Author The Lilly Commercial Team

Gen Zs Interested in the In-Office Experience, New Survey Finds

The return to in-person office work has been met with very mixed feelings. While some employers have pushed to get people back at their desks, many employees have pushed back. However, a new survey finds that Gen Zs are something of an outlier; they’re more interested in the in-office experience than their generational counterparts.

This is according to the 2022 Canadian Workplace Survey from the Gensler Research Institute, Gensler’s global research arm, which attributes the younger generation’s desire to be in the office to a “pent up demand for learning and career development opportunities.” The survey also finds that 43% of Gen Z respondents report coming into the office to access technology, 42% to attend meetings, and 39% to access specific spaces, materials, and resources.

Gensler’s research also explores why employees of other generations are motivated the return to the office, how the office can more effectively support them, and the strategic mix of design solutions and experiences that will accelerate their return.

Generally speaking, employees are open to returning to the office more frequently, “but only if the workplace offers the right experiences,” the research stipulates. “The quality of their office environments is holding them back.”

The survey finds that 24% of employees would be willing to return to the office full-time if provided a range of workspaces, while 42% would be willing to add an extra in-office day to their weeks. Diversifying the in-office experience stands to not only appease employees, but improve productivity at a time when the workplace’s effectiveness for focused work is at a 15-year low.

In addition, Gensler’s research shows that employees in high-performing workplaces are almost twice as likely to have a positive experience in the in-office format, citing benefits to personal well-being, career advancement, and job satisfaction. As such, those in high-performing workplaces express more willingness to return to in-person office work more regularly, suggesting that “the workplace can be a critical tool for talent attraction and retention.”

Source Storeys. Click here to read a full story

Blackstone To Buy Toronto Warehouse Portfolio For Over $400M

New-York-based Blackstone Real Estate has entered into an agreement to purchase six industrial properties in the Toronto area for more than $400M.

The properties’ locations have not yet been publicly disclosed, but are said total 1.5M sq. ft and are fully occupied, having traits seen as desirable to tenants such as being newer builds, having higher than average heights, and being in core infill locations.

“Global logistics is one of our highest conviction investment themes, and high-quality, last-mile industrial properties like these continue to benefit from some of the strongest real estate fundamentals in Canada,” Janice Lin, Blackstone’s Head of Canada Real Estate, said in a statement to STOREYS. “We look forward to continuing to grow our logistics portfolio, while supporting the supply chain in Toronto and providing best-in-class real estate to our tenants.”

The sale represents one of the largest private industrial portfolios to change hands in Canada since Blackstone’s 2018 privatization of Pure Industrial Real Estate Investment Trust — a transaction valued at $3.8B.

Although the seller has not yet been confirmed, a report from Bloomberg identified the the party as the asset-management arm of Toronto-Dominion Bank, according to an anonymous source. TD did not respond to a request for comment by the time of publication.

Even as Canada’s real estate market saw volatile fluctuations, the demand for industrial properties has remained strong, especially in the Greater Toronto Area. Last month, Thomas Cattana, Vice President at Colliers, said that Toronto-area vacancy rates are the lowest they’ve been in recent memory.

“If you look back 10 years ago, the availability rate would have been a number around 5%, and today that availability rate as of Q3 2022 is less than 1% — it’s 0.7%,” Cattana told STOREYS.

Source Storeys. Click here to read a full story

Adapt or Die: Why Converting Offices Into Homes Hasn’t Taken Off in Canada

Reduce. Reuse. Recycle. We all know these concepts as it relates to waste, but did you know they can be applied to buildings too? When it comes to real estate, they’re deeply-intertwined in what’s called “adaptive reuse.”

The concept is simple: take a building that’s run its course and convert it into something that suits the needs of the current time. Not only does this make use of a neglected or empty building, the companies that own and operate these buildings can also continue benefiting from their initial investments and save significant amounts of money they would otherwise need to spend on constructing an entirely new building.

One of the earliest examples of adaptive reuse also happens to be one of the most famous buildings in the world: The Louvre. Built in the late-12th to 13th Century under King Philip II, the Louvre was originally built as a defensive fortress for France. It was then converted into a residence in the 14th Century by King Charles V, and then became a residence for artists after King Louis XIV chose Versailles as his residence in 1682. The Louvre made its final transformation about a century later, opening in 1793 as the Musée du Louvre, now the most-visited museum in the world.

Over on our side of the pond, one of the first notable examples of adaptive reuse in North America was Ghirardelli Square in San Francisco. According to the Cultural Landscape Foundation, in the 1960s, architects Lawrence Halprin and William Wurster converted what was then a one-block plot with a chocolate factory into a shopping and tourist destination that’s still standing today, “creating a viable adaptive reuse model for other cities” in the process.

The trend didn’t exactly catch fire here in Canada, with the very-notable exception of the Distillery District in Toronto, which was originally established as the Gooderham and Worts Distillery. Distillery operations closed in 1990 and after gathering cobwebs for a while, re-opened to the public in 2003 as a commercial district that happens to include one of the largest collections of Victorian-era industrial architecture in North America.

Those three examples are all of conversions — sometimes also called “rehabilitations” — into commercial space, but nowadays what’s more common is turning commercial space into residential space.

Work From Home, Homes From Work

The world has just gone through a once-in-a-century event in the COVID-19 pandemic. Aside from changing how we think about things such as personal health, the pandemic also changed our relationship with space. Our homes used to be just that: our homes. These days, they’re increasingly doubling as places where we work, where we shop, and where we exercise. Because of this, spaces that once existed solely for those purposes are no longer as needed.

Many people purchased homes during the pandemic after realizing they needed more space to accommodate working from home. For a while, many office buildings, like streets and malls, became empty. Quite a few still are. Many people, now used to the benefits of working where they sleep, are not thrilled about returning to offices, and there aren’t strong indications that’s going to drastically change soon. Where does that leave office buildings?

You can’t exactly pick up an office building and drag it over to the recycle bin, but what cities around the world are now seeing is office buildings being turned into housing, particularly in places in dire need of it. Chicago is converting office buildings in its famous business district into apartments. New York City has created an Office Adaptive Reuse Task Force. California has passed legislation to encourage adaptive reuse, citing the state’s housing crisis. All of this happened just in the past few months.

According to the American-based National Apartment Association, 32,000 apartments have been created since 2020 as a result of conversions, including a record-high 20,100 in 2021, which included conversions of 7,400 offices, 3,400 factories, 2,850 hotels, and others. In March 2022, the NAA said they were expecting 53,000 more units in 2022.

Why are we talking about the US? Because here in Canada, we couldn’t be farther away from those numbers.

But Canada does have some examples.

In September, a redevelopment proposal was brought to the City of Toronto that would see a century-old office building restored and converted into a residential building. A similar planwas proposed for a different heritage office building in Toronto last December. On the West Coast, a 21-storey heritage office building in Vancouver was converted into a residential building called The Electra in 1995 that’s still going strong as a rental building. The historic Gastown area also continues to be restored, often with new uses.

Over in Calgary, 200,000 sq. ft of office space in the Palliser One building is set to be converted into 176 apartments, and if any city in Canada is leading the way on adaptive reuse, it’s the Stampede City. The City of Calgary has, by far, the most successful programs in the country — officially called the Downtown Calgary Development Incentive Program — that provide financial incentives specifically for conversions of office buildings into residential uses.

Calgary’s program wasn’t primarily birthed because the region desperately needed housing, or because they wanted to preserve heritage buildings, like the incentive programs in Victoria, Winnipeg, and Halifax. It was because they had an overstock of office space.

According to an economic report published by the City in November 2022, Calgary accumulated over 4M sq. ft of office space between 2013 and 2018. That was followed by a steep reduction in demand, by over 6M sq. ft, leaving Calgary with a bunch of office space occupied by nothing except dust. Since then, the City’s program has resulted in about 665,000 sq. ft of office space converted into over 700 homes, with more coming in Phase Two of the program.

But these are the exceptions in Canada. There has been little to no increase in adaptive reuse projects in Canada, let alone has the idea reached a critical mass, or a “tipping point” where the idea takes on a life of its own. Unlike in the States, statistics about adaptive reuse do not even exist and cannot even be compiled.

STOREYS reached out to Altus Group, a Toronto-based company that specializes in commercial real estate analytics, and a spokesperson said that they did not have such data. CBRE Canada and Avison Young, who regularly publish data reports about commercial real estate, were also reached and similarly did not have such data.

STOREYS also reached out to the Canadian Mortgage and Housing Corporation (CMHC), whose Rapid Housing Initiative specifically includes conversion projects. The CMHC has data about how much total units of housing have been created in Canada through the Initiative, but was unable to compile data specifically about units created via adaptive reuse, pointing only to examples of individual conversion projects that were previously announced. They estimated the grand total of housing units created via those projects to be at about 2,000.

The lack of such data is indicative of where adaptive reuse stands in Canada. On Everett Rogers’ famous Diffusion of Innovation curve, the concept of adaptive reuse in Canada is stuck in the Chasm. To identify why, it helps to understand the processes behind adaptive reuse projects.

How to Recycle an Office Building

Converting an existing office building into a residential building sounds cool, but it isn’t as simple as swapping out the furniture — like converting a spare bedroom in your house into an office. Buildings, regardless of how plain or basic they may appear, are designed for their specific intended uses. After all, before it began being used in other realms, “form follows function” was a maxim coined by an architect.

Because an industrial building can be drastically different from an office building, and an office building can be surprisingly different from a residential building, the building that’s targeted for conversion has to first be analyzed from top to bottom to see how feasible conversion really is, taking into account factors such as the structure of the building, its engineering, and even its aesthetics.

“These conversions are so asset specific,” Jessica Morin, Head of Research for CBRE US, told STOREYS. “The factors really have to be perfect: building, location, lighting, floorplates, attractiveness of the construction market, how quickly they can flip and lease it.”

Office buildings typically have larger floor-plates, because spreading out employees across multiple floors is more of a hassle than having them all on a single floor. Single-floor offices with open floorplans also facilitate communication, comradery, and cohesion (back before Slack was a thing). Offices also typically have washrooms clustered together, which means the plumbing of the building is quite different than in an residential building, where each unit in every corner of the floor has at least one washroom.

“Often, particularly in smaller or more rural municipalities, buildings are too old or too structurally precarious to support the business-case for adaptive reuse,” Alberto de Salvatierra, a professor at the University of Calgary’s School of Architecture, Planning, and Landscape — as well as the Founder and Director of the Center for Civilization, a design-research think tank — tells STOREYS.

“In these cases, it would just be too expensive to renovate. Demolition and reconstruction become surprisingly cheap in comparison. In other instances, available stock is spatially inadequate: in larger cities, like Calgary, vacant office buildings can have floorplates that are too deep or irregular to support the business case of adaptive reuse, or in smaller cities, like Medicine Hat, buildings are too small. When the motivation is to create dense, mixed-use developments and affordable housing, certain buildings simply cannot deliver.”

“It can be cheaper to demolish and build anew, particularly in cities where the land on which buildings sit has become more valuable that the building itself,” Professor de Salvatierra adds. “In these instances, developers would rather build a newer, taller, and more luxurious tower from scratch rather than try to adapt existing stock. Often, the biggest obstacle to adaptive reuse is the business case.”

In other words: a confluence of factors have to come together in a single building for a conversion to be the best approach — physically and financially. The more walls that have to be added into a building, the more money it’s going to cost. The more the office building’s insides have to be gutted, the more money it’s going to cost. Like it or not, developing housing is a business, which means if it doesn’t make money, it doesn’t make sense.

Adaptive Reuse in Canada: The Chasm

Would more incentives help? Asked this question, Morin and her colleague Eric Stavriotis, Executive Vice President in Location Incentives, say that CBRE US has been tracking adaptive reuse since 2016 and they have not seen a correlation between adaptive reuse projects and incentives. They’ve also not seen a material increase of adaptive reuse in the States, but it has been steady in recent years, with anywhere between 70 to 100 adaptive reuse projects of various kinds a year.

Stavriotis says that the question of making better use of existing buildings is being asked at the city and state levels, and many are increasingly looking at incentives, but many of them are still in the early stages and it’s too soon to tell if the incentives will make an impact. But he also stresses that “if the asset is right for [conversion] and the value gets low enough, and they can set the right rent, there doesn’t have to be incentives for this to take place.”

“Conversions may end up being a small share of the pie,” Stavriotis says, pointing out that only about 2% of US office stock has been converted since 2016. “But this is the time to look at it.”

Back in Canada, Professor de Salvatierra says that “adaptive reuse has been a longstanding interest and priority” in academia. “It is widely known that buildings themselves are a significant source of global CO2 emissions, so adaptive reuse — rather than demolition and reconstruction — is a more sustainable and environmentally friendly approach to city building. However, the “popularity” of adaptive reuse by the profession, or its adoption by industry, is uneven across geographies. Cities have varied and distinct challenges, and not all of them see the value or urgency of adaptive reuse.”

Another factor is office vacancy. In CBRE Canada’s Q3 Office market report, the national average vacancy rate of office space in Canada was 16.9% in downtown cores, nearly half of that of Calgary (32.9%), which had the highest office vacancy rate in the country. In Toronto, the vacancy rate is at 11.9%. In Vancouver, the vacancy rate is at 7.1%. You can’t convert empty office buildings into apartments if you don’t have any empty office buildings to begin with.

Perhaps governments on all levels need to examine adaptive reuse more. Perhaps developers need even stronger incentives, to make those not-quite-feasible conversions more appealing. Perhaps companies can be incentivized to move more operations to remote work, freeing up office space to be converted into housing. Perhaps the housing crisis needs to get even worse for people to really look at adaptive reuse. Or, perhaps we need to get with the times, because as they say: adapt, or die.

Source Storeys. Click here to read a full story

CRE Sees Strong Growth in 2021, “Asymmetric Impacts” Across Asset Classes

Although commercial real estate in Canada is yet to rebound from the pandemic, the sector still spurred notable economic benefits over 2021. On the whole, commercial real estate contributed a net of $148.4B to Canada’s Gross Domestic Product (GDP), created and supported 1M jobs — 372,710 of which were long-term, salaried positions, otherwise known as “direct jobs” — and generated $67.5B in labour income for workers. However, of the various commercial asset classes, some had a stronger year than others.

This is according to a report by Altus Group and commissioned by NAIOP Research Foundation to examine the economic benefits of commercial construction across commercial real estate in 2021.

“The pandemic has had asymmetric impacts on the CRE sector. Various asset classes have seen changes in valuations, and some have been repurposed,” the report explains. “For example, the transition to work-from-home and the acceleration of online shopping trends has reduced the value of some classes of office buildings (especially older or “B” and “C” class) and some categories of retail space and raised the value of clean, strategically located industrial distribution centres. Some of these trends may decelerate or reverse over time.

“The total value of commercial real estate transactions increased substantially in 2021 from very poor conditions in 2020. Industrial real estate accounted for the largest share of the investment value of those transactions. Commercial brokerage fees rose modestly in 2021, reflecting the recovery in transactions. Property management, asset management and landlord operations combined represent the largest single component of economic activity within the CRE sector.”

Industrial Construction Continues Pattern of Positive Growth

Canada’s industrial construction sector has observed steady growth not only in 2021, but over the past five years, including over the pandemic. Investment into the sector exceeded $16B in 2021, with the lion’s share of investment, 61%, related to new construction and the remainder related to the renovation and retrofitting of existing buildings.

The report notes that this growth may actually accelerate in the years ahead.

“The demand for industrial space continues to rise, with vacancy rates in many important industrial markets across the country remaining low. Industrial investment in recent years has been fuelled by transformation among many significant industrial users, including the rise of cannabis cultivation since its legalization and more recently the retail sector’s embrace of e-commerce and home delivery, which has spurred demand for additional logistics and distribution centres.

Multi-family Construction on the Rise, on Par With Rental Demand

Institutional investor-grade multi-family construction investment in Canada saw significant growth in 2021, rising to $24.1B.

This is largely attributed to investors accessing CMHC affordable housing incentive financing programs such as the Rental Construction Financing Initiative. Such incentives have served to return financially feasible to the sector for investors by reducing equity requirements and enabling higher loan-to-costs or loan-to-value ratios at below-market interest rates. The report further explains that “this reduces the cost of investment relative to condominium apartment development, which benefits from presale deposits that lower the costs of capital.”

The report goes on to say that growth in the country’s multi-family sector is expected to continue in tandem with rental demand.

“…an acknowledged housing shortage in Canada and the emergence of ‘Gen-Z,’ a large cohort of young people emerging into their prime rental years, will continue to create opportunities for multifamily investors looking to bring new apartment buildings to market. Although the commercial real estate industry faces challenges from the pandemic and slowing economic growth, it promises to continue to be a major contributor to the Canadian economy in the years ahead.”

Office Construction is Down, but Leasing Remains Strong

Although Canada’s office sector declined over the past two years, 2021 still saw a significant construction investment of $12.8B. The bulk of that investment (63%) was put toward new builds, and the remainder (37%) was put towards retrofits/renovations, including upgrades to HVAC systems.

Although investments in the office sector have risen since 2018, the report forecasts that the growth will likely taper off in the next few years as “post-pandemic trends may decrease the need for new office space at the same time as many office users find that adapting their spaces to emerging new working realities requires capital investment.”

With that said, leasing in the sector reportedly remains strong. Of the 17.2M sq. ft under construction across the country, pre-lease agreements account for just under 65%.

“This strong pre-leasing performance, even considering potential uncertainty regarding the amount of space required over the next few years given ongoing pandemic effects, reflects the strong flight-to-quality trends seen in many markets in recent years.”

Retail/Hospitality Construction Continues to Soften

Since reaching a peak in 2019, construction investment in Canada’s hospitality sector has seen downward pressure, falling 16% to $11.8B in 2021. This is certainly not surprising. The sector — particularly brick-and-mortar retail, hotels, and restaurants — was disproportionately impacted by the pandemic and is yet to recover.

That said, the report notes a “pent-up demand for in-person shopping experiences,” realized in 2021.

“Many markets across Canada saw a robust return of traffic and spending at brick-and-mortar retail locations, especially regional malls, as pandemic restrictions eased. To the extent that there has been a permanent shift toward e-commerce as a percent of retail sales, retailers are transitioning brick-and-mortar locations to focus on providing consumers with lifestyle shopping experiences, signalling the adaptability of retail to emerging trends and consumer preferences.”

Of the total investments, 55% of the retail investments were into new construction — “a trend that had been rising and peaked in 2020 with a modest decline in 2021.” This is perhaps reflective of some semblance of positivity amongst investors in the sector.

Source Storeys. Click here to read a full story

GTA Commercial Real Estate Investment Feels Rate Squeeze, Plunges 34% in Q3

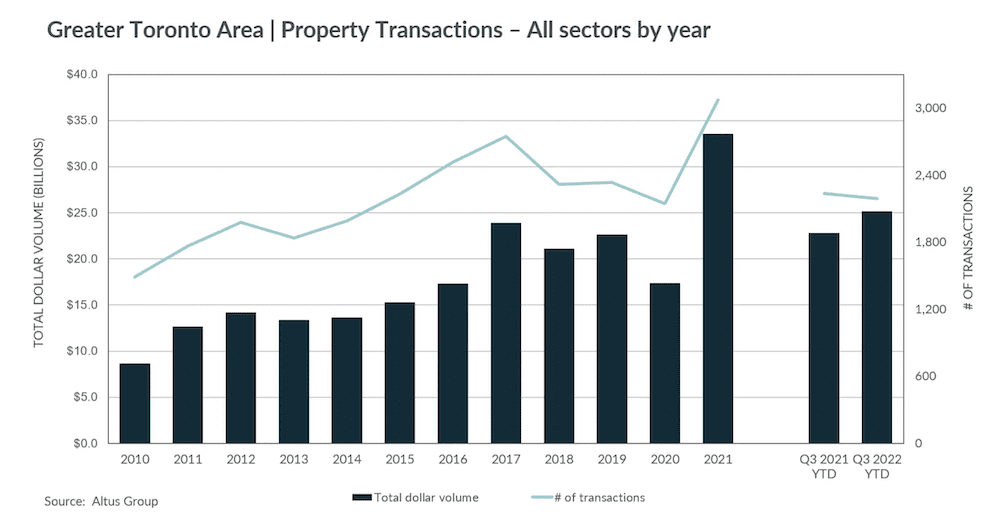

It’s not just prospective homeowners feeling the pinch of rising interest rates — an overall higher cost of borrowing has had a heavy impact on the commercial real estate sector in the Greater Toronto Area, according to the latest third-quarter data from Altus Group.

The numbers show that, following a record-setting first half of the year, spending chilled considerably between July and September, with $6.1B in total investment outcome. That reflects a decline of 34%, with registered transactions down 24% compared to the same time frame in 2021.

From a year-to-date perspective, though, total investment volume comes to $25.1B, still up 10% on a year-over-year basis. However, as Altus writes in the report, “The buying frenzy witnessed in the first half has morphed into investors pausing and navigating cautiously amidst the continually rising interest rate environment.”

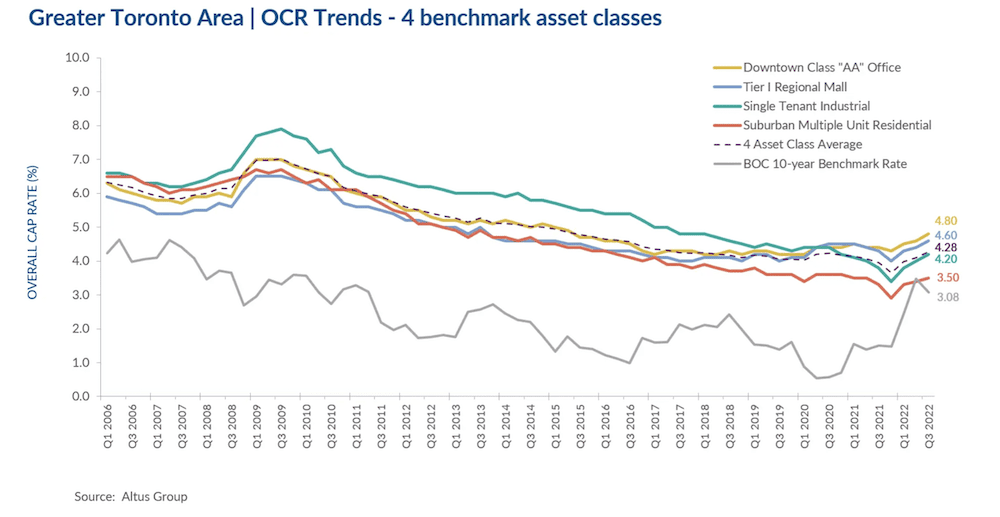

The Bank of Canada has raised interest rates a total of six times since March in order to combat soaring inflation. That has brought the benchmark cost of borrowing from a pandemic-era low of 0.25% to 3.75% today, a level not seen since April 2006. That has effectively thrown cold water on buying and investment intentions at all levels of the real estate market.

A rising cost of construction — exacerbated by inflation and borrowing costs — has also contributed to the commercial real estate sector’s decline. According to Altus, for the remainder of the year, it will be assets offering the greatest flexibility and redevelopment potential that will remain the most popular among investors, though the “cautiousness and uncertainty in investor sentiment will persist.” This will be especially apparent for those in the midst of obtaining financing for projects, as borrower criteria tightens up among lenders.

Due to this, Altus reports that cap rates have increased across all four major asset classes in the GTA: downtown class “AA” office, Tier 1 regional mall, single-tenant industrial, and suburban multi-unit industrial. An additional Investment Trends survey conducted by the advisory group revealed that, among participants, food-anchored retail strips, as well as suburban multi-unit assets remain the most coveted.

The office sector also remains a strong standout, with total investment doubling that of 2021 thus far at $3.5B. However, as Altus points out, this figure gets a notable boost by the sale of Royal Bank Plaza — which closed for $1.2B — in the first quarter of the year. The persistence of remote and hybrid work also continue to raise questions among investors about the viability of office demand into the near future.

Industrial space, meanwhile, continues to surge, given its steep scarcity of supply. Total industrial sales from the first three quarters of the year total $5.5B, just shy of the YTD $5.3B recorded in 2021.

“With GTA industrial vacancy rates continuing to hover around 1%, the demand for this asset persists,” writes Altus. “However, with an additional interest rate hike by the Bank of Canada anticipated in the fourth quarter, investors will continue to be cautious as the cost of capital increases.”

Overall demand for land in the GTA remained steady throughout the third quarter, with collective land sectors (residential lots, residential land and industrial commercial investment land) accounting for $11B to date – a 44% share of the pie for all commercial real estate deal volume this year. ICI land continues to be a strong presence, breaking the billion-dollar investment volume market for the sixth quarter in a row, while residential land showed signs of softening.

According to Altus, developers are indeed reducing their residential land acquisitions, or are pausing existing projects to ride out the rising cost of borrowing and labour. For the first time in four quarters, total investment for residential projects fell below the $2B-mark, with just $1.6B registered in Q3 — “a sign of caution after an enthusiastic previous four quarters.”

Source Storeys. Click here to read a full story

Filling In The Retail Spaces In The Second Largest Master-Planned Development in Toronto is a Problem, or an Opportunity, Depending on How You Look At It.

On a given day most people who come to the Concord Park Place real estate development in Toronto are there for some do-it-yourself furniture or meatballs from the IKEA it shares space with.

Concord’s site is sandwiched between Highway 401, a six-lane stretch of Sheppard Avenue and tracts of single-family homes: it is the definition of a car-centric community.

This is true in spite of the nearby Bessarion subway station (long in the Hall of Shame as Toronto’s least-used subway stop) and despite the fact that Concord is going to add almost 5,000 apartments to the 45-acre site (formerly a Canadian Tire distribution centre) and pepper the landscape with as many as 20 towers by the time all is said and done. This level of density is practically unheard of in North York, and it presents an opportunity to create a walkable streetscape in a part of Toronto not known for having many. This is strip mall and Big Box retail country (as the nearby Canadian Tire and IKEA would attest).

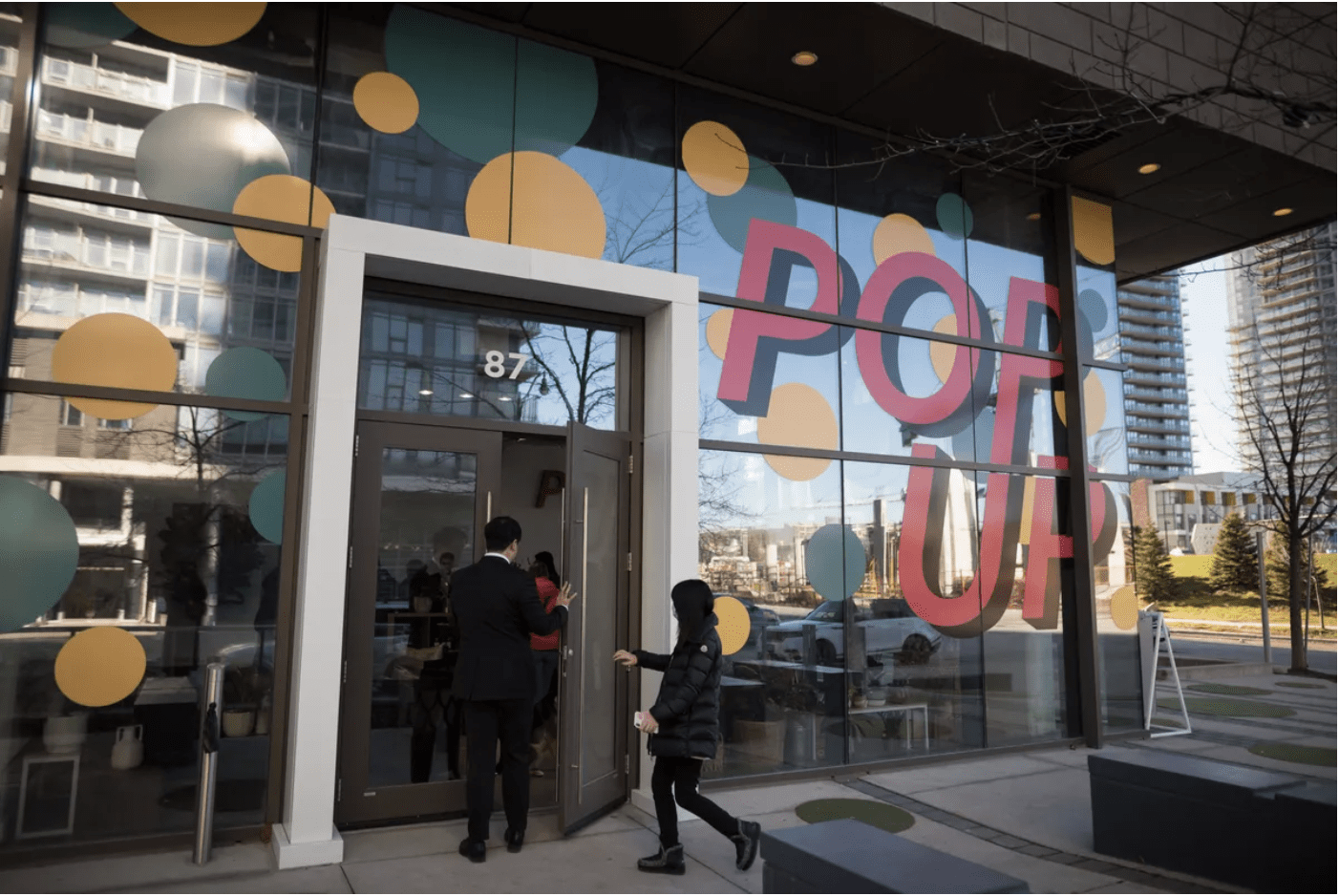

That’s why Isaac Chan, vice-president of sales and marketing at Concord Adex, an arm of the B.C.-based Concord Group, has spent much of 2022 experimenting to create a walkable high street by temporarily hosting a variety of retailers, cafés and community installations in a pop-up store location in one of its Park Place buildings across from recently finished Ethennonnhawahstihnen’ Park.

“We’ve had about eight in here,” said Mr. Chan, standing inside the most recent pop-up, a flower-shop/café called Olivia’s Garden. “Some of them said, ‘We just want to try for a weekend’ and then expanded to more weeks so that they can kind of feel out the community.”

Concord marketing specialist Tanya Kolacz found Olivia’s Garden on Instagram, and was drawn to the elegance of the offering: specialty pottery, minimalist design, coffees infused with edible flowers and unique floral arrangements while you wait.

The café opened during the pandemic in its sole location on Harbord Street in downtown Toronto, a tumultuous business environment that café manager Jason Korol says allowed the company to experiment with its unique caffeinated offerings.

“For example, we have a blue lavender drink and we grow the lavender [for the syrup],” he said, which is also harvested in spring, summer and fall to distill syrups from different stages of the plant’s life. “Depending on the season you come in it’s a slightly different flavor. So it’s the same song, but kind of like a different melody.”

One of the first pop-ups Concord hosted in July also married plants and coffee: connecting specialty roaster Terminal 3 (which plans to return to the pop-up soon) with plant retailer JOMO, which is an existing retail tenant in its City Place development. Over the summer and fall the pop-up site has hosted the Boxcar Social café, Courage Cookies, Hielito Bites (a purveyor of Mexican desserts) as well as art gallery installations and a physical pop-up of online function fashion retailer Stage 9 Secrets.

One thing many of these shops have in common is their permanent locations tend to be in walkable downtown neighbourhoods that grew up in a sometimes chaotic fashion over decades. A frequently referenced element of urbanist Jane Jacobs’s writing is the idea of the “sidewalk ballet” that makes up a lively streetscape: a mix of residents and visitors blending together throughout the day among a diversity of shops, services and eateries. Transplanting the functional chaos of a mature streetscape to a new community remains an abiding challenge for planners.

In 2020, the City of Toronto released a 56-page document outlining all the elements of built-form it believed contributed to ground-level retail streetscapes. Tellingly, many of the images it uses to illustrate good retail come from two-storey high streets such as Queen Street East and Greektown on the Danforth. The document offers advice on where to place signage and how to situate utilities and supporting columns for retail that sits at street level below a high-rise building, it does little to address the trickiest part of the equation: how to fill those spaces with retail that works.

As the city’s guidelines assert, build it right and, “the quality and diversity of retail tenants in the area will improve. Residents will have local and convenient access to goods, services and job opportunities. Lively active streetscapes will be created that invite people to gather in the public realm and make walking a more enjoyable experience.”

Toronto’s history of condo retail tends to be dominated either by risk-tolerant expansionist chains (everything from Shopper’s Drug Mart to the Liquor Control Board of Ontario), or services like dentistry and dry cleaning. Frankly, these kinds of retailers could be found in any place, but Mr. Chan is hoping to build a destination-worthy streetscape that is it’s own specific place.

As a society we’ve become used to the idea that on some big purchases you can try before you buy: we test drive cars, we have open houses, there’s even free samples at the supermarket. As Mr. Chan notes, this is less common in the world of commercial leasing where a typical retailer might have to sign on for a five- or 10-year term. Pop-ups have become a way-station for retailers stuck between the decision to stick with what they have or to make a new a long-term commitment.

Concord’s pop-up destinations have also formed part of the tours and open houses for residential real estate brokers who are weighing dozens of preconstruction GTA condominium sites for clients, and sometimes themselves.

“One realtor was like, ‘Oh wow, there’s a new concept: I like that and I’m gonna talk to some of my clients,’ ” Mr. Chan said.

In the next few weeks Concord’s pop-up will be hosting a pet-friendly Santa Claus installation for condo dwellers looking for holiday pictures with the jolly fat man (the nearby mall Santas restrict pet pictures to an hour a day, apparently). It’s all part of the mix of turning a condo complex from a place to stay into a place to live.

Source The Globe And Mail. Click here to read a full story

Real Estate Investors Push For Improved ESG Measures In Commercial Property

Canada’s commercial real estate sector is striving to meet increasingly demanding environmental, social and governance standards, but the ESG is still greener on the other side of the world.

For example, experts say Canada is playing catch-up in the use of “green leases” – commercial tenancy agreements in which the landlord and the renter incorporate sustainability, socially responsible management and good governance into their property deals.

According to Tonya Lagrasta, head of ESG for Colliers Real Estate Management Services, in Toronto, “Canada is behind places such as the European Union. Many Canadian developers are moving ahead anyway – we’re seeing a shift – but the rules and regulations aren’t necessarily in place.”

“In North America we’re seeing more of a push toward stronger ESG standards coming from investors, while in Europe it comes more from regulation,” says Avis Devine, associate professor of real estate finance and sustainability at York University’s Schulich School of Business, in Toronto.

A study last year by Deloitte, Green Leases – in the ESG Context

, found that the European Union Commission gave green leases and other ESG measures in the property sector a boost in December, 2019, when it adopted rules specifying what makes these measures green.

“In North America we’re seeing more of a push toward stronger ESG standards coming from investors, while in Europe it comes more from regulation.

— Avis Devine, associate professor, Schulich School of Business, York University

Lenders, developers and tenants can consider deals to be green if they include goals for climate change, protecting and conserving water and biodiversity (on the property), controlling and minimizing pollution and moving toward a circular economy that recycles and reuses materials.

According to the Deloitte report, research by Savills Investment Management found that 73 per cent of the world’s institutional investors expect green lease clauses to be incorporated universally between tenants and real estate investment managers by 2029.

In Canada, the experts say that major commercial developers, such as Oxford Properties, BentallGreenOak and Brookfield Asset Management, are typically ESG leaders. “These tend to be companies that have global assets, including those in places where the ESG rules are more developed than in Canada,” Ms. Lagrasta says.

Developers and institutional lenders in Canada were getting more serious about higher ESG standards before 2019, “but the pandemic set things back,” says Ryan Riordan, finance professor at Queen’s University’s Institute for Sustainable Finance, Smith School of Business, in Kingston.

On the other hand, COVID-19 gave real estate developers the opportunity to look more closely at environmental issues such as indoor air quality, Dr. Devine says.

There’s more interest than ever in commercial property ESG measures, but the challenge now is to make physical changes to buildings, Dr. Riordan says.

“We’re making strides on the construction side of ESG, but it takes a lot of time to retrofit and replace buildings with ones of higher standards,” he says.

Retrofitting is a daunting challenge but one that experts consider necessary because buildings contribute nearly 40 per cent of the world’s carbon emissions that are linked to the global climate emergency.

Canada and other countries are struggling to achieve net-zero emissions by mid-century amid concern that if we don’t succeed, damage to the Earth will be beyond repair.

“We need to retrofit nearly all the standing dwellings in Canada, but we’re doing this at 1 per cent of them per year. If we don’t go faster, it will take about 70 years – we should be going three times as fast every year,” Dr. Devine says.

There’s also a strong business case for retrofitting old office buildings to make them more eco-friendly, Dr. Devine adds. It’s partly good marketing – white-collar employees are still only trickling back to offices in major Canadian cities, and when they do, they want to go back to good quality workplaces, she says.

“There’s a premium earned by environmentally certified buildings,” she explains. It shows up in better occupancy rates, more likely lease renewal and lower costs to finish off rehab work for tenants once the basic environmental work is done, she says.

“And after we account for higher rents or lower water costs, is there a market premium for being a leader in sustainability? Evidence says yes,” Dr. Devine adds.

A study by Smith’s Institute for Sustainable Financing, released in April, shows investing in carbon reduction “more than pays for itself in terms of avoided physical damage alone.”

The Physical Costs of Climate Change: A Canadian Perspective suggests the savings come even before “taking into account the potential economic benefits of transitioning to a low-carbon economy” for Canada’s entire GDP.

But green leases are only a small part of how commercial real estate developers are boosting their ESG credentials, Ms. Lagrasta says. “There’s more attention being paid now to the S [social benefit] and the G [governance],” she says.

Institutional investors are looking more holistically these days at potential risks, for example, the cost of urban sprawl and the potential financial benefits of diversity on corporate boards.

“There is deep corporate finance literature showing that we end up with better risk-balanced outcomes in our real estate [investments] if the management isn’t all male,” Dr. Devine explains.

Source The Globe And Mail. Click here to read a full story

Long-Term Office Outlook Appears Positive, Says Insider

As Dorothy wistfully states in The Wizard of Oz, “There’s no place like home.” But what are owners, investors and tenants in commercial real estate (CRE) to make of ongoing visions of tumbleweeds blowing through our downtown cores in the fallout of an unprecedented shift to working from home?

According to a recent report commissioned by the National Association of Industrial and Office Properties (NAIOP), Canada’s leading organization for CRE developers, owners and investors, the reality is far from dire. In fact, even if the road ahead still looks a bit rough, there are numerous indicators that, well within the next decade, that yellow brick road might just be paved with gold.

Positive economic impact

Prepared for the NAIOP by Toronto-based real estate services company Altus Group, Economic Impacts of Commercial Real Estate in Canada (2022 Edition) emphasizes Canadian CRE’s positive economic impacts in 2021: the generation of $148.4-billion in net contribution to the GDP; $67.5-billion in labour income for workers; and the creation/support of one million jobs (372,710 direct).

An attractive angle, even though office-space surpluses continue to be exacerbated by the pandemic, the work-from-home trend and the green-lighting of construction for new “trophy” locations. Retail also faces great challenges as the pivot to online shopping remains strong, whereas industrial is hot but faces demand-over-availability issues.

Still, Canadian CRE’s largest hurdle is those empty offices – a short-term problem expected to be much improved within a few years, according to Peter Norman, Altus Group’s vice-president and chief economist. Pandemic-related decline in employee occupancy notwithstanding – compared to prepandemic numbers, weekly in-office attendance is currently down to between 25 and 35 per cent, though numbers on weekend-adjacent days (Monday, Friday) fall lower – Mr. Norman says “the economy is growing, and the number of office workers is growing. We are going to grow ourselves out of the issue of surplus office space.”

“The office sector will continue to transition over the next few years and 2023 will see more of what we’ve seen this year – which is that as lease rollovers come up, lots of tenants are negotiating smaller spaces but often in better buildings. The flight to quality will continue.”

— Peter Norman, vice-president and chief economist at Altus Group

When this will happen is harder to pin down. To start with, office-lease terms typically run between five and 10 years whereas the slow restart from the pandemic’s sudden stop has barely been in effect for one year – which means that the majority of leases are currently in effect but by no means guaranteed to be renewed. Exacerbating this uncertainty is the age-old truism “location, location, location”: Buildings more than a half-century old no longer cut it as tenants require modern spaces of reasonable sizes.

Flight to quality

“The office sector will continue to transition over the next few years,” says Mr. Norman. “2023 will see more of what we’ve seen this year – which is that as lease rollovers come up, lots of tenants are negotiating smaller spaces but often in better buildings. The flight to quality will continue.”

It’s ultimately a problem of linear programming, which many lease-bound bigger businesses will simply ride out; growth economics dictate that a 200-person capacity space half empty today might be full, or even too small, in less than a decade.

The needs of smaller businesses are another matter, and greater fuelers of the flight. Matthew Kingston, executive vice-president of development and construction at H&R REIT, Canada’s third-largest real estate investment trust, cites further complications for the future of older CRE spaces, particularly in Toronto, where renovations and rebuilds alike are required to conserve a minimum of 100 per cent of current office space.

H&R REIT is currently requesting permission from the City of Toronto to preserve a downtown heritage building, 69 Yonge St., by converting it from 100-per-cent office to 100-per-cent residential. “It’s too small a floorplate – one-quarter the size of what an office user would want in today’s market,” says Mr. Kingston, who puts the building’s current vacancy at around 20 per cent and calculates a whopping 87 per cent vacancy within two years.

A lack of modernity is what’s making it hard to hold on to 69 Yonge’s tenants, not just limited to issues of spatial design but also infrastructure, in terms of telecom, ESG (environmental, social and governance investing) and more. Plus, given the building’s floor plate, these tenants’ smaller businesses are most likely to adapt by simply leaving.

“For them, erasing office rent from the overhead is a massive deal,” says Mr. Kingston. “When you have a team of five, seven, 20 people, it’s much easier than a company with thousands to suddenly say, ‘We’re going to pursue a work-from-home policy.’

”The City of Toronto is in the dark ages from the conversion standpoint,” says Mr. Norman of the one-to-one office space retention requirement, citing other Canadian centres that are incentivizing change, notably Calgary with an available collective grant fund of over $20-million.

Commercial real estate remains crucial to the Canadian economy, especially because the owners of Canada’s estimated 750 million square feet of office space are, for the most part, pension funds. “What happens to commercial real estate values is very important because of pension funds alone,” Mr. Norman says.

In the near term, outmoded office CRE will remain a major issue for employers and employees alike, but says Mr. Norman, “office isn’t dead – it’s just transforming really quickly and almost everybody is altering their premises to be more amenable to the new way of working,”

”There is uncertainty for up to the next 10 years but in the end, we are probably going to need a lot of the space that we already have – and we might eventually need more,” he adds. “Many businesses will just ride out that linear programming problem. If growth isn’t quite as fast as perceived adjustment, some might opt for space reduction.”

Positive change is predicted in the next few years, though the trend might be hard to discern at first. “We see people returning to the office in 2023, but with a hybrid approach where they spend one to two days a week working from home,” says Mr. Kingston. “Businesses are looking for larger floor plates to accommodate more interaction and collaboration and offer amenities and outdoor space as incentives to entice people into the office – as well as top-of-the-line infrastructure to support increased digital usage, ESG targets and air-quality concerns.”

Prime locations that have these attributes will perform strongly, he says, but other buildings that cannot offer these demands will continue to struggle to maintain, as well as attract, office users.

”The vibrancy and economic activity that occur in a downtown core obviously have to do with the operation of CRE buildings – and the people that come to them and what they do at lunchtime, after work and all the rest of it,” says Mr. Norman. “It’s ultimately the difference between a live and a dead downtown.”

Source The Globe And Mail. Click here to read a full story

Industrious Plans Second Toronto Flex Workspace

Flexible workplace company Industrious is launching its second Canadian location in Toronto, this time in partnership with Dream Office Real Estate Investment Trust.

Industrious, a New York-headquartered office co-working company, will open Industrious Financial Core at 30 Adelaide St. E. in Toronto in March 2023. It will be located inside the 18-storey State Street Financial Centre in Toronto’s financial centre.

Industrious says it will feature 650 seats and span 53,622 square feet, according to a company release issued this morning.

One of the key attractions of the location, Industrious says, is its accessibility through walking, transit, bicycling or car.

The Industrious Financial Core facility will offer amenities including 24/7 security, underground parking, plus nearby restaurants and a coffee shop. Industrious also notes nearby conveniences like the downtown Toronto PATH indoor pedestrian network, food and entertainment options, hotels, gyms, shopping and cafes.

“This is our first dot on the map in Toronto and Canada, a market we’ve been excited to enter for years,” said Doug Feinberg, senior director of real estate at Industrious. “Toronto has historically been one of the lowest-vacancy and highest-performing office markets in all of North America.

“This adds a location in the Financial Core and Downtown East submarkets, with great walkable amenities and great access to Toronto’s PATH and subway system.

“It’s a good entry point to the market with room for us to add to our footprint as we build our network to support work-from-anywhere models.”

Industrious in Canada and worldwide

The partnership with Dream Office REIT (D-UN-T), a Toronto-based real estate investor with $17 billion in assets, marks the second Industrious location in Canada.

The first location is also in Toronto and opened its doors in September. It is hosted on the fifth and sixth floors at 33 Bloor St. E. in a 17-storey, 291,579-square-foot mixed-use building.

That building is owned by Epic Investment Services.

The location, formerly operated by WeWork, was converted into an Industrious flexible workplace featuring 450 seats. Like the Industrious Financial Core, Industrious highlighted its proximity to transit and amenities.

Industrious says its newest Toronto location is part of a strategy to expand its international presence of over 150 locations in over 65 cities.

It has also acquired flexible workspace providers The Great Room and Welkin & Meraki in Asia and Europe, respectively.

The company says it added over 350,000 square feet in Singapore, Hong Kong, Bangkok, Paris, Brussels and Eindhoven to its workplace portfolio through the acquisitions.

Industrious plans to “double its international presence by the end of the year and remains committed to growing domestically,” the firm states.

In an interview with RENX when it opened the Bloor Street East facility, Industrious director of real estate Sam Segal said the company is “actively looking at all major Canadian markets, including more sites in Toronto, for future locations.”

There was no specific timetable provided by Segal.

Source Real Estate News EXchange. Click here to read a full story

GALA Buys Bradford Ind. Land, Plans 1.4M Sq. Ft. Of Space

GALA Developments has closed on the acquisition of a strategically located 101-acre site in Bradford West Gwillimbury, north of Toronto, where it plans to develop approximately 1.4 million square feet of industrial space.

The property at 3664 8th Line was acquired for $37 million in mid-October from a private investor based in Quebec, GALA vice-president of real estate development Vito Valela told RENX. The developer had it under due diligence for four months before closing on the deal.

The site in growing Bradford West Gwillimbury, where GALA also has land as part of the multi-developer Bond Head low-rise housing community, will provide easy access to the Bradford Bypass via a ramp from Highway 400. That four-lane freeway, which is in the very early stages of construction, will connect Highway 400 to Highway 404.

“We knew it was coming and we were strategic in our selection,” said Valela of the bypass. “The opportunity arose and we seized it.”

The 16.2-kilometre Bradford Bypass has drawn criticism from environmental groups and some residents living near the corridor, raising concerns about potential damage to protected areas of the Greenbelt. However, the Ontario government wants to have it completed by the end of the decade.

GALA’s site will have coveted visibility from Hwy. 400 as well as frontage on 8th Line and 5th Side Road.

Site offers flexibility

“That gives us flexibility in our planning and phasing,” said Valela. “You can work the development as the need arises as we grow our tenant base.”

GALA is targeting large logistics users, warehousing providers and last-mile delivery companies as tenants for its business park. It will see what the market demands and will be able to deliver spaces ranging from 50,000 to 500,000 square feet.

GALA is designing its block and lot plan and hopes to have a pre-application consultation with municipal planning officials in December to receive feedback.

The goal is to have all approvals in place in the first quarter of 2024, have site servicing begin in the second quarter, and to start construction of the first building in the fourth quarter.

GALA ready to talk to potential tenants

GALA is already welcoming inquiries from members of the brokerage community on behalf of their clients and prospects regarding leasing.

“We’ve got patience to allow the market to take its course, but we believe that the long-term prospects are very good and we’re in it for the long haul,” said Valela.

With the downturn in the economy leading some property owners to potentially pull back on development plans, Valela believes new acquisition opportunities may arise. While GALA will keep its options open, it will take a cautious approach since it already has several properties in its industrial and residential development pipelines in and around the Greater Toronto Area.

“We have some industrial assets where we are fortunate to have excess land,” GALA president John Gagliano told RENX. “With the rise in the demand and need for warehousing, we are expanding some of our warehousing footprints on our existing boundary lines.”

GALA and TGA Group plan to start construction on the expansion of a 28,000-square-foot industrial building at 20 Royal Gate Blvd. in Vaughan next summer.

Other planned industrial expansions are: 250,000 square feet at 25 Clayson Rd. in Toronto; 70,000 square feet at 2645 Skymark Dr. in Mississauga; and 15,000 square feet at 18 Ingram Dr. in Toronto.

GALA’s multifamily developments

Gala also has several multiresidential projects in the works.

Danny Danforth — a 10-storey, 140-unit condominium with 4,400 square feet of street-level retail space at 2359 Danforth Ave., just east of Woodbine Avenue, in Toronto — will begin occupancy in late March or early April.

Other projects are in the approvals process, including a high-rise condo at 438 Avenue Rd. in Toronto and a mixed-use community with three condo towers at 189 Dundas St. W. in Mississauga. There are a number of longer term residential sites being assembled or that are already part of GALA’s portfolio and in the planning stages.

“We want to bring on more residential when the time is right,” said Valela.

GALA and TGA Group

North York, Ont.-headquartered GALA was launched by the Gagliano family-owned and operated TGA Group last year to oversee the development of the property portfolio the company has accumulated over the years. TGA provides leasing and construction services and owns, operates and manages approximately 1.2 million square feet of industrial space.

TGA’s Access Restoration Services arm is a disaster mitigation and property restoration company.

“We came from a very simple and humble beginning,” said Gagliano of the company created by his father Anthony in 1959. “Our approach to the market is to create great relationships and value, and that’s obviously been a family-driven component for many, many years.”

GALA has grown from a five-person operation to 10 since inception. Valela expects that number to double again a year from now as the company continues to grow and more developments are advanced.

“TGA and the Gagliano family have patient resources to see us through good times and more challenging times,” said Valela. “That makes it a little bit easier.”

Source Renx.ca. Click here to read a full story