Despite varied pandemic impact on individual sectors, national investment fared better than expected in 2020.

Despite varied pandemic impact on individual sectors, national investment fared better than expected in 2020.

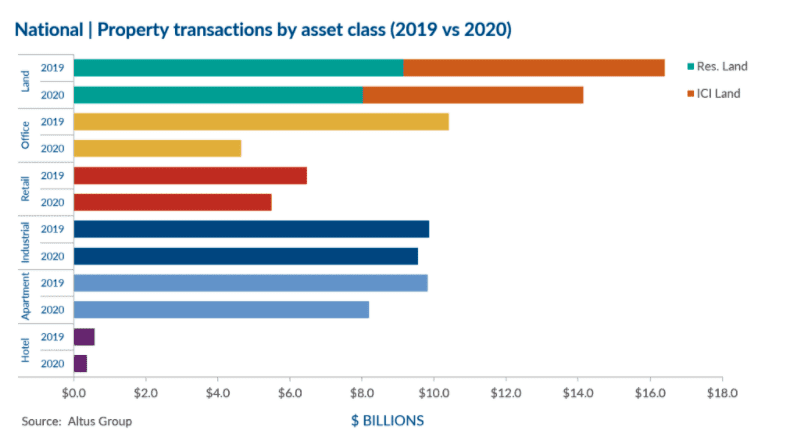

With a dip in commercial real estate investment activity seen in 2020 due to ongoing pandemic-related challenges throughout the year, some asset classes weathered the storm better than others. Industrial assets performed well across most major markets and remained a winner as a steady rise in e-commerce sales that begun during the initial lockdown continued to prompt demand for warehouse and distribution space throughout the pandemic. Existing trends in the industrial market have also been accelerated, including demand for newer facilities with more space, as well as demand for additional space to accommodate high return volumes. With availability rates still low, high activity in the industrial market is expected to persist.

Despite recording a slowdown, land sectors (both ICI and residential) have also seen steady activity levels throughout 2020 with investors leaning into record-low interest rates and prioritizing assets with development opportunities. Multi-family assets finished the year strong with demand pushing through after the slowdown in the spring market. Year-over-year totals indicate a significant drop in office sector transaction volume as the market continues to grapple with the impact of work-from-home that has lasted a full year. While landlords and tenants are working to make decisions regarding space needs and the future of the workplace, the progression of the vaccine rollout will be a large factor in determining when a potential return to offices on a large scale will be feasible and safe. It remains to be seen if vaccine distribution will become more robust and push the market forward, but many are cautiously optimistic for the economy to experience an uptick in 2021.

National investment volume in 2020 dropped 21% compared to 2019, with over 7,400 transactions reaching a total of more than $42 billion. Transaction counts were only down 4% year-over-year, demonstrating continued activity, just at lower values. The industrial sector performed well throughout the year with $9.5 billion in total investment volume, down only 3% compared to 2019, and making up 23% of total transactions in 2020. The multi-family and residential land sectors followed, recording $8.2 billion and $8.0 billion, respectively, down 17% and 12% from the previous year. Together, these two asset classes compose 38% of total activity throughout the year. Reaching a total of $5.5 billion in investment volume in 2020, the retail sector only fell 15% compared to the $6.5 million recorded in 2019, despite facing ongoing lockdown and restriction challenges since early in the year. With continued uncertainties driven by the pandemic, it is unsurprising that the office sector sustained the biggest year-over-year drop in 2020, falling 55% at $4.6 billion in volume. All major markets in Canada experienced a drop in year-over-year investment volume with the Ottawa market taking the biggest hit, falling 36% compared to 2019. Most of the activity in 2020 involved properties with upside rent potential through redevelopment, expansion possibilities and/or lease expiries.

According to Altus Group’s Investment Trends Survey results for Q4 2020, single-tenant and multi-tenant industrial have maintained their spot as the top two preferred product types by investors, followed by food anchored retail assets. This trend has been seen for the majority of 2020 with investors prioritizing stable assets with the potential for growth. Despite sustaining the largest drop in volume compared to other major markets, Ottawa food anchored retail and multi-tenant industrial assets sit among the top three preferred product-market combinations by investors, just under Toronto food anchored retail strip. Toronto and Vancouver remain the top two markets preferred by investors, both experiencing a rise in momentum on the buy/sell ratio. National cap rates recorded in Q4 2020 have compressed compared to the previous quarter, but have increased slightly compared to the same quarter in 2019. Aside from Montreal, all major markets have seen a rise in cap rates year-over-year, while Edmonton and Calgary were the only two markets to experience a rise in cap rates quarter-over-quarter. Nationally, tier I regional malls experienced the greatest jump in cap rates compared to the previous year, followed by downtown class AA office assets. Both single-tenant industrial and suburban multi-unit residential saw a decrease in national cap rates year-over-year.

While commercial real estate performance took a hit in 2020, year-end totals were better than expected for most asset classes across major markets given the circumstances. Lockdown measures and stay-at-home orders on and off throughout the year have undoubtedly presented challenges and dampened demand in areas including office and retail, but have somewhat pulled demand forward for industrial and land assets. After a year of new rules impacting all sectors, most have begun to adopt changes that were made and are ready to move forward. As many are eager for regional restrictions to be lifted, demand could pick up as we approach the spring of 2021.

View notable Q4 2020 transactions in GTA market.

Source Altus Group. Click here to read a full story