Industrial and food-anchored retail continue to win in commercial real estate, while Toronto regains its top spot as preferred market

Industrial and food-anchored retail continue to win in commercial real estate, while Toronto regains its top spot as preferred market

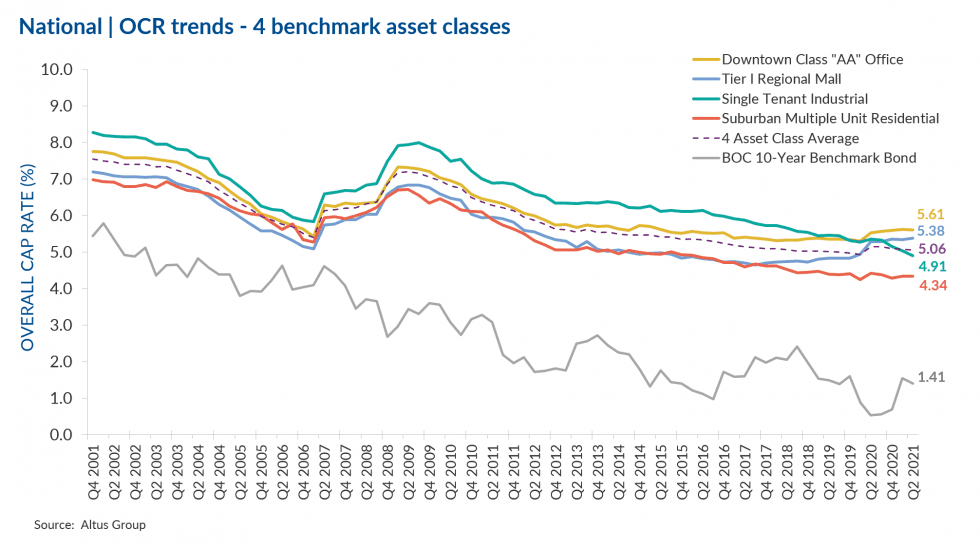

The latest results from Altus Group’s Investment Trends Survey (ITS) for the four benchmark asset classes show that the Overall Capitalization Rates (OCR) remained flat at 5.06% in Q2 2021 compared to the previous quarter, and fell from 5.15% in Q2 2020. For a second consecutive quarter, all three industrial assets have remained top preferred by investors with continued e-commerce activity driven in part by pandemic-related restrictions pushing demand for forward for high-quality and strategically located industrial space. As uncertainty continues in the office market with many still in decision-making mode when it comes to a return to in-person work, investor attention has turned to other asset classes, especially Suburban Multi-Unit Residential and Food-Anchored Retail Strip. While the fate of retail also remains uncertain, the re-opening of non-essential in-store shopping has led to an upswing in retail investment volume and an overall positive outlook moving forward. Transaction volume throughout the first half of this year shows strong momentum across most asset classes, with the presence of substantial investor capital available and a healthy appetite from lenders, combined with returning investor confidence after the pandemic-induced slowdown throughout 2020.

Amid the third wave of the pandemic, some regions saw re-openings while others remained in lockdown, with impacts mainly felt among small businesses. According to Statistics Canada, Canadian employment fell by 0.4%, leaving the unemployment rate at 8.2% as of May 2021, with the goods-producing sector taking the largest hit – the first time that manufacturing and construction industries recorded an employment decline since April 2020. While retail trade also felt the impact of continued restrictions, employment among accommodation and food services sectors remained unchanged, despite composing the majority of the employment gap compared to pre-pandemic levels. The Conference Board of Canada projects positive economic momentum in 2021, with economic expansion of 5.8% in 2021 and 4.0% in 2022 – a direct result of wide-spread vaccine rollout allowing for mass re-openings by autumn of 2021. Although recovery was halted earlier this year, many remain optimistic when it comes to economic and employment recovery. According to the location barometer for all available products, Toronto has slightly surpassed Vancouver to regain its spot as the top preferred market by investors, both followed by Montreal (Figure 2). Across major markets, Halifax was the lone market to experience negative buy/sell momentum this quarter. Calgary Single-Tenant Industrial sits as the top preferred product-market combination, followed by Montreal Industrial Land, and Vancouver Food-Anchored Retail Strip (Figure 4) – all demonstrating continued investor interest in Industrial and Food-Anchored Retail Strip assets with potential for growth.

Market highlights for the quarter include:

- Overall cap rates continued to decrease in Q2 2021 as accelerated vaccine rollout prompted a return to some market normalcy and rising investor confidence. Total transaction volumes are on the upswing as investment momentum continues from strong results recorded in the first quarter of the year. Cap rates compressed slightly across most asset classes, aside from Tier I Regional Mall which increased quarter-over-quarter, and Suburban Multi-Unit Residential rates remained stable. Edmonton was once again the lone market to mark an increase in average overall cap rates quarter-over-quarter.

- While there is some optimism in the office market due in part to robust vaccine rollouts progressing across Canada, low investment volumes and continued rising availability rates point to a remaining level of uncertainty. Still, increases in both cap rates and availability rates among office assets are less than those recorded at the same time last year, as some investor confidence returns. Downtown Class “AA” Office cap rates remained unchanged this quarter sitting at 5.61%. Still, Vancouver and Quebec City were the only two markets to record increasing rates, while Toronto, Montreal and Halifax rates remained stable quarter-over-quarter.

- Investment in industrial assets have continued to build off positive momentum seen throughout 2020. Investors remain interested in the industrial sector, with all three industrial asset types (Single-Tenant Industrial, Industrial-Land and Multi-Tenant Industrial) sitting as the top three products preferred by investors for the second consecutive quarter (Figure 3). Cap rates for Single-Tenant Industrial assets fell again this quarter, from 5.04% in Q1 2021 to 4.91% in Q2 2021. Rates decreased across all markets this quarter, aside from Ottawa and Quebec City where rates remained stable. Edmonton saw the most significant decrease in rates compared to the previous quarter.

- The easing of pandemic-related restrictions has seen the reopening of in-person retail across most regions throughout the first half of 2021. Food-Anchored Retail Strip maintained its spot as the fourth preferred product by investors, following industrial, for the second consecutive quarter (Figure 3). While slow growing investment volume demonstrates a cautious attitude among investors, many continue to prioritize Food-Anchored Retail Strip assets as those that offer strong return potential and room for future expansion. After rates compressed slightly in Q1 2021 for the first time since the pandemic began, Tier I Regional Mall rates remained stable at 5.38% in Q2 2021 compared to the previous quarter. Toronto and Calgary were the only markets to see rates decline, while rates in Vancouver remained stable.

- Suburban Multi-Unit Residential assets continued on an upswing this quarter, most notably in Vancouver, Ottawa and Montreal. Despite rising construction costs slowing new supply, persisting record-low interest rates are likely to continue driving demand. Suburban Multi-Unit Residential cap rates remained stable at 4.34% this quarter. Calgary and Halifax were the only two markets to record rising rates, while Vancouver and Quebec City recorded a drop. All other markets saw no change in cap rates this quarter.

Other highlights include:

Of the 128 combinations of products and markets covered in the Investment Trends Survey:

- 60 had a “positive” momentum ratio (i.e., a higher percentage of respondents said they were more likely to be a buyer than a seller in that particular segment), an increase compared to 54 in Q2 2020; 68 had a “negative” momentum ratio, a decrease from 74 in the previous quarter; and none were neutral, the same as the previous quarter.

- The top 15 products/markets, which showed the most positive momentum were (Figure 4):

- Calgary – Single-Tenant Industrial

- Montreal – Industrial Land

- Vancouver – Food-Anchored Retail Strip, Multi-Tenant Industrial, Single-Tenant Industrial, Industrial Land. Suburban Multi-Unit Residential

- Toronto – Food-Anchored Retail Strip, Suburban Multi-Unit Residential

- Edmonton – Multi-Tenant Industrial, Single-Tenant Industrial

- Ottawa – Food-Anchored Retail Strip, Multi-Tenant Industrial, Single-Tenant Industrial, Industrial Land

Source Altus Group. Click here to read a full story