Economic recovery and market uncertainty remains due to pandemic and disruptions

Economic recovery and market uncertainty remains due to pandemic and disruptions

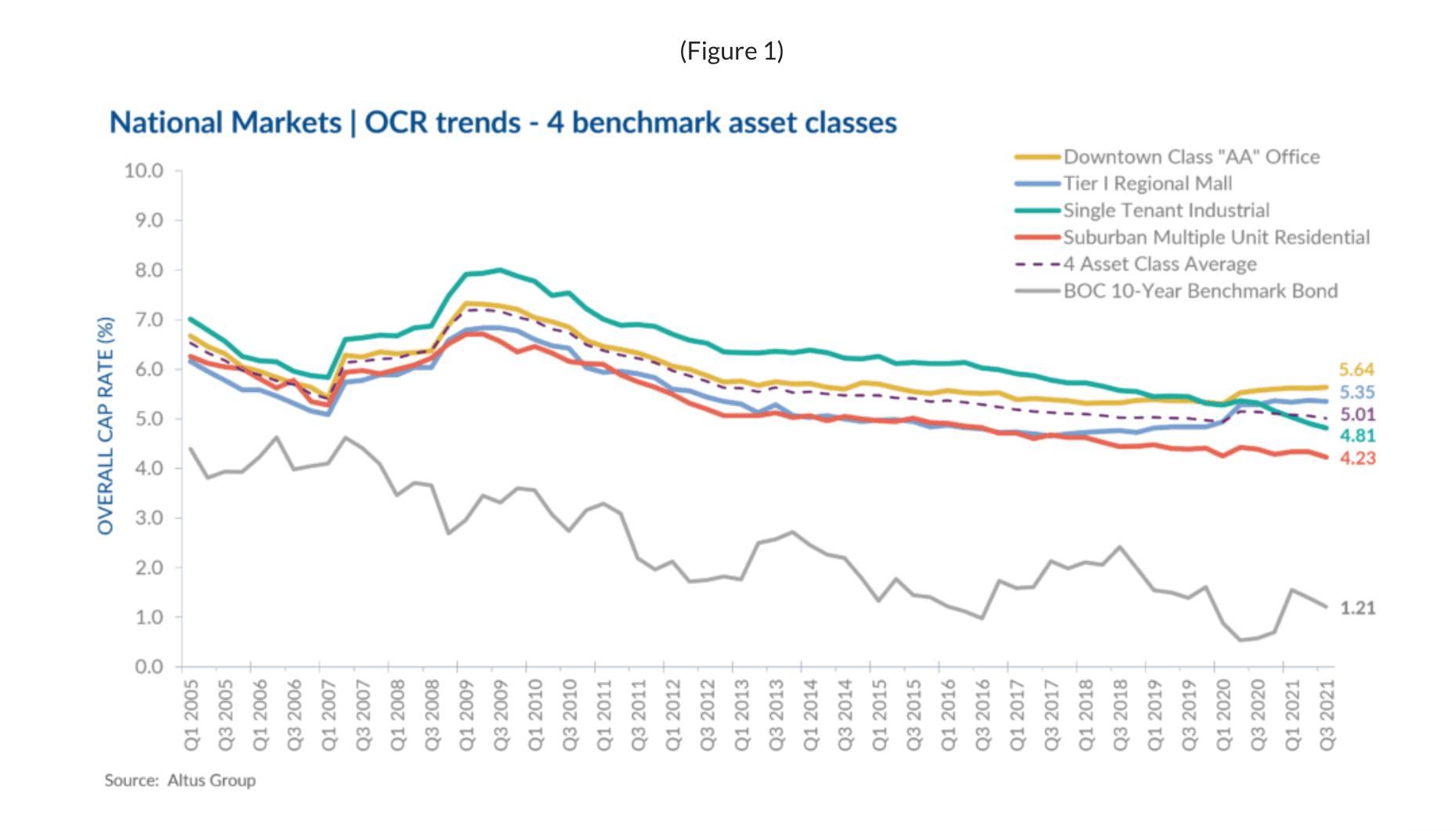

The latest results from Altus Group’s Investment Trends Survey (ITS) for the four benchmark asset classes show that the Overall Capitalization Rates (OCR) dropped slightly to 5.01% in Q3 2021 compared to the previous quarter which was at 5.06%, and from 5.14% in Q3 2020 (Figure 1).

Although vaccination efforts are helping to temper a fourth wave and the spread of the contagious delta variant, some markets are still vulnerable to imbalances and atypical drivers. In August, inflation levels peaked at a nearly 20-year high of 4.1% due to the effects of the pandemic and economic disruptions, which the Bank of Canada sees as temporary.

Amid labour shortages, the Canadian economy added another 157,000 jobs to the economy in September, finally recovering the jobs lost during the pandemic. The unemployment rate also dropped to 6.9% compared to 7.1% in August, the lowest rate since the start of the pandemic.

Although labour market conditions appear to be shifting, employment vacancies continued to peak to new highs in the second quarter of 2021 representing about 26% more vacancies compared to the same quarter two years ago. Job vacancies were up across all provinces predominantly in Quebec, Ontario, and BC, largely attributed to increases in the health care and social assistance sector. Vacancies in the construction and manufacturing industries also increased to its highest level since 2015. However, total investment in building construction increased by 7.3% in the second quarter, a fourth consecutive quarterly increase indicating signs of renewed activity and worker confidence.

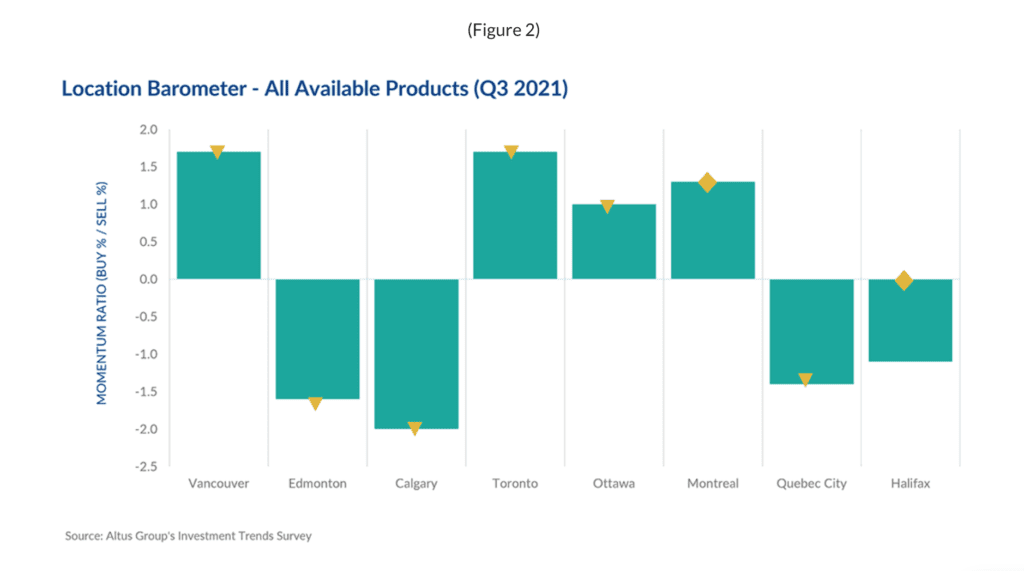

Real estate markets across Canada have had to face ongoing challenges as the pandemic drags on highlighting market vulnerabilities and shifts in demand for high yielding investments, especially office and retail. Compared to the previous two quarters, the location barometer for available products in the third quarter showed a decrease in all markets except for Montreal and Halifax, which remained unchanged. In Altus Group’s Investment Trends Survey for Q3 2021, the top 3 markets preferred by investors, Toronto, Vancouver, and Montreal, respectively (Figure 2), were also the most active in investment volume representing a combined 74% of the total market share for the first half of 2021. Still, many other regions have remained resilient and managed to push ahead in the first half of 2021, primarily due to low interest rates, pent up demand and lack of inventory.

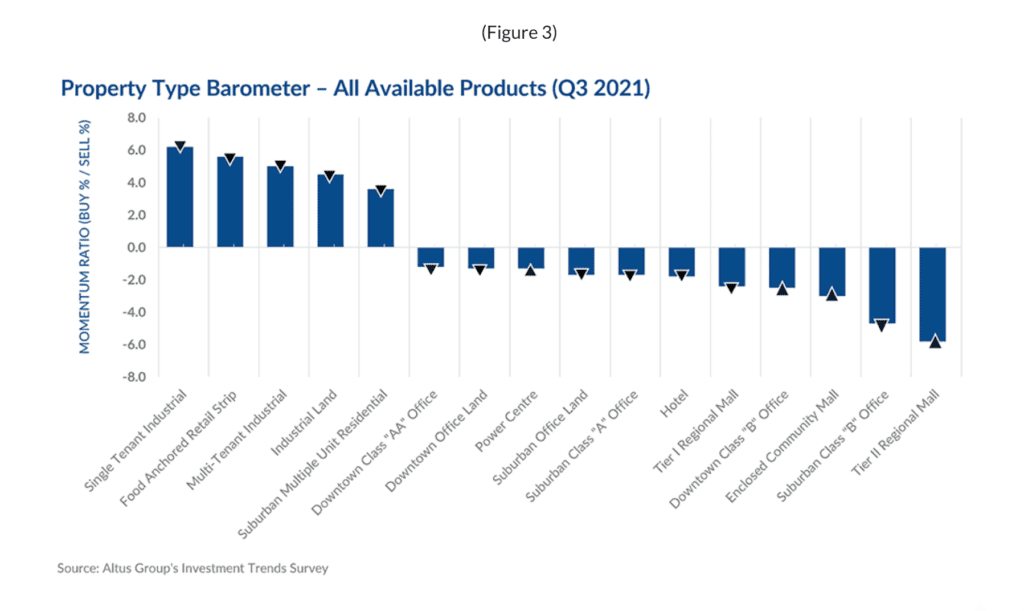

The top assets preferred by investors was unchanged from the previous quarter which were Single Tenant Industrial, Food Anchored Retail Strip, Multi-Tenant Industrial and Industrial Land, respectively (Figure 3). These products have continued to generate investor interest throughout the pandemic and can only be seen as primed for further growth as they adapt to new trends and post-lockdown expectations.

However, investor and market sentiment cooled across most assets with the third quarter showing signs of a general decrease compared to the first two quarters of 2021. Concerns over the delta variant, infection and vaccination rates, inflation spikes and monetary policy interrupting economic recovery have led investors to take some pause in their decision making.

Yet, with M&A activity increasing, there is still plenty of available capital out there waiting to be spent on the right assets as economic activity normalizes. The assets with an increase in investor momentum were also some of the less preferred products which were Power Centres, Downtown Class B Office and Enclosed Community Malls. The office and retail sectors had some of the most challenges although investors have taken a medium to long term view when scoping out product.

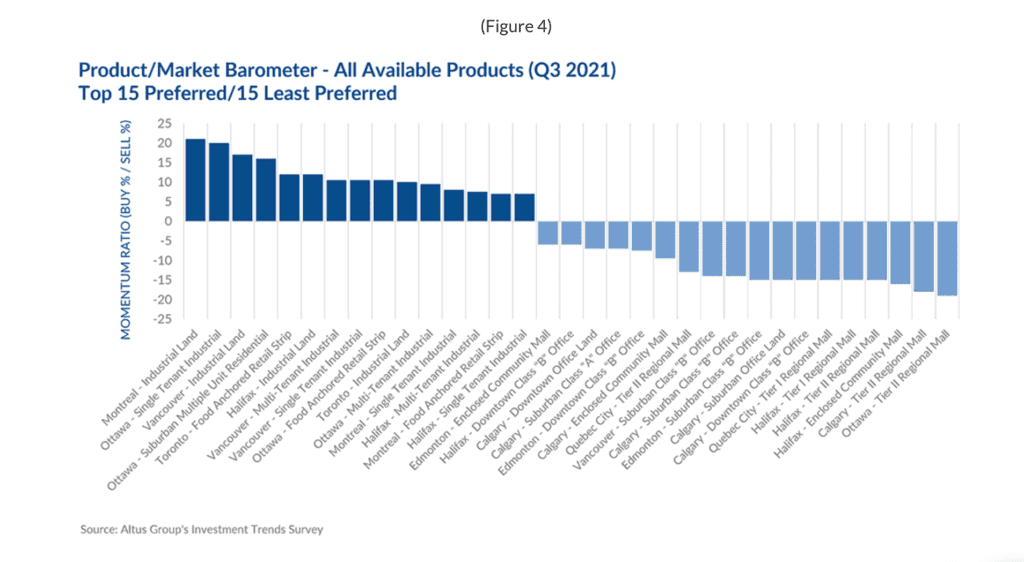

Retail, as one of the more struggling assets, posted as some of the least preferred products, specifically for Montreal’s Tier II Regional Mall, Quebec City’s Enclosed Community Mall and Tier I and Tier II Regional Mall, and Ottawa’s Enclosed Community Mall and Tier II Regional Mall (Figure 4). With investors still looking for high yielding product, struggling assets in secondary markets are likely to be those positioned for potential redevelopment given some of their prime locations.

Market highlights for the quarter include:

- Since the onset of the pandemic, overall cap rates have been decreasing and continued to decrease in the third quarter of 2021. Investment momentum has been steady and Canadian CRE is showing signs of recovery with national investment volume clocking in at $33B, a 57% increase in the first half of the year compared to the same period last year. Overall cap rates compressed across most asset classes, aside from Downtown Class “AA” Office which pushed up slightly from the previous quarter. Halifax and Calgary were the only two markets that showed a moderate increase quarter-over-quarter.

- There will be ongoing uncertainty in the office sector as employees and companies delay plans to return to the office with the onset of the delta variant and will continue to work via a hybrid workplace model. The office sector was the only asset class with a year-over-year decline in investment volume, a 32% falloff for the first half of 2021. Downtown Class “AA” Office cap rates moved up to 5.64% this quarter from 5.61% in Q2. Quarter-over-quarter, Vancouver and Quebec City were the only two markets to record decreasing cap rates, while Toronto, Ottawa and Montreal remained stable, and Edmonton, Calgary and Halifax increased.

- Demand for industrial product continues to soar as online shopping surges and distribution and logistics networks expand with single-tenant industrial product cap rates compressing and prices rising. Cap rates for Single-Tenant Industrial assets dipped this quarter across most markets from 4.91% in Q2 to 4.81% in Q3, aside from Montreal and Halifax which remained unchanged from the previous quarter.

- Although the retail sector has seen some signs of improvement as lockdown measures loosen, the sector still has a ways to get to pre-pandemic levels until in-person shopping behaviour and travel and tourism returns to somewhat normal. Food-anchored retail product continued to be an attractive product among investors due to its essential nature during the pandemic and potential for expansion. Tier I Regional Mall cap rates compressed slightly from the previous quarter from 5.38% to 5.35% in Q3. Calgary and Halifax saw an increase in rates, while Edmonton, Toronto, Montreal, and Quebec City saw a decline, while Vancouver remained stable.

- With exuberant housing prices, lower levels of rent defaults due to government support programs, and the prospect of increased immigration in the near future, rental housing will continue to be in high demand and attract a significant amount of capital. This quarter, Suburban Multi-Unit Residential cap rates compressed from 4.34% in Q2 2021 to 4.23%. Meanwhile prices have risen, and investors show no signs of a diminishing appetite as multifamily sales increased by 72% in the first half of 2021 compared to the same period last year. For Suburban Multi-Unit Residential assets, the Ottawa market reported the highest momentum, a significant increase from the previous quarter. Vancouver was the lone market that remained steady, while all other markets shifted downwards in cap rates this quarter.

Other highlights include:

Of the 128 combinations of products and markets covered in the Investment Trends Survey:

- 55 had a “positive” momentum ratio (i.e., a higher percentage of respondents said they were more likely to be a buyer than a seller in that particular segment), an increase compared to 60 in Q2 2021; 73 had a “negative” momentum ratio, a decrease from 68 in the previous quarter; and none were neutral, the same as the previous quarter.

- The top 15 products/markets, which showed the most positive momentum were (Figure 4):

- Ottawa – Multi-Tenant Industrial, Single-Tenant Industrial, Industrial Land, Food Anchored Retail Strip, and Suburban Multi-Unit Residential

- Montreal – Single Tenant Industrial and Industrial Land

- Halifax – Multi-Tenant Industrial and Suburban Multi-Unit Residential

- Vancouver – Industrial Land, Suburban Multi-Unit Residential, Single Tenant Industrial, and Multi-Tenant Industrial

- Quebec City – Multi-Tenant Industrial

- Toronto – Industrial Land

Source Altus Group. Click here to read a full story