Author The Lilly Commercial Team

Opening Of Toronto DC Completes $1B Metro Supply Chain Revamp

Grocer and retailer Metro Inc. (MRU-T) has inaugurated the final facility in its $1-billion supply chain modernization initiative, with its 567,000-square-foot automated Toronto fresh produce distribution centre (DC) now fully operational.

The modernization has taken place over seven years, and includes the development and/or expansion of four distribution centres in Quebec and in Toronto as well as other smaller projects.

“Our new automated distribution centres as well as the expansion of one of our facilities represent a substantial investment in Metro’s future,” Eric La Flèche, president and chief executive officer of Metro Inc., said in the announcement. “The transformation of our supply chain will provide capacity for future growth and efficiency, strengthen our market position and generate new opportunities for our employees.”

The newest Toronto facility represents an investment of about a half-billion dollars.

Initiated in 2017, the project has included a new 600,000-square-foot automated fresh and frozen distribution centre in Terrebonne, Que., that opened in late 2023, a 50,000-square-foot expansion of the fresh produce distribution centre in Laval, Que., and the construction of two new automated distribution centres in Toronto – a frozen facility that opened in 2022, and the opening of the fresh facility.

Robotics drive new distribution centres

The automated distribution centres are operated utilizing state-of-the-art robotics and inventory management technology provided by Metro’s automation partner, Witron. The German company is an international leader in automation in the food distribution sector, and has been working with Metro since the modernization program began.

“The opening of Metro’s Toronto Fresh DC represents a major milestone,” Dan Gabbard, vice-president of logistics and distribution, Metro Inc, said in the announcement. “This facility incorporates modern technology that boosts our efficiency as a retailer, ensuring we can deliver high-quality food products to our stores more efficiently, thereby enhancing freshness and quality.”

Metro says the modernized supply chain will:

- improve service to Metro’s store network with greater precision and reduced handling time;

- provide efficiency gains throughout the supply chain that will enable Metro to be more competitive with its major industry peers;

- offer greater precision in order fulfillment, which will improve its in-stock position in stores;

- improve customer experience through greater variety and freshness; and

- sustain anticipated growth.

Expanding store network

The company is also continuing to expand and modernize its store network as competition remains intense between major players in the grocery and pharmacy sectors. During its fiscal 2024, it planned to open one new Metro location, eight new discount banners (including two conversions from other company banners), and renovations at over 25 locations.

Earlier this month, Metro also announced the expansion of its Moi Rewards loyalty program into Ontario and New Brunswick starting Oct. 24. The program had originally been operating only in Quebec, where it was approaching 2.5 million members at the end of 2023.

The 2024 Leger Wow Survey ranked Moi as the most widely used loyalty program in Quebec, with 79 per cent of Metro customers actively engaging with the program.

“Our goal is to help Canadians save by becoming the most personalized and relevant loyalty program. The Moi Rewards program will be available in eight banners and more than 1,175 stores across Ontario, Quebec and New Brunswick,” Alain Tadros, vice-president and chief marketing officer and digital strategy, said in that announcement.

Metro is one of Canada’s largest grocery and pharmacy retailers, operating mainly in Quebec and Ontario with annual sales of more than $20 billion. The company employs more than 97,000 people.

It operates as a retailer, franchisor, distributor, manufacturer, and provider of eCommerce services, owning or servicing a network of some 980 food stores under several banners including Metro, Metro Plus, Super C, Food Basics, Adonis and Première Moisson. It also has 640 pharmacies primarily under the Jean Coutu, Brunet, Metro Pharmacy and Food Basics Pharmacy banners.

Source Renx.ca. Click here for the full story.

RioCan Makes Short Work of Retail Space Emptied by Bankruptcies

Canada’s Oldest REIT Also Sees Widening Lease Spreads in New Deals

Canada’s oldest and second-largest real estate investment trust said its retail portfolio can withstand an economic downturn and it has been able to quickly backfill space from tenant bankruptcies in the previous quarter while also getting record spreads on new leases.

Toronto-based RioCan Real Estate Investment Trust said that, for the three months ended June 30, its committed occupancy increased to 98.3% compared with 98% a year earlier.

“The strength of our assets and favourable market conditions resulted in record-breaking leasing spreads as we strategically selected resilient tenants while achieving higher rents, further improving our portfolio quality and our future growth potential,” said Jonathan Gitlin, president and CEO of RioCan, in a statement.

Royal Bank of Canada said in a recent report that consumer spending appeared to be finally pulling back this summer after what it called “pandemic revenue spending” and noted the decline in July retail sales.

“Appetite for discretionary goods remained limited, though July’s decline was broad-based. A decrease in spending on clothing, groceries and gasoline accounted for the fall,” according to the report.

RioCan’s net income increased to $122.4 million in the quarter from $112 million a year earlier. Spreads on new leases were up 52.5% in the quarter. On renewals, the REIT still saw a jump of 10.7% in lease margins year over year.

As of Aug. 8, RioCan reported that eight of the 10 initial vacant units resulting from tenant failures mentioned in previous quarters were filled in the second quarter and negotiations for the two remaining units were in the final stages. The retailers involved in the two remaining spaces were Bad Boy and Rooms + Spaces.

“Retail space is scarce, and building new supply is at a standstill,” said Gitlin on a call with analysts earlier this month. “Canada’s major markets are experiencing substantial population growth.”

RioCan’s 187-property portfolio, at 33 million square feet, is concentrated in Canada’s six largest metropolitan areas, which the REIT maintains are the most desirable places for retailers.

The REIT said its residential arm, RioCan Living, had a net operating income of $7.2 million in the quarter, up 40.7% from a year ago. RioCan Living has 14 buildings containing 3,160 residential units, 12 of the 14 buildings are stabilized.

“We recognize that sales of new condominiums have slowed, but fortunately, we have presold about 90% of over 2,500 units we will complete through 2026,” said Gitlin. “The majority of these firm deals were made before prices peaked.”

Source CoStar. Click here for the full story.

Is Pickleball About To Gobble Up 2.6M Sq. Ft. Of CRE Space?

U.S. firm Picklr partners with TPC Developments, plans 65 Canadian facilities for growing racquet sport

Bombardier Shows Off New Assembly Facility At Toronto Pearson International Airport

Montreal aerospace giant has operations rolling at new aircraft assembly centre

Canadian aerospace giant Bombardier has upgraded its operation in Ontario.

The company is highlighting the 550,000-square-foot Bombardier Aircraft Assembly Centre at the Toronto Pearson International Airport it has occupied since May. The facility contains a 120,000-square-foot test hangar nearby.

About 2,000 Bombardier employees work at the site to assemble a series of aircraft models from within a giant final assembly building. The operation includes a U-shaped production line that includes a series of four robots that drill, countersink and install fasteners using QR codes and floor reference systems.

The production is complete when the tail, fuselage, wings, landing gear, cockpit are all installed, as explained in an email from David Murray, Bombardier’s executive vice president, manufacturing, IT and Bombardier operational excellence system.

Once tested and certified, the newly assembled planes are flown to Montreal to have the interior installed and painted and the aircraft are then delivered to customers.

Next year, Bombardier is also planning to begin production on the Bombardier Global 8000, billed as “the world’s fastest and longest-range purpose-built business jet innovatively crafted with the smoothest ride and the industry’s healthiest cabin,” as Murray describes it.

The facility was also designed to have plenty of natural light, a dehumidifying system and advanced noise-reduction technology.

Bombardier relocated its assembly operations to Pearson after many years at its Downsview facility.

“With the optimization of production, it became too big, especially after the sale of De Havilland in 2018. Our footprint at Downsview saw us use only 35 of 375 acres for manufacturing. For comparison, the new Bombardier Aircraft Assembly Centre takes up 41 acres for the same output of finished aircraft,” said Murray. “The Pearson location is also strategic because it gives us the possibility to use an existing airport as needed, which is what has already proven optimal in our other locations, such as in Montreal.”

Bombardier is ranked as the 16th highest-earning aerospace company in the world according to a new survey by Flight International, after registering a profit of $793 million in 2023 on sales of over $8 billion.

Source CoStar. Click here for the full story.

Quadreal, Mattamy Homes Kick Off $6 Billion Project In Toronto

First phase of shopping mall redevelopment to include condo tower

The real estate arm of British Columbia’s largest pension fund is joining with a large homebuilder in launching a $6 billion redevelopment project in a west-end Toronto neighbourhood.

Vancouver-based QuadReal Property Group, the entity that manages the real estate of British Columbia Management Corp., recently kicked off the first phase of the Cloverdale Mall redevelopment with Toronto-based Mattamy Homes.

The project’s first phase, known as The Clove, is a residential condominium project on the 2.3-acre gateway at 2 & 10 The East Mall Crescent. It will include a 33-storey tower with an adjoining nine-storey mid-rise building, totaling more than 600 condo units, according to the development team.

The project is part of QuadReal’s plan to transform the 32-acre shopping centre site into a mixed-use urban neighbourhood.

Current plans for the Cloverdale Mall site at Highway 427 and Dundas Street West in central Etobicoke include 180,000 square feet of retail space. All told, there will be more than 5,000 new condos and purpose-built rental units with two new two public parks and additional green space along with new streets and blocks to integrate the new and existing communities.

“We’re embarking on a deliberate, multi-year process, informed by extensive consultations and community feedback, to extend the existing neighbourhood onto our site,” said Aaron Knight, senior vice president, development at QuadReal, in a statement.

Giannone Petricone Associates, the firm that created the master plan for Cloverdale, also designed The Clove.

Cloverdale Mall was built in 1956 as an open-air plaza with a central pedestrian promenade in a Modernist architectural style. It was expanded and converted to an enclosed mall in the 1980s and underwent significant renovations in 2006.

Today, the mall is anchored by retailers such as Home Hardware, Rexall Drugstore, Winners, Kitchen Stuff Plus, and Metro, as well as a host of community-focused organizations that occupy space in the centre.

Source CoStar. Click here for the full story.

CPP Partners With Blackstone On Asia-Pacific Data Center Deal Valued At $22 Billion

Canada’s largest pension plan takes 12% stake in Australia-based AirTrunk

Blackstone and the Canada Pension Plan Investment Board, the country’s largest pension fund, formed a partnership to buy AirTrunk, an Asia-Pacific data center operator in a deal valued at $22 billion as the artificial technology boom drives further demand for digital systems and support networks.

AirTrunk operates data centers in Australia, Singapore, Hong Kong, Japan and Malaysia. The deal is expected to be completed this year, pending regulatory approval, and marks one of the largest data center deals to date and Blackstone’s largest investment in the Asia-Pacific region.

CPP Investments and private equity giant Blackstone are buying AirTrunk from Macquarie Asset Management and other investors, including PSP Investments. Montreal-based PSP Investments manages the public sector pension plans of the federal public service, the Canadian Forces and the Royal Canadian Mounted Police.

Under the proposed deal, CPP Investments will acquire a 12% interest in AirTrunk in the transaction with an implied enterprise value of more than $22 billion, or 24 billion Australian dollars. That equates to a value of approximately 16 billion United States dollars.

“AirTrunk is another vital step as Blackstone seeks to be the leading digital infrastructure investor in the world across the ecosystem, including data centers, power and related services,” said Jon Gray, president and chief operating officer of Blackstone, in a statement announcing the deal.

CPP Investments said it partnered with the investment giant to expand the pension fund’s presence in the asset class.

‘Significant Growth’

“CPP Investments has invested in the Asia Pacific data centre sector for several years, and we have witnessed significant growth in this space, fueled by a strong demand for digital infrastructure and, more recently, the increasing adoption of artificial intelligence,” said Max Biagosch, senior managing director and global head of real assets & head of Europe for CPP Investments, in a statement.

CPP Investments currently has data centre joint ventures and investments in hubs in Australia, Hong Kong, Japan, Korea, Malaysia and Singapore, as well as the U.S.

The transaction is subject to approval from the Australian Foreign Investment Review Board.

In a recent report, CBRE said continued worldwide power shortages are significantly inhibiting the global data center market’s growth.

“Sourcing power is a top priority for operators across all regions, including North America, Europe, Latin America and Asia-Pacific. Secondary markets with ample power should attract more data center investment,” the real estate company said.

It added that “artificial intelligence advancements are projected to significantly drive future data center demand. High-performance computing will require rapid innovation in data center design and technology to manage rising power density needs.”

Source CoStar. Click here for the full story.

Ontario Teachers’ Pension Plan Expands Investment In Australian Industrial Market

Pension fund partners with Gateway Capital, Asian sovereign wealth fund on investment vehicle

The pension fund for Canada’s largest teacher union is teaming up with a pair of international investment partners to expand its presence in Australia’s industrial market.

The Gateway Capital Urban Logistics Partnership, known as GULP, has agreed to a deal to buy a Sydney logistics property at 2-34 Davidson St. in Chullora. GULP is an investment vehicle that includes the Ontario Teachers’ Pension Plan, an unnamed Asian sovereign wealth fund and Gateway Capital.

The partnership has exchanged contracts for the acquisition of a recently upgraded and expanded building that has more than 275,000 square feet of gross leasable area. It is leased to consumer products company Shriro Australia and food distributor Two Providores.

The move shows how global property investment plays a role in pension fund operations. Diversification not only can mean including commercial real estate investment, but geographical distribution as well to provide a mixture of markets.

No price was given for the building sale, but Toronto-based Ontario Teachers’ said the acquisition gave GULP a presence in the suburb of Chullora, “a prime Sydney urban industrial and logistics precinct.” C

hullora is 13 kilometres west of Sydney’s central business district and 12 kilometres northwest of Sydney Airport.

‘Growth potential’

“With strong sectoral tailwinds and market fundamentals, we see positive demand and continued growth potential in the Australian industrial and logistics sector,” said Jun Ando, head of Asia-Pacific real estate at Ontario Teachers’, in a statement.

Ando added that “the acquisition complements our existing portfolio, and we’re pleased to be expanding our partnership as we look ahead to identifying opportunities for future collaboration.”

GULP was established in April 2023 as a cornerstone investment by Ontario Teachers. This year, the equity base of GULP was expanded through the introduction of an Asian sovereign wealth fund, which provided additional capacity to seek investment opportunities.

“The acquisition of this asset complements the existing GULP portfolio, not only providing exposure to the key Sydney market but also adding strong core plus exposure in a premium asset with strong rental upside,” said Stuart Dawes, Gateway Capital chief executive and co-founder, in a statement.

Dawes also said, “The broader capital base increases our dry powder, allowing us to continue to seek additional assets for the GULP portfolio, with a focus on inner urban core plus and value-add opportunities on the east coast markets of Australia.”

Gateway Capital is an Australian-based investment management business focused on creating core assets in the industrial and logistics sectors through active management and development.

Source CoStar. Click here for the full story.

Cities’ Appetites Vary When Handing Out Patio Permits to Canadian Restaurants

Cost and Time Required To Open a Restaurant Patio Depends on Your City, Notes New CFIB Report

Restaurant owners hungry to feed their revenues by adding streetside patios in front of their locations are required to pay a wide variety of permit fees for this use across Canada according to a new study from the Canadian Federation of Independent Businesses.

Permits for restaurant owners to open streetside patios in Toronto cost $917 and require an eight-week delay, while that same permit can cost around $1,100 and take four weeks in Montreal and Vancouver, according to the CFIB data.

The best restaurant patio permit bargains can be found in Winnipeg and Saskatoon where the cost is zero and the process is fast. Calgary municipal authorities ask only $116 for a permit but require eight documents and a six-week wait, while Edmonton charges $405 for the permission and five documents.

In Canada’s capital, patio permits are among the most expensive, as Ottawa charges $1,424 for the permit, according to the study.

The most expensive spot to set up a patio is in St. John’s Newfoundland where the permit costs $2,765 and requires three documents, but only a two-week wait.

The political magnitude of the patio permitting issue was exposed in June after Montreal firefighters ordered all restaurant patios closed on downtown Peel Street during the Grand Prix festivities, one of the biggest tourist draws in Canada. The story caused a stir after the owner of the Ferreira Cafe posted a video online criticizing the forced closure of her terrace. Montreal Mayor Valerie Plante denounced the firefighters’ action and reopened the patios soon afterward.

Source CoStar. Click here for the full story.

Mckesson Agrees To Sell One Of Canada’s Largest Pharmacy Chains

Healthcare services giant strikes deal to shed retailer with 385 locations

U.S. healthcare services giant McKesson has struck a deal to sell its Rexall Pharmacy Group, one of Canada’s largest pharmacy chains, and online company Well.ca to private equity firm Birch Hill.

Founded in 1904, Rexall operates 385 pharmacies across Canada and employs approximately 8,000. Well.ca offers online customers more than 40,000 health and wellness products via delivery.

No price was disclosed for the deal, which must still meet certain regulatory conditions

“Birch Hill is committed to maintaining and investing in reliable, accessible healthcare services to expand Rexall’s current network of pharmacies across Canada,” Toronto-based Birch Hill said in a release.

As part of the deal, McKesson will remain Rexall and Well.ca’s wholesale distribution supplier.

Irving, Texas-based McKesson bought Rexall in 2016 for $3 billion, but it was reported earlier this year the company was looking to sell the division.

McKesson said the deal will allow it to “focus and prioritize investments” to grow its oncology and biopharma services platforms. The company said it is committed to its Canadian distribution and biopharma businesses.

“This transaction marks an important milestone aligned to our enterprise strategy, advancing our strategic priorities, further streamlining our business and prioritizing investment in our growth areas,” McKesson CEO Brian Tyler, said in a statement. “We remain fully committed to and confident in the strength of our Canadian distribution and biopharma businesses.”

Source CoStar. Click here for the full story.

Auto Dealer Goes On $200 Million Buying Spree In Ontario

CanadaOne Auto Group has acquired 20 Ontario dealerships so far this year to stake a claim in Ottawa’s flourishing auto sales market

An Edmonton-based car dealer, CanadaOne Auto Group, has been investing heavily in the Ontario region’s auto retail landscape. So far this year, CanadaOne has acquired 20 auto dealership properties in the area for an aggregated transaction volume of $201 million.

In total, the sales have accounted for approximately 5% of all retail space sold in Ontario this year, both in terms of square footage and dollar volume.

CanadaOne employs more than 3,000 people in its 42 dealerships across Canada, with locations in British Columbia, Alberta, Saskatchewan, Manitoba and Ontario.

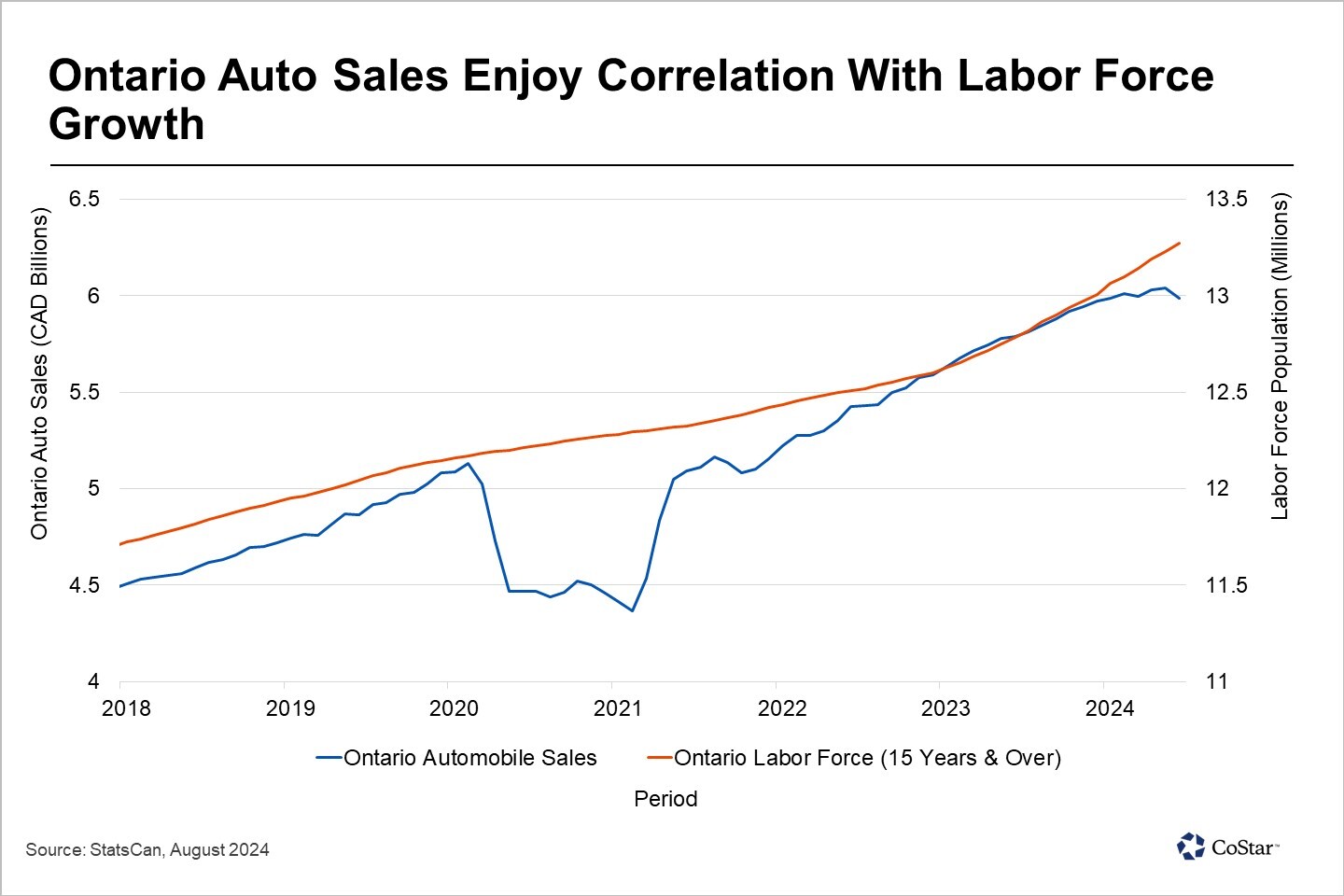

The flourishing Ontario auto trade has benefitted from a combination of factors. Since the beginning of 2018, Ontario auto sales have surged from $4.5 billion to $6 billion. This growth reflects a robust post-pandemic economic recovery and population growth.

Historically, there has been a strong correlation between auto sales and the size of the labor force in Ontario, notwithstanding the auto sales blip experienced throughout the pandemic.

In addition, Prime Minister Justin Trudeau recently announced plans to impose 100% tariffs on Chinese electric vehicle (EV) companies, a move aimed at protecting the burgeoning domestic EV market and encouraging local production.

Ontario is also experiencing a boom in the development of EV battery factories. These facilities are crucial for supporting the growing demand for electric vehicles and positioning Ontario as a key player in the global EV market.

Also, the new bridge set to open between Windsor and Detroit, will enhance cross-border trade by streamlining logistics and reducing transportation costs, making it easier for Canadian manufacturers to export vehicles and parts to the United States and vice versa.

The combination of increased sales, strategic tariffs, and infrastructure advancements paints a promising picture for the auto industry’s future in Canada, particularly Ontario.

Source CoStar. Click here for the full story.