RioCan sells 50% stake in eCentral & ePlace in Toronto & Rhythm in Ottawa to Woodbourne

RioCan sells 50% stake in eCentral & ePlace in Toronto & Rhythm in Ottawa to Woodbourne

RioCan REIT (REI-UN-T) is selling a 50 percent non-managing interest in its residential rental and retail eCentral/ePlace property in Toronto, and its Rhythm rental apartment development in Ottawa to WoodBourne Capital Management for a total of $156.2 million, the trust announced Wednesday night.

Woodbourne is already a partner with RioCan on other projects and is making the purchase on behalf of itself and one of its institutional pension fund clients.

The price includes $154.8 million for the interest in eCentral and ePlace, and $5.4 million for the interest in Rhythm. It represents cap rates of 3.5 percent and 4.5 percent for the residential and retail components in the Toronto properties, RioCan says in the release.

The price for Rhythm, which is located on the Westgate Shopping Centre property, is equivalent to $51 per square foot of buildable gross floor area. Woodbourne will also reimburse RioCan for a portion of Rhythm’s pre-closing development and construction costs.

RioCan reports Q3 financial results

“Amidst a global pandemic and economic slowdown, these transactions and strong deal pricing are a testament to the strength of our mixed-use assets,” said Edward Sonshine, RioCan’s CEO, in the announcement.

“The quality of our assets and our in-house development expertise continue to attract investment from well-respected partners and institutional funds.

“Such transactions not only allow us to realize the inherent value and drive net asset value growth, but also reduce the amount of capital required to build out our urban mixed-used development pipeline, enhance our balance sheet and liquidity position, and generate additional fee income.”

RioCan says it is in negotiations for the sale of interests in more than $100 million of other properties.

The trust also released its Q3 2020 results, reporting a net income of $117.6 million for the quarter.

For the year so far it reports a loss of $130.4 million, due mainly to $350 million in asset write-downs during Q2 associated with the pandemic and its impact on retail operations and valuations.

The same property NOI declined 9.1 percent in the quarter and is down six percent through the first nine months of 2020. Diluted FFO per unit was 41 cents in the quarter, down from 47 cents in Q2 and $1.21 in Q3 2019.

The eCentral, ePlace transaction

Upon closing, Woodbourne will assume 50 percent of the existing CMHC mortgage for the property, estimated to be $165.3 million as of the closing date. The loan consists of two tranches, both maturing October 2030, at an interest rate of 2.27 percent.

Maximizing CMHC financing is a key component of RioCan’s debt strategy as it provides access to a new source of financing and lowers the overall cost of debt.

Completed in 2019, eCentral is RioCan Living’s first purpose-built rental.

The 36-storey, 466-unit building includes 65 affordable housing apartments.

It has direct access to two rapid transit lines and is in close proximity to RioCan’s Yonge-Eglinton Centre.

Also nearby is the 623-unit, fully sold-out and completed e8 Condos, RioCan’s office and retail at 2323 Yonge St., and e2 Condos, a 440-unit condo development in which RioCan has a partial interest.

“As one of Canada’s most densely populated urban nodes, the highly trafficked Yonge and Eglinton area, where RioCan has a commanding presence, offers attractive growth opportunities,” RioCan states in its release.

eCentral is 92 percent leased, with rents averaging $3.90 per square foot for market rental units.

ePlace contains 23,600 square feet of new retail at the base of the luxury condominium tower e8 Condos. It is anchored by a TD Bank and includes 131 commercial parking stalls.

The available commercial space is fully leased and only concourse space remains to be leased once the direct connection to the Yonge-Eglinton Subway reopens in late 2021.

The transactions remain subject to standard closing conditions and are expected to close in January 2021.

The Rhythm transaction

Located adjacent to Westgate, Rhythm is currently under construction with completion expected in 2022-’23. It will feature a 24-storey, 213-unit residential rental building with approximately 20,000 square feet of podium retail and will also be served by existing retail and services at Westgate.

RioCan will remain the development manager for the project and upon completion, the property manager of the commercial component of Rhythm.

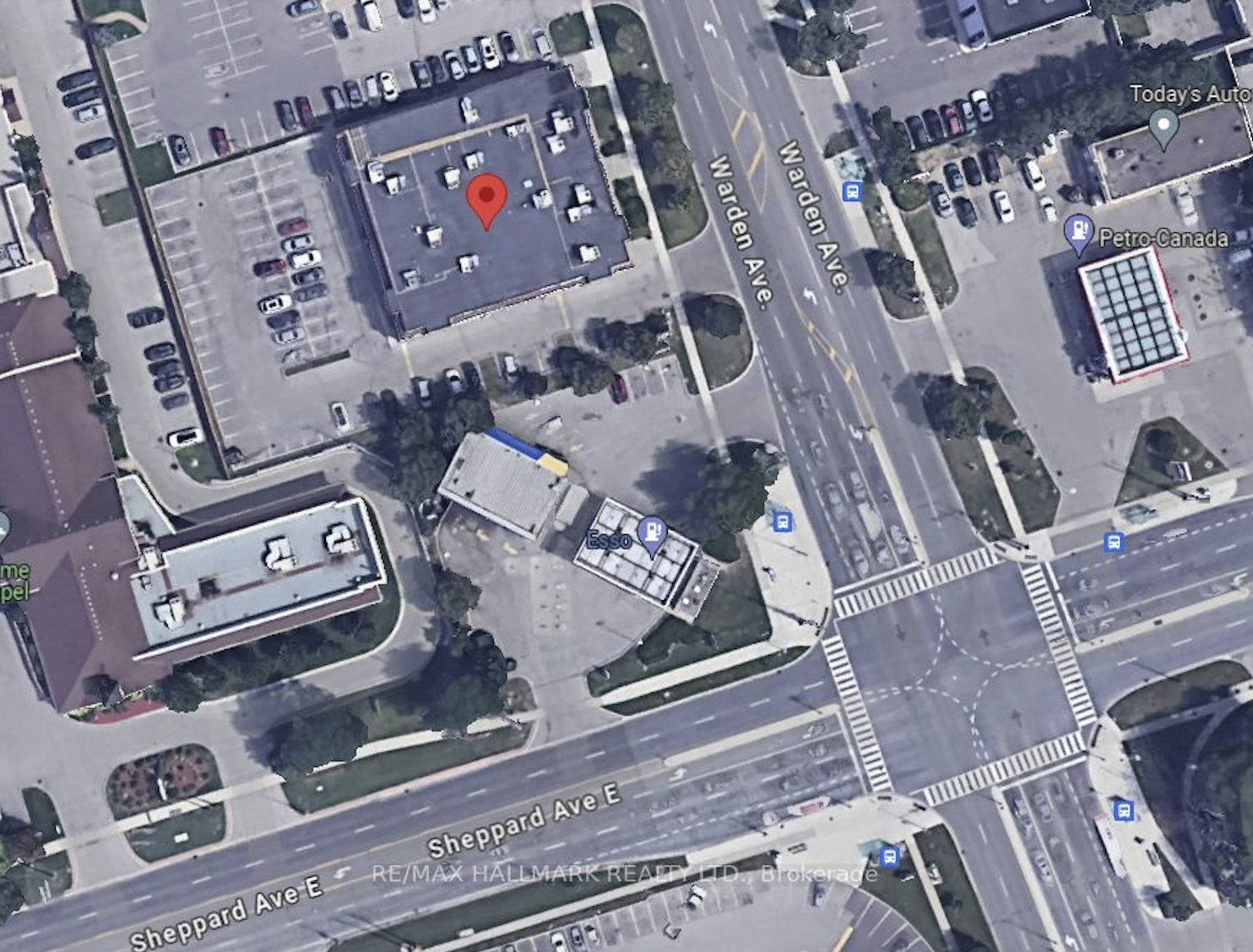

Located just west of downtown Ottawa, Westgate tenants include Shoppers Drug Mart, Royal Bank, and TD Canada Trust.

The site has immediate access to major arterial roads including Highway 417 and will benefit from stage two of the city’s Light Rail Transit system which is under construction.

RioCan acquired the nine-acre Westgate site in 1997 and plans a complete, phased redevelopment of the property.

Current plans call for approximately 729,000 square feet of residential distributed over 1,180 units and approximately 88,000 square feet of retail with parking.

The transaction is expected to close in late February 2021, subject to customary closing conditions.

This co-ownership will mark the fifth co-owned project between RioCan and Woodbourne, including the three existing projects plus eCentral / ePlace.

About Woodbourne, RioCan

Woodbourne Capital Management is a Canadian private real estate fund with capital commitments from a base of institutional partners in Canada and the U.S.

It has already partnered with RioCan on three urban mixed-use developments in Toronto currently under construction or development, including the residential tower FourFifty The Well, Litho at 740 Dupont St., and 3180 Dufferin St.

RioCan is one of Canada’s largest real estate investment trusts. RioCan owns, manages, and develops retail-focused, increasingly mixed-use properties located in prime, high-density transit-oriented areas concentrated in Canada’s six largest urban centers.

As of June 30, 2020, its portfolio was comprised of 221 properties with an aggregate net leasable area of approximately 38.6 million square feet (at RioCan’s interest) including office, residential rental, and 15 development properties.

Source Real Estate News Exchange. Click here to read a full story