Strong first quarter in the Ottawa CRE market driven by residential land investments

Strong first quarter in the Ottawa CRE market driven by residential land investments

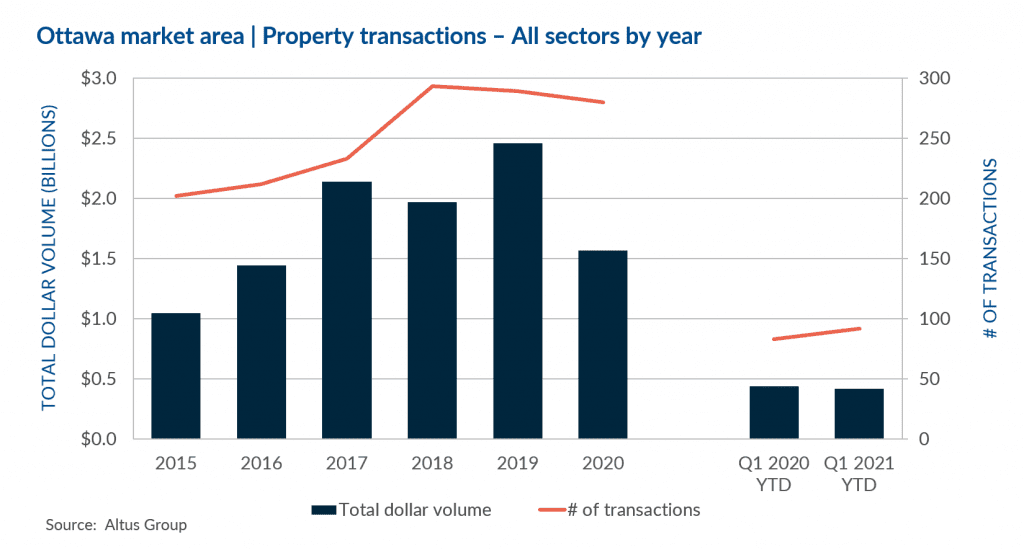

The first quarter of 2021 saw both optimism, in the form of vaccinations, and caution, with further lockdowns and stay-at-home orders. Still, while government restrictions would suggest a slow quarter for real estate activity, the Ottawa commercial real estate market remained steadfast as savvy investors have seemingly taken advantage of the market uncertainty and low interest rates. The quarter completed with a total investment volume of $420 million, which represented a decrease of 4% in comparison to the first quarter of 2020. Despite the slight dip in total investments, transaction activity continued at a torrid pace registering 92 transactions, which was an 11% increase over the same period last year. A number of trends that we saw throughout 2020 continued into 2021 – namely the bid-ask gap between sellers and buyers, and strong performance in the residential land sector. Despite ongoing pandemic-related challenges, investors remain confident in the Ottawa market as evident with investment momentum carrying through from the end of 2020.

With the overall strong quarter, residential land and apartment assets led the way with a total investment volume of $145 million and $94 million respectively. These housing-related assets attest to the strong demand and continued growth of the city. With much of the Ottawa workforce continuing to work from home, the immediate future and uncertainty of the office sector remains, with transactions totaling only $42 million, marking the third straight quarter of minimal office transactions. The sector which saw the most substantial increases, growing more than five times in comparison to the same period last year, was industrial which registered $50 million in total investments. As demand for warehouse space increases to accommodate the population growth and the ever-increasing space required for e-commerce distribution, investors will continue to pursue quality industrial assets in the Ottawa market. According to Altus Group’s Investment Trends Survey, respondents echo this sentiment showing the most positive momentum shown was for single-tenant industrial, multi-tenant industrial and industrial land in the Ottawa market.

Notable Q1 2021 transactions:

Montford Manor, Ottawa – Apartment

This $44 million acquisition by Centurion Apartment REIT was a component of a larger apartment portfolio which consisted of one property in the Ottawa market as well as two properties located in the GTA. The four-building apartment portfolio was sold by Starlight Investments and had an overall sale price of $92 million. This transaction, at 550 Lang’s Road, was the largest asset within this portfolio and also represented the largest transaction registered across all Ottawa asset classes in the first quarter.

Ottawa Central Station, Ottawa – Residential Land

Formerly operating as a Greyhound bus terminal, this vacant two-storey building located at 265 Catherine Street was acquired by Gatineau based developer Brigil. With a purchase price of $24 million and a site area of approximately 2.6 acres, the future intentions for this site will be a mixed-use development that will take advantage of the area which benefits from easy highway and transportation access.

2220 Walkley Road, Gloucester – Office

With an acquisition price of $18.3 million by Ottawa based Jennings Real Estate, this two-storey single tenant office building represented the largest office transaction seen in the quarter. The Scotiabank occupied property contains approximately 83,275 square feet and sits on nearly 7.4 acres of land.

110 Bentley Avenue, Nepean – Industrial

This fully occupied multi-tenant industrial building containing approximately 72,600 square feet was acquired for $10.6 million. The building has clear heights of 24 to 26 feet and is ideally located in Nepean with easy highway access to Highway 416 and Highway 417.

2440 Bank Street, Ottawa – Retail

This multi-building retail plaza ideally located in the high traffic Bank Street and Hunt Club Road intersection was acquired for $15.5 million, representing the largest retail transaction in Ottawa for the first quarter. The property consists of approximately 40,000 square feet of leasable area and sits on nearly 2.7 acres. At the time of sale, the property was approximately 97% occupied with tenancy made up of both national and local businesses.

Despite the ongoing third wave in Q1 2021, commercial activity illustrated the optimism that many investors have towards the Ottawa market. Both buyers and sellers are still aware of the risks that exist, however, with each wave of the pandemic, they have become more comfortable with these risks and how they could play out amid current market conditions. Once again, the bid-ask gap persists as investors are looking to avoid paying top dollar for coveted real estate assets. Overall, the demand for quality properties across the Ottawa market remains strong.

Source Altus Group. Click here to read a full story