Over the past four years, 35 cents of every dollar spent by foreign real estate buyers went to purchase industrial assets in the GTA

Over the past four years, 35 cents of every dollar spent by foreign real estate buyers went to purchase industrial assets in the GTA

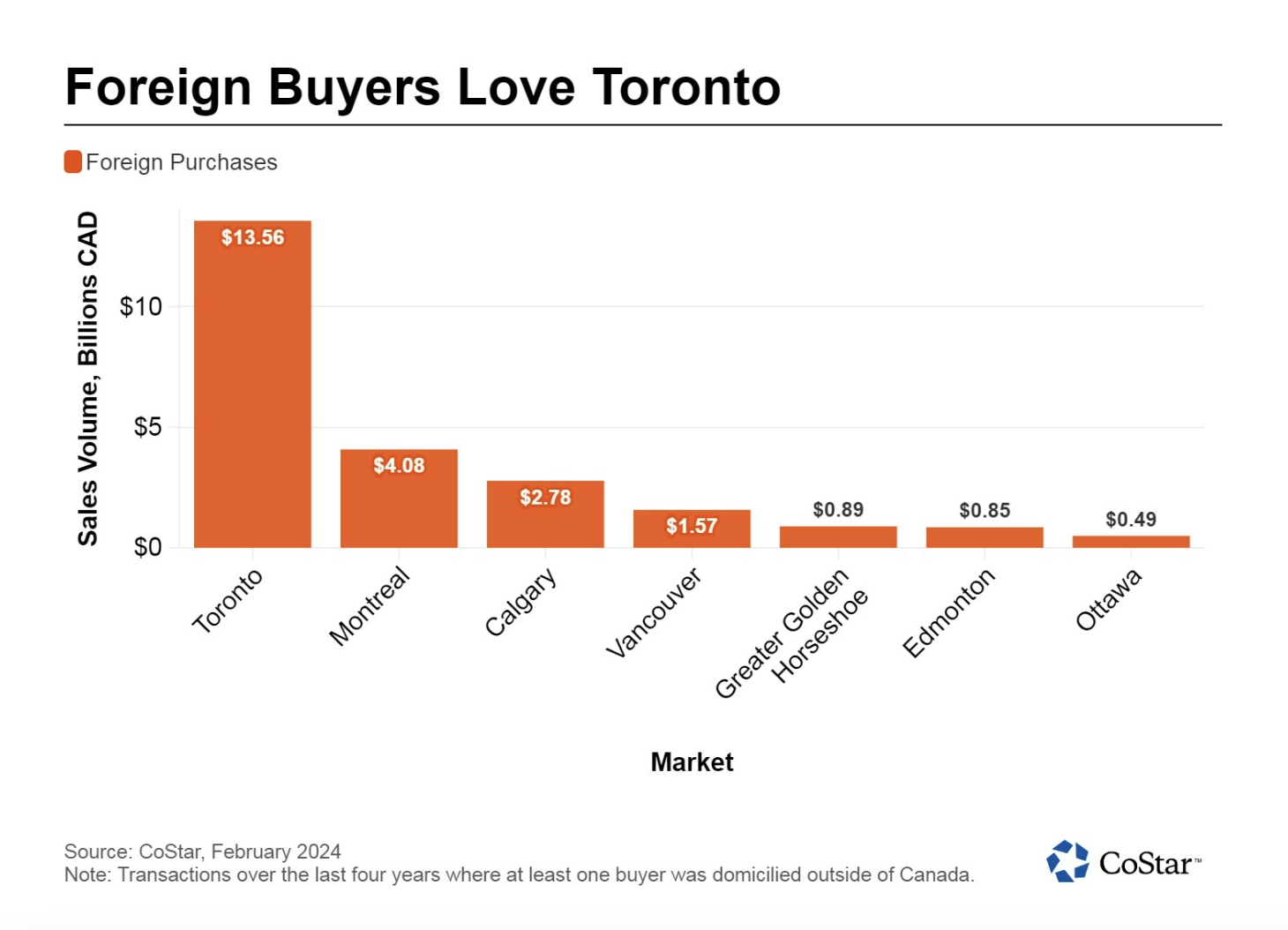

City Accounts for 56% of All Non-Canadian Property Purchases Since 2020

Over the past four years, 35 cents of every dollar spent by foreign real estate buyers went to purchase industrial assets in the Greater Toronto Area.

Across all four asset classes, Toronto accounted for 56% of all foreign real estate investment since 2020. Montreal was a distant second, accounting for 17% of foreign real estate acquisitions.

Across Canada, foreign buyers have been targeting industrial assets, thanks in part to several large portfolio deals in recent years, including the $5.9 billion Dream Industrial REIT and GIC’s purchase of Summitt Industrial Income REIT in early 2023. GIC is a Singapore sovereign wealth fund.

One outlier has been Calgary. In this market, office transactions dominated thanks to the sale of The Bow for $1.2 billion in 2021. The buyer in this transaction was a U.S. private equity real estate firm, Oak Street Real Estate Capital, which purchased the five-star trophy asset as part of a portfolio deal that included three smaller offices in Mississauga, Ontario. The reported capitalization rate on the transaction was 7.7% and the offices were 100% leased at the time of sale. However, excluding this sale, industrial would have comprised most foreign real estate purchases.

In Toronto, the foreign office transactions included the KDDI purchase of Allied REIT’s downtown office data centre portfolio. The three-asset portfolio sold for over $1.3 billion, accounting for nearly half of the recorded office purchases by foreign buyers in the market. KDDI is a Japanese telecommunications corporation. Allied, a Canadian office REIT, likely decided to sell these assets to raise liquidity in a difficult environment for the nation’s office sector.

In Ottawa, retail attracted greater interest foreign interest compared to other markets. This may be due to both the healthy demographics of the city as well as the importance of the public sector in the local economy, which should support employment — and therefore consumption — even as Canada’s economy continues to slow. The foreign retail transactions included a $42.5 million sale of two neighbouring assets along Cyrille Road near Highway 417 in March 2022. The buyer was U.S. warehouse retail giant Costco. This one transaction accounted for 9% of all foreign purchases made in Ottawa since 2020.

Trends in foreign asset purchases suggest that when international buyers add Canadian assets to their portfolios, they have a Toronto bias. The city, which accounts for over half of all foreign commercial real estate purchases in recent years, represents 20% of the country’s economic output and 17% of its total population. Toronto attracts foreign investors thanks in part to its larger size relative to other areas. But it is still punching above its weight.

Foreign investors likely prize the city not only for its size but also for its liquidity. As the nation’s largest real estate market, Toronto includes the most opportunity for deep-pocketed investors to deploy capital; finding a willing seller of larger assets is easier in Toronto than elsewhere.

Montreal, too, is punching above its weight, representing 17% of foreign commercial real estate purchases, yet accounting for just 11% of Canada’s economic output. Like most other markets, many foreign purchases have been of industrial properties. The most important of these transactions was Pure Industrial’s purchase of Cominar’s industrial assets for $2.04 billion in March 2022. These assets were concentrated primarily in Montreal and Quebec City. Pure Industrial is a portfolio company jointly operated by U.S. private equity behemoth Blackstone and Canadian institutional investor, Ivanhoé Cambridge.

One market that has not been overachieving in terms of attracting foreign buyers is Vancouver. The city represents 7.7% of the nation’s economy but attracted just 6% of foreign deals since 2020. One reason for this could be the economic slowdown in China over the past few years, which likely affected Chinese investors’ ability to deploy capital overseas. Traditionally the city’s real estate sector has attracted interest from Asian buyers, including from China and Hong Kong.

With the Bank of Canada’s monetary tightening cycle likely at an end, interest rates should start to fall in the coming months. When the rate cuts begin, foreign investors — many of whom with dry powder at the ready — may start to deploy capital more aggressively in Canada. Such activity would be welcome news for the country’s real estate capital markets which have seen total sales transactions across the four asset classes fall 23% from $57 billion in 2022 to $43.7 billion in 2023.

Source CoStar. Click here to read a full story.