Author The Lilly Commercial Team

Retail Leasing In Canada Rebounds With Positive Fundamentals: Morguard Report

Retail leasing market activity rebounded during the latter half of 2021 and early 2022, with the loosening and eventual removal of restrictions on brick-and-mortar store capacity.

Consequently, retailer sales revenues rose, and a modicum of leasing market normalcy was restored. Retail operators focused on revenue growth, balance sheet stabilization, and operational efficiency while landlords focused on increasing occupancy, says Morguard Corporation’s recent Canadian Economic Outlook and Market Fundamentals Report.

“As leasing activity increased, market fundamentals began to stabilize. Vacancy levelled off in certain market segments, having steadily climbed across much of the country in 2020/2021. A combined average vacancy rate of 10.3 per cent was reported for retail properties contained in the MSCI (Morgan Stanley Capital International) Index, as of the first quarter of 2021. The rate has steadily declined since then, with an average of 8.4 per cent reported at the midway mark of 2022. Regional centre and non-anchored strip centre vacancy has also trended downward but remained elevated.

“By early 2022, there was some anecdotal evidence suggesting rents may have begun to stabilize. However, rental rates generally remained below pre-pandemic levels in most regions, particularly for less desirable space. Vacancy and rents have been relatively stable in centres with necessities-based tenants. Looking ahead to 2023/2024, leasing activity will remain relatively muted, having increased over the recent past.”

Keith Reading, Director of Research for Morguard, said the retail sector in 2022 performed better than most people expected.

“I think that after the sort of worst of COVID was over, I think people thought it would be a long journey back. But that’s to say that there aren’t still some weaknesses there. But I think certainly retail fared better than most people thought,” he said.

“And my experience is things are never as bad as people think and they’re never as good as people think. And that was definitely the case with retail. We saw some decent expansion definitely in some of the newer developments. There didn’t seem to be a lot of concern with being able to find tenants. So better than we thought but I will say some of the longer term trends they didn’t go away because of COVID. Regional centres, we’ve still got double digit vacancy in some of the bigger centres. I’m not talking about the Yorkdale’s of the world or the Sherway Gardens. I’m talking about the next tier down . . . Some of those owners have struggled a little bit but I think even there, we’re starting to see vacancies slowly leased up.”

The consensus seems to be that Canada is either going to be in a recession or while we may not move into a recession it will feel like one, he said.

“But either way we’re going to see things slow down and part of that is what’s happened with interest rates,” said Reading.

“The one thing I think though that is working in the favour of consumers is we’ve seen some pretty healthy wage growth over the last little while. Consumer spending has certainly slowed down but people are still spending. We’ve got an unemployment rate of five per cent. That’s pretty close to full employment. So people have jobs right now. They’re still spending. They’re being a little more careful.

“So what does that mean for retailers? Their revenues might not be quite as good as last year. Leasing activity probably not quite as good as last year. But not terrible either. I think going ahead we’ll see things slow down but I don’t predict any kind of disaster. I don’t predict any kind of real pain. I think it’s just going to be quiet, which for real estate is not the best. But I think our country has proven over the decades that we can weather storms better than a lot of other places.”

Reading said COVID did contribute to a small jump in vacancy rates in the retail sector across the board from street fronts to shopping malls. But in some centres vacancy remained in the five to six per cent level even through COVID. Power centres continued to perform relatively well while secondary regional centres felt the most pain.

“If you want to summarize it, I would almost say you went from sort of a six, seven per cent up to eight or nine and now we’re back down to six or seven again,” explained Reading.

“So we’re not in a bad position to weather the next six, nine months of recession or recession-like conditions.”

Reading said investors are looking for properties anchored by grocery, drug and liquor stores – necessity-based retail. That still has a pretty strong audience and it has for several years.

“There is an appetite for shopping centres that have performed relatively well in the past and might need a little tweaking or perhaps more substantially a repositioning where the demographics are good, target market’s good, what can we do long-term, assuming they’ve got the cash to do that or can source the capital. I think there’s still a market for those types of retail assets,” he said.

“I think where it’s a little tougher or the audience is substantially smaller is in the properties where there’s a significant vacancy issue. Perhaps the property is tired. Maybe even at the end of its life cycle and it’s a significant redevelopment of some sort. There are groups that will look at those properties but you’ve got to be very careful. You’ve got to know what you’re doing and you probably need a partnership with a residential developer to add value to that property. It’s no longer strictly retail. It’s what else can you do with the property.”

Retail property sector investment performance has improved recently, following an extended period of negative outcomes, said the Morguard report.

“Properties contained in the MSCI Index generated a moderately attractive 3.1 per cent total return for the year ending June 30, 2022. Previously, retail sector performance patterns were decidedly negative, with total returns of -10.1 per cent and -10.9 per cent posted for the same time period in 2020 and 2021. The return was largely income driven. The capital value erosion of the past few years has eased over the past year. The investment performance improvement of the recent past coincided with a stronger capital flow trend,” it said.

“Canada’s retail property sector recently experienced a significant increase in capital flow. Approximately $13.2 billion of debt and equity investment capital flowed into the sector during 2021 and the first half of 2022 combined. The 18-month total was markedly higher than the $5.7 billion of capital that flowed into the sector in 2019 and 2020 combined. Despite a moderately stronger capital flow trend investors remained cautious, given heightened industry and performance uncertainty. Lower risk properties and centres with necessities-based tenants were coveted. In early 2022, cap rates began to rise, as investors looked to reduce the impact of higher interest rates on performance. The cap rate increase followed a period of increased retail property investment market capital flow.”

The report said Canada’s retail leasing market will continue to stabilize over the near term, against an elevated risk backdrop. Leasing fundamentals will be largely unchanged over the second half of 2022 and into 2023, following an extended period of pandemic-influenced weakness. Vacancy will be relatively flat, across much of the country, given limited expansion activity. Retail sales growth is expected to slow significantly over the near term, which will likely erode retailer revenues. Rents will also stabilize, given elevated vacancy levels in most market segments and muted leasing demand. Some operators will continue to right size, resulting in store closures. On balance, Canada’s leasing market is expected to continue to stabilize over the near term.

“Retail property investment market risk will remain elevated over the near term. The probability of an economic downturn in the second half of 2022 or in 2023 is expected to remain high. A downturn would most certainly have a negative impact on retail sector performance. Additionally, the potentially negative impact of interest rate hikes and inflation on retail consumption is another significant near-term sector risk. At the same time, inflation and higher borrowing costs will erode landlord income streams. Ongoing changes in consumer spending behaviour and supply chain challenges are also significant performance risks. Cap rates will likely rise over the near term, given an elevated level of retail property investment market risk,” said Morguard.

Source Retail Insider. Click here to read a full story

A Toronto Mall Is Getting A Massive Food Hall With 10 New Concepts

Toronto is crazy for food halls, and we’re due to get a massive new one with 10 vendors at one of our most high-traffic malls.

Signs emblazoned with the logo for Oliver & Bonacini (Canoe, Rabbit Hole) are now up for Queen’s Cross Food Hall at the Eaton Centre.

The signs also advertise 10 new concepts that should be coming to the hall: Le Petit Cornichon, Captain Neon Sushi + Bowls, Curryosity, Gil’s Fish and Chipperie, Red Sauce, Swanky Burger, Lala’s Cantina, Underground Sandwich, Beauty’s Fried Chicken and Cross Bar.

The sign also indicates the space will be designed by Solid Design Creative, responsible for the design at places like Baro and Maison Selby.

Eaton Centre leasing plans reveal that the hall will span almost 18,000 square feet.

It’s good news for anyone who’s been missing Richtree Market on Level One of the mall, as this new food hall will be taking its place near the entrance to the Queen subway station.

Retail Insider also reports that Oliver & Bonacini is planning on opening another restaurant at Eaton Centre that should be called Constance Taverne.

The signage says the Queen’s Cross Food Hall should open in late summer 2023.

Source Daily Hive. Click here to read a full story

KingSett Proposes 75 Storeys on Yonge Across From 76-Storey Tower

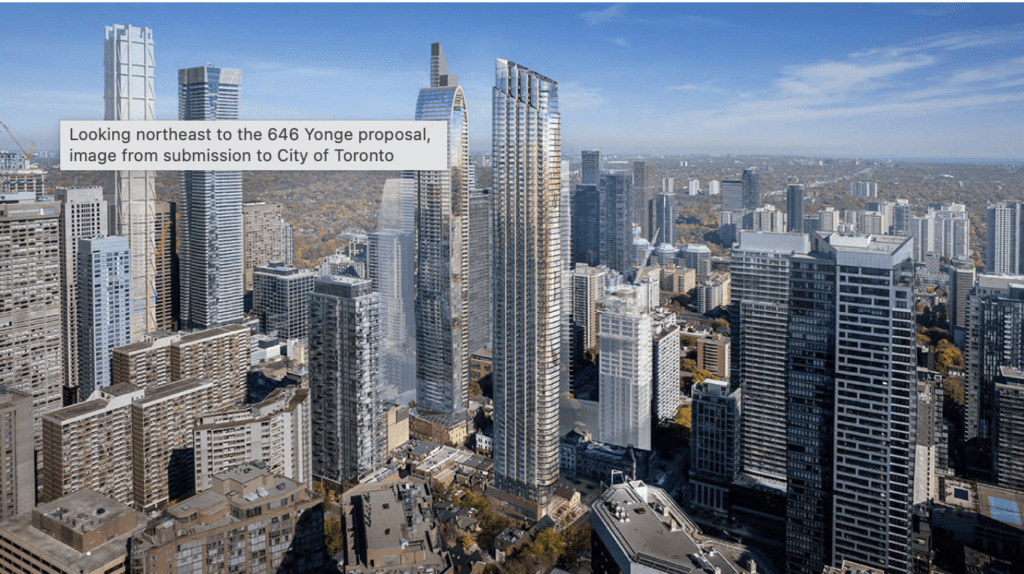

Hot on the heels of an October proposal for a landmark 76-storey tower on Yonge Street between Bloor and Wellesley Streets, developers KingSett Capital are doubling down on their bid to crank up density and height on Toronto’s most significant civic thoroughfare with a new 75-storey proposal located just across the street, at 646 Yonge Street. The proposal was received by the City late last month, marking the last major development application of 2022, and seeks to dramatically redevelop the rear of low-rise retail properties fronting Yonge with an architecturally prominent tower designed by Chicago’s AS + GG Architecture, creating 548 new dwelling units.

Currently occupied by a cluster of 10 properties that are described as contributors to the Yonge Street Heritage Conservation District, the proposal details a mixed approach of retention, reconstruction, and demolition to facilitate the construction of the tower. Based on the designation of the lands in the City’s Official Plan (OP), existing within an Urban Growth Centre, the proponents argue that their submission manages the need to intensify the centrally located site while preserving the existing character of the historic commercial corridor.

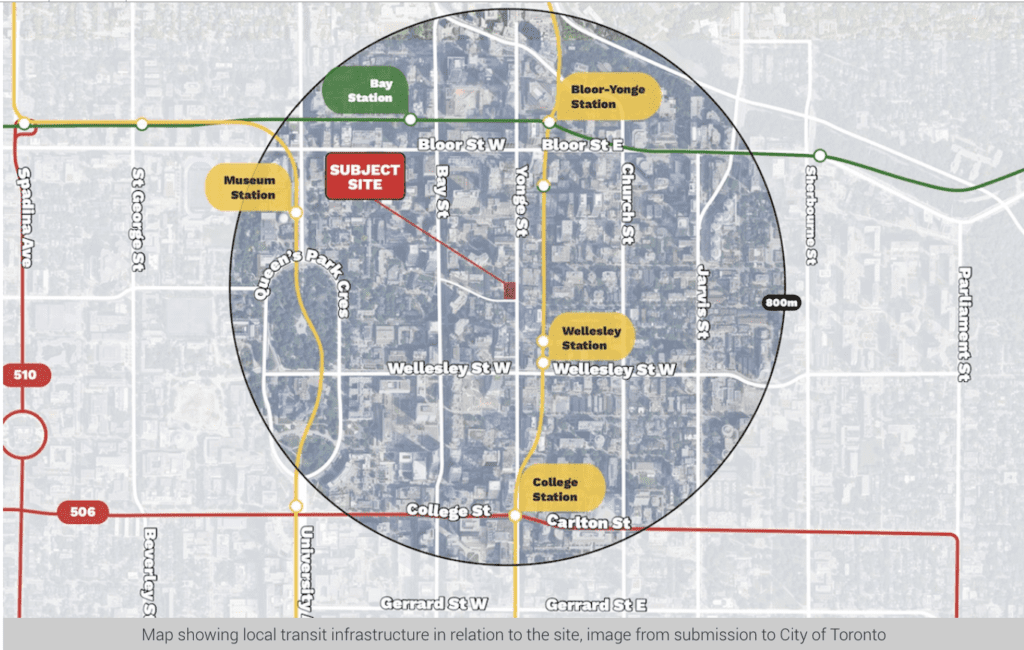

With access to higher order transit and cycling infrastructure, and an existing built form that is only growing more accommodating to exceptional heights, the proposal has a strong case to make for approval of the associated Official Plan Amendment and Zoning By-law Amendment applications submitted to the City that would permit the tower’s construction.

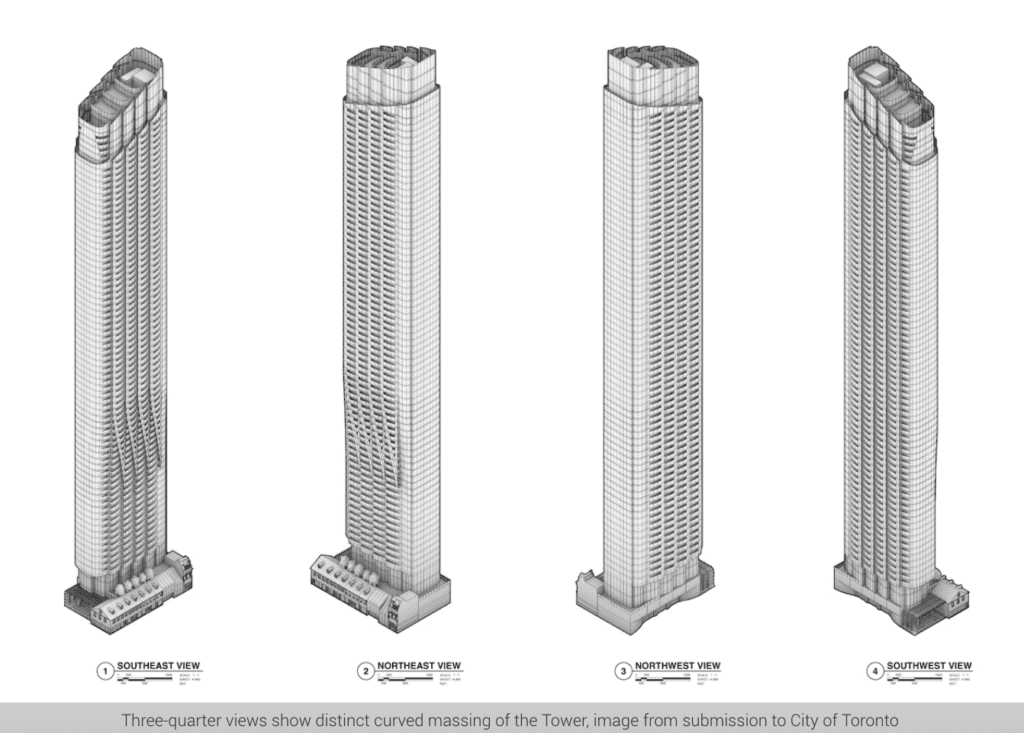

The design of the tower strives to maximize the potential for density on the downtown site with a relatively small total area of 1,349m², while simultaneously delivering a structure that embraces its role as one of the tallest in the immediate area. The tower seems to view the orthogonal norms of Toronto’s predominant high-rise style as references for what not to deliver, and instead presents a curved massing that features an ovular floor-plate, accented by a scalloped balcony pattern and an austerely angled crown that tops the tower off with a distinct peak 254m above the ground.

The tower begins at the 5th storey, rising above a base building with a setback of 10m from the primary (east) elevation fronting Yonge Street. Once the tower reaches a height of 50m (at the 15th storey), the repeating floor-plans are interrupted by a transitional zone that gradually decreases the tower’s setback from Yonge Street. By the 27th floor, the transition is completed, reducing the setback to 8m, and increasing the area of the tower’s floor-plate from 633m² to 701m². From that point on, the massing generally remains the same until the tapering of the floor-plate begins at level 71 to create the angled peak of the tower’s crown.

Externally, the early package of renderings that exists to date indicates that the tower would be finished with a blue glass and silver-grey spandrel glazing that carries over to the balconies as well. The scalloped balcony design creates an interesting visual character on the east and west elevations, with the straight edge of each balcony lining up vertically with the one below to create the impression of four continuous lines that run up the entire elevation. Interestingly, this motif is played with more on the eastern elevation, where the expanding floor-plate of the transitional zone is accentuated by a diagonal line of glazing that realigns itself vertically at the 27th storey.

At ground level, the existing retail occupying the row of buildings fronting Yonge Street would be updated, seeing the removal of the second floor rental units (slated to be replaced within the tower) to create a double height retail space. Meanwhile, the southern frontage on Irwin Street would see the removal of two existing buildings to create a new privately owned public space (POPS) that also allows for a patio space for the new retail unit set to occupy the south frontage.

Amenity space is proposed to be programmed into the base building, occupying the entirety of the second level while providing access to an outdoor amenity terrace that would be added onto the roofs of the existing Yonge Street buildings. Another Terrace would be found at the top of the tower, with an associated indoor amenity space harnessing the impressive views from 75 storeys high, and rounding out the 1,566m² total of proposed amenity space.

The proposal outlines a mix of 16% studios, 59% one-bedrooms, 15% two-bedrooms, and 11% three-bedrooms, meeting the City’s minimum guidelines for family-sized units. Six elevators are proposed for the 548-unit building, providing a ratio of 1 elevator for every 91.33 units, nicely below the threshold of 1 per 100 units, promising much better elevator service than many of the recent proposals. Bicycle parking is proposed to occupy two underground levels, while no motor vehicle parking spaces are proposed, emphasizing the area’s walkability and the proposal’s proximity to higher order transit services.

UrbanToronto will continue to follow progress on this development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

Will 3D-Printed Buildings Alleviate The Construction Labour Shortage?

This fall, the construction site of a pair of large warehouses near Kingston will look vastly different than a regular building site.

Instead of the typical dozen or so workers on site wielding tools to erect the structures, there will be just a few people – working mobile devices that control software to operate an immense 3-D-printing machine.

The printer’s human-sized nozzle methodically extrudes layer after layer of concrete to create walls. In just one pass, the printer can produce the equivalent of cladding, sheathing, thermal breaks and formwork for structure and interior finish, leaving perfect cut-outs for windows and doors (which, along with floors and roof, aren’t part of the printing process – yet).

If all goes according to plan, these warehouses will become Canada’s first 3-D-printed buildings permitted for commercial use.

Last August, the developers, Kingston-based nidus3D, printed the country’s first-ever multifamily apartment building, a fourplex in Leamington, Ont. And in December, the company printed the first two-storey structure in North America, a house on Wolfe Island, also near Kingston.

Those two residential projects are relatively narrow because the printable area of nidus3D’s gantry-style 3-D concrete printer stretches just 40 feet. The upcoming warehouse development will inaugurate a nidus3D-pioneered system that uses site-printed wall sections that will be fitted together by crane – allowing the company to print buildings that are much larger than the printer.

The company says 3-D-printed structures can be built quickly – the ground floor of the Wolfe Island house went up in two weeks – using less materials and producing virtually zero waste, such as off-cuts, to deliver sustainable, highly insulated, airtight and energy-efficient buildings.

For now, costs are equivalent to typical masonry structures, but it aims to become more affordable as it scales up, with more printers expected to be delivered to Toronto and Vancouver by next year.

“We do anticipate costs dropping dramatically,” says Ian Arthur, nidus3D’s president and founder, and until recently, Kingston’s NDP MPP. “We think that, within a couple of years, it will be the most affordable means of putting up a building.”

According to a 2018 study in the U.K. research publication IOP Science: Materials Science and Engineering, 3-D printing can cut costs by at least 35 per cent compared with current manual costs.

Mr. Arthur says his one-term political career spurred an entrepreneurial interest in solving housing affordability and some of the mounting issues challenging the construction industry.

“It’s a sector in nothing short of a crisis,” he says. “It’s facing pressures from so many different directions.”

In addition to material-cost and supply volatility, “we have a huge labour crisis across the country, and as the boomer generation retires, this labour pinch is only going to get worse.”

”We have a huge labour crisis across the country and as the boomer generation retires, this labour pinch is only going to get worse.

— Ian Arthur, president of nidus3D

Statistics Canada’s latest report records an all-time high job vacancy rate in the construction sector of 7.7 per cent, with employers seeking to fill 81,500 vacant positions.

Citing BuildForce, it says the industry needs to recruit 309,000 new construction workers over the next decade, driven predominantly by the expected retirement of 259,100 workers.

Meanwhile, the Canada Mortgage and Housing Corporation (CMHC) estimates that to meet affordable housing requirements, the country needs to substantially increase the number of homes projected to be produced by 2030 – from 2.3 million units to 3.5 million. The biggest housing supply gap is in Ontario and B.C., where housing is least affordable, according to the CMHC.

Unless the industry “starts solving how to build in a different way” that requires fewer workers, Mr. Arthur says, it is unlikely to meet the country’s housing demands.

“We build homes with hundreds of materials, thousands of components and, honestly, millions of steps to get a building out of the ground,” he says. “3-D construction printing simplifies the process and automates it,” making it substantially less labour-intensive, Mr. Arthur says, adding that nidus3D’s construction printers will eventually be run by just two people.

Another company goal is to print with an eco-friendly concrete alternative, “such as wood fibre with a binding agent,” he says. “We have research partnerships with universities, so over the winter we’re looking to print a lot of samples.”

Even if nidus3D succeeds at lowering costs and emissions, the question remains whether Canadian lenders and investors will be quick to embrace 3-D-printed buildings.

“Quick is never a word that’s used in Canada when it comes to banks,” says Marlon Bray, senior director at Altus Group. “The Canadian environment is a lot more risk- averse, a lot more cautious, than other countries.”

The international real estate industry has slowly started to warm to 3-D-printed buildings, a product Mr. Bray describes as “extremely niche.” China, an early adopter, boasts the world’s tallest 3-D-printed structure, a five-storey apartment building, while a 6,900-square-foot municipal building in Dubai is the world’s largest, according to ArchDaily.

In the U.S., last year construction firm SQ4D sold what it claims was the country’s first 3-D-printed home, in Riverhead, N.Y., for US$299,000 ($403,000).

U.S. construction company Icon is at the forefront of the country’s 3-D printing and is currently printing a 100-home community in Texas designed by Bjarke Ingels Group. In December, the partners were awarded a US$57-million NASA contract to develop a livable, 3-D-printed lunar base on the moon’s surface.

Mr. Bray says advances in construction automation, such as 3-D printing and robotically manufactured modular structures, will be part of Canada’s future, but it might take “at least a decade” to reach critical mass.

“The entire capacity for robotics in construction right now is about 2 to 3 per cent of the whole North American market: A tiny, tiny bit,” Mr. Bray says. “And while I think it’s a huge part of the future, it’s a mid- to long-term time range.”

Prefabricated buildings are further along than 3-D-printed ones, he says, “but could even modular apartments ramp up in two or three years? No. The technology needs significant investment.”

And that usually takes many, many years, he says.

“If you look at the car, it took 13 years for it to replace the horse,” he points out.

Source The Globe And Mail. Click here to read a full story

Shopify Looks to Sublet Its New 348K-Sq.-Ft Toronto Office Space

E-commerce giant Shopify has reportedly listed its shiny new downtown Toronto office space for sublease.

In December, Shopify confirmed that it would not be occupying the multi-storey office space it had leased at The Well complex, despite having, in 2018, signed a 15-year lease that began in 2022. The Ottawa-based company originally signed on for 254,000 sq. ft of space, with the option to expand to 434,000 sq. ft.

According to The Globe and Mail, Shopify has now listed for sublease 348,103 sq. ft of office space, spread across seven floors of The Well’s gargantuan office-retail-residential community, located on the north-west corner of Spadina Avenue and Front Street West.

Shopify plans to keep its current office space at the nearby King Portland Centre and will centralize Toronto operations there.

Neither Shopify nor The Well’s owners, RioCan REIT and Allied Properties REIT, responded to STOREYS’ requests for comment by the time of publication.

The news comes as office vacancy in downtown Toronto continues to rise, hitting 13.6% during the final quarter of 2022, per CBRE’s Q4 Office Figures report. This uptick, the report says, came amidst the delivery of 2.4M sq. ft of new supply in 2022.

“Much of the vacancy rise in Canada’s largest city is attributed to major tenant relocations to new developments, leaving behind dated product – the proverbial ‘flight to quality,’” CBRE notes in a press release.

Seeming to nail the Shopify situation on the head, CBRE goes on to explain how the sublease space is also rising in Toronto. “While most units are smaller than 10,000 sq. ft. and are from groups that have elected to work from home, Toronto is seeing an increased number of larger subleases from corporate occupiers curbing their growth plans,” CBRE says.

Office vacancy rates are even higher in Toronto’s suburban areas, at 19.3%, bumping up the city’s overall vacancy rate to 16.2%. Although the numbers may seem large, they are far from the highest in Canada and are actually below the national average of 17.1%. Edmonton office space clocks in at 22.2% vacant, meanwhile Calgary has a staggering 30% vacancy rate. Of the 10 major markets observed for the report, Vancouver had the lowest vacancy rate of just 7.8%.

Looking forward, CBRE Canada Chairman Paul Morassutti says “the office sector will face a bumpy 2023 as it contends with a potential recession, a re-structuring of the tech sector and continued uncertainty around the impact of hybrid work patterns.”

Source Storeys. Click here to read a full story

Dream Office REIT Announces $135M Sale of 720 Bay Street

On Monday, Dream Office Real Estate Investment Trust (Dream Office REIT) announced the sale of Toronto’s 720 Bay Street, known as the McMurtry-Scott Building, named in honour of two former attorney generals. The fully-leased, single-tenant commercial office building is presently the headquarters of the Ontario Ministry of the Attorney General.

Built in 1989, 720 Bay Street is a Class B building containing 11-storeys and 247,700 sq. ft, including 240,000 sq. ft of total office space. It’s a short distance from Queen’s Park — the site of the Ontario Legislative Building — the provincial courts, the Toronto Eatons Centre, and numerous hospitals, hotels, restaurants, and retailers.

Although Dream Office REIT has yet to release details on the buyer, they have revealed that the transaction will generate gross proceeds of $135M, “which is higher than the Trust’s carrying value as at September 30, 2022,” according to a news release from the Canadian real estate investment trust.

“The transaction is expected to close in the first quarter of 2023, subject to customary closing conditions,” the release goes on to say. “The unmortgaged property is currently pledged as security for the Trust’s $375 million revolving credit facility. The Trust intends to use the net proceeds from the sale to repay debt and to opportunistically repurchase REIT A Units under the Trust’s normal course issuer bid program.”

Dream Office REIT is a premier office landlord with over 3.5M sq. ft of landmark property owned and managed. According to a Q3 2022 update, the Trust’s portfolio contains 27 active investment properties valued at $2,596,815, with 5.4M sq. ft in gross leasable area and an 85.7% portfolio occupancy. The investments are primarily concentrated in Toronto’s Financial District. Dream Office REIT also has two projects in the development pipeline.

Source Storeys. Click here to read a full story

Rental Market Will Tighten in 2023, But Investment Will Remain Strong

As more and more Canadians become renters, interest and investment in multi-family rental properties are expected to remain high, despite an uncertain financial environment.

In a new 2023 Canadian Economic Outlook from real estate and property management firm Morguard, the Ontario-based company says that after a decline in spring 2020, demand for purpose-built, multi-family rental properties strengthened during the second half of 2021, extending to the midway point of 2022.

“Investment transaction volume totalled $7.1B for the first half of 2022, as reported by CBRE,” Morguard points out. “The total was in line with the record annual high of $14.1B in 2021.”

Multiple offers on investment properties were commonplace during that time, the report says, with confident investment in major markets amidst the supply of large portfolios falling short of demand.

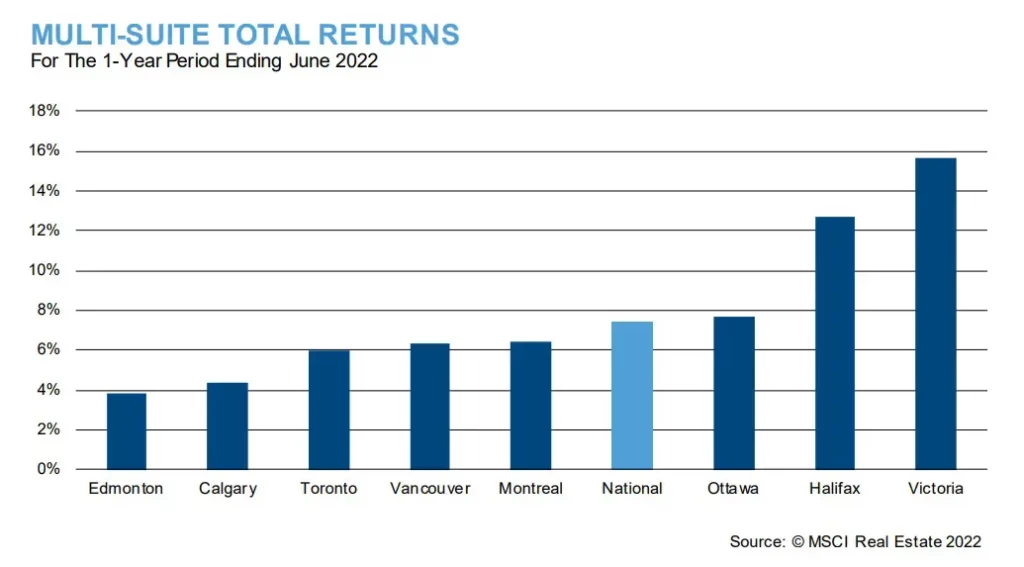

The returns on those investments also remained healthy, with a national average return of 7.4% for the fiscal year ending June 30, 2022 — an increase of 2.2% compared to the previous year.

Returns on multi-family investments in Victoria were the highest in the nation at nearly 16%, followed by Halifax at nearly 13% — the only two markets in Canada that saw average returns over 10%.

Meanwhile, in the larger markets such as Toronto and Vancouver, average returns were at about 6%. Calgary and Edmonton saw the smallest returns on multi-family investments in the nation, with both hovering around 4%.

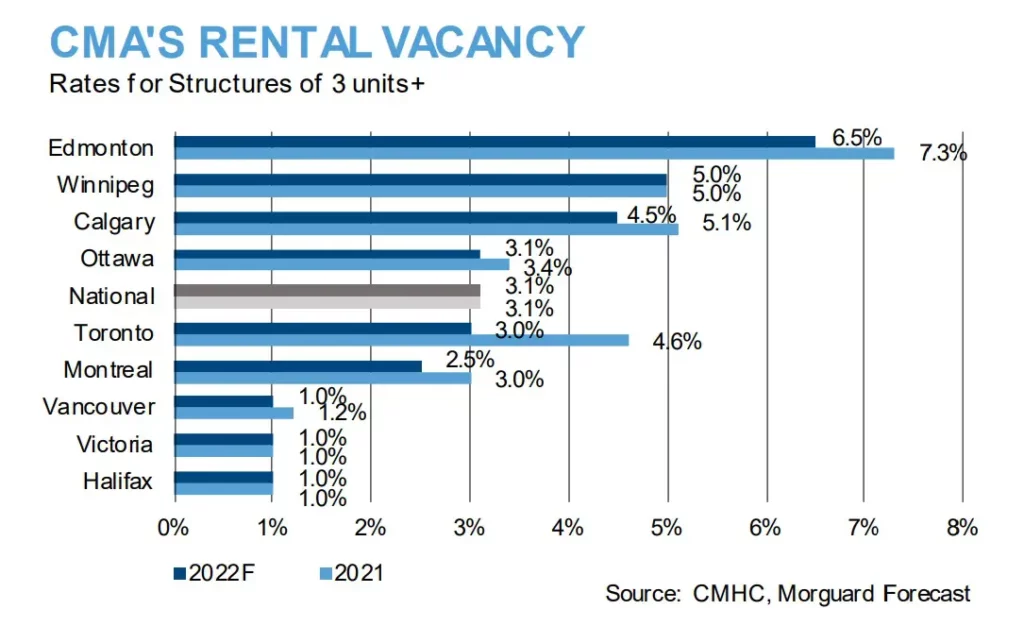

The strength of returns was found to be closely correlated to vacancy rates in their respective markets, particularly at the two ends of the spectrum: Calgary and Edmonton had some of the highest vacancy rates while Halifax and Victoria had some of the lowest.

By transaction volume, in the 18 months leading up to June 2022, Montreal accounted for 30% of total national sales, the most of any market in the country. Second was Toronto at 27%, followed by Vancouver at 16%.

In that same timespan, multi-family properties accounted for 22% of all real estate transactions, second only to industrial real estate sales, which accounted for 30%.

Notable transactions include CAPREIT’s $281M purchase of six properties from JOIA’s portfolio in Montreal, Q Residential’s $165M purchase of the 423-unit Golfview Towers in Toronto, and Centurion Apartment REIT’s $81.7M purchase of a 233-unit development in Surrey, British Columbia. Those three transactions were the largest transactions by price and amount of units in their respective markets.

The Rental Market

The increased investment in multi-family properties came as the national average rent price increased significantly. According to Rentals.ca data, the average listed rent in December across all types of rental unit was up 12.4% compared to a year ago, to $2,024.

And there is no evidence that the increases will be slowing down.

“Several factors contributed to the recent rental demand strengthening,” Morguard says. “Canada’s economic recovery boosted employment levels and rental demand. At the same time, young workers in the 15 to 24 age cohort were able to secure employment and rental accommodation.”

Morguard also pointed to increased international migration as adding to the demand for rentals. Many are concerned about whether the nation’s housing supply can keep up with Canada’s immigration targets, and those concerns will likely remain in place for the foreseeable future.

Vancouver-based Toby Chu, Chairman and CEO of CIBT Education Group — the parent company of GEC Living, which specializes in student rental buildings across Metro Vancouver — previously told STOREYS: “International and domestic students arriving in Vancouver to study, they rent. Migrants moving to Vancouver for work, they rent. New immigrants arriving in Canada, they rent before they buy. Interest rate causes stress test issues for new home buyers, thus they rent. Homeowners downsize from owning to renting, they rent. I think the rental crisis will transform a bad dream into a nightmare.”

Source Storeys. Click here to read a full story

Top-10 CRE Transactions Of 2022 In The GTA, GGH

Commercial real estate transaction activity in the Greater Toronto and Greater Golden Horseshoe areas slowed considerably in the second half of 2022 after an initial strong carry-over from 2021.

This year could see a reversal of that trend, with a slower start and business picking up in the third and fourth quarters, according to Altus Group vice-president of data operations Ray Wong. He believes the amount of deals that happened in 2021 and the first part of last year were unusually high and that a level of normalcy will return to the market in 2023.

“I think investment demand is still there,” Wong told RENX. “The challenge is the product.

“I think that, depending on what happens with interest rates and the availability of product, we’re probably going to see about the same amount of activity — or maybe less — compared to a year ago.”

Wong said there’s a challenge in finding price points that will satisfy both sellers and buyers, given rising interest rates, capitalization rates and carrying costs, as well as a more subdued commercial lending environment.

Riding The Real Estate Roller-Coaster: The Uncertainty Of Inflation

What is inflation? What caused it in 2022? Why is it hard to predict? What are the differences between 2022 and 1970s inflation?

Let’s examine the issue, its impact on real estate and how we can prepare for and attempt to mitigate those effects.

What is inflation and why did it skyrocket in 2022?

Inflation is a general increase in the price of goods and services in an economy over time.

We see it as a percentage and the Bank of Canada has the mandate to keep it at two per cent. The reason it skyrocketed in 2022 is that the cost of raw materials, labour and transportation all shot up.

But why did they become more expensive? We need to explain this if we want to have a chance at predicting what comes next.

It’s demand-driven: Too much money.

The COVID-19 fiscal response injected massive amounts of money into many economies. This explains increases in prices as “demand-driven” inflation. This means that governments, people and businesses had more money and spent more money.

But Europe received only half the fiscal stimulus of the U.S. yet still experienced comparable levels of inflation. Why is this?

It’s supply-driven: Too few goods.

I heard economists in early 2022 vigorously debating the topic of inflation. Most thought it was transitory.

Ben Tal of CIBC suggested it was mainly due to supply-chain problems (shipping, China’s zero-COVID policy, the war in Ukraine, etc.). And so, inflation would self-correct.

At the 2022 Canadian Apartment Investment Conference, Tal said 60 per cent of Canada’s inflation arises from supply-chain difficulties. If true, then a prudent approach for central banks would be to wait until these troubles resolve themselves.

But it gets more complicated.

Inflation is part goods and part services. Goods prices can come down (as some already have) but services can stay high (as most are).

Moreover, on the supply side, nothing is simple or predictable. The war in Ukraine is not ending. China relaxed its zero-COVID policy but then saw the ramifications due to a spike in the spread of infections.

We keep looking in the rear-view mirror and trying to find a model to explain what happened. Yet looking forward we keep getting our predictions wrong.

It looks like 2022’s climbing inflation came from both an increase in demand and a decrease in supply. Is it any wonder no one has a good model to make an accurate prediction?

The central bank and rate hikes

The Bank of Canada reversed fiscal stimulus into a tightening policy and rates went up fast. Rate hikes lowered the demand for goods and the expectation is that the supply side will work itself out . . . eventually.

The demand for services, however, has not changed drastically even after the hikes. People still want to travel and enjoy entertainment like concerts and sporting events.

But after interest rates go up, the economy tends to do the opposite. We expect a recession.

We have seen a downward trend in the number of total businesses in Canada and there have been recent tech company layoffs. Yet a net 104,000 jobs created in December shows a different story – the expected number of new jobs was only 8,000.

It’s complicated!

What will the Bank of Canada do on Jan. 25? Raise rates by 0.25 per cent or higher?

Real estate lessons from the 1970s

Reality is always more interesting and complicated than any model can address. But we’d be well-served to substitute complex models for simple heuristics.

For those of us in real estate, what do we know about the 1970s? How was business done back then?

The OPEC oil embargo of 1973–’74 drove oil prices up by almost three times in just a year. The cost of goods went up and with it, inflation.

Labour was unionized and wages went up to keep pace with the cost of living. Federal price controls did nothing and only when Paul Volcker raised interest rates to 20 per cent in 1980 did inflation go back down to 3.2 per cent by 1983.

Let that sink in . . . a 20 per cent federal rate! Eventually, in the 1990s the federal rates were back down to mid-single digits.

The point here is that looking back the rates we see are a shock to our system because we’ve enjoyed declining interest rates for decades.

Valuations of real estate are directly affected by the cost of borrowing. The cheaper the debt, the more people can pay for real estate and prices tend to go up.

But how did people do business in the ’70s when debt became more expensive? For one, high inflation meant no pre-sales or pre-leasing.

Some used seller financing. Others used more equity.

When inflation is high, those with cash do not want to hold cash as it is losing value.

We adjust how we work to match our current reality. Once the “shock to the system” wears off, we’ll adjust again.

Where does that leave us?

The key to doing well in an inflationary “roller-coaster” and ever-changing real estate market is resilience and preparedness.

CRE businesses must be nimble and ready to take advantage of opportunities when they arise and protect themselves from short-term losses by keeping an eye out for danger signs.

- Take advantage of creative acquisition terms such as vendor debt and delayed closing when purchasing.

- Leverage modestly to ensure liquidity if you are forced to own properties for a longer period of time.

- Invest only in the best locations.

- Research, research, research: zoning, environmental, soils, demographics and more.

- Focus on asset classes most in demand with the least supply (today it seems industrial and multiresidential rental).

- Stay informed on the latest industry trends.

Being ready and able to swiftly adapt to the market unpredictability can open opportunities that many overlook.

Like a roller-coaster ride, what goes down will eventually come back up again

Source Real Estate News EXchange. Click here to read a full story

Allied Puts Toronto Data Centre Portfolio Up For Sale

Allied Properties REIT has decided to offer its downtown Toronto urban data centre (UDC) portfolio for sale following a review of options for the three properties.

In an announcement Monday morning, Allied reports “selling the portfolio in its entirety now is optimal financially and operationally.” It has retained Scotiabank and CBRE to market the assets and facilitate any transaction.

“Our principal motivation here is two-fold,” said Michael Emory, Allied’s president and CEO, in the announcement. “First, we want to reaffirm our mission and pursue it over the next few years with low-cost capital.

“Second, we want to supercharge our balance sheet and reduce our dependence on the capital markets going forward.”

Proceeds from a sale would be utilized primarily for debt reduction and to finance its development activity, the release states. The REIT could also use some of the proceeds to repurchase units under its NCIB.