An application has been submitted for Microsoft to build a new communications technological facility in the Toronto suburb of Etobicoke.

WZMH Architects, the architect designing the facility, recently submitted an application to the City of Toronto’s planning department for Site Plan Control on behalf of 3288212 Nova Scotia Limited, referred to as Microsoft.

The site, located at 48 Lowe’s Place near Highway 401 and Islington Avenue in Etobicoke, currently includes a vacant “big box” retail store and associated surface parking lot which used to be operated by Lowe’s. The building design resembles a barcode.

According to a cover letter submitted by the architect, the proposal, which is still in the preliminary stages, includes a new two-storey building with a one-storey office administration-support component, surface parking and “state-of-the-art” emergency generator backup systems for the infrastructure within the complex.

A complete redevelopment of the site is being proposed, including a new energy-efficient facility which is expected to be similar to other complexes currently under construction or recently completed by Microsoft in other locations around the world.

Like similar facilities, it is expected to provide equipment, space, bandwidth, power, cooling and physical security for the servers, storage and networking equipment of digital businesses.

The application was submitted following a pre-application consultation meeting at the end of November 2021 and an informal meeting with city planning and urban design staff in September.

The team also completed an application for a preliminary project review and anticipates an application for a minor variance will be brought forward soon for items related to the parking rates and other issues that may be identified through the site plan control process, the application letter indicates.

“The proposed facility aims to build on the growing success Toronto has seen over the past five years in attracting global companies to the city that create high paying jobs and position our region as one of the key technology hubs in North America,” the letter states. “As more businesses embrace digital technologies, these facilities are increasingly vital to Toronto’s economic health.”

Source Daily Commercial News by Construct Connect. Click here to read a full story

Toronto had 125 cranes actively working on multiresidential towers in March, according to the RLB Crane Index, dwarfing the total of any other North American city.

“The urban density story for our city has clearly not stalled during the pandemic,” Terry Olynyk, president and managing director of Multiplex in Canada, said in introducing a recent webinar presented by Urban Land Institute Toronto chapter.

Multiplex, an international construction contractor founded in Australia in 1962 and owned by Brookfield Asset Management, was the lead sponsor of the event that looked at the role and future of multiresidential towers in Toronto.

Consulting firm BTY director Robyn Player — who has provided construction phase monitoring services for more than a billion square feet of high-rise, multifamily, commercial and mixed-use assets — moderated a panel of executives from three development companies.

They spoke about their current major projects and answered Player’s questions about the high-rise market.

Metropia

Metropia vice-president of sales, marketing and design Lee Koutsaris spoke about 11YV, a condominium it’s developing in partnership with RioCan Living and Capital Developments near Yorkville Avenue and Yonge Street.

The 62-storey, 593-unit tower will have 81 rental replacement units, including 20 offering affordable rents.

It will have 43,000 square feet of retail space at the bottom and a new mid-block park connecting Yorkville Avenue and Cumberland Street is part of the project.

It will have 16,521 square feet of indoor amenities, including a swimming pool, a wine-tasting room, a fitness studio, a family area, a theatre, a business centre, a lounge and a piano bar. There will also be 8,353 square feet of outdoor amenities on a third-floor outdoor terrace.

Sales for 11YV launched in the fall of 2019 and continued through the pandemic, and only a handful of suites are still available. Any concerns about living in high-rise towers brought about by COVID-19 should be gone by the time they’re ready for occupancy in five years, according to Koutsaris.

“We have not seen any major shifts or changes in demand for suite sizes or bedroom types,” she said. “The demand for quality, well-designed units in tall buildings has remained.”

However, developers are now looking at more flexible designs and incorporating home office and study areas into units or amenity spaces. Balconies, outdoor amenities and access to fresh air have also become a growing consideration.

Koutaris said there has been an increase in demand for units to accommodate multi-generational families, where older parents move in with their adult children.

Koutsaris also emphasized the importance of recognizing the role developers play in promoting inclusivity within the built environment.

She talked about how Metropia and Context have created a $3.5-million fund for Toronto Community Housing (TCHC) residents to provide scholarships and training programs to help them become tradespeople and get jobs on construction sites as part of their The New Lawrence Heights development.

In conjunction with their AYC development at 181 Bedford Rd., Koutsaris said Metropia and DiamondCorp have created a social equity fund for residents of a TCHC building at 250 Davenport to help them apply for scholarships and training programs.

Pinnacle International

The Prestige At Pinnacle One Yonge tower in Toronto is being developed by Pinnacle International. (Courtesy Pinnacle International)

Pinnacle International sales and marketing VP Anson Kwok spoke about The Prestige At Pinnacle One Yonge, which will eventually feature multiresidential towers of 65, 80 and 95 storeys and 80,000 square feet of indoor and outdoor amenities for residents.

“We have to design buildings in a timeless way,” said Kwok. “We spend a lot of time on layouts and I think it’s important for us to have something that works for everyone.”

Kwok is also seeing more multi-generational purchases, including families buying all four corner units of a floor in a condo in order to be close to each other without living together.

Kwok said Torontonians love towers and appreciate there are plenty of new ones being built in different heights and styles. They also appreciate what these tall buildings are generally surrounded by, he added.

“A really key component of living in an urban community is all the amenities that are around you, not just the ones that you’re building and providing to your local community, whether it’s parks, community centres, schools, great restaurants or great retail within walking distance.”

A certain number of unit pre-sales are usually needed to launch a condo project. Pinnacle originated in Vancouver, where Kwok said units are generally bigger than in Toronto, and the company has tried to carry that over as much as possible in Ontario’s capital.

“That doesn’t always correlate to the financing model that we have in the city, so we’re forced to be patient on those units and sell the smaller units at the beginning.”

Slate Asset Management

Slate Asset Management managing director of development Brandon Donnelly spoke about One Delisle, near Yonge Street and St. Clair Avenue. It’s the first project in Canada by architect Jeanne Gang, founder and partner of Chicago-based Studio Gang.

The 47-storey condo will have 383 residential units and rise from its square base with retail space to a 16-sided circular tower with balconies and large terraces. More than 80 per cent of the building has an outdoor space and the adjacent Delisle Park will be expanded by 50 per cent as part of the project.

“It’s about livability within the actual building and the residences, but it’s also about thinking of the broader urban context and how this project fits in with that,” said Donnelly.

Slate hasn’t begun leasing One Delisle’s retail component, but Donnelly said there will be food and beverage options, including patios.

“Our plan is to own the retail here forever. It’s all about curating the right experience in this node with a long-term view on it.”

One Delisle will also have approximately 20,000 square feet of private amenities, including a fitness centre, a wellness spa and a wine and cocktail lounge.

Slate has been working on the project, which will launch this spring, for more than four years.

“It’s really part of a broader city-building and place-making effort,” said Donnelly. “We have been investing in the Yonge and St. Clair neighbourhood since 2013.

“We own 10 buildings, including all four corners, and since 2013 we’ve been working on everything from large-scale public art to streetscape improvements to new retail, investing in existing office buildings and renovating them.”

Slate’s extensive ownership in the area has allowed it to do more than it would have been able to do had One Delisle been merely a one-off development, according to Donnelly. This includes doubling the width of sidewalks surrounding the project.

The pandemic brought on an aura of pessimism about people wanting to live in towers in major cities, but Donnelly said that’s already turned around.

“Cities are incredibly resilient and tall buildings form part of that,” said Donnelly. “Cities have always bounced back and the reality is that we are incredibly social beings.

“We also realize that we are more productive and more innovative when we cluster together.”

Despite the return of some pandemic-related restrictions at the end of March, gradual re-openings over the first quarter point to signs of economic recovery and positive momentum in commercial real estate. According to Statistics Canada, employment has continued to recover, growing by 1.6% in March and reaching within 1.5% of pre-pandemic levels. Unemployment sits at 7.5%, a drop from 8.6% recorded at the end of 2020. Canadians working from home in March also decreased slightly in part due to the re-opening of non-essential businesses in many regions – a trend that may not last early in the second quarter. With that, employment gains were the strongest among retail trade as well as accommodation and food services industries, growing 4.5% and 2.4%, respectively. Still, the goods-producing sector remained stable throughout the first quarter, up only slightly in March by 1.1% due to rising construction activity. Employment gains also continue among the healthcare and social assistance sectors, as well as educational services.

Across major markets, all provinces recorded positive employment momentum in March, with notable gains in Alberta due to a 3.2% rise in the natural resources industry. Although the third wave of COVID-19 has led to the re-implementation of public health restrictions in multiple regions, which will likely temper some of the economic progress made in the first quarter, momentum is expected to pick up towards the back half of Q2 2021. National office availability reached 15.0% in Q1 2021, up from 11.3% in the same quarter last year (Figure 1). National industrial availability has further compressed to 2.7% this quarter, down slightly from 2.9% in the same quarter last year (Figure 4).

(Figure 1)

As we surpass the one-year mark since the onset of remote work, some are eager for a return to offices due to a need for employee interaction, while others are hoping to maintain a hybrid working model moving forward. Productivity has also been a consideration when it comes to remote work, but many reports still point to at least a partial return to in-person work when it is safe to do so. As many do not expect this return until fall 2021 or early 2022, tenants are working with landlords to determine next steps, with conversations revolving not only around safety and physical distancing protocols but around flexible lease terms and on-site wellness-focused amenities. In the meantime, ongoing pandemic-related restrictions and the rise in sublease space are both pushing availabilities higher across most markets.

However, early 2021 transaction volumes indicate continued activity, which is a good sign compared to numbers recorded at the same time last year. In the industrial sector, availabilities continue to tighten across markets while developers are taking advantage of heightened demand with 22.8 million square feet of industrial space under construction in Q1 2021. Still, the flight to quality continues with companies prioritizing industrial assets with strong technology capabilities to support distribution efficiencies.

(Figure 2)

Nationally, eight office buildings were completed in the first quarter of 2021, totaling 535,625 square feet of space with an availability rate of 38.3% (Figure 2), down from the nearly 2 million square feet completed in Q4 2020 at a 11.8% availability rate.

The Montreal market saw the most completions this quarter, with the most notable being the completion of Phase 4 of the Junxion. Located at 5025 Lapiniere Boulevard in the South Shore West district, this phase included 167,300 square feet of office space across 10 storeys. This joins three other completed office buildings in the park, for a total of 34 storeys. Strategically located with surrounding greenspace and just off of two major highways and the Reseau Express Metropolitan (REM), the complex boasts convenience and wellness-focused amenities including nearby hiking and cycling paths as well as on-site shower facilities.

Also in Montreal was the completion of 118,994 square feet of office space within Phase 1 of 7236 Waverly. Owned by Fabrik8, this complex is a shared workspace that offers multiple flexible leasing structures for freelancers and small businesses, including private lofts for a capacity of up to 50 employees, flex space for up to 25 employees, as well as custom office space for up to 500 employees and customizable event spaces. This first phase includes 29 flex offices, 4 conference rooms, 10 private lofts and 54,000 square feet of custom space with the second phase set to include a total of 32,000 square feet. On top of this, the building boasts a skating rink that transforms into a soccer pitch and basketball court in summer months – another example of perks introduced by landlords aimed at attracting employees back to the office once pandemic-related restrictions ease.

The third most notable completion is The Brixton Building C, located in Toronto at 41 Alma Avenue in the King and Dufferin area. The mixed-use complex includes 65,736 square feet of completed office space across 5 storeys, adding to 400 residential units and ground-level retail spaces across the rest of the complex that spans three buildings in total.

(Figure 3)

Rising sublease space across most major markets continues to contribute to an uptick in overall availability levels in the office market. Q1 2021 saw a total of 16.9 million square feet of sublease space, with national sublet availability reaching 20.0%, up from 15.6% in the previous quarter and 14.4% in the same quarter last year (Figure 3).

Although the sublease trend since the onset of the pandemic was especially prevalent in larger cities, Vancouver was one of the only major markets to see a drop in sublet availability compared to last quarter, sitting at 20.8% this quarter, down slightly from 31.9% in Q4 2020, but still up from 27.7% recorded at the same time last year.

Sublet space in Calgary also dropped from 24.1% last quarter to 21.0% in Q1 2021. As office landlords and tenants anticipate a return to offices in alignment with vaccination progression, a focus on flexible solutions remain, and the sublease trend is likely to continue growing, at least for the first half of 2021.

(Figure 4)

Industrial demand has not slowed with availability rates continuing to drop across all major markets in Q1 2021 compared to the previous quarter, with the lowest availability rates recorded in Vancouver at 1.5% and Toronto at 1.6%, followed closely by the Southwestern Ontario region at 2.1% (Figure 4). Edmonton and Halifax were the only markets to see increasing availability year-over-year.

Nationally, 25 industrial buildings were completed this quarter totaling 3.9 million square feet, at an availability rate of 11.5% (Figure 5). This is less than half of what was completed in the previous quarter. The Toronto area saw the majority of new completions for a second consecutive quarter with a total of 2.6 million square feet across 15 buildings, followed by the Montreal area with 1.1 million square feet across four buildings. Vancouver saw three completions, totaling 152,348 square feet, and Southwestern Ontario saw three new buildings totaling just over 89,000 square feet, but there were no new industrial completions in the other major markets this quarter.

The largest completion was located at 6125 de l’Aeroport Road in the St-Hubert Industrial Park in Montreal. Totaling 837,531 square feet, this building is the new Molson Coors brewery and distribution center. The company prioritized the conservation of land surrounding the construction site, with a reforestation program to be implemented in the area moving forward. Said to be the company’s most modern brewery in Canada, the facility also boasts systems that reduce waste, energy consumption and overall environmental footprint.

The second largest completion was in the General Motors Industrial Area in Oshawa, on the outskirts of the GTA, at 1121 Thornton Road South. The building totals 410,588 square feet of industrial space, partially tenanted by Aosom Canada Inc., a growing Canadian e-commerce company looking to expand its warehouse footprint from its initial facility in Scarborough. Another notable completion, also located in Toronto, was the first phase of grocery giant Metro Inc.’s newest distribution center built to replace and expand their previous facility on the same site. At 17 Vickers Road in Etobicoke, the modernized building includes new cold-storage capabilities for the distribution of fresh and frozen food. The second phase is set for completion in 2023, for a total of over 700,000 square feet of industrial space.

(Figure 5)

Demand for industrial space has been strong for four consecutive quarters driven by ongoing growth in e-commerce activity in part due to continued pandemic-related restrictions and the closure of non-essential retail across many regions. With availability rates especially tight in larger cities, there is growing appeal for facilities in surrounding areas in order to maximize distribution efficiencies while remaining in close proximity to more densely populated regions. Overall, investors continue to prefer industrial assets with potential for stable returns and future growth, with rising rental rates across markets pointing to continued demand throughout the year.

Early 2021 has seen positive momentum in the economy and in commercial real estate activity that may be slowed slightly in some major markets due to rising pandemic case counts and the re-implementation of tight restrictions. Despite rising office availability rates, companies are still working to finalize return to office plans that meet employee needs while waiting for vaccine rollout to progress. Multiple new industrial developments are on the horizon for 2021, aiming to ease the tight availability rates and space shortages across markets. Although new restrictions in the second quarter could hamper the progress made throughout Q1 2021, many anticipate a return in momentum in the back half of the year.

Source Altus Group. Click here to read a full story

As a tumultuous year came to a close, the economic impacts of the COVID-19 pandemic were felt both globally and locally in 2020, especially in the Ottawa commercial real estate market. Uncertainties throughout the year led to a hesitancy to purchase among many investors, and ultimately the Ottawa market finished the year with $1.5 billion in total investments, representing a 36% decrease from the record setting $2.5 billion seen in 2019. While deal volumes also dipped, they only decreased by 3%, indicating activity continued but at smaller transaction values. Investors navigated the Ottawa commercial real estate landscape with caution which was reflected in the lack of high-profile transactions seen in previous years, as larger institutional buyers maintained a wait-and-see approach throughout 2020. Another factor resulting in the lower than expected total investments was the continued bid-ask gap between buyers and sellers throughout the year. Overall, the fourth quarter recorded $498 million in volume, down only 8% compared to 2019.

Most asset classes saw a significant drop in total investments, yet the land sectors (residential and ICI land) were the only asset classes to experience growth, both displaying a 5% increase in total 2020 investments compared to the previous year. ICI land investments totalled $212 million and residential land $332 million, which attests to the need for new supply of both residential and commercial space in the burgeoning Ottawa market. As seen in prior years, the apartment and office sectors once again led in total investments, registering $396 million and $361 million, respectively. However, these investment totals were stark decreases, as they represented 34% and 46% drop-offs compared to 2019. The most significant declines in total 2020 investments were in the industrial sector with $82 million, dropping 75%, and in the retail sector with $99 million, dropping 72%. According to Altus Group’s Investment Trends Survey for Q4 2020, the Ottawa market sits on the positive end of the buy/sell ratio and has experienced upward momentum as the fourth most preferred major market by investors. Cap rates across all asset classes have compressed, with the exception of Tier I Regional Malls that recorded a quarter-over-quarter increase.

Notable Ottawa investment transactions during Q4 2020:

81 Metcalfe Street, Downtown – Office

Acquired by Toronto based Marlin Spring, this 12-storey, 57,170 square foot office building was the largest office transaction seen in the quarter. The transaction involved a 75% interest stake in the property for $12.5 million. The asset is favourably located in Ottawa’s central business district and marks the first investment into the Ottawa market for Marlin Spring.

2105 Bantree Street, Gloucester – Industrial

At $11.5 million, this 108,500 square foot property was the largest industrial sale of the quarter. Previously occupied by Greyhound Canada, the building was acquired by Manulife Financial whose ultimate plans are to re-develop the nearly 10-acre site.

Homestead Land Holdings Ltd. CAPREIT Multi-Family Portfolio 2020, Gloucester & Downtown – Apartment

This 380-unit, two-property multi-family portfolio was sold by Homestead Land Holdings Ltd. and acquired by CAPREIT for $95,500,000. The portfolio included a 330-unit townhouse complex located in Gloucester and a 50-unit, seven-storey apartment building located in downtown Ottawa. At the time of sale, the combined properties had a 99% occupancy rate.

Royalton Place, Gloucester – Apartment

Located at 3360 Paul Anka Drive, this 12-storey, 232-unit apartment building was also sold by Homestead Land Holdings Ltd. and was marketed for sale together with the assets mentioned above that were purchased by CAPREIT. Acquired by Starlight Investments for $53.8 million, this property sits on nearly 3.6 acres and offers the potential for additional density to be added in the future.

Albert At Bay & Best Western Plus Hotel Portfolio, Downtown – Hotel

Purchased by a private investor, this two-property downtown Ottawa hotel portfolio was acquired for a total of $79.4 million. The two properties were permanently closed at the time of sale and were formerly operating under the hotel banners Best Western Plus and the Albert on Bay. The new owners are seeking to convert these hotel assets into rental apartment buildings.

After a trying year that included restrictions, lockdowns and work from home, the Ottawa commercial real estate market was undoubtedly impacted by the pandemic. Still, investment activity is predicted to rebound with the promise of vaccine distribution on the horizon bringing some relief to current uncertainties. Given the strong outcomes closing out 2020 with fourth quarter investments totalling nearly $500 million, the Ottawa market looks to carry this momentum forward into 2021.

All references in this article are to arms-length transactions.

Source Altus Group. Click here to read a full story

With a dip in commercial real estate investment activity seen in 2020 due to ongoing pandemic-related challenges throughout the year, some asset classes weathered the storm better than others. Industrial assets performed well across most major markets and remained a winner as a steady rise in e-commerce sales that begun during the initial lockdown continued to prompt demand for warehouse and distribution space throughout the pandemic. Existing trends in the industrial market have also been accelerated, including demand for newer facilities with more space, as well as demand for additional space to accommodate high return volumes. With availability rates still low, high activity in the industrial market is expected to persist.

Despite recording a slowdown, land sectors (both ICI and residential) have also seen steady activity levels throughout 2020 with investors leaning into record-low interest rates and prioritizing assets with development opportunities. Multi-family assets finished the year strong with demand pushing through after the slowdown in the spring market. Year-over-year totals indicate a significant drop in office sector transaction volume as the market continues to grapple with the impact of work-from-home that has lasted a full year. While landlords and tenants are working to make decisions regarding space needs and the future of the workplace, the progression of the vaccine rollout will be a large factor in determining when a potential return to offices on a large scale will be feasible and safe. It remains to be seen if vaccine distribution will become more robust and push the market forward, but many are cautiously optimistic for the economy to experience an uptick in 2021.

National investment volume in 2020 dropped 21% compared to 2019, with over 7,400 transactions reaching a total of more than $42 billion. Transaction counts were only down 4% year-over-year, demonstrating continued activity, just at lower values. The industrial sector performed well throughout the year with $9.5 billion in total investment volume, down only 3% compared to 2019, and making up 23% of total transactions in 2020. The multi-family and residential land sectors followed, recording $8.2 billion and $8.0 billion, respectively, down 17% and 12% from the previous year. Together, these two asset classes compose 38% of total activity throughout the year. Reaching a total of $5.5 billion in investment volume in 2020, the retail sector only fell 15% compared to the $6.5 million recorded in 2019, despite facing ongoing lockdown and restriction challenges since early in the year. With continued uncertainties driven by the pandemic, it is unsurprising that the office sector sustained the biggest year-over-year drop in 2020, falling 55% at $4.6 billion in volume. All major markets in Canada experienced a drop in year-over-year investment volume with the Ottawa market taking the biggest hit, falling 36% compared to 2019. Most of the activity in 2020 involved properties with upside rent potential through redevelopment, expansion possibilities and/or lease expiries.

According to Altus Group’s Investment Trends Survey results for Q4 2020, single-tenant and multi-tenant industrial have maintained their spot as the top two preferred product types by investors, followed by food anchored retail assets. This trend has been seen for the majority of 2020 with investors prioritizing stable assets with the potential for growth. Despite sustaining the largest drop in volume compared to other major markets, Ottawa food anchored retail and multi-tenant industrial assets sit among the top three preferred product-market combinations by investors, just under Toronto food anchored retail strip. Toronto and Vancouver remain the top two markets preferred by investors, both experiencing a rise in momentum on the buy/sell ratio. National cap rates recorded in Q4 2020 have compressed compared to the previous quarter, but have increased slightly compared to the same quarter in 2019. Aside from Montreal, all major markets have seen a rise in cap rates year-over-year, while Edmonton and Calgary were the only two markets to experience a rise in cap rates quarter-over-quarter. Nationally, tier I regional malls experienced the greatest jump in cap rates compared to the previous year, followed by downtown class AA office assets. Both single-tenant industrial and suburban multi-unit residential saw a decrease in national cap rates year-over-year.

While commercial real estate performance took a hit in 2020, year-end totals were better than expected for most asset classes across major markets given the circumstances. Lockdown measures and stay-at-home orders on and off throughout the year have undoubtedly presented challenges and dampened demand in areas including office and retail, but have somewhat pulled demand forward for industrial and land assets. After a year of new rules impacting all sectors, most have begun to adopt changes that were made and are ready to move forward. As many are eager for regional restrictions to be lifted, demand could pick up as we approach the spring of 2021.

View notable Q4 2020 transactions in GTA market.

Source Altus Group. Click here to read a full story

With tightening restrictions and another stay-at-home order issued, COVID-19 continued to impact commercial real estate in the GTA. In 2020, the GTA saw $17.5 billion in total investments, a 23% decrease compared to the $22.7 billion seen in 2019. Deal volumes also dipped with only 2,140 transactions recorded, which was a decrease of 8%. Surprisingly, even though most asset classes saw a drop in total investments, residential land investments were only down 1% compared to 2019, and industrial investment volume grew by 5%. Given the unprecedented year, the overall drop in transactions was not as bad as expected. The commercial real estate market finished strong with $5.7 billion in investment volume delivered in the fourth quarter.

The GTA market proved once again to be resilient amid continued uncertainty, maintaining its position as the most sought after and stable Canadian market as investors showed confidence with a strong second half in 2020. Similar to prior years, the land sectors (ICI land, residential land and residential lots) were prominent with $7 billion registered in transactions, representing 40% of overall investments for the year. The industrial sector continued to thrive and led all asset classes, registering $4.6 billion in transactions which outperformed the previous high of $4.4 billion seen in 2019. The asset class hit the hardest by the pandemic was the office sector which registered $1.6 billion, a 61% decrease compared to 2019. This resulted from a lack of significant transactions in the GTA office market, with only a single transaction closing at over $100 million. It is evident that larger institutional buyers were taking a more cautious approach throughout 2020 due to ongoing uncertainty in the office market as work from home became the new normal. According to Altus Group’s Investment Trends Survey for Q4 2020, Toronto remained as the top market preferred by investors, alongside Vancouver. Toronto Food-Anchored Retail is also the top preferred product-market combination by investors in the fourth quarter. Cap rates remained stable across asset classes except for single-tenant industrial which saw rates slightly compress, reflecting continued investor interest in industrial assets. Stable rates exhibit some optimism moving forward into 2021 as investors have adjusted to market risks over the past year.

Notable Q4 transactions:

Parkview Apartments, Old Toronto – Apartment

Located at 500 Duplex Avenue, this 330-unit multi-residential asset was acquired by Q Residential, a prominent investor in multi-family residential with holdings located across Ontario. At $158 million, representing a price per unit of $478,712, this addition to their portfolio was the largest apartment deal of the quarter. This acquisition also marked the third asset acquired by Q Residential in the GTA market in 2020, along with 141 Erskine Avenue ($64 million) and 2777 Kipling Avenue ($93 million).

Concorde Corporate Centre, North York – Office

The biggest market office transaction of 2020 was completed in the fourth quarter. Acquired by Fengate Asset Management on behalf of LiUNA Pension Fund in November for $114 million, this property is comprised of three office buildings totalling 567,619 square feet, as well as a high-density residential land development site. Situated on nearly 7.7 acres, this asset has desirable access to the DVP and downtown Toronto.

First Meadowvale Centre Phase I, Mississauga – Office

This 249,345 square foot, 10-storey office complex which is fully occupied by BMO was acquired by Groupe Mach in December for $72.2 million. Located at 2465 Argentina Road, this acquisition marks the first entrance into the GTA market by the prominent Montreal based investors.

1895 Williams Parkway & 30 Bramtree Court, Brampton – Industrial

At $119 million, this property was the largest industrial sale of the quarter. The 400,000 square foot data centre was acquired by California based Equinix REIT. This acquisition represents the second GTA data centre acquisition by the purchaser, as they also acquired 45 Parliament Street in 2019 for $223 million.

480 Yonge Street, Old Toronto – Residential Land

This high-density property was acquired under distress in October by QuadReal for $172 million and was the largest land deal of the year. The site is centrally located on Yonge Street just north of College Street, and development has already commenced on a 39-storey, 425-unit, mixed-use residential condominium.

Continued uncertainty surrounding the pandemic is having its greatest effects on the retail and office markets, as investors prioritize assets that will provide stability and future growth opportunities. As seen in previous quarters, investors are still confident in the multi-residential and industrial sectors, as these two asset classes have been affected less by current market conditions. Investors are being more selective and do not want to pay top dollar amid the current uncertainty as a bid-ask gap persists between buyers and sellers. Overall, demand for quality GTA real estate assets remains stable and investors are using record low interest rates to their advantage.

Source Altus Group. Click here to read a full story

The continuing adoption of technology and an industry-wide recognition of the new realities created by the pandemic will be two dominant trends in 2021, according to two of Altus Group‘s top data experts.

“In 2021, the real estate sector will move from adapting to adoption as workplace needs continue to change and evolve,” Ray Wong told participants at Altus Group’s annual state of the market event in February.

The virtual presentation offered an overview of commercial and residential real estate activity and trends in major markets across Canada.

“The impact of digitalization on real estate cannot be underestimated,” said Wong, Altus’ vice-president of data operations for its data solutions division. “This will be one of the key adoptions in 2021 as owners and tenants will implement increasingly smart building management tools which allow for better monitoring of systems and providing timely and needed services, with results that can be both measured and monetized.

“Look for more partnerships between tenants and owners with respect to safety protocols, wellness initiatives, new space layouts and dealing with new workplace dynamics and staff interactions.”

Total commercial real estate investment activity was $42.9 billion in 2020, down 21 per cent from 2019, the second-highest year on record. However, investment activity increased over the last few months of 2020.

Wong said environmental, social and corporate governance (ESG) and sustainable investing will also continue to grow, and portfolio strategies will focus more on ESG priorities.

Office

There’s uncertainty about the office market, owing to fallout from COVID-19 and its effects on how and where people work. With offices being largely empty over the past year, working from home has generally proven successful although there’s some belief productivity has declined as the situation has persisted.

“The office space must evolve to address the balance between the needs of the employers and employees to foster collaboration and reinforce company culture,” said Wong. “The office needs to be the connection point.”

The average square foot per employee is expected to increase based on the need for physical distancing, but footprints are expected to decrease based on a new hybrid model where people work in the office three days a week and from home two days a week.

Altus Group’s November 2020 key assumptions survey showed 57 per cent of respondents expect office tenants to downsize. Sixty-two per cent expect that downsizing to be less than 20 per cent.

The office availability rate is increasing across Canada, especially in Vancouver and Toronto, and that’s likely to continue due to an increase in sublet space.

Office sublet availability as a percentage of available space in Toronto was 24.3 per cent in the fourth quarter of 2020, compared to 14.1 per cent a year earlier. Those numbers, respectively, were 32.1 per cent and 23.3 per cent in Vancouver.

Sublet space is having less of an impact on the Winnipeg, Quebec City and Halifax markets.

There’s approximately 20 million square feet of office space under construction across Canada, primarily in Toronto, Vancouver and Montreal.

Pre-leasing activity has been solid.

Wong said: “This is the type of space that tenants want because of space layout that allows for better social distancing, updated HVAC systems and a focus on wellness. We don’t anticipate any big drops with regards to AA or AAA space or newer space.

“Where we see some weakness in posted rents are in class-B and class-C spaces in urban areas.”

Building owners have been offering more tenant incentives — including free rent, built-out space or tenant improvements — and Wong expects to see more incentives moving forward.

Retail

After a year comprised largely of online shopping and curbside pick-ups, retailers will need to lure shoppers back to physical stores and restaurants once more government restrictions are lifted.

“Retail brick and mortar gets knocked down every year, but it comes back in a different form every year, with a different experience or something that can’t be replicated online,” said Wong.

E-commerce sales increased by about 200 per cent in 2020 over 2019, according to Wong. This year and 2022 are expected to see more gradual increases as more people return to stores after the pandemic.

Wong said at least 20 per cent of goods bought online are returned and an estimated two to three million square feet of space will be needed every year in order to handle these returns. This will add two to three per cent to warehouse operating costs — and triple that when they’re returned from retail locations.

Some companies in the United States have warehouses and distribution centres dealing exclusively with returns. This could also take hold in Canada. Such centres don’t have to be located in urban areas, so they cost less to operate, according to Wong.

Industrial

Industrial space supply isn’t keeping up with demand and there are low availability rates across Canada. Warehouse distribution continues to drive demand.

Most new industrial construction is being designed and built for tenants, with little speculative construction, which is contributing to the lack of availability.

“Tenants are driving renewal activity more than landlords to secure space, based on low availability rates,” said Wong.

Land and residential sales

Land sales volumes were down across the country, though the volume of high-density land sales was relatively stable.

“The fact that land was still trading during the pandemic speaks to the fact that there’s still confidence in the outlook and the opportunities in the market,” said Altus Group’s data solutions VP of product management Matthew Boukall.

“Land sales today are 2023, 2024 and beyond (residential) supply.”

Residential sales were growing before the pandemic, which caused a significant short-term decline in sales activity in resale and new homes, but they recovered quickly.

Low interest rates have helped fuel the market, as single-family housing and townhome demand picked up in 2020 in almost every major Canadian market outside of Alberta. Boukall expects that to continue this year.

The supply of resale housing has declined as sales have increased and the inventory of single-family housing remains tight.

Housing completions were up in the Greater Toronto Area (GTA), down in Vancouver, Edmonton and Calgary, and essentially the same in Montreal.

Boukall said completions being down in Alberta is a good thing because there were oversupply concerns in Edmonton and Calgary.

Condominiums

Condominium unit sales were down in most markets as a result of lower inventory due to fewer project launches and weaker demand in downtown cores.

Near-term challenges impacting condo demand should fade as a market balance returns and offices reopen later this year, according to Boukall.

“The market actually performed quite strongly,” said Boukall. “It was the disruptions from the pandemic that disrupted supply in the spring, which is typically when you see a lot of product coming to the market.”

Pressures around rental vacancy increases and lower rental rates disrupted some sales activity later in 2020. There was a heightened focus on affordable inventory and those units generally moved quickly, but condo pricing rose outside of Vancouver and Edmonton.

Average new condo prices in the GTA surpassed Vancouver because there were fewer luxury condos and more affordable units coming on to the market in Vancouver.

Multifamily rental market

Multifamily rental vacancies have increased in almost every major market, particularly in urban areas and rents have also come down recently.

Vancouver and Toronto were the hottest rental markets before the pandemic, with very low vacancy rates and consistent rent growth, and they still have low vacancy rates despite COVID-19-related changes to the market.

Boukall said longer-term unemployment caused by COVID-19, largely based in the service sector, could cause challenges for housing demand in 2022 and beyond.

The bad news is that in its latest Key Assumptions Survey Update, a majority of CRE executives canvassed by Altus Group are concerned an office space downsizing of 10 to 20 per cent could result from the COVID-19 pandemic.

The good news is that for owners and managers of high-quality office space, strong market fundamentals across most of Canada should allow this space to be taken up fairly quickly — if in fact the downsizing occurs.

The results show 57 per cent of respondents active in the office sector believe their tenants will downsize (21 per cent were not yet sure, 22 per cent did not believe there would be a downsizing).

“I think if it is 10 to 20 per cent (downsizing), we will be able to absorb that in most of the CBDs in Canada fairly well,” said Altus Group’s Colin Johnston, the firm’s president of research and valuation, Canada. “The important thing to remember is we had some of the healthiest office markets in North America prior to the pandemic. We had very, very low vacancy in Toronto,] and in Vancouver we had positive rental growth and had for several years.

“Montreal had new construction for the first time in a while so it was very, very strong. We had great fundamentals, we hadn’t overbuilt (and) even though we had new product coming on, it was predominantly pre-leased, so the market was very strong.”

Large office occupiers waiting to make decisions

The survey was conducted in November and drew responses from 115 executives with pensions funds and life companies, publicly traded corporations (REITs), private companies and brokerages. The survey focused on office and retail trends.

“By no means is surveying 100-plus people a massive sample size, but I think it was interesting people said 10 to 20 per cent,” Johnston noted. What is already evident is that larger occupiers are attempting to hedge their bets on the future of office space.

“It will definitely take a long time to play out but what I think is interesting, when it comes to renewals, we are seeing people doing two- and three-year renewals because they don’t want to make a call on their long-term space planning needs.”

With so many factors in play, there is almost a wait-and-see attitude across the industry, from both tenants and building owners and managers. Leasing rates are generally holding steady in the major urban centres, despite more sublease space coming onto the market and an expectation work-from-home trends will remain to some degree.

While there is also a shift back toward suburban office space, there is no firm commitment to a massive hub-and-spoke movement. At least not yet.

Questions remain about work-from-home

Johnston said there is more certainty among larger occupiers such as financial and accounting firms, law firms and other service-based sectors that, at some level, work-from-home will continue. The question remains how many workers?

“In our discussions with them, what they’ve found is it’s the back-office workers they are not really going to need (in the office full-time). The finance departments, the marketing departments, IT etcetera. There’s a lot that can just be done remotely,” Johnston explained.

“When we talk to law firms, the lawyers are saying, ‘Of course the partners will be back, we need to be back, to collaborate. But the paralegals, I don’t know if we are going to need all of them to come back.’

“I think there’s an idea that some people will have hybrids, will be working one or maybe two days at home, but there will be some people that there won’t be a requirement for them to come back. What we don’t know is if they don’t come back, you have less employees but are these less employees going to need a bit more space?”

While the overall office footprint is still a big question mark, Johnston said one trend is beginning to solidify. He expects a “flight to quality” to quickly absorb the best space, but to create challenges for lower-quality office owners.

“One thing that is more clear is that people are definitely more pessimistic for the lower-quality office assets. That seems to generally be more entrenched than it was before,” he said. “I think the B and C market is definitely going to be challenged and that became clear in this report.”

Retail key assumptions

The retail report highlights a sector which is facing challenges across almost all segments. Trends already in play due to e-commerce and last-mile distribution have been accelerated.

About 90 per cent of respondents believe rents will decline for virtually all classes of retail properties through 2021. The exceptions are power centres (68 per cent believe rents will decline), and grocery- and food-anchored strip retail where 53 per cent believe rents will remain stable and 14 per cent believe they will increase.

Lag vacancy is expected to grow, as well as financial allowances for vacancies and bad credit.

“The one thing that has become pretty clear to me is that these secondary malls, the ones that were already in trouble and perhaps lost a Sears and lost a Target, the timeline for redevelopment or repurposing has definitely been accelerated,” Johnston said.

Some of these properties could join a trend already taking hold in the U.S. Since 2016, Johnston said, 24 malls representing eight million square feet have been repurposed for distribution facilities.

“I think we’ll see that happening in Canada, maybe not to that extreme because the U.S. was over-retailed and had a lot more ghost malls.”

Source Real Estate News Exchange. Click here to read a full story

Last year’s Canadian commercial real estate return was the worst since the recession of 1993, according to the 2020 MSCI/REALPAC Canada Property Index.

The total return plummeted from 6.68 per cent in 2019 to negative 4.12 per cent in 2020. Data has been collected since 1985, and the total average return since then has been 8.5 per cent, to put the numbers in perspective.

“Real estate suffered a down year,” MSCI executive director Simon Fairchild said during the virtual MSCI/REALPAC Canada Real Estate Investment Forum sponsored by Avison Young on Feb. 2.

“We’ve not been able to say that many years, certainly recently, but we recorded a 7.8 per cent fall in values for the year on a stabilized basis and an income return that’s less than four per cent.”

What the MSCI/REALPAC property index measures

The index measures unlevered total returns of directly held property investments. Its goal is to enhance transparency, enable comparisons of real estate relative to other asset classes and facilitate comparisons of Canadian real estate performance to other private real estate markets globally.

The index includes buying, selling, development and redevelopment activity data provided by major pension funds, insurance companies and large real estate owners in Canada.

It encompasses 44 portfolios with 2,356 assets totalling 505.8 million square feet and a gross capital value of $158.1 billion.

Of the four countries which have released 2020 figures, Canada’s performance is the weakest. The United States’ total return was 1.8 per cent, the United Kingdom’s was negative 0.8 per cent and Ireland’s was negative 0.9 per cent.

While Canada’s rate of return deteriorated by 10.8 points, the downturn was four per cent in the U.S.

REALPAC chief executive officer Michael Brooks hosted the forum.

Fiera Real Estate president and head of global real estate Peter Cuthbert, TD Asset Management head of global real estate investments Colin Lynch and Ontario Teachers’ Pension Plan head of responsible investing and director of total fund management Deborah Ng provided commentary.

Lynch was surprised by how much better the U.S. performed than Canada. He said some of it was likely related to how different governments have handled the COVID-19 crisis; there were more government-imposed lockdowns in Canada, which meant fewer buildings and businesses were open.

“Hopefully this is the extent of the downside and we get some recovery coming soon,” said Cuthbert.

Returns by asset class and market

At the extreme ends of the spectrum, industrial properties had a 12.7 per cent return and retail had a negative 15.1 per cent return.

“That spread between best and worst is twice as big as it was last year, and last year was the highest that we’d seen,” said Fairchild.

The residential return was 5.7 per cent and the office return was negative 1.5 per cent.

Eight major cities were included in the index, and the top performer was Ottawa with a 0.1 per cent return. All of the rest were in negative territory: Toronto at -0.8 per cent; Vancouver at -2.3 per cent; Montreal at -3.9 per cent; Halifax at -8.5 per cent; Edmonton at -8.6 per cent; Winnipeg at -9.5 per cent; and Calgary at -12.7 per cent.

Capital growth by asset class and market

Capital growth for all properties was negative 7.8 per cent and the overall income return was 3.9 per cent.

Industrial had 7.8 per cent capital growth and a 4.5 per cent income return. The respective numbers were 2.2 and 3.5 per cent for residential, negative 5.9 and 4.7 per cent for office, and negative 17.8 and 3.2 per cent for retail.

MSCI executive director Simon Fairchild. (Steve McLean RENX)

Fairchild said retail valuations were hit particularly hard in Q4 2020, as the asset class had experienced only a four per cent drop in valuation through September.

Capital growth was negative in all eight cities: -4 per cent in Ottawa; -4.2 per cent in Toronto; -5.9 per cent in Vancouver; -7.2 per cent in Montreal; -12.7 per cent in Halifax; -12.9 per cent in Edmonton; -13.1 per cent in Winnipeg; and -17.2 per cent in Calgary.

Income returns and losses

The income returns were 4.3 per cent in Ottawa, 3.6 per cent in Toronto, 3.8 per cent in Vancouver, 3.5 per cent in Montreal, 4.8 per cent in Halifax and Edmonton, 4.2 per cent in Winnipeg, and 5.4 per cent in Calgary.

Every city experienced negative net income growth, with Vancouver at -7.6 per cent; Ottawa at -10 per cent; Calgary at -11.4 per cent; Toronto at -11.7 per cent; Edmonton at -14.5 per cent; Montreal at -14.8 per cent; Halifax at -16.1 per cent; and Winnipeg at -23.6 per cent.

Net income growth was negative 13.1 per cent for all properties. It was 1.2 per cent for industrial, negative two per cent for office, negative 2.7 per cent for residential and negative 30.2 per cent for retail.

Retail and office performance

“Retail has been under pressure for a number of years since the peak back in 2013 and we’ve seen a gradual decline since then,” said Fairchild. “But it turned into a sharp decline in 2020 and it’s the largest malls that are being hit the hardest.”

Regional shopping centres had a negative 18.3 per cent total return, while larger super-regional malls were close behind at negative 16.5 per cent. Local neighbourhood retail fared better with a negative 2.9 per cent return.

Large new office buildings in prime downtown areas have been the focus of investors for several years, as they’ve outperformed suburban office properties. That wasn’t the case in 2020, however, as downtown major metro properties had a total return of negative 1.7 per cent and suburban major metro properties had a total return of negative 0.9 per cent.

“One quarter doesn’t make a trend, but it’s interesting to note that we’ve seen the downtown markets fall more sharply through the last part of this year,” said Fairchild. “Returns of eight to 10 per cent are down to negative two, where things in the suburbs have moderated from plus-four to minus-one.”

Annual net investment

Net investment was $1.29 billion in industrial, $1.01 billion in office, $660.3 million in residential, $202.4 million in retail and $694.9 million in other property types.

“Investors still have an appetite for real estate and the amount of money going into these portfolios has actually gone up from about $3.7 billion to $3.9 billion,” said Fairchild. “Half of the net new money is in development.”

Toronto led all markets with $2.72 billion in net investment, followed by: Vancouver with $520.5 million; Ottawa with $246.1 million; Montreal with $146 million; Calgary with $92.7 million; Edmonton with $75.7 million; Winnipeg with $73.6 million; and Halifax with $6 million.

COVID-19 disruptions

MSCI executive director of real estate solutions research Bryan Reid said some COVID-19-related disruptions were accelerations of trends in play before the pandemic hit.

“The pandemic has put a rocket behind some of the things that were already evident in these sector profiles,” said Reid. “The COVID crisis has impacted some of these retail assets a lot more heavily than other property types.”

REALPAC COVID-19 surveys of rent delinquencies showed they were highest in retail, particularly in enclosed malls during Q2 and Q3.

Capital growth outlook for 2021

All of the panelists predicted commercial real estate capital growth of between zero and five per cent in Canada this year.

“The dynamic of low interest rates and monetary fiscal policy will provide a little bit of a floor relative to other periods of distress,” said Lynch. “However, I can’t see a dramatic positive overall return for real estate in Canada.”

Cuthbert believes the industrial sector could cool off a bit since “pricing has gone through the roof” and rents are now similar to those at open-air big box retail centres.

He thinks well-located retail properties could recover because they’re well-suited to handle last-mile logistics through deliveries and product returns.

“Who’s to say that your 15,000-square-foot box can’t have 10,000 square feet of warehouse and 5,000 square feet of single SKU retail in the front?” asked Cuthbert.

Many major shopping centres also act as community hubs where people spend time together, a trend that could be accentuated after COVID-19 lockdowns are lifted, Cuthbert added.

“I’m not as bullish on retail, just thinking of the number of bankruptcies that we’ve had,” said Ng.

About MSCI and REALPAC

MSCI’s research-based indexes and analytics have helped investors build and manage portfolios for more than 40 years.

Its products and services include indexes, analytical models, data, real estate benchmarks and environmental, social and corporate governance research.

MSCI serves 97 of the 100 largest money managers, according to the most recent Pensions & Investments ranking.

REALPAC, founded in 1970, is the national industry association dedicated to advancing the long-term vitality of Canada’s real property sector.

Its more than 120 members include publicly traded real estate companies, real estate investment trusts, private companies, pension funds, banks and life insurance companies with investment real estate in all asset classes.

Source Real Estate News Exchange. Click here to read a full story

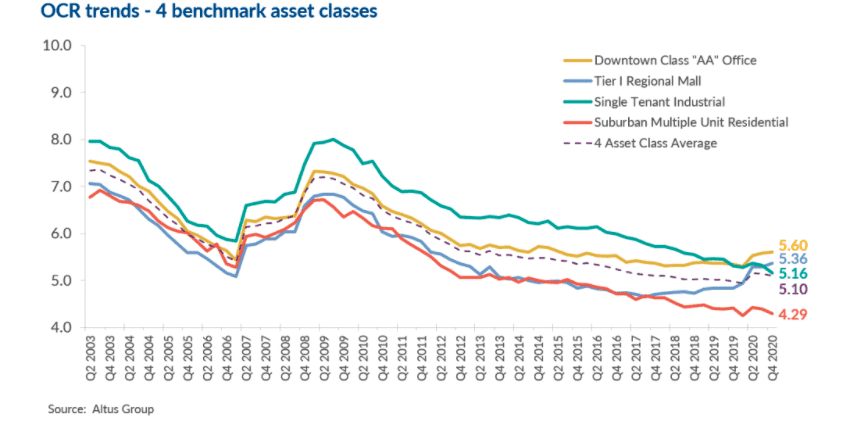

The latest results from Altus Group’s Investment Trends Survey (ITS) for the 4 Benchmark asset classes show that the Overall Capitalization Rate (OCR) compressed to 5.10% this quarter, down from 5.14% in the previous quarter but up slightly from 4.98% in Q4 2019 (Figure 1).

While COVID-19 restrictions continued to impact the market by way of lockdowns, business closures and employment slowdowns, investor preference in certain asset classes points to key areas of strength. As stay-at-home measures accelerate e-commerce growth and distribution demand, investors have consistently shown a preference for industrial assets across markets, and the fourth quarter has seen rising industrial net rental rates. Multi-family assets have also seen growing preference, especially in the Toronto and Ottawa markets. The retail sector still faces the brunt of pandemic-related challenges, but as investors prioritize and seek out assets with growth potential, Food Anchored Retail Strip is the third most preferred asset type. Although year-over-year transaction volume is down, these high performing asset classes have bolstered the market, which is likely to continue as we move into 2021.

(Figure 1)

With pandemic restrictions persisting in most Canadian markets, economic recovery is losing momentum. While Statistics Canada reported 62,000 jobs added in November, bringing the unemployment rate down to 8.5%, employment has seen a slowdown, growing only 0.3% compared to the average monthly increase of 2.7% seen between May and September. According to the Conference Board of Canada, employment gains were seen in wholesale, transportation, and finance sectors, where accommodation and food service sectors continued to struggle. Despite improvements in overall household consumption, consumer spending on goods is up 17%, and spending on services remains weak. The Board forecasts growth to continue for industries that can adapt to ongoing restrictions, but those that cannot – especially in the hospitality and entertainment sectors – are not likely to see any improvements until the vaccine becomes widely available. Although news of the vaccine has instilled some optimism in the market, challenges and uncertainties remain when it comes to vaccine distribution, which leaves many anticipating tough winter months ahead before positive economic impacts come to fruition. According to the location barometer for all available products, Vancouver has re-gained its spot as the top preferred market by investors, alongside Toronto, both of which saw increasing momentum this quarter (Figure 2). While most markets experienced a rise in momentum, Montreal, Halifax and Calgary all saw a drop. Single- and Multi-Tenant Industrial have surpassed Food Anchored Retail Strip as the top preferred products this quarter, and Industrial Land is the fourth preferred product type by investors (Figure 3).

(Figure 2)

Market highlights for the quarter include:

- Overall cap rates have slightly compressed this quarter as investors have become more comfortable making decisions amid pandemic challenges. Similar trends are expected as we move into the new year as investors prioritize assets with growth potential. Overall cap rates decreased slightly this quarter, with an average drop seen in Single-Tenant Industrial and Suburban Multiple Unit Residential assets, and an increase in Downtown Class “AA” Office and Tier I Regional Mall. Montreal recorded the largest drop compared to the previous quarter, and Edmonton and Calgary were the lone markets that increased slightly. All markets rose slightly year-over-year.

- With continued uncertainty in the office market, tenants are re-assessing their space needs and working with landlords to find flexible solutions for the year ahead. Despite the vaccine approval, uncertainties are likely to persist early next year, putting pressure on leasing terms and rental rates and further driving an increase in sublet space. Downtown Class “AA” office cap rates rose to 5.60% this quarter, up slightly from 5.58% in the previous quarter, and up significantly from 5.34% in the same quarter last year. The largest jump was recorded in Calgary this quarter, while Ottawa and Halifax were the only markets to see a drop.

- Industrial assets have been a clear winner throughout the pandemic, with Single- and Multi-Tenant Industrial assets sitting as the top two products most preferred by investors this quarter (Figure 3). This strong momentum is expected to continue with heightened demand for warehouse and distribution space persisting in the upcoming months to accommodate growing e-commerce volume including holiday returns. Tight supply and low availability rates, especially among high-quality assets, are likely to remain as supply works to catch up with demand. Single-tenant industrial cap rates decreased again to 5.16% this quarter, down from 5.33% in the previous quarter and 5.31% at the same time last year. While most markets saw cap rates compress, Montreal saw the largest drop with Calgary and Edmonton remaining stable, both compared to the previous quarter and year-over-year.

- With pandemic restrictions posing continued challenges in the retail sector, many retailers are pivoting to offer personalized and accessible solutions including curb-side pickup and omni-channel offerings to help offset lost foot traffic. Still, investor preference has shifted away from retail assets, apart from food-anchored retail that has performed well amid pandemic challenges and is strongly preferred by investors especially where they offer potential opportunities for expansion. Tier I Regional Mall cap rates grew to 5.36% this quarter, up from 5.29% in the previous quarter and from 4.84% in the same quarter last year. While Ottawa and Quebec City grew the most quarter-over-quarter, Edmonton was the only market to see a drop. Compared to last year, all markets saw an increase, with Ottawa and Halifax experiencing the largest jump.

- Demand for multi-residential assets remains robust in the fourth quarter as pent-up demand from the spring, as well as low interest rates, continue to push the market forward. With vaccine distribution planned for next year, the potential lift of travel bans and other pandemic restrictions could prompt further demand in 2021. Suburban apartment cap rates fell to 4.29% this quarter, down from 4.39% in the previous quarter, and 4.41% at the same time last year. Compared to the previous quarter and last year, Edmonton was the only market to see an increase, and Ottawa experienced the largest drop year-over-year.

(Figure 3)

Other highlights include:

Of the 128 combinations of products and markets covered in the Investment Trends Survey:

- 55 had a “positive” momentum ratio (i.e., a higher percentage of respondents said they were more likely to be a buyer than a seller in that particular segment), a slight decrease compared to 57 in Q2 2020; 72 had a “negative” momentum ratio, an increase from 69 in the previous quarter; and 1 was neutral compared to 2 in the previous quarter.

- The top 15 products/markets, which showed the most positive momentum were (Figure 4):

- Toronto – Food Anchored Retail Strip, Multi-Tenant Industrial, Suburban Multiple Unit Residential, and Industrial Land

- Ottawa – Food Anchored Retail Strip, Single- and Multi-Tenant Industrial, Industrial Land, and Suburban Multiple Unit Residential

- Halifax – Single- and Multi-Tenant Industrial, and Industrial Land

- Quebec City – Single- and Multi-Tenant Industrial, and Industrial Land

(Figure 4)

The Report

Every quarter, senior Altus Group professionals reach out to over 200 investors, managers, owners, lenders, analysts and other market stakeholders to survey their opinion on value trends and perspectives. Conducted with the same benchmark properties for more than 15 years, the survey provides valuable insights on investor preferences and valuation parameters for 32 asset classes in Canada’s 8 largest markets.