GTA commercial real estate market registers a record-setting first half

GTA commercial real estate market registers a record-setting first half

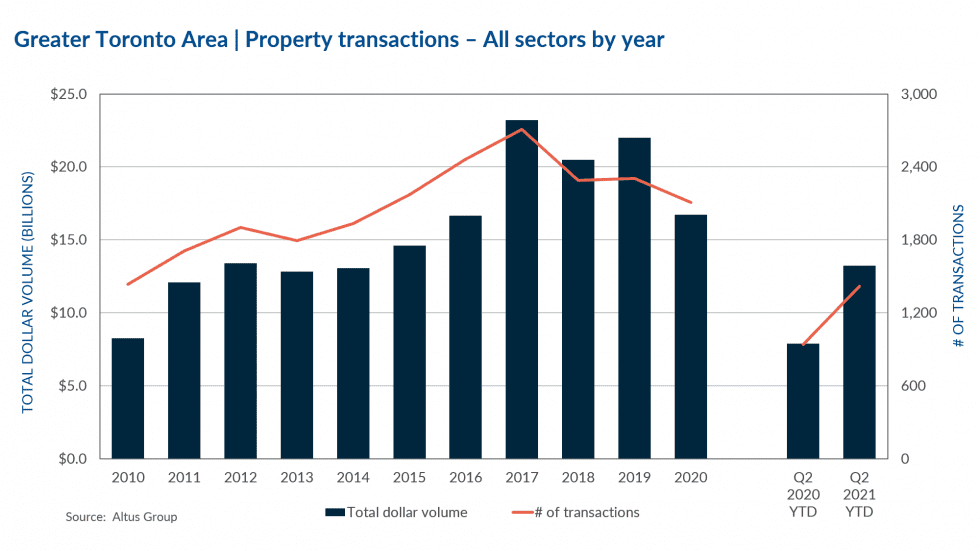

The Greater Toronto Area continues to remain strong and resilient as it registers record-breaking volumes in the first half of 2021 despite enduring a third wave of COVID-19 and continued restrictions. With mass vaccinations taking place and a return to normalcy on the horizon, the conclusion of the first half of 2021 saw an astounding investment total of $13.2 billion, which represents the largest first half recorded in the GTA market on record. Compared to the first half of 2020, this represents an increase of 68%.

The first half not only saw a significant increase in activity, with a total of 1,417 transactions, it also witnessed the return of significant transactions – registering 13 deals coming in at over $100 million. The combination of low interest rates and high demand prompted investors to prioritize the GTA market, creating a buying frenzy that translated into growing transaction volume across all asset types compared to the same period last year.

With the continued demand for both residential units and industrial space, it was no surprise that the industrial and land sectors (residential land, ICI land and residential lots) were the most desired assets once again. Land sector investment volume topped $6.7 billion in Q1 and Q2 2021, which represents 51% of total investments seen in the first half of the year. With disruptions and uncertainty brought on by the global pandemic in 2020, the development industry has once again resumed at a blistering pace in the GTA, especially in the City of Toronto, where a total of 138 development applications were submitted in the first half of 2021, an 18% increase compared to the 117 submissions seen in the same period last year. Of the 138 development applications, 66% of the applications were for apartment condominium or purpose-built rental developments.

As industrial availability remains tight in the current market conditions, industrial assets continue to be highly sought after by investors, as evident by the $2.9 billion invested in this asset class in the first half of 2021. According to Altus Group’s Investment Trends Survey results for Q2 2021, all three industrial assets (Single-Tenant, Multi-Tenant and Industrial Land) remain as the top preferred asset classes by investors. Survey results also see the GTA market re-gaining its spot as the most preferred Canadian market amongst investors. Overall, after steady growth in the GTA across asset classes in the first two quarters, momentum is likely to last as investors continue to take advantage of current market conditions and lifted restrictions throughout the back half of the year.

Notable Q2 transactions:

501 Consumers Road, North York – Industrial

With a building size of 417,000 square feet, this multi-tenant industrial building was acquired by Amazon for $56 million. The property sits on 10.4 acres of land and is ideally situated within close proximity to Highway 401 and Highway 404. The property was originally acquired by the vendor in April 2015 for $20.5 million and will likely be re-developed by Amazon for a future fulfillment centre. This acquisition by Amazon was one of three GTA properties they acquired in the first half of 2021. Other locations of their acquisitions included Pickering and Etobicoke. In all, the three properties were acquired for a total consideration of $161 million.

8000 Dixie Road, Brampton – ICI Land

This 980,000 square-foot industrial building located in south Brampton sits on approximately 58.8 acres of land. Sold by the current tenant Ford Motor Company of Canada who utilized the site as a distribution centre, the property was acquired for $195 million by Panattoni Development Company Canada who will look to re-develop this sizeable site for future industrial uses.

Toronto Buttonville Municipal Airport, Markham – ICI Land

With a sale price of $193 million, the 50% interest sale of the 169-acre Buttonville Municipal Airport to Cadillac Fairview Corporation was one of the largest deals seen in the second quarter in the GTA. Originally a joint venture development by the vendor Armadale Properties and Cadillac Fairview, this transaction saw Armadale divest their interest in the development site to Cadillac Fairview, now the sole owner of the property. Development applications for this site were originally submitted in 2011 which proposed a Master Planned phased development which would add approximately 10 million square feet of mixed-use space to the site. The applications were appealed to the Ontario Municipal Board and were subsequently withdrawn. At the time of sale, no new applications had been submitted to the City of Markham regarding re-development of the property.

261-283 Queen Street East, 360 & 410 Richmond Street East, Old Toronto – Residential Land

This 2.1-acre site located in the east end of downtown Toronto was acquired by Tricon Residential for $129 million. Current development applications submitted to the City of Toronto proposes the development of two purpose-built rental apartment buildings containing a total of 824 residential units with building heights of 33 and 24-storeys.

8350 Lawson Road, Milton – Industrial

Sold by Oxford Properties Group and acquired by GWL Realty Advisors, this $90.6 million sale represents the largest industrial transaction seen in the second quarter in the GTA. At the time of sale, the 321,000 square-foot property was fully occupied with a WALT under 3 years. The property was originally acquired by Oxford Properties in September 2008 for a total consideration of $27.6 million.

At the midway mark of 2021, the lone major asset class yet to crack the billion-dollar mark in total investments is the office sector, which is understandable given the uncertainty and struggles driven by the pandemic. As seen in previous quarters, investors in the GTA market continue to seek out multi-residential, industrial and land assets. As confidence in the GTA market grows, the second half of 2021 looks to continue its rebound from the slump seen in 2020. Pent-up demand from investors combined with current low borrowing costs and the lack of inventory will continue to drive the red-hot GTA commercial real estate market.

Source AltusGroup. Click here to read a full story