Author The Lilly Commercial Team

‘No inventory’: Warehouse space in short supply as Amazon sets up shop in London area

The London-area warehousing boom that helped lure Amazon.com is so hot it is nearly doubling the size of some businesses and left few vacancies, just as the e-commerce giant begins building here.

“The warehousing, trucking sector is booming. London has always been a cheap market and now it has caught up and there is no inventory” of available space, said Paul McLaughlin, a partner with E&E McLaughlin Ltd. Warehousing.

“There is not much inventory out there.”

The Tillsonburg-based McLaughlin business owns and operates more than 25 warehouse spaces in London and across Southwestern Ontario, including some high-profile former industries in London such as the Electro-Motive Diesel plant, Brose and Keiper auto parts plants and Kellogg.

As London and area braces for the looming arrival of two new Amazon warehouses in the city and the possibility of an Amazon fulfilment centre on the site of the former Ford assembly plant in Talbotville, area logistics businesses are experiencing the growth that has drawn the e-commerce giant here.

“Warehousing is a big need. It is a hot sector,” said Jason Salmon, president of Drexel Industries, a warehouse and shipping business.

“We are growing. The market and e-commerce is hot right now.”

Located in the former Kellogg site, Drexel Industries is one of the hottest logistics businesses in London and is expanding into Brose, while keeping its Kellogg space.

There is about 2,300 square metres of warehouse space at Kellogg. Brose is 16,000 square metres and an additional 32,500 square metres is being added in a two-phase expansion, with Drexel taking all of it, Salmon said.

“It is not uncommon to see this in the warehouse market. It has increased a lot in London and area and the inventory of warehouse space is down, big time. We don’t have enough,” McLaughlin said.

McLaughlin Bros. has sold some warehouse space recently to a real estate investment firm and the new owner is planning to add about 18,500 square metres to those spaces, he said.

As for Amazon’s two warehouses, one is under construction at Huron Street and Robin’s Hill Road and another is being renovated at 580 Industrial Rd.

“There is a lot more coming,” McLaughlin said.

Construction began this week on converting the former Ford plant site on Highway 4, south of Highway 401, to become home for an e-commerce business several sources have said will be an Amazon fulfilment centre.

“I have workers mobilizing there. The job is starting. We have only been told it is a large e-commerce business. There is no name yet,” said Brandon MacKinnon, business manager at LiUNA Local 1059, a building trades union.

“It will be great to have a large industrial construction site to anchor out there. It will mean long-term employment for our members.”

The general contractor is Broccolini Construction, a builder for Amazon. It is looking to develop the entire site and it may take several years to build out.

“It is good to see that land being developed,” MacKinnon said.

A recent report from the commercial realty firm CBRE said only 1.2 per cent of the city’s 3.5 million square metres of industrial space is available and warehousing is part of that shortage.

“There has been a huge uptick in industrial market needs throughout Ontario and North America. Anything of this scale near 400-series highways is a great opportunity,” said Ted Overbaugh, a vice-president at CBRE.

“This is why we need new space to fulfil consumer needs.”

The city has more than 65,000 square metres of industrial space being built, but that is largely for the Maple Leaf Foods processing plant. London could use about 93,000 square metres of industrial space in the next two years, Overbaugh said.

“The need will not go away. We are in need of new space,” he said.

McLaughlin cites London’s location, close to two U.S. states, as a factor in its logistics strength.

“You can bring a lot of products here from the States,” he said.

Logistics includes receiving, warehousing and shipping goods, everything from machinery for industry and auto parts to products from Canadian Tire or Best Buy delivered to your home.

The London businesses see no downside to Amazon locating here, saying it will boost the profile of the sector.

“It won’t impact us. They sell from websites. They are the last mile. We ship to different customers,” Salmon said. “It’s a different kettle of fish.”

Added McLaughlin: “It will open up some doors here. Some businesses might say, ‘If Amazon is there, we should be.’ That will happen.”

Source The London Free Press. Click here to read a full story

Toronto businesses pulling back on sublet space as return to office looms: report

A new report suggests Toronto businesses are making plans to call employees back to the office.

The report, released last week by commercial real estate firm Avison Young, says office market activity in downtown Toronto remains muted due to the COVID-19 pandemic. The downtown office vacancy rate hit a new all-time high of 7.3 per cent in the second quarter, but the report suggests the market may be on the brink of recovery.

According to Avison Young, some companies that were trying to shed downtown office space on the sublet market are reversing course. Available sublet space fell for the first time in six quarters, ending the quarter at 288,000 square metres or 32 per cent of available space downtown. The report suggests this is a sign that some Toronto businesses are anticipating more employees will return to the office soon.

Some companies including TMX Group and Intelex Technologies have withdrawn sublet space from the market in part or altogether. In addition, Netflix’s selection of Toronto over Vancouver for its Canadian headquarters affirms Toronto’s status as a growing tech hub, the report said.

Other companies have already offered a glimpse into what return-to-work strategies could look like. Sun Life is allowing staff flexibility to decide their own work arrangements, while Apple has asked its employees to return to the office three days a week starting in the fall.

The frequency of remote versus on-site work will vary by industry, function, and location, as well as personal circumstances and preferences, Avison Young said.

“Downtown will be the catalyst for the GTA’s growth when the market recovers,” Avison Young said in the report. “The possibilities of a hybrid workplace have helped shift occupiers’ mindset from `will we ever return to the office?’ to `when and how?’ “

Source CTV News. Click here to read a full story

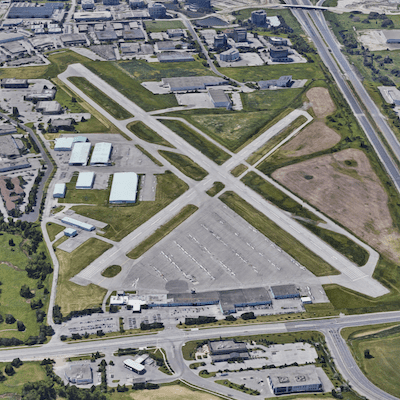

Cadillac Fairview buys 100% stake in Toronto Buttonville airport

Cadillac Fairview is now the sole owner of the Toronto Buttonville Municipal Airport, a 169-acre property in the City of Markham which for years has been considered a prime site for a major redevelopment.

The real estate giant has paid almost $193 million to acquire the 50 per cent interest in the property which it did not already own, according to sale information provided to RENX by Altus Group’s RealNet database.

The property is located at the junction of Highway 404 and 16th Avenue in the northern portion of the Greater Toronto Area (GTA). It’s about 30 kilometres north of Toronto.

Although Cadillac Fairview declined a RENX request for an interview about the sale, the Toronto-based firm did confirm the acquisition – saying for now it will continue to operate as an airport.

“We can confirm that CF is now the 100 per cent owner of the Buttonville site,” Cadillac Fairview wrote in an email reply.

“The airport lands have been leased back to (Torontair Ltd.) who will continue to operate the Buttonville airport for the foreseeable future.

“Over the coming year, CF will explore various land use options to optimize the site’s future development potential.”

CF, Armadale had development plans

The acquisition price represents $2.283 million per acre and values the entire site at almost $386 million, according to the RealNet data.

The vendor, Armadale Properties Ltd., is owned by the Sifton family, which also operates Toronair Ltd. Cadillac Fairview and Armadale formed a joint venture about a decade ago to hold the property with plans to redevelop the land.

Armadale had acquired its 50 per cent interest in the land in two transactions totalling about $35.3 million in 2010 and 2014 (a blended purchase price of $417,637 per acre).

The development plans have yet to come to fruition despite the submission in 2011 of a proposed mixed-use development which would have comprised about 10 million square feet of space.

It proposed Official Plan amendments to allow for a combination of office, retail, hotel, entertainment, public use and residential space. The application was subsequently appealed to the Ontario Municipal Board – which is now known as the Local Planning Appeal Tribunal.

Among the highlights of the plan were a dozen or more mid- and high-rise towers up to 60 storeys and a 13-acre man-made lake surrounded by commercial and office buildings. The community would have accommodated up to 7,000 residents and created thousands of jobs.

The proposal was ultimately shelved in 2020 after years of negotiations and no new plan has been submitted.

Buttonville airport property zoned industrial

The property is currently zoned for industrial uses as a business park area.

Cadillac Fairview and Armadale had put the property up for sale early in 2020 with CF – the real estate owner and manager for the Ontario Teachers’ Pension Plan – stating it wanted to concentrate on its downtown Toronto development land portfolio.

At that time, CF and Armadale said the airport would continue operating until at least the spring of 2023. Despite its relatively small size, Buttonville is consistently one of Canada’s top-10 busiest airports.

It was founded as a grass airstrip and became an official airport a decade later. It currently includes about 330,000 square feet of office and hangar space and operates mainly for private aircraft, a flight school and aircraft sales and maintenance, according to Torontair president Derek Sifton in a 2020 interview with Skies magazine.

Cadillac Fairview and Armadale

Cadillac Fairview is one of the largest owners, operators and developers of office, retail and mixed-use properties in North America. Its real estate portfolio is focused on Canada, but includes properties across the Americas and U.K. The firm also plans expansion into both Europe and Asia.

It’s real estate holdings are valued at more than $36 billion.

The Canadian portfolio includes more than 35 million square feet of leasable space at 69 properties, including Toronto-Dominion Centre, CF Toronto Eaton Centre, CF Pacific Centre, CF Chinook Centre, Tour Deloitte and CF Carrefour Laval.

Armadale is a Markham-based Sifton family holding company of assets in various industries. It identifies opportunities to develop properties and participates operationally and financially either as consultants, owners or in joint ventures.

Source Real Estate News Exchange. Click here to read a full story

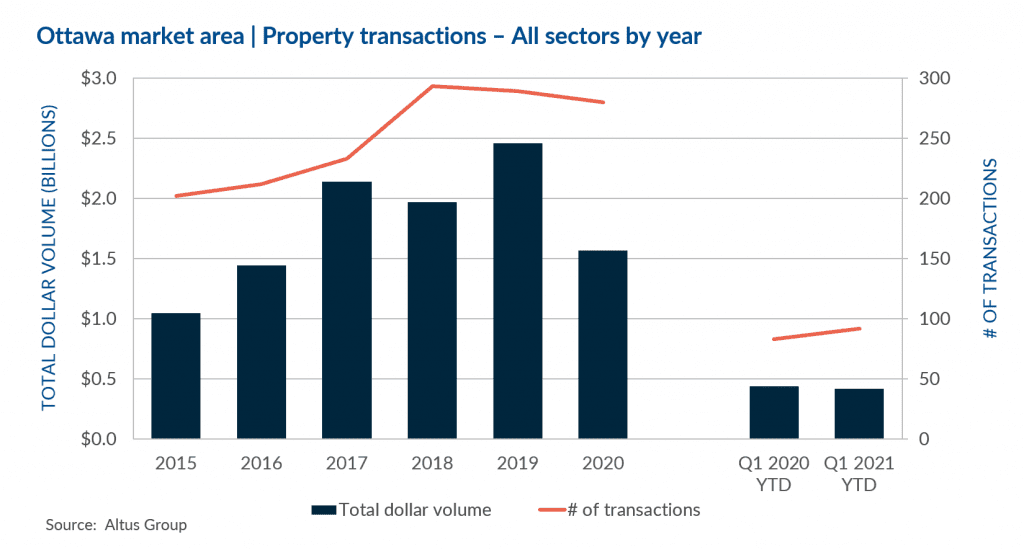

Strong first quarter in the Ottawa CRE market driven by residential land investments

The first quarter of 2021 saw both optimism, in the form of vaccinations, and caution, with further lockdowns and stay-at-home orders. Still, while government restrictions would suggest a slow quarter for real estate activity, the Ottawa commercial real estate market remained steadfast as savvy investors have seemingly taken advantage of the market uncertainty and low interest rates. The quarter completed with a total investment volume of $420 million, which represented a decrease of 4% in comparison to the first quarter of 2020. Despite the slight dip in total investments, transaction activity continued at a torrid pace registering 92 transactions, which was an 11% increase over the same period last year. A number of trends that we saw throughout 2020 continued into 2021 – namely the bid-ask gap between sellers and buyers, and strong performance in the residential land sector. Despite ongoing pandemic-related challenges, investors remain confident in the Ottawa market as evident with investment momentum carrying through from the end of 2020.

With the overall strong quarter, residential land and apartment assets led the way with a total investment volume of $145 million and $94 million respectively. These housing-related assets attest to the strong demand and continued growth of the city. With much of the Ottawa workforce continuing to work from home, the immediate future and uncertainty of the office sector remains, with transactions totaling only $42 million, marking the third straight quarter of minimal office transactions. The sector which saw the most substantial increases, growing more than five times in comparison to the same period last year, was industrial which registered $50 million in total investments. As demand for warehouse space increases to accommodate the population growth and the ever-increasing space required for e-commerce distribution, investors will continue to pursue quality industrial assets in the Ottawa market. According to Altus Group’s Investment Trends Survey, respondents echo this sentiment showing the most positive momentum shown was for single-tenant industrial, multi-tenant industrial and industrial land in the Ottawa market.

Notable Q1 2021 transactions:

Montford Manor, Ottawa – Apartment

This $44 million acquisition by Centurion Apartment REIT was a component of a larger apartment portfolio which consisted of one property in the Ottawa market as well as two properties located in the GTA. The four-building apartment portfolio was sold by Starlight Investments and had an overall sale price of $92 million. This transaction, at 550 Lang’s Road, was the largest asset within this portfolio and also represented the largest transaction registered across all Ottawa asset classes in the first quarter.

Ottawa Central Station, Ottawa – Residential Land

Formerly operating as a Greyhound bus terminal, this vacant two-storey building located at 265 Catherine Street was acquired by Gatineau based developer Brigil. With a purchase price of $24 million and a site area of approximately 2.6 acres, the future intentions for this site will be a mixed-use development that will take advantage of the area which benefits from easy highway and transportation access.

2220 Walkley Road, Gloucester – Office

With an acquisition price of $18.3 million by Ottawa based Jennings Real Estate, this two-storey single tenant office building represented the largest office transaction seen in the quarter. The Scotiabank occupied property contains approximately 83,275 square feet and sits on nearly 7.4 acres of land.

110 Bentley Avenue, Nepean – Industrial

This fully occupied multi-tenant industrial building containing approximately 72,600 square feet was acquired for $10.6 million. The building has clear heights of 24 to 26 feet and is ideally located in Nepean with easy highway access to Highway 416 and Highway 417.

2440 Bank Street, Ottawa – Retail

This multi-building retail plaza ideally located in the high traffic Bank Street and Hunt Club Road intersection was acquired for $15.5 million, representing the largest retail transaction in Ottawa for the first quarter. The property consists of approximately 40,000 square feet of leasable area and sits on nearly 2.7 acres. At the time of sale, the property was approximately 97% occupied with tenancy made up of both national and local businesses.

Despite the ongoing third wave in Q1 2021, commercial activity illustrated the optimism that many investors have towards the Ottawa market. Both buyers and sellers are still aware of the risks that exist, however, with each wave of the pandemic, they have become more comfortable with these risks and how they could play out amid current market conditions. Once again, the bid-ask gap persists as investors are looking to avoid paying top dollar for coveted real estate assets. Overall, the demand for quality properties across the Ottawa market remains strong.

Source Altus Group. Click here to read a full story

The professional approach to estimating property replacement cost

One of the reasons there is such a high percentage of underinsured properties (around 75% based on research) is that many policies are underwritten based on rough square-foot replacement cost estimates and are often imprecise.

A wide variety of methodologies are used to determine a building replacement cost for insurance purposes – and a wide variety of individuals prepare these estimates. Insurance brokers, real estate portfolio managers, property managers may conduct insurance appraisals using software or industry cost guides.

In some cases, such as a simple, standard building, a replacement cost estimate produced by software or a costing manual may be appropriate. These tools can provide average estimated costs for commercial structures and equipment.

But there are limitations and risks when unqualified individuals conduct appraisals of commercial real estate assets and multi-family buildings relying solely on previous estimates, software or cost guides. These approximate replacement costs are based on the cost-per-square-foot of a similar type of building, and often rely on an architect’s zoning area and not the actual gross building area (which a qualified QS will account for). The result is only a rough estimate of rebuilding cost and does not take into account location, construction quality, actual measurements, specific features of a property or current bylaws and building codes.

Especially today, when many properties are complex – combining mixed uses or encompassing a heritage component – accurate estimating is more demanding than it was in the past. The process of calculating an accurate replacement cost estimate for a building requires a variety of data and extensive knowledge of construction.

This is why working with a third-party professional is important for delivering an unbiased and accurate insurance appraisal. Quantity surveyors are professional cost consultants who have construction experience and follow consistent and standardized processes to produce estimates based on substantiated costs.

The cost professional approach:

Quantity surveyors follow a thorough, regulated process adapted to the type of building, the needs of the owner or in the case of condominiums, the board, and whether the assessment is an annual update or a comprehensive evaluation.

- Collect and review documentation from the owner or property manager. This would include, as available: building condition assessment report; architectural, structural, mechanical and electrical drawings; renovations history.

- Physically inspect the property when possible. This involves taking photos, measuring in some cases and inspecting to verify and supplement supplied information. The inspection encompasses above-grade built form as well as below-grade assets such as underground parking and storage and the grounds around the building.

- Measure the building area from the plans provided (if available). Often estimates rely on measurements from the architect’s zoning area which exclude some building areas and this will lead to inaccuracies. A qualified professional will validate the gross construction area and will ensure the correct building area is used for the estimate.

- Benchmark with similar properties. To verify the accuracy of insurable value, they will also benchmark estimated construction costs for the building with similar appraised properties.

- Estimate construction costs. The quantity surveyor will develop a current cost estimate by cross-referencing supplied documentation, the results of a physical inspection, historical cost data and industry data that is available to them, and their own experience with construction cost increases in specific market sectors and regions.

- Prepare a dependable replacement cost estimate report. The quantity surveyor will prepare a draft report for discussion with the property manager, owner or board. This will include a description of the building structure, services and finishings; building areas; and photos; and a summary of estimated replacement costs.

Once the report is finalized, you will receive an independent third-party report your property insurer can rely upon for current, accurate insurable value. In the event of a partial or full loss, this report will facilitate a quick and complete settlement.

Protect your investment by getting an accurate and current replacement cost estimate to mitigate risk and gain peace of mind that if the need arises, you’ll be covered.

Source Altus Group. Click here to read a full story

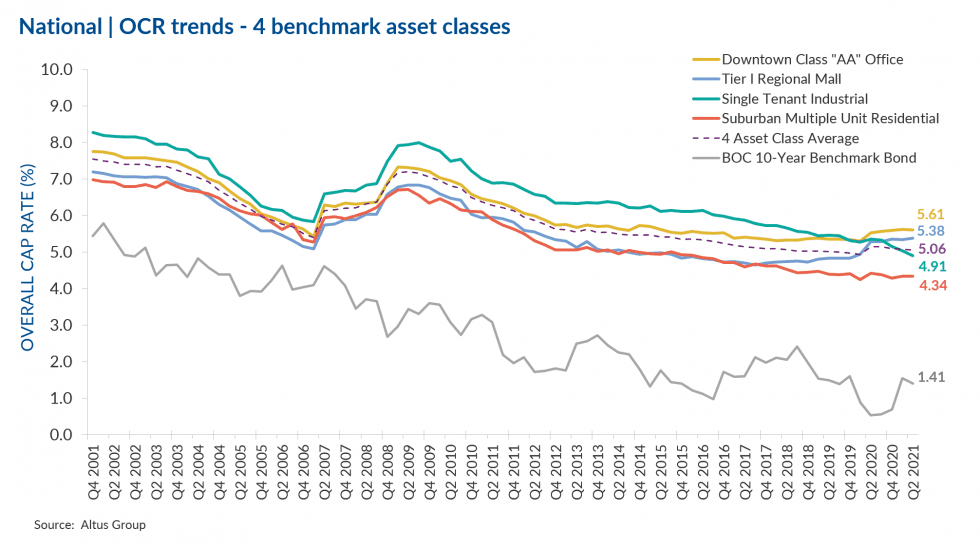

Industrial and food-anchored retail continue to win in commercial real estate, while Toronto regains its top spot as preferred market

The latest results from Altus Group’s Investment Trends Survey (ITS) for the four benchmark asset classes show that the Overall Capitalization Rates (OCR) remained flat at 5.06% in Q2 2021 compared to the previous quarter, and fell from 5.15% in Q2 2020. For a second consecutive quarter, all three industrial assets have remained top preferred by investors with continued e-commerce activity driven in part by pandemic-related restrictions pushing demand for forward for high-quality and strategically located industrial space. As uncertainty continues in the office market with many still in decision-making mode when it comes to a return to in-person work, investor attention has turned to other asset classes, especially Suburban Multi-Unit Residential and Food-Anchored Retail Strip. While the fate of retail also remains uncertain, the re-opening of non-essential in-store shopping has led to an upswing in retail investment volume and an overall positive outlook moving forward. Transaction volume throughout the first half of this year shows strong momentum across most asset classes, with the presence of substantial investor capital available and a healthy appetite from lenders, combined with returning investor confidence after the pandemic-induced slowdown throughout 2020.

Amid the third wave of the pandemic, some regions saw re-openings while others remained in lockdown, with impacts mainly felt among small businesses. According to Statistics Canada, Canadian employment fell by 0.4%, leaving the unemployment rate at 8.2% as of May 2021, with the goods-producing sector taking the largest hit – the first time that manufacturing and construction industries recorded an employment decline since April 2020. While retail trade also felt the impact of continued restrictions, employment among accommodation and food services sectors remained unchanged, despite composing the majority of the employment gap compared to pre-pandemic levels. The Conference Board of Canada projects positive economic momentum in 2021, with economic expansion of 5.8% in 2021 and 4.0% in 2022 – a direct result of wide-spread vaccine rollout allowing for mass re-openings by autumn of 2021. Although recovery was halted earlier this year, many remain optimistic when it comes to economic and employment recovery. According to the location barometer for all available products, Toronto has slightly surpassed Vancouver to regain its spot as the top preferred market by investors, both followed by Montreal (Figure 2). Across major markets, Halifax was the lone market to experience negative buy/sell momentum this quarter. Calgary Single-Tenant Industrial sits as the top preferred product-market combination, followed by Montreal Industrial Land, and Vancouver Food-Anchored Retail Strip (Figure 4) – all demonstrating continued investor interest in Industrial and Food-Anchored Retail Strip assets with potential for growth.

Market highlights for the quarter include:

- Overall cap rates continued to decrease in Q2 2021 as accelerated vaccine rollout prompted a return to some market normalcy and rising investor confidence. Total transaction volumes are on the upswing as investment momentum continues from strong results recorded in the first quarter of the year. Cap rates compressed slightly across most asset classes, aside from Tier I Regional Mall which increased quarter-over-quarter, and Suburban Multi-Unit Residential rates remained stable. Edmonton was once again the lone market to mark an increase in average overall cap rates quarter-over-quarter.

- While there is some optimism in the office market due in part to robust vaccine rollouts progressing across Canada, low investment volumes and continued rising availability rates point to a remaining level of uncertainty. Still, increases in both cap rates and availability rates among office assets are less than those recorded at the same time last year, as some investor confidence returns. Downtown Class “AA” Office cap rates remained unchanged this quarter sitting at 5.61%. Still, Vancouver and Quebec City were the only two markets to record increasing rates, while Toronto, Montreal and Halifax rates remained stable quarter-over-quarter.

- Investment in industrial assets have continued to build off positive momentum seen throughout 2020. Investors remain interested in the industrial sector, with all three industrial asset types (Single-Tenant Industrial, Industrial-Land and Multi-Tenant Industrial) sitting as the top three products preferred by investors for the second consecutive quarter (Figure 3). Cap rates for Single-Tenant Industrial assets fell again this quarter, from 5.04% in Q1 2021 to 4.91% in Q2 2021. Rates decreased across all markets this quarter, aside from Ottawa and Quebec City where rates remained stable. Edmonton saw the most significant decrease in rates compared to the previous quarter.

- The easing of pandemic-related restrictions has seen the reopening of in-person retail across most regions throughout the first half of 2021. Food-Anchored Retail Strip maintained its spot as the fourth preferred product by investors, following industrial, for the second consecutive quarter (Figure 3). While slow growing investment volume demonstrates a cautious attitude among investors, many continue to prioritize Food-Anchored Retail Strip assets as those that offer strong return potential and room for future expansion. After rates compressed slightly in Q1 2021 for the first time since the pandemic began, Tier I Regional Mall rates remained stable at 5.38% in Q2 2021 compared to the previous quarter. Toronto and Calgary were the only markets to see rates decline, while rates in Vancouver remained stable.

- Suburban Multi-Unit Residential assets continued on an upswing this quarter, most notably in Vancouver, Ottawa and Montreal. Despite rising construction costs slowing new supply, persisting record-low interest rates are likely to continue driving demand. Suburban Multi-Unit Residential cap rates remained stable at 4.34% this quarter. Calgary and Halifax were the only two markets to record rising rates, while Vancouver and Quebec City recorded a drop. All other markets saw no change in cap rates this quarter.

Other highlights include:

Of the 128 combinations of products and markets covered in the Investment Trends Survey:

- 60 had a “positive” momentum ratio (i.e., a higher percentage of respondents said they were more likely to be a buyer than a seller in that particular segment), an increase compared to 54 in Q2 2020; 68 had a “negative” momentum ratio, a decrease from 74 in the previous quarter; and none were neutral, the same as the previous quarter.

- The top 15 products/markets, which showed the most positive momentum were (Figure 4):

- Calgary – Single-Tenant Industrial

- Montreal – Industrial Land

- Vancouver – Food-Anchored Retail Strip, Multi-Tenant Industrial, Single-Tenant Industrial, Industrial Land. Suburban Multi-Unit Residential

- Toronto – Food-Anchored Retail Strip, Suburban Multi-Unit Residential

- Edmonton – Multi-Tenant Industrial, Single-Tenant Industrial

- Ottawa – Food-Anchored Retail Strip, Multi-Tenant Industrial, Single-Tenant Industrial, Industrial Land

Source Altus Group. Click here to read a full story

New platform ‘democratizes’ commercial investing

A new platform that uses blockchain technology and AI to democratize investing in commercial real estate launched this week, and according to its president and co-founder, gone are the days when small-time investors were turned away from potentially lucrative opportunities.

“Commercial real estate requires a huge amount of upfront cash to gain entry and that ranges from $500,000 to $1 million-plus, so a common investor who doesn’t have that much cash won’t be able to enter these opportunities,” said AcreageWay’s Aditya Koparde. “Where we come into the picture is we’re fractionalizing these opportunities so they can invest.”

Commercial investments have indeed been financially prohibitive for common investors for a few reasons, says Sunny Sharma of the Sunny Sharma Commercial Team and co-owner of Century 21 Leading Edge VIP Realty.

“If there’s a block fee and the investor needs $1 million to buy one share, unfortunately, if you’re a developer, do you want to deal with 50 investors or 10 investors? Ten investors are easier to deal with than 50,” said Sharma.

AcreageWay uses tokens that are worth $1,000, $5,000 or $10,000 in what’s tantamount to equity shares in developments, which range from shopping malls, industrial facilities, redevelopments, and new residential complexes. The company scales from $5 million to $100 million, and that opens the door to a lot of small- and medium-sized investors, says Koparde.

“There’s a $13 million deal we’re currently working on where the issuer needs to raise $7 million, so the common investor will be told $30,000 isn’t valuable and they’re accepting no less than $100,000 per person, and that’s where we’re democratizing the process,” he said.

AcreageWay is licensed by the Ontario Security Commission (OSC), which requires the company to put prospective investors through full due diligence to ascertain their risk threshold, and that will determine their suitability for certain projects. Being licensed by the OSC means AcreageWay isn’t limited to crowdfunding; it can source all kinds of investors from accredited and retail-eligible to friends and family and, of course, institutional.

It also forgoes the need for proof of funding and credit scores, and provides investment portfolios as short as three months. Koparde says the returns on investment are higher and faster than what flips and new builds offer over longer terms.

“What blockchain technology enables us to do is issue fractional token ownership linked back to the corporation, and it defines what kind of shares or control the investor has on a per-token basis,” said Koparde. “It’s nothing but representation of a share in the class in which the investor is investing, and we allow investors to invest in multiple opportunities. When you can invest fractionally into assets, there’s a better chance to diversify.”

Source Canadian Real Estate Magazine. Click here to read a full story

Record demand, supply woes, hungry buyers

Before the pandemic struck, the purpose-built rental apartment market was one of the soundest asset classes in Canadian commercial real estate.

Though apartment building deal-making slowed down a year ago along with everything else during the first-wave lockdown, the appetite quickly rebounded late in 2020 and is now showing signs of dramatic acceleration in terms of demand and pricing.

Colliers conducted a national panel discussion on Canada’s regional rental apartment building market to offer a snapshot of the state of each city and to forecast where each market appears to be heading.

TORONTO: Dayma Itamunoala, associate VP, sales representative

On new institutional money coming to Toronto

There was brief uncertainty at the start of the pandemic, but multifamily is on fire.

Right now, institutional capital is seeking predictability, stability and feasible financing. For them, multifamily is the perfect asset class, and due to the strong fundamentals in the city, the GTA is the ideal location.

As a result, we’ve seen deal activity accelerate this year above Q1 2020 levels. We’re seeing a whole new set of purchasers aggressively bidding on deals, vying for a foothold in the market.

On steady demand creating secure investments

We saw higher vacancy downtown, especially in newer assets that typically demand premium rents. We’re currently at a 14-year rental vacancy high of 3.4 per cent, up from 1.5 per cent a year ago.

More than 340,000 immigrants enter Canada each year and a third of those newcomers typically settle in the GTA. That number has been cut in half due to the pandemic, but it won’t stay that way.

With Canada mandating increased immigration to 1.2 million people over the next three years, demand will return in a big way.

In Toronto, the barriers to home ownership have continued to increase with the average home now selling for over $1 million. On the supply side, rising construction costs, in addition to policies like inclusionary zoning in Toronto, only serve to limit the supply and increase the need for new housing.

All these factors mean that owning multifamily in the GTA – especially while you can buy below replacement cost – is only becoming more attractive.

On healthy optimism and potential risks

I’m quite optimistic for Toronto’s multifamily sector.

The industry is going through an exciting transformation. Many owners who have held assets for over 50 years are cashing out due to the attractive selling environment.

Market headwinds are also important. Many of our clients are extremely concerned about a potential capital gains increase next year. With the U.S. paving the way for a tax hike, it’s not unreasonable to expect the same in Canada and this would have a major impact on our market.

Policy changes around rent control also present a looming threat. Even with a Conservative premier, guideline increases were restricted in Ontario in 2020. Increased rent control measures could put a lot of pressure on owners and it’s happened before.

Source Real Estate News Exchange. Click here to read a full story

Microsoft buying GTA land and retail? What’s up with that?

When you think of Microsoft in the context of commercial real estate, you think of the firm as a global technology player and as an occupier in gleaming downtown high-rise office towers or sprawling suburban office campuses.

However, Microsoft Canada recently pivoted from occupier to investor – acquiring a parcel of land and a retail property a month apart in the Greater Toronto Area (GTA).

This has raised the question: Why?

The acquisitions:

– 48 Lowe’s Place & 50 Resources Road (retail).

The first acquisition took place in March 2021 and included a free-standing, 145,000-square-foot vacant retail property on a 13.5-acre site, owned by Lowe’s Canada. Microsoft paid $49 million, or $338 per square foot, for the property that is near major highways and a large urban population. This type of site is highly coveted by e-commerce retailers, 3PL, logistics, and distribution players in what is arguably the hottest industrial and land market in North America.

– 6100 Langstaff Road (land).

The second transaction concluded in April 2021 and involved a 28.2-acre site (vacant and unimproved) in the GTA’s Vaughan market for $95.7 million or $3.4 million per acre from Zzen Group, a private developer. Some will argue Microsoft paid a hefty premium, given the highly competitive land market.

The race for cloud domination

The recent acquisitions may have to do with Microsoft’s ambition to become the top cloud data-service provider with its Microsoft Azure software-as-a-service offering – pitting the company head-to-head against Amazon Web Services.

Let’s face it, the COVID-19 pandemic has fuelled Microsoft’s cloud business, as a multitude of enterprises use Microsoft Teams for remote work and, by all indications, this is expected to persist even after the pandemic.

In January 2020, Microsoft Canada announced it was undertaking the largest expansion of its Canadian-based cloud computing infrastructure since it launched two Canadian cloud data-centre regions in 2016.

The announcement included plans to add Azure Availability Zones in the Azure Canada Central region (i.e. Toronto), increasing the region’s “compute capacity” by more than 1,300 per cent since it was brought online five years ago.

Furthermore, in March 2021, Microsoft announced investment geared toward the creation of a new Data Innovation Centre of Excellence to be housed within its new state-of-the-art headquarters in downtown Toronto and the addition of a new Azure Edge Zone in Western Canada – further increasing the company’s significant national cloud footprint.

Microsoft has also been busy south of the border, acquiring a 22-acre development site in San Jose in early May for almost US$79 million or $3.6 million per acre.

Microsoft’s existing data-centre network

Microsoft’s data centres for Azure and Office365 offerings are in 50 regions, spanning 140 countries – two in Canada, Central (Toronto) and East (Quebec City) and soon to be in Vancouver, in Western Canada.

According to the announcement, Azure Edge Zones are extensions of Azure’s cloud services and are intended to place infrastructure close to customers to support latency-sensitive workloads and improve connectivity.

Clearly, demand for cloud-based solutions is heating up in the fourth-largest city in North America and a critical data centre market.

Not too long after the Microsoft acquisitions in the GTA, U.S.-based STACK Infrastructure announced a partnership with local developer First Gulf to develop a 56-MW data centre campus on a 19-acre site with a vacant 186,000-square-foot industrial building in Toronto’s East End.

The property was purchased by First Gulf from Eli Lilly Canada in December 2020 for $24.6 million or $133 per square foot – the building selling essentially for its land value. This is STACK’s first international expansion, looking to provide what it calls hyperscale and enterprise solutions to its clients.

It looks like the playing field just became a lot more crowded in what already is a very tight industrial and land market with e-commerce and data centre demand – the virtual world – demanding more space in the physical world.

So, is it possible that these recent acquisitions will end up being Microsoft data centres?

Source Real Estate News Exchange. Click here to read a full story

National investment activity in first quarter points to strong rebound for commercial real estate this year

The commercial real estate market is on the upswing in Canada, with increasing transaction volume across most major markets and the continued return of investor confidence following the pandemic-related slowdown in 2020. Despite ongoing restrictions and lockdowns in most regions across Canada persisting into the first quarter of 2021, investment volume rebounded and marked an increase compared to the same time last year. The industrial sector remained among the top-performing asset classes this quarter, alongside both land sectors, compared to the previous year as investors continue to seek out opportunities for future growth and development. Especially in the industrial market, this trend is forecasted to continue throughout the year as industrial availability rates remain tight.

Although the market is now shifting towards recovery and the return to some level of normalcy with growing investor confidence and the progression of vaccine rollouts, the office market is still facing challenges, with transaction volume dropping significantly in Q1 2021 compared to the same quarter last year. Conversations continue to revolve around return-to-office plans, with some companies aiming for a partial return by Fall 2021 and others projecting returns in early 2022. Still, as plans for hybrid office models have yet to be finalized amid continued remote work for the near term at least, a level of uncertainty remains in the office market, contributing to high availability rates and holding back investments in the sector. Overall, the commercial real estate outlook is favourable to start the year off, pointing to signs of climbing momentum moving forward.

National investment volume in Q1 2021 increased 25% compared to Q1 2020, reaching a total of nearly $15.0 billion. Once again, the industrial sector saw robust activity this quarter, with $3.5 billion in volume, marking a 46% increase compared to the same quarter last year, and composing 23% of total transaction volume for the quarter. Land sectors also saw substantial increases this quarter, with ICI land reaching $2.4 billion in value and residential land reaching $3.6 billion – up 49% and 54%, respectively, compared to Q1 2020. Together, these two sectors make up 40% of the total Q1 2021 volume. Multi-family has also seen a rise in momentum this quarter, reaching just under $3.0 billion in volume, increasing 23% compared to the same time last year. With continued pandemic-related impacts on the office market, the sector only saw $822 million in transactions in the first quarter, down 50% compared to the same time last year. Despite lockdowns persisting at the beginning of the year, the retail sector marked a 10% increase in transaction volume compared to Q1 2020, reaching $1.7 billion. Against Q1 2020, all major markets in Canada recorded growing investment volume in the first quarter of this year, aside from Edmonton dropping 45%, Ottawa decreasing slightly by 4%, and Montreal remaining relatively stable, with a drop of 0.4%.

According to Altus Group’s Investment Trends Survey results for Q1 2021, single- and multi-tenant industrial assets sit as the top two preferred product types by investors, followed by industrial land. Investors have indicated an interest in all three asset classes, especially in the Ottawa market area as outlined in the product-market barometer this quarter. With ongoing tight availability rates across the industrial sector in most major markets, burgeoning demand continues to leave industrial assets in a position to grow. Food-anchored retail strip has also remained of interest in Q1 2021, despite losing its spot as the top preferred asset class, which it held for most of 2020. While retail assets still face the brunt of pandemic-related challenges early in 2021, food-anchored retail continues to drive traffic and have strong growth potential. With Vancouver and Toronto sitting as the top two preferred markets by investors, Ottawa and Montreal follow as the third most preferred markets as investors have reached a higher comfort level with current economic conditions and prices, returning some activity to these larger markets. National cap rates in Q1 2021 still mark a year-over-year increase compared to Q1 2020, but again compressed slightly compared to the previous quarter. All markets experienced a drop in rates aside from Edmonton, which saw a slight increase and Ottawa, which saw no change over Q4 2020. Nationally, industrial rates saw the most significant drop both compared to the previous quarter and year-over-year, further reflecting investor interest in industrial assets. As e-commerce sales volume is expected to rise even as we emerge from the pandemic fallout, this trend is likely to continue. Overall, the slow but steady decrease in rates between quarters indicates ongoing market recovery.

As most sectors saw strong performance in the first quarter of 2021, even amid continued pandemic-related lockdowns and restrictions across many regions, the commercial real estate market is poised for continued growth throughout the remainder of the year. Investors remain highly interested in industrial assets with strong demand and tight availability across the sector but are also shifting some preference towards land sectors in order to maximize growth potential. With a more robust vaccine rollout plan coming to fruition in Canada, a level of optimism has returned when it comes to retail assets, and could return for office assets later in the year, as the workforce slowly shifts away from fully remote work and back into offices in some capacity. With the imminent easing of restrictions across most major markets as we move into Q2 2021, the outlook is positive for commercial real estate.

Source Altus Group. Click here to read a full story