Author The Lilly Commercial Team

Bottom Is Nigh For Most CRE Valuations, Office Still A Struggle: Altus

Real estate data provider offers insights into commercial real estate industry survey

Flashy Designs, Fresh Amenities: Building Owners Eye Upgrades Amid Return-To-Office

Picture this: Your commute ends in a lobby with soaring stone pillars and a nine-storey indoor trellis that’s cascading with live greenery. A series of art is featured on 80-foot digital display as you pass by a calming pond before the workday ahead.

These are just some of the design plans for 33 Yonge St., a 42-year-old office building in downtown Toronto that is rebranding as Berczy Square after the neighbouring Berczy Park.

Home to GWL Realty Advisors (GWLRA) – one of Canada’s largest real estate companies that also manages the property – and Altus Group, a commercial real estate intelligence firm, 33 Yonge will undergo renovations that are expected to be complete by fall 2025. Part of the upgrades include five new high-end dining options that serve different cuisines such as French, Italian and Latin.

The office is classified as a ‘Class A’ building, meaning it’s a premier space in a prime location with high-quality finishes. Commercial buildings can also be classified as ‘Class B’ or ‘Class C.’ The former refers to buildings slightly less central that are accessible to transit and in good condition, while the latter tend to be less well-maintained and in more isolated locations.

“[33 Yonge] has great bones, so we just needed a new design that matches what tenants expect in the modern age of employee attraction and retention,” says Steffan Smith, the executive vice-president of asset management at GWLRA. “It’s not necessarily an Instagrammable moment, but tenants want something unique that they can attach their brand to.”

Owners will continue to offer upgraded amenities

The newly designed 33 Yonge Street is set to finish renovations by fall 2025 – complete with a new interior lobby designed by Dialog Design.Supplied by GWLRA

Updating amenities to entice employees to return to office is just one trend highlighted by the CBRE in its recent report on Canadian office figures.

These amenities include everything from boutique gyms and sleek dining options to bike storage and shower facilities. “Historically, owners of real estate in Canada have not really invested in building amenities in a way that aligns with tenant interests,” says Marc Meehan, CBRE Canada’s managing director of research. “This shift is a good thing. It’s good for tenants. It’s good for their employees.”

The first half of 2024 has seen some welcome stability in key areas, the report shows. Office vacancy rates and sublet space for downtown Class A buildings declined, while eight out of 10 markets saw more space leased than vacated. Nationally, the overall office vacancy rate held at roughly 18.5 per cent over the past year, with a lack of vacancy growth indicating a slowly improving market.

New supply high, construction will remain low

Office construction is at a 19-year low at just 5.7 million square feet, compared with the 10-year average of 14.6 million square feet, according to the CBRE’s recent report. However, Canada still had a strong start for new supply in 2024, with three new buildings delivered – the highest since 2017.

In Toronto, 160 Front St. – also known as TD Terrace – offers 1.26 million square feet of space in a 47-storey glass and steel office tower, a striking addition to the city skyline. The National Bank of Canada also opened two new office towers at 700 and 800 Saint Jacques Ave. in Montreal, complete with a daycare, 400 bike parking spots and more. All projects were delivered nearly or fully preleased.

New construction starts have petered out, with only three small projects under 30,000 square feet begun in the second quarter of this year. Mr. Meehan remains cautiously optimistic and acknowledges that the next wave of development won’t be new builds. “We’ve built a lot of Class A space and so it’s going to take a bit of time to go through that. But as tenants start to prioritize high-class buildings in the markets with good transit accessibility, eventually we’re going to run out of those buildings. I think that’s what’s going to kick off the next development cycle.”

Class B buildings will retrofit and renovate

While older and farther from prime downtown locations, Class B and C buildings will continue to play a key role in the market. To remain competitive, some of these owners are assuming the high costs to upgrade their facilities. These retrofits will help address the eventual lack of new Class A supply, add or upgrade amenities to attract and retain employees, and ensure compliance with emerging environmental, social and governance (ESG) rules.

The gap between vacancy rates for Class A and B/C buildings has widened in downtown locations, with Class A buildings showing a vacancy rate of 16.4 per cent and Class B/C buildings showing one of 25 per cent. “There are a wide range of buildings that fall within this B class, and many are doing quite well,” says Mark Fieder, principal and president at Avison Young Canada. “So long as owners continue investing in their assets, the gap between A and B class won’t widen.”

More incentives for office conversions

The National Bank of Canada recently opened two new buildings on St. Jacques Street in Montreal.Supplied by National Bank of Canada

The city of Calgary was the first to offer an incentive program to entice downtown office owners to convert underused buildings into mixed use and residential rental units, amenities and other services.

Calgary’s first office conversion, the Cornerstone, opened in June and offers commercial space for up to 50 retail businesses, as well as 112 two- and three-bedroom units. “Adaptive reuse contributes to the revitalization of neighbourhoods,” says Mr. Fieder. “Granted, conversions are not simple because buildings must meet criteria … and these projects are often costly, but if we can see public and private partnerships, such as what is happening with Calgary’s incentivization program, it would help pave the way.”

Municipal incentive programs are required to make conversions worthwhile for office owners, and more cities are coming on board. Last quarter, 10 conversion projects were initiated across five markets. “The reason that it has worked in Calgary is because they offered $75 a square-foot, and that allows you to buy that building for the cost of the land. If you’re able to buy the land value, then it’s more appealing to owners,” Mr. Meehan says.

Over all, office conversions are a small part of the market, comprising just six million square feet – less than 2 per cent of inventory – since 2021. But there’s a real desire to help within the commercial real estate sector. “The affordable housing crisis is real,” says Mr. Meehan. “[Calgary]’s done a great initiative, we should be doing more of it and finding ways to support it.”

Source The Globe And Mail. Click here for the full story.

RioCan’s Real Estate Developement Pipeline

Jonathan Gitlin, CEO of RioCan Real Estate Investment Trust, joins BNN Bloomberg to discuss the company’s latest earnings and outlook for the future.

Source BNN Bloomberg. Click here for the full story.

Challenges For Office Real Estate

Michael Cooper, CEO of Dream Office REIT, joins BNN Bloomberg to discuss the outlook for Canada’s office real estate market.

Source BNN Bloomberg. Click here for the full story.

There Might Be Lab Space in Your Office Tower’s Future

Global Design and Engineering Firm’s Experiment With Unique Conversion Could Have Shared Results

When the University of Toronto’s Temerty Faculty of Medicine needed to expand its laboratory near its urban campus, the institution found that such space is at a premium in Canada’s largest city. And having employees doing biotechnology work from home wasn’t a viable option, so the school had to conduct a different type of lab experiment.

It turned to the design, engineering and management consulting firm Arcadis, charging it with figuring out how to convert two floors of a 1980s office building into labs. Arcadis has a distinct vision for making this type of space out of office floors in the historic downtown Toronto building.

“You cannot take your lab home; you cannot make that shift,” said Jay Deshmukh, associate principal and practice lead within architecture at Arcadis, in an interview. When it comes to Toronto demand for lab space, she added, “it is only growing in terms of its presence within the global bioscience marketplace in terms of research and manufacturing.”

Finding ways to repurpose underused office space has been attracting interest in the United States, the United Kingdom to other countries. The pandemic accelerated the trend of working outside the office, leaving some owners and landlords coping with low demand, particularly in buildings that are more than 20 years old. While office space has been converted to labs for decades, and more than 100 conversions are estimated to be underway at the moment in the United States, the Amsterdam-based design firm said what it’s learning in its work with a portion of a tower in Toronto spanning 30 floors could influence its projects globally.

While office-to-residential conversions have drawn interest due to the surge in downtown office vacancies and the pressing need for housing, particularly across North America, the concept of converting office floors into laboratory space is a relatively new one in Canada.

Lab space availability in the Toronto and Hamilton Area is very low: Only 0.2% of the 12.3 million square feet of vacant inventory in the region, according to real estate brokerage CBRE.

The university was preparing a massive renovation and addition in 2020, and it needed to keep the research going while being close enough to campus, which is where the conversion of 777 Bay Street made sense.

Lab Requirements

Arcadis was engaged to explore the feasibility of converting space within a conventional 1980s office tower in downtown Toronto into a safe and functional biotech laboratory environment for potential tenants like the university.

In collaboration with property owner Canderel and the university, in 2020-21, Arcadis studied the multifaceted constraints and opportunities for converting 40,000 square feet of vacant office space on two floors into a wet and dry laboratory.

They quickly discovered how lab requirements differ from day-to-day office space.

“The simple issue that everyone starts with is the floor-to-floor height because the requirements are far more intensive, and it is a much more controlled environment,” said Deshmukh. “You can imagine air changes, pressures, humidity, you name it. Everything around the conditioning of the air. You are bringing in air at a much higher volume.”

Labs also need mechanical and electrical backups because if a device like a freezer goes down, it can mean months or years of lost research.

Also, labs generally require 15 feet of floor-to-floor space, but Arcadis only had 12 feet.

Precision Matters

“My mechanical engineer likened it to designing a large Swiss Army knife because everything had to be just so. Stuff no one sees because it is behind the ceiling,” said Deshmukh. “We had to be incredibly precise.”

Labs also have unique problems, including security issues, and most need their own entrance, making a service elevator important.

“Can you imagine someone getting their coffee and doughnut and going up the same elevator with someone taking biowaste up,” said Deshmukh. She added that equipment can be significantly heavier. “You may have to bolster some structures.”

The Canderel building had a service elevator, making it attractive. It also had rooftop space above the podium that extended to the 10th floor.

“They thought they were putting all heat, ventilation and air conditioning on the roof, and they managed to find space for them on floors nine and 10 where the podium turns into the tower,” said Deshmukh.

But the venting had to go above the building, so her group found a technical solution to avoid building a 25-floor chimney stack that would take expelled air above the building.

“We ultimately created a solution that could have gone into any floor,” said Deshmukh. The solution was to install ductless fume hoods with filters that remove impurities.

Higher Lease Rates

The building also worked because the in-place zoning allowed for certain lab functions. Other buildings probably would have required some rezoning. Zoning rules for tenants handling infectious diseases would be even more stringent.

For the landlord, the advantage was the ability to charge a higher dollar per square foot. Lease terms were not disclosed on the deal at 777 Bay.

The University of Toronto had already taken advantage of the Canderel building’s proximity for programs that may not be classic office uses, including a dental clinic on an upper floor — another type of use where staff have to come to the office for work.

The cost of fitting out the space varies on the use, but it could be two or three times the cost of a traditional office, with a longer time frame.

But that could work for a long-term tenant like the University of Toronto which is covered by a 10-year lease.

Mike Vilner, senior vice president of leasing and business development at Canderel, with more than 26 million square feet of commercial space across its portfolio, said filling the space was a primary issue.

“What we were thinking is adapt this space for different uses and help future-proof our real estate,” said Vilner, in an interview. “It makes our building stay relevant in the changing economic landscape.”

Creating an Ecosystem

Canderel owns the property with TD Asset Management and with BIMCOR, a subsidiary of Bell Canada.

While vacancy rates in downtown Toronto offices continue to climb, 777 Bay St. was 95% occupied, so there was no urgency to lease to just any tenant.

“Is it a solution for every building? No. You can only have so many labs,” said Vilner.

Those companies can include healthcare providers, medical device makers and clinical trial organizations, Vilner said. “You are creating an ecosystem within the area or within the district.”

Canderel officials knew the broker representing the university, but its building was not on their list because they wanted one that could accommodate labs.

“We proved to them through a study that a standard office building could house a lab,” said Vilner. He said this marked the first such conversion in Canada. “This was on our radar. We were watching what was going on in the United States.”

More Common in US

The conversion of offices to lab space is more prevalent in the United States. About half of the more than 125 office conversions underway in the United States are to labs, according to recent comments from CBRE.

“We are studying even more,” said Vilner. “We believe we can do it in Montreal. We studied it in Ottawa and in Western Canada.”

Robin Buntain, a principal at Avison Young, said there haven’t been many conversions but noted there was a project in Vancouver’s False Creek Flats where lab space was converted back into conventional offices.

“But now Low Tide [Properties], which owns the asset, is looking at converting some of the floors back to lab because of some of the infrastructures in place,” said Buntain. “There is basically no space now, but we have one anchor tenant building a lot of it, So there will be opportunities able to use some of the older stuff as they step into new” space.

Arcadis’ Deshmukh said with the conversion fundamentals learned, tested and in place, another project would have a head start compared to where her group was three years ago.

The University of Toronto “ultimately found this solution was cheaper for them than building something new. The calculation for them was against building new space on new land,” she said.

Source CoStar. Click here to read a full story.

Toronto’s Financial Core Appears to Be Shifting South

Congestion and Office Tenants’ Priorities Driving Push

Based on an analysis of commercial real estate deals, it looks like the financial heart of Canada’s biggest city may be edging south.

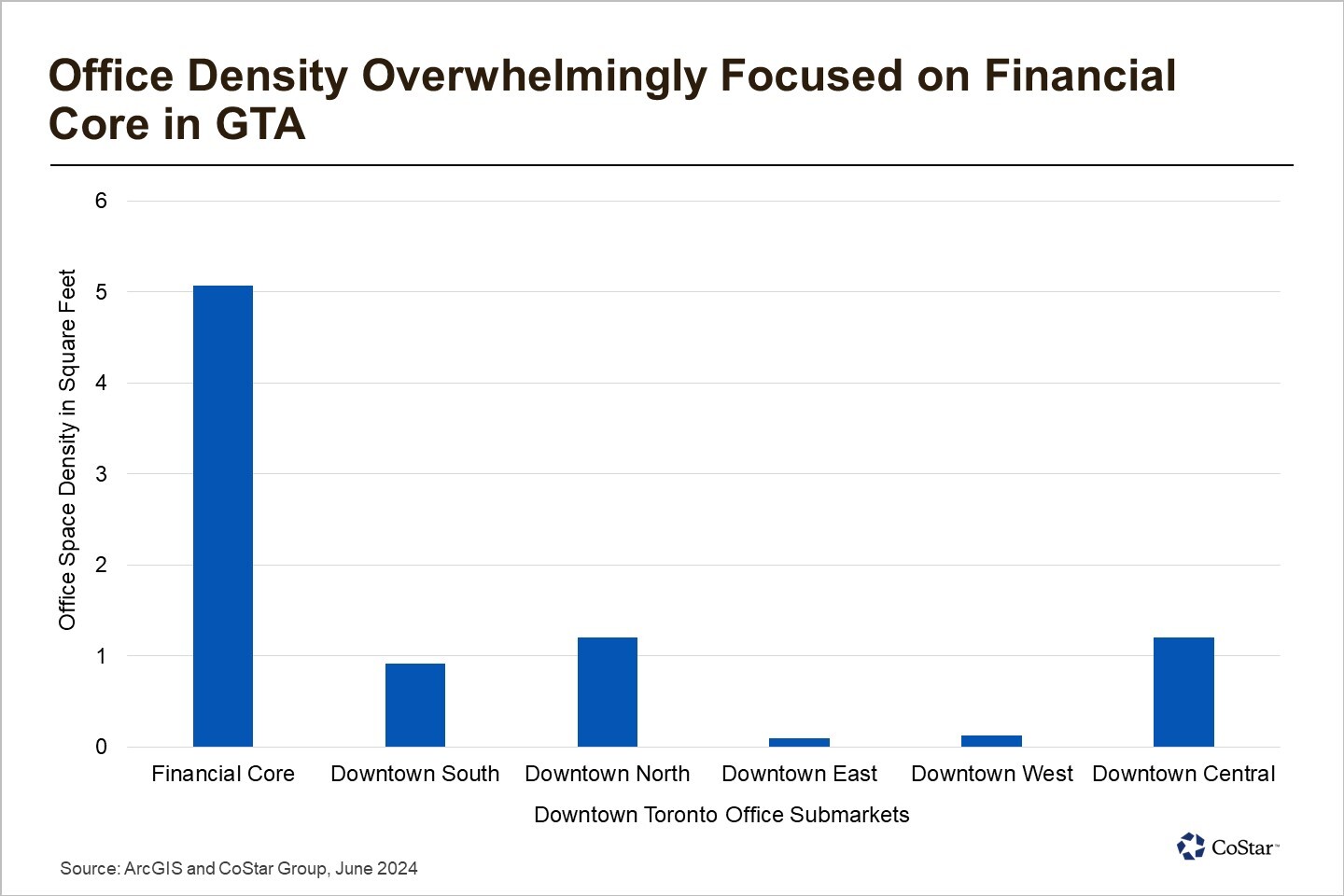

Toronto’s financial core has traditionally been located between John and Church streets to the east and west and between Queen and Front streets to the north and south. At the heart of this downtown area is the Toronto Stock Exchange, and scattered throughout are the trophy assets of national and international banks that have shaped Toronto’s iconic skyline. The area boasts the highest density of office space among all of Toronto’s downtown submarkets by a long stretch, if not in all of Canada.

Historically, this density had been supported by the high demand levels for space in the city leading up to the pandemic. Toronto is one of North America’s top 10 financial centres and is the fifth largest tech services center. This diversity has generally hedged occupier demand and resulted in less volatility than other major markets that may be comparatively pigeonholed and dependent on a single sector such as tech in San Francisco.

In contrast, Toronto’s dense diversity underpinned investor demand and development feasibility. The financial core’s liquidity was well represented by the owner of the Zara retail chain, Amancio Ortega’s purchase of RBC Plaza for $1.2 billion in 2022, notwithstanding pandemic concerns.

However, since that major transaction, the financial core has seen negligible deal activity. Leasing has been similarly subdued, with net absorption averaging less than 103,000 square feet quarterly since the beginning of 2020, compared with an average of approximately 138,000 square feet over the trailing five years.

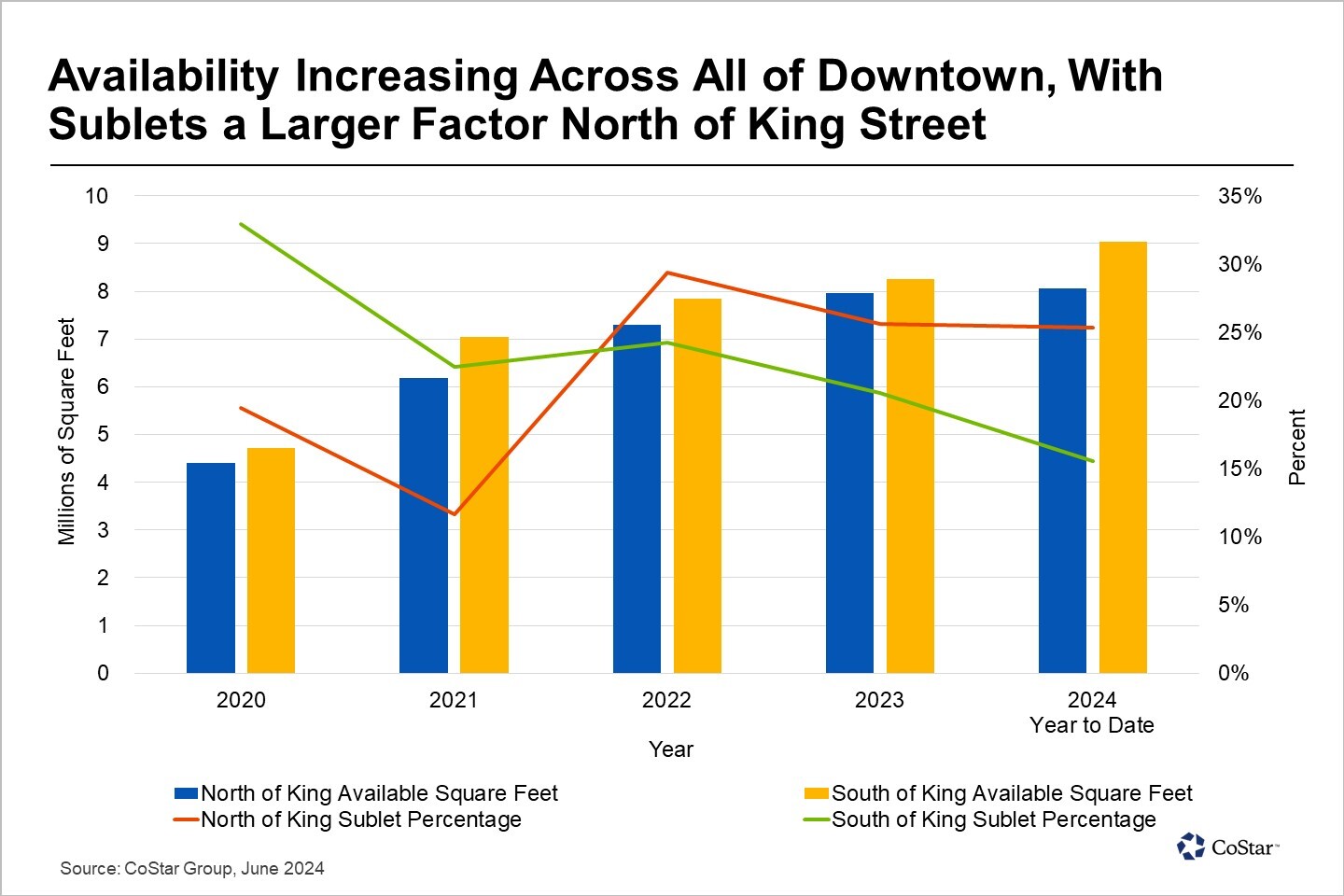

Interestingly, it appears that absorption, which measures the net change in occupancy, is increasingly bifurcated on a north-south divide. Downtown, south of King St. has seen positive absorption of approximately 184,000 square feet per quarter, compared with approximately 217,000 square feet of negative absorption when looking at the north of King in the downtown area.

Furthermore, while office availability has increased in both directions, the proportion of space available through the sublet market has continued to increase to the north and decreased to the south, inferring that SoK office occupiers are happier with their space and the associated lease agreements than those in NoK.

The trajectory of office availability, in both SoK and NoK, may indicate a general exodus of space. However, there are some large deals that back up that idea that the financial core may be edging to the south.

CPP’s upcoming move from 1 Queen St. to CIBC Square complex under construction at 141 Bay St., adjacent to Union Station, is one of these. Furthermore, TD’s occupation of 160 Front St. also lends itself to this narrative, although this lease was signed in 2019, so it may not wholly align with the pre- vs post-pandemic theme.

Traffic Congestion Making an Impact

In a post-pandemic world of increased traffic congestion and hybrid work, close proximity to commercial peers is proving to be a less valuable proposition than a streamlined commute for staff. This has been further exacerbated by the recent construction work on the Gardiner Expressway, which began earlier this year and is slated to continue for the next three.

A recent study by Geotab showed that travel times have increased by 250% during morning rush hour since the construction work commenced. It has also affected the roads around the Gardiner, with the main alternate routes seeing a 43% increase.

It appears that a driver of this comparative demand for space in the south core is the ease of access to the Gardiner and Union Station, particularly when considering the connection to the PATH and what that offers in Toronto’s colder (and even hotter) months.

Most Toronto commuters will confirm that getting onto the Gardiner can be half the battle, notwithstanding the gridlock they may then have to face.

The often-cited ‘flight to quality’ could be more aptly labeled a ‘flight to accessibility.’ Just like Canada’s geese, the country’s banks and pension funds may discover that their path leads southward.

Source CoStar. Click here to read a full story.

Dream Industrial REIT Further Expands Portfolio in Ontario

REIT Purchases Manufacturing Building and a Trio of Warehouses for $110 Million

Dream Industrial REIT continued to expand its portfolio in the Ontario region with the purchase of four industrial properties last month.

In two separate deals, the REIT acquired a trio of warehouses located in Markham, Burlington and Cambridge totaling 332,915 rentable square feet from CanFirst Capital Management for a total price of $72 million and a 156,093-square-foot manufacturing facility in Brampton for $38 million from Triovest Capital.

The four properties were fully leased at the time of sale and were acquired by the company’s Dream Summit joint venture investment platform. The deals follow Dream Industrial’s first-quarter purchase of seven industrial buildings acquired from Fiera Real Estate for $71.75 million or approximately $228 per square foot. That 313,811-square-foot portfolio included four properties in Pickering and three in Ajax.

The three warehouses sold by CanFirst Capital Management include 400 Jamieson Parkway in Cambridge, 1180 Corporate Dr. in Burlington and 400 Cochrane Dr. in Markham.

Together with the recent acquisitions, the Dream Summit Joint Venture has made nearly $550 million in acquisitions in the GTA since forming in 2023, including a portfolio of seven industrial buildings acquired from Fiera Real Estate for $71.75 million or approximately $228 per square foot for this 313,811 square foot portfolio..

Source CoStar. Click here to read a full story.

Chartwell Retirement To Acquire Two Senior Housing Portfolios

Toronto-Area REIT To Spent $511 Million for Quebec Properties

Chartwell Retirement Real Estate Investment Trust has entered into agreements to increase its holdings by 3,233 senior housing suites as part of a major expansion of its Quebec portfolio.

The Toronto-area REIT said it has agreed to separate deals to purchase a 100% ownership interest in a portfolio of five retirement complexes with 1,428 suites in greater Montreal, Gatineau, and Sherbrooke for $297 million and a 50% ownership interest in a five-property portfolio with 1,805 suites in the Quebec City area and Shawinigan for $214 million.

The aggregate purchase price for the two portfolios is $511 million, Chartwell said.

Chartwell, with its head office in Mississauga, just outside Toronto, did not name the sellers on the deals, both of which are expected to close in the third quarter.

“The acquired properties are expected to enhance the quality of Chartwell’s portfolio and fit strategically with Chartwell’s growth objectives, increasing its presence in key cities in Quebec,” said the REIT.

The REIT also said it has closed on the purchase of an 85% ownership interest in residences with 685 suites from EMD-Batimo for $166 million. The units are in complexes known as Chartwell Le Prescott and Chartwell Trait-Carré.

On a combined basis, the deals for the two portfolios and the Batimo acquisition are expected to result in Chartwell acquiring 12 properties containing a total of 3,918 suites. The average age of the suites is five years, and their current occupancy level is 95%, excluding two assets in lease-up, Chartwell said.

Chartwell said the purchase price per suite for all properties to be acquired is approximately $230,000, 30% below current replacement costs.

The acquired properties will reduce Chartwell’s weighted average portfolio age by approximately three years on a pro forma basis, Chartwell said. Since they are relatively newer, the properties should have lower capital expenditure requirements than Chartwell’s existing portfolio, the REIT said

The acquisitions are being funded through proceeds from previously announced dispositions, the assumption of in-place debt and net proceeds from a $300 million offering.

Chartwell has agreed with a syndicate of underwriters led by TD Securities Inc., Scotiabank, and RBC Capital Markets to issue to the public, on a bought-deal basis, 24,600,000 trust units.

Source CoStar. Click here to read a full story.

First Capital REIT To Issue $300 Million in Debentures

Retail Landlord To Use Proceeds To Pay Down More Expensive Floating-Rate Debt

One of Canada’s largest retail real estate investment trusts is issuing $300 million in unsecured debentures and plans to use the proceeds to pay down costlier debt.

First Capital REIT said the debentures are being offered on an agency basis by a syndicate of agents co‐led by RBC Capital Markets, Desjardins Capital Markets and TD Securities. The debentures, which will be issued at par, are at a rate of 5.455% per year and will mature on June 12, 2032, the company said.

The debentures would be direct unsecured obligations of the REIT and will rank equally with all other present and future unsecured and unsubordinated indebtedness. The offering is set to close on June 12.

First Capital, based in Toronto, also issued debentures last quarter to pay down more of its expensive floating-rate debt.

As of March 31, the REIT owned retail property interests in 139 neighbourhoods with 22.2 million square feet of gross leasable area worth $9.2 billion.

Mark Rothschild, an analyst with Canaccord Genuity, said last month the REIT could incur greater interest expenses as it refinances mortgages.

“The rise in long-term interest rates will partially offset organic growth, and in 2024, the REIT has $435 million of debt maturities comprising $134.8 million of mortgages (cost of 3.7%) and $300 million of unsecured debentures (4.7%), representing 13% of total debt (excluding credit facilities),” said Rothschild, in a note on the company.

Source CoStar. Click here to read a full story.