GTA commercial real estate market finished strong in 2020 and shows promise for 2021.

GTA commercial real estate market finished strong in 2020 and shows promise for 2021.

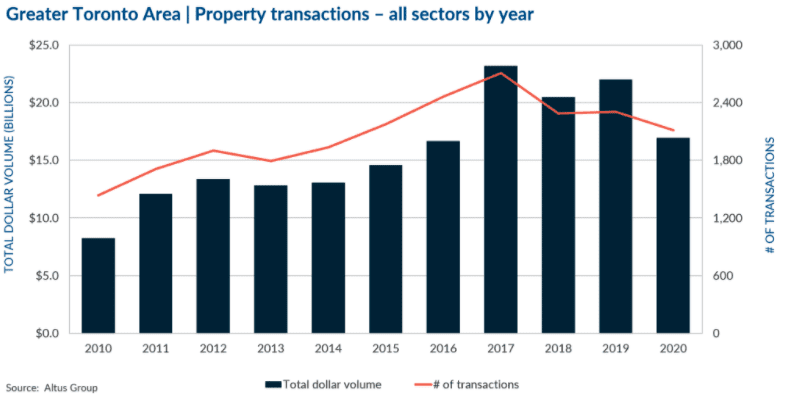

With tightening restrictions and another stay-at-home order issued, COVID-19 continued to impact commercial real estate in the GTA. In 2020, the GTA saw $17.5 billion in total investments, a 23% decrease compared to the $22.7 billion seen in 2019. Deal volumes also dipped with only 2,140 transactions recorded, which was a decrease of 8%. Surprisingly, even though most asset classes saw a drop in total investments, residential land investments were only down 1% compared to 2019, and industrial investment volume grew by 5%. Given the unprecedented year, the overall drop in transactions was not as bad as expected. The commercial real estate market finished strong with $5.7 billion in investment volume delivered in the fourth quarter.

The GTA market proved once again to be resilient amid continued uncertainty, maintaining its position as the most sought after and stable Canadian market as investors showed confidence with a strong second half in 2020. Similar to prior years, the land sectors (ICI land, residential land and residential lots) were prominent with $7 billion registered in transactions, representing 40% of overall investments for the year. The industrial sector continued to thrive and led all asset classes, registering $4.6 billion in transactions which outperformed the previous high of $4.4 billion seen in 2019. The asset class hit the hardest by the pandemic was the office sector which registered $1.6 billion, a 61% decrease compared to 2019. This resulted from a lack of significant transactions in the GTA office market, with only a single transaction closing at over $100 million. It is evident that larger institutional buyers were taking a more cautious approach throughout 2020 due to ongoing uncertainty in the office market as work from home became the new normal. According to Altus Group’s Investment Trends Survey for Q4 2020, Toronto remained as the top market preferred by investors, alongside Vancouver. Toronto Food-Anchored Retail is also the top preferred product-market combination by investors in the fourth quarter. Cap rates remained stable across asset classes except for single-tenant industrial which saw rates slightly compress, reflecting continued investor interest in industrial assets. Stable rates exhibit some optimism moving forward into 2021 as investors have adjusted to market risks over the past year.

Notable Q4 transactions:

Parkview Apartments, Old Toronto – Apartment

Located at 500 Duplex Avenue, this 330-unit multi-residential asset was acquired by Q Residential, a prominent investor in multi-family residential with holdings located across Ontario. At $158 million, representing a price per unit of $478,712, this addition to their portfolio was the largest apartment deal of the quarter. This acquisition also marked the third asset acquired by Q Residential in the GTA market in 2020, along with 141 Erskine Avenue ($64 million) and 2777 Kipling Avenue ($93 million).

Concorde Corporate Centre, North York – Office

The biggest market office transaction of 2020 was completed in the fourth quarter. Acquired by Fengate Asset Management on behalf of LiUNA Pension Fund in November for $114 million, this property is comprised of three office buildings totalling 567,619 square feet, as well as a high-density residential land development site. Situated on nearly 7.7 acres, this asset has desirable access to the DVP and downtown Toronto.

First Meadowvale Centre Phase I, Mississauga – Office

This 249,345 square foot, 10-storey office complex which is fully occupied by BMO was acquired by Groupe Mach in December for $72.2 million. Located at 2465 Argentina Road, this acquisition marks the first entrance into the GTA market by the prominent Montreal based investors.

1895 Williams Parkway & 30 Bramtree Court, Brampton – Industrial

At $119 million, this property was the largest industrial sale of the quarter. The 400,000 square foot data centre was acquired by California based Equinix REIT. This acquisition represents the second GTA data centre acquisition by the purchaser, as they also acquired 45 Parliament Street in 2019 for $223 million.

480 Yonge Street, Old Toronto – Residential Land

This high-density property was acquired under distress in October by QuadReal for $172 million and was the largest land deal of the year. The site is centrally located on Yonge Street just north of College Street, and development has already commenced on a 39-storey, 425-unit, mixed-use residential condominium.

Continued uncertainty surrounding the pandemic is having its greatest effects on the retail and office markets, as investors prioritize assets that will provide stability and future growth opportunities. As seen in previous quarters, investors are still confident in the multi-residential and industrial sectors, as these two asset classes have been affected less by current market conditions. Investors are being more selective and do not want to pay top dollar amid the current uncertainty as a bid-ask gap persists between buyers and sellers. Overall, demand for quality GTA real estate assets remains stable and investors are using record low interest rates to their advantage.

Source Altus Group. Click here to read a full story

gate.io | May 11,2023

At the beginning, I was still puzzled. Since I read your article, I have been very impressed. It has provided a lot of innovative ideas for my thesis related to gate.io. Thank u. But I still have some doubts, can you help me? Thanks.

Participate in Activities and Win Mega Rewards on gate.io | Jun 13,2023

Reading your article has greatly helped me, and I agree with you. But I still have some questions. Can you help me? I will pay attention to your answer. thank you.