Author The Lilly Commercial Team

Crane Goes Up at 400 King West With Excavation Complete

It has been nearly four years since Mountain Equipment Coop (MEC) vacated their King Street retail store for Queen Street, leaving the well situated Entertainment District site poised for a significant redevelopment effort. Purchased by Plaza, the developer is now building a 49-storey mixed-use, but mostly residential condo development, 400 King West, on the site. Designed by BDP Quadrangle, the project started construction last year, with demolition getting underway in the late spring. More recently, the project is now well into construction, with excavation complete and a tower crane installed.

Tracking how the project got to this stage reveals some interesting construction processes that were activated in response to the complex set of site specific circumstances that define projects taking place within the dense urban context.

One of these processes was reported on in an earlier story, describing how the building is repurposing the existing foundation walls of the demolished MEC building. With additional excavation required to carve out the project’s three levels of below grade parking, the installation of shoring walls beneath these existing foundations has been an interesting and technical process to follow, and has appeared to advance in stages so as not to destabilize the foundations of the surrounding buildings.

The project’s shoring walls have been installed below the existing foundations of the previous building, image by UT Forum contributor Red Mars

The project’s shoring walls have been installed below the existing foundations of the previous building, image by UT Forum contributor Red Mars

Another interesting tactic implemented on the confined site to aid in the construction process was the creation of a robust staging platform on the southwest corner of the site. Pictured to the right in the image below, the platform is made of a solid concrete slab reinforced with rebar, and is supported by eight steel piles that were drilled deep into the ground. The platform provides invaluable space at grade level for the storage of materials, and allows the crew to work within the boundaries of its site without overflowing into the street.

A staging platform was installed on the southeast corner of the site to provide grade-level storage space, image by UT Forum contributor tstormers

A staging platform was installed on the southeast corner of the site to provide grade-level storage space, image by UT Forum contributor tstormers

With excavation and shoring continuing into the winter months, the pit bottomed out early this year, allowing the crew to move on to the next stage, preparing the base for the tower crane. Rising from a central location in the pit, the image below captures the installation of the crane, which took place on January 9th. Not pictured is the crane’s boom, which was successfully added on shortly after.

Looking south as the tower crane is installed on site, image by UT Forum contributor tstormers

Looking south as the tower crane is installed on site, image by UT Forum contributor tstormers

With the crane in place, the last two months of work have been focussed on the early stages of concrete forming for the tower’s lowest levels. In the image below, we can see that a number of concrete columns have already been poured and set, while forms are in place to continue creating more, beginning on the east side of the site. On the left of the frame, we can see rebar being laid in position for the eventual pouring of the building’s first concrete slab.

With excavation complete, concrete work is now underway below grade, image by UT Forum contributor Red Mars

With excavation complete, concrete work is now underway below grade, image by UT Forum contributor Red Mars

Concrete work will continue to advance over the next few months, and could be expected to emerge above grade by the end of the summer. After that, the tower will have another 49-storeys to complete before it can deliver on its promise of 612 new condo units with at-grade retail.

UrbanToronto will continue to follow progress on this development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

Canada’s Lodging Industry Made Big Comeback In 2022: C&W

Canada’s lodging industry rebounded in a big way in 2022 as revenue per available room (RevPAR) increased 91 per cent year-over-year and was 3.5 per cent over 2019’s year-end level, according to a new report from Cushman & Wakefield.

“Resorts performed very well through ’21 and ’22,” said Brian Flood, Cushman & Wakefield’s vice-president and practice leader for hospitality and gaming valuation and advisory. “City centre hotels were the ones that really felt the most impact through COVID.”

Average daily rates (ADR) surpassed 2019 levels starting in June 2022, driven by pent-up leisure demand and inflation. Room demand only began to exceed 2019 levels in September, with December showing the largest gain.

Group travel returned somewhat, along with events that had been postponed or cancelled the previous two years due to health precautions, according to Flood.

Though business travel still has a way to go to reach previous levels, Flood said those he’s spoken with are confident it will. Travellers are no longer avoiding densely populated major cities, as witnessed by the huge RevPAR gains made in those areas last year.

RevPAR rose about 160 per cent in Toronto, Montreal and Halifax, and about 125 per cent in Quebec City, Calgary and Vancouver.

Victoria recorded the lowest RevPAR growth, but the B.C. capital was one of the best-performing markets over the COVID-19 period and had less room for growth.

Slower transaction activity

Accommodation transaction activity softened in 2022 despite the strong recovery. Cushman & Wakefield tracked more than 160 transactions, accounting for approximately $1.6 billion in total volume – down from over 200 transactions and about $2 billion in 2021.

With last year’s stronger performance, most owners were happy to hold and reap the financial benefits after two years of losses.

“I think it’s still a sector that investors are attracted to,” Flood said. “It is a sector that does provide somewhat of a hedge against inflation.”

The 2021 transaction market was largely driven by the financial impact of COVID, owner fatigue and acquisitions by public bodies.

As in 2021, the 2022 market was dominated by sales of smaller, independently owned properties acquired by private buyers. There were very few transactions in larger urban centres and the Canadian hotel market has little institutional ownership.

“It was a good time to sell in a rising market if your long-term plan was not to hold on to the asset,” said Flood.

Biggest transactions of 2022

The largest 2022 sale was the $112.5-million acquisition of the 239-room The Oakes Hotel in Niagara Falls, adjacent to Fallsview Casino Resort and overlooking the falls.

It was acquired in July from Kerrio Corp. by Hennepin Realty Holdings, which plans to redevelop it into a twin-tower 1,140-room hotel.

The largest urban sale was the 285-room Bond Place Hotel in downtown Toronto, acquired by the City of Toronto from Silver Hotel Group for $94 million in September.

The property had been under contract to the city for emergency housing during COVID and was acquired to provide social housing.

Hotel 2170 Lincoln, a former 221-room Residence Inn by Marriott in downtown Montreal, was sold by Reluxicorp Inc. to Immeuble 2170 Lincoln Inc. for $63 million in November.

The plan is to convert the property to multiresidential, according to Flood.

There was an increase in strategic dispositions in 2022. Morguard sold several hotels from the Temple Hotels Inc. portfolio, which it fully acquired in February 2020, to a variety of purchasers from March through December.

They included 2,037 rooms at properties in Thunder Bay, Calgary, Regina, Winnipeg, Edmonton, Saskatoon, Moose Jaw, Lloydminster and Fort McMurray.

An Ontario portfolio of five Motel 6/Studio 6 properties with 613 rooms in Mississauga, Brampton, Burlington and Whitby was sold by G6 Hospitality to a private group in July.

Four of the hotels sold for $56.5 million and the other was a leasehold for which a price wasn’t registered.

Resorts and leisure-based properties continued to attract investor interest.

InnVest Hotels acquired the 65-room Charltons Banff and 99-room Royal Canadian Lodge in Banff from a local family for an undisclosed price in August. Both will be repositioned as upscale resort hotels.

Few distress sales

Since the lodging industry downturn was related more to COVID restrictions than a poor economy, and because governments and lenders were supportive of owners, there were few distress sales – just two per cent of the total in 2022.

“Having worked through some earlier downturns, like in the early ‘90s, lenders then were much more apt to close on properties that weren’t performing,” said Flood.

“I think lenders now realize that working with the owner is far more productive and will result in a better outcome for the owner and also for the lender.”

Accommodation development is picking up again

The recovery has reignited interest in development, particularly in suburban growth areas and secondary and tertiary markets that have been underserved in the past and where land is cheaper to purchase.

Through Q3 2022, 1,026 new hotel rooms opened, 7,126 were under construction and 27,497 were being planned. That last figure is 12 per cent above Q4 2019.

“I think we’re at pre-COVID levels in terms of new development,” said Flood. “We’re certainly getting a lot of calls from developers that had postponed projects but are moving forward today.”

Fifty-five per cent of the national development pipeline is in Ontario, with British Columbia second at 19 per cent.

At the city level, the Greater Toronto Area accounted for 22 per cent of the national pipeline, followed by Vancouver at six per cent and Montreal at five per cent.

The national pipeline, comprised of hotels under construction and in planning, represents about seven per cent of Canada’s existing room supply.

Outlook for 2023

Cushman & Wakefield anticipates hotel pricing will remain strong through 2023. Where better quality assets are available, brokers are reporting strong buyer interest and multiple bids.

As the Canadian hotel market enters the next phase of its recovery, Cushman & Wakefield anticipates a change in demand characteristics this year, with growth in the group and corporate sector despite a weaker economic outlook.

ADR growth is expected to moderate.

With more travel options available and the high cost of travel and hotels in Canada, some leisure demand could dissipate this year.

“There are some concerns around a recession and inflation has had an impact on consumer spending,” said Flood, who believes the overall outlook is still positive.

“I think the sector is quite healthy right now. I think the biggest challenge for investors is just difficulty in finding properties to acquire.”

Labour shortages and costs will continue to be an issue for hotels as they return to normal staffing levels.

The Hotel Association of Canada, Tourism HR Canada and the Government of Canadacreated the Destination Employment program last year to mobilize 1,300 new Canadians into hotel jobs in five regions of the country.

These groups continue to advocate for modifications to programs that will ease the labour shortage for the hospitality industry.

Source Real Estate News EXchange. Click here to read a full story

UTPro Instant Reports: Retail Grounds Projects in Southwestern Scarborough share

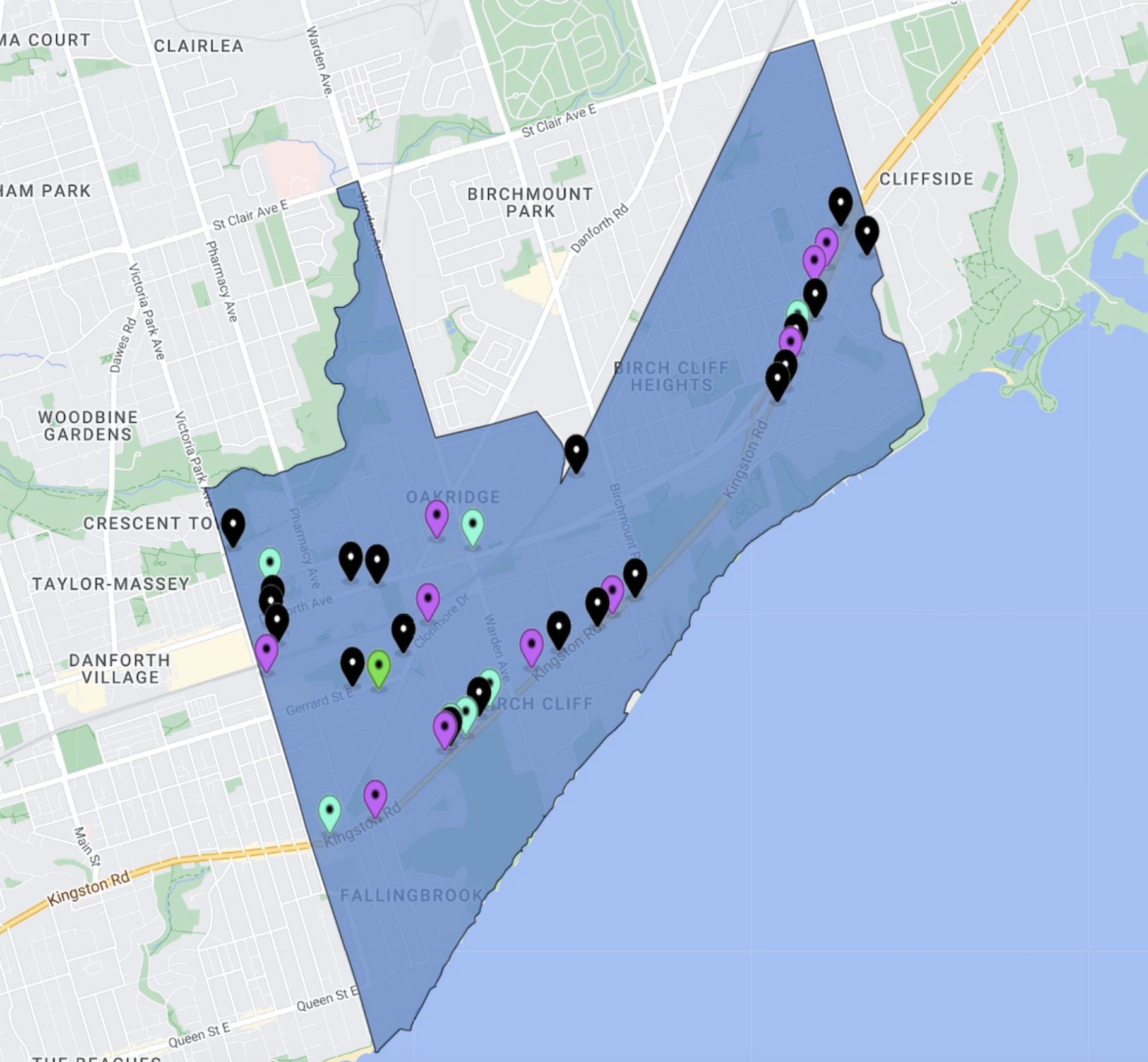

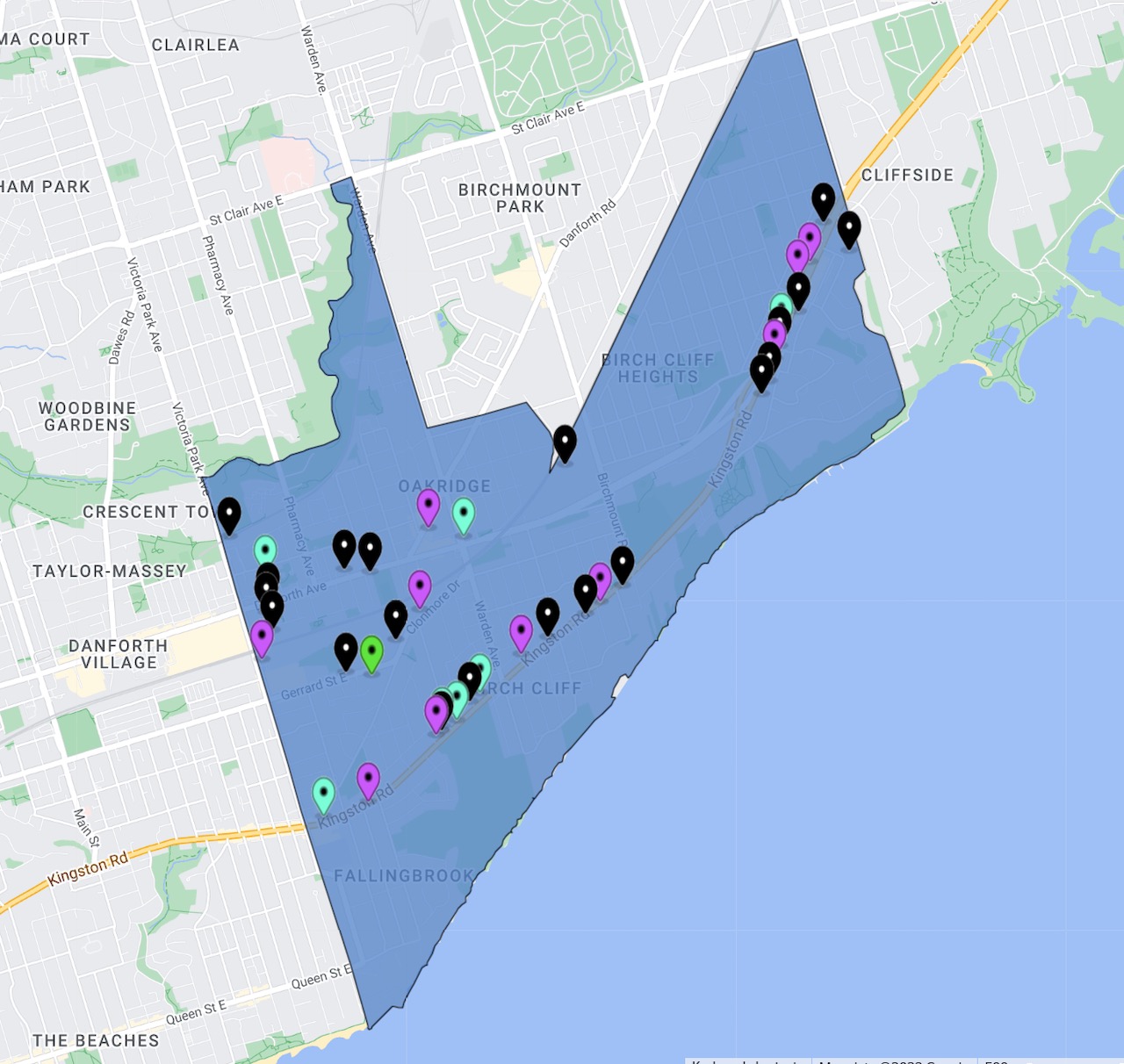

UrbanToronto is back with another instalment of our weekly UTPro Instant Report, analyzing the trends of development taking place in the most active nodes of Toronto and the GTA with the help of our UTPro software. Using the MLS Zone Report function, which instantly creates a report containing the key data on every project within a specific Multiple Listings Service Zone, we will be zooming in on one of the City’s eastern waterfront communities: Zone E06.

Located in the southwestern corner of Scarborough, E06 encompasses the Oakridge, Birchcliffe, and Cliffside areas, and is bordered roughly by Victoria Park Avenue to the west, Lake Ontario to the south, and Midland Avenue to the east, while the Zone’s north border is a meandering line that in part follows the Lakeshore East rail corridor and in part Taylor Creek. The Zone is generally defined by “Neighbourhood Area” land use designations, with narrow corridors of “Mixed-Use Areas” along Kingston Road and Danforth Avenue. Development over the last decade has been concentrated within these mixed-use areas, and has seen success at the mid-rise scale.

Map of MLS Zone E06, containing 37 projects, image from UTPro Instant Report

Map of MLS Zone E06, containing 37 projects, image from UTPro Instant Report

Our MLS Zone Report for Zone E06 came back with a list of 37 total projects. Breaking that figure down, 20 of those projects qualify as pre-construction, 10 currently under construction, and the remaining seven projects are in the complete category. This represents a balanced spread, indicating that development in the area has been ongoing for years and is not merely a recent phenomenon for the area.

Among the various completed projects in Zone E06, the most recent of the group is Upper Beach Club, a seven-storey boutique condo that was completed in 2021. The project offers a total of 42 units, representing a markedly low density by the area’s standards, but formally offers an average impression of the massing that has seen success in the surrounding context. At a height of 24 metres, the building has little impact on the neighbouring single family homes.

Complete design of Upper Beach Club boutique condo, image from submission to City of Toronto

Complete design of Upper Beach Club boutique condo, image from submission to City of Toronto

Just getting under construction in the west end of the Zone, Birchley Park is on the more ambitious side of the spectrum, seeking to deliver a new mixed-use community offering a total of 8 new buildings and a significant affordable housing component. With nearly 1,000 units planned, the project is taking advantage of the proximity to the higher order transit offering of nearby Victoria Park subway station to turn up the dial on density.

Complete design for 8-building Birchley Park community, now under construction, image from submission to City of Toronto

Complete design for 8-building Birchley Park community, now under construction, image from submission to City of Toronto

Finally in the pre-construction stage, 2540 Gerrard East is another project that stands out in the group, making a push to advance the tolerance for high-rise development in an area that has seen little of it. At 32 storeys, the proposal is the tallest in the Zone, and not by a close margin, but an approval from the City could be a catalyst for future high-rise projects beyond the immediate surroundings of the Danforth.

Complete design for 2540 Gerrard East, the tallest proposed project in Zone E06, image from submission to City of Toronto

Complete design for 2540 Gerrard East, the tallest proposed project in Zone E06, image from submission to City of Toronto

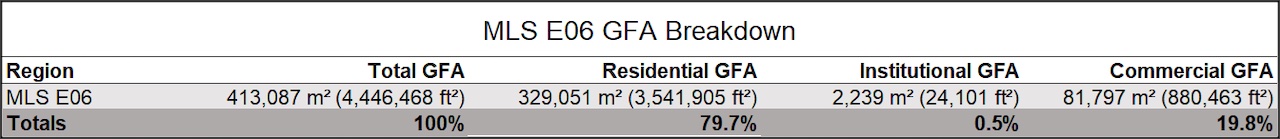

Looking at the accompanying statistics, it’s clear among this group of projects that an effort is being made to integrate commercial components into the largely residential slate of projects. Of the 37 total projects, 19 are listed as offering retail, which is an important inclusion for development striving to preserve the character of established retail strips along the Avenues. This fact is elaborated on further in the graphic below.

GFA Breakdown for all 37 projects in Zone E06, image from UTPro Instant Report

GFA Breakdown for all 37 projects in Zone E06, image from UTPro Instant Report

While the incorporation of mixed-use programming is catching on in the Zone, height appears to be a characteristic that will continue to lag behind. With an average height of just below 30 metres, the relative dearth of higher order transit in the immediate area — other than Victoria Park subway station — may be having a direct impact on the tolerance for more aggressive density.

To access the full data set from this or any UrbanToronto Pro Instant Report—with even more stats and a full list of projects—purchase a report here! Stay tuned for next week’s instalment to learn more about why UrbanToronto’s Instant Report is one of the most valuable tools for staying informed on development in the GTA.

Source Urban Toronto. Click here to read a full story

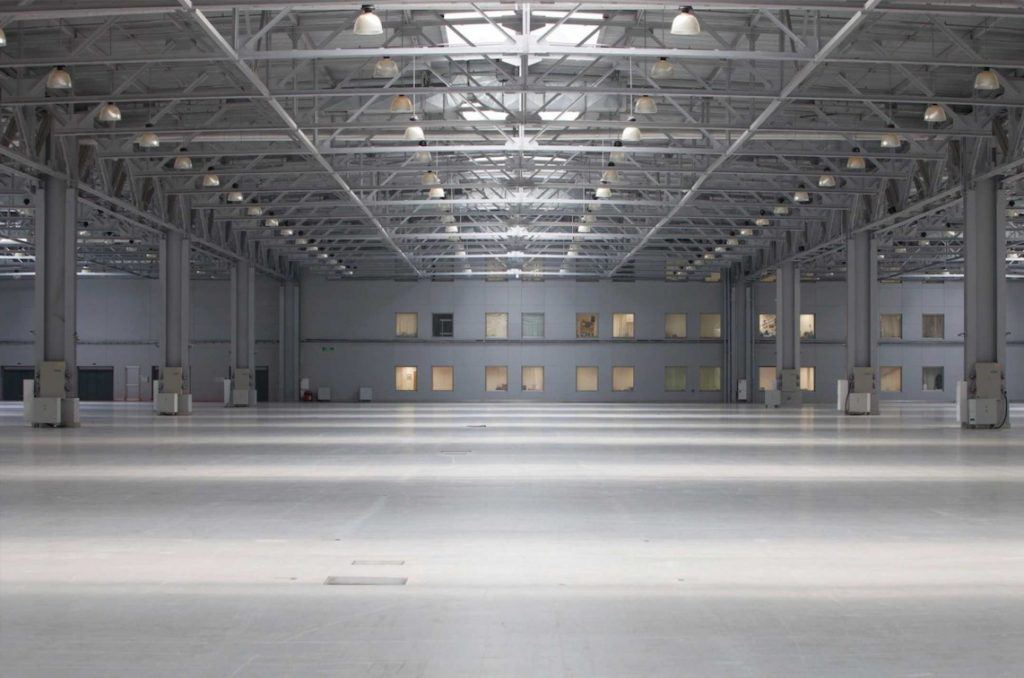

Canada’s Industrial Sector Still Has Room To Grow: RealCapital Panel

While there are concerns about potential headwinds, industrial remains the top-performing commercial real estate asset class in Canada.

And that’s expected to continue according to a three-person panel of executives, who’ve spent considerable time in acquiring, developing and managing industrial real estate, at the Feb. 28 RealCapital conference at the Metro Toronto Convention Centre.

The four men discussed industrial real estate performance, issues and challenges during the session. Colliers vice-chairman Gord Cook moderated the discussion and offered an introductory overview of the sector.

Industrial started seeing substantial rent growth in 2017, when the availability rate was around three per cent — about three times as high as it is now. It was already a landlord’s market when the COVID-19 pandemic hit and led to tremendous e-commerce expansion.

“That had a very strong ripple effect for not only the occupiers of industrial real estate, but the outlook of investment and where those investment dollars should be spent,” Cook said.

“Those fundamentals through COVID saw strong absorption levels and even further rates of growth within rental rates.”

Canadian industrial investment hit a record in 2021 after the pandemic-induced doldrums of 2020. That continued through early 2022 before a steady stream of interest rate hikes slowed activity.

Outlook for 2023

Triovest chief investment officer Prakash David said he’s working on three deals at the moment and is bullish on industrial real estate, but still thinks there will be a slowdown in activity.

He’s especially high on core-plus and value-add properties where environmental, social and governance elements can be improved to increase sustainability and profitability.

“We still feel really good about development because we have the fundamentals,” David said. “We think there are still good tenants out there and a lack of good space, notwithstanding a lot of new supply coming on in certain markets.

“So we’ll continue to invest there, but we’re going to be more disciplined about the way we underwrite and probably not bet that we’re going to absorb that space as quickly as we might have, or that rents will grow as quickly as we might have thought last year.”

“Industrial is a great asset class that has strong fundamentals and leasing can do well,” Choice Properties senior vice-president of office and industrial Andrew Reial said. “If it’s a well-located property with great functionality, I think people will want to be there.”

Dream Industrial REIT senior VP and head of investments Bruce Traversy thinks the first and second quarters of the year will likely be a bit slow, but he believes there are many buyers interested in value-add industrial real estate where they can increase rents.

There’s less enthusiasm for properties with long-term leases and relatively small annual rent increases, he added.

“The short-term view is tough to swallow as you wait for that cash flow to improve,” Cook noted.

While David thinks there will be continued industrial rent growth, Triovest is being conservative and cautious about its belief in hitting peak market rents at this point.

Property owners and brokers are becoming more open to selling pieces of a portfolio individually or in smaller bundles rather than as a whole because getting debt financing to make larger acquisitions has become more difficult for some buyers, according to Traversy.

More industrial development is needed

“The Canadian industrial development market has generally been under-supplying the market since 2008,” Cook explained.

“We had an exodus of merchant developers and we started to see more institutions building to core but, with the exception of maybe Alberta, the entitlement process for development always takes longer than expected.

“Land values and development charges were constantly running at a pace somewhat higher than rental growth until we hit about 2017.

“Through moderate absorption for over a decade, we continued to see those vacancy rates and availability rates drop to a level that was truly awkward to grow an economy. The benefit was dramatic rent growth.

“With the exception of Vancouver, we have a development pipeline that’s under two per cent. You put that into context and most U.S. markets are typically building two to five per cent of new inventory for markets that typically have five to seven per cent vacancies.

“Put that in the context of the Toronto market, where we would actually need to develop about 45 million feet and put it into the market just to get back to a five per cent availability rate.”

The Toronto industrial market currently has less than 14 million square feet under development, with pre-leasing generally occurring within six months of launch, Cook added.

Industrial rents across Canada

Cook said industrial rents last year rose by 18 per cent in Vancouver, 31 per cent in Toronto, 41 per cent in Calgary and 74 per cent in Montreal.

That helped offset increases in land prices, construction costs and development charges.

Triovest just leased a 50,000-square-foot industrial building in Vancouver for $27 per square foot, with annual four per cent rent escalations built in.

Comparatively, David said industrial space can still be had for nine dollars per square foot in Calgary. While Montreal rents have risen rapidly, they still lag Vancouver and Toronto.

“We’re investing heavily in Montreal and Balzac (a community north of Calgary) at the moment because we think they have room to run whereas in other markets I’m not sure they have as much,” said David.

Traversy said he thinks underwriting for five to 10 per cent rent growth is realistic.

Development postponements not expected

Cook wondered if some industrial developments might be postponed due to new underwriting, higher capitalization rates or concerns about capital markets and economic fundamentals.

“Most developers are in for the long haul as they’ve got the capital and balance sheet and I think they’re going to drive on,” Reial said.

“If you go to tertiary locations where you’re supporting Toronto but you’re an hour-and-a-half outside the city, maybe those numbers start getting a little riskier because there will be a flight to quality and being closer to major cities.

“But I think, for the most part, people will keep on driving forward.”

Even with older and smaller buildings, Reial said Choice is getting calls about space before it comes to the market.

New industrial space might be priced too low

Cook said lease renewals for 20- or 30-year old industrial buildings with clear heights of 22 to 30 feet are going for $17 on average, whereas new space with 40-foot clear heights, modern design and sustainability features are leasing for $18 to $21 per square foot.

He thinks tenants in those newer buildings are getting a great deal.

David agreed with Cook, but added: “We’re building best-in-class assets so that when times get really tough, just like in the office market, there’s a flight to quality and you know your cash flows.

“So right now, yes, we like that small-bay rent because you’re really getting more rent than you want to for that space. But it’s not the way to think of it over the long term and it will probably revert back.”

Choice has a lot of second-generation industrial product that’s performing well, in addition to its new developments.

“If you can afford $16 or $17 rents for 24-foot clear, paying $23, $24 or $25 isn’t unreasonable in a new-generation building,” Reial said, because you’re getting 50 per cent more space with a 36-foot clear height.

Source Real Estate News Exchange. Click here to read a full story

An Outlook On Specialized Sectors That Will Define CRE In 2023

The year kicked off with a unique landscape for commercial real estate.

The market transitioned from the comfort of record-low interest rates to 14-year highs while stronger-than-expected employment data from Statistics Canada in January left central bankers uncertain of their next steps to slow inflation.

The reaction of the market adjusting to central bank fiscal policy has led to investors taking a closer look at specialized sectors.

By diversifying their commercial real estate portfolios, they are setting plans in motion for their best assessments on potential short- and long-term returns.

I sat down with Colliers’ national practice group leaders in brokerage to get their outlooks on their respective sectors, which are garnering significant attention from our clients and the market.

Warren Wilkinson, national alternative asset practice group leader

The best way for investors to mitigate investment risk is to diversify. In this current economic climate, we are seeing traditional commercial real estate assets command less attention and alternative assets begin to gain significant traction.

These assets include self-storage, medical and life sciences, retirement and long-term care facilities, student housing, data and call centres, manufactured housing and RV parks.

As interest from clients and the market continues to grow in this segment, sector experts across Canada are seeing a rise in inquiries to share best practices, research, access to available properties and knowledge to advise decision-makers on an alternative asset commercial real estate investment.

Tyler Dolan, national debt advisory practice group leader

Debt advisory is an important commercial real estate solution for 2023 given the frequent changes in the risk tolerance and appetite of lenders due to rising interest rates, along with ever-changing regulatory and economic conditions.

This makes it more important to engage experts with strategic relationships with the lending community to matchmake quality borrowers and projects with the right source of capital. That expertise can assist in putting together comprehensive loan applications tailored to the target audience, whether it be a pension fund, insurance company, bank, credit union, trust, non-bank lender or private lender.

The recent upward movement of interest rates has caused challenges for many looking to finance new construction or refinance existing properties – the result being that borrowers must inject additional cash equity into their projects or bring additional mezzanine debt.

We are also seeing complications in replacing construction debt with term debt upon completion of new developments, with shifting metrics from when deals were written versus when they are closing.

As a result, the old saying “time is money” is critical and it has become paramount for debt advisory teams to deliver a strategy that aligns with clients based on the economic factors of the year, so only viable lending partners will be approached.

Peter Garrigan, national industrial practice group leader

Our industrial advisors across Canada continue to observe a sustained demand for industrial real estate, accompanied by a shortage of new supply.

This trend has fuelled growth in the sector, particularly in our three major markets of Toronto, Vancouver and Montreal.

Since Q1 2021, these markets have experienced exponential growth with an availability rate of approximately one per cent. Notably, over 90 per cent of the new supply that entered the market was already pre-leased, indicating persistent demand.

In response to supply-chain issues that have impacted construction in recent years, many organizations have turned to technology to overcome these challenges and innovate industrial supply.

Despite the limited availability of space, with only one to three per cent of the total inventory for each market currently under construction, we anticipate further rental growth throughout 2023 and beyond.

However, tenants with flexibility in their lease terms are expected to delay major decisions as they assess the economic outlook throughout the year.

Robert Frost, national multifamily practice group leader

The multifamily sector is projected to perform well in 2023 and continues to be one of the most sought-after asset classes for both private and institutional investors.

While the current economic environment has slowed investment volume, there are early signs of the market stabilizing, which should result in a marked increase in activity for the latter half of the year.

This will largely be driven by inflation continuing to ease and interest rates holding, which should bring confidence back to the investment community.

Rental demand remains very strong in an undersupplied market and the big question will be whether new supply can keep up with the projected Canadian immigration targets set at approximately 1.5 million people over the next three years.

With high interest rates and cost to borrow, many newcomers are likely to rent for some time, fuelling rental demand and rising rents.

With the market stabilizing and strong long-term fundamentals, we should see a resurgence of capital flowing back into the multifamily sector this year, leading to cap rate compression despite elevated interest rates.

Madeleine Nicholls, national retail practice group leader

The long-term outlook for the retail sector in Canada for 2023 is positive, with anticipation of one to two years of heightened openings and closures.

Canadian retail sales outpaced inflation and climbed to an all-time high of $735 billion at the end of 2022 and are expected to continue growing throughout this year.

Additionally, retail rents have generally held steady for the second half of 2022 after significant increases in the first half of 2022. They appear to look stable into the first half of 2023, with some upward pressure on inducements.

In 2023, we expect to see new business concepts emerge, especially those with a focus on the consumer experience both in-store and online, which will continue to evolve the retail landscape.

Bobby MacDonald, national technology practice group leader

Our tech advisory team has observed the pivotal role of tech occupiers in pre-leasing new developments in major Canadian cities over the past few years.

Landlords in Canada’s three largest cities continue to consider tech tenants as downtown anchors and support the incubation of the next major tech startups.

In Vancouver, significant leasing commitments from Amazon and Microsoft demonstrate the enduring significance of the tech sector to the city’s economy, given the city’s proximity to the major global tech hub in Seattle.

In Ontario, Waterloo has earned the title Silicon Valley of the North due to its thriving tech industry which boasts the highest density of tech startups in all of Canada and ranks second in the world behind San Francisco.

In Montreal, the city’s lively culture of food, music and arts, coupled with affordable living, has created an optimal talent pool for creative and technology-focused organizations.

Despite the recent news cycle highlighting layoffs in the tech sector, many companies are simply right-sizing their employee bases and divesting from moonshot programs to reduce expensive capital.

Throughout 2023, practical programs will continue to stabilize the tech industry and demonstrate its longevity, thereby confirming the necessity of real estate requirements.

This stability is further enhanced by government funding commitments to digital technology and scale AI.

Source Real Estate News Exchange. Click here to read a full story

Ontario Moves To Ban Use Of Non-Disclosure Agreements In Real Estate Transactions

Confidentiality clauses, or non-disclosure agreements, are increasingly found in all manner of legal agreements Canadians enter into, but as of April 1, 2023, Ontario real estate professionals will be restricted from using them when settling a dispute with a client.

To advocates pushing for an end to the widespread use of non-disclosure agreements (NDAs) the changes are welcome, but for an industry where reputation is a valuable currency it could raise the stakes for realtors facing complaints or business disputes.

“One of the main reason [any party] wants to settle is they don’t want their dirty laundry in public,” said Gosia Bawolska of Cadence Law. Ms. Bawolska said she can see both sides of the issue. “[As a homebuyer], I wouldn’t want to hire a realtor with six settlements … but if I were the lawyer acting for [a realtor] I would still want to have the ability to use a confidentiality clause.”

That ability will be circumscribed as of as of April in Ontario when new language will be added to the Trust in Real Estate Services Act code of ethics regulations to say registered salespersons and brokers will not “obstruct or attempt to obstruct any person from making a complaint to the registrar.” It goes on to make it crystal clear that settlements are still allowed, but a client must be able complain to the industry regulator – the Real Estate Council of Ontario (RECO) – about it.

“Though real estate agents and brokerages have resolved consumer issues directly for years, just as any other business does, this makes it clear that those resolutions cannot include an obligation to withdraw a complaint, not file a complaint or to not provide evidence to RECO,” said RECO registrar Joseph Richer in a statement. “The new provision follows existing case law and other regulated sectors that have similar provisions. … This will help further strengthen consumer protection and allow consumers to do what’s right and inform the regulator.”

NDAs have been much in the news lately with the revelations around secret Hockey Canada sexual assault settlements. There has been a push in several industries to limit the use of NDAs when it comes to assault or harassment claims.

According to Julie Macfarlane, a professor emerita in the law department at the University of Windsor, NDAs were widely used in the technology sector in the 1980s. While Ms. Macfarlane still sees the value in intellectual property protection, she argues that confidentiality that shields potential bad actors from scrutiny has the effect of making misconduct a trade secret.

“I’ve certainly seen cases where people are told they cannot complain to the regulator, I’ve come across this in healthcare,” said Ms. Macfarlane, who is the founder of the Can’t Buy My Silence campaign aiming to restrict NDA use in Canada and the world.

She has advised several provincial governments on new laws that will restrict NDAs specifically that aim to cover up bullying, harassment and abuse, with Prince Edward Island passing the first legislation while Manitoba and New Brunswick have also tabled bills.

On Feb. 9, The Canadian Bar Association passed a non-binding resolution on NDAs that it said would “discourage their use to silence victims and whistleblowers who report experiences of abuse, discrimination and harassment in Canada.” Ms. Macfarlane said that’s a signal as to where the profession is moving on the subject.

While case law in Canada is very limited on the enforceability of such clauses, in the U.S. courts have begun to strike them down on a number of grounds: “For vagueness, exploitation, clear unequal bargaining, for public policy reasons where public safety is involved,” Ms. Macfarlane said.

For working realtors, threats of lawsuits or complaints to the regulator are not unknown.

“Have we been sued? Yes. Has it gone anywhere? No. Whether they were right or wrong, there have been instances of settlement and NDAs or releases,” said Andre Kutyan, a broker with Harvey Kalles Real Estate Ltd. Over 18 years in the business he’s seen everything from clients trying to back out of deals to agreements of purchase and sale that included chattels – one time it was a central vacuum system – that weren’t there at closing time. When calculating the likely cost of legal fees or insurance deductibles to fight with an upset client in court, a settlement sometimes makes the most business sense.

But will they still make sense if a realtor is settling over conduct that could still be reported to RECO?

“It may rub people the wrong way if they enter into an agreement, put a stop to the issues between them and then one side turns around and reports the other party to RECO,” said Daniel Waldman, a lawyer and real estate litigator with Dickinson Wright. “When they enter into a settlement and/or release, the intention of the agreement is to bring finality to the issue and close it off. That is why they are meant to be kept confidential, as it is supposed to be the final word on the matter, just between the parties who enter into it.”

There are still many industries that allow the use of confidentiality clauses. But Ms. Macfarlane argues Canadians shouldn’t just accept that silence is a condition of settling any claim.

“People sign [NDAs] because they are being told they must sign to get a settlement. That’s actually not true,” she said. “If you think about it rationally, the party that wants the NDA is the same party that doesn’t want to bring this into court, that doesn’t want to be in the public domain in any case. It’s a bluff.”

Source The Globe And Mail. Click here to read a full story

Despite a Rocky Road Ahead, There’s Positive News for Canada’s Commercial Investors

Canada’s commercial investors can’t catch a break in recent years: if it’s not pandemic restrictions, it’s tougher financing conditions and a potential economic slowdown.

A new report from commercial real estate services firm CBRE, however, suggests that there’s room for optimism on Canada’s commercial real estate front.

CBRE’s just-released Canadian Real Estate Market Outlook doesn’t deny that investors are in store for a bumpy road. But, given the immense amount of global capital targeting real estate, and the greater certainty expected with respect to interest rates, the report forecasts an active 2023 of mergers, acquisitions, and high-profile deals that could push investment volumes to an all-time high of $59.3B.

“We are fundamentally very positive about Canadian commercial real estate but it also undeniable that the short term is going to be very bumpy,” says CBRE Canada Chairman Paul Morassutti. “However, with better visibility around where interest rates are settling, we expect that pricing expectations will re-calibrate in 2023, deal flow will pick up, and by Q3 and Q4 we should see much more robust investment activity.”

It’s no secret that office space across the country took a major hit in the thick of the pandemic and — thanks to a new-found remote work culture — they’re still not where they were pre-pandemic. The report highlights how office utilization and the space needed per worker will evolve to a new equilibrium as companies fine tune their optimal remote-office balance.

The report also discusses how spaces that help attract workers back to the office will be a priority, with many of Canada’s forward-thinking tenants using the coming year to relocate to properties with the best amenities (which have increasingly gone from nice-to-have to expected), commute times, and sustainability profiles that are aligned with their own ESG priorities.

“Tenants are demanding more from their spaces and prioritizing high-quality offices that support new ways of working,” reads the report. “Not all buildings are created equal, and the bifurcation of office space will widen in 2023.”

In a climate of increasing vacancy, the prospects for older office space becomes more challenging with their loss of appeal.

With Canada’s relentless housing supply issues, there has been talk of converting aging and vacant office spaces to residential units, however, feasible opportunities are limited. According to CBRE, office properties are more likely to be retrofitted to attract new tenants or demolished for better uses.

Unlike the uncertain office market, the industrial sector is very much alive and well. According to CBRE, the national average industrial rental rate surged 30.9% year-over-year to hit $13.71 per sq. ft. at the end of 2022. CBRE expects rents to continue to be driven up by strong levels of demand as well as from the influx of new builds that command higher asking rents due to increased construction costs. The big box segment remains a hot commodity, with very limited available space that inevitably comes at a premium.

Despite a record 46.4M sq. ft of new supply expected to be delivered in 2023, the industrial market will remain undersupplied relative to demand. Robust pre-leasing activity and a conservative approach to construction in Canada means the national availability rate is forecast to only rise modestly by 40 bps to 2.0% in 2023.

Industrial construction starts are expected to ease in 2023 as markets across Canada work through their existing development pipelines. CBRE says that speculative construction may also become less viable amid elevated financing and construction costs, in addition to rising capitalization rates. Third-party logistics firms accounted for over 26.1M sq. ft. of new leasing activity in Canada over the last two years, and this trend is expected to continue into 2023 as more companies look to outsource their supply chain processes.

CBRE highlights how growing demand for multifamily rentals compressed the overall vacancy rate in Canada to a 20-year low of 2% in 2022. The outlook expects elevated demand levels to continue to persist and drive vacancy rates even lower in 2023 — something that will be driven by Canada’s record-breaking immigration targets. A return to the office is also driving the increased demand for urban rental product, as workers returning to the office look to minimize commute times. According to CBRE, a continued supply-demand balance is expected to push multifamily rents higher in 2023, with the rent growth forecast to remain largely in line with 2022’s record pace.

The report highlights a growing trend in the retail space of adding a residential component to shopping malls — something reflected everywhere from Toronto’s Yorkdale Shopping Centre, to Ottawa’s famed CF Rideau Centre. In fact, according to CBRE, more than half of the 30 top performing regional shopping malls in Canada are undergoing redevelopment, which will add thousands of residential units to these properties in the coming years.

CBRE says that revenge shopping — a desire to shop to make up for the time shutdowns prevented doing so — has started to cool, and is anticipated to slow further in the year ahead thanks to elevated interest rates and inflation. “Changing behaviours will redefine new growth opportunities for retailers, especially among the value category, as consumers become more cost-conscious,” reads the report. “Brands will need to differentiate their products or provide a higher quality of service in the year ahead to capture consumer attention and dollars.”

Refreshingly, retail foot traffic levels have largely returned to pre-pandemic levels, with consumers eager to engage in more lively, personalized shopping experiences that can’t be offered online.

“While it is widely assumed that younger consumers are highly engaged with e-commerce, Gen Zers are less likely to shop online than millennials, CBRE research shows,” says Morassutti. “This indicates that despite being digital natives, even the youngest consumers are choosing to shop in-store. So much for the death of retail.”

At least there’s that pleasant surprise.

Source Storeys. Click here to read a full story

Redevelopment of Hamilton Heritage School Proposes Nearly 1000 New Units

New Horizon Development Group has kicked off 2023 with an ambitious redevelopment proposal on the east side of Hamilton that would see the residential conversion of the historic Delta Collegiate Institute (DCI) building, coupled with a site-wide intensification effort. Designed by Graziani + Corazza Architects, the proposal contemplates the construction of three separate mid-rise buildings of 14 storeys, with four blocks of townhouses at three or four storeys surrounding the site’s perimeter. All together, the redevelopment would offer 975 new dwelling units with a significant rental component in an area with emerging transit infrastructure.

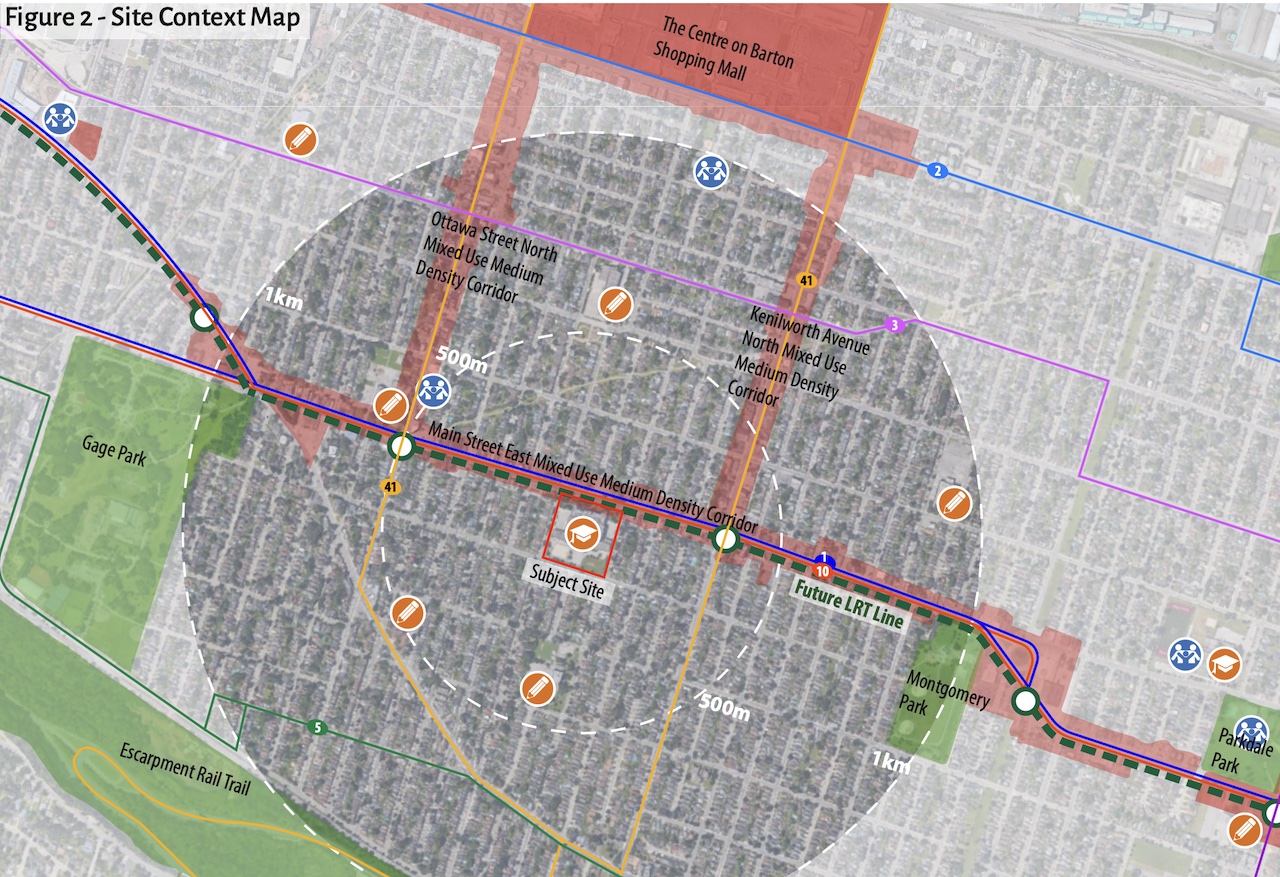

Addressed to 1284 Main Street East, the DCI building occupies a substantial area of nearly 25,000m², a significant plot within mature low-rise residential community on the edge of a broader mixed-use context. More active commercial corridors are located in the immediate vicinity, on Main Street, Kenilworth Avenue, and Ottawa Street, with the latter streets also slated to be stops on the coming Hamilton LRT, giving the DCI redevelopment proposal a transit oriented scope.

Map view of site and surrounding area, image from submission to City of Hamilton

Map view of site and surrounding area, image from submission to City of Hamilton

The existing building is designated heritage property in the City of Hamilton with layers of history as an institution of cultural significance and a well preserved example of design excellence. Opened in 1924, the school was just the second collegiate institute in Wentworth Country (now Hamilton), offering the highest level of secondary education at that time. As a piece of built history, the building represents an exceptional display of modern gothic architecture, while the landscape draws on the symmetry and order of the beaux-arts tradition, creating picturesque vistas at an impressive scale.

Historical photograph of the 1920’s-built Delta CI building, image from submission to City of Hamilton

Historical photograph of the 1920’s-built Delta CI building, image from submission to City of Hamilton

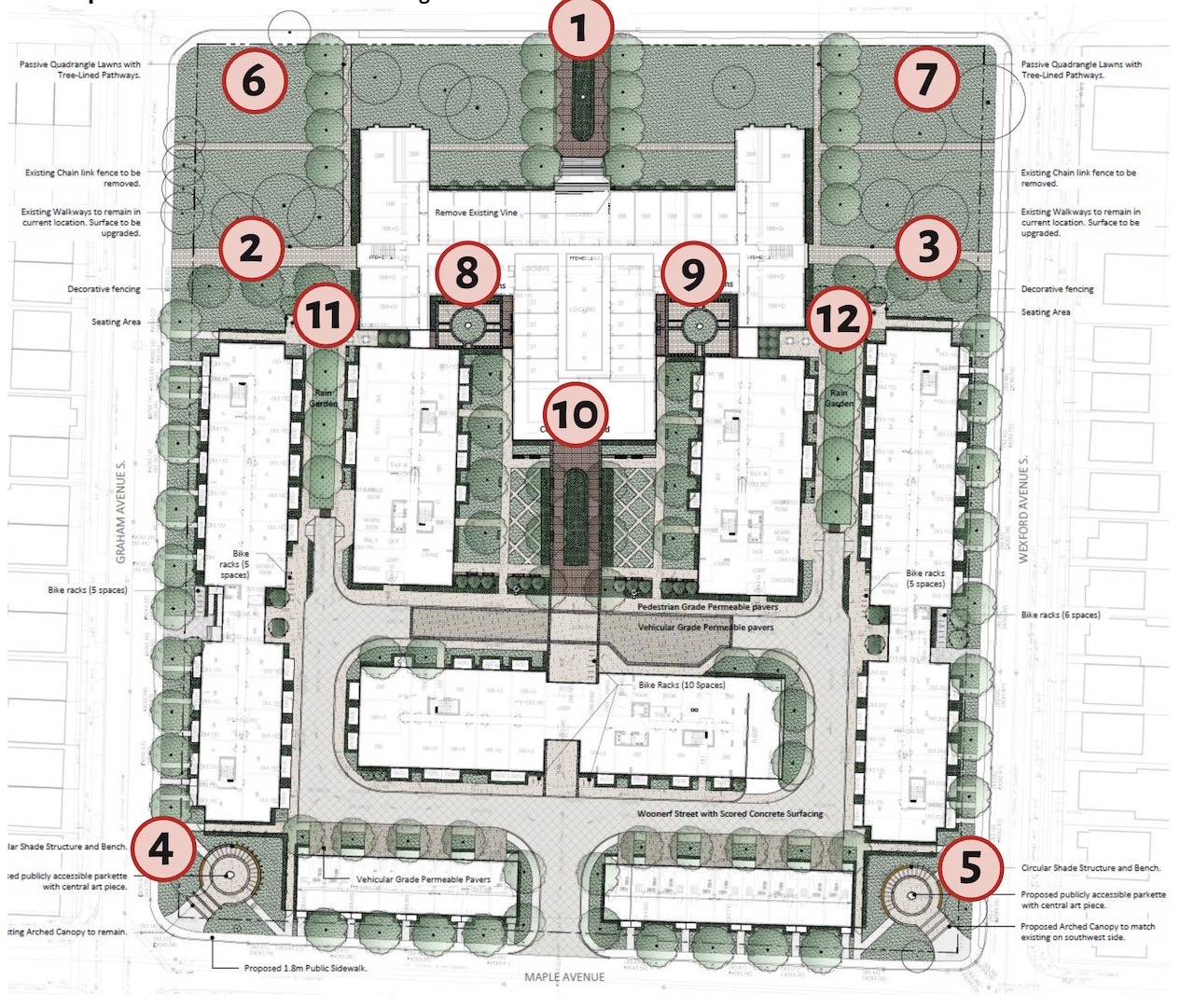

Digging into the extent of the proposed redevelopment, the new buildings are all situated to frame the existing building and activate what would be considered the back portion of the site to the south. Referring to the site plan below, we can see that the mid-rise buildings (labeled A, B, and C) are rectangular in their footprint, and together form a U-shaped arrangement extending from the school building, creating a large central courtyard.

Meanwhile, blocks D, E represent the four-storey townhouses, with blocks F and G representing the three-storey townhouses. The placement of the townhouse structures around the edges of the site is purposeful, working as a buffer in scale between the mid-rise volumes and the surrounding low-rise neighbourhood on all sides.

Site plan shows massing and height of all proposed buildings, image from submission to City of Hamilton

Site plan shows massing and height of all proposed buildings, image from submission to City of Hamilton

Managing both the heritage value and the impacts of development on the surrounding context are the primary considerations in the proposed massing and expression of the new-build structures. The mid-rise buildings all fit within the boundaries of prescribed angular planes from Graham Street to the west, Maple Avenue to the south, and Wexford Avenue South to the east, with the placement of the townhouses providing an appropriate setback to facilitate that passage of light.

Setback of mid-rises behind townhouses allows for pedestrian friendly scaling, image from submission to City of Hamilton

Setback of mid-rises behind townhouses allows for pedestrian friendly scaling, image from submission to City of Hamilton

The pedestrian scaled townhouse volumes across the development rely on a material palette that aims to complement the heritage building. The extensive use of brick maintains a consistent materiality among all the low-rise structures, while the mid-rise buildings provide the necessary visual distinction to add variety to the exterior condition.

An offset rectangular framing pattern is expressed on the facades of the mid-rise buildings, appearing above where the higher volumes separate from the brick volume below, with a single storey glass reveal. The pattern is created by precast concrete panels, and works in concert with vision glass and aluminum mullions to deliver a motif that aims to translate the formal rhythms of the heritage building into a contemporary expression.

The low-rise volumes of the development would be finished in brick to reflect the heritage building, image from submission to City of Hamilton

The low-rise volumes of the development would be finished in brick to reflect the heritage building, image from submission to City of Hamilton

Grade level landscaping is meant to create a network of symmetrical circulation routes for pedestrians and vehicles as well as open garden style spaces at the north and south borders of the site, making direct reference to the existing beaux-arts style layout of the site. Parking would be accommodated in three underground levels, offering a total of 1,136 vehicle spaces and 539 bicycle spaces. Of the 975 total units, 715 are proposed to be made available as rentals.

Landscape plan shows symmetrical approach, image from submission to City of Hamilton

Landscape plan shows symmetrical approach, image from submission to City of Hamilton

New Horizon submitted applications for both Zoning Bylaw Amendment and Official Plan Amendment to the City of Hamilton in January, and will seek approval based on the proposal’s ability to activate a transit oriented site with a built form that seeks to minimize its impact on the surrounding low-rise community.

UrbanToronto will continue to follow progress on this development, but in the meantime, you can learn more about it from our Database file, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

2022 Non-Residential Construction Saw Highest Cost Increase in More Than 40 Years

As inflation grew and interest rates rose in 2022, compounding with the supply chain issues and labour shortages that resulted from the pandemic, the cost of construction grew accordingly, forcing many developers and builders to pause and reassess.

Last week, Statistics Canada published new data that quantifies those construction cost increases, and puts what we saw in 2022 in context.

According to Statistics Canada’s composite price index that includes 11 key census metropolitan areas (CMAs) across Canada — Vancouver, Edmonton, Calgary, Saskatoon, Winnipeg, Toronto, Ottawa, Montréal, Moncton, Halifax, and St. John’s — non-residential construction saw a cost increase of 12.5% from 2021 to 2022, which was the highest year-over-year increase since 1981, when the Non-Residential Building Construction Price Index was first introduced.

Non-residential buildings include commercial buildings such as offices and warehouses, as well as industrial buildings including factories and bus depots with maintenance facilities, and Statistics Canada attributes the cost increases to the rising costs of wood, plastic, structural steel framing, and metal fabrications required for these buildings.

By building type, factories and bus depots with maintenance facilities saw the highest construction cost increases in 2022, with costs increasing 14.7% and 14.9%, respectively.

By region, non-residential construction costs increased the most in Toronto (16.2%), followed by Ottawa (13.6%), then Montréal (12.9%). Each of the 11 CMAs saw their highest annual construction cost increase since the Index’s inception in 1981, except for Calgary, Edmonton, and Vancouver, which saw a significant increase in 2007.

Construction costs increased significantly in the first half of 2022, but increased at a slower pace in the latter half of the year.

However, all of this does not seem to have made a significant dent on non-residential construction investment, according to data Statistics Canada published today.

According to that data, while overall investment in building construction decreased by 1.3% to $20.2B in December and investment in residential construction declined 2.1% to $14.6B, investment in non-residential construction saw an increase of 0.8%, to $5.6B.

Furthermore, that increase in non-residential construction investment was the seventh consecutive month investment had increased, indicating that investment saw an uptick again after the cost increases slowed down in the second half of the year.

In December, Ontario accounted for most of the growth (by dollars), seeing a 2.7% increase in non-residential construction investment. By building type, investment in industrial construction saw an increase of $2.1B, an increase for the 13th consecutive month, evidence that the demand for industrial space has been strong enough to outweigh rising construction costs.

Like non-residential construction, residential construction saw cost increases as well in 2022, with the 11-CMA composite price index rising 19.1%, the highest year-over-year increase since the index was introduced in 2017, with double-digit cost increases in all 11 CMAs except for Moncton, and costs rising the most for single-detached homes (20.9%).

“A combination of increasing demand for construction and supply challenges due to labour shortages resulted in limited availability and higher prices for materials and labour in the construction industry in 2022,” Statistics Canada said.

Fuel prices were also a factor, as were construction industry job vacancy rates, which hit a high of 8.3% in April before starting to decline, and also added upward pressure on labour wages that raised overall construction costs once again.

The amount of building permits and permit values for residential construction were down in 2022 compared to 2021, but were — yet again — higher for non-residential construction, further evidence that despite all the changing variables, the demand for non-residential space may continue to win out.

Source Storeys. Click here to read a full story

Canada Computers To Open New HQ And Expand Operations With Stores Across Canada

Canada Computers & Electronics has plans to open a new headquarters in Richmond Hill and is planning to open stores throughout Canada within the next five years.

The new headquarters is going to be over 150,000 square feet and will have everything under one roof.

“We have outgrown the location we are in now many years ago, so our sales team is actually working from a different location. Now with the new office, we can place everyone under the same roof and it will give us room to grow and provide a more relaxing space for the staff. We will offer a 24 hour gym, a badminton court, and it will give the space we need in the warehouse,” says Gordon Chan, the CEO of Canada Computers & Electronics.

The opening of the warehouse was supposed to be for the end of this year; however, Chan said because of delays it will most likely be opening in the first quarter of 2024.

Canada Computers & Electronics was founded in 1991 and focuses on computers, IT, accessories, and electronics from phones to drones. Since the company has been open, Chan said its goal has always been to provide the best customer service, the best products for consumers, and all at the best value compared to other electronic retailers in Canada.

Remodeling Online and Physical Stores

Instead of opening any new stores this year, Chan said he will be focusing on improving stores that he currently operates and improving its e-commerce platform to better serve consumers.

“I believe that 2023 will be challenging, but we have a lot of plans so we can grow. This year, we will not be reopening any new stores but I believe this will allow us to grow faster in the future. We will be remodeling a lot of our stores to improve the design and customer service.”

Chan said the plan is to remodel the whole store and will be “reinventing how they are going to merchandise” to improve consumers’ shopping experience. Chan said the renovations will make it easier for consumers to see features of the product, there will be more lighting, a sitting area for staff to sit and talk with consumers, and the space will provide a friendlier environment for consumers.

In addition to renovating existing stores, Chan said he is also going to improve the e-commerce platform and mobile app.

“We will be making the e-commerce platform more accessible. With the new warehouse, we are looking at ways to make our online website easier to use and also provide faster shipping. The new platform will be more informative, easier for consumers to order, and we will shorten the delivery time.”

Chan said the team is working on providing a one hour delivery time with consumers who place orders 5km from a store. In addition, Chan said he is investing into a service team that can go to consumers homes or commercial locations to install or fix products. These two services, along with the new e-commerce platform, will be available this year.

Canada Computers & Electronics will also be improving its mobile app where customers can browse products with ease, get information about products, and make an inquiry.

“We are trying to make these things happen this year, but a lot of planning has to be done as we want to do this perfectly. We have continued to expand our service and there is a lot of room to improve. We are going to be working on those to make the company more efficient, to provide better service, and also better communication. These are things we are going to be working on, and it is going to be a busy and exciting year for us.”

Five Year Plan

Canada Computers & Electronics currently has 40 locations spread across British Columbia, Quebec, Ontario, and in Halifax. Chan said within the next five years, he is looking to expand the company to have a store in every province and has the goal to open 20 new stores within the next five years.

“With the new warehouse, it would allow us to grow and expand. The goal would be to open across Canada so Canada Computers is available to everyone. And we are going to be setting up the new designs so any new stores that we open in the future, we are going to be using the new format.”

Source Retail Insider. Click here to read a full story