Commercial Mortgage Commentary CMLS Mortgage Analytics Group

Commercial Mortgage Commentary CMLS Mortgage Analytics Group

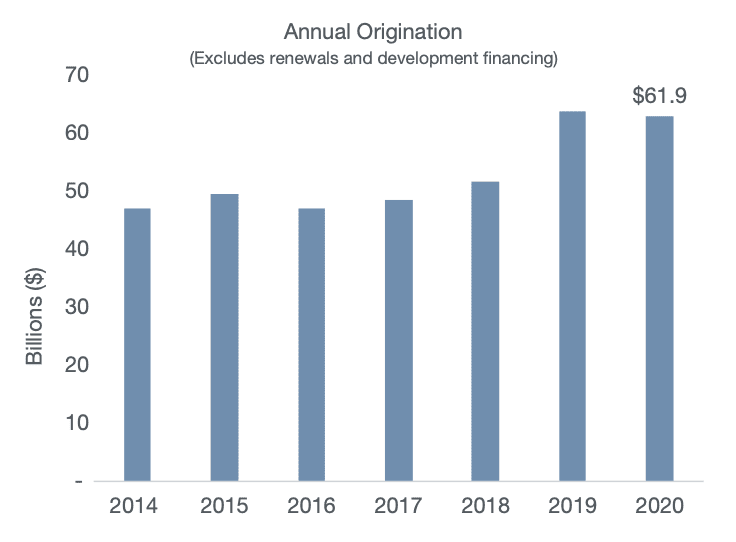

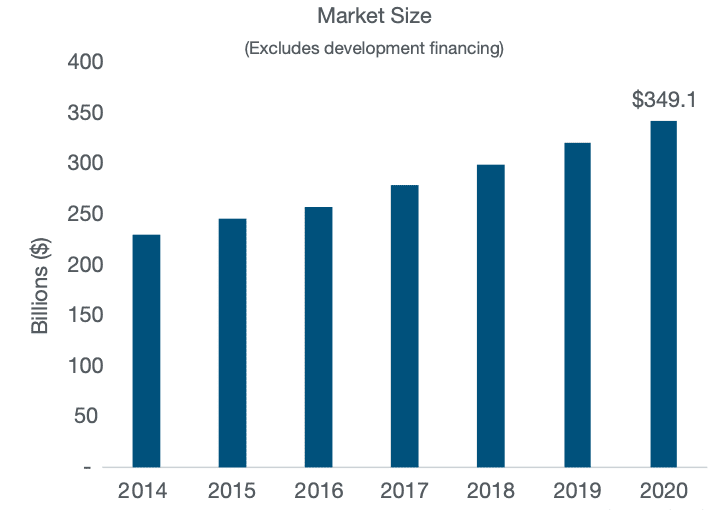

Making News Results from CMLS annual commercial real estate lender survey indicate that the Canadian CRE term debt market continued its upward trend in 2020. Total outstanding debt ended the year north of $349 billion, a 7% increase year-over-year. The increase comes despite a 2% year-over-year decline in annual origination, which totaled nearly $62 billion in 2020. The market was buoyed by especially strong lending in the CMHC-insured space, which saw origination volumes increase 45% year-over-year.

Economic Environment

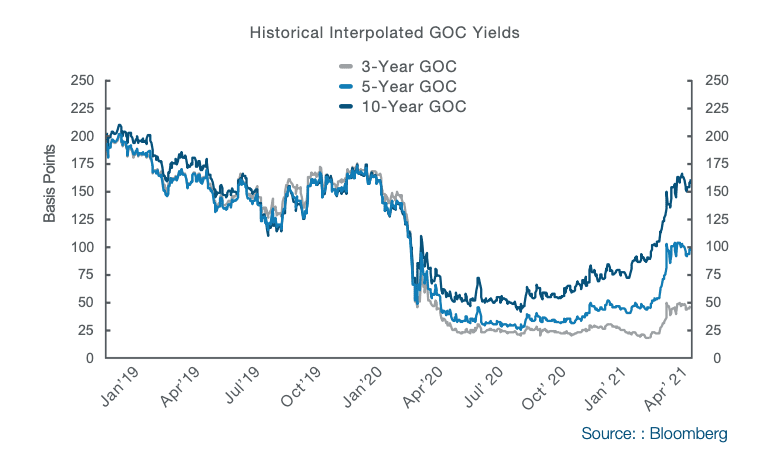

After a relatively smooth start to the year, markets were jolted by a large global sell-off of bonds in late February and early March. Yields on both the 5yr and 10yr GOC more than doubled over the course of the quarter, as investors digested new economic data and priced in higher expected inflation due to stronger than previously expected economic growth.

Bank of Canada Revises Economic Outlook, Begins Tapering Bond Purchases

After leaving forecasts unchanged in their March rate announcement, the Bank of Canada (BoC) upgraded their economic guidance for 2021 and beyond in their April report. The BoC now forecasts 6.5% growth in 2021, up 2.5% since their January forecast. In addition, target inflation is now expected to be sustainably achieved in the second half of 2022 rather than in 2023 as previously expected. As a result, many analysts believe this new inflation timeline will result in the BoC hiking rates sooner than previously predicted. The Bank also announced that it would be reducing the amount of bonds purchased per week from $4 billion to $3 billion. This follows last month’s decision in which the BoC announced the winding down of various emergency liquidity programs. Despite the Bank’s more hawkish moves, fears of an overheating economy have led some analysts to wonder if monetary and fiscal policy remains too loose. Canada’s housing market has been particularly concerning. In March, data from the Canadian Real Estate Association indicated home sales prices increased 20% YoY on a seasonally adjusted basis. But governor Tiff Macklem -while expressing concern- noted that the Bank’s policy tools might not be best suited to address the issue when compared to other government agencies.

Conventional Mortgages

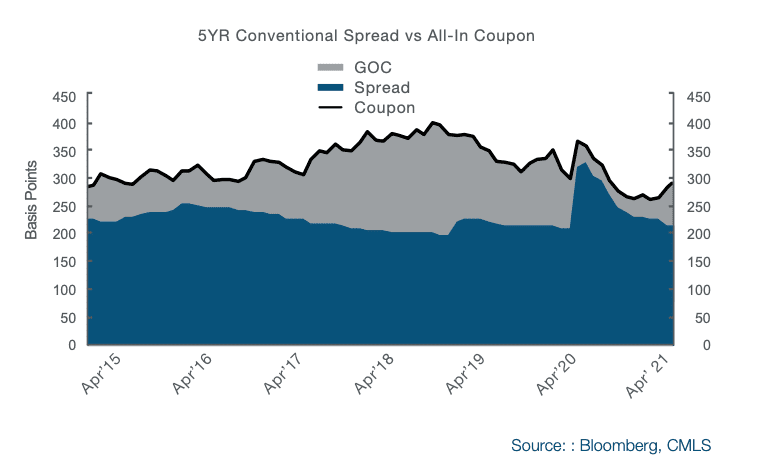

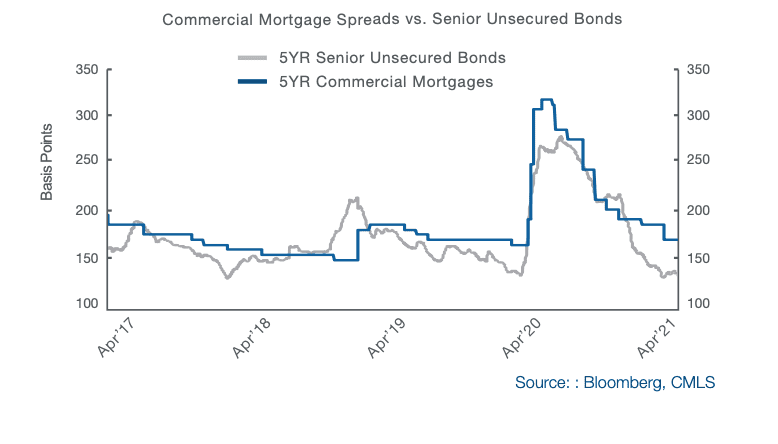

Surging bond yields raised some alarm among both borrowers and lenders alike in Q1. But, despite initial uncertainty from market participants, deal flow and market liquidity remained strong through the end of the quarter. Over 80% of respondents to our quarterly lender survey reported seeing similar or increasing deal flow for conventional mortgages relative to the prior quarter. Looking at all-in coupons helps illustrate the resiliency of demand, its clear that the cost of borrowing is still relatively cheap when compared to the past five years.

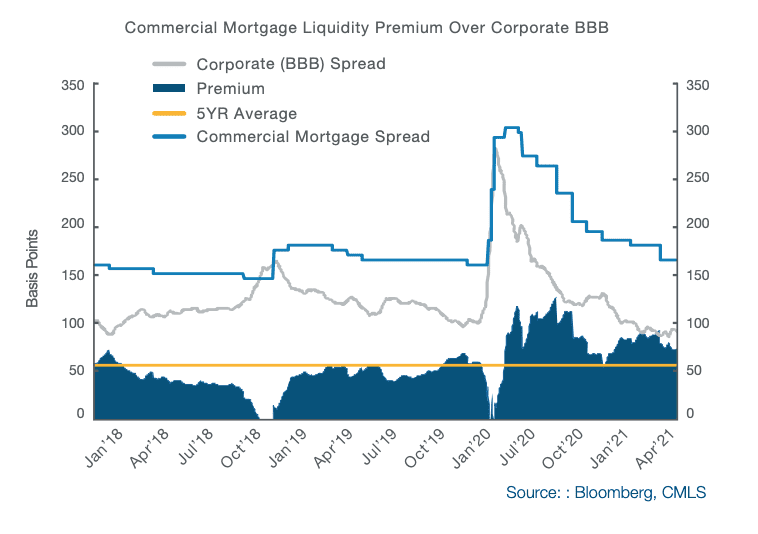

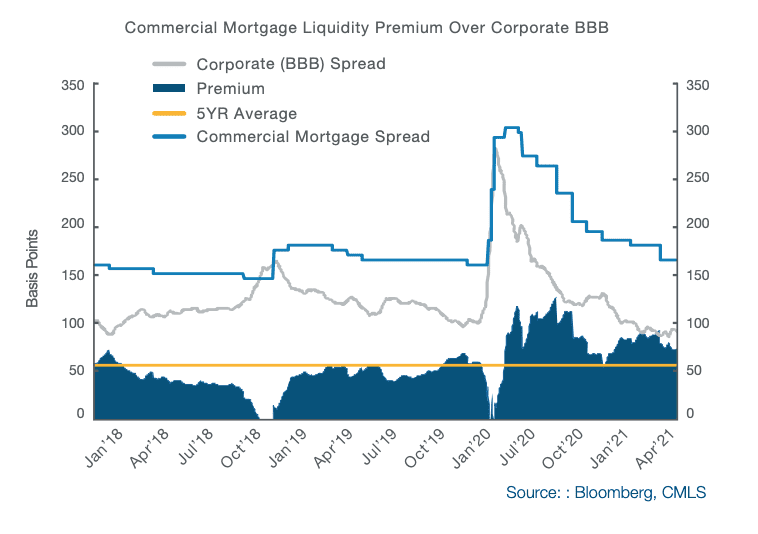

From a lender perspective, commercial mortgages have continued to be an increasingly attractive investment of late. The premium over corporate bonds has remained above its 5yr average in Q1, despite the continued compression in commercial mortgage spreads.

CMHC

CMHC

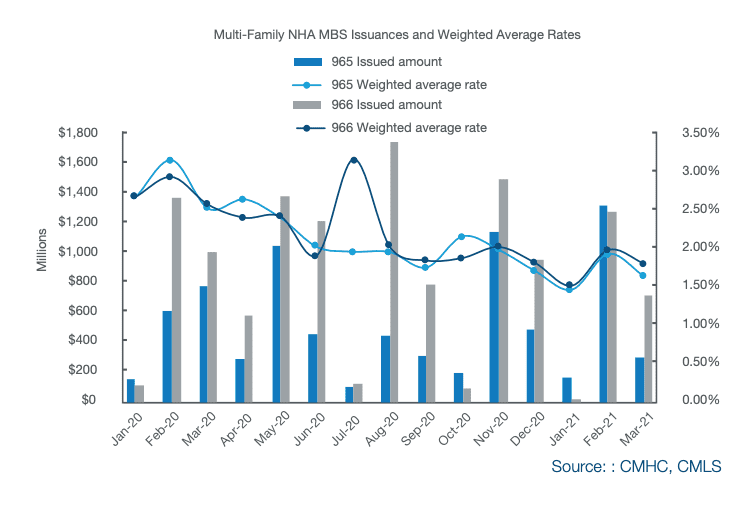

The CMHC market was also rocked by the global bond sell-off, which saw rising Canada Mortgage Bond (CMB) yields early in March. Similar to the conventional mortgage market, borrowers were forced to recalibrate their market expectations after almost a year of rock-bottom yields. Despite the volatility, many lenders reported that deal flow remained healthy in the second half of Q1. March issuances into NHA MBS multi-family pools’ 965 and 966 however, were down 62% and 29% respectively from the same time last year.

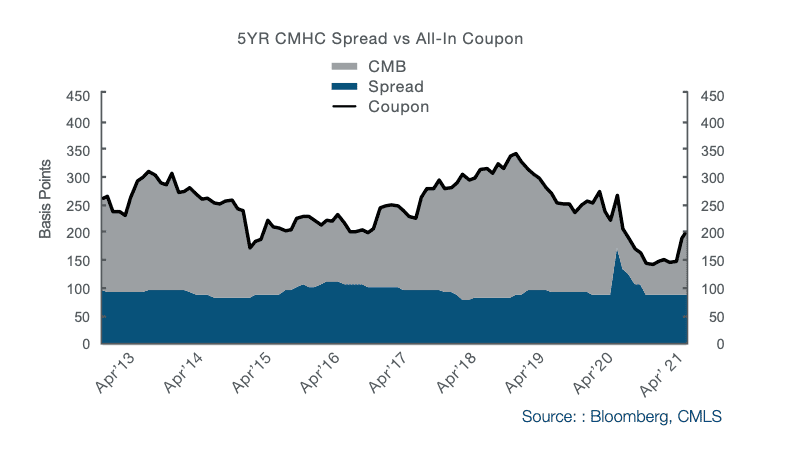

Borrowers will take comfort in the fact that CMHC all-in coupons remain near 5yr lows despite the rising CMB. And while CMHC spread have remained relatively flat since the start of the year, new intel suggests that balance sheet lenders have once again begun to cut rates which could translate into further compression in market pricing.

CMHC Announces Enhancements to its Financial Capacity Review Process In March, CMHC updated its policy regarding Financial Capacity Reviews (FCRs) for large multi-unit borrowers. Those borrowers, classified as having >$75 million in CMHC lending exposure, will now submit required FCR documents directly to their CMHC underwriter rather than have the lender do it on their behalf. The change is expected to reduce CMHC’s turnaround times; however, some worry it could reduce the capacity of lenders to advocate to CMHC on behalf of their borrower clients.

High Yield

Preliminary results from our Q1 survey indicate 93% of conventional plus and high yield lenders saw stable or increasing deal flow and transaction volume relative to last quarter. However, deal flow may be poised to slow down for multi-family second mortgages after a recent change to CMHC’s underwriting approach for property value. The net result is that CMHC appears able to provide higher first mortgage proceeds resulting in less room for high yield lenders to offer subordinate debt.

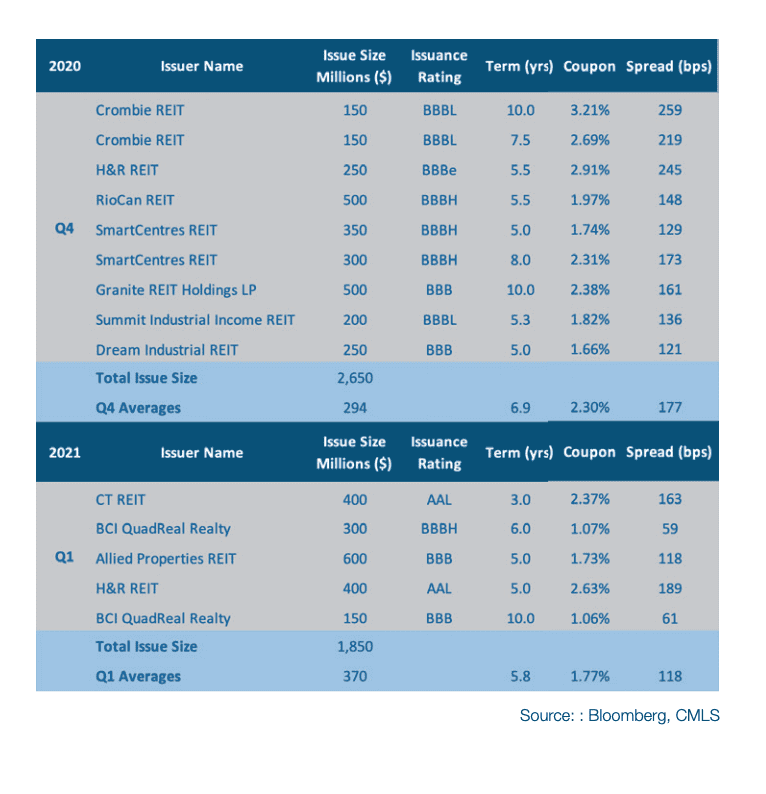

Senior Unsecured Debt

Overall issuance volume for senior unsecured bonds was ~$800 million lower than Q4 of 2020; however, average issuance size was up ~$80 million. The duration of issuances was also slightly lower than last quarter, which may in part be due to the continued steepening of the yield curve. In terms of trajectory, senior unsecured yields have kept pace with commercial mortgage spreads, hitting lows not seen since just before the pandemic.

Source CMLS Altus Group Click here to read a full story