GTA commercial real estate market closes record-setting first quarter

GTA commercial real estate market closes record-setting first quarter

With an unprecedented year behind us, the first quarter of 2021 saw the beginning of the COVID-19 third wave due to rapid spreading of new variants across regions. Talks of stay-at-home orders towards the end of March were back on the table, and while it seemed as though additional restrictions would slow activity, similar to what was seen last year, the GTA commercial real estate market is booming this year.

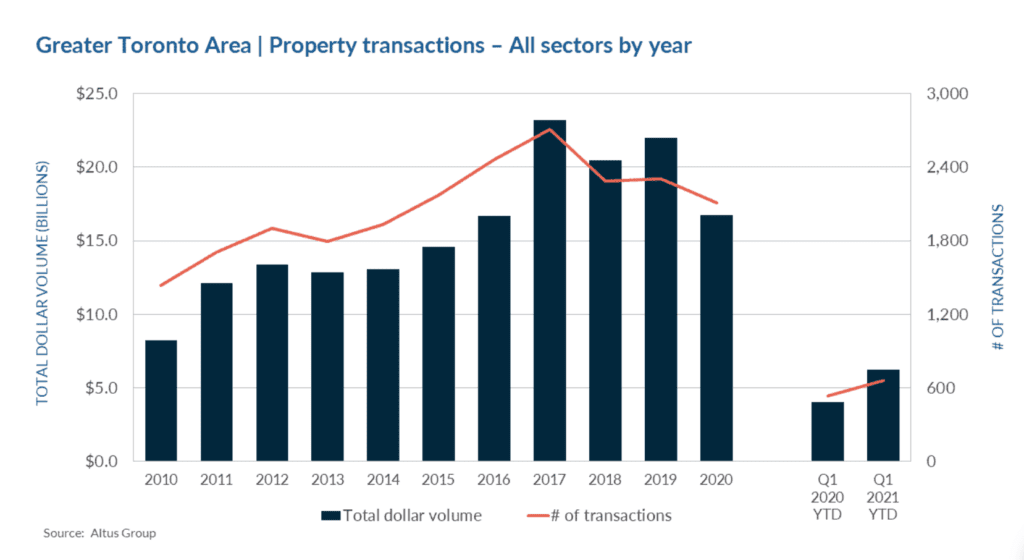

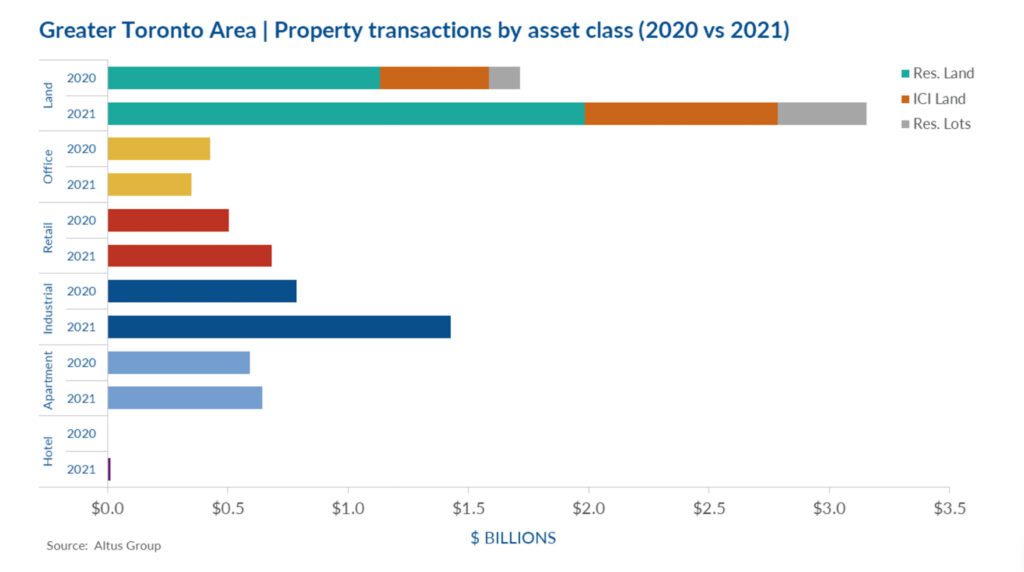

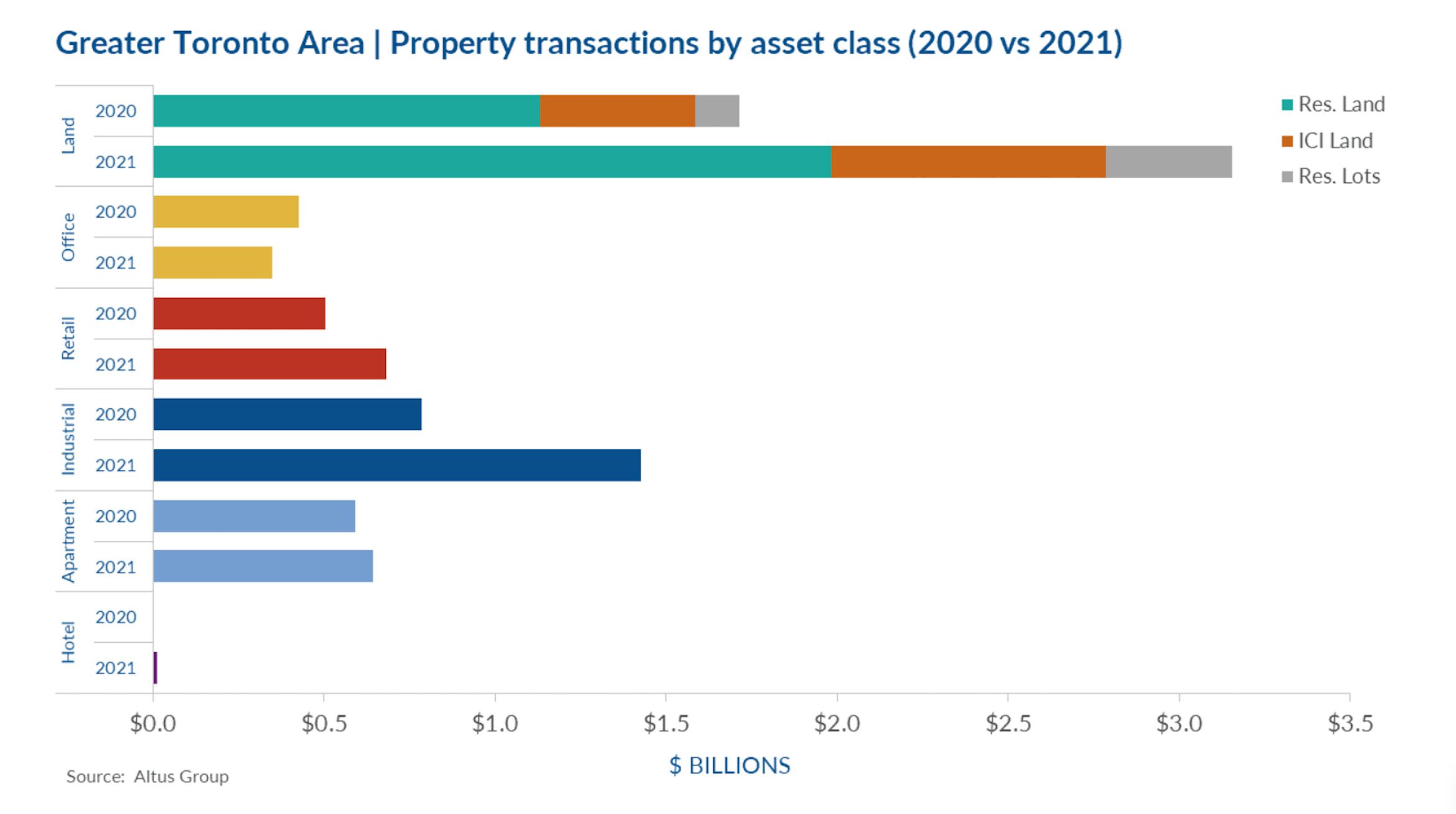

Q1 2021 saw the largest first quarter on record, with GTA investments totalling $6.3 billion, up 56% compared to Q1 2020. Investment momentum carried forward from the end of 2020 with the first quarter registering 663 transactions, a 24% increase compared to the same period last year. As vaccine rollouts began – albeit slowly compared to our US counterparts – work from home has continued, as have conversations of a continued remote work lifestyle even after vaccines are widely available. This uncertainty was evident in office sector activity, which saw an 18% decrease in investment totals compared to the same period last year – the lone asset class to see a decrease in volume this quarter. Overall, market performance to start off the year was strong, and the GTA continues to be one of the most sought-after markets for real estate investment in Canada.

The land sectors (residential land, ICI land & residential lots) led the charge during the first quarter of 2021, totalling nearly $3.2 billion, accounting for 50% of overall investment totals. Residential land was the most invested in, with almost $2 billion in sales, and residential lots recorded $369 million. This trend is expected to continue with rising demand for new homes due in part to record low interest rates still being offered by banks across the country. The ICI land sector came in at $803 million, with the lack of supply for industrial warehouse space persisting in the GTA. On the improved asset side, the industrial sector continued to dominate, with an investment total of $1.4 billion, accounting for 23% of overall Q1 2021 total investments and rising 81% compared to Q1 2020. The retail sector continued to gain back momentum, with $684 million in transaction volume, up 35% from Q1 2020. As confidence in the GTA market never wavered, investor challenges revolved around a lack of available assets for purchase.

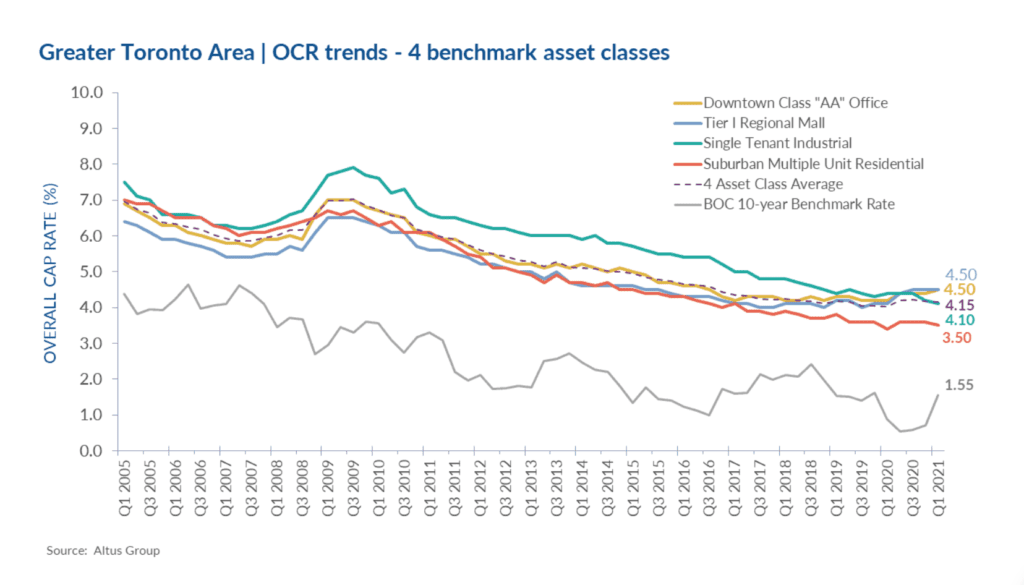

According to Altus Group’s Investment Trends Survey for Q1 2021, all three industrial asset classes (multi-tenant, single-tenant & industrial land) are the most preferred by investors, followed by food-anchored retail strip. Toronto remains the second most preferred market by investors this quarter, following Vancouver. Overall capitalization rates in Toronto compressed slightly compared to the previous quarter, with rates remaining stable among downtown class “AA” office and tier 1 regional mall assets and decreasing in both single-tenant industrial and suburban multiple unit residential.

Notable Q1 transactions:

27, 37 Yorkville Avenue & Cumberland Street, Old Toronto – Residential Land

With a purchase price of $300 million, this property was sold under receivership and was acquired by the Pemberton Group. The 1.4-acre parcel is site plan approved for a gross floor area of approximately 961,161 square feet. The previous owner Cresford Developments originally acquired the property from KingSett Capital in December 2017 for $268.5 million.

357 & 359 Richmond Street West and 120-128 Peter Street, Old Toronto – Residential Land

This 0.4-acre high-density redevelopment site was acquired by China Aoyuan Group for $72 million. The vendor of the property was Carlyle Communities who assembled the site between 2014 and 2019 for a total consideration of $31 million. Prior to the date of sale, the property had been zoning approved for a 39-storey, 270-unit residential condominium building. This purchase represents the second acquisition by the China-based developer who previously acquired the Newtonbrook Plaza in North York for $200.8 million in September 2017.

388 Yonge Street, Old Toronto – Retail

This retail asset acquired by Ingka Group for $100 million represents the largest retail transaction of the quarter in the GTA. The subject property consists of just over 132,000 square feet of retail space within the first three levels of the 78-storey Aura condo building. At the time of sale, the top-level unit was fully occupied by Marshalls and the second-floor unit was recently vacated by Bed Bath and Beyond. The purchaser intends to open the first downtown IKEA store in Canada by occupying the second-floor unit and parts of the first floor. Once renovations are complete, IKEA would occupy approximately 66,175 square feet of space which would be scheduled to open late 2021 or early 2022.

55 & 105 Commerce Valley Drive West, Markham – Office

This two-building office complex located within minutes of Highway 404 and 407 in Markham was acquired by Soneil Investments for $115 million. The eight-storey buildings contain 375,255 square feet and sit on nearly 8.9 acres, which offers the new owners the opportunity of future development on the excess land.

100 – 110 Iron Street, Etobicoke – Residential Land

With a purchase price of $125.3 million, this two-building distribution facility was acquired by Triovest from Mantella Corporation. The property contains approximately 525,000 square feet of space and is ideally situated between Highways 401 and 409 in north Etobicoke. With a weighted average lease term of less than two years and rental rates below market levels, this property offers the new owners rental growth potential in the near term.

With the rollout of vaccines, all sectors except office have started 2021 strong, and show no signs of slowing. Although the third wave was imminent towards the end of the first quarter, this does not seem to be scaring off investors, as the market and overall population continue to look to the future with a more positive outlook. As seen throughout 2020, investors are still most confident in the land and industrial sectors, as these two asset classes have been impacted less by current market conditions, if not driven by it. The bid-ask gap persists between buyers and sellers, as investors do not want to pay top dollar given the risks that still linger. Overall, demand for quality GTA real estate assets is growing and shrewd investors are continuing to use the pandemic and record low interest rates to their advantage.

Source Altus Group. Click here to read a full story