Author The Lilly Commercial Team

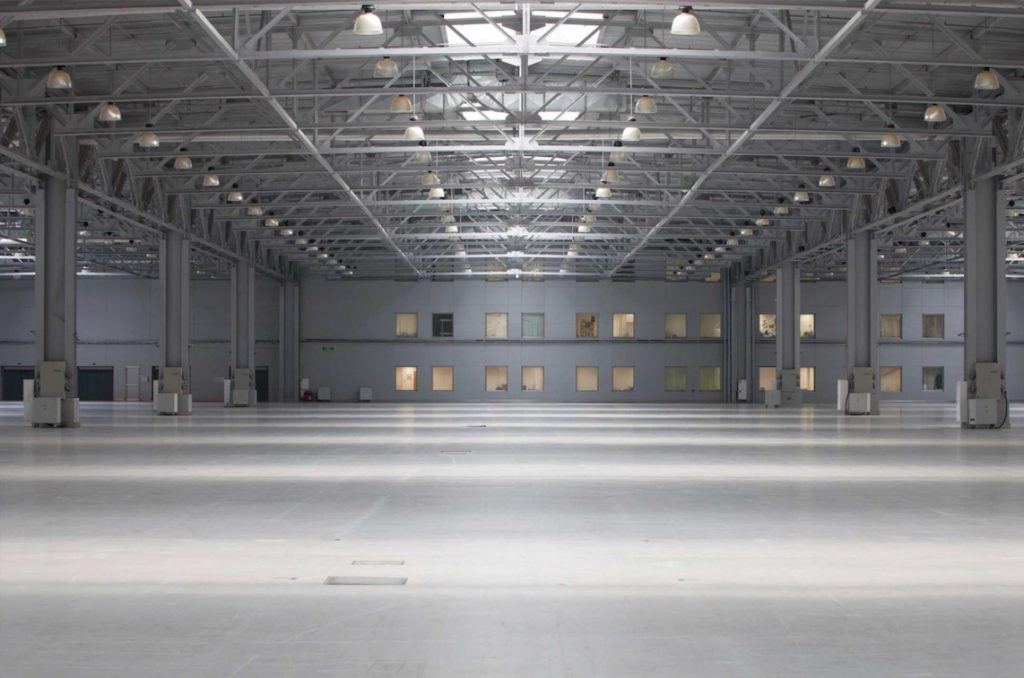

214 Carson Co. Builds Ontario Industrial Development Niche

Kris Carson’s entrepreneurialism has served him well over the years and he’s found another successful business with 214 Carson Co., which focuses on mid-sized industrial developments in Southwestern Ontario.

Carson has bought and sold a variety of businesses, and he made a handsome profit from buying BGI Retail in 2008 and selling it last year, after impressive growth, to TC Transcontinental.

His first building was constructed in 2013, when he started acquiring land, and a more focused effort on the 214 Carson enterprise began four years ago.

The company is involved with land acquisition, development, construction, site service work, facility maintenance, hardscaping, financing, mergers and acquisitions.

“We buy strategic and pad-ready land and typically build industrial class-A buildings ranging from 50,000 to 250,000 square feet,” Carson told RENX. “We don’t compete with the big guys that are doing 500,000 or more.

“We try to find them in three tiers of locations. Our tier-one locations are along the Highway 403 and 401 corridors. Our tier-two locations are along Queen’s highways, like Highway 24. Tier-three properties are in prestigious business parks that aren’t necessarily exposed to a secondary or major highway.

“We typically build and sell tier-three properties. We have a goal to get to two million square feet of rentable industrial assets. Once we get to that point, we’ll start to filter through and unload our tier-two stuff and replace it with more tier-one stuff.”

While the deal won’t close until October, 214 Carson has conditionally sold its first property: a 51,000-square-foot building in Brant County. A 120,000-square-foot facility built in Brant County in 2016 is going up for sale.

214 Carson’s portfolio

The Paris, Ont.-headquartered company’s properties are typically within a 45-minute driving radius of Brant County. Much of the land 214 Carson has acquired is from local municipalities and has ranged in size from four to 143 acres.

The company’s industrial land portfolio is comprised of 161 acres in Ingersoll, 26 acres in Brant County and 23 acres in Woodstock. It also owns 116 acres of residential land in Norfolk County.

The company has a strong relationship with CBRE senior vice-president and managing director Ted Overbaugh and his team members, whom 214 Carson relies on to source land and tenants for the facilities it builds.

Carson said the majority of its tenants are publicly traded Fortune 500 companies.

The company has several industrial developments under construction, including:

• adding 50,000 square feet to a two-year-old building in Brant County;

• a 51,000-square-foot building in Brant County;

• a 125,000-square-foot building in Brant County;

• demolishing a property on a three-acre parcel of land in Cainsville that’s being repurposed;

• a 151,000-square-foot speculative building in Woodstock;

• a 31,000-square-foot spec building in Woodstock;

• a 135,000-square-foot spec building in Woodstock;

• and a 120,000-square-foot spec building in Ingersoll.

Site plan approvals are also being sought for a 240,000-square-foot facility in Ingersoll and a 107,000-square-foot building in Woodstock.

Projects scheduled into 2029

The company has a development schedule, with land that’s already been secured, that goes into 2029. Since it works with many of the same tradespeople for its projects, that schedule is shared with them so they know what’s coming.

“Our goal is to maintain control of our business by being both the owner and landlord,” said Carson. “What makes us different from the next guy is that we control all of these things. We’re not chasing opportunities for projects.”

While 214 Carson does some residential development, its founder and president doesn’t consider the company to be a homebuilder. It’s a fast-growing operation, however, as its number of employees has risen from six last year to 31 now.

Carson said he doesn’t come from a privileged background, saying he was a sign installer as a teenager who made himself into an entrepreneur. He said he’s benefited from making good and timely business and investment decisions.

Land purchased at advantageous time

“We invested in land early so I wasn’t paying $1 million an acre, which is what we’ve got to pay today,” Carson said. “I was sometimes paying $25,000 an acre for 403-facing product.

“I’m looking at a parcel out my office window right now where I paid $125,000 an acre four years ago and could sell it for $1.2 million an acre right now.”

The industrial market remains strong and there’s plenty of activity in 214 Carson’s area of focus.

Carson said it took him more than a year to lease his first spec building in 2016, and now he’s getting six to 10 leasing inquiries within the first 30 days of a development getting underway.

With high land and construction costs, it’s more difficult for users to buy their own facilities. That opens up opportunities for 214 Carson, which constructs all of its buildings so they can be occupied by a single tenant or multiple tenants.

“We’ve created a breeding ground of facilities where we can put somebody in a 30,000-square-foot building and work with that tenant and grow them into a 60,000- or 90,000-square-foot building over windows of time,” said Carson.

Carson is an avid boater and fisherman who spends much of his summer leisure time at Turkey Point on Lake Erie, where he also owns vacation rental properties.

Carson 214 also owns a recently renovated luxury vacation property that can be rented in Great Exuma, Bahamas.

Source Real Estate News EXchange. Click here to read a full story

Soneil Buys Mississauga Ind. Portfolio, Office Bldg. For $86M

Soneil Investments has closed on two recent acquisitions in Mississauga, a five-property industrial portfolio on nine acres of land at the Dixie and Eglinton intersection, as well as a 150,000-square-foot office complex in the Meadowvale neighbourhood.

The transactions represent an $86 million investment – $46 million for the industrial assets and $40 million for the class-A office property at 2233 Argentia Rd.

“In a high inflation and rising interest rate market, strategically acquiring properties becomes even more difficult,” said Neil Jain, president and CEO of Soneil Investments. “We saw immense potential in the opportunity to fill vacancies, raise below market rents, and most importantly, capitalize on the location with a better use in the long term.”

The industrial properties, which closed last week, are located at 1331 Crestlawn Dr., 1330 Eglinton Ave. E., and 4700, 4800 and 4900 Dixie Rd. in an established industrial and commercial node.

They comprise a mix of small- and mid-bay buildings with building heights in the 18- to 24-foot range, Jain told RENX in an interview.

“We prefer the smaller tenants, the smaller and mid-bay stuff,” Jain explained. “Because of the location they’ve been able to use it as a quasi-retail type of use as well, which generally draws higher rents.

“Obviously the gap between retail and industrial has narrowed over time, but that also allows us to change some of the uses back over to industrial as time passes.”

Soneil’s acquisition of the industrial portfolio

The buildings combine for about 140,000 square feet, and the acquisition pushes Soneil’s portfolio over the four million square foot plateau. The buildings were constructed during the late 1970s and renovated just a couple of years ago.

The portfolio was acquired via a competitive bid process, which Jain said was occurring just as interest rates began to rise.

“It was interesting because during the time we were bidding, that was when interest rates really started to go up and the market started to change,” Jain said, noting private and public investors often have different risk profiles to consider.

“We were probably able to put in an aggressive offer at a time when people were unsure, putting their pens down from an investment perspective, similar to when COVID started.”

Jain said these situations, as long as lenders are on board, can offer private investors the chance to “jump on these opportunities pretty quickly.”

He said underlying the acquisition is the land itself, and that Soneil is a long-term investor.

“From a land perspective alone, this type of site is hugely valuable. One of the reasons that we are able to take on these types of sites is because if we are looking at it from a development perspective, our timeline isn’t necessarily five to seven years.

“Whenever the life of the buildings has run out, or it’s the right time to develop be it 10 years or 20 years, we are in it for the long haul.”

The 2233 Argentia Rd. office acquisition

The office acquisition involves a four-storey, multi-tenanted building in an established industrial and commercial district.

The building was constructed in the 1980s and renovated to become a BOMA 360 Performance Building about two years ago by former owner Crown Realty Partners, which sold the property on behalf of its third value-add fund.

Much of the surrounding real estate is occupied by industrial buildings, which was one of the attractions of the property, Jain said.

“This area of Mississauga, over time, will probably start to see shifts in what people are creating. Not a lot of people are looking to create too much office these days,” Jain said.

“It’s surrounded by a bunch of industrial assets; in the long term, whether it’s 10 or 20 years from now, industrial might be the right thing to build, or it might be something else. There’ll be a lot of potential once the life of this building runs out.

“But in the meantime there is a ton of life left in it . . . it’s a great quality building and it’s been maintained very well.”

Both the industrial and office acquisitions are well-tenanted, with occupancy at about 95 per cent.

The office property also has a large and diverse mix of tenants. While the more intensive management requirements of such buildings might turn off some firms, Jain said that was another attraction for Soneil.

“A lot of the class-A office in this area is the same size, but only split among three or four tenants. It creates a lot of concentration of risk, which is something we like to avoid, especially in office. This building has close to 25 tenants,” he said.

“These are the sorts of (assets) we are drawn to, because we have all those management and leasing capabilities in-house.”

Soneil owns over $1B in properties

Soneil, which surpassed the $1 billion mark in its holdings earlier this year, has now acquired about $180 million in assets during 2022. Jain said it’s on the lookout for more.

“I always like to say that our strategy is flexible in the sense that when opportunities come, as they did during COVID, that we can afford to be aggressive,” he explained, “but strategically aggressive.

“If the right opportunities come at the right price, that are financeable and make sense based on what our core beliefs are in terms of add value, we are very much always in the acquisition mode.”

Source Real Estate News EXchange. Click here to read a full story

GTA Industrial Market Vacancy Remained At Record Low In Q2

Would-be commercial tenants in need of industrial space have had a tough time finding it in the Greater Toronto Area — and there’s no relief in the immediate term as the latest vacancy numbers reveal the region is among the tightest markets in North America.

The second-quarter Industrial Market Report from Avison Young reports an availability rate of just 0.9% in the industrial rental sector, remaining virtually unchanged from the previous quarter — the lowest on record — and reflecting a 135% increase over the past five years. In fact, there are only 16 available properties in the GTA measuring more than 250,000 sq ft. New supply is also slow to come online; currently, there is a total of 15M sq ft. under construction, a decline of 700,000 sq ft. from Q1.

That’s resulting in favourable conditions for landlords, as rental rates have continued to climb, hitting $15.09 psf, up 11% from the previous quarter.

The GTA industrial market “remains a hotbed of activity,” reads the report, supported by strong fundamentals and a classic supply-and-demand imbalance; while a number of new building competitions came to market during the quarter, it barely made a dent, given 84% were leased prior to completion.

A total of 20 buildings, totalling 2.8M sq ft., were delivered between April and June, with 15M remaining under construction across 64 buildings by quarter’s end, 45% of which have already been leased.

However, buildings under construction “equate to a mere 1.7% of the GTA’s existing industrial stock, split between design-build (36%) and speculative (64%) developments,” says the report. Meanwhile, pre-construction developments total 50M sq ft. in 143 buildings across the GTA, with the GTA West market leading the way with 62% of pre-construction opportunities, followed by 20% in the North, and 9% each in the Central and East markets.

However, supply conditions should ease slightly in the coming years. According to Avison Young, there’s currently 65M sq ft. in the development pipeline over the next three years (including existing and pre-construction projects). Given this, “rising availability will likely provide more space options to a broader spectrum of industrial tenants compared with today’s constrained supply environment.”

While the GTA’s availability rate remained flat QoQ, overall space has been on the decline over the long term, down 7.1% from the first quarter of 2010. As well, demand for spaces 10,000 sq ft. has surged, especially among the logistics and distribution sector, making up 38%. Manufacturing companies account for 19% of leasing demand, followed by consumer goods and services (15%), and retail/e-commerce (13%) tenants.

The majority of investor demand for spaces 10,000 sq ft. and greater during the same time frame was driven by private investors (51%), followed by users (31%) and institutional investors (9%).

Notable large-block lease signings — a total of 11 with more than 100,000 sq ft. were inked during the quarter — include Pet Valu’s 670,500 sq ft. lease at 10750 Highway 50 in Brampton, Chrysler’s 513,500 sq ft. lease at 100 Edgeware Rd. in Brampton and Brimich Logistics & Packaging’s new deal for 467,500 sq ft. at 1330 Martin Grove Rd. in Etobicoke.

“Low availability rates have offset the high land values and construction costs evident in today’s market. Given the supply-demand imbalance, the consensus is for continued growth across the GTA industrial market for the foreseeable future,” reads the report.

Source Storeys. Click here to read a full story

In Vaughan Metropolitan Centre (VMC), the Final Structure Atop the High-Rise Portion of Menkes Developments and QuadReal Property Group’s Mobilio Was Recently Completed

As the last of the concrete was poured for the 13-storey south tower, employees and trades gathered in the retail space on the ground floor of the 18-storey east tower, for a “topping off” celebration.

The project first broke ground in June of 2020. Now, the three Turner Fleischer Architects-designed condominium buildings have all officially reached their final heights of 18, 15, and 13 storeys. Next steps for the buildings will include having cladding and glazing installed on their exteriors.

The east, west, and south towers will house 267, 232, and 186 units, respectively.

The rest of the Mobilio site includes three separate blocks of three-storey, two-bedroom and three-bedroom townhomes, which are currently in the early stages of construction southwest of the three condo towers. Some of the townhome residents will also enjoy rooftop terraces.

The Mobilio community is walking distance from the VMC transit hub, and will be located right next to a linear park, which is part of Vaughan’s Black Creek Renewal project – bringing a series of promenades, plazas and parks to the area, spanning over 30 acres.

Mobilio will be the first project in VMC to incorporate a mix of high- and low-rise housing types, park space, and amenities all in one site. The expected occupancy for the west tower is in Fall of 2022. The east and south towers will follow shortly thereafter.

Source Urban Toronto. Click here to read a full story

Choice Properties Income Up, But Takes Q2 Loss As Fair Value Dips

Choice Properties REIT reported an $11.8-million net loss in Q2 2022, but some positives were also revealed in the July 22 earnings conference call covering the three months ended June 30.

Choice (CHP-UN-T) reported six-month net income of $375.2 million, compared to $22.4 million for the same period a year earlier. Net operating income (NOI) increased by $8.2 million and $15.9 million through three and six months, respectively, year-over-year.

Choice reported a net fair value loss on investment properties of $522.3 million on a proportionate share basis as fair value declines in the retail portfolio – due to capitalization rate expansion from rising interest rates and economic volatility – were partially offset by gains in the industrial portfolio and certain development properties.

The REIT anticipates rising interest rates may put further downward pressure on the fair value of properties in the second half of 2022.

Choice also recorded a $158.7-million unfavourable adjustment to the fair value of its investment in real estate securities of Allied Properties REIT, due to the decrease in Allied’s unit price.

These were held pursuant to its sale of six office properties to Allied in the first quarter of 2022.

Choice issued $500 million of unsecured debentures in the quarter to increase its liquidity position and further stagger its debt maturity profile.

It ended the quarter with a strong liquidity position, with approximately $1.3 billion of available credit and a $12-billion pool of unencumbered properties.

Improved occupancy at Choice properties

Overall occupancy in the quarter improved to 97.6 per cent, reflecting 420,000 square feet of positive absorption. Retail occupancy was 97.5 per cent, industrial was 99.2 per cent and mixed-use, residential and other properties were 87.5 per cent.

Choice’s portfolio is primarily leased to necessity-based tenants and logistics providers that are less sensitive to economic volatility and therefore provide stability.

“We continue to see strong new leasing velocity and tenant retention driven by increased consumer spending, retailer confidence in opening new locations and continued demand from industrial users,” executive vice-president of leasing and operations Ana Radic said during the call.

Choice completed 517,000 square feet of new leasing and renewed 1.3 million square feet of its 1.4 million square feet of lease expiries, at an average spread 7.8 per cent higher than expiring rents, during the quarter.

Office properties no longer core to portfolio

Choice decided in 2021 to focus on the opportunities available in its core business of essential retail and industrial properties, its growing residential platform and its development pipeline.

That led to the sale of six office properties to Allied and office no longer being a stand-alone asset class in the REIT’s reporting.

“The size, quality and growth potential of our industrial portfolio contributed to a strong operating performance in the quarter,” said president and chief executive officer Real Diamond.

“Our 17.4-million-square-foot industrial portfolio includes large, purpose-built distribution facilities for Loblaw as well as high-quality generic industrial assets which can accommodate a wide range of tenants.

“We have significantly embedded growth in our industrial portfolio, with non-Loblaw tenants representing two-thirds of NOI, with leases being on average 40 per cent below market.”

Subsequent to the second quarter, Choice and Loblaw Companies Limited renewed 42 of 44 retail leases from the initial public offering portfolio that expire in 2023.

They comprise 2.9 million of 3.1 million square feet at a weighted extension term of 7.7 years. The average rent increased by five per cent.

The two leases not renewed are both for vacant stores in Quebec that Radic said have “great redevelopment potential.” Choice is working with Loblaw with regards to the two stores and plans to reveal plans shortly.

Choice’s approximately 44-million-square-foot retail portfolio “is one of the best-performing in the Canadian REIT industry,” according to Diamond.

Q2 acquisitions and dispositions

Choice completed $211.3 million worth of acquisitions and $16.6 million of dispositions during the second quarter.

The REIT acquired an 85 per cent interest in an additional 97-acre land parcel in Caledon, Ont., which was part of an existing industrial development project totalling 380 developable acres, for $86.7 million.

“We are currently working through the rezoning process with the Town of Caledon to permit a total of approximately 5.5 million square feet of industrial space,” said Diamond.

Choice acquired a 75 per cent interest in 154 acres of industrial development land in East Gwillimbury, Ont. for $52.8 million by exercising the equity conversion option on a mezzanine loan advanced to Rice Group.

Both Caledon and East Gwillimbury are at the northern edges of the Greater Toronto Area.

The REIT completed the acquisition of strategic retail assets in Halifax and Burlington, Ont. for $57.3 million.

Choice acquired its partner’s 50 per cent interest in an industrial building in Edmonton for $14.5 million, bringing its interest in the building to 100 per cent.

The REIT sold a non-core retail asset and a development land asset for $16.6 million.

Development activity

Choice invested $19.7 million of capital in development on a proportionate share basis during the second quarter and transferred $16 million of properties under development to income-producing status, delivering approximately 108,000 square feet of new gross leasable area.

The REIT has a mix of active development projects ranging in size, scale and complexity, including retail intensification projects, industrial development and rental residential projects in urban markets with a focus on transit accessibility.

Choice continues to progress on the construction of two high-rise residential projects, one in Brampton, Ont. next to the Mount Pleasant GO Transit station, and the other in Ottawa’s Westboro neighbourhood.

The REIT has three active industrial development projects that it expects will deliver 1.5 million square feet, at share, of new generation logistics space in the near to medium term.

An industrial project at Horizon Business Park in Edmonton, comprising two buildings totalling 300,000 square feet, is progressing. Occupancy of the first building is underway and substantial completion and occupancy of the second building is anticipated in the second half of 2023.

Choice commenced construction of a 300,000-square-foot modern logistics facility in a prime industrial node in Surrey, B.C. that’s expected to be completed in the second half of 2023. Leasing is anticipated to be done before that time.

The plan for the East Gwillimbury property is to build a multi-phase industrial park with approximately 1.8 million total square feet of new-generation logistics space.

For the first phase, Choice has entered into an approximately 100-acre land lease with Loblaw, which intends to build a 1.2-million-square-foot, automated, multi-temperature industrial facility. Site preparation is underway.

“We believe that, over time, we have the ability to significantly increase our industrial portfolio through development,” said Diamond.

Choice also has a substantial pipeline of larger, more complex mixed-use developments and land held for future industrial development.

It’s advancing the rezoning process for several mixed-use sites, with 11 projects representing more than 10.5 million square feet in different stages.

Net-zero targets approved

Finally, the Science Based Targets initiative (SBTi) has validated Choice’s greenhouse gas emissions reduction targets, making it one of the first entities in Canada to have net-zero targets approved by the SBTi.

“Fighting climate change is fundamental to our purpose of creating enduring value for all stakeholders and we are proud to deepen our environmental commitment with these targets,” said Diamond.

Source Real Estate News EXchange. Click here to read a full story

Ahmed Group Sees Opportunity In Mississauga, Plans Dundas Towers

Ahmed Group of Companies, a family-owned real estate investment firm, has launched its latest proposal for a purpose-built rental development in Mississauga as the company continues to expand its reach in the multiresidential market.

President and CEO Moe Ahmed told RENX there will be more to come.

The proposed development at 1000 and 1024 Dundas St. E. would include towers of 16 and 20 storeys over a four-storey podium that would bring a total of 462 rental units to the market.

Ahmed said the Region of Peel, and much of Ontario, is in the midst of a housing supply crisis. He said Canada needs 5.8 million new homes by 2030 to tackle the situation and the majority of the supply gap is found in Ontario.

“We hope that our project will (help) address the housing crisis by delivering essential rental housing to the residents of the City of Mississauga,” said Ahmed.

“Few places have been more impacted by the housing crisis in this country than the City of Mississauga. We’re looking at a shortage of 200,000 rental units over the next decade, according to the Federation of Rental-Housing Providers of Ontario.

“Mississauga is a rapidly growing city, home to more than 700,000 residents, many businesses, the airport, post-secondary institutions and many more. A lot of people around the country don’t know about Mississauga. Similarly to us, it’s flown below the radar.

“Mississauga is the largest city in the region (surrounding Toronto). The largest city in the GTA – the third-largest in Ontario, the sixth-largest in Canada, so we’re very optimistic.”

Ahmed wants to break ground in 2024

Ahmed said the company intends to break ground on the project in 2024 and anticipates having occupancy ready for residents in late 2026.

Once completed, the transit-oriented, mixed-use development will feature one-, two- and three-bedroom apartments, green space, improvements to the public realm, community space and an urban farm.

The development, designed by WZMH Architects, is envisioned as a walkable community with a pedestrian-focused experience. It will also offer ground-level commercial space for retail and office use to support current and future businesses in the area.

Landscape architecture has been designed by the IBI Group Landscape Division.

Ahmed said the region has taken important steps to guide future urban growth and intensification, including a proposed bus rapid transit (BRT) system along Dundas Street.

The four levels of government have invested about $675 million to support transit initiatives in Mississauga. A new bus rapid transit system would create a new, stronger connection to Toronto.

“We have a BRT station right at the intersection (of the proposed rental development) on both sides of it. We think it’s a fantastic location, a very promising location and a location that’s going to be gentrified very quickly.”

Three facets to Ahmed Group

The Ahmed Group of Companies’ primary objective is to invest in the development and construction of Canadian real estate. The group consists of three primary subsidiaries: Ahmed Holdings, Ahmed Developments and Ahmed Asset Management.

The development arm of Ahmed Group has a pipeline of over $1 billion in completed value and the asset management arm has nearly $60 million in assets under management.

The Ahmed Group is involved in the development of over 1.5 million square feet of new purpose-built rental construction across Ontario.

“We have three main businesses. We have a real estate development business, we have an asset management business and we also have a holding company where we manage our own properties, our own portfolio,” said Ahmed.

The group traces its origins back to 1966 in Edmonton when the late Dr. Hashim M. Ahmed put down roots and established his real estate investment business. Originally from Hyderabad, India, Dr. Ahmed was among the first Hyderabadis to migrate to Canada in the early ’60s.

The Ahmed Group also has additional projects at various planning and proposal stages in the Queen and Main, Dundas and Confederation, and Mississauga Road and QEW areas of the city.

Developments to focus on purpose-built rental

The developments will be geared toward the purpose-built rental market, further addressing Mississauga’s growing housing needs with the objective to support transit equity through bicycle facilities, walking paths and mass transit connections, Ahmed added.

“As city builders, we have a corporate social responsibility to help create more attainable rental housing options and contribute to the revitalization of neighbourhoods,” Ahmed said.

“Healthy, transit-oriented communities are an essential tool in building a thriving Mississauga. We take pride in our responsibility of developing new rental units that will enrich the lives of people in the community.”

He said more details about those projects will be coming in the near future.

“One is very large and it’s also along the Dundas corridor. We are a very adamant supporter of the intensification of the corridor. But we do have other projects in the city,” he said, adding the company would be developing more than 1,000 rental units.

“The projects will be geared toward the purpose-built rental market . . . Mississauga needs these projects. There’s a housing crisis. We need to be building more.”

In a recent press release, several businesses and landowners from the Dundas Street corridor, including the Ahmed Group, announced they were pleased by Peel Region Council’s July 7 decision to remove the lands south of Dundas Street East from Employment Areas and allow for residential mixed-use developments.

This decision came despite Mother Parkers Tea & Coffee Inc.’s recent attempt to roll back planned land-use changes and maintain the lands’ designation as Employment Areas.

Ahmed said a Land Use Compatibility Study conducted by Rowan Williams Davies & Irwin Inc., affirmed that the residential mixed-use redevelopment of Ahmed Group’s lands would be compatible with Mother Parkers’ operations.

“Peel Council’s decision means we can build a true transit-oriented community where businesses operate, people work and families live,” Ahmed said.

Source Real Estate News EXchange. Click here to read a full story

The Pitfalls Of Verbal Commercial Real Estate Negotiations

There are limited occasions where it can be an acceptable strategy, when it has become necessary to finish a deal. But often it is not a viable solution; often it can result in causing hard feelings between parties to the negotiation and, at worst, blowing up the deal entirely.

Typically I’d categorize a verbal offer as more of a fishing expedition that is far less likely than a written contract to lead to a transaction that closes.

When it can work, why to avoid it

There are occasions when an in-person meeting between parties can result in finalizing a complex negotiation.

If most of the terms of an offer have been hammered out on paper, and there is clear motivation between both parties to complete a deal, I will sometimes recommend an in-person meeting.

It can work if the conversation is solution-focused and properly facilitated.

I want some compatibility between the parties that come to the table and do my best to stay clear of a meeting where that compatibility does not exist.

I had a situation a couple of years ago where a landlord insisted on being present during a pitch to a potential corporate tenant. A couple of well-intentioned statements that individual made during the meeting eliminated any hopes of securing this corporation as a tenant.

Risk of a misunderstanding

A quick review of a standard offer to lease reveals about 15 details that are likely to be overlooked in a verbal negotiation. It’s easy to start a business relationship on the wrong foot by forgetting to talk about essential elements of a deal.

Both parties can walk away feeling like they have an understanding only to find out when the paper gets drafted that too many details were left out of the discussion that materially impact the transaction.

When negotiating a lease with third-party management in place, I’ll ask the property manager to review the offer before proceeding.

There can be issues such as the number of electrified or non-electrified parking stalls available to contract for staff, exclusive use clauses that may have been previously negotiated by other tenants in the development, or a first right of refusal may have been granted to adjacent tenants.

The list of essential considerations is long.

And, finally, have I been granted the authority to negotiate if the client I’m representing isn’t present?

Where there are only one or two elements to discuss, obtaining that authority from my client before a discussion is easy.

If, however, there are many elements to be determined, I simply can’t engage in the negotiation unless I have a written power of attorney.

Source Real Estate News EXchange. Click here to read a full story

The Greater Toronto Area Created The Most Tech Employment Growth On The Continent In The Past Five Years: Report

Canada’s three largest cities all improved their rankings in CBRE’s Scoring Tech Talent 2022 report of North American cities, including Toronto which is now No. 3 on the list.

The Greater Toronto Area created the most tech employment growth on the continent in the past five years, the report states. The commercial real estate firm’s report said Toronto added 88,900 jobs in the tech sector between 2016 and 2021 – more than any of the 50 North American markets surveyed.

It moved up one spot in the rankings from a year ago.

In the overall ranking, the San Francisco Bay area was first followed by Seattle and then Toronto. Vancouver was the only other Canadian market in the top 10 as it jumped three spots in the ranking to take No. 8, adding 44,460 jobs in that same five-year period, or 63 per cent growth, the highest percentage of all 50 ranked markets.

Ottawa, with the highest concentration of tech talent on the continent – 11.6 per cent of the city’s total employment force – took No. 13 in the tech talent ranking, while Montreal moved up a spot to No. 15. Waterloo Region (No. 24), Calgary (No. 28), Edmonton (No. 35) and Quebec City (No. 39) also made repeat appearances in the Top 50.

“Canadian markets continue to be among North America’s top-performing destinations for tech talent, with 11 cities well-positioned in the latest CBRE rankings. It’s a testament to the impressive momentum this sector has been gathering over the past five years,” said Paul Morassutti, CBRE’s vice-chairman.

Tech growth not just a Toronto story

“Though the industry faces some very real, short-term cyclical challenges, our longer-term thesis remains unchanged: the technology sector will continue to drive outsized growth as our knowledge- based economy expands.

“Canada’s digital economy is now bigger than the forestry industry, the mining industry, the natural gas industry.

“This expansion of the knowledge-based economy is not unique to just Toronto. It really has taken hold in many cities across the country. It’s one of the really nice success stories that this is not simply a Toronto story.

“It’s very much a Canada story and when you look at the different markets there are different areas of specialty in each market.”

For example, Montreal and Quebec City are well-known for gaming technology. Toronto and Edmonton are well-known for companies dealing with Artificial Intelligence.

Software development is a specialty in Vancouver, while oceans-related technology is emerging as an important sector in Halifax.

“There’s this nice balance of tech expertise across the country and even in places like Calgary, where traditionally so much of their economy has been focused on the energy sector, increasingly we’re beginning to see that Calgary’s made really great strides as well,” said Morassutti.

“Since 2016, about 750,000 square feet of tech office space has been leased in Calgary and 70 per cent of that has happened since 2020.

“So they are making pretty good strides in helping to attract these companies.”

Schools, universities producing tech talent

In Toronto, the total number of tech occupations is 289,700 with a five-year growth rate of 44.3 per cent. The average wage of $88,254 has seen 7.4 per cent growth over five years.

Morassutti said the tech ecosystem in Toronto has been developing over the last decade “of really being almost best in class.”

“When I talk about the tech ecosystem I mean the combination of really good quality post-secondary schools or universities that produce a lot of tech talent . . . the accelerators like MaRS (Discovery District). There’s a number of tech accelerators in the city which almost act as breeding grounds for small startups,” he explained.

“And then you have the interplay of large tech behemoths who are already in the city and smaller tech startups that the genesis of those companies is often talent coming from those large tech companies.

“You have a very evolved venture capital tech ecosystem in Toronto. . . . You put all of those things together and Toronto has sort of slowly and steadily moved into this position of being a true tech powerhouse.”

In the CBRE report, tech talent is defined as 20 key tech professions – such as software engineers and systems and data managers – across all industries.

The Scoring Tech Talent report ranks top tech markets in the U.S. and Canada and outlines the industry’s job-growth trends amid economic shifts and increased remote hiring.

Scoring Tech Talent report analyzes 13 factors

The report analyzes 13 measures of their ability to attract and develop tech talent, including tech graduation rates, tech job concentration, tech labour pool size, and labour and real estate costs.

CBRE also ranks the Next-25 emerging tech markets on a narrower set of criteria. Halifax (No. 9), London (No. 10) and Winnipeg (No. 12) made repeat appearances on this list, with London seeing 99 per cent growth, or a doubling of its total tech employment, between 2016 and 2021.

Morassutti said the commercial real estate firm began conducting deep research into the tech sector because it identified many years ago the connection between the growth of the sector and the use of office space.

“When you look at office-using jobs for example, over the last decade the amount of tech-related office-using jobs is more than double than all of the other office-using job growth combined,” he said. “A lot of that growth has been in the Googles and Facebooks of the world.

“A lot of it has been in smaller tech companies, but then a lot of it has been in banks and insurance companies and real estate companies where so much of the hiring has really been tech people.

“Every company needs this talent and this has been what’s driving the office market and demand for office space, and given some of the challenges that the office market has we want to understand the tech industry as best we can because despite the short-term challenges that the industry has – it’s going to be a choppy year for tech.

“Long-term we think this expansion of the knowledge-based economy and the digital economy is still in its early stages and technology will continue to drive demand for office space, or at least the primary driver of demand for office space.”

Source Real Estate News EXchange. Click here to read a full story

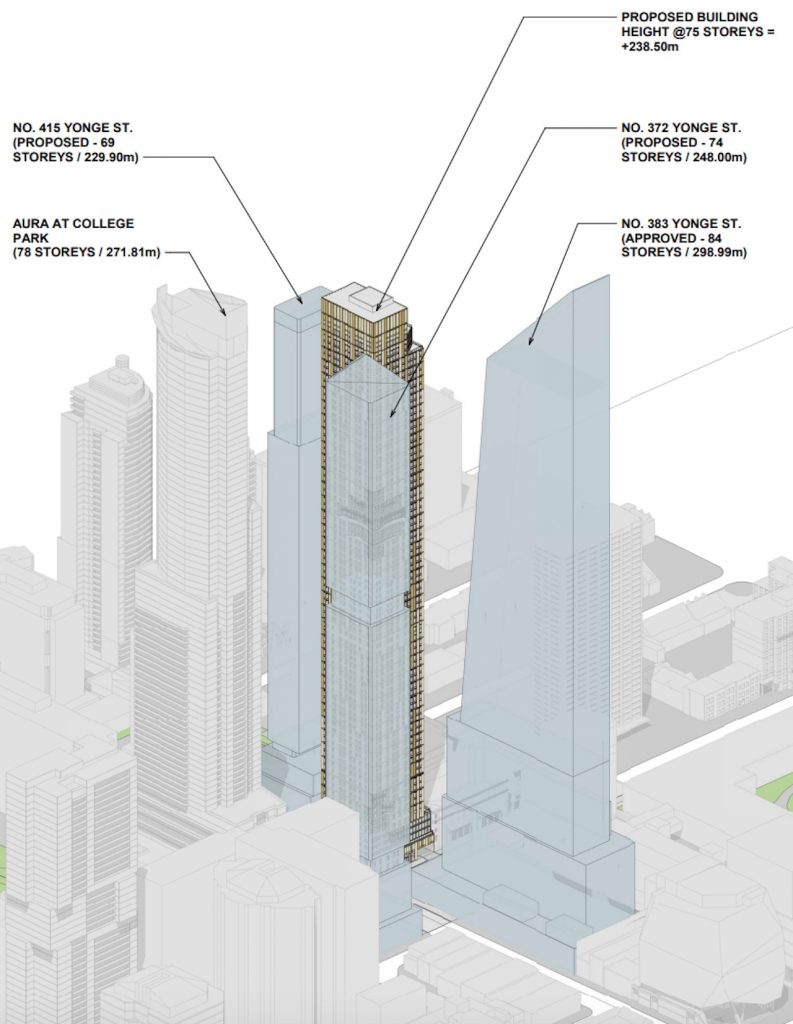

Capital Developments Proposes 75-Storey Tower at Yonge and Gerrard

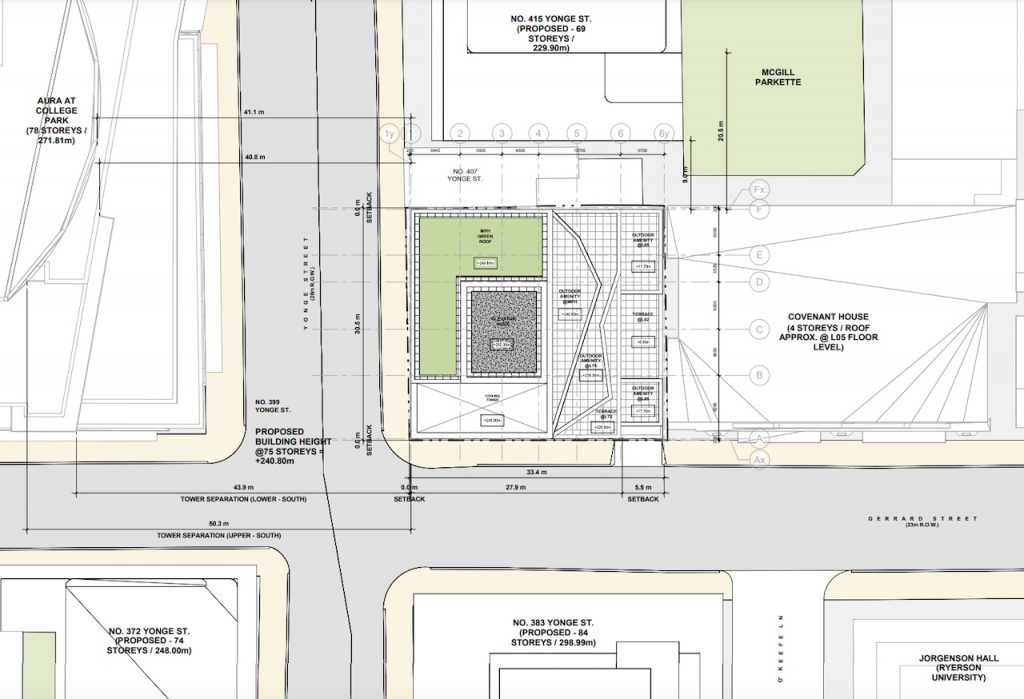

Zoning By-law and Site Plan Amendment applications have been submitted to the City of Toronto by Capital Developments, which is proposing to construct a 75-storey condominium and retail tower at 399-405 Yonge Street, located on the northeast corner with Gerrard Street in the city’s Downtown.

The proposed tower, designed by Teeple Architects, would join the existing 78-storey Aura at College Park at the intersection’s northwest corner, and the under-construction 85-storey Concord Sky at the southeast corner of the two streets. At the southwest corner, 372 Yonge is still awaiting approval, proposed to stand 74-storeys tall. More similarly tall buildings are proposed on neighbouring sites.

The building’s architecture mostly frames pairs of punched windows in two-storey segments, with certain vertical piers emphasizing the height staggered through the rise of the building, while there are also three areas of interruption in an otherwise gridded exterior; at the base, at about 50 storeys up, and finally against the crown. Various corners at these three locations would have sections of exterior wall deviating from the grid as a visual tease.

Currently, the site is occupied by several three-storey commercial properties: those at 401 and 405A Yonge Street are listed under Part IV of the Heritage Act, although not designated. All of the buildings would be demolished to make way for the proposed tower. The retained heritage facade of 401-405A Yonge Street would be maintained and integrated into the podium building facade along Yonge. See in the image below at left, the facade would be integrated where the white space is pictured two images below.

To the immediate east of the site is Covenant House, which takes youth in off the streets, and run by a non-profit organization which, according to submitted documents, will continue to be consulted with as part of the ongoing planning process. To the north, separated from 399 Yonge by a single two-storey structure at 407 Yonge, is 415 Yonge, another recent proposal which includes the replacement of the existing 19 storey office development with a 69 storey mixed-use tower.

Proposed at 75-storeys, the mixed-use 399 Yonge would contain a total of 828 units, along with retail and service commercial space at-grade, within a four-storey base building. The development would consist of of 53,602m² of residential gross floor area (GFA) which would result in a Floor Space Index (FSI) of 51.6 on the lot.

The proposed unit mix is 73 junior one-bedroom units (9%), 426 one-bedroom units (51%), 243 two-bedroom units (29%), and 86 three-bedroom units (11%).

Amenity space would be found in a number of location throughout the building, particularly on floors 2, 5, 49, and 75. In most cases, indoor amenity space on those levels would be contiguous with terraces. Generally, balconies are not planned on the building, but a few suites would have terraces related to the sections where the exterior deviates from the grid.

The site is within walking distance of College and Dundas subway stations. The site is served by bike routes with dedicated lanes along College Street, Gerrard Street, and Sherbourne Street.

Bicycle parking spaces for long-term use is located below grade and on the mezzanine level, and short-term parking spaces are located at street level. A total of 844 bicycle parking spaces are provided for both residential and non-residential uses. The proposed driveway access to the loading and underground bicycle parking area would be located along the eastern boundary of the site, immediately west of and adjacent to The Covenant House at 20 Gerrard Street. The driveway would solely be for bicycles and service vehicles as there are no resident motor vehicle parking spaces proposed within the building.

We will continue to follow progress on the development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread, or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

Commercial real estate investment in Canada is experiencing a major resurgence in confidence: Altus Group report

Commercial real estate investment in Canada is experiencing a major resurgence in confidence, with an Altus Group report chronicling $23.8 billion in Q1 transaction activity.

The real estate analytics and research company said that figure, transacted across all major asset classes in Canada during Q1 2022, is a 52 per cent hike from Q1 2021. Deal volume was up across all major asset classes with the exception of hotel transactions.

Just over 3,250 transactions were completed in the first quarter of 2022, a 25 per cent increase compared with the same period of 2021.

“The Canadian commercial real estate industry demonstrated resiliency throughout 2021, investment activity kicked off 2022 with an upswing in momentum,” the report states. “All asset classes reported an increase in activity (with the exception of hotels) accompanied by a return in investor confidence, the market was also subjected to heightened investor scrutiny.

“This closer analysis can be attributed to rising interest rates, volatility catalyzed by the pandemic, and the impacts of the current geopolitical climate.

“The most active asset classes in the first quarter of 2022 involved transactions of industrial and office assets as well as both ICI and residential land. A combination of excitement and tentativeness characterized 2022 with a note of cautious optimism and anticipation of growth in Canada’s commercial real estate space.”

Confidence in Canada’s CRE market

Raymond Wong, vice-president of data operations for Altus’ data solutions division, said overall there is a fair degree of positive confidence in investment in the CRE market.

“We can see that with the first-quarter results and granted, also realize that a lot of the first-quarter activity was based on overflow from 2021,” said Wong. “Then we got hit with the Ukraine war, we got hit with higher interest rates.

“So now the numbers have changed to a certain extent. Construction costs are now higher. The cost to borrow is a little bit higher and real estate is still performing quite well on the industrial and multifamily side, but I think now we’re looking at more scrutinization of those numbers.”

He said there are a number of potential questions in play.

“What are the expectations on returns, as well what are the expectations between the purchasers and vendors?” Wong explained. “Has that changed? And, whether or not that may cause a bit of a pause in the marketplace as people get caught up with the new numbers, as well as where we’re going with inflation and employment activity and the question of a possible recession.”

Andrew Petrozzi, director, commercial research, Western Canada, for Altus Group, said the market has seen and continues to see, a strong demand for land, particularly in Vancouver, and an increasing demand for land in Alberta.

“Industrial remains a very strong asset class, both in the West, in both Alberta and B.C., particularly you are seeing increased demand for industrial in Calgary and industrial in Vancouver remains red hot as well. In Edmonton you’re actually starting to see an increase in demand, particularly around the multifamily side,” he said.

“You’re seeing a recovery of sorts in Alberta. Part of that is fuelled by probably some of the conflict obviously in Eastern Europe. Higher energy prices do translate generally to a more positive outlook for Alberta and when people have a positive outlook for Alberta that increases confidence and we have seen that confidence reflected in the early part of the year and certainly in late 2021 and into 2022 as well.”

Office sector investment doubles

According to the Altus data, the office sector was quite active with just over $3 billion in sales activity – almost double the investment volume registered in Q1 2021 – securing its place as the asset class with the strongest growth year-over-year in dollars invested.

With 245 transactions conducted in Q1 2022 accompanied by people beginning to go back into the office, investment in the office sector is resurgent.

This resumption in activity was also a reflection of negotiations that were paused in the second half of 2021 now coming to fruition, according to the report.

“The industrial sector recorded the highest investment volume in terms of both dollars and the number of transactions. In the first quarter of 2022, the industrial asset class saw 735 transactions valued at slightly less than $5.8 billion, a 66 per cent increase when compared with Q1 2021,” said the report.

“The land sector remained very active in the first quarter of 2022 registering 643 ICI land sales and 553 residential land deals, a 26 per cent and 30 per cent increase in the number of transactions, respectively, from the same period in 2021.

“Land transactions represented more than $8.9 billion in investment volume, an increase of more than 110 per cent compared with the same period last year, which totalled 36 per cent of all transactions across all of the asset classes to the end of the first quarter of 2022.”

“Investment in the retail and apartment sectors also continued to demonstrate growth, reporting a 24 per cent and five per cent increase in the transactions completed, respectively, year-over-year.

“The national investment in retail properties grew 55 per cent and was valued at $2.6 billion in the first quarter of 2022; more than $3.1 billion – an eight per cent increase compared with a year earlier – was invested in the Canadian apartment sector.”

Nationwide interest in land

Wong said the nationwide interest in land is positive.

“That shows that there is overall confidence going forward and a lot of the owners and developers are banking on future growth and the need for housing. Industrial has always been the sort of silent (asset class) but every year it produces good returns.

“With the pandemic it just accelerated that demand and to a certain extent Canada is still under-warehoused, especially compared to the U.S.,” said Wong.

“So you have a very good increase in rents especially for the last seven years – 10 to 20 per cent depending on the building. We have very strong returns and you always had an active market both from the user standpoint as well as from the investment standpoint.

“Over the last couple of years, we’ve had a stronger increase in demand from investors, driving up the price, and I think that’s caused some of the users to step back a little bit. There’s been very strong investment activity from institutions as well as private investors coming into the industrial side.”

Wong added that the office sector has come back. It has been a bit of a grey area recently with more people working remotely on a regular basis, or the adoption by some companies of hybrid work models.

“The good news is that for office there’s still a certain level of confidence with the number of people that have stepped up. . . . Yes, residential and industrial is getting a lot of that attention, but office is not dead yet,” he said.

“I think we can still see an evolution and by the level of investment activity, there are buyers for the office assets.”

Petrozzi said land is severely constrained in B.C. both for industrial and residential real estate.

“Land has always demanded a bit of a greater premium in British Columbia as a result of our geographical and political boundary constraints,” he said. “As a result, that supply has continued to tighten which is another modifying factor adding on to this increased demand. . . .

“That’s one of the reasons you’re seeing a kind of rush for land – try to get it while you can.”

Toronto, Vancouver, Montreal top markets

According to Altus Group’s Investment Trends Survey for the first quarter of 2022, the most preferred markets by investors were Toronto and Vancouver, followed closely by Montreal. All three markets reported an upswing in their momentum ratio, which calculates the percentage of buyers over the percentage of sellers.

Food-anchored retail strips, suburban multiple-unit residential and industrial land were the Top-3 most preferred products by investors.

This is consistent with similar trends noted in 2020 and 2021 that can be attributed to the essential nature of the assets as well as the flexibility these property types offer with potential for redevelopment in a time of constantly evolving consumer needs.

“National overall capitalization rates continued to compress across all major asset classes in the first quarter of 2022 with the exception of industrial assets. This may be driven by the rise in interest rates and the related impact on consumer spending, thereby reducing demand for manufacturing/distribution facilities,” the report states.

“However, the impact of rising interest rates is expected to be minimal in the first half of 2022 as transactions were negotiated prior to the change in interest rates, but will become more apparent in the second half of the year. Industrial assets will continue to remain a favourite with investors as supply lags absorption.”

“As investment in all asset classes (except hotels) registered strong performance in the first quarter of 2022, the Canadian commercial real estate industry appears poised for continued growth through the year with some caveats.

“Interest rate hikes, combined with the ongoing impact of a volatile geopolitical environment and the lingering aftermath of pandemic containment measures, will become more apparent as the year progresses and may constrain select investment activity.”

Source Storeys. Click here to read a full story