively we will have an opportunity to achieve meaningful operational and leasing synergies in addition to diversifying our robust industrial tenant base.”

PROREIT and Crestpoint will each acquire 50 per cent interests in the 21-asset Burnside portfolio, which is currently owned by a third party, for $228 million.

Transactions add scale to PROREIT holdings

In conjunction with that transaction, PROREIT will sell a 50 per cent interest in 21 of its currently owned properties to Crestpoint for $113.5 million (valuing that portfolio at $227 million).

“Crestpoint is excited to take a significant presence in the Halifax industrial market with an ideal partner, PROREIT,” said Kevin Leon, president and CEO of Crestpoint, in the announcement.

“The City of Halifax has been such a strong beneficiary of population and economic growth in the last several years and we believe going forward it will continue to demonstrate these growth patterns as the dominant commercial centre for Eastern Canada.

“Combining Crestpoint’s national industrial expertise alongside PROREIT’s local industrial knowledge will result in a leading East Coast industrial platform. Crestpoint, with this acquisition, will have a significant presence from coast to coast which will contribute to Crestpoint’s leading position as one of Canada’s top investment managers.”

PROREIT, through its property management business Compass Commercial Realty, will act as the property manager for the portfolio.

PROREIT’s acquisition of the 50 per cent interest in the Burnside properties, which total 1.6 million square feet, will be financed via a 50 per cent interest in approximately $148 million of new mortgages. The $40-million balance will be paid in cash, including the proceeds of the sale of the existing properties to Crestpoint.

Crestpoint’s share in the PROREIT assets

The sale of the interest in the 21 currently owned properties will result in approximately $49 million in cash to Crestpoint, which also assumes a 50 per cent interest in approximately $129 million of mortgages currently held by PROREIT.

The balance of the proceeds to PROREIT, net of the acquisition payment, will be used to reduce the REIT’s credit facility.

The transaction is expected to close in the coming weeks and remains subject to customary closing conditions.

“We are pleased to manage and operate this highly desirable portfolio,” Beckerleg noted in the announcement.

“Given Halifax’s solid economy and tight industrial real estate market, we look forward to unlocking the significant market leasing upside embedded in these properties and to further benefit from the accretive effect that should result from the scale of this joint venture.”

When the transactions close, PROREIT will own interests in 42 properties in the Burnside Industrial Park. Burnside is the largest industrial node east of Montréal and north of Boston.

It benefits from strong market fundamentals with an all-time low vacancy of 2.5 per cent and “consistent growth in net rental rates,” according to PROREIT and Colliers’ 2022 Q1 industrial report for Halifax.

The 42-asset portfolio is comprised of warehouse, light industrial and flex office spaces. The properties are approximately 95 per cent leased to a diverse mix of tenants with a weighted average lease term of three years.

Many of the in-place leases contain contracted rent step escalations and/or are below current market rents, presenting substantial future rental upside upon turnover, PROREIT says.

About PROREIT and Crestpoint

PROREIT is an unincorporated open-ended REIT established under the laws of the Province of Ontario.

Founded in 2013, PROREIT owns a portfolio of Canadian commercial real estate properties with a strong industrial focus in robust secondary markets.

Crestpoint Real Estate Investments Ltd. is a commercial real estate and mortgage investment manager holding a diversified portfolio of commercial real estate assets.

Crestpoint’s current portfolio has a market value in excess of $8.5 billion and is comprised of over 31 million square feet of commercial properties.

Crestpoint is part of the Connor, Clark & Lunn Financial Group, a multi-boutique asset management company that provides investment management products and services to institutional and high-net-worth clients.

With offices across Canada and in Chicago, London, and Gurugram, India, Connor, Clark & Lunn Financial Group and its affiliates manage $104 billion in assets.

Source Real Estate News Exchange. Click here to read a full story

The Well, One Of Toronto’s Largest Ongoing Downtown Developments, Has Now Leased 98 Per Cent Of Its 1.17 Million Square Feet Of Office Space, Its Developers Say.

Allied Properties REIT (AP-UN-T) and RioCan REIT (REI-UN-T), which each own a 50 per cent stake in the commercial component of The Well, reported Wednesday they have signed an unnamed “leading technology organization” to a 89,964-square-foot lease for a term of 12 years. The lease is to commence Nov. 1, 2023, and leaves one floor (29,886 square feet) remaining to be leased.

Office tenants at The Well comprise 15 knowledge-based organizations, the release states.

“This is an important milestone in completing the premiere mixed-use urban development in Toronto,” said Michael Emory, Allied’s president and CEO, in the announcement.

“The Well has become a large-scale success for all concerned, one that’s reshaping Toronto’s downtown core and propelling the King and Spadina neighbourhood to even greater ascendency.”

Two-thirds of The Well’s retail space leased

Allied and RioCan also announced the retail component of The Well is 66 per cent leased to 41 retail users. The REITs consider that to be well on track, with the retail segments of the development expected to be available for grand opening in mid-2023.

Efforts to lease the remaining commercial space are underway.

The commercial component at The Well comprises:

– 1,168,000 square feet of office GLA;

– 320,000 square feet of retail GLA;

– 677 underground commercial parking spaces;

– significant third-party digital signage on the northwest corner of Front & Spadina; and

– an energy-storage facility to extend Enwave’s heating and cooling network to Toronto’s Downtown West.

The Well’s office component is targeting a LEED Platinum certification, slated to include operational, environmental, life-safety, and health and wellness systems.

Residential components of the development

The overall project includes seven towers and mid-rise buildings on the 7.8-acre site.

RioCan Living and Woodbourne’s 46-storey FourFifty The Well will have 592 residential rental suites.

During an earlier update at The Well in May, the developers said 90 per cent of the condo component, representing more than 650 units, had been sold by Tridel.

Tridel at The Well – Signature Series is a luxury 14-storey, 98-unit building fronting Wellington Street. Tridel at The Well – Classic Series I is a 38-storey condo with limited suite availability, while Classic Series II had 258 suites of up to 1,800 square feet.

About RioCan and Allied

RioCan is one of Canada’s largest real estate investment trusts. It owns, manages and develops retail-focused, increasingly mixed-use properties located in high-density transit-oriented areas.

As of March 31, 2022, RioCan’s portfolio was comprised of 204 properties with an aggregate net leasable area of approximately 36.2 million square feet (at RioCan’s interest) including office, residential rental and 13 development properties.

Allied is a developer, owner and operator of urban workspace in Canada’s major cities and network-dense UDC space in Toronto.

Allied’s mission is to provide knowledge-based organizations with workspace and UDC space that is sustainable and conducive to human wellness, creativity, connectivity and diversity.

Source Real Estate News Exchange. Click here to read a full story

Canadian Industrial To Continue Delivering Historic Returns

Canada’s industrial real estate market was performing well for owners and managers before COVID-19 hit, and it’s been cranked up to another level since the onset of the pandemic.

Panattoni Development Companyresearch manager for strategy and market intelligence John Scioli moderated a four-person panel on how the industrial market has outperformed all other sectors and what to expect in the future at the June 7 Land & Development conference at the Metro Toronto Convention Centre.

The session was led off by a short presentation by MSCI executive director Bryan Reid.

The rolling 12-month total return on the MSCI/REALPAC Canada Annual Property Index was well over 30 per cent in December 2021, which Reid said eclipses anything historically seen in institutional investment markets — and the gap between industrial performance and other asset classes is widening.

MSCI tracks approximately 90 global metropolitan areas and Toronto’s 22.7 per cent, five-year annualized total return for industrial properties (as of December 2021) ranked second only to Riverside, Calif.’s 23.7 per cent. Edmonton’s four per cent return during that same period was among the weakest in the world, but was still positive.

Due to this strong performance, investment allocations are shifting and industrial’s share is increasing domestically and around the world. From December 2011 to December 2021, industrial’s allocation rose from 10.3 per cent to 20.7 per cent in Canada.

“Some of that is the organic component that values are rising faster for industrial,” said Reid. “So what’s in the portfolio is increasing proportionally, but then also we are just seeing a huge amount of net inflows into the asset class.”

The share of industrial transaction volumes in Canada has also increased and is now at more than 30 per cent.

Industrial rents are increasing by eight to 10 per cent year-over-year, according to Reid, but recent transaction activity suggests potential 20 per cent-plus increases in some markets.

Industrial development moving farther out of GTA

Fengate senior vice-president of development Andrew Konev said his company will look at land outside the core Greater Toronto Area (GTA) market based on its performance projections and benefits such as access to labour and transportation, sensible development approval timelines and reasonable construction costs.

When looking for spaces of 100,000 to 300,000 square feet, there are often few options so National Logistics Services director of supply chain solutions and engineering Nick Gaganiaras said his company might be forced to look elsewhere.

He said this might only offer a short-term solution of less than five years because another market might be sub-optimal from labour and transportation perspectives. However, if it meets immediate needs, the decision can be re-evaluated later.

Labour remains critical, according to Gaganiaras, who pointed out that large, fully automated Amazon facilities in Brampton, Ont. still employ 1,000 people per shift.

“We need the technical capabilities, the maintenance, the computer and the local knowledge to keep the systems running, so labour is still a very critical component of decision-making.”

Avison Young real estate broker, associate and principal Ben Sykes said some companies have no option but to move outside of the GTA because most land, aside from some infill sites, has been built out.

While there are a large amount of large industrial facilities in the pipeline in the GTA, Sykes said there’s very little small and mid-bay space available. Yet, there’s a large market because few developers are servicing that segment.

Konev said there are price discounts outside of the GTA, but they’re not significant.

Sykes reminded attendees that, despite skyrocketing rents, they only account for five per cent of overall supply chain costs. A 20 per cent increase should therefore be looked at from that perspective.

Supply chain issues

Gaganiaras said the supply chain is moving from a just-in-time to a just-in-case model, which presents challenges.

“Now you’re paying more for space to store product that you’re hoping to sell, but then we move further upstream and we have huge disruptions in ocean and air schedules. So the inventory that you’re bringing in that you’ve planned for is missing the season. And so we’re now building up inventory that’s off-season.”

Konev said Fengate sees plenty of demand for short-term storage.

“When you want to put up a building, you need a building to store a lot of your equipment. If you’re building condominium building, you need to store your appliances. A lot of demand is coming from that segment of the market, so we’re trying to figure out how to cater to that short-term piece.”

Forecasting is another challenge, according to Gaganiaras, who said e-commerce was growing very rapidly two years ago but has now flattened out. E-commerce facilities typically require four to five times the amount of space as a traditional retail fulfillment operation, he added.

“When you’re forecasting inventory and you’re trying to build out systems and facilities and supply chain strategies, there’s really a lot of potential outcomes where you could be at 200,000 square feet or you might be at 150,000 square feet,” said Gaganiaras.

“And there’s a huge difference as it grows and compounds. It becomes a long-term impact. So the idea of short-term storage or short-term solutions is very attractive to the end-users and the occupiers because it allows us to manage more discrete challenges.”

“Users are trying to figure this out on the fly and at the same time they’re being forced into signing long-term leases,” said Sykes. “We have clients that are literally at the start of a project in some cases and don’t exactly know the specific business operation or how they’re going to operationalize the building.”

Seventy million square feet of industrial space is in the GTA development pipeline, said Sykes.

Gaganiaras said delivery of automated systems for new industrial buildings takes at least a year and often longer, so they don’t coincide with the building fit-up. The systems also take two months to commission.

“There are a lot of challenges in marrying up all these different components, where historically you could order racking. You knew what the lead time was and you knew exactly how long it took to take it up. And as soon as it’s up, you could start using it.”

In a rising rental rate environment, developers often want to wait as long as possible to lease a new building to maximize leasing rates. Sykes said 90 per cent of the industrial space being delivered this year is already leased and much of the space coming in 2023 has also been committed, so tenants are looking into late 2023 or 2024 to secure space.

Everyone is building in aggressive inflation rates into their costs and Fengate errs on the conservative side and builds in bumps on interest rates when considering land purchases.

“You have to believe in the growth to really make sense of any land purchase these days,” said Konev.

Multi-storey industrial and automation

Fengate hasn’t built multi-storey industrial buildings because of the high cost and lack of tenant demand, but said it could make sense once land hits $6 million to $8 million per acre.

Sykes said multi-storey industrial is being driven by developers – due to high land costs and constrained land availability – more than by end-users, which can face higher fit-out costs for taller buildings.

Spec-built, single-storey facilities in Canada are topping out at 40-foot clear heights while many European industrial buildings are up to 60 feet.

Gaganiaras said most traditional equipment caps out at 40 feet and the costs of adding automation and going higher are significant. Such buildings also reduce the potential tenant pool as most users can’t take advantage of 55-foot clear heights, he added.

Sykes pointed out that moving products up and down also takes more time, adds to costs and may not be appropriate for items that churn quickly. Operating heavier equipment that can go higher also requires wider aisles, which may somewhat negate any benefits, Gaganiaras added.

Konev said municipalities are often willing to push fully automated industrial facilities through the approvals process faster because of the promise of high-paying jobs for the area.

Gaganiaras said tenants are making their automation systems work in whatever space is available. In a market with more equilibrium, users would be seeking buildings with higher power availability and clear heights, and sufficient structural strength to manage conveyances at ground level and connected to the ceiling.

Sykes said automation is very expensive and users have to consider payback periods before making such investments.

“The challenge for a lot of these users on the automation side is their business could be quadruple or half, or they could be bought by somebody.

“So how do they go and invest in a 20-year payback automation system, not knowing that in five years they may need twice the amount of space? And then all of a sudden all that infrastructure’s just out the window.

“Automation is great, but it’s not the cure for even e-commerce.”

Scioli said many tenants are seeking three- to five-year leases and thus aren’t willing to invest in automation systems.

Traditional racking solutions offer flexibility via adding or subtracting staff to manage inventories, Gaganiaras noted, while automation is expensive fixed infrastructure but can continuously run at full speed.

Konev said tenants planning sophisticated automation will seek a design-built facility to incorporate it and offer built-in expansion capabilities. They’ll also lock in to 30-year leases.

Impact of ESG considerations

Fengate is a speculative developer focused on keeping costs down but still delivering quality, and Konev said many tenants aren’t willing to pay a premium for LEED-certified buildings. Sykes agreed, saying tenants are primarily focused on rents and when they can move in.

“If you truly want to future-proof your building and you’re OK to take a small return today, then work some of these things into your model,” said Sykes of LEED and other ESG initiatives.

“If it’s all about ‘What are my returns from Day One and will the tenants pay?’ I don’t think the tenants now will pay.”

Reid said all major institutional investors have ESG mandates for assets that will be held a long time.

Scioli said green buildings trade at a premium in Europe and he’s starting to see some demand for LEED-certified buildings by both tenants and some municipalities in Canada. He noted Panattoni is building class-A industrial buildings that are close to LEED status.

Source Real Estate News Exchange. Click here to read a full story