Data, Decision Making, and Opportunity in the GTA Industrial Market

Data, Decision Making, and Opportunity in the GTA Industrial Market

An In-Depth Analysis of Values, Rental Rates, and Historical Trades

When looking to invest, develop, purchase, or lease commercial real estate assets, CRE professionals often fail in their pursuits when they let a widespread belief get in the way of sound decision-making.

Making the right move is simple but extremely difficult; with hindsight humbling even the savviest of investors. Going against the grain can be incredibly lonely and attract criticism, yet it’s often also a prerequisite for creating big wins (assuming equal access to information), especially in a market with so many intelligent and dialled-in pros.

That being said, with the rise of social media and online communities over the past couple of years, we’ve seen a growing transparency and collaboration between brokers and investors in terms of process, data, and completed trades; a good thing. However, as people compete for attention on all the mainstay platforms, the noise is astounding, often influencing people to ignore their gut instincts and forget fundamental first principles. For example, yes, there is a desperate shortage of space. At the same time, leaders in the industry continually defy the odds and get projects done. We see so many familiar faces on the trade records and social media announcements.

So what’s behind this phenomenon? Well…

You know most folks just love a good story. A carefully crafted narrative.

With all that’s happening around the world and in business—and constantly being bombarded by information—telling stories is one of the simplest methods in which to make sense of it all. Humans are programmed to tell tales. Thus, we tend to convert complex cause-effect relationships and deep data into anecdotes.

This tradeoff of simplicity versus accuracy allows us to communicate with one another in an efficient manner, without having to build up the narrative from the ground-up each time we wish to discuss a nuance or isolated issue.

In the context of business, these ‘nuances’ are what can give an investor, developer, or user an ‘edge’ or insight that can lead to supernormal profits and first-mover advantage. Why endlessly debate zoning laws or labour pool data when we can leverage them to find the next prime development pockets of land?

Sometimes, however, we repeat sound bites that are not factually true. We reject data that doesn’t fit the model and cherry-pick to avoid conflict. We outsource too much computing power. We oversimplify and grant too much credence to those in positions of authority. There, our naïvety of the fact that they too can be fallible or possess bad intentions clouds our judgment. Or at the very least, it makes us lazy thinkers who forget that professional skepticism is not just a ‘career skill’ but also a survival tool. Take your pick from history to prove this point.

That is why we wanted to embark on an exploration of the GTA industrial market – not just by looking at the broad-stroke narratives being circulated in your run-of-the-mill social media mastermind groups, but by examining the cold hard data.

Hopefully, we can each derive our own story regarding the evolution of these individual sub-markets over time… and possess the facts to back it up. So without further ado, let’s take a closer look…

Toronto Central Markets (North York, Etobicoke, Scarborough)

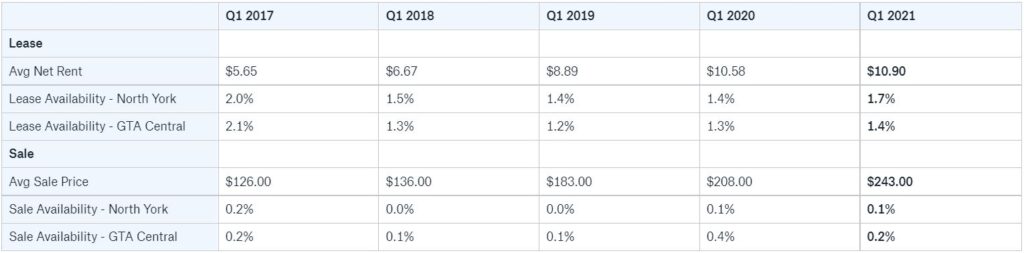

GTA Central Markets (North York)

Valuation and Rental Rate Analysis Q1 2017 to Q1 2021

North York – Sample Lease Transactions – (10,000 SF+)

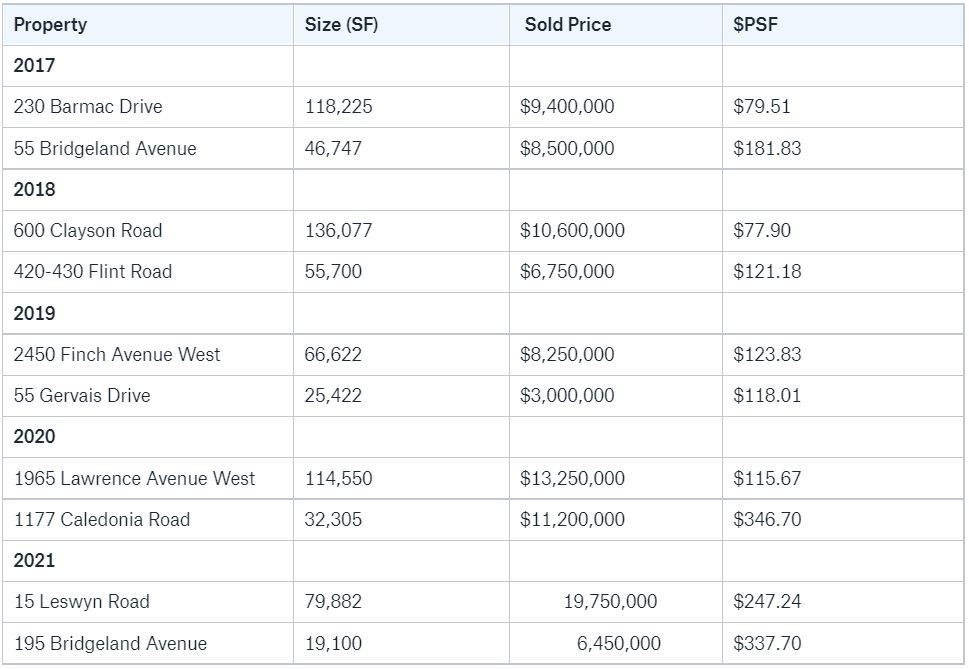

North York – Sample Sale Transactions – (10,000 SF+)

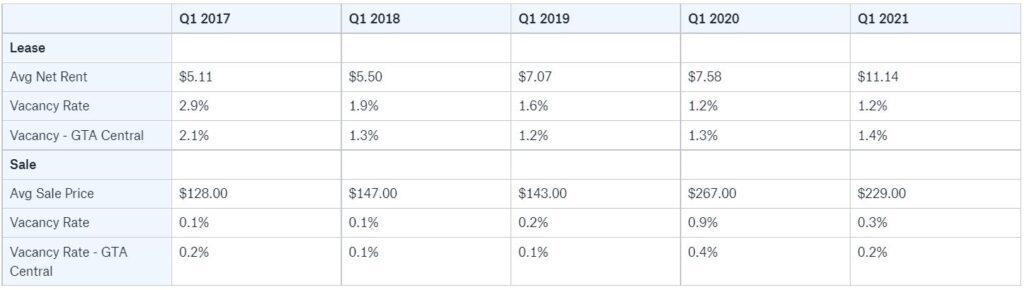

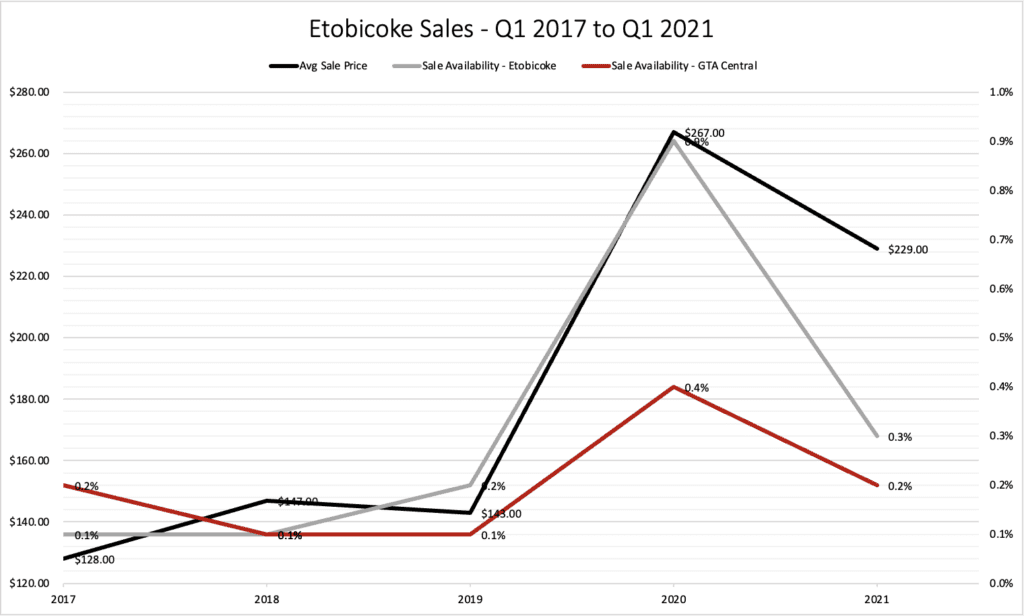

GTA Central Markets (Etobicoke)

Valuation and Rental Rate Analysis Q1 2017 to Q1 2021

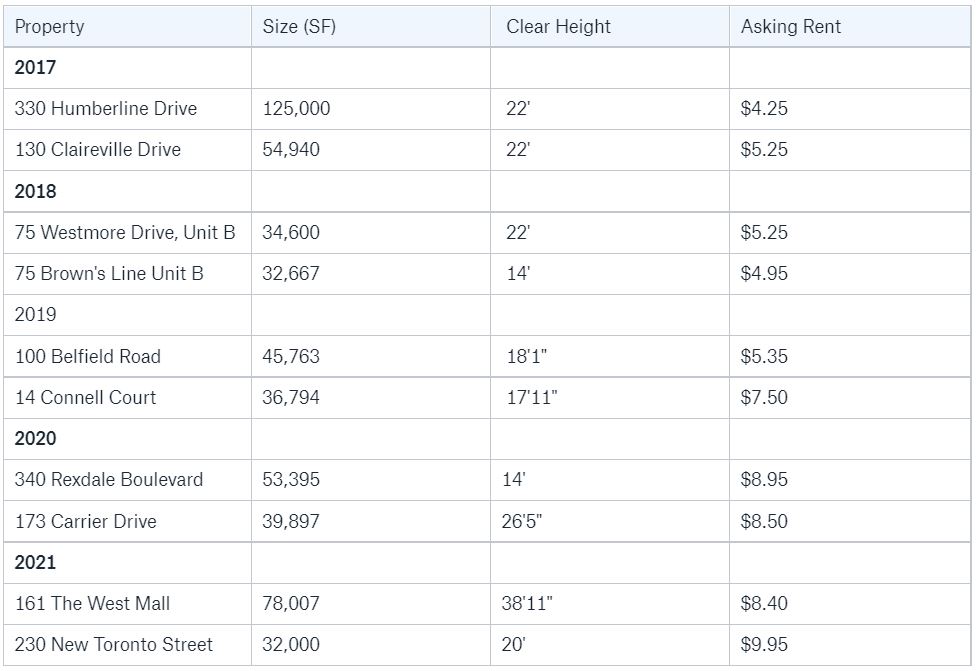

Etobicoke – Sample Lease Transactions – (10,000 SF+)

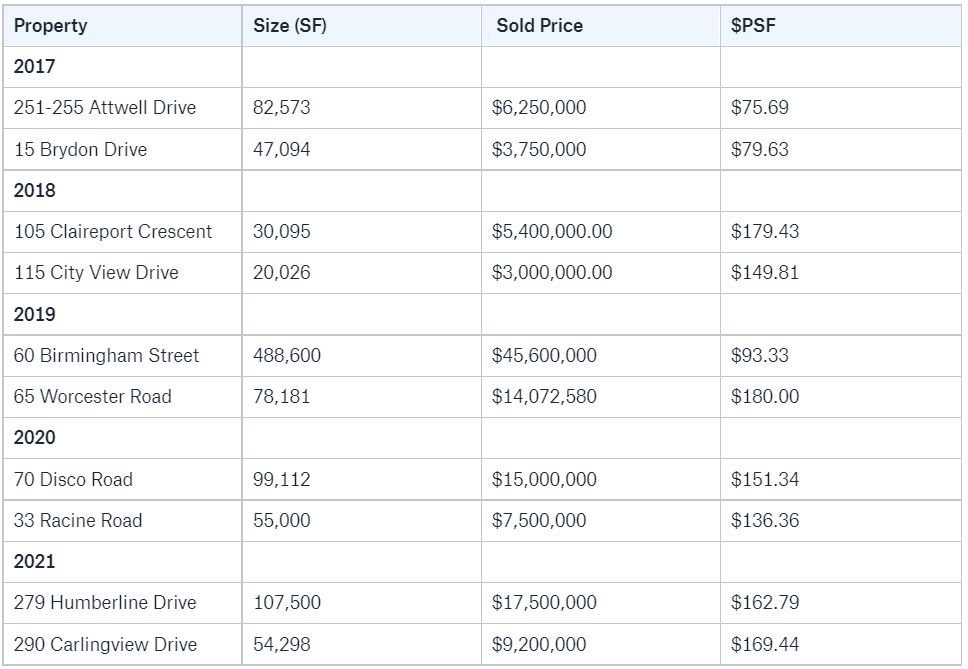

Etobicoke – Sample Sale Transactions – (10,000 SF+)

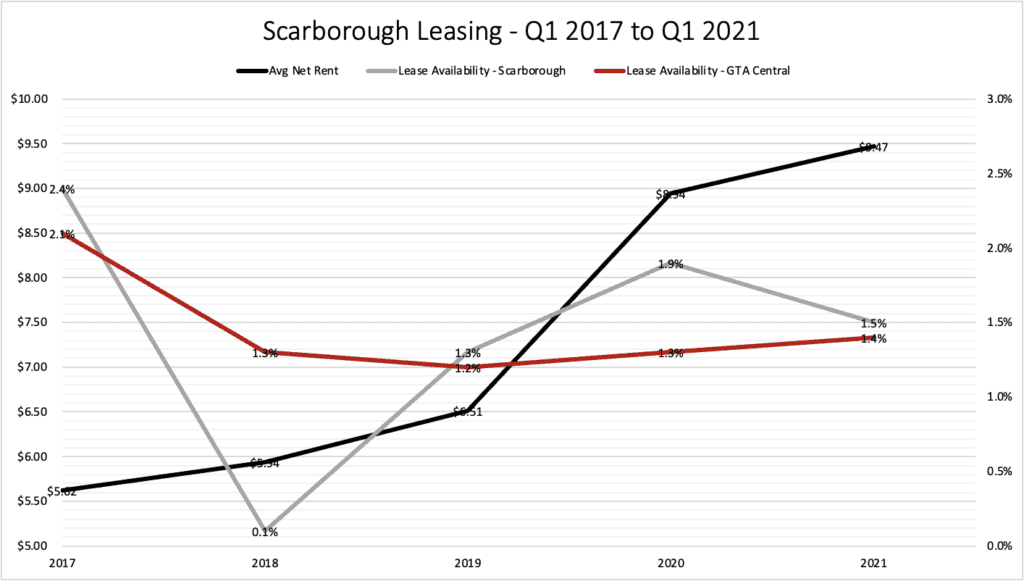

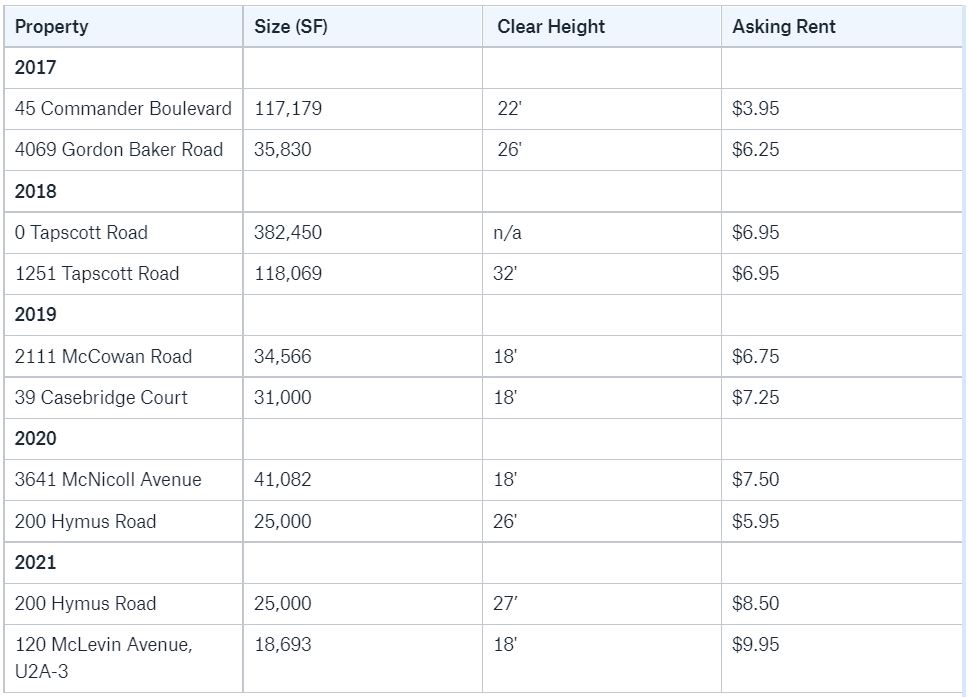

GTA Central Markets (Scarborough)

Valuation and Rental Rate Analysis Q1 2017 to Q1 2021

Scarborough – Sample Lease Transactions – (10,000 SF+)

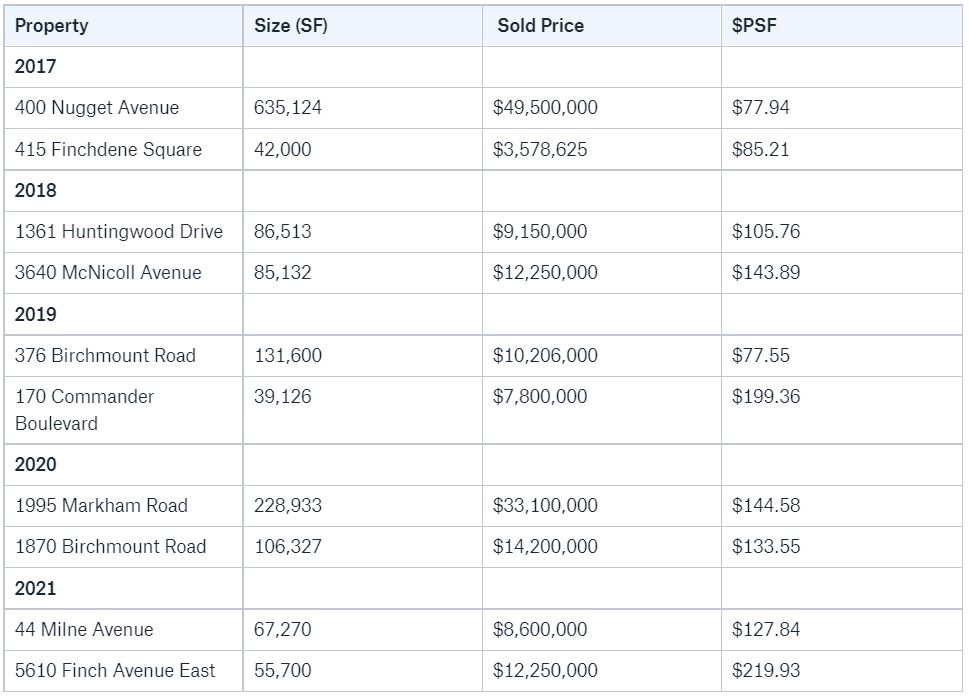

Scarborough – Sample Sale Transactions – (10,000 SF+)

Conclusion

After looking through the data, we hope you can not only begin to see some of the broader patterns but perhaps also create hypotheses as to why things may have played out the way they did. Keep in mind that much of the data collected is imperfect and should be taken with a grain of salt. Further, we hope you can also begin to make soft predictions about where the market is headed.

Our thoughts are this:

- Industrial is definitively being fuelled by E-commerce demand, as well as other verticals such as online grocery sale, transportation, and even film production;

- Supply chain disruptions are causing many businesses to on-shore their operations;

- These disruptions are also causing businesses to increase inventories where possible;

- Land is scarce, as is available product;

- New supply is being hamstrung by labour and material shortages, as well as delayed permitting and zoning processes.

- Leadership is needed at the table to bring new supply on board: from the developer to the potential user to the city and economic planning or municipal boards.

Key Takeaways

For investors: Now that we seem to be caught in a supply trap, one should expect to see values increase further, albeit at a decelerating pace relative to the jump we saw over the past 5 years. Only future data will tell how much further values have to go… That being said, it’s very likely that cap rates will continue to compress and pricing will go up further.

For Occupiers: Similarly, one should expect further increases in pricing. If you want to lease, you’ll have to pay more. If you want to own, you’ll have to pay more. In addition, it will be more difficult to find opportunity and the deals may take more time to complete unless you are lucky or hit the timing perfectly. Further to this, if you cannot find anything, you may have to develop; only if you can find any land available to do so.

Overall, prepare to pay more. Introduce more time into your pursuits of deals. And be prepared to build (two years or more in advance) or complete an early renewal (18 to 24 months out) if you want to stay at your current location.

You can leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story