Investors show strong preference for select asset classes and are optimistic for the second half of 2021.

Investors show strong preference for select asset classes and are optimistic for the second half of 2021.

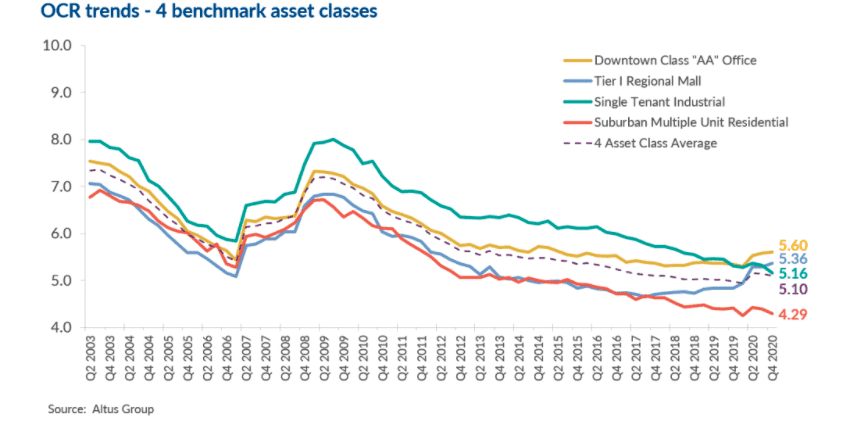

The latest results from Altus Group’s Investment Trends Survey (ITS) for the 4 Benchmark asset classes show that the Overall Capitalization Rate (OCR) compressed to 5.10% this quarter, down from 5.14% in the previous quarter but up slightly from 4.98% in Q4 2019 (Figure 1).

While COVID-19 restrictions continued to impact the market by way of lockdowns, business closures and employment slowdowns, investor preference in certain asset classes points to key areas of strength. As stay-at-home measures accelerate e-commerce growth and distribution demand, investors have consistently shown a preference for industrial assets across markets, and the fourth quarter has seen rising industrial net rental rates. Multi-family assets have also seen growing preference, especially in the Toronto and Ottawa markets. The retail sector still faces the brunt of pandemic-related challenges, but as investors prioritize and seek out assets with growth potential, Food Anchored Retail Strip is the third most preferred asset type. Although year-over-year transaction volume is down, these high performing asset classes have bolstered the market, which is likely to continue as we move into 2021.

(Figure 1)

With pandemic restrictions persisting in most Canadian markets, economic recovery is losing momentum. While Statistics Canada reported 62,000 jobs added in November, bringing the unemployment rate down to 8.5%, employment has seen a slowdown, growing only 0.3% compared to the average monthly increase of 2.7% seen between May and September. According to the Conference Board of Canada, employment gains were seen in wholesale, transportation, and finance sectors, where accommodation and food service sectors continued to struggle. Despite improvements in overall household consumption, consumer spending on goods is up 17%, and spending on services remains weak. The Board forecasts growth to continue for industries that can adapt to ongoing restrictions, but those that cannot – especially in the hospitality and entertainment sectors – are not likely to see any improvements until the vaccine becomes widely available. Although news of the vaccine has instilled some optimism in the market, challenges and uncertainties remain when it comes to vaccine distribution, which leaves many anticipating tough winter months ahead before positive economic impacts come to fruition. According to the location barometer for all available products, Vancouver has re-gained its spot as the top preferred market by investors, alongside Toronto, both of which saw increasing momentum this quarter (Figure 2). While most markets experienced a rise in momentum, Montreal, Halifax and Calgary all saw a drop. Single- and Multi-Tenant Industrial have surpassed Food Anchored Retail Strip as the top preferred products this quarter, and Industrial Land is the fourth preferred product type by investors (Figure 3).

(Figure 2)

Market highlights for the quarter include:

- Overall cap rates have slightly compressed this quarter as investors have become more comfortable making decisions amid pandemic challenges. Similar trends are expected as we move into the new year as investors prioritize assets with growth potential. Overall cap rates decreased slightly this quarter, with an average drop seen in Single-Tenant Industrial and Suburban Multiple Unit Residential assets, and an increase in Downtown Class “AA” Office and Tier I Regional Mall. Montreal recorded the largest drop compared to the previous quarter, and Edmonton and Calgary were the lone markets that increased slightly. All markets rose slightly year-over-year.

- With continued uncertainty in the office market, tenants are re-assessing their space needs and working with landlords to find flexible solutions for the year ahead. Despite the vaccine approval, uncertainties are likely to persist early next year, putting pressure on leasing terms and rental rates and further driving an increase in sublet space. Downtown Class “AA” office cap rates rose to 5.60% this quarter, up slightly from 5.58% in the previous quarter, and up significantly from 5.34% in the same quarter last year. The largest jump was recorded in Calgary this quarter, while Ottawa and Halifax were the only markets to see a drop.

- Industrial assets have been a clear winner throughout the pandemic, with Single- and Multi-Tenant Industrial assets sitting as the top two products most preferred by investors this quarter (Figure 3). This strong momentum is expected to continue with heightened demand for warehouse and distribution space persisting in the upcoming months to accommodate growing e-commerce volume including holiday returns. Tight supply and low availability rates, especially among high-quality assets, are likely to remain as supply works to catch up with demand. Single-tenant industrial cap rates decreased again to 5.16% this quarter, down from 5.33% in the previous quarter and 5.31% at the same time last year. While most markets saw cap rates compress, Montreal saw the largest drop with Calgary and Edmonton remaining stable, both compared to the previous quarter and year-over-year.

- With pandemic restrictions posing continued challenges in the retail sector, many retailers are pivoting to offer personalized and accessible solutions including curb-side pickup and omni-channel offerings to help offset lost foot traffic. Still, investor preference has shifted away from retail assets, apart from food-anchored retail that has performed well amid pandemic challenges and is strongly preferred by investors especially where they offer potential opportunities for expansion. Tier I Regional Mall cap rates grew to 5.36% this quarter, up from 5.29% in the previous quarter and from 4.84% in the same quarter last year. While Ottawa and Quebec City grew the most quarter-over-quarter, Edmonton was the only market to see a drop. Compared to last year, all markets saw an increase, with Ottawa and Halifax experiencing the largest jump.

- Demand for multi-residential assets remains robust in the fourth quarter as pent-up demand from the spring, as well as low interest rates, continue to push the market forward. With vaccine distribution planned for next year, the potential lift of travel bans and other pandemic restrictions could prompt further demand in 2021. Suburban apartment cap rates fell to 4.29% this quarter, down from 4.39% in the previous quarter, and 4.41% at the same time last year. Compared to the previous quarter and last year, Edmonton was the only market to see an increase, and Ottawa experienced the largest drop year-over-year.

(Figure 3)

Other highlights include:

Of the 128 combinations of products and markets covered in the Investment Trends Survey:

- 55 had a “positive” momentum ratio (i.e., a higher percentage of respondents said they were more likely to be a buyer than a seller in that particular segment), a slight decrease compared to 57 in Q2 2020; 72 had a “negative” momentum ratio, an increase from 69 in the previous quarter; and 1 was neutral compared to 2 in the previous quarter.

- The top 15 products/markets, which showed the most positive momentum were (Figure 4):

- Toronto – Food Anchored Retail Strip, Multi-Tenant Industrial, Suburban Multiple Unit Residential, and Industrial Land

- Ottawa – Food Anchored Retail Strip, Single- and Multi-Tenant Industrial, Industrial Land, and Suburban Multiple Unit Residential

- Halifax – Single- and Multi-Tenant Industrial, and Industrial Land

- Quebec City – Single- and Multi-Tenant Industrial, and Industrial Land

(Figure 4)

Every quarter, senior Altus Group professionals reach out to over 200 investors, managers, owners, lenders, analysts and other market stakeholders to survey their opinion on value trends and perspectives. Conducted with the same benchmark properties for more than 15 years, the survey provides valuable insights on investor preferences and valuation parameters for 32 asset classes in Canada’s 8 largest markets.

gate.io fund password | Mar 22,2023

Reading your article helped me a lot and I agree with you. But I still have some doubts, can you clarify for me? I’ll keep an eye out for your answers.

20bet | Sep 12,2023

Your article gave me a lot of inspiration, I hope you can explain your point of view in more detail, because I have some doubts, thank you.